Changes to El Salvador’s Bitcoin Law have ignited discussions about whether bitcoin retains its status as legal tender. Samson Mow, CEO of JAN3, a Bitcoin technology company focused on expanding access to BTC and financial freedom around the world, addressed the confusion through multiple posts on social media platform X on Feb. 13. He summarized the situation by stating:

It’s complicated, but the short answer is: Bitcoin both is and isn’t legal tender.

Revisions to the law adjust bitcoin’s classification, keeping its recognition as legal tender but removing its designation as “currency.” This shift makes its use discretionary rather than obligatory. Mow clarified: “It leaves bitcoin defined as legal tender while removing the word ‘currency’ and makes bitcoin optional/voluntary. So this is why bitcoin is and isn’t legal tender. It is defined as legal tender but lacks the thing that actually makes it legal tender.”

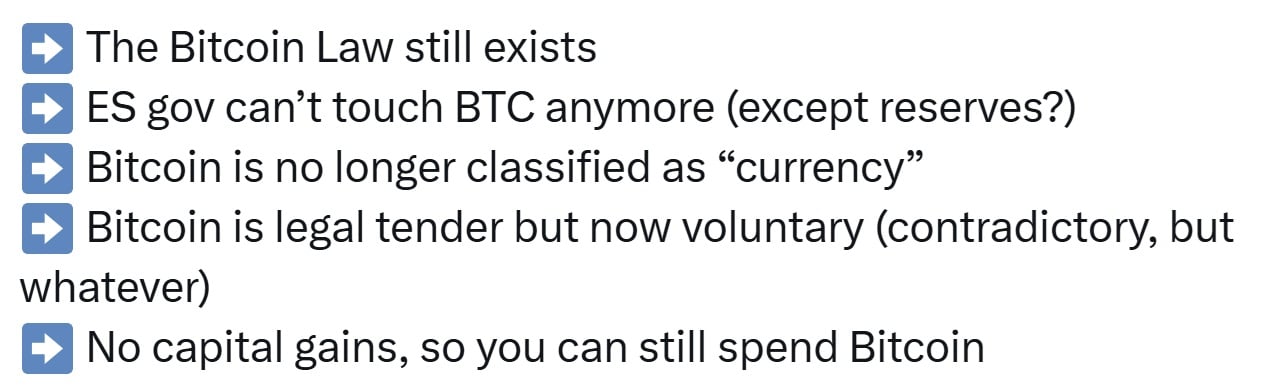

El Salvador’s Bitcoin Law remains active, though government authority over bitcoin is now limited primarily to managing reserves. The asset is no longer categorized as “currency” under the law, yet transactions in bitcoin remain exempt from capital gains taxes. Its use is permitted but no longer enforced.

TL;DR of El Salvador’s Bitcoin Law by Samson Mow. Source: Samson Mow

To prevent misinterpretation, Mow emphasized that his team personally translated the legal amendments to preserve their full meaning. He highlighted that these modifications align with International Monetary Fund (IMF) requirements, allowing El Salvador to comply with external agreements while keeping bitcoin legally recognized. “The amendments to the Bitcoin Law are very clever and allow for compliance with the IMF agreement while allowing the ES [El Salvador] gov to save face,” Mow opined.

Further breaking down the revisions, Mow examined the impact of changes to Article 3. He noted:

‘Any price may be expressed in BTC’ is now ‘Any price may be converted into BTC.’ Most people convert fiat prices to BTC for payment so this is just saying do what comes naturally. Or you could read it as, previously you could price an apple in sats on a price tag/sign, but now you cannot.

Other notable alterations involve bitcoin’s use for government-related payments. “Article 4: You can’t pay taxes in BTC anymore. But, also stemming from Article 1 it seems like the government also can no longer accept BTC for payments such as incorporating a company, the passport program, future citizenship by investment programs, OR even the $12 tourist fee at the airport,” Mow stated. The government’s role in facilitating bitcoin transactions is also diminishing. “Article 8: The state doesn’t need to help facilitate BTC transactions—so paving the way for a Chivo phase-out or sale,” he remarked, referring to the state-backed digital wallet.

These legal updates introduce uncertainty regarding bitcoin adoption in El Salvador, particularly in terms of business acceptance. Mow acknowledged that the revised law weakens the country’s distinctiveness in the crypto space. “The weakening of the Bitcoin Law definitely makes ES a bit less unique,” he commented. Other regions continue to offer bitcoin-friendly environments, he noted, pointing to alternatives such as Bhutan, which holds bitcoin reserves, and Próspera, where bitcoin remains legal tender. Additionally, bitcoin-focused communities exist in locations like Bitcoin Jungle in Costa Rica. Countries including Hong Kong, Dubai, Singapore, and Switzerland (Lugano) impose no capital gains tax on bitcoin transactions, while Madeira and the Czech Republic provide exemptions after specific holding periods along with government support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。