编译:Tim,PANews

比特币在2025年第一季度的表现创下近十年最差纪录,尽管年初价格一度飙升至109590美元的历史新高,但季度收盘仍录得近11%的跌幅。市场最初对特朗普可能胜选及推行亲加密货币政策的乐观预期,随着实质性监管改革迟迟未落地,迅速演变为教科书般的"卖出事实"行情。自历史高点以来,比特币最低跌至77041美元,最大回撤近29%,此后主要在78000至88000美元的交易区间内震荡。

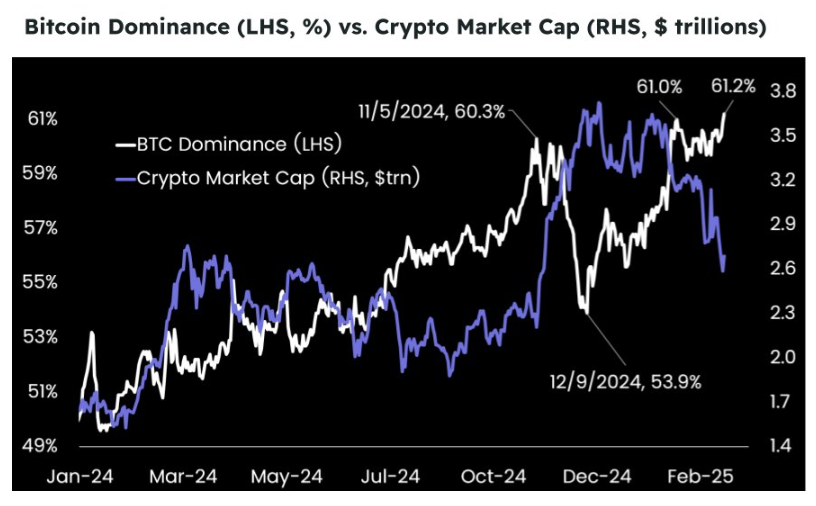

然而,市场结构仍对比特币有利。尽管加密货币总市值大幅下跌,但比特币的主导地位已攀升至61%以上,这表明在宏观不确定性加剧的环境下,资金正从风险更高的山寨币轮动至比特币。以太坊、Solana等山寨币较周期高点已下跌35%-50%,这进一步强化了比特币作为加密市场“储备资产”的地位。

随着第二季度的开启,市场价格走势仍高度依赖宏观经济信号的指引,美联储政策动向及ETF资金流动情况将继续主导市场方向。尽管当前投资者恐慌性抛售的迹象已有所缓解,但在流动性持续紧缩的环境下,市场若要形成趋势性突破,仍需等待具有足够影响力的催化剂事件出现。

从宏观经济形势来看,美国经济的某些领域正显现出韧性,例如贸易逆差收窄和耐用品支出增加,但这些亮点被更深层次的结构性隐忧所掩盖。受新关税政策推高进口成本等因素推动,通货膨胀的加速超出预期。2月份核心通胀率环比上涨0.4%,创下一年多来最大月度涨幅,而消费者预期显示通胀可能在较长时间内持续处于高位。

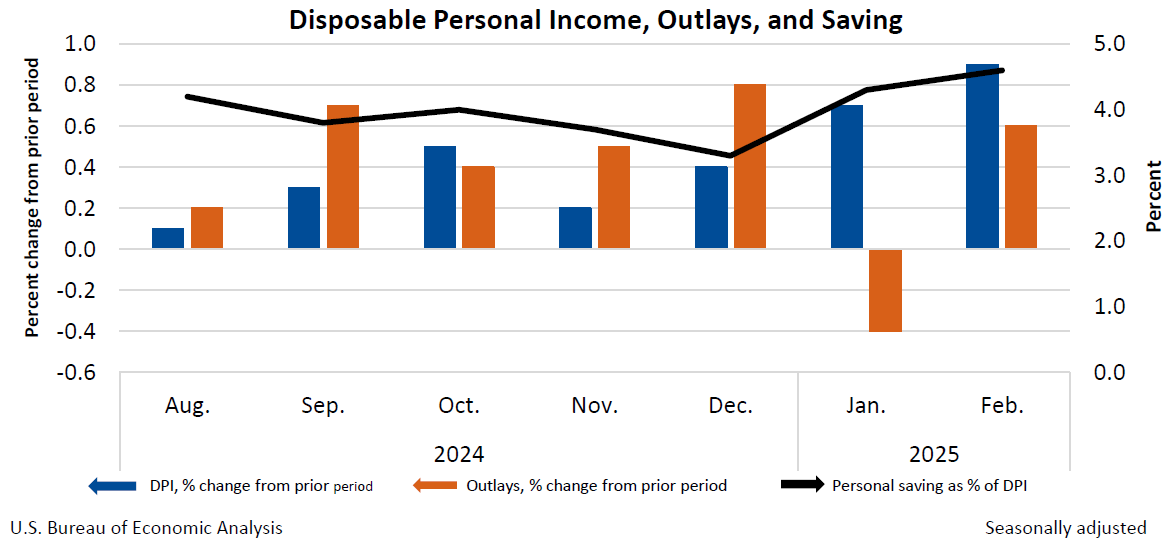

个人可支配收入、支出与储蓄

与此同时,经济增长正在放缓。扣除政府支出后,实际收入增长依然疲软,而作为关键经济驱动力的服务业支出已开始萎缩。消费者信心持续下滑,美国经济咨商会消费者信心指数跌至两年低点,更多美国人预期失业率将会上升。这些趋势表明家庭的谨慎情绪正在加剧,具体表现为个人储蓄率持续攀升。

贸易政策仍是当前的核心压力点。近期关税上调以及市场对四、五月可能出台进一步措施的预期,正促使企业和消费者调整行为模式,包括提前采购、推迟投资或缩减招聘规模。尽管二月贸易逆差有所收窄,但这一数据紧随一月份进口激增之后,而此前的进口激增可能已计入GDP预测。受此影响,一季度经济增长预计将显著放缓。

尽管当前经济不确定性持续存在,但加密行业仍受益于友好的政治环境,特朗普政府正推动监管框架的日益明晰,另外机构参与热情也在不断增长。

美国证券交易委员会正式撤销了对行业三大主要参与者Kraken、Consensys和Cumberland DRW的诉讼。这一举措标志着该机构从先前强硬执法的监管立场,转向了更具协作性的监管方式。同时预示着监管部门将致力于为加密货币行业制定明确、更具建设性的规则体系。

为进一步推进加密监管,美国证券交易委员会加密资产工作组宣布,将于2025年4月至6月期间举办四场专题圆桌会议。这些会议将围绕加密交易监管、数字资产托管、代币化及去中心化金融未来发展等核心议题,邀请行业各方参与研讨。活动将向公众开放,此举体现了SEC在制定加密货币政策过程中推动公开对话、增强透明度的监管导向。

与此同时,特朗普媒体与技术集团宣布与加密货币交易平台Crypto.com达成合作,计划推出一系列专注于加密货币的交易所交易基金ETF。此举标志着该集团正式进军金融产品领域,旨在满足市场对数字资产投资工具日益增长的需求。尽管该计划仍需获得监管机构批准,但若成功落地,将大幅提升特朗普媒体与技术集团与Crypto.com在传统金融领域的知名度。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。