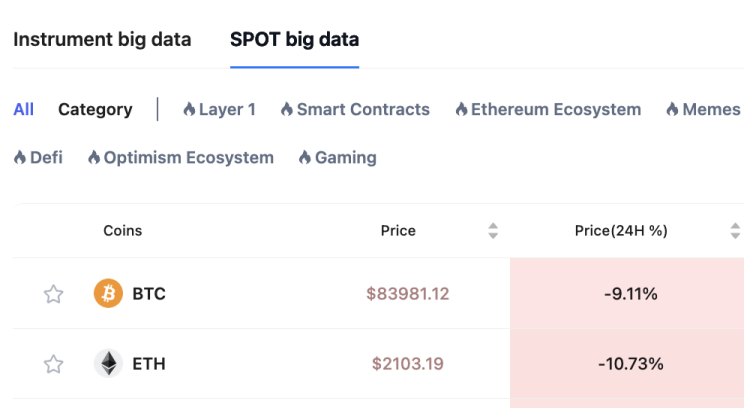

Trump's Tariffs on Canada and Mexico Cause US Stocks and the Crypto Market Led by BTC to Experience a 24-Hour Plunge from Heaven to Hell

Macroeconomic Interpretation: As Trump wields the 25% tariff stick, global capital markets seem to enter "panic mode." The three major US stock indices collectively plummeted, with the Dow Jones falling 1.48% in a single day, and the tech-heavy Nasdaq recording a 2.64% drop, the largest of the year. In this wave of capital migration, the crypto market became the most dramatic stage—Bitcoin plummeted over 11% within 24 hours, Ethereum fell below 17%, and the total liquidation amount across the network exceeded $1 billion, affecting 310,000 people. This financial storm, created solely by Trump, has deeply impacted each of us.

The double-edged sword effect of the tariff policy is revealing its ugly side. Economists estimate that the tariffs on 41.5% of imports from Mexico and Canada could directly raise domestic inflation by 0.6 percentage points. Behind this seemingly mild figure lies a continuous rise in the prices of goods in the Purchasing Managers' Index and persistent pressure on the Consumer Confidence Index. When the S&P 500 index retreated 5% from its historical high, the market suddenly realized: this is no longer just a bargaining chip in trade friction, but could evolve into a long-term risk to economic growth. When tariffs shift from negotiation tools to strategic norms, the pricing logic of capital markets will undergo reconstruction.

The crypto market is the first to bear the brunt of policy risk. The overnight plunge script is filled with dark humor: just two days ago, Trump's tweet about establishing a "national cryptocurrency strategic reserve" brought Bitcoin close to a high of $95,000. But when the market realized that this "strategic reserve" might become an advertising space for altcoins, the celebration quickly turned into a stampede. The market anticipates that if the reserve plan turns into a mishmash of XRP, SOL, and ADA, it becomes a speculative game. This extreme swing in policy expectations, combined with the lethal blow of tariffs coming into effect, led cryptocurrencies to experience an extreme transition from heaven to hell within 48 hours.

On-chain data reveals the microcosm of this storm. Coinank data shows that the total open interest of BTC contracts across the network shrank by 13.11% in a single day, with CME and Binance, the two major exchanges, evaporating over $2 billion in positions. The capital flow is even more brutal—Bitcoin saw a net outflow of $660 million in 24 hours, Ethereum lost $314 million, and the top ten mainstream coins collectively faced liquidity withdrawal. When the US market sneezes, the global crypto market catches a cold. This strong correlation is particularly glaring given that CME Bitcoin futures account for 25.14% of the open interest.

The smoke of policy games is spreading globally. The tug-of-war between El Salvador and the IMF has entered a new round, with the latter explicitly requiring "limits on public sector Bitcoin holdings" in a $1.4 billion financing agreement, forcing this country, which once recognized Bitcoin as legal tender, to amend its laws to weaken its legal attributes. Meanwhile, on the other side of the Pacific, the Australian government has clearly rejected emulating Trump's crypto reserve plan. Concentrated holdings of specific tokens are like putting all eggs in a digital basket. This global policy divergence resembles the sword of Damocles hanging over the crypto market—bringing both regulatory arbitrage opportunities and systemic risks.

The long and short game among market participants has never been so intense. WhaleWire's founder proclaims, "The bear market has just begun," predicting that Bitcoin will fall below the support level of $83,000. Meanwhile, Mike Alfred of Alpine Fox LP senses a conspiracy from capital giants: Wall Street is using price suppression to clean out leveraged players. This is also confirmed by the data: the altcoin season index has dropped to 15, meaning only 15 tokens have outperformed Bitcoin in the last 90 days, and the market is voting with its feet to return to the original narrative of "digital gold." However, miners' actions reveal an alternative signal—more mining machines coming online have led to a counter-cyclical expansion in the hash power market, creating a subtle hedge against the panic in the secondary market.

As Japan's 30-year government bond yield rises to a new high since 2008, global capital is undergoing deep structural adjustments. The seesaw effect between traditional safe-haven assets and digital assets is showing cracks, and the correlation between US Treasury yields and Bitcoin prices is being restructured. In this uncertain March, investors may need to revisit the advice: trading requires navigating through the policy minefield. Just like surfers facing sudden giant waves, one must maintain respect for trends while having the courage to dance on the crest of the wave. After all, in the script of the crypto market, black swans often serve as the prelude to white swans.

BTC Data Analysis: With the crypto market experiencing a widespread decline, Coinank data shows that the ETH/BTC exchange rate has dropped to 0.02469, approaching the low point of 0.02337 from early last month and nearing the lowest point of 0.02275 since December 2020.

We believe that the decline in the ETH/BTC exchange rate approaching the lowest range since the end of 2020 reflects a deep-seated logic of risk preference in the crypto market continuing to tilt towards Bitcoin. This round of exchange rate decline can be broken down into three driving factors:

Short-term liquidity squeeze: The accelerated balance sheet reduction by the Federal Reserve, combined with rising geopolitical risks, prompts funds to migrate from high-beta assets (like ETH) to safer assets like Bitcoin. The funding rate for ETH perpetual contracts in the derivatives market remains negative (-0.15%), while Bitcoin maintains neutrality, indicating that hedge funds are arbitraging by shorting ETH/BTC.

Ecological narrative divergence: The institutional capital accumulation in Bitcoin spot ETFs (holding over 6%) reinforces its status as "digital gold," while the delay in Ethereum spot ETF approvals, declining staking yields (from 5.2% to 3.8%), and competition in Layer 2 weaken the capital attractiveness of its "world computer" narrative.

Historical cycle warning: The current exchange rate level is similar to that of December 2020 (the eve of the DeFi explosion), but at that time, the median Gas consumption on the Ethereum chain reached 150 gwei, while it is currently only 5 gwei, indicating a decline in ecological activity and exposing weak value support. If the exchange rate falls below the historical support level of 0.02275, it may trigger programmatic selling by quantitative funds, creating negative feedback.

The future path may depend on two major variables: first, whether Ethereum can rebuild ecological barriers through technological upgrades like account abstraction and parallel EVM; second, whether the capital flow into Bitcoin ETFs can reverse and release liquidity into the altcoin market. The current price level has entered a long-term allocation window, but a trend reversal will require a resonance between macro liquidity improvement and ecological catalysts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。