Macroeconomic Interpretation: As Bitcoin hovers around $96,000, the market seems to have entered a delicate state of balance. Today, I came across data indicating that the ETF cost basis is $89,000, acting like a shot of adrenaline, while Bloomberg's analysis suggests that there is still a 10%-15% growth potential in Bitcoin ETF holdings, which adds significant weight to the undercurrents in the market. These numbers may seem cold, but they weave a new tapestry of the crypto ecosystem where institutional capital and retail sentiment intertwine.

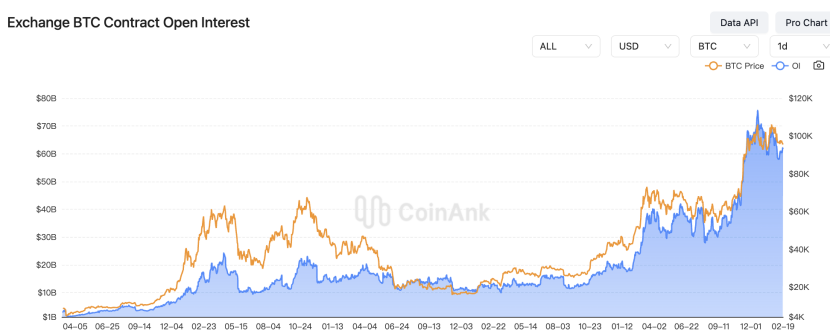

From the data in the derivatives market, we capture key clues about market resilience. The total open interest in BTC contracts across the network has reached a peak of $61.3 billion, with CME and Binance accounting for nearly half of this. However, a 0.07% fluctuation within 24 hours is almost negligible. Matrixport's analysis provides a footnote to this data: even in the face of $600 million in liquidations, Bitcoin can still stabilize quickly at the bottom, contrasting sharply with the 20% volatility seen during the bull market of 2020-2021. This formation of "low-leverage resilience" may be attributed to the institutional dividends brought by the SEC's approval of spot ETFs—when the selling pressure from Grayscale's GBTC is offset by the continuous inflow from institutions like BlackRock, the market naturally forms a new dynamic equilibrium.

The rhythm of institutional capital entering the market hides secrets. CryptoQuant's data shows that the cost basis for ETF and custody wallet holders is as high as $89,000, creating a tiered distribution compared to Binance traders at $59,000 and miners at $57,000. This structure acts like a natural price buffer: when the price falls below the miners' cost line, it often signals the onset of a bear market, while the current price is well above the miners' breakeven point, leaving a 30% gap to the institutional cost line. Bloomberg analysts further point out that if the institutional holding ratio of Bitcoin ETFs can reach the 40% level of gold ETFs, it implies there is still a trillion-dollar space for capital entry. This "cost inversion effect" may explain why Ki Young Ju firmly believes that even if Bitcoin retraces 30% from its high of $110,000 to $77,000, the foundation of the bull market remains unshaken.

The script of gold prices reaching a new high of $2,943 per ounce provides an alternative perspective for the crypto market. ANZ attributes the surge in gold prices to safe-haven demand driven by trade war risks, and this logic applies equally to Bitcoin—when the Federal Reserve's interest rate cut expectations resonate with geopolitical risks, digital gold and physical gold are performing a "duet of safe-haven assets." Interestingly, the explosive sales of Trump's crypto project WLFI tokens (with 86.2% of new shares sold out) suggest that some investors have begun to bet on "political narrative coins." While this frenzy may not be a reliable indicator, it does confirm the ample liquidity in the market.

From the current standpoint, the Bitcoin market exhibits three main characteristics: institutional holding costs create price support, the deleveraging in the derivatives market enhances volatility resistance, and macro safe-haven demand forms a value consensus. These elements collectively point to one conclusion—the adjustments in 2024 are more likely to present a "bullish retracement" rather than a "bear emergence." When traditional institutions enter the market with an $89,000 cost basis, when the holding structure of gold ETFs indicates incremental space for Bitcoin, and when market liquidation pressure is diluted by institutional dividends, we may be witnessing the "coming of age" of cryptocurrencies as they transition to mature assets. As for those speculators keen on hyping celebrity coins, it might be wise to remember Buffett's famous saying: "Only when the tide goes out do you discover who's been swimming naked." After all, in the face of true digital gold, all meme coins ultimately amount to mere bubbles on the beach.

BTC Data Analysis:

According to Coinank data, the total open interest in BTC contracts across the network has reached 640,400 contracts (approximately $61.295 billion), with a 24-hour decline of 0.07%. Among them, CME leads with 172,500 BTC (approximately $16.49 billion), accounting for 26.9%, with a 24-hour decline of 0.93%; Binance ranks second with 117,000 BTC (approximately $11.198 billion), accounting for 18.26%, with a 24-hour increase of 0.61%.

We believe that from the data in the derivatives market, the current high-level oscillation of Bitcoin contract open interest reflects an intensifying tug-of-war between bulls and bears. The total open interest across the network stands at $61.295 billion, with a slight decline of 0.07% over 24 hours, indicating overall stability in the holding structure, but the segmented market shows differentiation:

Institutional holdings are becoming cautious, with CME, as the main battlefield for traditional institutions, seeing a 0.93% decline in open interest, accounting for nearly 27%, which may suggest that some institutions are choosing to take profits or hedge risks at high price levels. Historical data shows that changes in CME holdings are often related to macroeconomic expectations, necessitating attention to the ongoing impact of Federal Reserve policy on institutional strategies.

Retail trading remains active, with Binance's open interest rising 0.61% against the trend, indicating high participation enthusiasm among retail investors, possibly betting on short-term price fluctuations. This aligns with the recent trend of positive funding rates in the derivatives market, but caution is warranted regarding the liquidation risks following the accumulation of high-leverage positions.

The current total open interest remains close to historical peaks, and with CME and Binance accounting for over 45% of market concentration, it indicates that mainstream exchanges are still the core of liquidity. If prices experience unilateral fluctuations, it may trigger a chain liquidation, amplifying market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。