Author: Frank, PANews

In the deep night of the cryptocurrency market, a precise strike against the decentralized derivatives exchange Hyperliquid quietly unfolded. On March 26, a trader opened a massive short position of 430 million JELLYJELLY tokens, pushing Hyperliquid into a liquidity crisis and liquidation risk. As the price of JELLYJELLY skyrocketed by 560% and leading exchanges rapidly launched contracts, Hyperliquid was forced to make a life-or-death decision between decentralized principles and user asset security. This 2.5-hour-long battle not only exposed the governance paradox of decentralized exchanges but also became a textbook case of capital hunting in the crypto world.

Short Attack: A Carefully Planned Precision Strike

Following the previous 50x leverage whale incident, Hyperliquid was once again targeted by a malicious team. On the evening of March 26, a trader opened a short position of 430 million JELLYJELLY tokens (worth $4.08 million) on Hyperliquid. After a slight price increase, the user voluntarily closed part of the order and withdrew the margin. Due to insufficient counterparty liquidity, the remaining 398 million JELLYJELLY short positions had to be taken over by Hyperliquid again.

Subsequently, as the price of JELLYJELLY continued to rise, Hyperliquid's short positions sustained ongoing losses, with the maximum floating loss reaching $11.45 million. On-chain analyst @ai9684xtpa stated on social media that if the price of JELLYJELLY rose to $0.17, the treasury would be liquidated, resulting in a loss of the current $240 million held (Note: this was a calculation error by @ai9684xtpa; the actual liquidation price is $0.1479, and Hyperliquid employs a position splitting mechanism, meaning a single order will not lead to total loss).

It seemed that a deliberate short squeeze operation targeting Hyperliquid's treasury was about to unfold. If Hyperliquid chose to intervene, it would face community skepticism regarding its identity as a decentralized exchange. If it ignored the orders, a large number of users who had deposited funds in Hyperliquid's treasury would suffer significant losses. The sophistication of this conspiracy strategy could be likened to the contemporary "two peaches kill three warriors."

Next, the price fluctuations of JELLYJELLY repeatedly teased the life-and-death line of Hyperliquid.

Leading Exchanges Launch Contracts in a Flash, Hyperliquid Slams the Brakes

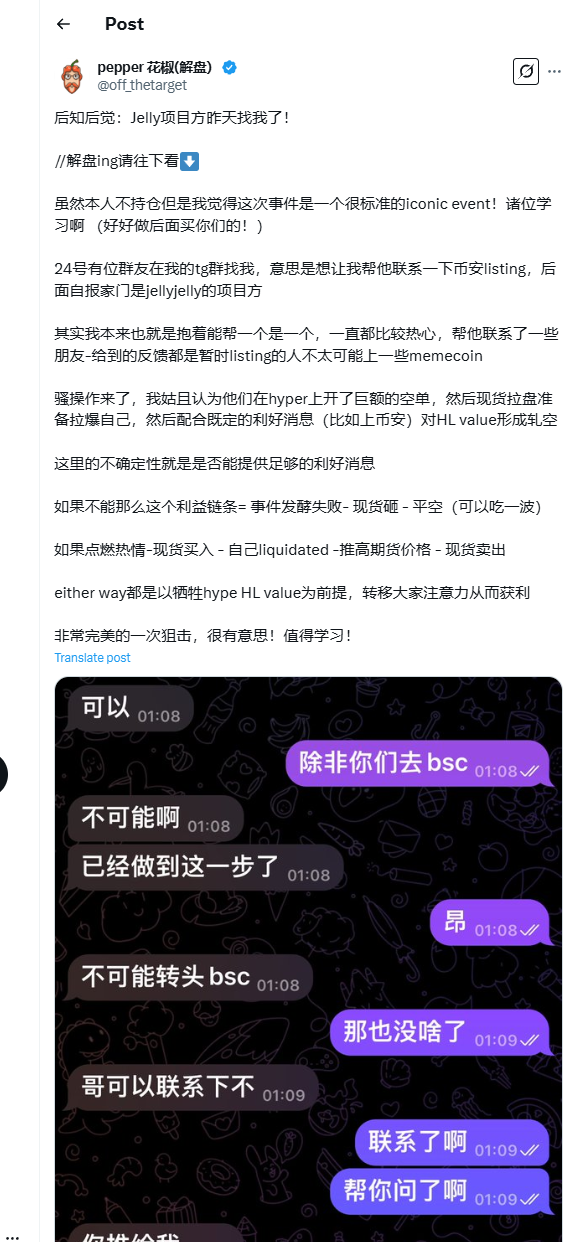

Blogger @offthetarget revealed on X that someone had contacted him on March 24 to help push for the listing of JELLYJELLY on Binance. @offthe_target believed that for the team operating the JELLYJELLY event, if they successfully listed on Binance, they could gain substantial profits through spot purchases. If the listing on Binance failed, they could still profit by holding short positions.

As events unfolded, the question of whether Binance would list JELLYJELLY at this critical moment became a sword hanging over Hyperliquid. Discussions about JELLYJELLY on social media continued to heat up.

At 11:10 PM, OKX announced that it would officially launch JELLYJELLY perpetual contract trading at 11:30 PM. A few minutes later, Binance also announced the launch of JELLYJELLY perpetual contracts.

Affected by this news, many users rushed to join the long positions, and the price of JELLYJELLY quickly surged from the initial $0.0095 at which the trader opened the position on Hyperliquid to a high of $0.06276, an increase of 560%, just needing to rise about 135% more to trigger Hyperliquid's liquidation price of $0.1479.

In this critical moment, Hyperliquid began to act. At 11:21 PM, users noticed that the price curve of JELLYJELLY on Hyperliquid had stopped updating, and the order book displayed as blank. The previously heavily losing JELLYJELLY positions were also no longer visible. The community speculated that Hyperliquid had delisted the JELLYJELLY token and controlled losses in this manner. (Some community users also reported that Hyperliquid had actually delisted the JELLY contract before Binance's launch announcement, right after OKX announced the contract launch.)

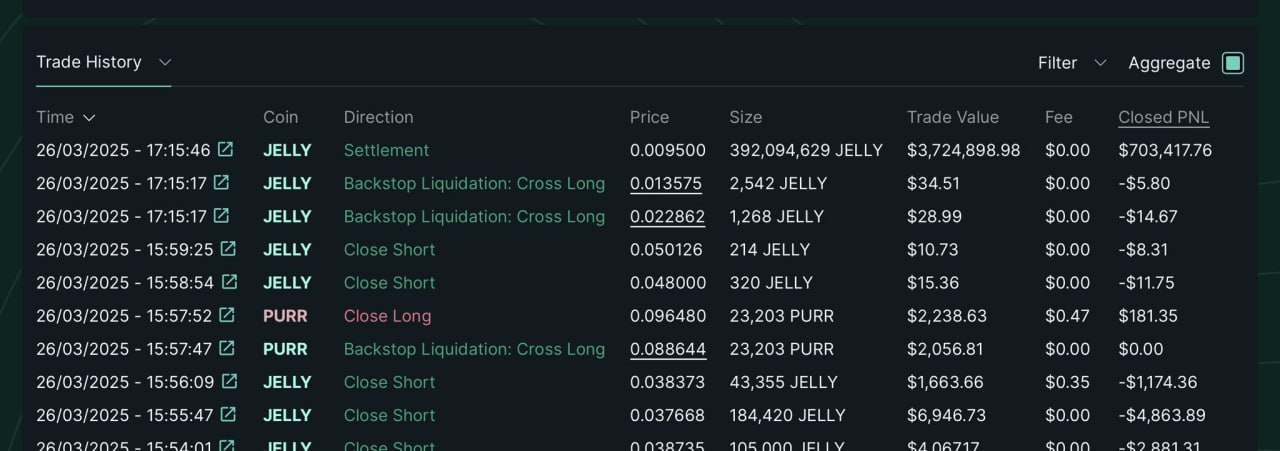

A few minutes later, in the settlement history order book of Hyperliquid's treasury, people discovered the settlement records of the JELLYJELLY short positions. The settlement price was $0.0095, the same as the opening price of the initial attacker. This also meant that Hyperliquid did not incur any losses on this order.

However, the market's spot price for JELLYJELLY at the time of settlement should have been around $0.05, a difference of over five times. This operation clearly defies logic. It seemed that Hyperliquid had intervened artificially, simply and crudely closing this losing order.

At 11:44 PM, after remaining silent throughout the process, Hyperliquid's official account finally explained on Discord: "After discovering evidence of suspicious market activity, the validator group held a meeting and voted to remove the JELLY violators. All users except the marked addresses will receive full compensation from the Hyper Foundation. This will be automatically completed in the coming days based on on-chain data. No tickets are required. The method will be detailed in a later announcement. Like other chains, validators usually need to convene everyone to take decisive action to ensure the integrity of the network. Enhancing the robustness and transparency of the voting system is a priority. Please note that as of the writing of this article, HLP's 24-hour profit and loss is approximately $700,000. We will make technical improvements and learn from this experience to make the network stronger. More details will be shared soon."

In this announcement, several core elements were highlighted: 1. The operation was a voting decision (maintaining the mechanism of decentralized governance). 2. Compensation will be provided for users who incurred losses by opening positions in JELLYJELLY on Hyperliquid (but excluding the violators, i.e., the addresses that initiated the attack). 3. In this practice, the treasury did not incur losses and still maintained a profit of $700,000 within 24 hours (boosting user confidence in the treasury's profitability).

With Hyperliquid forcibly closing the orders, this targeted attack on Hyperliquid was declared a failure. The price of JELLYJELLY began to plummet, dropping 67% within 13 minutes. Perhaps sensing that the market's violent fluctuations could affect the listing outcome, OKX quickly announced a delay in the listing of JELLYJELLY.

Dual Questions of Liquidity Traps and Treasury Design

At this point, the targeted demolition of Hyperliquid seemed to come to an end. Although the entire event lasted only 2.5 hours, during this short time, a decentralized derivatives exchange with a market value of about $5 billion became the target of criticism. The issues exposed and the various forces at play can be considered a classic case of conspiracy in the crypto world. There are still some questions worth interpreting.

First, what was the logic behind the initial trader's operation? What design flaws of Hyperliquid does this reveal?

The first exposed issue is Hyperliquid's trading liquidity problem. Unlike the previous 50x leverage whale choosing Ethereum as the trading currency, this time the trader chose a relatively niche token like JELLYJELLY. Data shows that the trading volume of Hyperliquid's JELLYJELLY contracts is sluggish, usually only a few tens of thousands of dollars per minute. Therefore, when the trader attempted to close a large short position, if there was not enough liquidity on the order book, Hyperliquid would intervene to provide liquidity.

Secondly, this raises the downside of Hyperliquid's treasury acting as a counterparty. Compared to Hyperliquid's situation, centralized exchanges (CEX) rely more on market makers and centralized order book management when handling large orders, rather than depending on community-provided liquidity pools (such as GLP or HLP).

Behind the Zero-Sum Game: No Winners Among the Instigators

It seems that Hyperliquid preserved its reputation for decentralized governance through voting. However, subsequent revelations from @spreekaway indicated that Hyperliquid's voting validators were all votes from the Hyper Foundation. This was criticized by the community, as this vote was still not a resolution reached by the entire community but rather a decision made by Hyperliquid's officials. Although the situation was urgent, from this perspective, Hyperliquid's decentralized governance still had a veil pulled back.

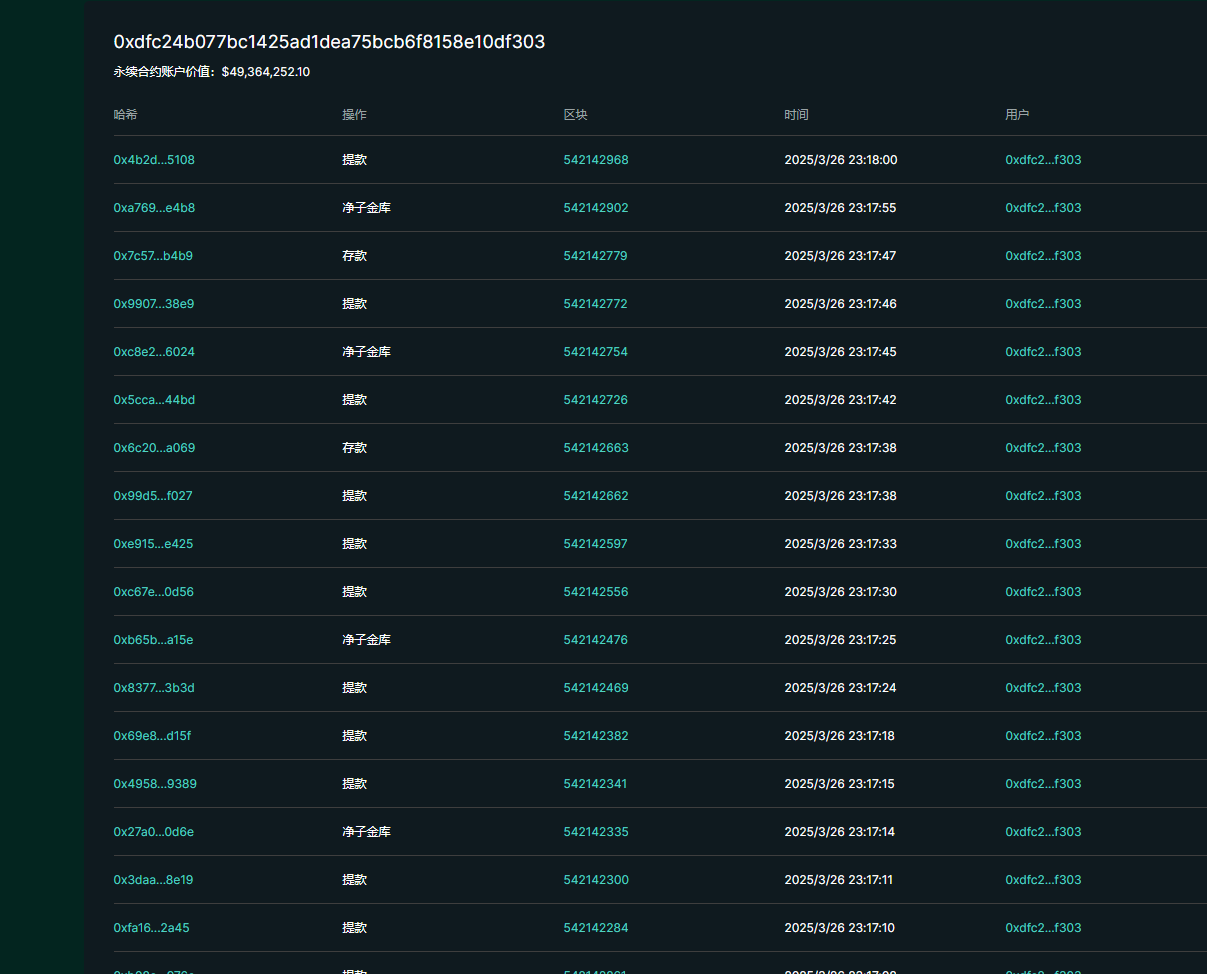

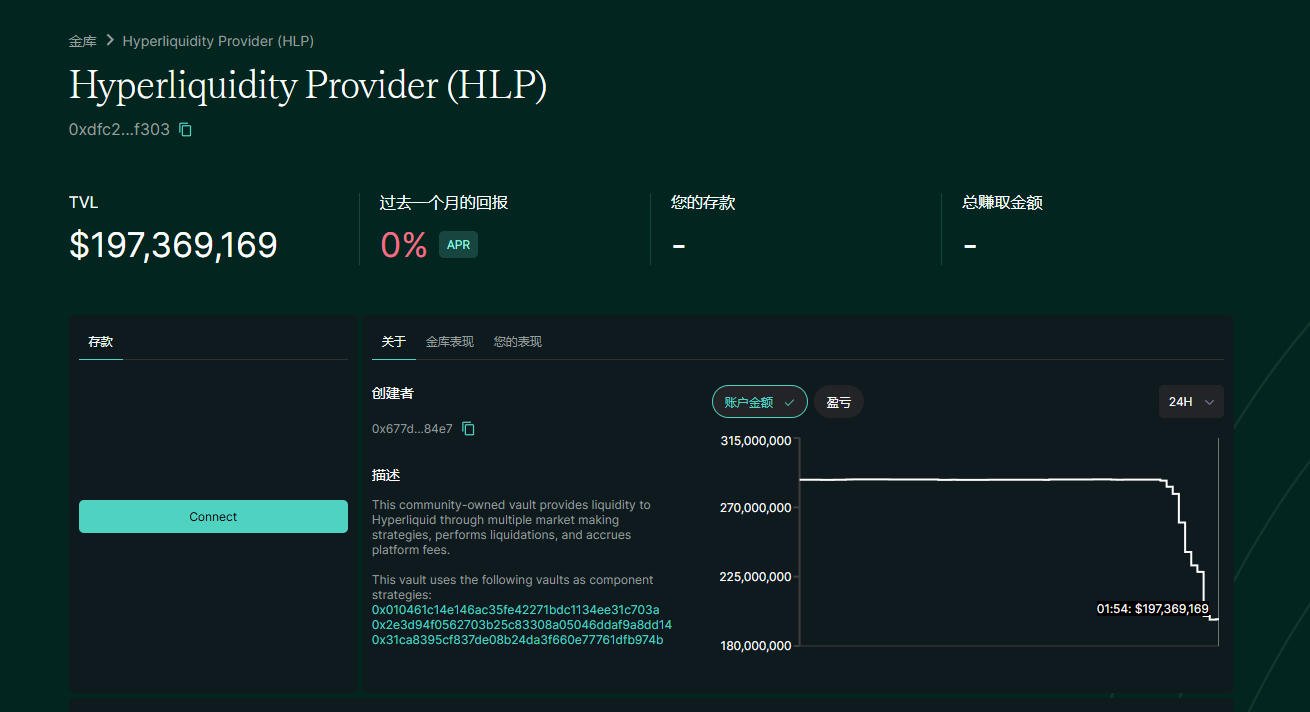

Moreover, Hyperliquid's user trust was significantly damaged as a result. During the holding of short positions, PANews found that many funds on-chain chose to withdraw from the treasury to avoid being affected by potential liquidation losses. Although Hyperliquid's treasury yield was eventually pulled back to normal levels, the deposit amount decreased by $90 million in a short time, a reduction of 30%. From this perspective, while Hyperliquid seemingly avoided treasury losses, it also suffered a significant blow.

The growth of the treasury over the past three months was wiped out overnight.

Moreover, the trader who initiated this event seems to have failed to profit from it. Since Hyperliquid chose to exclude the violators from the compensation list, this trading team will suffer losses from the price fluctuations of the long and spot orders they opened on Hyperliquid, and thus did not gain the expected profits. Their positions opened on other platforms may also incur losses due to the market's violent fluctuations.

For the other exchanges that quickly listed JELLYJELLY during this process, the token's popularity may not attract many users after this incident, and instead, it has sparked considerable user resentment on social media due to this seemingly opportunistic operation. Especially within the Hyperliquid community, many users have condemned Binance's actions.

The initiators of this event have also become a focal point of discussion on social media. According to revelations from @off_thetarget, it seems that the JELLYJELLY-related team attempted to exploit this loophole for profit.

Many users also believe that this was a deliberate attack on Hyperliquid by other centralized exchanges. According to Lookonchain's monitoring, the funds used to attack Hyperliquid and open positions were withdrawn from both Binance and OKX.

Additionally, during this process, many KOLs participated in the discussion, further fueling the situation.

Retail Investors Foot the Bill for the Farce

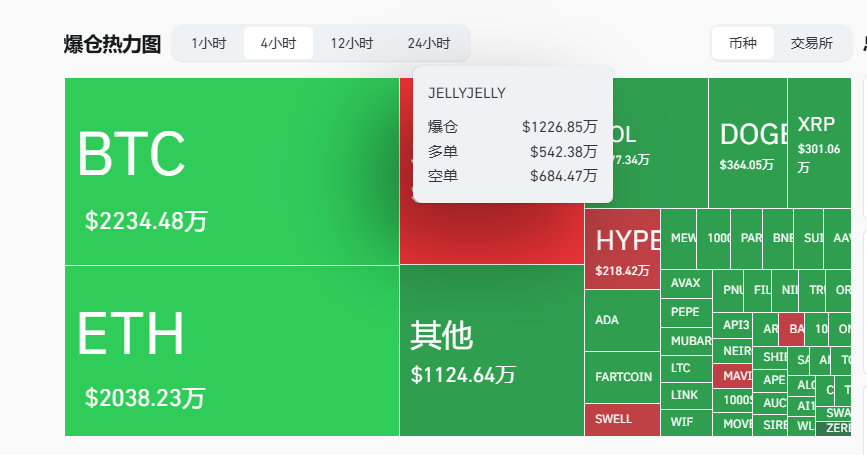

In reality, the retail investors who followed the trend to buy in or go long became the biggest victims of this event. According to data from Coinglass, within 4 hours, the liquidation amount for JELLYJELLY reached $12.2685 million (with JELLYJELLY's market cap only at $23 million), ranking third across the network, only behind Bitcoin and Ethereum.

As the price surged from $0.0082 to $0.0627 within 2 hours, it then fell from the peak to $0.021. The maximum increase reached 665%, while the maximum decrease was 67%. How many retail investors lost sleep over this operation?

When the price of JELLY finally settled at $0.021, this thrilling sniper battle seemed to end with Hyperliquid's "defensive victory," but the battlefield left behind deeper industry questions: Does governance of decentralized exchanges belong to the community or the foundation? Can liquidity traps be avoided from becoming a gap for capital hunting? Are retail investors destined to become sacrificial offerings in the face of KOL misguidance, exchange games, and price manipulation? The event may have temporarily subsided, but the road to rebuilding trust in the crypto world is far longer than a thrilling liquidation operation. As the community states: this is not the first time, nor will it be the last—under the guise of decentralization, the game of power has never left the stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。