Macroeconomic Interpretation: A dramatic scene is unfolding in the global financial markets: while U.S. tech stocks are suffering a "black February" plunge, the cryptocurrency market is staging a counterattack in response to Trump's declaration of a "strategic reserve." Behind this capital migration spectacle lies a massive capital web woven by Coinbase whale players, alongside a fervent bet from traditional financial institutions on cryptocurrency ETFs.

If Trump's statement acts like a shot of adrenaline, then the whale players on Coinbase are quietly weaving the dark web of capital flows. Data shows that Bitcoin's recent rebound is highly synchronized with the Coinbase premium index, with whale accounts accumulating 2,100 BTC in the past 72 hours, equivalent to a cash flow of $178 million. This "sunrise in the east, rain in the west" scenario is quite darkly humorous—while Tesla's stock price plummeted 13% in a single week, institutional players in the crypto market were quietly accumulating.

State Street's prophecy provides a strategic footnote to this capital migration: the asset management scale of cryptocurrency ETFs is expected to surpass that of precious metal ETFs within the year, aiming for the third seat in the $15 trillion ETF market. Behind this prediction is a frenzied influx of $136 billion, and even during the recent market pullback, crypto ETFs have shown a magnet-like ability to attract capital. More intriguingly, the SEC may approve index funds based on the top ten tokens, effectively installing a "siphon pipe" for institutional funds into the crypto market.

In this capital reconstruction, Bitcoin is writing a new market value myth. Its market value surged 8.85% in a single day, surpassing $2 trillion, leaving traditional assets like silver and Saudi Aramco behind. This reversal is even more pronounced with ADA—its price skyrocketed 68% in 24 hours, propelling this veteran public chain up 386 global ranking positions in a single day. This inevitably brings to mind the famous saying in the crypto circle: "Bear markets accumulate chips, bull markets count eggs."

On-chain data reveals a deeper capital game. The total market value of stablecoins shrank by $1.9 billion in a week, which seems bearish but is actually a classic case of "openly repairing the road while secretly crossing the river." When market panic reaches its peak, whale accounts are frantically accumulating on exchanges, with operations withdrawing over 600 BTC from Binance in a single day, reminiscent of the capital sharks in "The Big Short" making reverse bets. The market has validated the effectiveness of this strategy— as ETF selling pressure eases, the basis arbitrage window is reopening.

The endgame of this capital migration may be hidden in cold data: global Bitcoin holders account for less than 4%, a figure that exposes the market's enormous potential while also hinting at the brutality of future volatility. When Trump's vision of incorporating cryptocurrency into the "national strategic reserve" resonates with State Street's prediction of an ETF explosion, we may be witnessing the craziest "cognitive arbitrage" in financial history—traditional financial elites and crypto-native forces are competing for pricing power in the same arena of the new era.

Standing at the crossroads of March, the crypto market is enjoying the "magical moment" of Trump's policy dividends while also facing the uncertainty of the Federal Reserve's monetary policy. But the truth that capital never sleeps is once again validated: when tech stocks face a cold wave, the safe-haven property of crypto assets is being repriced. This capital migration driven by political declarations, institutional games, and technological evolution will ultimately inscribe a new wealth code on the blockchain.

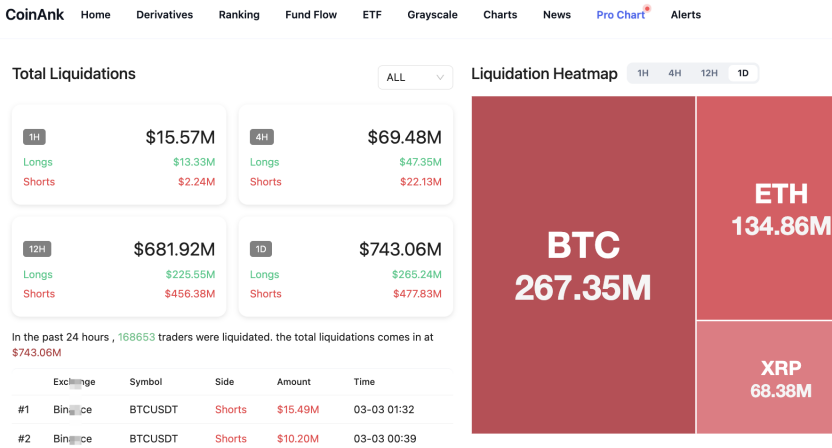

Data Analysis: In the past 24 hours, the crypto market has once again witnessed a thrilling leverage liquidation. According to CoinAnk data, the total liquidation amount across the network reached $743 million, with short liquidations accounting for 64%, totaling $478 million, while Bitcoin and Ethereum contributed over half of the liquidation volume. What market secrets lie behind these numbers? Let us delve into three core logics for a deep analysis.

First Logic: The trap of mutual destruction between bulls and bears. The current market appears to be a bear's carnival, but it actually hides intricacies. After Bitcoin touched the psychological threshold of $80,000, it triggered a technical rebound, directly leading to a large number of high-leverage short positions being forcibly liquidated. However, note that this is not a simple oversold rebound—the strong support level of $73,000 predicted by Standard Chartered has not been broken, and some institutions are quietly positioning on the left side, creating a battleground of "short squeeze" and "bullish bottom-fishing." Interestingly, the traditional financial market is simultaneously experiencing a risk asset sell-off. The expectation of the Federal Reserve delaying interest rate cuts has caused U.S. tech stocks and crypto assets to resonate in their decline, creating a cross-market dynamic that forces institutions shorting the crypto market to hedge spot risks through derivatives, further amplifying the scale of liquidations.

Second Logic: Systemic crisis of leading assets. We note that Ethereum's liquidation volume reached $135 million, which hides a more dangerous signal—a black swan event where 400,000 ETH were stolen from an exchange continues to ferment, causing investor panic over the safety of their holdings to spread from a single platform to the entire ecosystem. Meanwhile, Bitcoin's $267 million liquidation is forming a vicious cycle with ETF fund outflows: institutions like BlackRock redeemed hundreds of millions in a single day, forcing market makers to sell spot to hedge, creating a self-reinforcing "redemption-sell-off-liquidation" transmission chain. A key detail here is that although retail long liquidations are significant, the unusually high proportion of short positions indicates that some institutions are using the derivatives market for hedging. This "spot + futures" dual attack has led to a structural liquidity exhaustion in the market—Bitcoin's bid-ask spread has widened to 1.2%, reaching a new high since the 2024 bull market began.

Third Logic: The death spiral of leverage bubbles. The current market leverage ratio is nearing the levels seen before the May 2021 crash, with the open interest of perpetual contracts exceeding $28 billion. On such a tightrope, even minor price fluctuations can trigger a chain reaction. For example, a 20x leveraged short position can be liquidated with less than a 5% price rebound. This "mutual destruction" effect is the core driver behind ETH's price plummeting 8% in just 2 minutes during the previous downturn. More concerning is that a liquidity crisis on exchanges is brewing. The depth of the BTC/USDT contract market has decreased by 40% compared to last month, with even a single $10 million liquidation order occurring. When the market loses its buffer, any sudden news could trigger a snowball effect—just like when Trump delayed regulatory easing, Bitcoin instantly dropped $2,000. However, crises often give birth to opportunities. We have identified three key signals: first, MicroStrategy has once again increased its Bitcoin holdings, which is a recent trend of buying the dip; second, the fear index has dropped to the extreme fear zone of 10, historical data shows this is usually a mid-term bottom area; third, the CME Bitcoin futures premium has rebounded to 0.8%, indicating that institutional funds are beginning to flow back.

Finally, we remind all trading friends: the current market is in a state of overlap between a policy vacuum and technical breakdown points. It is advisable to keep leverage below 3 times; remember, only the ships that survive the storm can welcome the next blue ocean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。