I. Outlook

1. Summary of Macroeconomic Trends and Future Predictions

Last week, the U.S. stock market showed an overall downward trend, particularly with technology and AI-related stocks performing poorly. However, on Friday, there was a certain degree of rebound in the U.S. stock market, indicating a short-term improvement in sentiment. The U.S. macroeconomy appears weak but not out of control, with stock market declines coexisting with localized rebounds, and macroeconomic uncertainties continue to affect market confidence. Investors should pay attention to the economic data set to be released in early March (such as the February non-farm payroll report), which will provide key insights for the Federal Reserve's March meeting.

2. Market Movements and Warnings in the Crypto Industry

Last week, the crypto market experienced a significant decline due to macro pressures and policy uncertainties, leading to a gloomy sentiment and a conservative flow of funds. On Sunday evening, Trump's comments about crypto reserves became a turning point, triggering a major rebound in cryptocurrencies mentioned, including BTC, ETH, SOL, and ADA, revitalizing market confidence. However, attention should still be paid to the implementation of tariff policies, adjustments in expectations for Federal Reserve interest rate cuts, and progress in regulatory frameworks, as short-term volatility may persist. Investors should closely monitor the White House crypto summit hosted by Trump this Friday and the subsequent policy details.

3. Industry and Sector Hotspots

Knidos is dedicated to redefining the true decentralization of Proof-of-Stake networks through its modular decentralized enhancement layer, gaining strong support from the Avalanche Foundation; Obol Collective is a decentralized operator ecosystem aimed at enhancing the security, resilience, and decentralization of Layer 1 blockchains and infrastructure networks;

Byzantine is a trustless and efficient re-staking layer that supports permissionless strategy creation, with the latest funding of $3 million.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Performance of Potential Sectors

1.1. Analyzing how the Depin protocol Knidos, which has gained strong support from the Avalanche Foundation, transforms static staking systems into liquid systems to enhance user returns

Knidos is a protocol committed to redefining the true decentralization of Proof-of-Stake networks through its modular decentralized enhancement layer.

The protocol focuses on developing innovative solutions that promote blockchain decentralization. Knidos aims to contribute to the decentralization of Proof-of-Stake blockchains through a trustless, network-agnostic orchestration layer.

Proof-of-Stake networks achieve consensus through validator nodes, which require substantial initial capital and deep technical expertise. The decentralized enhancement layer of Knidos Labs addresses these limitations by modularizing validator nodes and separating funds and technical setups. This creates opportunities for liquidity providers lacking technical expertise and developers and operators lacking sufficient liquid capital. Additionally, the integrated Node-Fi protocol activates dormant capital without sacrificing true custody or decentralization.

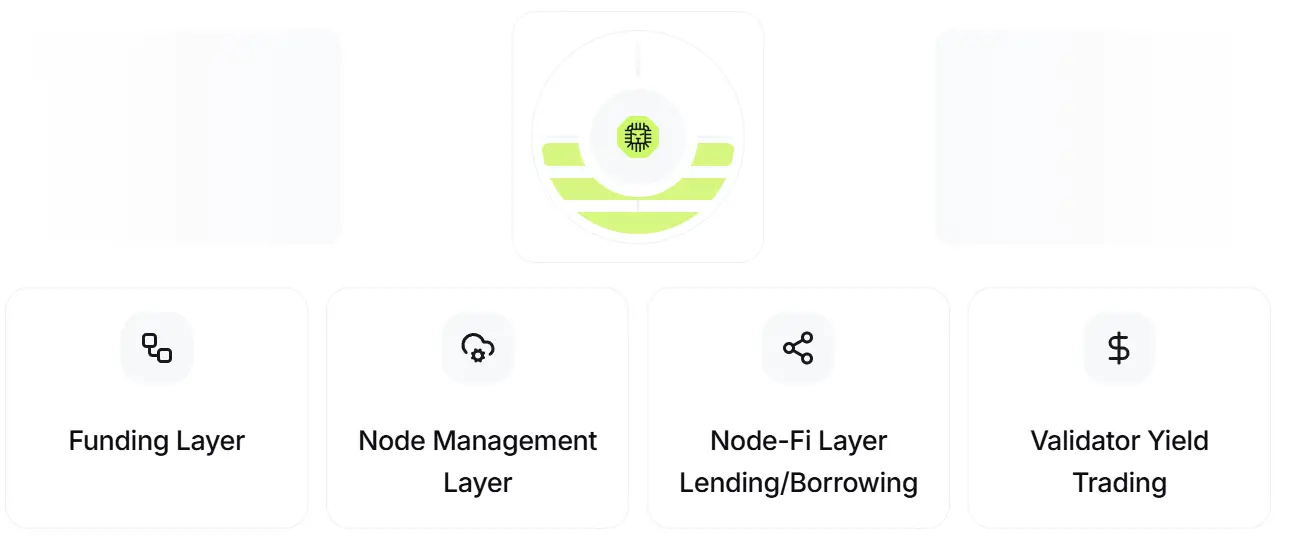

Architecture Overview

Knidos Decentralized Enhancement Layer The decentralized enhancement layer of Knidos provides a trustless, network-agnostic orchestration environment designed to support decentralized Proof-of-Stake networks. We activate dormant capital through modular validator nodes and the integrated Node-Fi mechanism. The three-party protocol includes the following interrelated sub-layers:

- Capital Layer The first sub-layer attracts capital by offering the highest annual percentage yield (APR) aside from setting up individual validator nodes. The capital pool is initiated by users without permission, and the pool initiator defines the validation configuration. Investors can flexibly contribute any funds they choose, which are then invested in split nodes.

Ownership of split nodes allows users to truly own a part of the blockchain node rather than merely delegating their coins, decentralizing access to network consensus by making node consensus more accessible and affordable. Partial ownership of each node is represented by non-fungible tokens (NFTs) held by users. All fees and rewards generated by the nodes are collected by the holders of these NFTs.

All processes occur within a trustless framework, ensuring that the Knidos protocol itself cannot access the funds at any time.

- Node Management Layer The second sub-layer creates a DePIN market for node operators, enabling them to monetize their hardware and technical capabilities without needing to invest liquid capital.

Operators pair with capital from the capital pool to establish Proof-of-Stake validator nodes in a completely non-custodial manner on any network. All processes are trustless, and node keys are transferred to the validation engine via on-chain ZK proofs.

The validation engine initiates the validation process, and nodes join the consensus. Operator nodes will be validated by Knidos protocol nodes.

- Node-Fi Layer The third sub-layer activates dormant capital in the staking pool without re-staking or sacrificing true custody.

Liquidity providers can stake their NFTs (see 3.3. Capital Layer) and continue to earn rewards, supporting network consensus and security. They can also borrow directly from the integrated Node-Fi engine for broader DeFi ecosystem use, and the entire structure is completely trustless. Lenders provide capital to smart contracts, and the interest paid by borrowers incentivizes lenders. This introduces a new layer of financialization for dormant assets, enhancing the network's TVL (Total Value Locked) and user activity.

Revenue Model The protocol generates income by charging fees on staking rewards produced by validator nodes and through its Node-Fi engine. Rates can be dynamically adjusted through governance to stimulate liquidity and operators, drive activity and TVL, and promote decentralization.

- Investor Reward Fees: Deducted from the staking rewards of investors.

- Operator Reward Fees: Deducted from the fees of operators.

- Node-Fi Lending Fees: Added to the base rate to further increase financial reserves and ensure solvency.

$KNIDOS is expected to launch in the second quarter of 2025, serving as the backbone of the entire protocol, providing access to tools, governance, and protocol revenue:

- Operator Registration: To register as a node operator in the Knidos protocol, users need to lock $KNIDOS tokens as a security deposit.

- Revenue Sharing: $KNIDOS stakers will be able to receive a portion of the revenue generated by the protocol upon governance approval.

- Governance: Stakers will participate in key decisions regarding the platform's future, empowering the community to shape the development direction of the Knidos protocol, including rate adjustments, incentive mechanism design, and strategic liquidity deployment to promote TVL growth and/or developer activity.

Commentary

Knidos collaborates through three sub-layers to form a large enhancement layer, liberating the yield limitations of traditional staking models through the dynamic mechanisms of this enhancement layer, infinitely amplifying the returns of nodes and node delegators while maintaining extreme decentralization.

The role of the Depin network in Knidos is more like a tool for generating additional income for nodes rather than being the core function of the protocol. This is an industry-first protocol that treats Depin operations as a subsidiary business for generating income. Therefore, from a revenue perspective, this protocol has significant potential, and with its close collaboration with Avalanche, users interested in staking may want to pay attention.

1.2. Can the unique performance of the stablecoin exchange protocol Torch Finance on Ton reignite liquidity for both new and old stablecoins?

Obol Collective is a decentralized operator ecosystem aimed at enhancing the security, resilience, and decentralization of Layer 1 blockchains and infrastructure networks. By providing modular tools and technologies, such as the Charon middleware client and Techne credentials, Obol enables node operators to run high-performance, anti-slashing nodes. This ecosystem facilitates collaboration between staking protocols, node operators, and home stakers, aiming to effectively scale decentralized networks.

Participants can earn OBOL tokens through programmatic incentives and retroactive funding, driving the growth and sustainability of decentralized infrastructure.

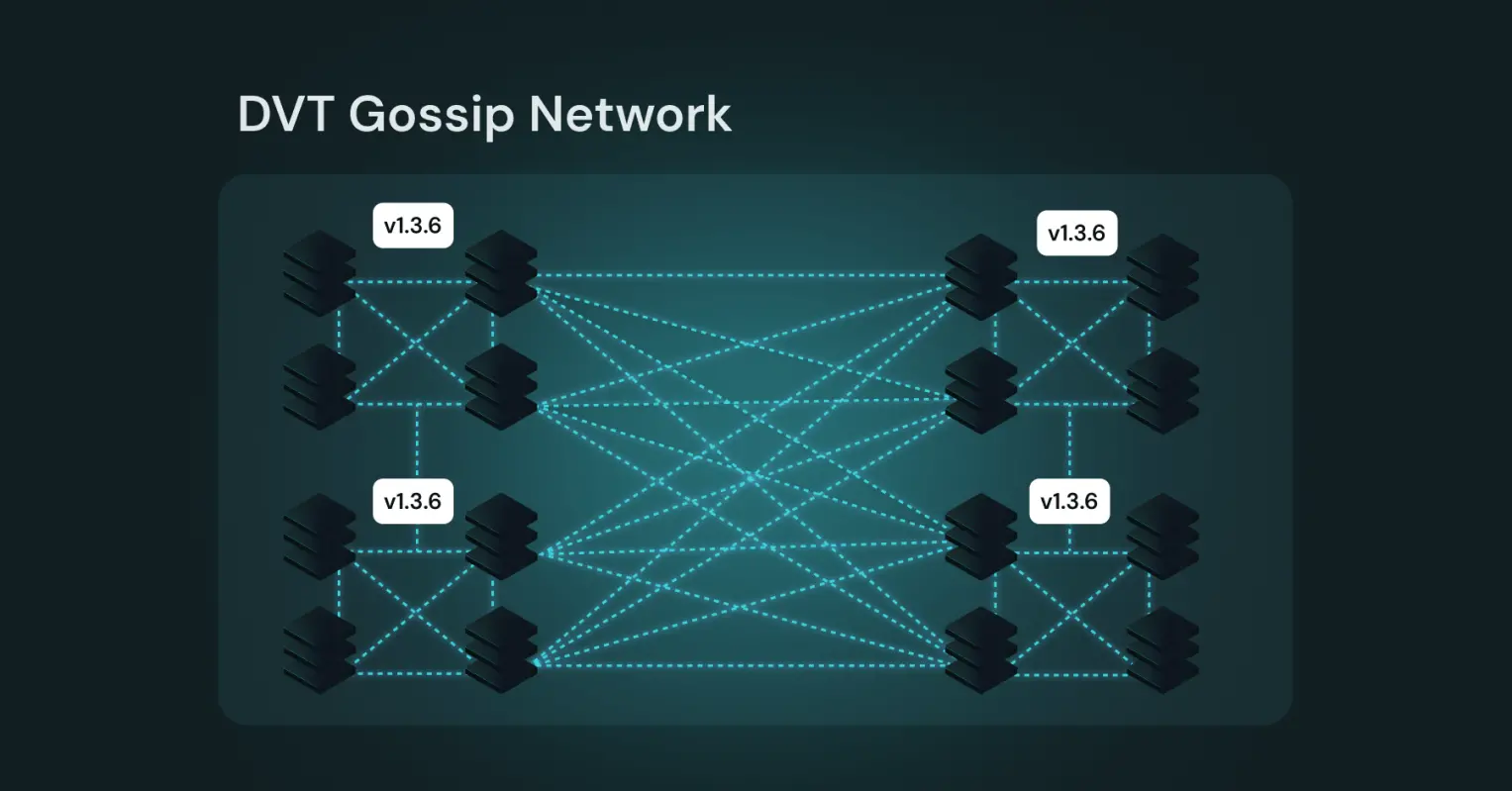

Expanding Infrastructure Networks Obol focuses on expanding consensus by providing permissionless distributed validators (DVs), which not only prevent client issues and key management errors but also possess Byzantine Fault Tolerance. We believe that distributed validators should and will become an important component of mainnet validator configurations, opening a new trust paradigm as the Ethereum community transitions to distributed validators.

Distributed Validator Middleware Client Charon

By enabling "squad staking," it enhances the security, resilience, and decentralization of the Ethereum validator network. This ecosystem is driven by Obol's economic model, which supports ecological projects through retroactive funding, creating a positive flywheel effect that accelerates the adoption of DVs and expands infrastructure networks like Ethereum.

Core Elements

Execution Client The execution client runs the EVM (Ethereum Virtual Machine) and manages the transaction pool of the Ethereum network. These clients provide execution payloads to consensus clients to be included in blocks.

Consensus Client The consensus client's responsibility is to run Ethereum's Proof of Stake consensus layer, commonly referred to as the Beacon Chain.

DV Middleware Client The DV client intercepts standardized REST API communications between any consensus client and validator client and coordinates with other Charon clients in the cluster to reach consensus, determine what needs validator signatures, and aggregate the returned signatures.

Validator Client The validator client operates as usual, using validator key shares to sign messages received from Charon, which are then sent back to Charon for aggregation.

Comparison of Obol with Other DV Implementations

No Private Keys on Chain

- Obol's Distributed Key Generation (DKG) event generates key shares for nodes in each DV cluster. The private key of the entire validator never exists in one place. Keys are generated locally on the nodes and can be backed up. The private keys of Obol DVs are never uploaded to the internet or made public on-chain.

- An alternative method is to split the private key into multiple shares, encrypt each share using the public key of the node operator, and then publish the encrypted private key on-chain. The operator's node key can decrypt this private key. However, we believe this practice is not secure. We think the safest way is to avoid having a single private key and absolutely not to publish the private key on a public chain.

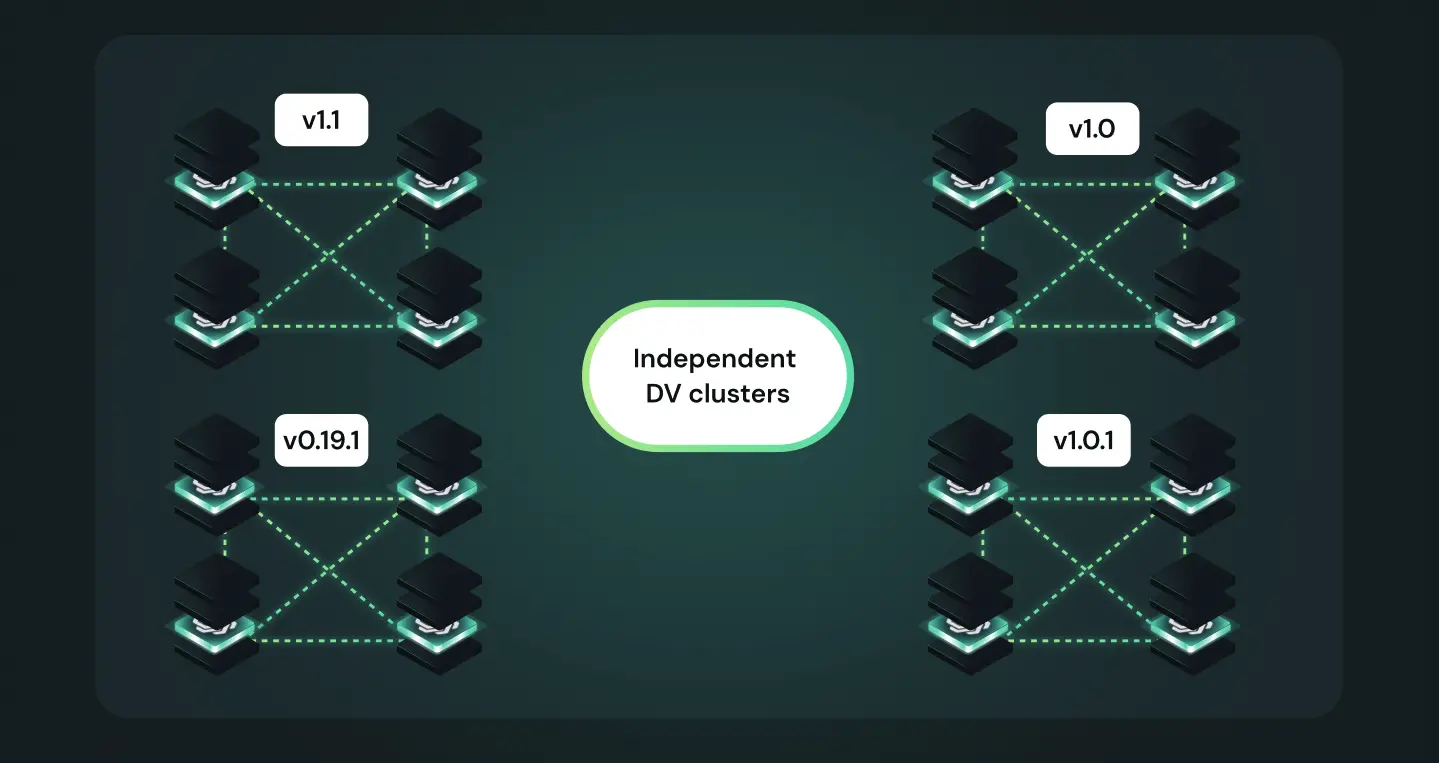

Cluster Independence: Clusters can upgrade independently without relying on a public P2P gossip network

In Obol's DV clusters, nodes communicate directly using LibP2P, with communication encrypted end-to-end via TLS. The clusters are completely independent and can run different versions of Charon without needing to upgrade together. This means that when Obol releases a new version of Charon, the Obol DV clusters can upgrade independently according to their own schedules, without needing to upgrade alongside other clusters. Charon never requires hard forks or simultaneous updates between clusters.

This direct communication between nodes enhances latency performance and makes cluster communication more resistant to denial-of-service (DOS) attacks. Additionally, it allows Obol DV clusters to operate in a private network. This can save data egress costs for operators running cluster nodes across multiple cloud providers.

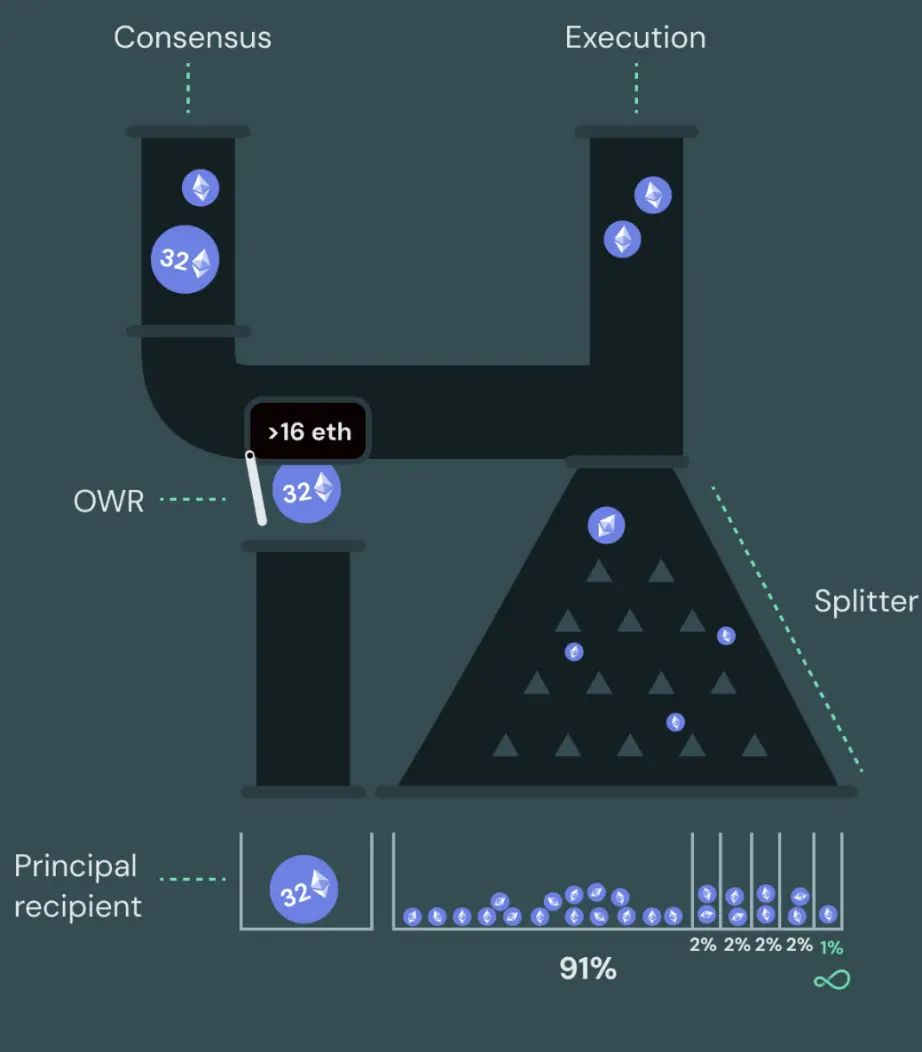

Obol Split

Obol develops and maintains a set of smart contracts for use with Distributed Validators (DVs). These contracts include:

- Withdrawal Recipients: Contracts for the withdrawal addresses of validators.

- Split Contracts: Contracts for distributing Ether to multiple entities, developed by org.

- Split Controllers: Contracts that can change the configuration of splitters.

Two key objectives of validator reward management are:

- The ability to distinguish between reward Ether and principal Ether, allowing node operators to pay based on the percentage of rewards accumulated for principal providers, rather than based on the percentage of principal + rewards.

- The ability to extract rewards continuously without needing to exit the validator.

The following section outlines the different contracts that can be combined to form solutions to achieve one or both of these objectives.

Withdrawal Recipients

Validators have two streams of income: consensus layer rewards and execution layer rewards. Withdrawal recipients focus on the former, continuously receiving balances from validators holding more than 32 Ether and receiving the principal of the validator upon exit.

Optimistic Withdrawal Recipient

This is the primary withdrawal recipient used by Obol, as it allows for the separation of rewards from principal and enables continuous extraction of accumulated rewards.

Commentary

Obol's unique features, such as the Charon middleware, retroactive funding mechanism, squad staking, and decentralized collaboration, set it apart from other DV implementations. It provides a more modular, secure, and scalable solution for building resilient blockchain infrastructure, especially in the context of Ethereum's transition to distributed validators, offering stronger fault tolerance and decentralization. Obol's focus on Byzantine fault tolerance and distributed trust makes it an important choice for the future development of blockchain infrastructure.

**1.3. With the latest funding of $3 million, what innovations does the decentralized yield aggregator **Byzantine Finance, claiming to "stake any asset anywhere," bring?

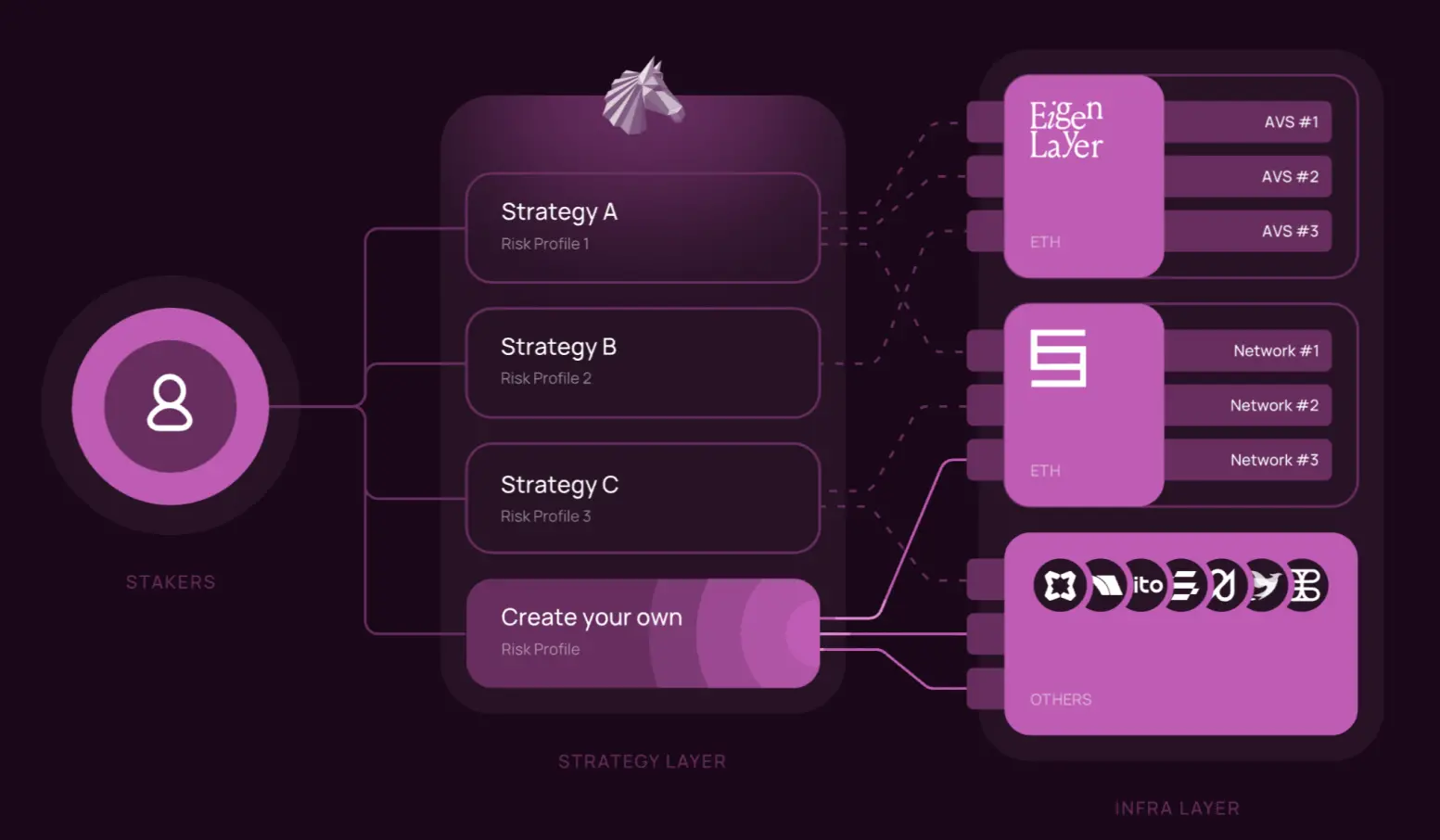

Byzantine is a trustless and efficient re-staking layer that supports permissionless strategy creation. We support the deployment of minimal, independent, and isolated re-staking strategy vaults by specifying the following:

A re-staking strategy consists of the following components:

- A set of AVS / networks

- One or more re-staking protocols

- A collateral asset

- Portfolio flexibility (immutable or mutable strategies)

- Investor permissions (open or whitelisted stakers)

- (Optional) liquidity tokens

The Byzantine protocol is trustless and aims to be more efficient, modular, and flexible than any other decentralized re-staking platform. All vaults are completely independent of each other: funds are fully isolated between them, and risks are entirely independent. Vaults are not affected by governance.

Separating Risk Management from Infrastructure

The strategy vault is just one example of permissionless risk management built on Byzantine. Any protocol, DAO, or individual can build on the Byzantine infrastructure layer to help users manage risk or integrate re-staking yields into existing services.

Crucially, risk management is executed outside of Byzantine. Therefore, Byzantine is unrelated to any specific investment outcome.

Core Components Byzantine is a decentralized protocol that allows for the permissionless creation of separate cross-protocol re-staking strategy vaults.

It separates the roles of investors (stakers), risk managers (strategy managers), and the infrastructure layer. Users can create strategy vaults permissionlessly according to their needs and can optionally open these vaults to other stakers.

- ByzVault Factory: A smart contract for permissionless deployment of ByzVaults.

- ByzVault: A deployed vault with a specific re-staking strategy. It handles reward settlement for PoS rewards (if ETH is the collateral) and re-staking rewards.

- AVS and Network Strategies: A combination of AVS / networks and protocols that specific strategy vaults will re-stake into.

- Operator Registry: A licensed institutional node operator registry that allows permissionless vault deployers to select one or more from it.

- Ethereum Validators: Ethereum validators for ETH staking.

- Re-staking Operators: Operators of re-staking strategies.

- Trust Market Protocols: Protocols like EigenLayer, Symbiotic, or Babylon.

Native vs. Liquidity Re-staking

The Byzantine protocol uniquely supports both native and liquidity re-staking strategies.

Liquidity Re-staking Liquidity re-staking allows stakers to stake liquid staking tokens (LSTs), stablecoins, or other ERC-20 tokens and earn additional rewards from re-staking. This enhances the utility and capital efficiency of the underlying tokens and is the simplest method of re-staking.

Byzantine strategy vaults can deploy various ERC-20 assets as underlying collateral tokens.

Native Re-staking Native re-staking allows stakers to stake and re-stake ETH in the same operation. The process is as follows:

- Stake ETH: Stakers stake ETH through the Byzantine vault. Validators are handled by operator partners chosen by the strategy manager.

- Delegate Staked ETH: Through Byzantine's smart contracts, validators containing staked ETH will automatically delegate to the trust market chosen by the strategy manager. The staked ETH thus ensures the AVS and network required by the strategy manager.

- Earn Re-staking Rewards!

Byzantine strategy vaults handle native re-staking strategies through a group of licensed Ethereum operators. When the vault is deployed, the strategy manager can choose specific operator partners if desired.

Advantages of Native Re-staking

- Dual Rewards: Stakers earn both staking rewards and re-staking rewards simultaneously.

- Risk Isolation: While LSTs aggregate deposited assets, native Byzantine vaults use validators specifically set up for the vault. Therefore, the risks of staking and re-staking are completely isolated.

- Higher Transparency: Strategy managers and stakers have clear visibility and control over their dedicated validators.

- Higher Yield Potential: By staking and re-staking through one protocol, stakers do not have to pay fees for multiple protocols. Additionally, removing the need for integration between protocols reduces friction and can enhance capital efficiency.

Commentary

With Byzantine, users can choose any re-staking protocol, network, operator, and collateral asset to instantly deploy their strategies.

Byzantine vaults easily integrate into DeFi. You can trade and leverage your vault shares or build your own custom services, products, or even assets based on Byzantine's flexible architecture.

Depositors can withdraw at any time. Since depositors own shares of the vault, they have complete control over their assets. Vault owners can change strategies but can never withdraw users' assets, adding an extra layer of security.

Every part of the Byzantine protocol has undergone multiple audits before going live. No one has the authority to access or decide how to handle users' assets. All deployed vaults can only be upgraded by the vault owner, meaning no one else can change the vault's functionality besides you. Your vault's liquidity will never mix with other vaults or share rewards.

2. Detailed Overview of Projects to Watch This Week

2.1. Can the unique performance of the stablecoin swap protocol Torch Finance on Ton reignite liquidity that has stagnated on-chain?

Introduction

Torch Finance is a cutting-edge decentralized exchange (DEX) designed for the TON blockchain. With innovation at its core, Torch Finance focuses on enabling stable trading, allowing users to trade liquid staking tokens (LSTs), stablecoins, and yield-bearing tokens (YBTs) with unparalleled convenience and efficiency.

Key Features

- StableSwap: Provides efficient and low-slippage trading of stablecoins, liquid staking tokens (LSTs), and yield-bearing tokens (YBTs), optimizing maximum capital efficiency.

- Cross-Chain Trading (Coming Soon): Seamlessly bridges assets across different chains, achieving a truly interconnected DeFi ecosystem.

Technical Analysis

- Torch Finance's Solutions

Torch Finance: The Stablecoin Hub Torch Finance is the ultimate stablecoin trading hub on the TON blockchain, designed to address the inefficiencies of existing platforms. By leveraging the industry-leading StableSwap algorithm, Torch Finance offers:

- Customized Price Curves: Tailored for each pool, ensuring unparalleled flexibility.

- Maximum Capital Efficiency: Reduces slippage, saving user funds, especially during high trading volumes.

With Torch Finance, users can enjoy a seamless and efficient trading experience, revolutionizing the way stablecoins are traded on TON.

Beyond Stablecoins: Exploring LSTs and YBTs The TON blockchain is not only a hub for stablecoins but also a growing ecosystem encompassing assets like liquid staking tokens (LSTs) and yield-bearing tokens (YBTs). These asset classes have the potential to simplify the DeFi yield experience and attract the 900 million users on Telegram into the DeFi ecosystem, with Torch Finance designed to unlock their value.

Instant Liquidity for LSTs Liquid staking tokens typically require up to 36 hours to complete the validation process before being converted back to TON. For users needing instant liquidity, Torch Finance provides a seamless solution.

By using Torch, users can instantly swap LSTs for TON with minimal slippage, ensuring quick access to liquidity when it is most needed.

Specialized Market for YBTs Yield-bearing tokens (YBTs) are a key innovation in DeFi, providing passive income through the yields of underlying assets. However, due to their unique value dynamics and reliance on yield strategies, YBTs often face liquidity challenges.

Torch Finance addresses this by utilizing its StableSwap infrastructure to create customizable liquidity pools optimized for YBT trading. These pools offer:

- Efficient Pricing Mechanisms: Taking into account the gradual accumulation of yields.

- Enhanced Liquidity: Ensuring users can trade without significant slippage while accumulating yields on YBTs.

By providing a customized trading environment for YBTs, Torch Finance not only enhances their accessibility but also ensures fair and competitive pricing. This approach simplifies the trading experience for YBTs, attracting more users to participate in the broader DeFi ecosystem on TON. With Torch Finance, the TON blockchain is no longer constrained by the inefficiencies of traditional exchange mechanisms. By focusing on stablecoins, LSTs, and YBTs, Torch Finance positions itself as the preferred platform for optimizing trading, helping users unlock the full potential of their assets on TON.

- Torch Finance Architecture

TON Virtual Machine (TVM): The Foundation of Scalability The TON Virtual Machine (TVM) supports smart contracts on the TON blockchain, featuring cutting-edge capabilities like the Infinity Sharding Paradigm, enabling dynamic scalability and ultra-fast transaction processing. This unique approach ensures that TON can meet growing demands, making it a robust foundation for DeFi innovation platforms like Torch Finance.

However, the TVM also presents unique challenges:

- No Transaction Rollbacks (Between Addresses): Failed transactions cannot be rolled back between different addresses, requiring more careful design of contracts.

- No Cross-Contract State Access: Contracts cannot directly retrieve state information from other contracts, necessitating innovative solutions to handle complex interactions.

Advantages of the Torch Finance Architecture The architecture of Torch Finance is designed to overcome these challenges and maximize the capabilities of the TVM. Its architecture offers several key advantages:

- High-Speed Transactions: Torch Finance leverages the TVM's Infinity Sharding to achieve ultra-fast transaction processing, ensuring scalability even during peak demand.

- Single-Sided Liquidity Provision: Users can provide liquidity with a single token without needing to use token pairs.

- Quasi-Atomic Swaps Supporting Multi-Token Pools: Supports multi-token pools, allowing seamless exchanges between any tokens within the pool. Faster swaps reduce routing complexity. Nearly atomic execution ensures reliable transaction outcomes.

Meta Pool Liquidity Aggregation Aggregating liquidity into smaller products enhances their availability while providing higher returns for liquidity providers.

Fuel Optimization By building on the DeDust foundation and introducing further optimizations, Torch Finance reduces fuel costs for single pool and cross-pool operations.

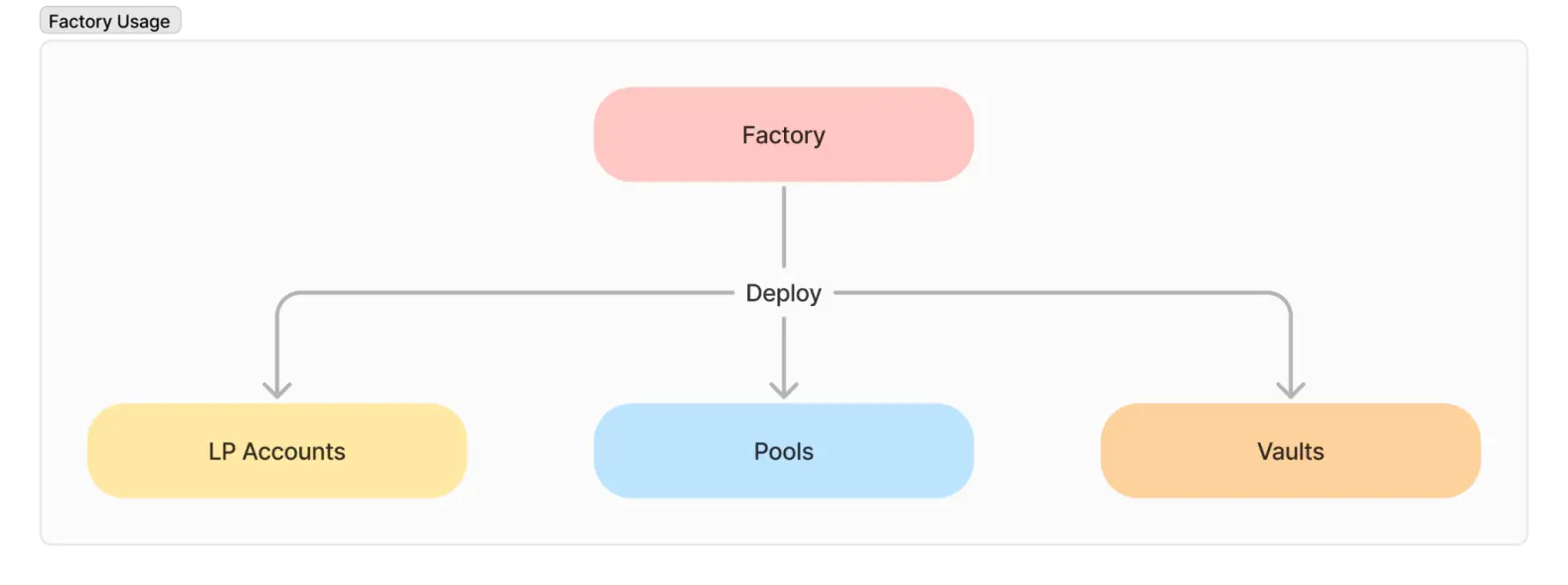

Core Elements The architecture of Torch Finance is built around five key components: Factory, Vaults, Pools, LP Account, and Oracle. Each component plays a crucial role in managing liquidity and facilitating seamless asset exchanges and trading, ensuring the protocol remains stable and efficient.

Factory

The Factory is the core coordinator of Torch Finance, responsible for deploying all contracts, including Vaults, Pools, and LP Accounts.

The Factory can be likened to a supermarket manager, deciding which checkout counters (Vaults) should be set up, which cash registers (Pools) need to be activated to handle discounts and exchanges, and arranging delivery services (LP Accounts) to consolidate all purchased goods for users, ensuring transactions are faster and more efficient.

When a new asset enters the system, the Factory deploys a new Vault (checkout counter) to manage and store that asset, ensuring it has a dedicated space for processing.

If a new liquidity pool is needed, the Factory sets up the corresponding Pool (cash register), responsible for asset exchanges, discount calculations, and transaction processing.

Based on different user needs, the Factory creates dedicated LP Accounts (delivery services) that efficiently deliver assets to users in one go after all transactions are completed, ensuring a smoother and more streamlined trading process.

Whether deploying new liquidity pools or LP Accounts, the Factory can quickly allocate and deploy resources, ensuring the Torch system operates smoothly and ensuring seamless coordination between components.

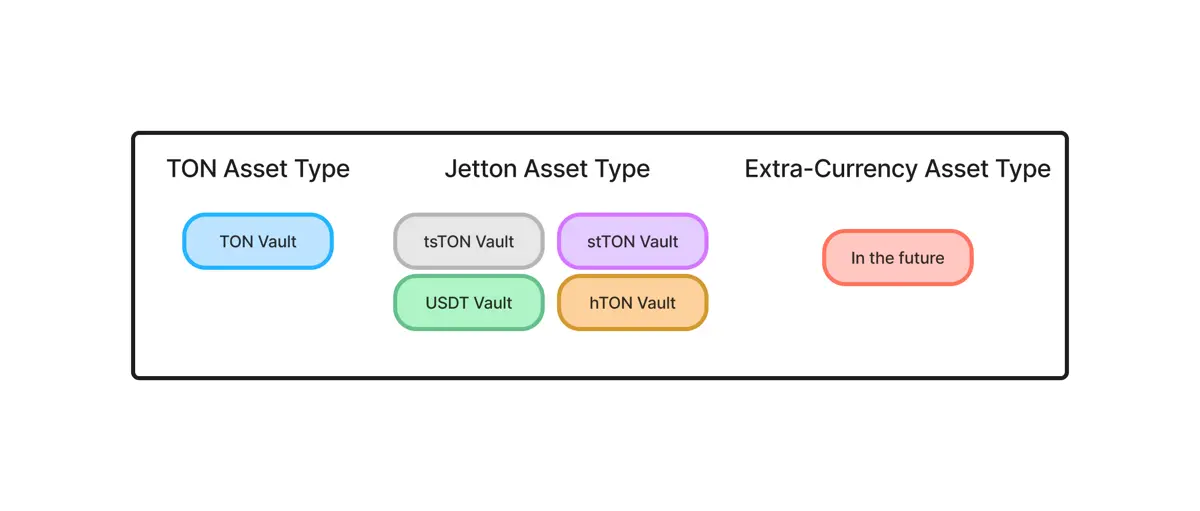

- Vaults

The Vault is a key component of Torch Finance, responsible for managing user assets and utilizing TON's sharding mechanism. Each Vault stores and manages specific types of assets, protecting user funds and executing transfer operations according to Torch contract instructions.

In Torch, TON and Jetton are viewed as different asset types:

- TON is a unique asset type managed by the TON Vault, used for storing and processing users' TON assets.

- Jetton represents another asset type managed by Jetton Vaults. Each Jetton has a dedicated Vault, such as USDT Vault or tsTON Vault.

The primary function of the Vault contract is to store user assets and handle deposits, exchanges, and withdrawals when users interact with the system.

- Pools

In the design of Torch, asset management is handled by the Vault contracts, which directly inform the Pools of the type and amount of user assets. This separation allows the Pools to focus on trading and liquidity algorithms without needing to handle the storage or retrieval of assets.

This design decouples the Pools from the Vaults, giving Torch exceptional flexibility and scalability in creating liquidity pools.

- LP Account

Due to the asynchronous nature of TON, a separate transaction is required to transfer assets into the Vault when assets are deposited.

When users batch deposit assets, the LP Account acts like a delivery service, only delivering all assets to the user's home (Pool) for asset exchange or liquidity provision once all items are checked out and packaged.

If a user deposits only one type of asset, an LP Account is not needed—the Vault will send the asset directly to the Pool for processing, simplifying the transaction process.

- Oracle

In Torch Finance, general stable pools do not require oracles. However, if a pool contains assets that appreciate over time, directly using these assets can lead to increased slippage over time.

To address this issue, Torch Finance collaborates with the blockchain industry's leading oracle, Pyth, to launch the Yield Bearing Stable Pool, which utilizes Pyth to reference the redemption rates of yield-generating assets, allowing for the calculation of exchange rates based on the underlying assets, significantly enhancing the user trading experience.

Conclusion

By providing a seamless, user-centric experience, Torch Finance is revolutionizing decentralized trading. Inspired by the innovative pool abstraction models of Curve Finance and Balancer, Torch Finance enables efficient, low-slippage trading of stable assets while paving the way for cross-chain interoperability.

III. Industry Data Analysis

- Overall Market Performance

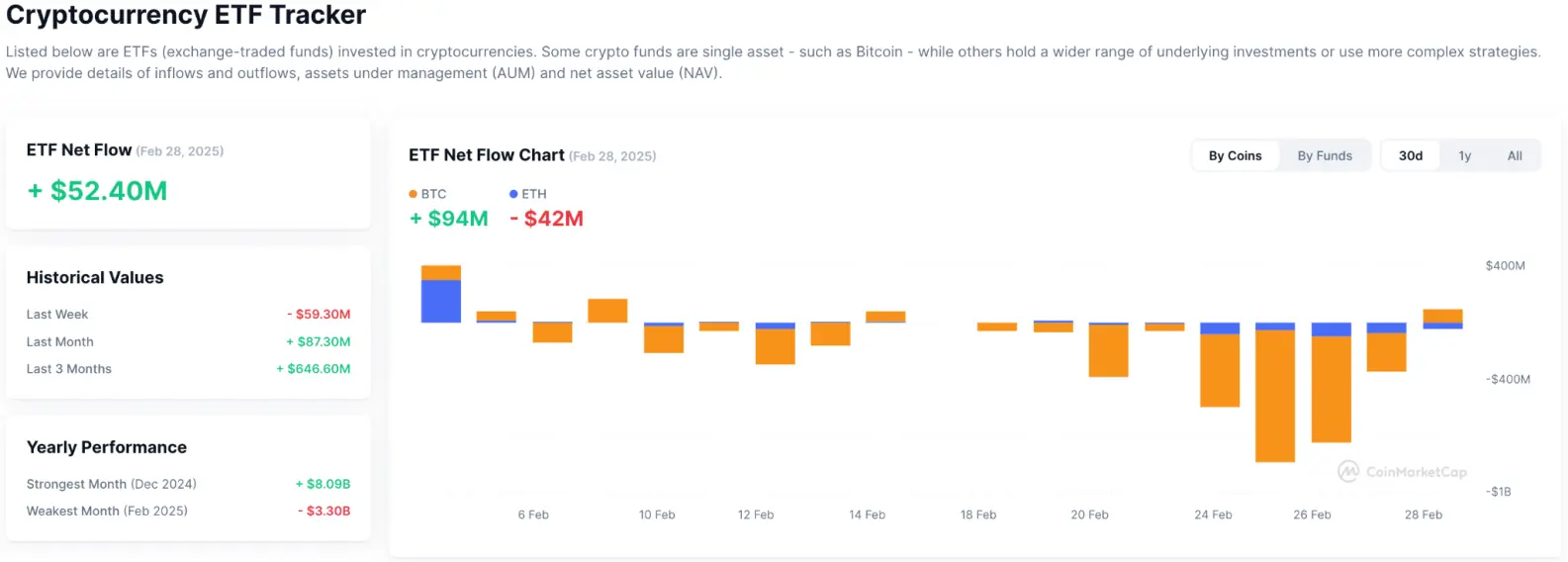

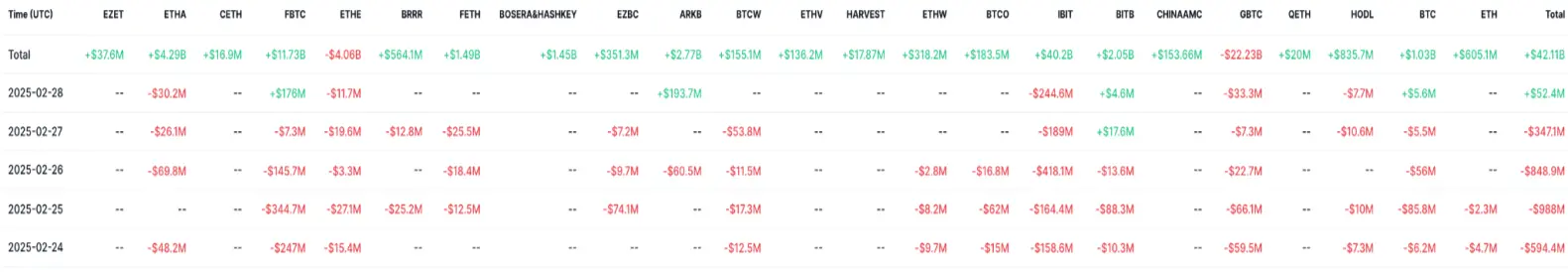

1.1 Spot BTC & ETH ETF

As of November 1 (Eastern Time), the total net outflow of Ethereum spot ETFs was $10,925,600.

1.2 Spot BTC vs ETH Price Trends

BTC

Analysis

Last week, BTC experienced a decline of over 18% throughout the trading day cycle. Despite the adverse fundamental factors continuously suppressing the coin price, the bearish sentiment was almost entirely shattered by Trump's speech on Sunday night. Given that several significant economic indicators will be released this week, it remains uncertain whether the rebound can continue. However, if the non-farm payroll and initial jobless claims meet expectations, BTC's pullback could stabilize above $90,000. In that case, a continued rebound towards the end of this week, breaking through the upper boundary of the descending wedge pattern, would be anticipated. Once a breakthrough is confirmed, the short-term downward trend could be considered reversed, and subsequent rebound points can continue to focus on the three key resistance zones highlighted in the chart.

Conversely, if the aforementioned economic indicators do not meet expectations, leading to a decline in the capital markets, there is also a probability that BTC could fall below the $90,000 or even $88,000 support range. Of course, considering the Trump administration's positive stance on protecting the crypto market, this is a low-probability event. However, the market is ever-changing, and users should remain vigilant.

ETH

Analysis

For ETH, the rebound after falling close to $2,000 is similarly suppressed by the bottom of the February consolidation range, which is $2,550. It has now entered a correction phase. However, given the current strength of the correction, it is highly likely that the price will stabilize above $2,400. Still, there are numerous resistance zones above, especially the long-term downward trend line marked in black. Although this trend line was temporarily invalidated at the end of January, it was revalidated during the market on February 25, indicating that the breakout at the end of January can be considered a false breakout.

Therefore, the trend for ETH is relatively clear. Until it effectively breaks through and stabilizes above the downward trend line, ETH's movement will remain weak. Conversely, another attempt to challenge or even break through $3,000 is highly likely.

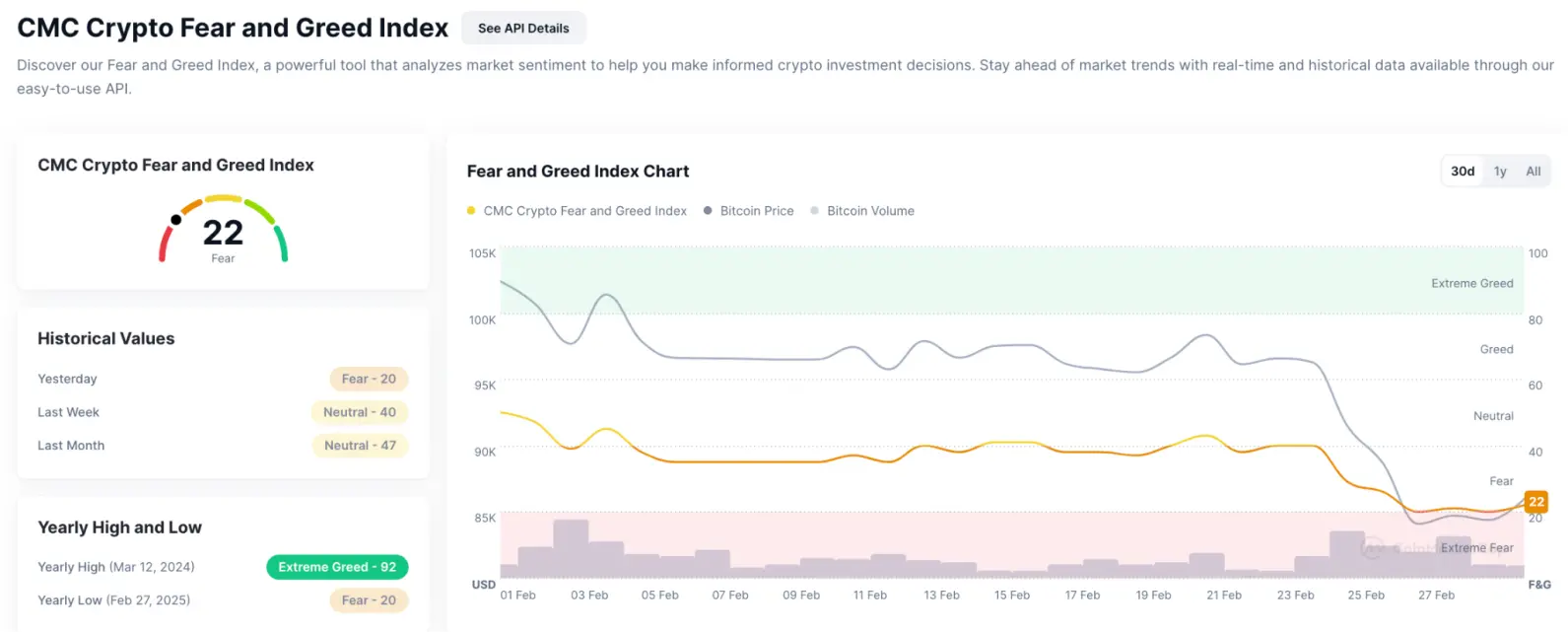

1.3 Fear & Greed Index

Analysis

This week, the index dropped to 22, indicating that the market is in a state of "extreme fear." This decline reflects investors' anxiety, primarily due to the following reasons:

Increased Market Volatility: The significant drop in prices of major cryptocurrencies like Bitcoin and Ethereum has raised concerns about a downward spiral. Such strong volatility typically leads investors to become more cautious, exacerbating market fear.

Decreased Trading Volume: Recent trading activity has noticeably decreased, indicating a lack of confidence among investors. Lower trading volumes can amplify price fluctuations, making the market more susceptible to significant declines, further intensifying investor panic.

Macroeconomic Uncertainty: Global economic instability, including concerns over monetary policy, interest rates, and geopolitical tensions, has prompted investors to reassess their investments in high-risk assets like cryptocurrencies. This risk-averse sentiment has led to an increase in market fear.

Currently, the fear sentiment is decreasing as prices stabilize. This week, attention should be paid to the strength of Bitcoin's rebound. If the rebound is strong, it may indicate that the index of 22 will become a thing of the past; conversely, it may continue to decline.

- Public Chain Data

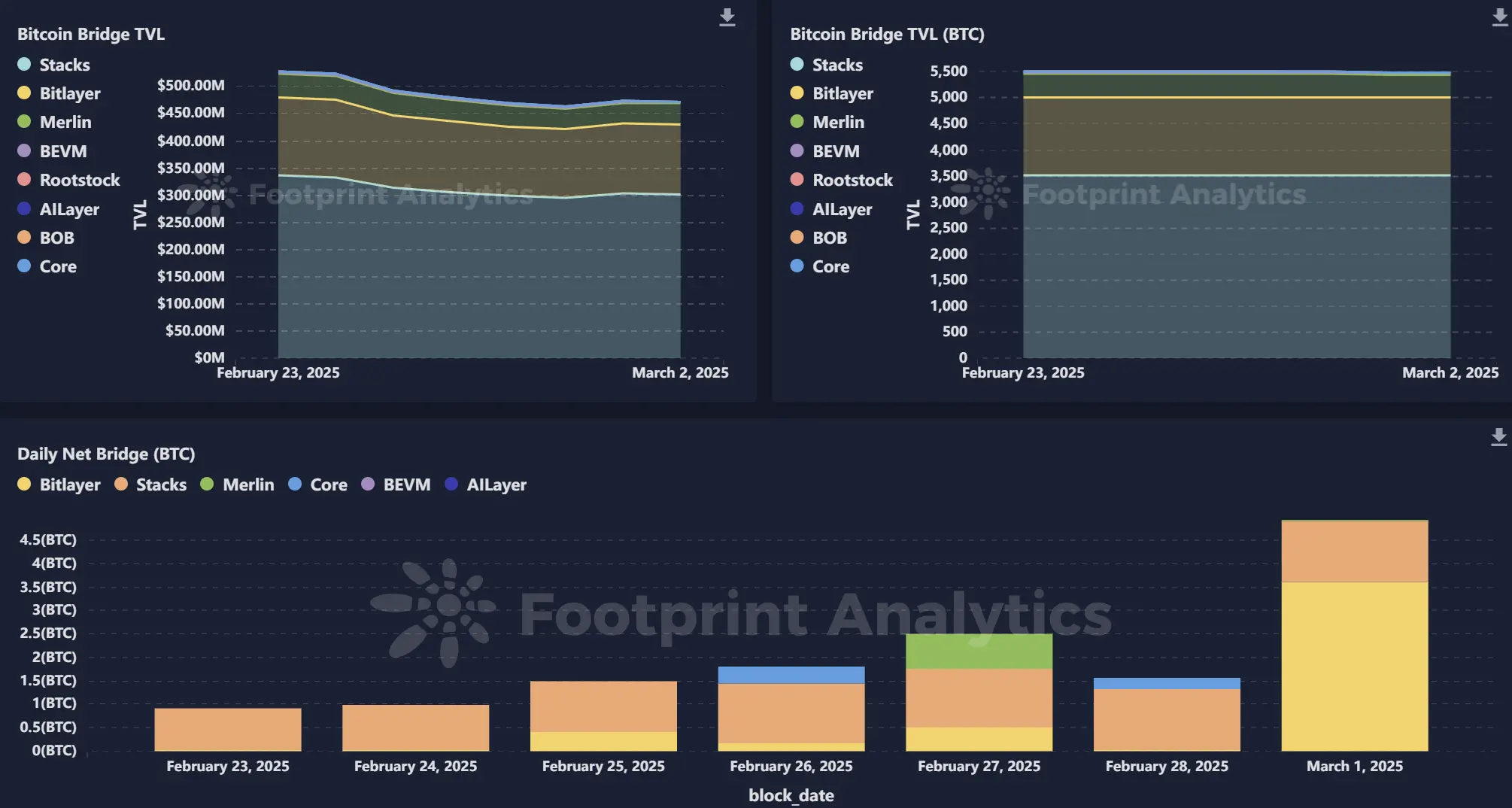

2.1 BTC Layer 2 Summary

Analysis

From February 24 to February 28, 2025, the Bitcoin Layer 2 ecosystem experienced significant developments and challenges.

Bitlayer's BitVM Implementation and Strategic Partnerships

On March 1, Bitlayer announced significant progress in implementing BitVM. BitVM is a technology that enhances Bitcoin's programmability and scalability without requiring a fork. This advancement has received strategic support from the following blockchain platforms:

- Base: Bitlayer's BitVM bridge allows Bitcoin to transfer within the Base ecosystem, enabling Bitcoin holders to participate in decentralized finance (DeFi) applications.

- Arbitrum: This integration allows users to bridge assets between Bitcoin and Arbitrum, enhancing liquidity and opportunities in decentralized finance while maintaining a trust-minimized framework.

- Starknet: The collaboration with Starknet aims to provide Bitcoin users with fast transactions and low fees, ensuring security through STARK proofs and promoting the development of a Bitcoin DeFi hub.

- Plume Network: Through collaboration with Plume Network, Bitlayer is committed to optimizing the liquidity of real-world asset (RWA) use cases, bringing institutional-grade products into the Bitcoin ecosystem.

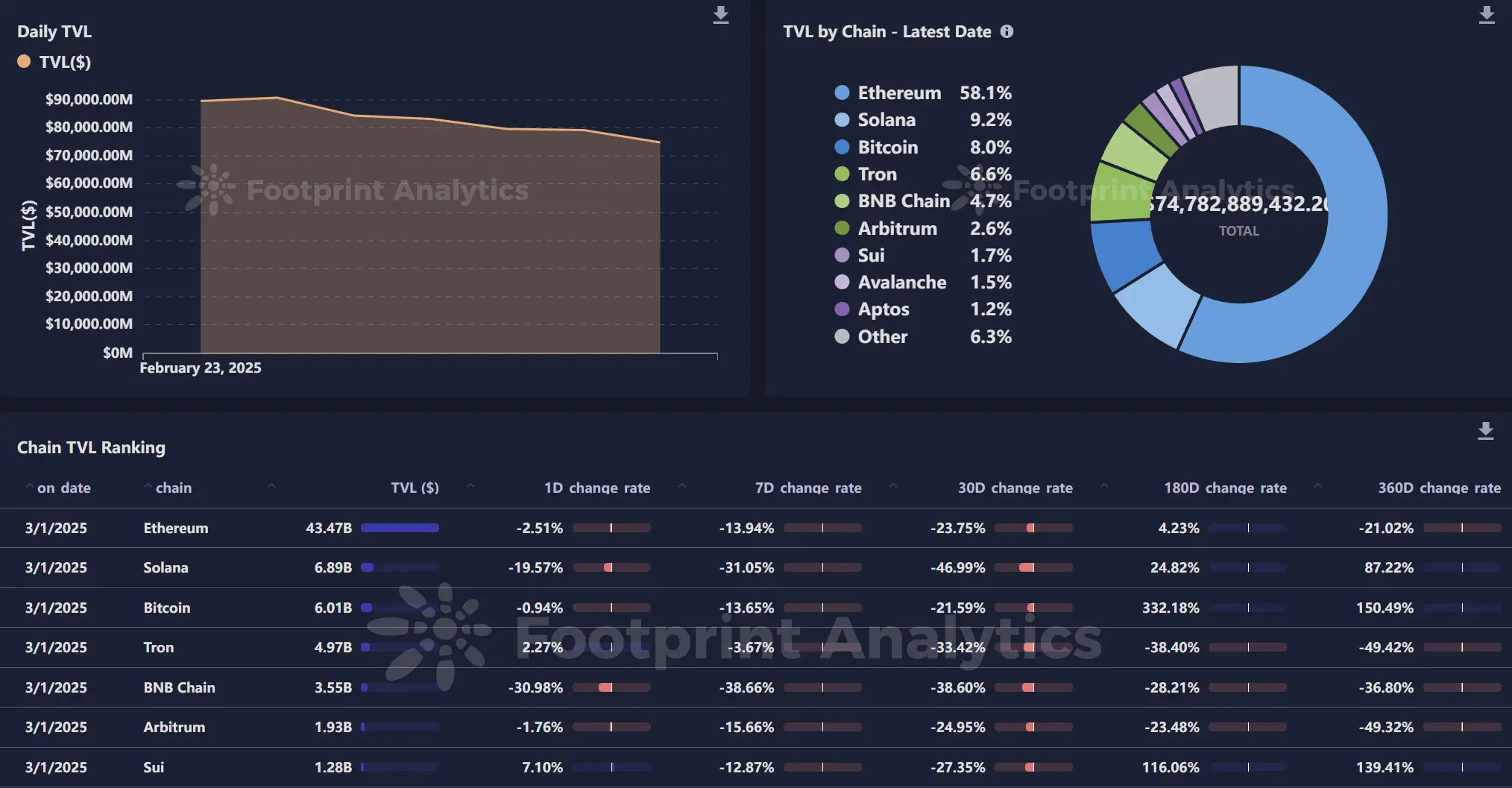

2.2 EVM & Non-EVM Layer 1 Summary

Analysis

From February 24 to February 28, 2025, several important developments related to EVM and non-EVM Layer 1 blockchains attracted industry attention.

EVM Layer 1 Related Progress:

- Autonomys Labs Developer Sync Meeting: On February 24, Autonomys Labs held a bi-weekly developer meeting at the ETH Denver event, discussing various updates and innovations within the community, with a particular focus on the progress of its decentralized autonomous organization (DAO) governance model.

- Cross-Chain Integration of EVM and Non-EVM Networks: Recent integrations have enabled trustless cross-chain messaging between EVM and non-EVM Layer 1 networks (such as Solana), facilitating secure interactions between different blockchain ecosystems.

Non-EVM Layer 1 Related Progress:

- Exploration of Stacks Smart Contract Potential: Research has delved into the smart contract potential of Stacks as a Bitcoin Layer 2 solution, emphasizing its integration with the Bitcoin main chain through anchored transactions, ensuring immutability and allowing for transaction settlement on the Bitcoin main chain.

2.3 EVM Layer 2 Summary

Analysis

The following is a comprehensive summary of the main progress and trends of leading protocols in the EVM Layer 2 ecosystem from February 24 to February 28, 2025:

- MetisDAO: Optimizing Withdrawal Speed and Governance Innovation

- Application of Ranger Mechanism: MetisDAO has introduced the Ranger role to further shorten asset withdrawal times based on Optimistic Rollup. Rangers enhance transaction credibility by locally verifying transactions on Layer 2, thereby reducing the waiting period for users withdrawing assets from Layer 2 to the Ethereum mainnet.

- DAC Ecosystem Expansion: MetisDAO emphasizes the concept of "Decentralized Autonomous Companies" (DAC), aiming to provide customized execution layers for specific application scenarios, further attracting enterprise-level users and developers to participate in ecosystem building.

- Governance Experimentation: The team may explore the deep integration of DAO governance and Layer 2 technology during this period, promoting a more decentralized network operation model.

- Optimism: Public Goods Funding and Ecosystem Access

- Public Goods Funding Allocation: The Optimism team may announce a new round of public goods funding during this period, continuing its commitment to using profits to support open-source projects and infrastructure, attracting community developers to participate.

- Ecosystem Access Mechanism Adjustment: Optimizing the review process for DApp deployment to balance openness and security, potentially introducing new governance tools to enhance the quality of ecosystem projects.

- Cross-Chain Bridge Integration: Collaborating with cross-chain bridges like Hop Protocol to improve the efficiency of asset transfers between different Layer 2s, alleviating liquidity fragmentation issues.

- Rollux (Syscoin): Bitcoin-Powered Security Innovations

- Merged Mining Technology: Rollux further solidifies its position as a high-performance EVM Rollup by combining Bitcoin's hash power security. More partners or technical details based on Bitcoin merged mining may be announced during this period.

- Low Costs and High Throughput: The team continues to optimize transaction fees (as low as $0.07 per transaction) and TPS (up to 576), attracting high-frequency trading DApps to migrate to its network.

- AI and Blockchain Integration: Exploring the application of Layer 2 in emerging fields like social finance (SocialFi) through AI-enhanced social platforms like SuperDapp.

IV. Macroeconomic Data Review and Key Data Release Points for Next Week

Last week, the U.S. January core PCE price index year-on-year at 2.6% indicated that inflation is slowly retreating, meeting expectations and reaching a six-month low. However, the month-on-month increase of 0.3% shows that inflationary pressures have not completely dissipated. Combined with strong personal income but weak spending, the U.S. economy presents a complex situation. The macro environment is dominated by uncertainties surrounding Trump's policies, and the market's sensitivity to inflation data has decreased. Attention will need to be paid to the actual impact of the March Federal Reserve meeting and the implementation of tariff policies in the future.

This week (March 3 - March 7), important macro data points include:

March 5: U.S. February ADP employment numbers

March 6: U.S. initial jobless claims for the week ending March 1

March 7: U.S. February seasonally adjusted non-farm payrolls

V. Regulatory Policies

The market experienced a significant drop on the 28th, but prior to that, U.S. regulatory agencies reached settlements with several crypto platforms or paused investigations. Despite this series of influences, the market did not rebound. It wasn't until the evening of March 2 that Trump announced the U.S. crypto reserve plan, explicitly including five assets such as BTC and ETH. This means the U.S. has officially launched a Bitcoin national reserve, leading to a significant market surge, with prices rebounding from below $80,000 to around $95,000.

U.S.: Establishment of Crypto Strategic Reserve

President Trump announced the establishment of the U.S. Crypto Strategic Reserve, aimed at establishing the U.S. as a leader in digital asset innovation. The reserve will initially include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This move has led to a substantial increase in the market capitalization of these cryptocurrencies and indicates a shift in policy from past regulation to more support for the crypto industry.

On February 21, the SEC announced the withdrawal of its lawsuit against Coinbase and terminated investigations into Uniswap Labs and Gemini over the past week, also ending accusations against platforms like OpenSea and RobinHood Crypto. On the other hand, on February 27, the SEC requested to pause the lawsuit against Justin Sun and the Tron Foundation to seek potential resolutions.

European Union: Implementation of MiCA Regulation

The EU's regulation on the crypto asset market (MiCA) will come into full effect on December 30, 2024. MiCA provides a comprehensive regulatory framework for crypto assets, aiming to protect investor rights while promoting the adoption of blockchain technology. The regulation covers various participants in the market, including issuers, trading platforms, exchanges, and custodial wallet service providers.

UAE: Official Approval of USDC and EURC

The Dubai Financial Services Authority (DFSA) has officially approved USD Coin (USDC) and EURC, both under Circle, as the first recognized stablecoins. The new regulations will allow businesses within the Dubai International Financial Centre (DIFC) to use these two stablecoins in various digital asset applications, including payments and fund management. Since its establishment in 2004, DIFC has attracted nearly 7,000 active companies and strictly allows only recognized crypto tokens to operate.

Hong Kong: Will Release Second Policy Declaration on Virtual Asset Development

Hong Kong's Financial Secretary Paul Chan announced in the 2025-26 Budget that a second policy declaration on the development of virtual assets will be released soon. This declaration will explore how to combine the advantages of traditional financial services with technological innovations in the virtual asset field, enhancing the security and flexibility of real economic activities, and encouraging local and international companies to explore innovations and applications of virtual asset technology. Chan reiterated that the government will consult on the licensing system for over-the-counter trading and custody services for virtual assets within the year. Regarding stablecoin regulation, the Hong Kong government has submitted a draft bill to the Legislative Council, and once the bill is passed, the Monetary Authority will expedite the approval of license applications.

International Dynamics: OECD Launches Crypto Asset Reporting Framework (CARF)

The Organisation for Economic Co-operation and Development (OECD) has launched the Crypto Asset Reporting Framework (CARF) to facilitate automatic information exchange among countries to address tax evasion risks associated with digital assets. Under CARF requirements, Crypto Asset Service Providers (CASPs) must collect users' personal information (such as tax residency and identification numbers) and report this data to domestic tax authorities, which will then exchange information internationally to enhance tax compliance and regulatory efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。