I. Introduction

As the most representative automated market maker (AMM) decentralized exchange in the Ethereum ecosystem, Uniswap has long been the leader in the DEX space, playing a foundational role in promoting the development of the DeFi ecosystem. With the continuous growth of user numbers and trading volume, the Ethereum mainnet on which Uniswap operates has gradually exposed bottleneck issues such as limited scalability, high transaction costs, and MEV spillover.

To address these challenges, Uniswap Labs, in collaboration with Flashbots, OP Labs, and Paradigm, launched a new Layer 2 network called Unichain. This network is built on Optimism's OP Stack, integrating a decentralized validation network and a verifiable block construction mechanism, while also aiming to optimize MEV handling logic and user trading experience. On April 15, Unichain launched a liquidity incentive program with a scale of one million UNI, leading to a rapid increase in TVL and quickly becoming the focus of market attention.

This article will conduct an in-depth analysis of multiple dimensions, including the mechanism principles and characteristics of Unichain, on-chain data performance, current ecological development status, opportunities and challenges faced, and future development prospects, striving to provide readers with a panoramic interpretation to fully understand the positioning and potential of this emerging Layer 2 project.

II. Mechanism Principles and Characteristics of Unichain

On February 11, Uniswap Labs announced the launch of the Unichain mainnet for Layer 2, allowing users and developers to build and use DeFi applications and tools within the ecosystem. The technical architecture of Unichain is based on Optimism's OP Stack, utilizing Optimistic Rollup technology to package a large number of transactions and submit them to the Ethereum mainnet, achieving high throughput and low transaction costs. Additionally, Unichain introduces several innovative mechanisms, including verifiable block construction (Rollup-Boost), a decentralized validation network (UVN), and cross-chain interoperability, aimed at enhancing the network's performance, security, and user experience.

1. Mechanism Principles of Unichain

1) Optimistic Rollup Based on OP Stack: Unichain is built on top of Optimism's OP Stack, utilizing Optimistic Rollup technology to package a large number of transactions and submit them to the Ethereum mainnet, achieving high throughput and low transaction costs. The Optimistic Rollup technology reduces the load on the Ethereum mainnet by moving transaction execution and data storage to the Layer 2 network, improving transaction speed and lowering costs.

Moreover, the OP Stack provides a set of open-source components that enable one-click chain deployment and interconnectivity among multiple chains, forming a superchain ecosystem that includes several Layer 2 networks such as Base, Blast, Mantle, and Manta. As part of the OP Stack, Unichain can achieve seamless interoperability with other Layer 2 networks, enhancing the network's interoperability and scalability.

2) Verifiable Block Construction (Rollup-Boost): Unichain introduces the Rollup-Boost module developed in collaboration with Flashbots, providing two key features: Flashblocks and verifiable priority ordering.

Flashblocks: By dividing a single block into multiple parts, creating a partial block every 250 milliseconds and sending it to the sorter, this feature enables rapid state updates and early execution confirmations, reducing latency, improving user experience, and mitigating the impact of malicious MEV.

Verifiable Priority Ordering: This feature ensures that the transaction ordering process is verifiable through cryptographic proofs, enhancing the fairness and transparency of transactions.

3) Decentralized Validation Network (UVN): The validation network of Unichain (UVN) consists of node operators who independently validate the blockchain state. Validators are required to stake UNI tokens and are selected as part of the active node set based on their staking weight, executing validations and earning rewards. This mechanism enhances the decentralization and security of the network.

4) Cross-Chain Interoperability: Unichain participates in the Superchain ecosystem, enabling seamless interoperability with other Layer 2 networks, enhancing the network's interoperability and scalability, and providing users with a better trading experience. The Superchain is an ecosystem composed of multiple Layer 2 networks aimed at achieving seamless interoperability between different networks, enhancing liquidity and user experience across the entire ecosystem.

2. Characteristics of Unichain

As a Layer 2 solution for Ethereum launched by Uniswap Labs, Unichain aims to address the challenges of scalability, transaction costs, and maximum extractable value (MEV) on the Ethereum mainnet. Its unique design and technical implementation allow it to stand out among numerous Layer 2 solutions.

1) Significantly Reduced Transaction Costs: Unichain utilizes Optimistic Rollup technology to package a large number of transactions and submit them to the Ethereum mainnet, achieving high throughput and low transaction costs. According to official estimates, transaction costs on Unichain will be 95% lower than those on the Ethereum mainnet after its launch, with plans to further reduce costs.

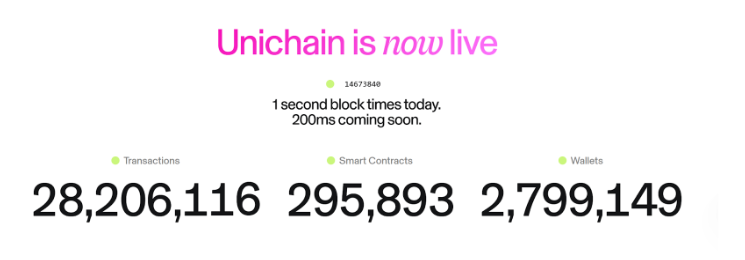

2) Enhanced Transaction Speed: Unichain has a block time of 1 second, with future plans to shorten it to 0.2-0.25 seconds. In contrast, the Ethereum mainnet has a block time of 12 seconds, and most Layer 2 solutions have a block time of 2 seconds. This speed not only improves user experience but also plays a crucial role in enhancing market efficiency.

3) Strengthened Security and Decentralization: Unichain introduces a decentralized validation network (UVN) composed of node operators who independently validate the blockchain state. Validators are required to stake UNI tokens and are selected as part of the active node set based on their staking weight, executing validations and earning rewards. This mechanism enhances the decentralization and security of the network.

4) Internalizing MEV to Optimize User Experience: Unichain allows applications to directly extract and internalize MEV, reducing the occurrence of value being extracted externally, thereby enhancing user experience and the economic benefits of the protocol.

5) Strengthened Cross-Chain Interoperability: Unichain plans to participate in the Superchain ecosystem, providing users with a seamless liquidity experience through cross-chain solutions, enhancing the network's interoperability.

6) Modular Design and Open Source Ecosystem: Unichain adopts a modular design, allowing developers to add new features based on their needs, making it more decentralized and user-friendly. Additionally, Unichain is open source, allowing other chains to join and utilize its technology, promoting the development of the entire ecosystem.

III. Current Status of the Unichain Ecosystem

1. Liquidity Incentive Program and On-Chain Performance

The Uniswap community passed the Uniswap Unleashed governance proposal on March 21, 2025, with Gauntlet responsible for executing and optimizing the incentives. This initiative launched on April 15, 2025, and will last for three months. The total rewards for the first two weeks amount to 5 million UNI, which will be distributed as UNI rewards to 12 different liquidity pools on Unichain. This liquidity incentive measure has driven a surge in Unichain's TVL.

Source: https://app.merkl.xyz/?protocol=Uniswap

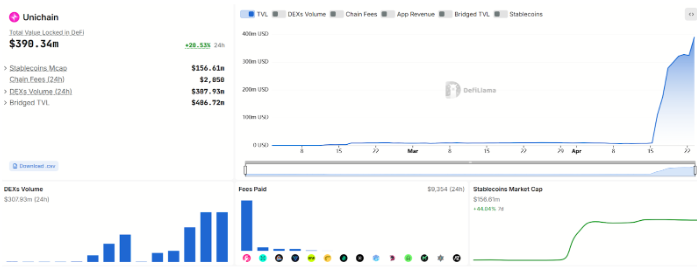

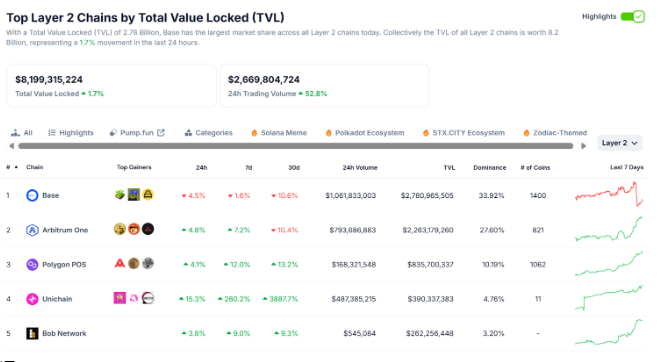

As of April 23, 2025, Unichain's total locked value (TVL) has reached $390 million, showing strong growth momentum. Among this, the market value of stablecoins is approximately $156 million, with a 24-hour DEX trading volume reaching $307 million, on-chain fees amounting to $2,050, application revenue at $9,354, and the TVL of cross-chain bridging at $406 million, making it the fourth-ranked Layer 2 network by TVL.

Source: https://defillama.com/chain/Unichain

Source: https://www.coingecko.com/en/chains/layer-2

The Unichain ecosystem is rapidly expanding, attracting the attention of numerous developers and users. As of April 23, the number of smart contracts deployed on Unichain continues to grow, reaching 295,893, with the number of wallets reaching 2,799,149, indicating strong user growth. The number of transactions is also steadily increasing, reflecting user activity and trust.

Source: https://www.unichain.org/

2. Development Status of Ecological Protocols

Unichain has deployed over 100 applications and infrastructure providers, including well-known protocols such as Uniswap, Circle, Coinbase, Lido, and Morpho, covering various fields such as trading, lending, stablecoins, cross-chain bridging, data indexing, and development tools.

2.1 Decentralized Exchanges (DEX)

Uniswap V4: As the core protocol of Unichain, Uniswap V4 provides an efficient trading experience, supporting concentrated liquidity management and automated strategies.

Matcha: A DEX aggregator supported by 0x, integrating liquidity from multiple exchanges to provide users with the best trading prices.

2.2 Lending Protocols

Compound: A decentralized lending protocol that allows users to deposit assets to earn interest or borrow assets.

Venus: A multi-chain lending platform that offers lending services for various assets.

2.3 Stablecoins and Payments

Circle: A leading global fintech company that issues the USDC stablecoin, providing stable payment methods for Unichain.

Transak: Provides conversion services between fiat and cryptocurrencies, supporting users in over 160 countries worldwide.

2.4 Cross-Chain Bridging

LayerZero: A protocol that supports cross-chain messaging, enabling Unichain to seamlessly connect with over 100 blockchains.

Wormhole: Provides multi-chain applications and bridging services, supporting large-scale cross-chain asset transfers.

2.5 Data Indexing and Analysis

The Graph: A decentralized data indexing protocol that provides efficient data query services for developers.

Dune: A data analysis platform that allows users to query and visualize on-chain data, supporting community-contributed query templates.

2.6 Development Tools and Infrastructure

Alchemy: A leading Web3 development platform that provides reliable node services and development tools.

Blockdaemon: An institutional-grade blockchain infrastructure platform that offers node operation, staking services, and API interfaces.

IV. Opportunities and Challenges Facing Unichain

1. Opportunities

1) Continued Growth of the DeFi Market: The DeFi market has rapidly developed over the past few years, with increasing demand for high-performance, low-cost Layer 2 networks. Unichain, as a Layer 2 solution optimized for DeFi, is expected to gain more attention and adoption.

2) Brand Influence of Uniswap: Uniswap is the leading decentralized exchange in the Ethereum ecosystem, with a large user base and a good brand reputation. The launch of Unichain can leverage Uniswap's brand influence to attract more users and developers to its ecosystem.

3) Competitive Advantage from Technological Innovation: Unichain introduces innovative technologies such as verifiable block construction and decentralized validation networks, enhancing the network's performance, security, and decentralization. This helps Unichain stand out among numerous Layer 2 solutions and gain more market share.

4) Enhanced Cross-Chain Interoperability: Unichain plans to participate in the Superchain ecosystem, providing users with a seamless liquidity experience through cross-chain solutions, which will attract more users and assets into the Unichain ecosystem.

2. Challenges

1) Competition with Other Layer 2 Networks: Currently, there are several Layer 2 solutions in the market, such as Arbitrum, zkSync, and StarkNet. Unichain needs to establish competitive advantages in performance, cost, and ecosystem to attract users and developers.

2) Complexity of Technical Implementation: Unichain introduces several innovative technologies, such as verifiable block construction and decentralized validation networks, which have a certain level of complexity in implementation and maintenance. Unichain needs to ensure the stability and security of these technologies to guarantee the normal operation of the network.

3) Migration Costs for Users and Developers: Users and developers migrating from other networks to Unichain incur certain costs, including learning new technologies and adapting to new environments. Unichain needs to provide sufficient incentives and support to lower the migration costs for users and developers.

4) Building and Developing the Ecosystem: As an emerging Layer 2 network, Unichain needs to establish a complete ecosystem, including DeFi protocols, NFT projects, and infrastructure. This requires time and resource investment, as well as close collaboration with the community and partners.

V. Summary and Outlook

As a Layer 2 network meticulously crafted by Uniswap Labs, Unichain not only inherits Uniswap's deep foundation in decentralized trading but also enhances the network's performance, security, and decentralization through the introduction of innovative mechanisms such as verifiable block construction and decentralized validation networks. Since the launch of the liquidity incentive program in mid-April, the TVL has rapidly increased, making it the fourth-ranked Layer 2 network by TVL. In terms of ecosystem development, Unichain has already attracted the deployment of multiple DeFi protocols, and the ecosystem is gradually improving. However, to stand out in the fierce market competition, Unichain needs to continuously optimize its technical architecture, provide more attractive incentive mechanisms, and strengthen cooperation with the community and partners to promote the healthy development of the ecosystem.

Looking ahead, Unichain is expected to become the infrastructure for DeFi, driving innovation and development across the industry. By continuously optimizing technology, expanding the ecosystem, and enhancing token value, it aims to occupy an important position in the DeFi field, providing users and developers with more efficient, secure, and decentralized financial services.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend analysis + value discovery + real-time tracking" service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and 24/7 market volatility monitoring, combined with weekly live strategy broadcasts of "Hotcoin Selection" and daily news updates of "Blockchain Today," providing precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。