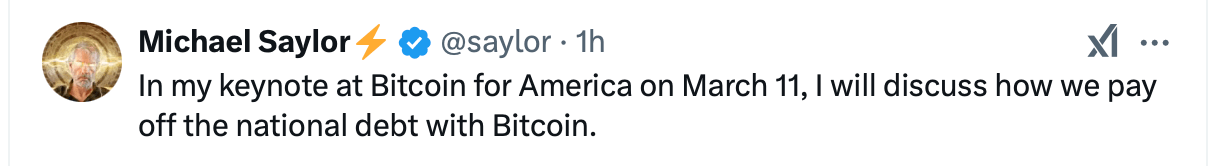

Saylor’s provocative assertion, central to his March 11 keynote, likely rests on a detailed, hypothetical plan demanding rare collaboration among lawmakers, regulators and financial bodies. This analysis explores the layered strategy the U.S. might employ to turn this vision into reality.

First, the U.S. Treasury would probably need to convert a portion of its reserves into bitcoin. This could involve reallocating funds from traditional assets like gold or foreign currency holdings. Peter Schiff would not be pleased. Lawmakers might also legislate a federal bitcoin mining initiative, leveraging the nation’s energy resources to generate BTC revenue. Such a reserve would grow in value proportionally to bitcoin’s price appreciation. Rough estimates say around 30-40% of the global hashrate reside in the United States.

Next, the U.S. government would presumably hold these bitcoin reserves long-term, mirroring Strategy’s corporate strategy. If BTC’s price rose to approximately $5 million per coin—a 100x increase from early 2025 levels—a 7.2 million BTC stash (roughly one-third of bitcoin’s total supply) might be able to cover the debt. Achieving this price would require extreme hyperbitcoinization: global adoption of BTC as a reserve currency, displacing unstable fiat regimes.

To monetize holdings, the Treasury could execute a phased sell-off, offloading BTC incrementally to avoid market destabilization. Proceeds would directly repay creditors or buy back Treasury bonds. Alternatively, BTC-backed bonds could be issued, using future bitcoin gains as collateral to refinance debt at lower interest rates. Hyperbitcoinization, however, risks destabilizing the mighty greenback — a variable demanding rigorous analysis within this hypothetical fiscal calculus.

This plan’s feasibility relies on three pillars: sustained bitcoin demand from institutions and nations, regulatory frameworks protecting U.S. BTC holdings from geopolitical risks, and a decades-long timeline to mitigate volatility. Critics argue such projections are speculative, but proponents cite bitcoin’s finite supply and historical four-year returns as justification.

While Saylor’s proposal exists in the realm of conjecture — and his vision may diverge from our highly speculative model — his keynote on bitcoin’s fiscal potential amplifies the cryptocurrency’s expanding gravitational pull within debates about sovereign economics. Whether lawmakers would risk national solvency on a decentralized asset—however mathematically predictable—remains a divisive question, one unlikely to be resolved without drastic shifts in global monetary paradigms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。