Editor | Wu Says Blockchain

On the evening of March 26, Beijing time, JELLYJELLY faced a short squeeze, surging 429% between 21:00-22:00 UTC+8. Hyperliquid Vault took over a trader's self-liquidated JELLYJELLY short position, which at one point had an unrealized loss exceeding $10.5 million. The situation was such that if JELLYJELLY reached $0.15374, Hyperliquid Vault would lose all of its $230 million funds; as funds flowed out of Hyperliquid Vault, it would further lower JELLYJELLY's liquidation price.

JELLYJELLY is a memecoin token released on pumpfun by former Facebook product vice president Sam Lessin. Hyperliquid launched the contract on January 30, stating, "This perpetual contract uses on-chain AMM to obtain the underlying oracle price."

At 22:48, Binance co-founder He Yi replied to a community member's suggestion on Twitter to list JELLYJELLY, triggering another price fluctuation for JELLYJELLY.

Subsequently, OKX and Binance announced the listing of JELLYJELLY perpetual contracts, with the price of JELLYJELLY peaking at $0.62, an increase of over 380% compared to four hours earlier, before rapidly dropping back to around $0.25. After the launch of futures contracts on Binance and OKX, Hyperliquid delisted JELLYJELLY, and the massive loss short position in Hyperliquid Vault was settled.

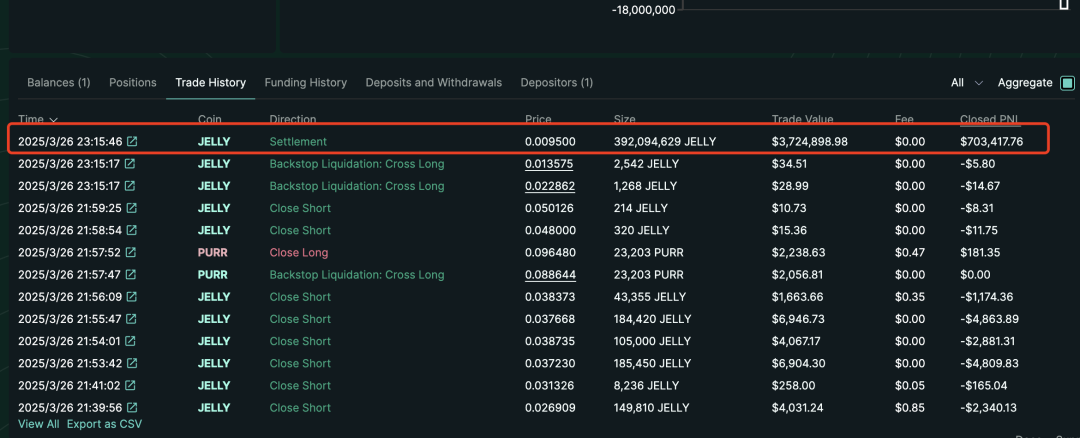

According to historical data from Hyperliquid's official website, the JELLYJELLY short position taken over by Hyperliquid Vault was settled at $0.0095 at 23:15 UTC+8, slightly earlier than the announcement of the contract listing on Binance, when the price was about $0.045. However, Hyperliquid Vault settled at $0.0095, resulting in a profit of $703,000 on that position.

Hyperliquid stated that after evidence of suspicious market activity was discovered, a meeting of validators was convened, and a vote was held to delist the JELLY perpetual contract. All users, except for the marked addresses, will receive full compensation from the Hyper Foundation. HLP's 24-hour profit and loss was approximately $700,000 USDC.

It is understood that this liquidation method is defined as automatic deleveraging (Auto-deleveraging) in the official documentation. This is the last resort for liquidators to avoid causing significant drawdown liquidations. Automatic deleveraging strictly ensures that the platform maintains solvency. If a user's account value or independent position value becomes negative, the counterparty's users will be ranked based on unrealized profits and losses and the leverage used. The positions of these traders will be liquidated at the previous oracle price against users currently in a loss position, ensuring that the platform has no bad debts. However, Hyperliquid has officially announced its commitment to compensate affected users (except for marked violators).

In response to this incident, OKX CEO Star stated: "Does Hyperliquid's decentralized model and smart contracts for derivatives trading exempt it from derivatives regulation?"

Bitget CEO Gracy remarked that Hyperliquid might become FTX 2.0. Its handling of the JELLY incident was immature, unethical, and unprofessional, leading to user attrition and serious doubts about its integrity. Its operational model resembles an offshore CEX without KYC/AML, fostering illegal flows and bad actors. The decision to close the JELLY market and forcibly settle positions at discounted prices sets a dangerous precedent. Additionally, the platform's product design exposes concerning flaws: the mixed vault exposes users to systemic risks, and unrestricted position sizes open the door to manipulation. Unless these issues are addressed, more altcoins may be used against Hyperliquid, making it a potential candidate for the next catastrophic failure in cryptocurrency.

According to Parsec panel data, during the hours following the Jelly liquidation event, Hyperliquid experienced a net outflow of USDC amounting to $140 million. In the four days surrounding the ETH whale long liquidation event on March 12, Hyperliquid's total net outflow of USDC approached $300 million. Over the past 30 days, Hyperliquid's USDC balance has decreased from approximately $2.5 billion to $2.07 billion.

This is not the first time Hyperliquid has encountered similar issues. Earlier, a whale using 50x leverage opened a long position in ETH worth about $300 million, peaking at an unrealized profit of $8 million. However, the user subsequently withdrew most of the principal and profits, causing the liquidation price to rise, ultimately leading to the position being liquidated, netting about $1.8 million USDC. Meanwhile, the platform's insurance fund (HLP Vault) incurred a loss of approximately $4 million as a result.

Hyperliquid uses the marked price provided by oracles rather than order book depth to determine contract prices, which normally enhances trading efficiency. However, during periods of extreme market volatility, this mechanism may not effectively buffer the impact of large trades. For instance, when whales quickly build positions using high leverage, the oracle price may not timely reflect market depth, leading to a disconnection between the liquidation price and the actual market price. This design was amplified during multiple whale operations in March 2025, ultimately causing HLP to bear additional losses.

Hyperliquid's HLP (Hyperliquid Liquidity Provider) mechanism provides liquidity through active market making and plays a crucial role in liquidations. However, when the market experiences extreme volatility or a single account holds an excessively large position, HLP's liquidity may not respond in time. For example, in the aforementioned ETH long liquidation event, HLP had to cover substantial losses. This situation indicates that the design of HLP may have vulnerabilities when facing abnormally large positions, especially in the absence of sufficient external liquidity support, forcing the platform to cover the shortfall from its own funds.

In response, on March 13, Hyperliquid also announced that due to a recent incident exposing the need for further strengthening the margin system under extreme conditions, it would upgrade the network after 08:00 UTC+8 on March 15, adjusting margin transfer requirements and setting the margin ratio at 20%, involving funds transferred from cross-margin wallets and independent margin positions.

Hyperliquid is a high-performance decentralized derivatives trading platform developed by Hyper Foundation, focusing on providing a low-latency, high-throughput perpetual contract trading experience, supporting up to 50x leverage. It integrates liquidity through the innovative HLP (Hyperliquid Liquidity Provider) mechanism and optimizes trading efficiency using oracle prices, attracting a large number of whales and high-frequency traders.

The platform was co-founded by Jeff Yan and iliensinc, both Harvard University alumni. Jeff Yan previously worked as a quantitative analyst at high-frequency trading firm Hudson River Trading before entering the cryptocurrency space and founding one of the industry's largest market makers, Chameleon Trading. After the collapse of FTX in 2022, he shifted his focus to Hyperliquid. iliensinc also has a strong technical background and co-leads the team with Jeff, which includes elites from Caltech and MIT who have worked at well-known companies such as Airtable, Citadel, and Nuro. The Hyperliquid team is self-funded and has not accepted external investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。