来源: Cointelegraph原文: 《{title}》

根据Prometheum创始人兼联席首席执行官Aaron Kaplan的说法,代币化现实世界资产(RWAs)的市场正在快速增长,但与普遍看法不同,广泛采用的最大障碍并非监管,而是缺乏专门的二级市场来买卖代币化证券。

在接受Cointelegraph采访时,Kaplan提到了ARK Invest首席执行官Cathie Wood最近在纽约数字资产峰会上的发言。她表示,监管不明确阻碍了她的公司将基金代币化的进程。

然而,Kaplan指出,“与普遍看法相反,障碍并不是模糊的监管。”他强调,美国证券交易委员会(SEC)的特殊目的经纪商框架和另类交易系统(ATS)许可“已经为发行区块链原生基金提供了一个受监管的途径,这种方式比传统发行更具效率优势。”

“真正的瓶颈在于向广泛投资者群体提供代币化证券交易的市场基础设施有限,”Kaplan补充道。

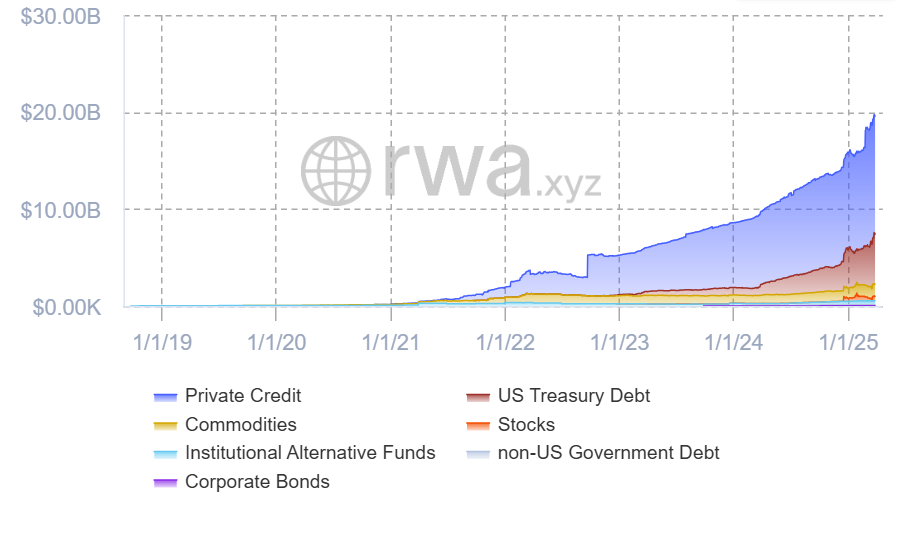

根据行业数据,剔除稳定币后,代币化RWA的市值在过去30天内增长了近8%,达到195亿美元。私人信贷和美国国债仍然是两个最大的应用场景。

代币化RWA资产的价值在过去一年中迅速增长。来源:RWA.xyz

“这些资产目前分布在少数几个区块链上,但仍然没有一个完全公开的二级市场,机构和散户投资者可以像在纳斯达克或通过富达这样的经纪账户那样买卖和交易这些资产,”Kaplan说道。他还指出了两种构建这些平台的总体方法。

第一种方法是使用去中心化金融(DeFi)框架来构建代币化证券市场,就像Ondo Finance、Ethena Labs和Securitize正在做的那样。

第二种方法是将代币化协议集成到现有的经纪平台中,这些平台在SEC注册并受联邦证券法监管。

“传统加密和金融科技平台已经习惯于促进加密货币交易,因此可以预期它们会寻求扩大其产品范围,包括代币化证券,”Kaplan表示。

然而,他也指出,许多现有的传统平台虽然并未完全数字化,但它们“不会轻易放弃市场份额”。“许多平台已经在投资自己的代币化计划,或者与金融科技和加密公司合作,以保持竞争力。”

“关键在于下一波用户将如何进入数字资产领域……问题是,那时券商行业是否会进入数字资产领域,还是由加密平台为投资者构建下一代数字证券市场?”

作为一家数字资产交易和托管公司,Prometheum正试图通过构建一个全方位服务的数字资产证券市场来弥合基础设施的差距。该公司声称,在Prometheum交易的证券具有更低的费用、更快的结算时间以及更高的效率。

相关推荐:特朗普关税政策临近,稳定币和代币化资产获青睐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。