Tokenized U.S. Treasuries are now at the forefront of the tokenization trend, successfully attracting the attention of numerous global financial giants and digital asset companies.

Written by: James, BlockTempo

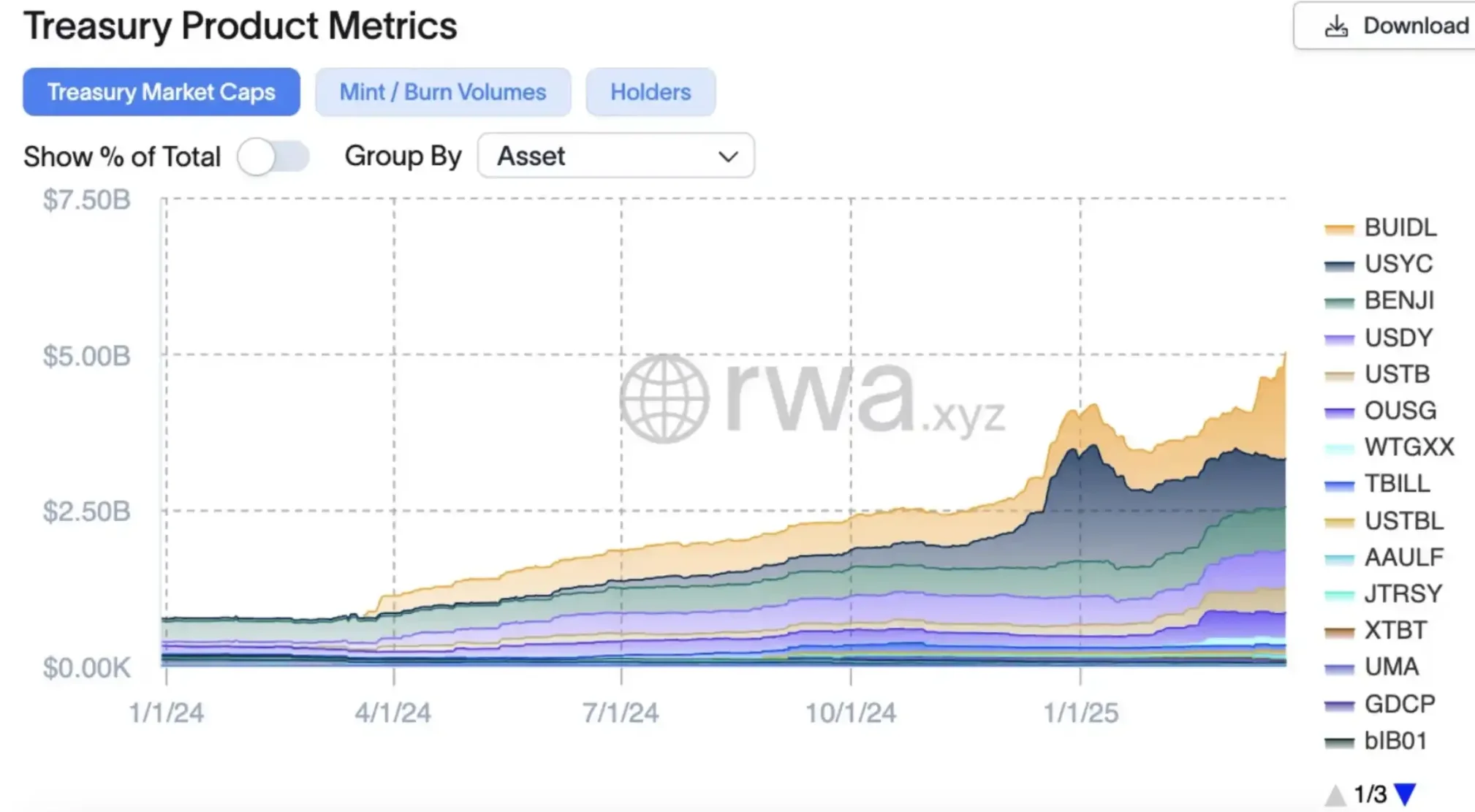

According to data from wa.xyz, the market value of tokenized U.S. Treasuries has surpassed $5 billion for the first time this week, with a surge of $1 billion in just two weeks, primarily driven by the tokenized U.S. Treasury fund BUIDL launched in collaboration by asset management giant BlackRock and digital asset company Securitize.

Currently, the top five tokenized U.S. Treasury funds are:

- BUIDL by BlackRock and Securitize: $1.702 billion

- USYC by Hashnote: $765 million

- BENJI by Franklin Templeton: $693 million

- USDY by Ondo Finance: $594 million

- USTB by Superstate: $413 million

Tokenized U.S. Treasuries are now at the forefront of the tokenization trend, successfully attracting the attention of numerous global financial giants and digital asset companies. Fidelity Investments has recently become the latest large U.S. asset management company to attempt to establish a tokenized money market fund. Last week, the company submitted an application to launch a tokenized version of a U.S. dollar money market fund on Ethereum.

Cynthia Lo Bessette, head of Fidelity's digital asset management division, stated that the company is optimistic about tokenization and its potential to transform the financial services industry, as it can enhance trading efficiency by effectively acquiring and allocating capital across various markets.

Potential for Development of Tokenized U.S. Treasuries

Tokenized U.S. Treasuries allow investors to deploy idle funds onto the blockchain to earn returns, operating similarly to traditional money market funds. Additionally, tokenized Treasuries are increasingly being used as reserve assets in DeFi protocols, with another significant potential use case being the use of tokenized Treasuries as collateral in trading and asset management activities.

State Street Bank is also exploring the possibility of tokenizing bonds and money market funds. Donna Milrod, head of product at State Street Bank, pointed out that collateral tokens could have been used to avoid or mitigate the liability-driven crisis faced by U.K. pension funds in 2022, allowing pension funds and asset management institutions to use money market fund tokens to meet margin requirements without needing to liquidate assets to raise cash.

Advantages and Disadvantages of Tokenized U.S. Treasuries

Some readers may wonder why there is a need to purchase the tokenized version when traditional U.S. Treasuries and tokenized assets are essentially the same. Here is a comparison of the pros and cons:

Disadvantages of Traditional U.S. Treasuries:

- Cross-border trading restrictions: Traditional U.S. Treasuries have high costs and slow speeds in cross-border transactions.

- Low settlement and delivery efficiency: Traditional financial transactions typically require T+1 or longer settlement periods.

Advantages of Tokenized U.S. Treasuries (based on blockchain technology):

- Achieve 24/7 instant settlement, significantly enhancing trading efficiency.

- Break geographical and financial institution restrictions, promoting global capital flow.

However, tokenized U.S. Treasuries also carry risks, such as how to implement AML/KYC regulations to prevent money laundering and fund misappropriation. Additionally, the potential risks of blockchain asset security, smart contract vulnerabilities, and hacking attacks could pose serious systemic risks if issues arise, which remains a challenge for the entire industry to overcome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。