美联储主席热门人选抨击鲍威尔;BTC周涨幅超12%,但资金费率却持续为负值

宏观解读:今天是周末,市场波动较小,但也发生了一些宏观层面的动态值得去聊一下,关于美联储独立性危机、监管真空与比特币技术形态的微妙变化,共同构建起加密市场发展的新叙事框架。在这些看似分散的事件背后,暗含着可能重塑数字资产价值逻辑的核心线索。

美联储目前正面临前所未有的信任考验,下一任美联储主席潜在人选,前理事凯文·沃什在IMF年会期间对现任政策的尖锐批评,与特朗普政府试图解雇鲍威尔的传闻形成政策共振。这种行政干预央行独立性的风险,正在动摇市场对美元体系稳定性的根本信心。值得关注的是,美国国债市场已出现异常波动——30年期国债收益率较4月高点回落30个基点,单周190亿美元的资金净流入创下历史纪录,这既反映出避险情绪升温,也暗示着机构投资者正在重构资产组合。

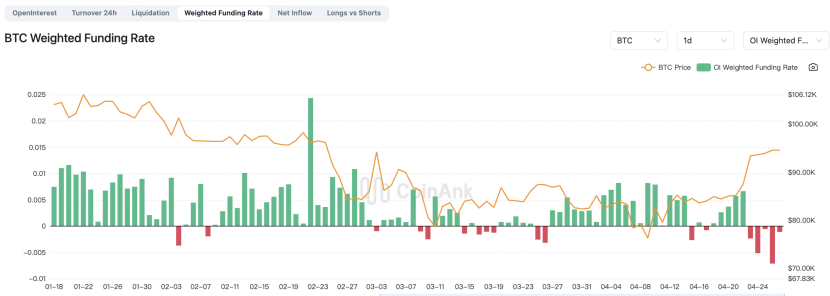

监管迷雾中的加密货币市场呈现出矛盾景象,SEC委员Hester Peirce用"地板是熔岩"的比喻,生动描绘了美国金融机构在加密业务中的尴尬处境。这种监管不确定性导致传统机构采取"不接触地面"的迂回策略,但衍生品市场却呈现另类繁荣:比特币永续合约未平仓量突破21.8万枚BTC,较3月初增长15.6%,即便平均资金费率转负显示空头占优,杠杆交易的活跃仍暗示市场正在酝酿变盘契机。

技术面上比特币展现出令人玩味的双重信号。当价格重新站上200日均线释放积极信号时,日线级别的"死亡交叉"却如影随形。历史数据显示,自2009年以来出现的10次类似形态中,仅有部分引发了熊市,这种技术指标的矛盾性恰与当前市场情绪的撕裂形成呼应。值得注意的是,比特币在美股持续疲软背景下逆势突破95000美元关口,其与传统风险资产的关联性正在经受历史性考验。

核心开发者John Carvalho提出的比特币单位改革方案,意外成为观察市场情绪的风向标。主张废除"聪"单位、重塑计量体系的BIP提案,表面上关乎技术细节,实则触及比特币作为价值存储的核心叙事。反对者担忧这会稀释2100万枚的稀缺性概念,支持者则认为降低认知门槛将加速大众 adoption。这场争论的本质,实则是比特币在"数字黄金"与"支付货币"双重属性间的艰难平衡。

衍生品市场的看跌信号与现货价格的强势形成鲜明对比。Coinank数据显示,尽管比特币周涨幅超过12%,期货资金费率却降至-0.023%,这种背离暗示着专业交易者正在构建对冲头寸。结合即将公布的4月非农数据和核心PCE物价指数,市场似乎正在为潜在波动积蓄能量。有趣的是,比特币隐含波动率已降至45%的年内低点,这种表面平静与期权市场的"熔岩"暗流形成戏剧性反差。

政策不确定性的持续发酵正在重塑加密资产的避险逻辑。当特朗普政府通过人事管理办公室收紧联邦机构岗位审批,展现出强力的行政干预倾向时,比特币的去中心化特性获得新的价值支撑。从历史数据看,比特币价格与纳斯达克指数的乘数效应正在弱化,这种"脱钩"迹象若在美联储独立性危机中得以确认,或将开创数字资产定价的新纪元。

在这场传统金融与加密世界的角力中,市场参与者需要警惕一些风险:美联储政策公信力受损可能引发的流动性危机,监管真空导致的机构入场迟滞,以及比特币自身叙事逻辑的潜在嬗变。值得关注的是,世界黄金协会即将发布的一季度需求报告,或将为"数字黄金"的价值重估提供关键参照。当熔岩开始凝固,谁能在新形成的陆地上率先建造城堡,或许将决定下一个加密周期的权力格局。

BTC数据分析:

Coinank数据显示,比特币现货价格周线录得12%反弹,但衍生品市场释放预警信号,期货资金费率中枢下沉至-0.023%,形成近六个月最显著的空头溢价结构,合约价格相对现货贴水幅度扩大至1.2%,显示专业交易者正通过衍生品构建对冲保护。永续合约未平仓仓位攀升至21.8万枚BTC,较季度低点扩张15.6%,创2024年2月以来最大单周杠杆敞口增幅。

我们认为,此轮期现背离暴露三层风险逻辑:杠杆敞口扩张与价格反弹形成「非对称风险敞口」,当价格波动超3%时可能触发35亿美元级连环清算;还有,资金费率持续负值预示「轧空」风险累积,当前空头头寸集中度达CME历史分位的92%;另外,做市商Delta对冲需求激增导致现货市场流动性错配,买卖价差扩大至三个月峰值。

对加密市场而言,这种结构性压力可能延缓突破关键阻力位的动能,同时催生跨交易所套利机会,但需警惕高杠杆环境下黑天鹅事件引发的流动性螺旋。历史数据显示,类似期现背离周期后30日内波动率中枢抬升58%的概率高达79%,当前市场正步入高敏脆弱期。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。