This article will review Trump's tariff measures during his term and explore their potential impact on the cryptocurrency market and possible response strategies.

Written by: FinTax

One of the core economic strategies of the Trump administration was a tough trade policy. During his first term, the tariff-centered U.S.-China trade war drew global attention. Now, with Trump returning to the White House, his trade protectionist stance has become even more aggressive, and the issue of tariffs has once again become a focal point. This will inevitably lead to renewed global trade friction, resulting in a series of economic chain reactions, causing economic fluctuations and even regional hot conflicts, and this uncertainty will profoundly affect the cryptocurrency market. This article will review Trump's tariff measures during his term and explore their potential impact on the cryptocurrency market and possible response strategies.

1. Overview of Trump's Tariff Policies

1.1 Trump's Tariff Measures 1.0 in 2018

On March 23, 2018, Trump signed a trade memorandum against China, announcing tariffs on $60 billion worth of goods imported from China and restrictions on Chinese companies' investments and acquisitions in the U.S., marking the official outbreak of the U.S.-China trade war. Subsequently, the U.S. continuously expanded the scope of tariffs, including both high-end manufacturing products and daily consumer goods, covering aerospace, industrial machinery and equipment and their parts, motor vehicles, automotive parts, electronic products, as well as clothing and home goods such as bags, furniture, and lighting. The tariffs on electronic products posed a threat to mining machine manufacturers. For instance, Bitmain, which once held a 90% market share in the Bitcoin mining machine market, was significantly affected by Trump's tariffs in 2018 and moved some production lines from China to Southeast Asia. In addition to China, the U.S. also imposed tariffs on multiple countries and regions globally, with the core goal of reducing trade deficits and protecting domestic industries, which also triggered retaliatory tariff measures from other countries.

1.2 Trump's Tariff Measures 2.0 in 2025

On January 20, 2025, Trump signed the U.S. First Trade Policy Memorandum, emphasizing the importance of protecting the U.S. economy and national security, including improving the trade deficit, investigating unfair trade practices, strengthening economic and trade relations with China, assessing export control measures, and ensuring the interests of American workers and manufacturers.

Subsequently, the U.S. implemented new tariff measures against multiple countries. Initially, a 10% tariff was imposed on all imported goods from China, followed by an announcement to increase tariffs on China by another 10%, which took effect on March 4. The cumulative tariff rate on China reached 20%, combined with the previous 25% tariff under Section 301, resulting in a comprehensive tax rate on some key technology equipment (such as servers, storage devices, semiconductors) potentially reaching 45%-70%, which could significantly impact the cryptocurrency industry. Additionally, a 25% tariff was imposed on goods from Canada and Mexico. Meanwhile, U.S. Treasury Secretary Basent stated that specific reciprocal tariffs would be allocated for each trading partner. Besides tariffs targeting specific countries and regions, Trump also planned to impose tariffs on specific products, such as agricultural products, timber, steel and aluminum, automobiles, copper, semiconductors, and pharmaceuticals.

During his campaign, Trump expressed his desire for Bitcoin to be "mined, minted, and manufactured" in the U.S., and his tariff measures would inevitably involve the cryptocurrency industry. For example, in January, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) updated export controls on advanced computing semiconductors and added some entities in China and Singapore to the entity list. These regulations targeted chips using "16nm/14nm nodes" and below, and even strengthened due diligence on foundries, which would undoubtedly impact mining machine manufacturers.

2. Potential Impact of Trump's Tariff Measures on the Cryptocurrency Market

2.1 Impact on the Overall Cryptocurrency Market

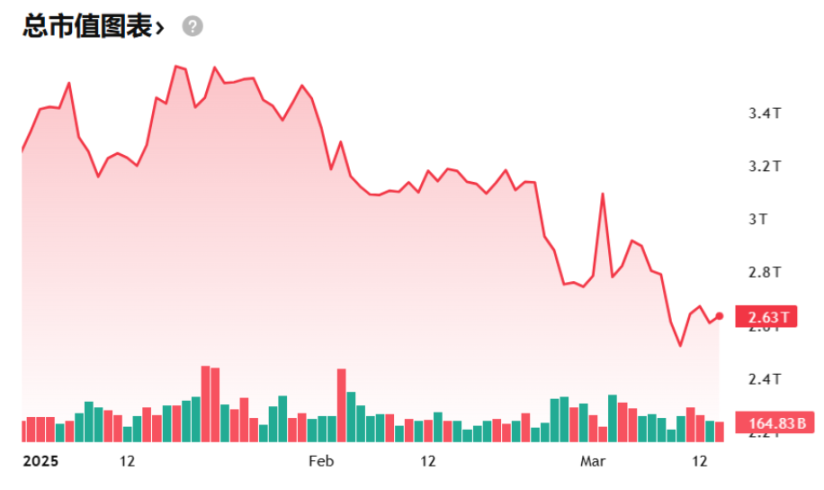

In the short term, Trump's tariff measures have already had a negative impact on the cryptocurrency market. In January, Trump signed an executive order to establish a working group to formulate clear rules for U.S. cryptocurrency companies within six months and to study the establishment of a potential cryptocurrency reserve to support the development of cryptocurrencies. Following this announcement, the total market capitalization of cryptocurrencies grew to $3.65 trillion by the end of January, with a cumulative increase of 9.14%. However, in February, the tariff policies announced by Trump quickly offset the positive effects of the aforementioned executive order, triggering a series of negative chain reactions in the cryptocurrency market. Particularly on February 3, after Trump announced long-term import tariffs on Canada, Mexico, and China, the cryptocurrency market exhibited a downward trend in sync with the stock market, with Bitcoin plummeting 8% within 24 hours, Ethereum dropping over 10%, and over $900 million in liquidations across the network, forcing 310,000 investors to close their positions. Behind this market volatility was investor panic over the escalation of trade frictions and concerns about the global economic outlook.

From a macroeconomic perspective, trade frictions will lead to global market fluctuations, and the appeal of the U.S. dollar as a safe-haven asset will further increase, resulting in capital flowing back to the U.S., strengthening the dollar, and exacerbating shocks in global capital markets. Investors' risk appetite for high-volatility assets will decline, leading to a massive sell-off of cryptocurrencies. Large funds and venture capital firms may also contribute to market volatility. If their equity positions decline, they may liquidate cryptocurrency holdings to manage risk. Additionally, tariff policies may trigger inflation, weaken consumer purchasing power, and further suppress economic growth. In this context, investors will generally turn to safer asset classes, and cryptocurrencies, as high-volatility assets, will naturally be among the first to be sold off, leading to a significant drop in their prices and a corresponding decline in sentiment in the cryptocurrency market.

However, in the long term, Trump's tariff policies may still have a positive impact on the cryptocurrency market, specifically in the following areas:

First, the U.S. tariff policies may increase market liquidity. While implementing tariff policies, the Trump administration may also adopt expansionary fiscal policies, such as large-scale tax cuts and increased infrastructure investment. These policies may temporarily boost the U.S. economy but will also exacerbate the fiscal deficit. To fill the funding gap, the government may increase market liquidity through bond issuance or monetary easing, creating a favorable environment for the cryptocurrency market. For example, in 2020, the Federal Reserve expanded its balance sheet by over $3 trillion, during which Bitcoin's price surged over 300%.

Second, tariffs will raise the prices of imported goods, while a depreciating dollar may drive capital towards the cryptocurrency market. Eugene Epstein, head of trading and structured products at Moneycorp, stated that if the trade war leads to inflation that weakens the dollar, Bitcoin may actually benefit. This is because, in the long run, under the trend of dollar depreciation, global investors may seek other assets to hedge against the risk of dollar depreciation, and they may turn to invest in Bitcoin and other fixed-supply inflation-resistant assets. Additionally, some other countries may choose to devalue their currencies in response to tariff shocks, at which point cryptocurrencies may also become a channel for capital outflows.

Finally, trade conflicts may exacerbate the trend of de-dollarization, as tariff trade wars deepen the trust rifts between countries, prompting nations to reduce their reliance on the dollar. For example, Russia and China have gradually reduced their use of the dollar in international trade, and countries in the Middle East have begun to experiment with using the yuan or other currencies for energy settlements. In 2022, Iran used Bitcoin mining to circumvent oil export sanctions. This trend of de-dollarization will further drive global demand for cryptocurrencies, bringing new development opportunities to the cryptocurrency market.

2.2 Impact on Investors

On one hand, investors will have to optimize their investment portfolios. Cryptocurrencies are still viewed as speculative or high-risk/high-volatility asset classes. In the context of escalating trade frictions triggered by tariff policies, investors may need to reassess their portfolios, reduce exposure to volatile assets, and lower the investment proportion of high-risk investments like cryptocurrencies, ensuring an appropriate ratio of cash, government bonds, or other safe investment asset classes.

On the other hand, the frequent changes in Trump's tariff policies affect investors' stable expectations and impact their investment confidence. Trump claimed during his presidential campaign that he was "the president who supports innovation and Bitcoin," announcing a package of supportive policies for cryptocurrencies. Just before his second term as president, he publicly issued a personal meme coin, "Trump Coin ($Trump)." After taking office, he also sent signals of support for cryptocurrencies, including establishing a working group to study regulatory frameworks and cryptocurrency reserve plans. However, the macro risks triggered by tariff policies offset the market's expectations for policy benefits. Starting in February, Trump implemented comprehensive tariff measures against China, Canada, and Mexico, with a nearly frenzied tariff offensive. The related policies were erratic, and the hastily announced news created chaos in the economy and financial markets. This uncertainty posed challenges for all parties trying to make decisions, triggering market concerns, and investors' confidence may be undermined, forcing them to sell off cryptocurrencies or reduce new investments.

2.3 Impact on Related Enterprises

Trump's tariff policies have multifaceted impacts on cryptocurrency enterprises, especially those in the upstream and downstream of mining. First, tariffs will affect hardware imports, leading to increased costs for mining machine manufacturers to obtain key components, raising production costs and impacting their profitability, while research and development will also face certain obstacles. Second, in the short term, there may be a shortage of mining machines, with rising prices, increasing the costs for pool operators and mining enterprises to upgrade equipment, significantly increasing their operational pressure. Third, in the long run, tariff policies may lead mining machine companies and mining enterprises to relocate to regions less affected by the trade war, altering the geographical distribution of cryptocurrency enterprises globally.

Additionally, tariffs will impact exchanges. First, tariffs may lead to global trade tensions, stock market fluctuations, or increased economic uncertainty. In this context, some investors may view cryptocurrencies as hedging tools, increasing trading volumes and attracting more short-term traders into the cryptocurrency market, which may lead to a short-term rise in trading volumes and fee income for exchanges. Second, tariffs may trigger capital controls or foreign exchange restrictions, making cryptocurrencies an alternative channel for cross-border capital flows, driving demand for deposits and withdrawals on exchanges. Finally, the Trump administration may adjust the financial regulatory framework alongside tariff policies, strengthening scrutiny of cryptocurrencies, such as anti-money laundering and tax compliance, which may increase the operational costs and compliance pressures for exchanges.

Lastly, tariffs will also affect the stablecoin market. Companies seeking to maintain profits will inevitably look for alternative solutions to bypass tariff barriers, and stablecoins may become one of those options. In regions with strict capital controls, such as Asia and Latin America, USDT is a primary tool for circumventing dollar exchange restrictions. If tariffs lead to the depreciation of emerging market currencies (such as the yuan), local users may increase their holdings of USDT to hedge against risks, thereby driving up demand for USDT; however, if U.S. sanctions involve entities using USDT, it may threaten its liquidity. USDC, due to its high compliance, is more often used for traditional institutional deposits and compliant DeFi protocols. If U.S. companies turn to using cryptocurrencies for payments due to increased tariff costs, USDC may become the preferred settlement tool; if market risk aversion continues to rise, institutional investors may also view USDC as a "safe stablecoin," encroaching on USDT's market share.

3. Response Strategies from Various Parties

3.1 Overall Level of the Cryptocurrency Market

Tariff threats can trigger panic over trade wars, leading to phase-specific risk aversion, but this panic generally has a short-term characteristic. Historical experience shows that during the tug-of-war period of the U.S.-China trade relations in 2018, the market's reactive response to sudden tariff policies typically underwent three stages of evolution: "panic - digestion - recovery." Initially, there is panic, but over time, the market often adapts and stabilizes. The market usually possesses strong self-regulating capabilities and forms stable expectations based on historical experience and policy patterns. Although this tariff policy has caused short-term market fluctuations, in the long run, as mentioned earlier, it will not fundamentally change the market. The cryptocurrency market will continue to attract investors who are optimistic about its development potential, and these investors will buy on dips when market prices fall, providing stable support for the market.

3.2 Corporate Level

First, for cryptocurrency companies affected by tariffs on their production and operational activities, they can consider expanding their suppliers to regions not affected by tariffs, such as Southeast Asia, to avoid reliance on a single supply chain from the U.S. or China. Additionally, under tariff pressure, they can consider establishing production bases in the U.S., Russia, and other locations to mitigate the impact of import tariffs. Second, international traders and cryptocurrency companies can flexibly use stablecoins for settlement to reduce the impact of trade policies on cross-border payments, and they can even utilize DeFi protocols to address traditional financial restrictions caused by trade barriers. Furthermore, cryptocurrency companies can set up overseas subsidiaries and use offshore financing methods (such as in Singapore or Dubai) to circumvent uncertain tariff and regulatory risks. Finally, cryptocurrency companies should also focus on compliance building, emphasize communication with government departments, and actively protect and advocate for their rights.

3.3 Individual Investor Level

First, investors can diversify their asset holdings and pay attention to risk management. In addition to investing in cryptocurrencies, they can also invest in traditional assets such as stocks, bonds, and gold, as these can hedge against investment risks in cryptocurrencies during significant market fluctuations, enhancing the robustness of their asset allocation. Second, investors can adopt a long-term investment philosophy ("HODL"), avoiding blind chasing of price increases or selling during declines, and instead patiently wait for market recovery and suitable entry opportunities. Third, by keeping an eye on industry dynamics and policy trends, and understanding relevant information, investors will be able to make more informed investment choices. Fourth, even if unfortunate investment losses occur, individual investors can minimize losses through methods such as pre-tax capital loss deductions. For example, under U.S. tax law, any realized capital losses can be used to offset similar capital gains or ordinary income, which helps investors save significant tax expenses in the volatile cryptocurrency market. However, it is important to note that such tax calculations can often be complex and require a high level of expertise. Considering the high costs, low efficiency, and potential for errors in manual tax filing, individual investors may consider using FinTax for Individuals, a professional tax filing software that allows for safe, accurate, and quick generation of compliant tax reports by simply importing cryptocurrency wallet or exchange data with one click.

4. Summary and Outlook

The tariff policies of the Trump administration are a direct manifestation of trade protectionism, which has had both direct and indirect impacts on the cryptocurrency market. In the short term, the liquidity tightening caused by tariff increases will lead to a simultaneous decline in the cryptocurrency market; however, if the tariff policies persist, in the long run, they may accelerate the decentralization transformation of the cryptocurrency industry, promote stablecoins as a new medium for cross-border trade, generate positive effects, and give rise to more compliant cryptocurrency financial products. In the current context, both enterprises and individuals can flexibly formulate strategies to respond to tariff shocks, seize structural opportunities from negative impacts, and adjust risk aversion demands amid economic fluctuations, thereby achieving optimal benefits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。