Short-term trading or diamond hands? That's the question.

Written by: 1912212.eth, Foresight News

Once upon a time, Zhao Changpeng's saying "If you can't hodl, you won't get rich" was regarded as the golden rule of investment in the crypto world. Buying, holding firmly, and then selling at a time of substantial profit made the HODL philosophy very popular in the community.

Some investment institutions, through in-depth research and betting, have achieved very high returns, such as the last cycle where top-tier funds gained hundreds or even thousands of times returns on MATIC and AAVE. Various legendary wealth stories led retail investors to generally believe in the powerful effect of diamond hands. However, while this investment philosophy was somewhat effective in the last cycle, it is no longer revered by the market in this cycle, especially among players holding a lot of altcoins.

With a four-year cycle, the market structure has undergone significant changes. If one cannot adjust their style in a timely manner, they often face the risk of standing guard at the peak. Has the market really stopped rewarding diamond hands?

1. Memes and AI as the Mainstream, General Bull Market No Longer

In past cycles of the crypto market, a general bull market often followed six months after Bitcoin's halving. Market funds would gather around Bitcoin, then spread to Ethereum after reaching a certain level, followed by mainstream altcoins, and finally, small-cap altcoins and meme coins would go wild, marking the end of a typical bull market cycle.

This cycle, however, saw the first wave of upward momentum brought forward by the favorable news of Bitcoin spot ETFs. After Bitcoin enjoyed its moment in the spotlight, the crypto market remained quiet for a long time. The long-awaited rise in Q4 2024 turned out to be quite brief.

If you embraced popular assets like Bitcoin, SOL, and Dogecoin early in this cycle, the returns for diamond hands have been quite substantial. But if the altcoins you chose were not favored by the market, such as re-staking, inscriptions, gaming, and NFTs, the returns you might see could be "tragically poor."

Recently, Binance has been criticized for launching new coins that often peak immediately upon listing, followed by a continuous decline. Projects with slightly better quality and popularity might experience a brief period of increase, while those that are neither popular nor useful and are continuously unlocking will see weak buying pressure and keep hitting new historical lows. If a diamond hand unfortunately chooses a niche track with obscure coins and holds on without selling, they could face significant losses.

Moreover, compared to the previous cycle's hot DeFi and NFTs, this cycle has not seen any truly groundbreaking innovations that could compete with them. Market funds have been stagnant for a long time, concentrated in Bitcoin, memes, and AI concept coins.

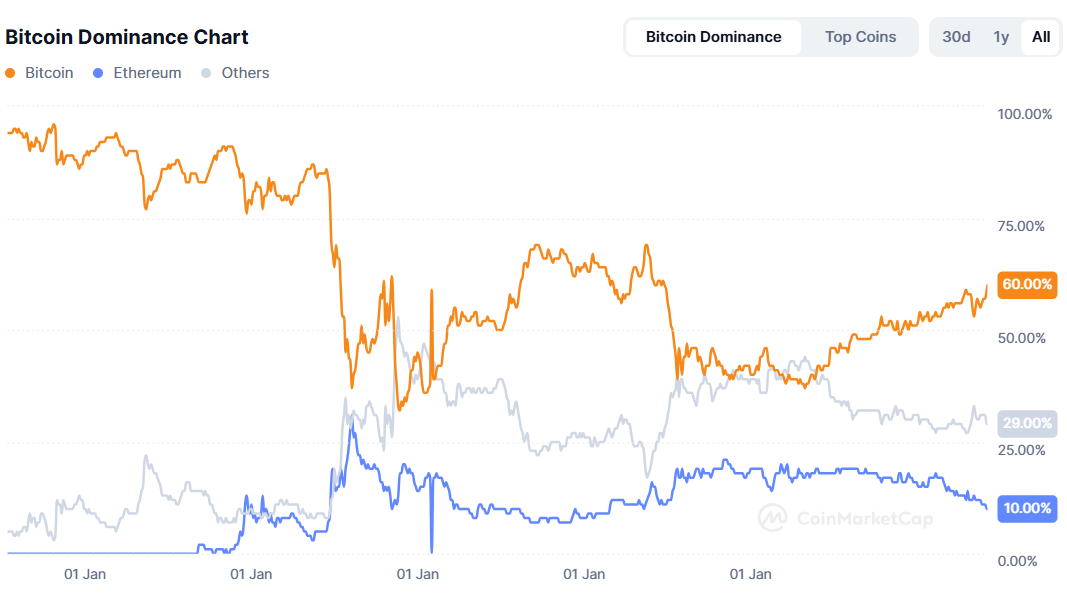

The chart below clearly shows that Bitcoin's market cap share saw significant declines in 2017 and 2021 due to the general rise of altcoins. Fast forward to 2023, Bitcoin's market cap share has been climbing steadily, rising from 38% to even over 60% at one point. In contrast, Ethereum has been troubled by multiple factors, with its market cap share starting to decline since the beginning of 2023.

Historically, it is difficult for Bitcoin's market cap share to rise without a corresponding general bull market for altcoins.

Now, the market seems to only reward diamond hands holding a very small number of coins like Bitcoin.

2. Mainstream Altcoins Underperform Expectations

The difficulty of the altcoin market in this cycle is incomparable to the last cycle. Taking the last cycle's L1 as an example, based on the lowest points after listing on Binance, DOT had a maximum return of over 20 times, NEAR nearly 40 times, AVAX over 40 times, and SOL over 250 times returns, with UNI in the DeFi sector also exceeding 20 times returns. The wealth effect in the industry was very significant.

It is worth mentioning that the aforementioned tokens with high returns all fell back to their bottom ranges six months to a year after reaching historical highs.

In this cycle's infrastructure L1, apart from SOL/SUI performing decently, the rest have underperformed. In L2, OP recorded a maximum return of 10 times, while ARB had a maximum return of 3 times. Both fell back to their bottom ranges within five months after reaching new highs, with ARB even dropping from a historical high of $2.42 to a historical low of $0.34. Stablecoins like USUAL/ENA once recorded significant returns, but from their bottoms, they also fell short of 10 times.

Some projects that were highly sought after by VC capital have shown lackluster performance, with EIGEN achieving a maximum return of 2 times, now hitting a historical low. Re-staking ETHFI and RENZO even began a continuous decline after listing on Binance. IO had a maximum return of 2 times, but has also reached a historical low.

More and more players are unwilling to take over high-valued VC coins, leading to a discount in market participation for both new and old projects.

Additionally, data from CoinMarketCap and CoinGecko shows that there are currently over 20,000 altcoins (excluding low-market-cap memes), which is 2-3 times more than in 2021. The variety of tokens and the rise of memes inevitably impact the attention given to mainstream altcoins, resulting in smaller returns.

3. MEME Market Fast-Paced and Intense

In previous cycles, VC coins that attracted much attention are no longer in demand. After failing to find the elusive wealth effect on CEX, market players have turned to on-chain mining.

The trend of chasing meme coins on Solana has swept the industry. Undeniably, the wealth effect of memes like WIF/BOME/TRUMP has drawn significant market attention, but if you chose to hold on without cashing out, the pullback in profits could be several times over.

WIF peaked at around $4.8 after listing on Binance but has now dropped to $0.8. BOME reached a high of $0.029 after listing on Binance, and is now priced at $0.002. Although TRUMP brought wealth effects to some on-chain players, if you didn't take profits at the market's peak of $70, it plummeted to a low of $16 in just about a week.

MEME may seem fair, but the difficulty is not small. The pace of growth and decline of market targets is accelerating, and participants can easily get severely trapped if they are not careful.

Taking the AI meme GOAT as an example, on October 23, 2024, trader Nachi tweeted that he had acquired 4% of GOAT's total supply, calling it "the best trade of this cycle," when GOAT's price was around $0.5. On December 12, Nachi still claimed to hold GOAT, at which point the price was $0.84. After that, the situation took a sharp downturn, first overshadowed by ACT, and then further by AI agents like VIRTUAL, with the price dropping below $0.1, while GOAT's historical high was once at $1.37.

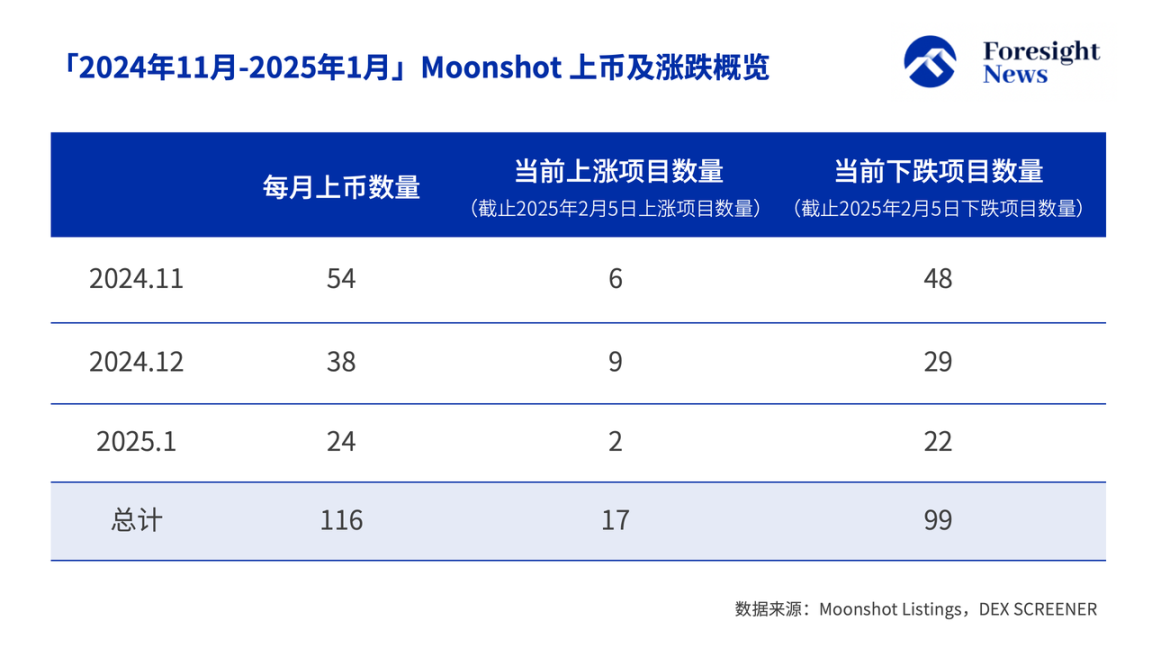

Using the well-known Moonshot meme coins as an example, Foresight News selected tokens launched on the Moonshot platform between November 2024 and January 2025 as a research sample. Out of 116 launched tokens, only 17 are currently priced higher than their launch price, a ratio of less than 15%, with the vast majority of projects currently in a downward trend, with over 85% of projects experiencing declines.

The cold, hard data tells market players that finding good targets and achieving high returns at low costs is not easy. MEME dropping over 80% or even going to zero is the norm.

The fast pace and high intensity of MEME have also spread to parts of the altcoin market that are already precarious in liquidity. Those exchanges with low narrative ceilings, no heat, and high valuations are all facing their "dark moments."

4. What to Do?

From a macro perspective, the market's requirements for diamond hands are becoming increasingly stringent. First, one needs to assess market sentiment and the range for taking profits at the top; if one holds on incorrectly without selling, all profits may ultimately vanish. Secondly, careful selection of targets is essential; which targets are worthy of diamond hands must be considered very carefully. If the wrong target or track is chosen, even if a bull market returns, it may have nothing to do with you.

Generally, do not hold meme coins as diamond hands.

Cashing out in a timely manner to improve one's life is also a good strategy. Reducing positions helps alleviate subsequent holding pressure, and once a significant pullback occurs, realized profits can ensure there is still capital available to seize opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。