回顾上轮行情,最大的玩法其实可以用 PVP 概括。

去这里 PVP,去那里 PVP,去任何一条还有点热度和叙事的链上去 PVP。

时间进入 2025 年,这些链们也早已进入了存量竞争的阶段 --- 从几年前的百链大战争夺以太坊杀手名号,到现在大多数链被冠以「狗都不用」的标签,剩下来的那些,也在努力解决自己的吃饭问题。

不光是 P 小将们在 PVP,这些链们其实也在 PVP。

只是每条链似乎都想复制 Solana 的热闹,但不管它们如何折腾,都复刻不了 Solana 的 Meme 盛景。

一方水土养一方人,一条公链或许只能办一件事。

还活着的每条公链,都已经被暗中标好了用途。

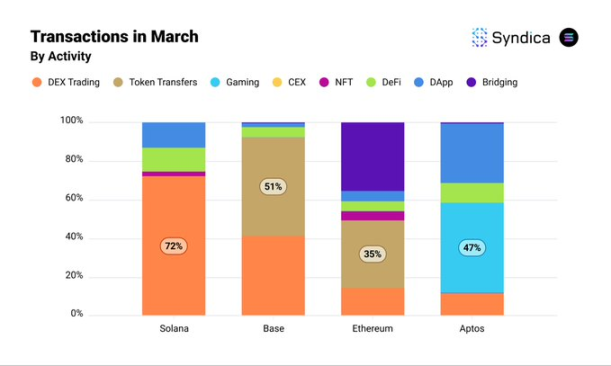

最近,海外新闻和研究机构 Syndica(@Syndica_io) 发布的一份 3 月 L1/L2 数据洞察报告,则将这种宿命的感觉通过数字变得更加具象化:

- Solana 的所有交易中,有 72% 与去中心化交易所(DEX)相关,显然符合你的打狗印象。

- Base 有 51% 的交易用于代币转账;

- ETH 有近 40% 的交易用于跨链(上图紫色柱状)

Delphi Digita l 的研究主管 @ceterispar1bus 在面对这组数据时,直接点题说出了本质:

- Solana 是交易用的

- Base 是给 Coinbase 的 USDC 记账用的

- Ethereum 是跨链转移资产用的

行业走到今天这一步,项目不再是单纯的技术比拼,而是找到一块属于自己的「锚地」——一个能顺理成章的用途定位。

是身份标签,更是宿命

表面上看,公链的用途像是用户和市场选出来的;但深想一层,这更像是被资源禀赋和背景「暗中标价」的结果。

总结一下三条公链的身份标签:

Solana 是交易热土,Base 成了 Coinbase 的「账房先生」,Ethereum 被桥绑架,资产加速外流。

每条链的现状背后,都有技术与非技术的双重推手。

先说 Solana。

Solana 的链上生态在 2025 年依然是圈内最热闹的 Meme 交易热土。

其生态中的 DEX 交易量连续两个月稳坐头把交椅,市场份额遥遥领先。自 2024 年 10 月以来,Solana 每月创建超 50 万 MEME 币,像是在开永不停歇的「打狗派对」。

P 小将们勇于枯坐和找角度,交易员忙着监控池子和车头,玩过 Meme 的人提起 Solana,第一反应是:「这链不就是个大赌场吗?」

Solana 的高吞吐量(TPS 是 Base 的 12 倍)和低成本(低于 0.01 美元的交易占比高)是其交易热土的基础。Syndica 报告显示,Solana 在小额交易(低于 100 美元)中领先,适合 MEME 币的高频交易。

至于去不去中心化,实操和体感上恐怕没那么重要。

更关键的,是资源禀赋上的启动优势。

2019-2023 年间,Solana 获得 a16z、Multicoin Capital 等投资支持,通过 grant 和孵化器吸引 DeFi 和 MEME 币开发者;

Solana 的 Breakpoint 大会也会时常成为 Meme 币的灵感来源,还记得前年 Toly 在大会上穿着绿色卡通龙形象服装,引爆之后一波对现象级 Meme SillyDragon 的关注么?

创始人主动设置形象,有意无意的暗示某种 Meme 关联,今天也逐渐成为一种寻常的玩法。

社区文化也「预定」了其 Meme 土壤,通过社交媒体(如 X)和 Meme 币竞赛,Solana 成了「草根玩家」的乐园,PEPE、BONK 和 POPCAT 等也成功形成了正反馈。

用户心智被框住:「Solana=交易」,各种鱼龙混杂的 Dev 蜂拥而至,Pumpfun 的出现更显得顺理成章。

再说 Base。

Base 上也有 Meme,AI Agent 上一波热潮里也不乏生态中的亮眼代币,但这更像之前 Solana 资金外溢的结果,以及 PVP 难度低的套利行为。

3 月的数据显示,Base 上 51% 的交易为代币转账,更深层的原因在于 Coinbase 与 Circle 的利益关系。

Coinbase 和 Circle 在 2018 年共同成立了 Centre Consortium,这个组织专门负责 USDC 的发行和管理,Coinbase 和 Circle 作为联合发起方,不仅共同推动 USDC 的普及,还通过 Centre 制定了 USDC 的运营标准。

Base 作为 Coinbase 的「亲儿子」,成了 USDC 转账的首选通道。

此外,Circle 最近提交的 IPO 文件显示,Coinbase 和 Circle 在 USDC 上的合作有明确的利益分成——Coinbase 从 USDC 储备的剩余收益中拿 50% 的分成。

这意味着,Coinbase 每沉淀一笔 USDC 交易,或者推广 USDC 的使用,就能多分一杯羹。

Base 的低成本和高效率,正好适合这种「记账」需求——无论是 Coinbase 内部的资金转移,还是用户的 USDC 交易,Base 都能高效记录和管理这些链上活动,比如转账记录、流动性管理和结算操作。这种「记账」不仅降低了 Coinbase 的运营成本,还通过 USDC 的收益分成直接创收。

再看生态文化,Base 更倾向服务机构和合规用户,Coinbase 的 1 亿 + 用户大多是「正经玩家」,开发者自然也不会选 Base 来大搞特搞「打狗派对」。

Base 从诞生之初就被 Coinbase 和 Circle 的战略预定成了 USDC 的「账房先生」,被这对合作伙伴的利益链条牢牢框住。

最后说到以太坊,无疑是让人失望的老话题。

近 40% 的交易与跨链桥接相关,成了其他公链的「中转站」。

ETH 价格更像是被架在火上烤逐渐丧失水分。尽管 Ethereum 依然是 DeFi 龙头,锁仓价值(TVL)占比高达 60% 以上(Syndica 数据),但社区的负面情绪却在蔓延。

Ethereum 的「桥接宿命」,技术上是高 Gas 费逼出来的。

行情好的时候,普通用户早已不堪重负,只能通过跨链桥将资产转移到成本更低的链上;更不用说行情差的时候没什么东西可以玩。

此外,ETH 的主网吞吐量也有限,远不如 Solana 的高性能,交易效率低下进一步推高了跨链需求。

更深层的原因,则来自于历史地位的分流。

作为最早的智能合约平台,Ethereum 积累了最多的资产和 dApp,天然成为跨链桥的枢纽。

生态路径依赖让 DeFi 项目和资金集中在 Ethereum 上,但高成本迫使用户外流,桥接成了「必然选择」。

与此同时,Layer 2 的崛起分流了用户、以太坊基金会多轮调整、Vitalik 和女性同框被指不务正业,币价下跌连呼吸都是错的...

梦想是「世界计算机」,现状是「提款机」。

它的命,像是被网络效应和市场变迁锁死,从 DeFi 霸主变成了资产中转站。以太坊的突围之路,恐怕比 Solana 和 Base 都要艰难。

接受宿命,寻找锚点

2025 年的公链竞争,已经不再是百链大战的狂热,而是存量博弈的冷静。

公链的生存之道,归根结底是「接受宿命,寻找锚点」。

交易可以是锚点,稳定币的流通可以是锚点,甚至跨链也可以。但「锚点」的固化,也意味着公链的想象空间被压缩。

Solana 能摆脱「Meme 赌场」的标签吗?Base 能跳出「记账员」的框框吗?Ethereum 能从「中转站」里突围吗?

这些问题,并没有答案。

但更讽刺的是,大多数 P 小将们并不关心这些问题。

哪条链有热度就去哪条链「打狗」,哪条链有套利空间就去哪条链「薅羊毛」。公链之争,其实只是每一个急于变现且憧憬千倍收益的过路人,背后的那块背景板。

或许,只有下一轮周期的到来,才能给出真正的答案——谁能拉来增量,谁才能找到新的「锚点」。

行业的未来,公链的未来,依然悬而未决。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。