The key to winning in the new generation of EVM chains lies in comprehensive value rather than mere throughput.

Written by: yusufxzy, Delphi_Digital Researcher

Translated by: Rhythm Little Deep

Editor's Note: The current competition focus among EVM-compatible chains (such as Sonic, MegaETH, Monad, Sei, Fuel) has shifted from decentralization and security to raw performance and ecological strategy. Each chain is vying for market share through differentiated paths (such as developer incentives, extreme speed, ecological pre-construction, technical optimization, or DA layer innovation), but the ultimate winner must establish advantages across comprehensive dimensions such as speed, user experience, economic models, and ecological maturity, rather than relying solely on throughput.

Below is the original content (reorganized for readability):

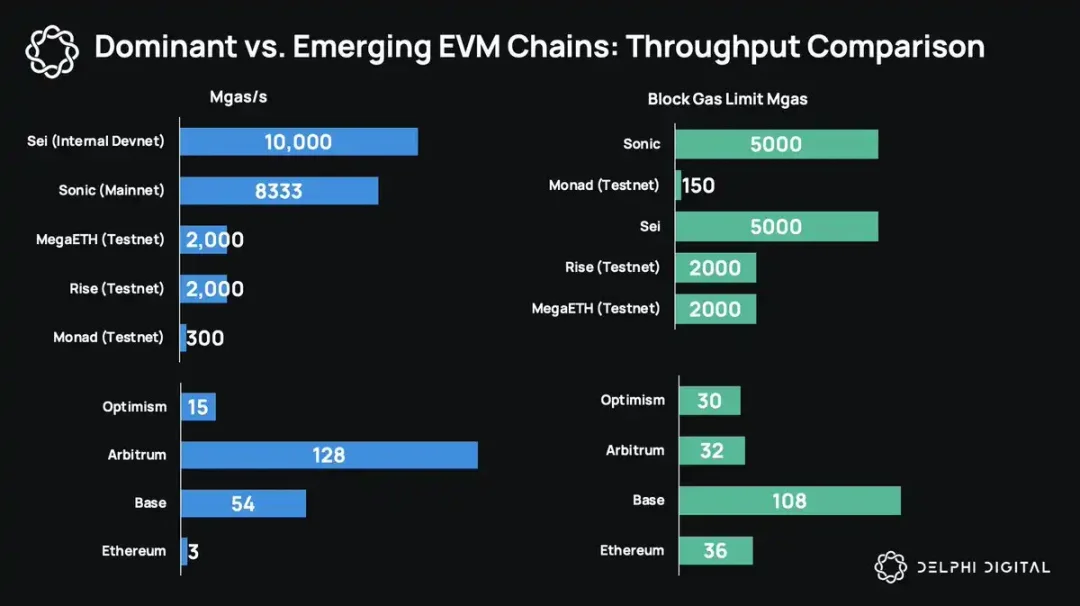

The blockchain field has entered a new competitive dimension. The early L1 and L2 battles focused on decentralization, composability, and security, but the battlefield has now shifted to raw performance. Multiple EVM-compatible chains, including Sonic, MegaETH, Fuel, Monad, and Sei, are competing to break through what was once considered the impossible scalability peak. But is raw performance the key to victory? This article analyzes the strategic differences among these chains.

Sonic: Linking Developer Earnings to Ecological Contributions

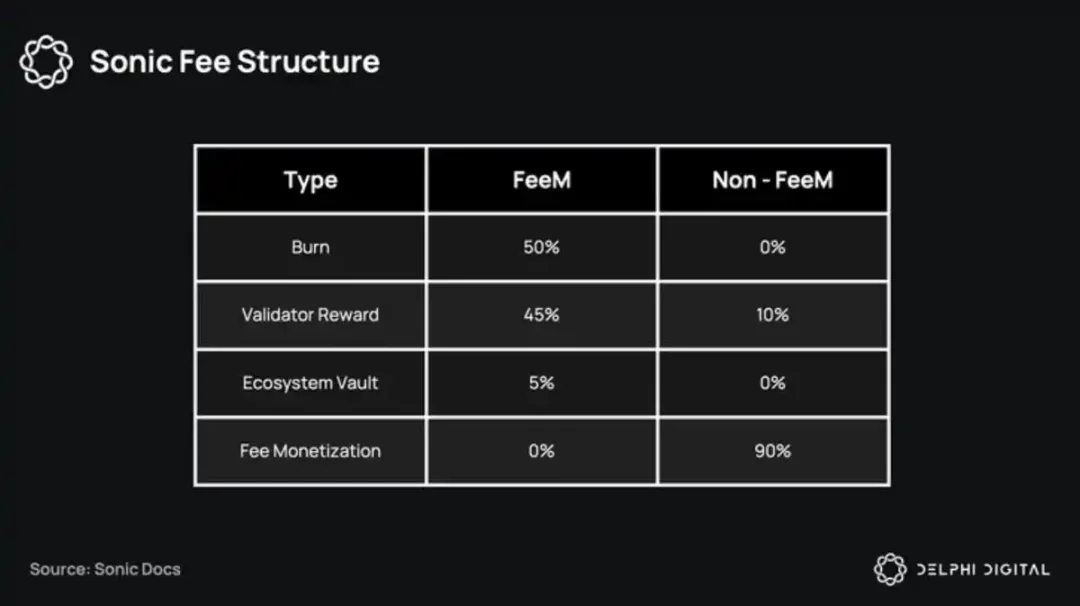

@SonicLabs (formerly Fantom) has completed a strategic transformation, with its core innovation, the "Fee Monetization (FeeM)" mechanism, allocating 90% of transaction fees generated by applications to developers, while validators receive only 10%.

This model has shown results—within the ecosystem, the DEX project @ShadowOnSonic quickly ranked in the Top 4 for weekly revenue. At the same time, Sonic has driven TVL to a historical high of $962 million through dual incentives of DeFi application interactions and token airdrops.

Competitive Advantages:

- Direct economic incentives tied to developer loyalty

- High-yield driven application ecosystem stickiness

- Early adoption metrics validate model effectiveness

Potential Challenges:

- Decentralization is still at a primary stage (currently about 35-40 validator nodes)

- Needs to maintain development momentum to eliminate the historical impact of the Fantom brand

MegaETH: Balancing Extreme Speed and User Experience

@megaeth_labs' testnet has set a performance record of gigabit Gas/s with a block time of 0.1 milliseconds, achieving breakthroughs by discarding the consensus mechanism.

But the chain's ambitions go beyond data: it is the first to experimentally support EIP-7702, addressing a historical pain point where users have lost over $300 million since 2020 due to authorization operations through transaction batching and Gas abstraction innovations.

In terms of community building, MegaETH raised $10 million in just 10 minutes at a $2 million valuation, with subsequent NFT fundraising reaching a valuation of $6 million, forming a stark contrast to VC financing.

Competitive Advantages:

- Testnet performance metrics are industry-leading

- UX innovation first-mover advantage (EIP-7702)

- Community consensus gained through fair token distribution

Potential Challenges:

- Dependence on EigenDA data availability layer

- Radical performance goals awaiting real-world validation

Monad: Building an Ecosystem Before Launch

Although @monad_xyz's mainnet has not yet launched, it has already built a complete infrastructure matrix: on the first day, it integrated with Phantom Wallet, attracting top DeFi protocols like Uniswap/Balancer, and incorporated cross-chain solutions like LayerZero.

This "out-of-the-box" strategy is a dimensional strike in today's crowded blockchain race.

Competitive Advantages:

- Ready-to-use ecological infrastructure

- High liquidity channels at launch

Potential Challenges:

- Needs to convert early momentum into sustained growth

Sei: The Dilemma of a Technological Overachiever

@SeiNetwork has achieved internal scalability breakthroughs through deep optimization of the consensus and storage layers, and has poured funds into supporting early developers. However, the current ecosystem still lacks benchmark applications, and there is a gap in user scale compared to competitors, with technological advantages yet to translate into market influence.

Competitive Advantages:

- Proven scalable technology architecture

- Special funding programs for builders

Potential Challenges:

- Low actual adoption rate

- Urgent need to create phenomenal applications

Fuel: Breaking Free from Ethereum's DA Constraints

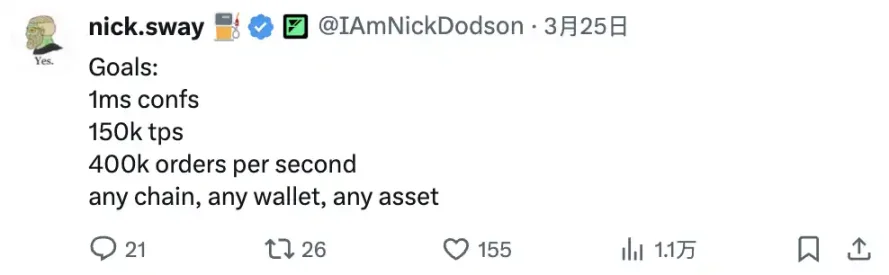

@fuel_network's upcoming "Redacted" L2 adopts an alternative DA solution, aiming for a throughput of 150,000 TPS, marking a strategic shift from Ethereum compatibility to performance priority. Its vision of 1 millisecond confirmation and 400,000 orders per second will redefine public chain performance benchmarks.

Final Thoughts: The Value War Beyond Throughput

Although the market value of these tokens remains to be seen, the current L1 and L2 tracks have become saturated. As various chains compete fiercely in terms of liquidity, applications, developers, and users, valuations may show a downward trend.

When gigabit-level Gas becomes the norm, the true winners will be those public chains that can provide higher value—encompassing speed advantages, incentive mechanisms, user experience, ecological completeness, and security guarantees. The gigabit Gas war is intensifying, but the ultimate key to victory is certainly not limited to raw throughput.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。