You will see many L1s with low activity but valuations in the billions, while such L2s are rare.

Written by: taetaehoho, Chief Strategy Officer of Eclipse

Translated by: Luffy, Foresight News

It's 2025, and it's time to stop confusing L1 and L2 blockchains.

You should read these tweets a hundred times.

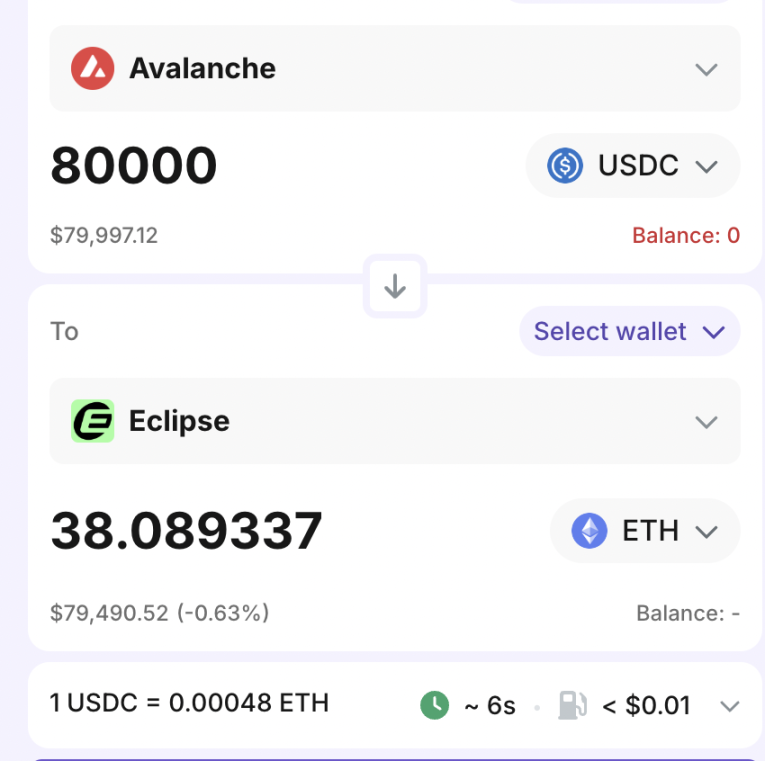

For end users, there is no difference in product experience between L1 and L2. There are also no essential differences or limitations in liquidity between L1 and L2. A new L1 chain must attract stablecoins or non-native liquidity across chains to achieve initial liquidity guidance. Similarly, an L2 chain also needs to introduce stablecoins or non-native liquidity across chains to complete its initial liquidity accumulation. L2 chains are simply connected to L1 chains through a trust-minimized bridging method, while alternative L1s (non-mainstream L1s) do not have such bridging. We have seen that some large whales are very sensitive to these trust assumptions, but many ordinary users do not care.

A rather mediocre viewpoint (mainly from those committed to developing alternative L1s) is that "L2 will fragment liquidity."

L2 merely provides a trust-minimized bridging method with L1, and every L2 launched today will connect with all alternative L1s and other L2s.

Every valuable L2 will be equipped with other message bridges upon launch. Through L1 as an intermediary, any participant connected to the base layer can conduct large-scale fund transfers between alternative L1s and L2s using Ethereum or Solana. If an alternative L1 is not connected to L2, it may increase the difficulty of capital outflow, but if it integrates message bridges, this statement becomes contradictory.

The essence of L2 products is not determined by their relationship with L1. It is simply an execution layer, just like other execution layers with different characteristics.

So, why is L1 more valuable than L2?

There are two reasons.

1. Is L1 more valuable than L2?

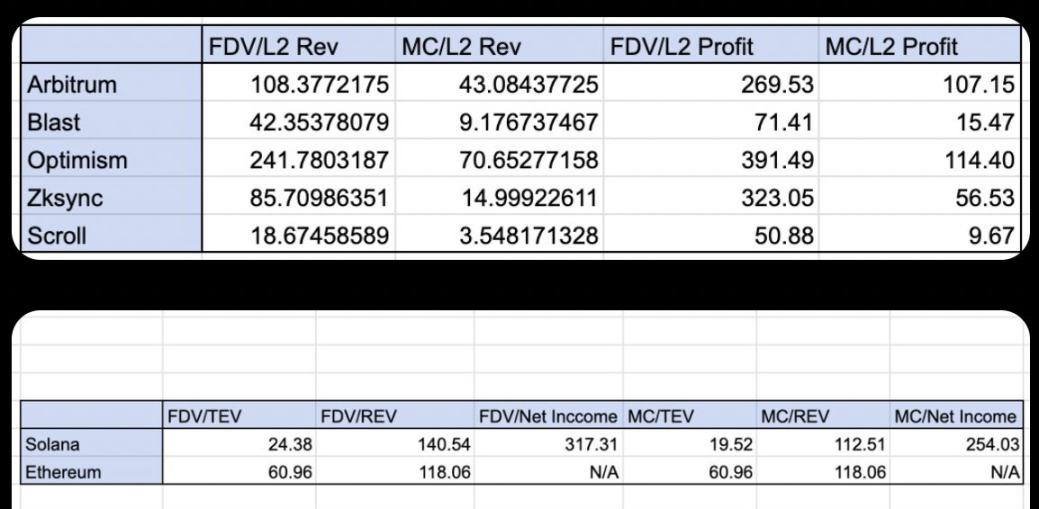

In cases where it is not more valuable: L1 has higher activity. The market cap to revenue ratio (REV) of Solana and Ethereum is about 100 times. The market cap to revenue ratio of mature L2s is also in a similar range, between 10 and 200 times. (Data from October 2024, but this viewpoint still holds).

From this perspective, the multiples of mature L1 chains and mature L2 chains are relatively close (for example, Arbitrum and Optimism compared to Solana and Ethereum).

In cases where it is more valuable: The frequency of inexplicable high valuation outliers in L1 is higher than in L2. In other words, you will see more L1s with low activity but valuations in the billions, while such cases in L2 are relatively rare.

- L1: Sui, Mantra, Pi, ICP, IP

- L2: Move

In my opinion, this is an initial misstep in positioning for L2. Arbitrum and Optimism positioned themselves as extensions of Ethereum, serving as execution layers to help Ethereum scale. Combined with Ethereum's Rollup-centric roadmap, this was a good initial guidance method.

However, the downside of this approach is that it limits the total addressable market (TAM) to the Ethereum user base and sets an upper limit on the potential total liquidity, market attention, and revenue that these chains can capture. The initial market entry strategy of Arbitrum and Optimism was to promote themselves as extensions of Ethereum, even though they had the capability to attract new decentralized applications and participants into their specific ecosystems, including projects that were not previously on Ethereum. This is precisely why they have always been seen as a subset of Ethereum (and thus valued at only a certain proportion of the base layer network). To be fair, at the time of their launch, Ethereum was the only major blockchain in the market.

2. Token Model

The token model of L1 has a fundamental network flywheel effect, where the increase in activity on the L1 chain is directly related to the demand for tokens from two different participant groups (searcher users and stakers).

The higher the activity, the more fees searcher users are willing to pay to have their transactions included in blocks. The entropy from various activities increases the probability, frequency, and scale of people competing to capture economic opportunities. In terms of staking, the more fees a chain earns, the more people will want to stake the tokens of that L1 chain to gain potential economic benefits. Activity is also related to the issuance of new assets, which is usually tied to the native tokens of the L1 chain: people must purchase these native tokens to participate in transaction activities (e.g., minting NFTs with ETH, buying memecoins with SOL).

How should L2 respond?

1. Mindset Shift

L2 needs to decide whether to become an L2 that aligns with a certain L1 or to attract users from any source. The construction of L2 should fully leverage the unique advantages of L2 technology (trustworthy/customized block construction, performance optimization).

2. Improvement of Token Economics

L2 should refine its token economics so that they can also form a flywheel effect, where the increase in network activity stimulates demand for tokens in two aspects (searcher users and stakers).

Current L2s are attempting to use customized Gas tokens, but this only addresses the issue for searcher users and does not benefit stakers. Theoretically, since most L2s incorporate the profits of the sorters into the treasury of decentralized autonomous organizations (DAOs), and tokens can govern the DAO treasury, this seems equivalent. However, to ensure that token holders have the same recognition, better governance rights need to be granted to token holders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。