来源: Cointelegraph原文: 《{title}》

币安(Binance)已停止在欧洲经济区(EEA)提供与泰达币(USDT)相关的现货交易对,以遵守《加密资产市场监管条例》(MiCA)的要求。

Cointelegraph获悉,币安已根据3月初披露的计划,在EEA下架了多种不符合MiCA要求的代币现货交易对。

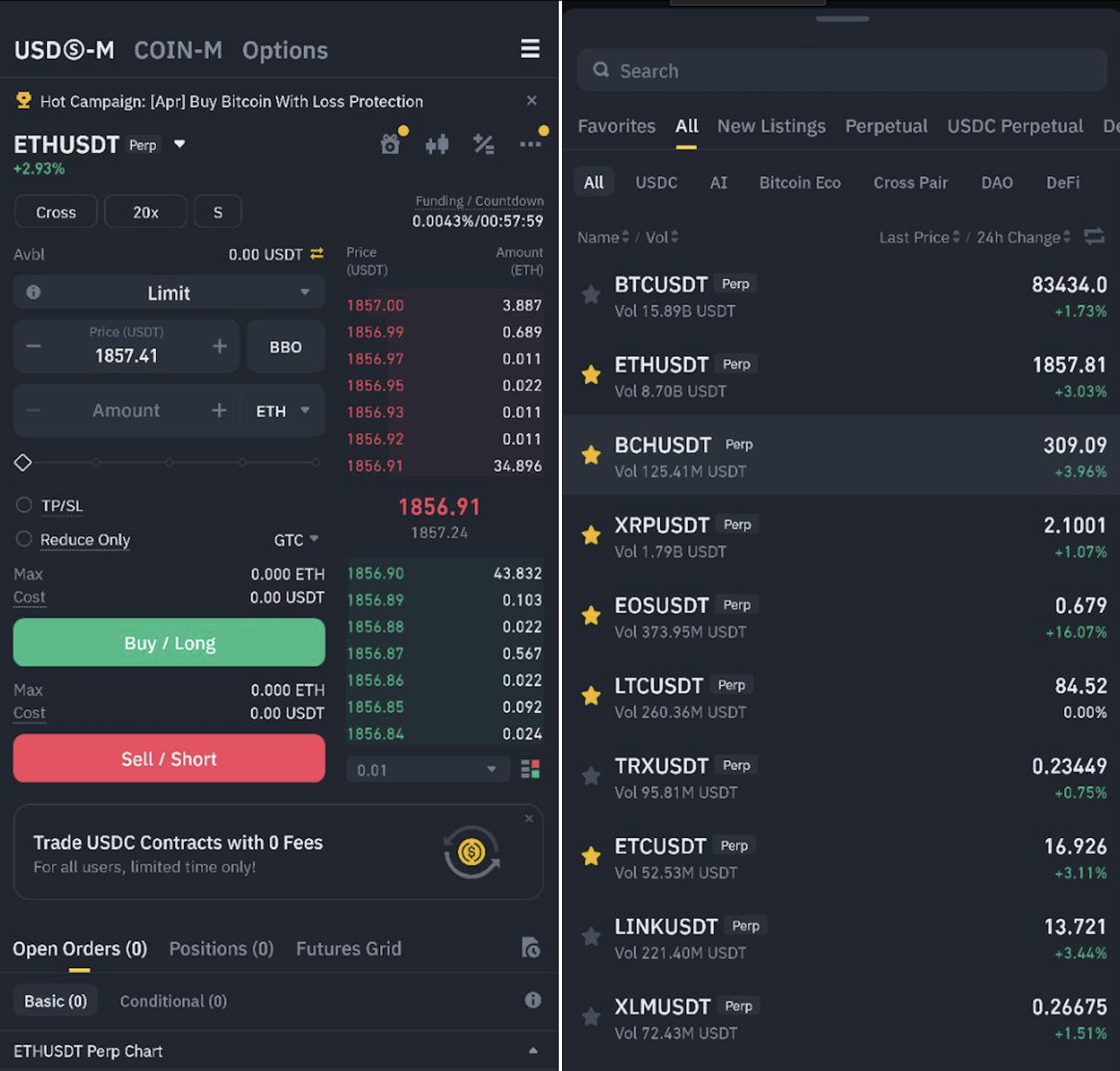

尽管像USDT这样的代币现货交易对已在币安下架,但EEA用户仍然可以托管这些受影响的代币,并通过永续合约进行交易。

USDT在币安平台上仍可用于永续合约交易。来源:币安

根据币安此前的公告,不符合MiCA要求的代币现货交易对需在3月31日之前下架,这与当地要求在2025年第一季度末前完成此类代币下架的规定一致。

币安并非唯一一家在EEA地区下架不符合MiCA要求代币现货交易对的加密货币交易所。

其他交易所,例如Kraken,也在2月宣布了相关计划,并在EEA地区下架了包括USDT在内的现货交易对。

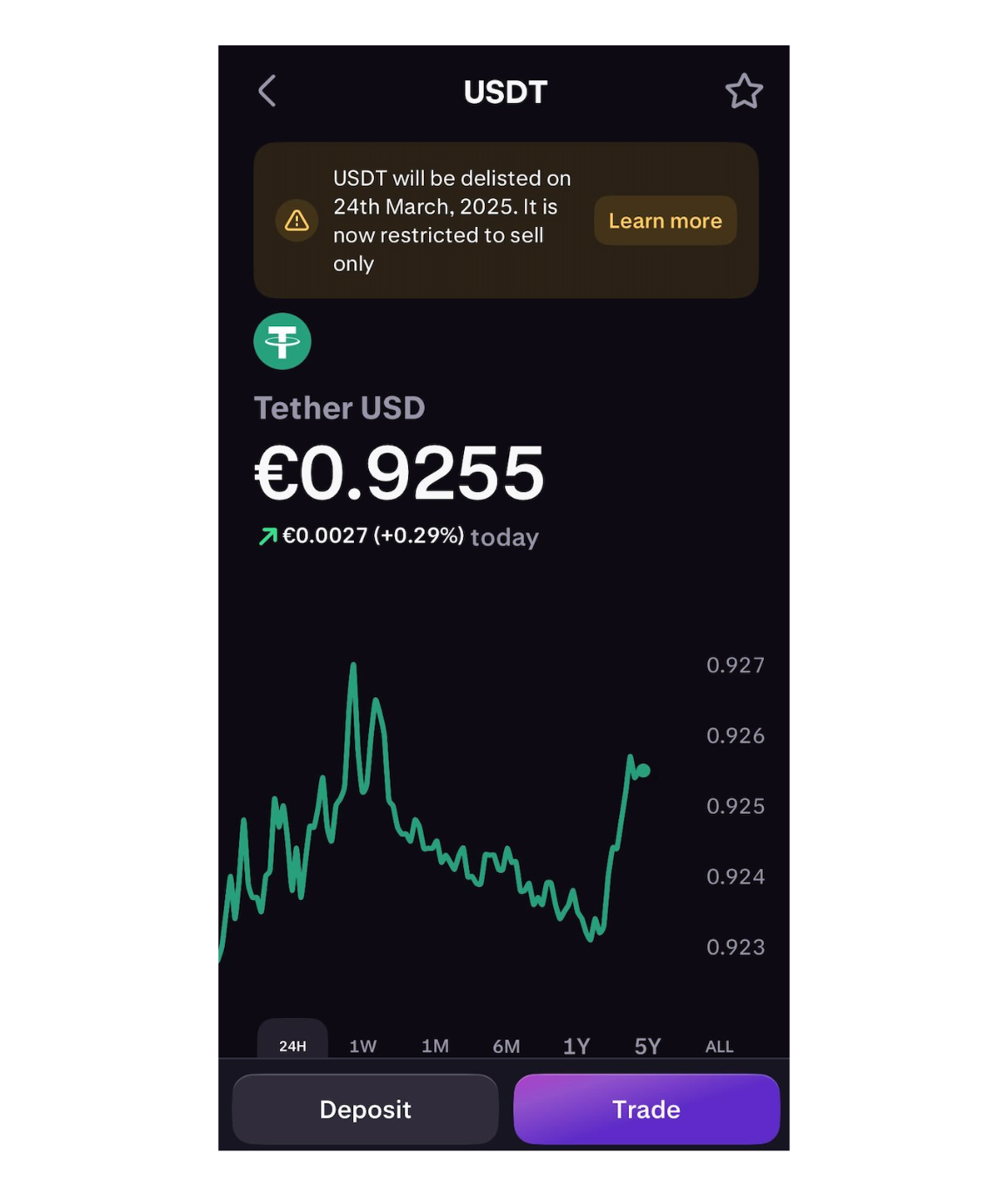

根据Kraken官网的公告,该交易所在3月24日将USDT限制为仅可出售模式(sell-only mode)。截至目前,该平台不允许EEA用户购买受影响的代币。

Kraken于3月24日将USDT在EEA限制为仅可出售模式。来源:Kraken

币安除了下架USDT的现货交易对外,还下架了以下不符合MiCA要求的代币现货交易对:Dai(DAI)、First Digital USD(FDUSD)、TrueUSD(TUSD)、Pax Dollar(USDP)、Anchored Euro(AEUR)、TerraUSD(UST)、TerraClassicUSD(USTC)、PAX Gold(PAXG)。

Kraken在EEA的下架计划涉及以下代币:USDT、PayPal USD(PYUSD)、Tether EURt(EURT)、TrueUSD(TUSD)、TerraClassicUSD(USTC)。

币安和Kraken继续为不符合MiCA要求的代币提供托管服务的举措,与MiCA合规监管机构此前的声明保持一致。

3月5日,欧洲证券和市场管理局(ESMA)的一位发言人向Cointelegraph表示,为不符合MiCA要求的稳定币提供托管和转账服务并不违反新的欧洲加密货币法律。

然而,同一监管机构此前建议欧洲的加密资产服务提供商在3月31日之后停止所有涉及受影响代币的交易。这一矛盾的表态在一定程度上增加了MiCA法规要求的复杂性和困惑。

相关推荐:欧盟监管机构要求保险公司对加密货币提供100%担保,理由是波动性

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。