Either a self-revolution within the Ethereum community or a price revolution from the BTC and SOL ecosystems.

Written by: Wenser, Odaily Planet Daily

There is no doubt that the Ethereum ecosystem, which has just celebrated its tenth anniversary, is now facing a "midlife crisis."

On one hand, co-founder Vitalik is still pushing for ongoing reforms within the Ethereum Foundation, which have yet to be declared complete; on the other hand, ETH is experiencing setbacks in various aspects such as technical direction, ecosystem development, and price performance. A series of issues, including sell-offs from numerous ancient whales, net outflows from Ethereum spot ETFs, and the increasingly rigid ETH deflationary mechanism, are troubling this once "king of altcoins" large ecosystem.

When the vision of decentralization and market price performance cannot coexist, perhaps we need to look for answers in the various data performances of the Ethereum ecosystem.

Ethereum in Trouble

Ethereum's Daily Burn Rate Hits Historic Low

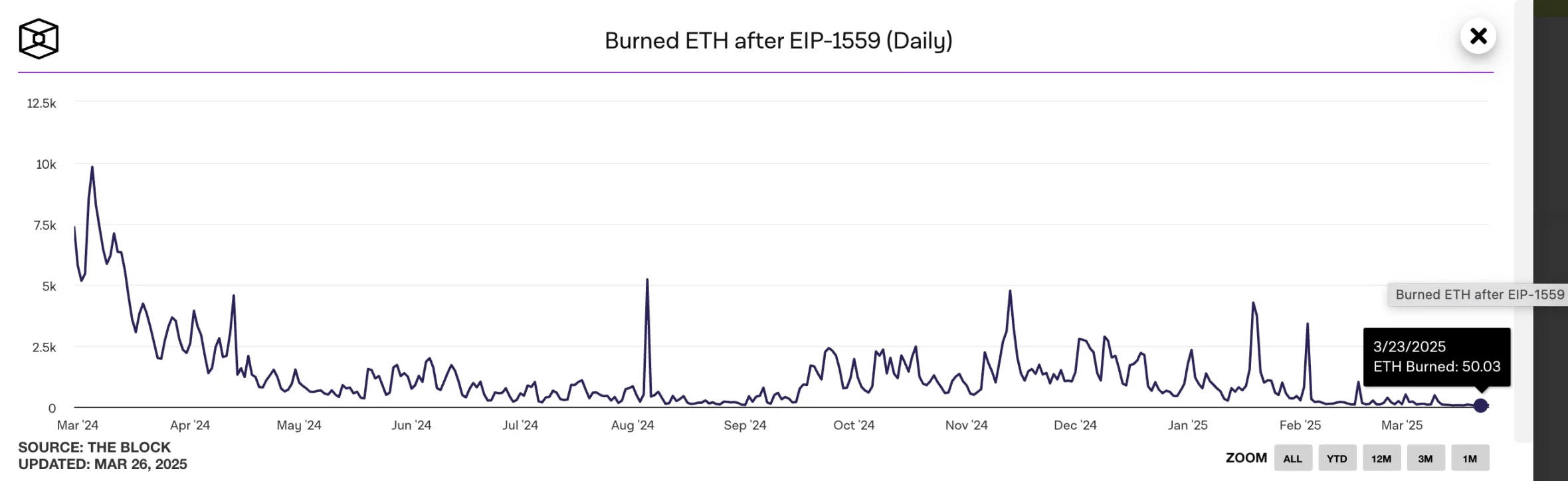

On March 22, the Ethereum network burned only 53.07 ETH in a single day, worth approximately $106,000; on March 23, the network burned just 50.03 ETH, setting a new historic low.

Source: TheBlock Data

These figures indicate a significant decrease in demand for Ethereum's block space. The EIP-1559 change simplified the transaction fee process while requiring the burning of all ETH used to pay the base transaction fee. This mechanism aims to reduce inflationary pressure and may make Ethereum a deflationary asset during peak network activity.

However, contrary to expectations, the effect of EIP-1559 in alleviating ETH's inflation is not apparent as the activity within the Ethereum ecosystem continues to decline.

Additionally, in recent weeks, the number of new addresses created, transaction counts, and daily transaction volumes within the Ethereum ecosystem have also decreased.

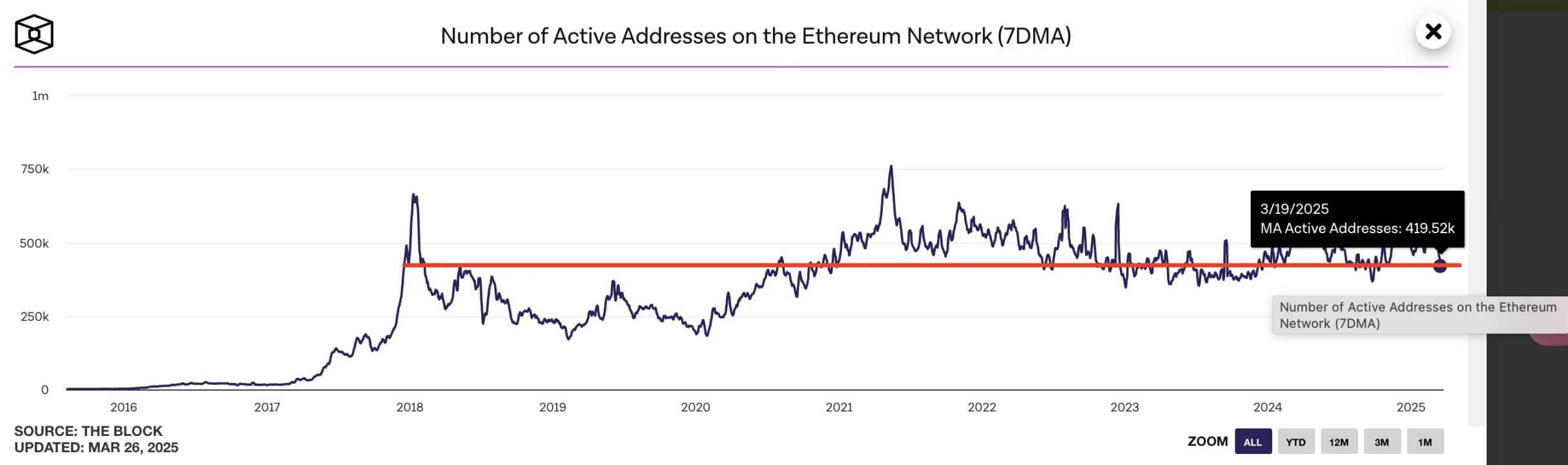

Ethereum Network's 7-Day Average Active Addresses Drops to Year-to-Date Low

Source: TheBlock Data

According to TheBlock data, the 7-day average number of active addresses on the Ethereum network fell to 419,000 on March 19, marking the lowest point since 2025; it is on par with the number of active addresses in October 2024.

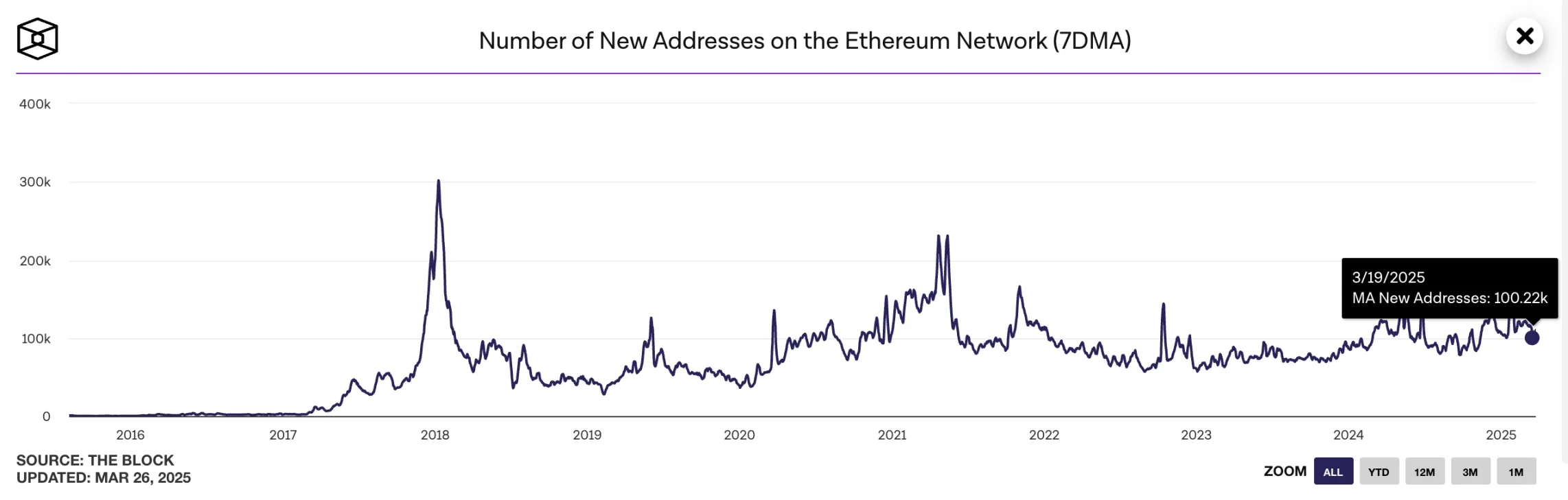

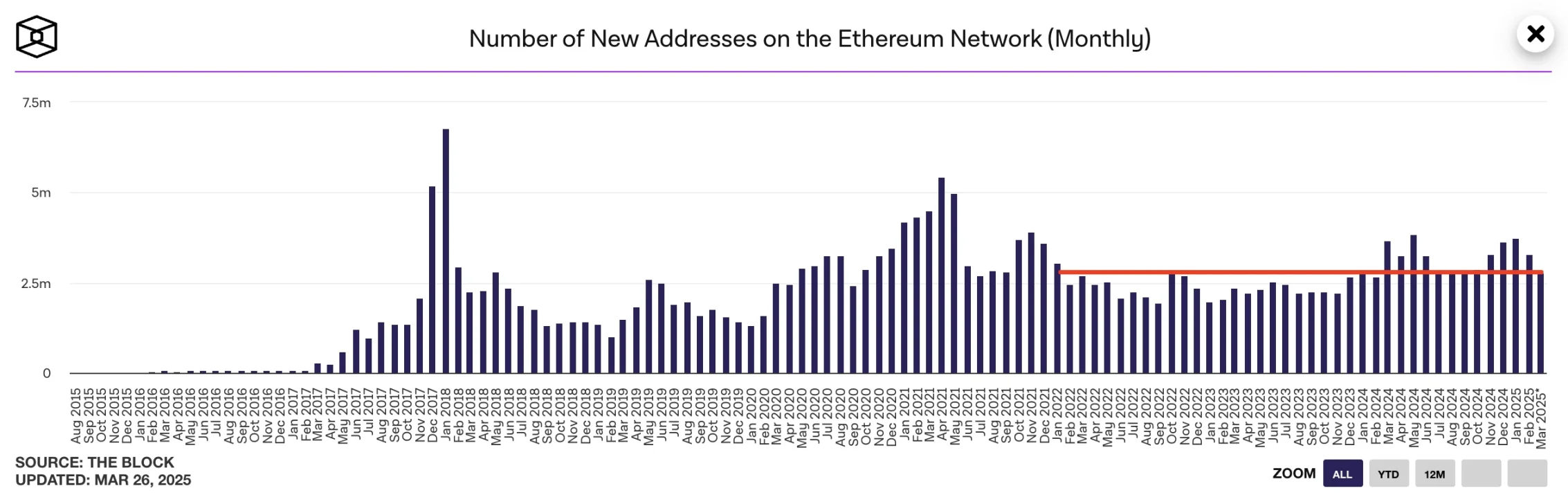

Ethereum Network's 7-Day Average New Addresses Drop to 100,000 Level

According to TheBlock data, on March 19, the 7-day average number of new addresses on the Ethereum network dropped to 100,220, matching levels seen around November 12, 2024; this represents a decline of over 38% compared to the 163,000 recorded on January 25 of this year.

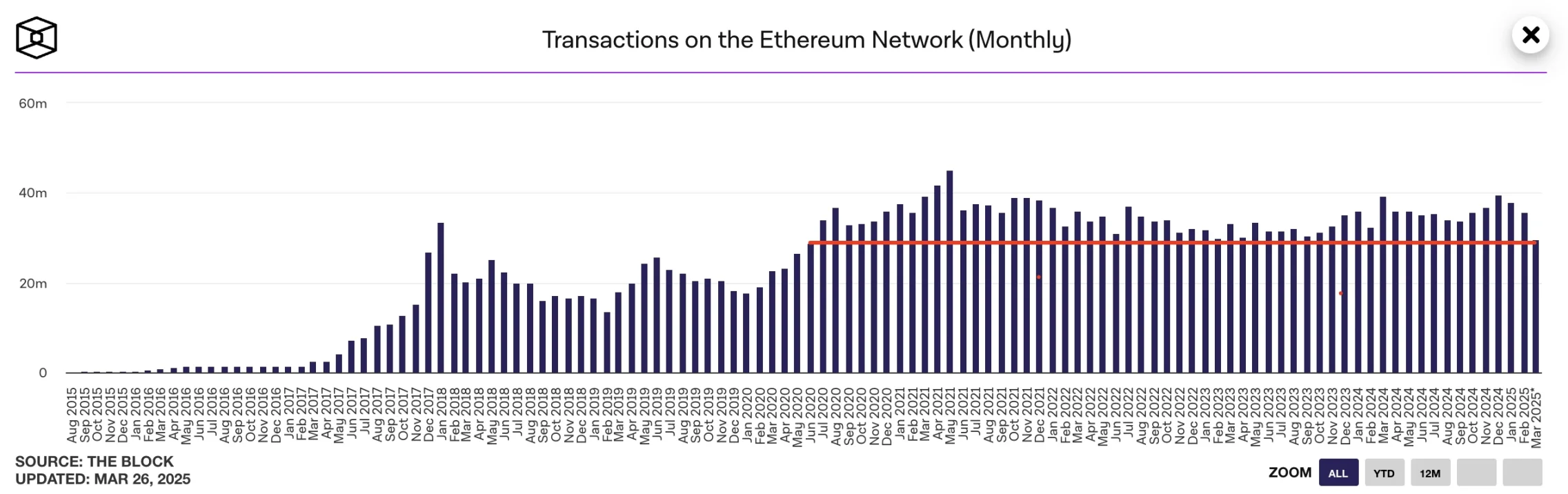

Ethereum Monthly Transaction Count Falls to Around 30 Million

According to TheBlock data, as of March 26, the monthly transaction count on Ethereum was 29.53 million; this is close to the level seen in September 2023, when the figure was approximately 28.8 million.

Ethereum Monthly New Address Count Drops to Pre-October 2024 Levels

According to TheBlock data, as of March 26, the monthly new address count on Ethereum was approximately 2.75 million, comparable to levels seen before October 2024; it is slightly higher than February 2024.

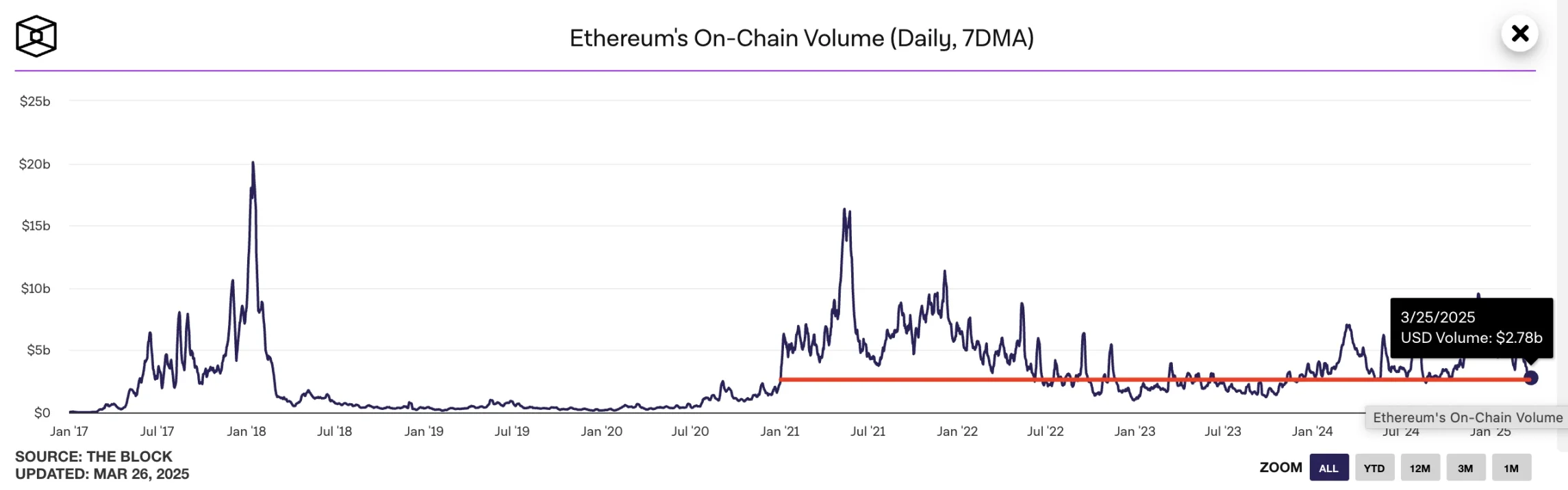

Ethereum Network's Daily Transaction Volume Drops to August 2024 Levels

According to TheBlock data, on March 25, the on-chain transaction volume for Ethereum was approximately $2.78 billion, which is about the same as the level seen in August 2024.

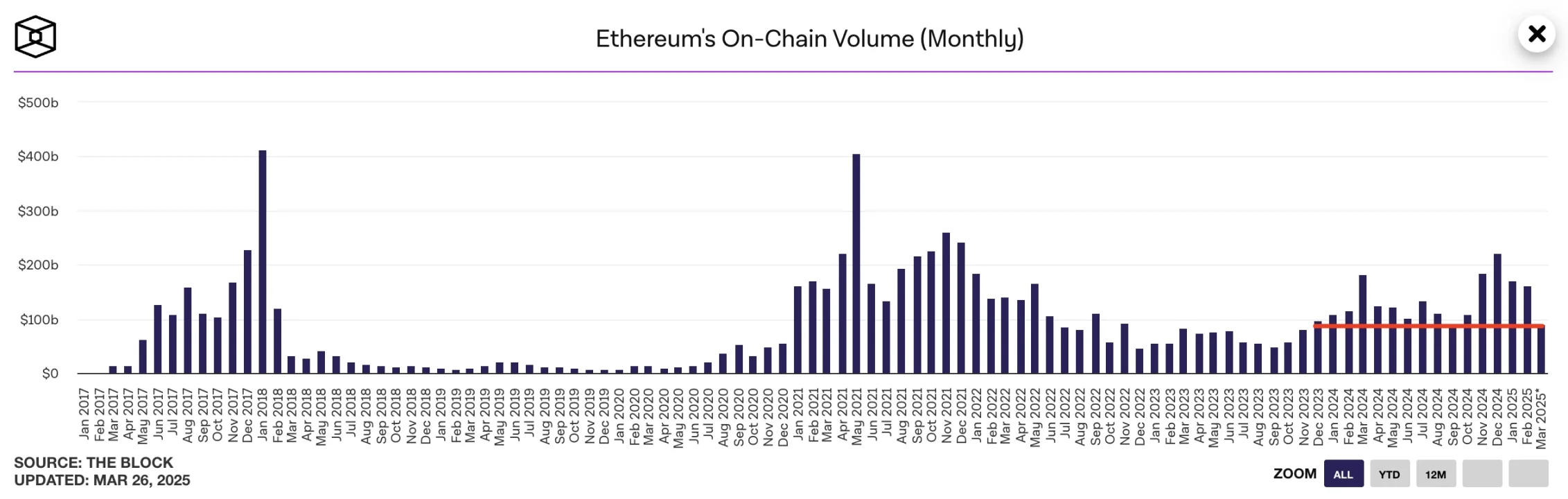

Ethereum Network's Monthly Transaction Volume Drops to September 2024 Levels

According to TheBlock data, as of March 26, the monthly on-chain transaction volume for Ethereum was approximately $90.93 billion, comparable to levels seen in September 2024, and slightly higher than the $80.99 billion recorded in November 2023.

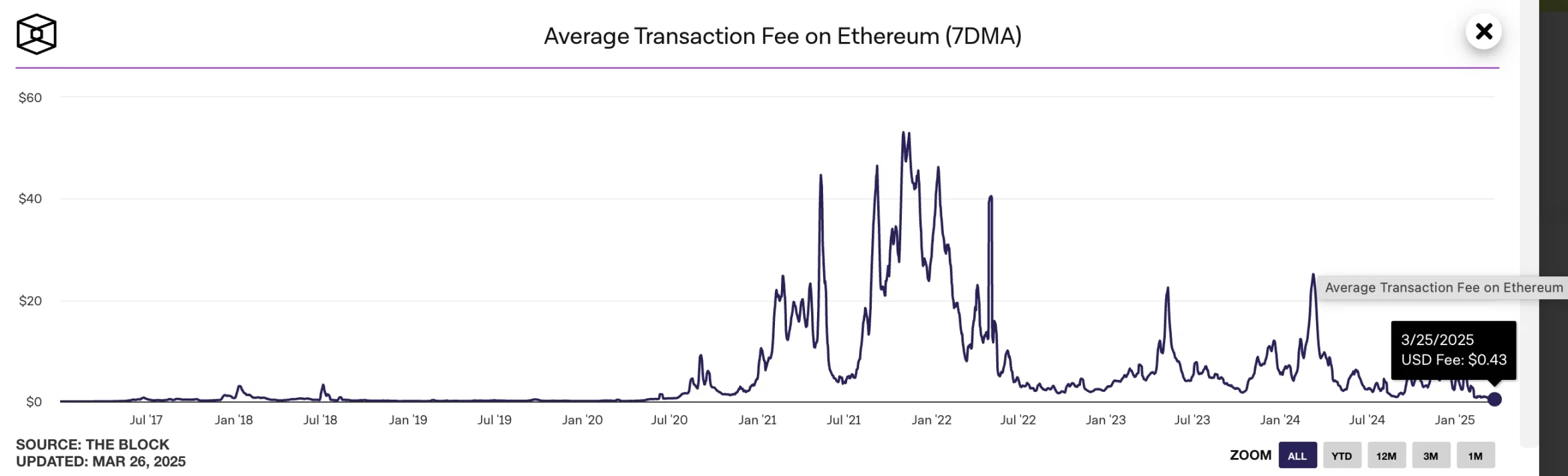

Ethereum Average Transaction Fee Cost Drops Over 99.1% from Historical Highs

According to TheBlock data, on March 25, the average transaction fee cost on Ethereum was only $0.43; compared to the average transaction fee of $52.53 on November 2, 2021, this is just 0.81%.

ETH Annual Inflation Rate Approximately 0.76%, Slightly Lower than BTC's 0.82%

According to ultrasound.money data, considering the burn rate over the past 7 days, ETH's supply is expected to grow by 0.76% annually.

Currently, the total supply of ETH is approximately 120 million; over the past 7 days, a total of 18,128.15 ETH was issued; 487.76 ETH was burned; the expected annual burn amount is about 25,000 ETH.

ETH's "Midlife Crisis": Wavering Between the Urgent Need for a New Positioning and Resistance to Traditional Financial Systems

ETH's "New Positioning Dilemma": Unable to Become the Second BTC

As Geoff Kendrick, head of digital asset research at Standard Chartered Bank, stated, Ethereum is in a "midlife crisis," still groping its way through a series of technological upgrades aimed at making itself more appealing to a broader audience.

In my personal view, whether it is ZK or L2 routes, in the short term and even in the medium term of 3-5 years, they seem somewhat powerless in boosting ETH's price and ecosystem development.

Meanwhile, in the past three months, the price of ETH has dropped by 40%, and even meme coins promoted by Trump and Argentine leader Milei have adopted Solana. Data provider Kaiko's research analyst Adam McCarthy believes that Ethereum is not interesting to most people; compared to Bitcoin, which has already established the narrative of digital gold, FalconX research director David Lawant also stated that Ethereum has lost in its native domain, and ETFs do not hold much attraction.

In other words, the vision of ETH as a world computer has lost the exciting feeling of "participating in building a new world" that characterized the blockchain world during its primitive period. It has gradually become a huge vested interest group and a closed development laboratory for technocrats.

Nevertheless, traditional financial markets still hold high expectations for the ETH ecosystem and are placing heavy bets.

BlackRock's BUIDL Fund Invests in RWA Sector: Over $1 Billion Deployed on Ethereum Chain

On March 23, news from Token Terminal indicated that BlackRock's BUIDL fund has deployed over $1 billion on the Ethereum chain, currently reaching approximately $1.145 billion. The BUIDL fund focuses on tokenizing real-world assets (RWA) and diversifies investments across chains such as Avalanche, Polygon, Aptos, Arbitrum, and Optimism, but Ethereum remains its core allocation.

Additionally, according to Nansen analysis, since March 12, 2024, the number of addresses holding 1,000-10,000 ETH has increased by 5.65%, while the number of addresses holding 10,000-100,000 ETH has grown by 28.73%. In other words, ETH whales are still accumulating, and their faith in Ethereum remains unshakable.

From an outsider's perspective, this is both a blessing and a curse for ETH— the blessing is that diamond hands are an indispensable part of maintaining price stability and ecosystem development; the curse is that vested interest groups are often unable and unwilling to promote disruptive innovation and transformative development, as it involves their own vested interests— as the saying goes, "touching the cake is like killing one's parents," and the crypto circle is no exception.

Conclusion: ETH Has Regressed to 2021 Levels and Needs a New Wave of Revolution

After experiencing the waves of GameFi, NFTs, and meme coins that began in 2021, ETH has gradually regressed to levels seen before 2021 starting in 2024. On one hand, there is the issue of liquidity further dispersing due to the embrace of L2 technology routes; while the ETH mainnet's gas issues have been resolved, the problems of lack of usage and interest have emerged. On the other hand, various sectors are being layer by layer debunked; not only the ETH ecosystem but all cryptocurrencies, including BTC, are gradually becoming "Americanized," becoming appendages of the U.S. economy.

The next step will either be a self-revolution within the Ethereum community or a price revolution from the BTC and SOL ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。