Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

Following the attack on Hyperliquid by a 50x leveraged whale exploiting a mechanism flaw, the platform has encountered another issue.

The method was similar, with operations being open and transparent, but this time the target was the meme coin $JELLYJELLY, which has far less liquidity than ETH.

Although the platform adjusted its mechanisms after the last incident, the results indicate that the protections remain weak. Hyperliquid ultimately paid the price for its negligence and arrogance.

Event Overview

Last night, the decentralized contract platform Hyperliquid faced a meticulously planned on-chain hunt. Surrounding the $JELLYJELLY token, someone opened a short position, manipulated the coin price, and lured the system into liquidation, drawing widespread attention.

The incident was triggered by a massive short position: address 0xde9…f5c91 opened a $4.08 million short position on $JELLYJELLY at a price of $0.0095, using $3.5 million USDC as margin, effectively serving as "bait" to lure the system into taking over the position.

Subsequently, another address Hc8gN…WRcwq dumped on the spot market, creating unrealized profits for the shorts. The short position holder took the opportunity to withdraw most of the margin, causing the platform to automatically take over the position, transferring the risk to the treasury.

(For more on HyperLiquid's mechanisms, we recommend reading: "When it gets tough, even exchanges get cut! A deep dive into how Hyperliquid lost $1.8 million"

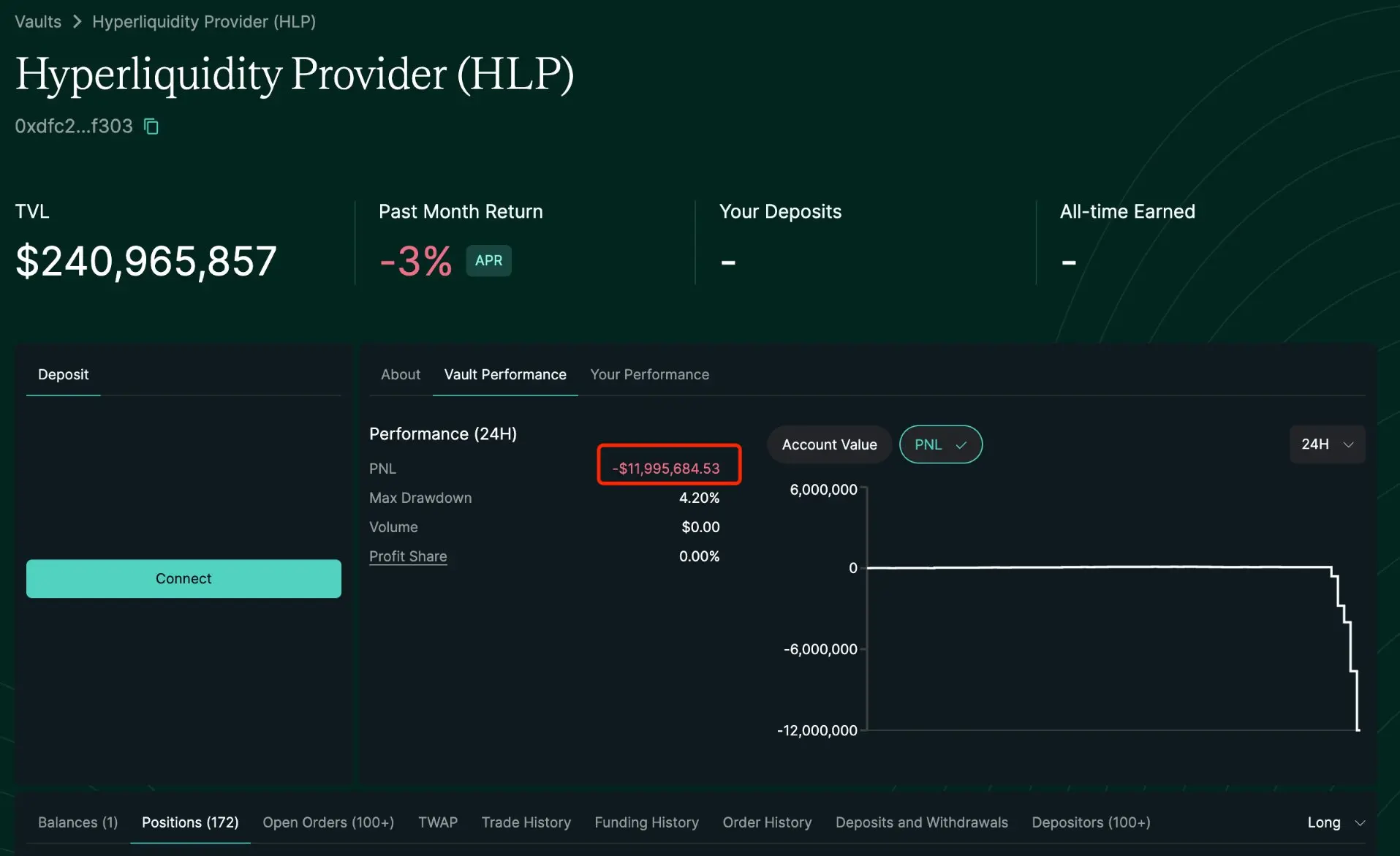

The operator then reversed course and bought a large amount of $JELLYJELLY, driving up the coin price and causing significant losses on the short positions held by the system. At this point, retail investors began to withdraw their funds, increasing pressure on the treasury and causing the liquidation price to drop continuously. By the peak, the treasury's unrealized losses exceeded $10 million, and the TVL decreased by about $20 million. Meanwhile, according to crypto KOL @ai_9684xtpa's analysis, if the coin price rose to $0.17, the treasury could face forced liquidation, with potential losses of up to $240 million.

Monitoring indicated that the address driving the price up previously held 120 million $JELLYJELLY (about $5 million), making it the largest on-chain holder. The funds in that address appeared to be exhausted, leading to significant price volatility.

Community Reaction

Such a thrilling event quickly sparked widespread discussion on Twitter.

Crypto KOL @thecryptoskanda was the first to speak out, calling for "Binance to list $JELLYJELLY." Shortly after, Binance co-founder He Yi retweeted in agreement. Minutes later, Binance officially announced the launch of $JELLYJELLY perpetual contracts the next day.

Meanwhile, Hyperliquid's official response was to "pull the plug," directly delisting $JELLYJELLY, and profiting $703,000 from liquidating the short positions before the delisting. Although they stated this was a decision made by the committee, this move sparked further controversy.

BitMEX founder Arthur Hayes immediately stated, "Hyperliquid is no longer decentralized," predicting that HYPE would continue to weaken and eventually return to its origins.

Sonic Labs co-founder Andre Cronje also criticized Hyperliquid's leverage mechanism on the X platform. He argued that leverage should not be a fixed function but should be dynamically adjusted based on available liquidity and actual volatility. For example, small positions could allow for 1000x leverage, while large positions should be limited to 1.2x. In DeFi, fixed leverage is an extremely dangerous design.

On-chain detective ZachXBT expressed his anger, criticizing Hyperliquid for price manipulation and for being oblivious to hackers opening positions and laundering money on the platform.

After the incident, according to information from Hyperliquid's official website, its HLP TVL briefly plummeted to $197 million. It was reported that the HLP TVL had previously reached as high as $240 million.

In an instant, public opinion completely reversed, and Hyperliquid, once hailed by its followers as the "on-chain Binance," was rapidly losing market trust.

A CEX in DEX Clothing?

Although this hunting incident ended with Hyperliquid pulling $JELLYJELLY and temporarily stopping the bleeding, the community achieved a "real-world test" of the mechanism flaws in the short term, but the underlying issues remain unanswered.

For instance, after the first mechanism was attacked, did the platform truly assess the risks of imbalance between leverage and liquidity? Why, in the face of a liquidation crisis, did it choose to stop losses by delisting trading pairs in such a centralized manner instead of relying on preset risk control mechanisms?

From another perspective, if the platform claims to uphold decentralization, why can it "turn off the network" with a single click at a critical moment? If it chooses "survival first," how much of a fundamental difference remains between Hyperliquid and a CEX?

These unanswered questions point to a deeper dilemma: when decentralized platforms face extreme market shocks, should the code speak for itself, or should the backend team make the decisions?

As users, we believe that on-chain trading will ultimately be the future, but whether Hyperliquid can reach that point remains uncertain. Perhaps it is an experiment, or perhaps it will survive to become a new standard. But today, its narrative of decentralization stands on the edge of a cliff.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。