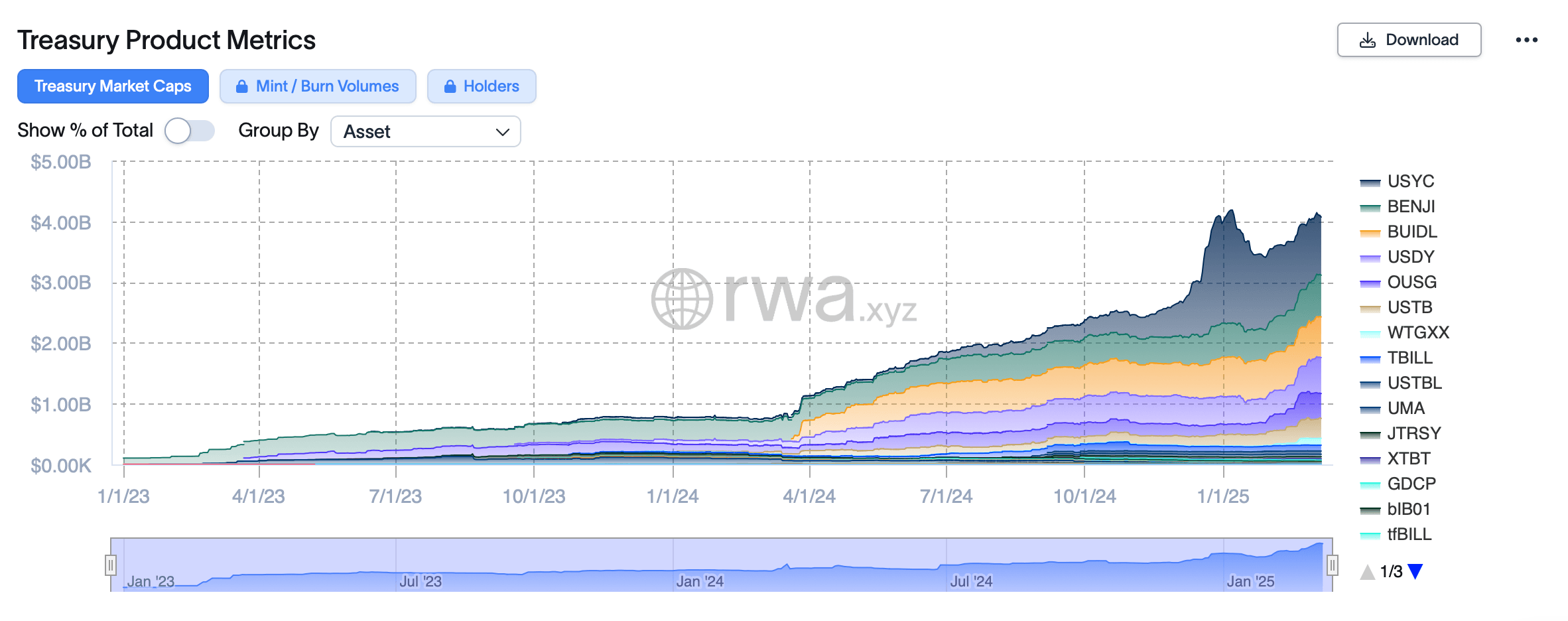

Just recently, tokenized U.S. Treasuries vaulted to a $4.07 billion valuation, according to rwa.xyz data. Essentially a modest dent in the short-term U.S. Treasury holdings temporarily sold to counterparties traversing the Federal Reserve’s Overnight Reverse Repurchase Agreements (ON RRP). Though diminutive in scale, this market has defied expectations with an impressive $1.57 billion expansion across 103 days.

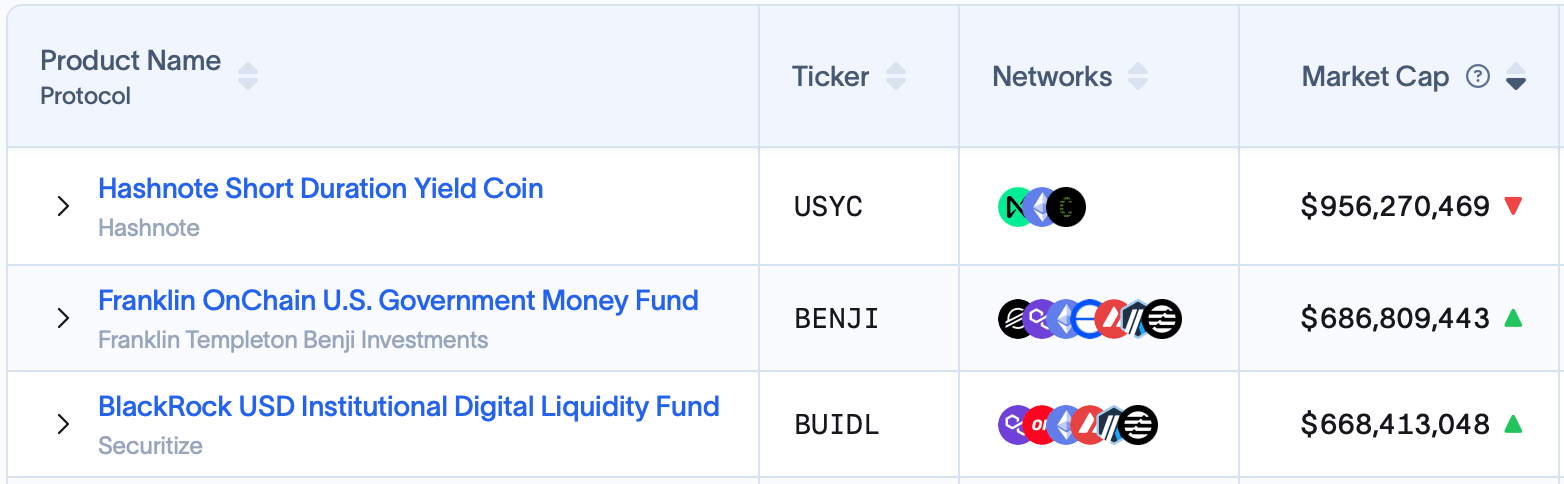

Reigning supreme with the largest market capitalization, Hashnote Short Duration Yield Coin (USYC) saw its market valuation balloon by $461.2 million between Nov. 26, 2024, and today, catapulting from $495.07 million to $956.27 million. Global investors outside the U.S. may tap into this vehicle via the Hashnote International Feeder Fund or the Short Duration Yield Fund (SDYF), provided they clear eligibility hurdles (including a $100,000 minimum stake).

Stateside participants must satisfy the Commodity Futures Trading Commission’s (CFTC) Qualified Eligible Participant (QEP) criteria to access USYC through the Hashnote Feeder Fund. Following behind USYC is Franklin Templeton’s onchain fund called Franklin Onchain U.S. Government Money Fund also referred to as FOBXX or BENJI. Institutional investors can participate with BENJI through Franklin Templeton’s Institutional Web Portal.

BENJI is also available to institutional investors in several European countries, including Austria, France, Germany, Italy, Liechtenstein, Netherlands, Spain, and Switzerland. Franklin Templeton’s fund, since Nov. 26, grew by $270.35 million to its current market cap of $686.80 million. Claiming the bronze position is Blackrock’s tokenized offering, the Blackrock USD Institutional Digital Liquidity Fund (BUIDL).

Distributed via Securitize, BUIDL caters exclusively to heavyweight institutional clients—hedge funds, asset managers, and multinational firms—a focus mirrored in its lofty $5 million entry threshold. Though BUIDL once reigned supreme 103 days ago with a $530.29 million market cap, its growth to $668.41 million now places it third in a rapidly evolving hierarchy. Together, the top three funds command 56.78% of the tokenized Treasury sector’s $4.07 billion valuation.

Also prominent are Ondo’s USDY ($592 million) and OUSG ($408 million), Superstate’s USTB ($328 million), Wisdomtree’s WTGXX ($112 million), and Openeden’s TBILL ($96.54 million). Data from Rwa.xyz reveals these initiatives boast an average annual percentage yield (APY) of 4.2%, with 15,463 holders collectively invested across 37 tokenized Treasury funds—a near doubling from 8,754 holders in just over three months. This explosion of capital and participant influx signals a tokenized Treasuries market transitioning from niche experiment to mainstream contender.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。