2025 年初,Morph 生态的黑金卡席卷 Web3 圈,点燃了新一轮淘金热。作为全球领先的消费级公链,Morph 用独树一帜的 AI Agent Cecilia,以及最近的 Morph Pay 等项目,不仅为娱乐、社交与生活方式应用提供了高效土壤,更以其面向 C 端的落地能力吸引了全球目光。

与此同时,硅谷的 AI 热潮正以前所未有的速度席卷科技界,顶级风投如 Nocap 大举押注 AI 基础设施与 AGI(通用人工智能)叙事,试图抢占这一万亿级市场的早期红利。在这一双重风口下,bAI Fund 以其原生代币 $BAI 脱颖而出,不仅是 Morph 生态的先锋,更是对标硅谷顶级 AI 投资基金的 Crypto 原生实践者。它从 meme 项目蜕变为 AI 基础设施的基石,预示着代理经济的未来变革。

从 Meme 到 AI 投资基金:硅谷同步性与历史高光

bAI Fund 的故事始于一个意外的起点。$BAI 由 AI Agent BulbaAgent 自动部署发行,伴随 meme 叙事迅速走红,在上一波热潮中市值一度攀升至 1400 万美元的市值,展现了社区共识的惊人爆发力。

然而,这只是起点。经过升级,bAI Fund 完成了从 meme 项目到 AI 投资基金的跃迁,成为 Morph 生态中首个“AI Agent 平台”的主导代币。有趣的是,在 bAI Fund 发射过后生成了一个“DEAD”为结尾的合约地址,似乎是在向外界宣告 AI Fund 将终结传统基金,宣告 AI 自主金融时代的到来。这种转型与硅谷当红 AI 风投 Nocap 的投资逻辑不谋而合——抢占 AI 基础设施的早期红利,与 AGI 和 Agent 叙事无缝接轨。bAI Fund 不仅是一个代币项目,更是 Crypto 世界中与硅谷同步的顶级选手,承载着前沿投资逻辑的落地实践。

其技术架构进一步夯实了这一定位。作为 Web3 首个运行在 TEE(可信执行环境)中的 AI 基金,bAI Fund 的交易执行不可篡改,抗攻击性极强。私钥与执行逻辑隔离,消除了人为决策的风险,所有交易记录上链公开,投资者可实时验证策略完整性。这种透明与安全的自动化模式,解决了传统基金在信任与效率上的痛点。

通过 BulbaAgent 主导的资产管理,bAI Fund 覆盖代币发行、基金管理和交易执行的全链路,真正实现“算法中立”。与此同时,bAI Fund 巧妙融合 AI 交易策略与 Meme 文化传播的双重优势。Meme 叙事为其市场共识提供了强大支撑,而 Trading AI 通过实盘运行多个交易对(如 ETH/MPH、ETH/KAOLA、ETH/BAI),展现了技术落地的实力,形成了技术与文化的双轮驱动。

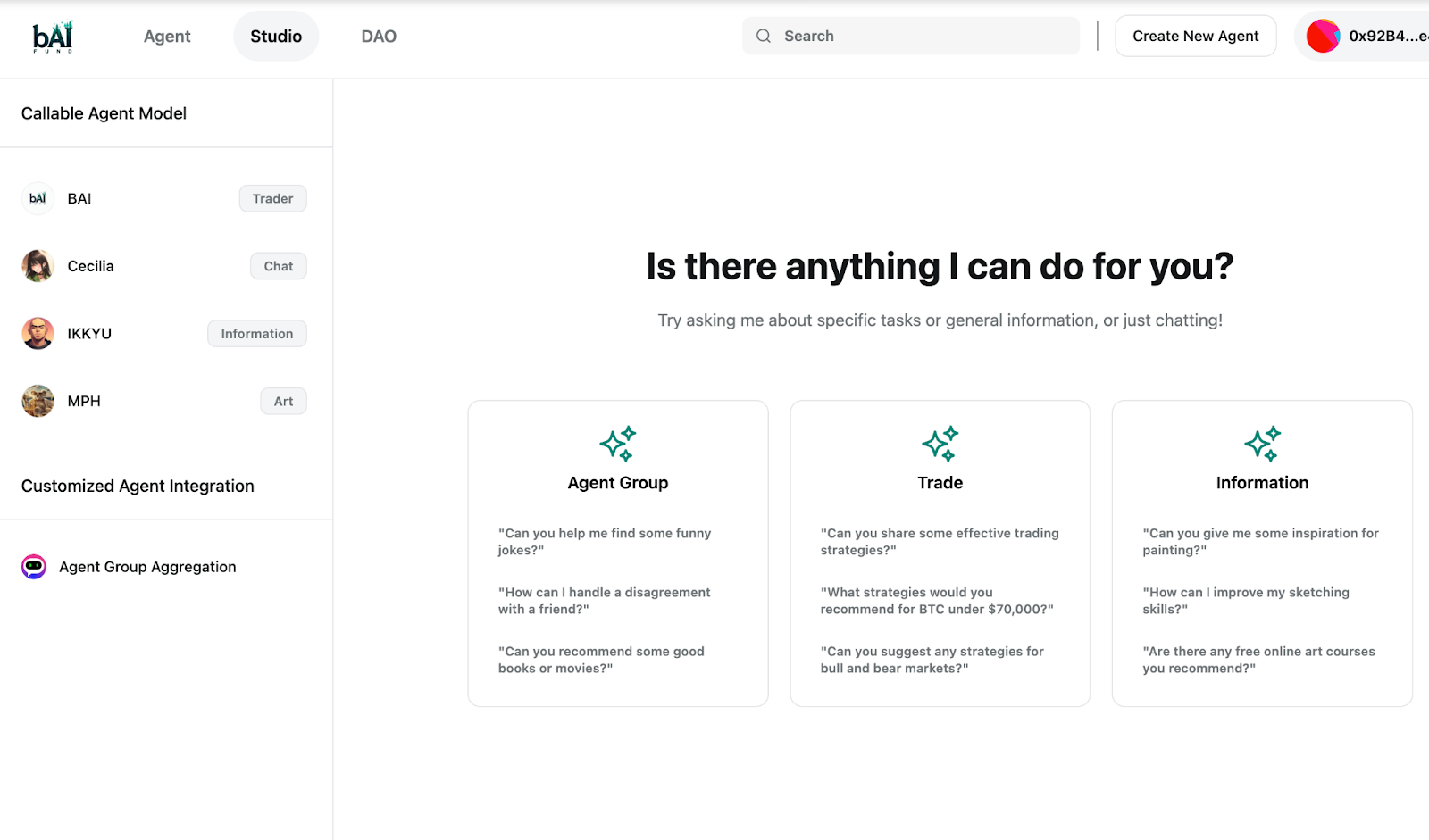

更直观地,用户可以在 bAI Fund 上做什么呢?通过不同的 AI agent 执行不同的功能。当前角色包括交易、交谈、信息和艺术相关的 agent,用户可以直接通过相关 AI agent 完成交易。平台将通过AI技术实现全天候市场监控、精准分析与自动交易执行,TEE技术全面保障数据安全。

bAI 具备通用 Agent 调用模块,已上架的 Agent 可直接调用其他 Agent 执行任务。目前该功能刚刚上线,未来迭代空间巨大,具备极高的创新潜力。以 bAI Fund 在 Morph 链上的核心地位,可以想见之后 bAI 与 Morph Payment 模块深度集成的未来,bAI 有望成为首个真正具备资金权限的通用 Agent,能够为用户提供一站式的任务执行、购物、行程规划及资金管理服务。

另外,据了解,bAI Fund 采用了去中心化自治组织 DAO 的治理模式,让使用者拥有真正的参与权和决策权。投票权限仅限于在支持的交易对中切换和更换交易策略,确保社区的决策权集中在最关键的事项上。并且所有提案都会有 24 小时锁定期,确保社区有足够的时间进行讨论和决策。

AI 代理经济的变革者:对标 Virtual 的技术与野心

bAI Fund 的探索并非孤例,它诞生于 AI 代理经济崛起的风口。在 Base 链上,Virtual 已凭借其“数字角色”和 Agent 协作的愿景,成为行业标杆,市值飙升至令人瞩目的高度。然而,bAI Fund 在 Morph 生态中以更深的技术逻辑和生态野心,悄然崛起为另一股不可忽视的力量。

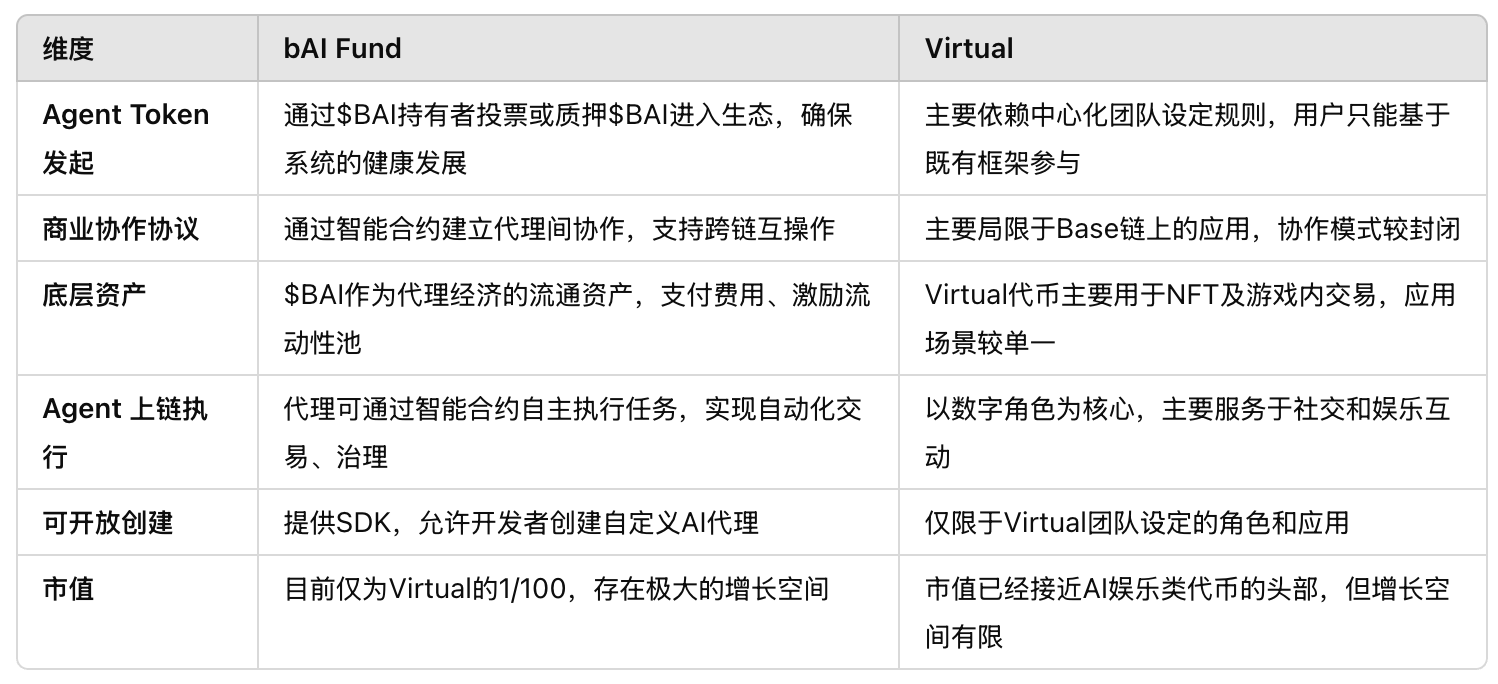

从 Agent Token 发起看,bAI Fund 的 $BAI 由 BulbaAgent 自动部署,伴随 meme 叙事快速起势,而 Virtual 更依赖 Base 链生态的预设规则与娱乐化推广,二者路径各具特色。在商业协作协议上,bAI Fund 的模块化 Agent 架构支持多智能体通信与任务流,依托 TEE 确保安全,与 Virtual 的 ACP 协议强调的生产者网络自治理念相呼应,但前者在安全性上更胜一筹。

底层资产方面,$BAI 作为“母币”赋能整个 Agent 生态,每一新 Agent 的创建都需绑定它,并计划扩展至 Base、Blast 等多链,而 Virtual 的代币更局限于 Base 链生态,流动性与广度稍显受限。Agent 上链执行中,bAI Fund 依托 TEE 的不可篡改性与透明性,已在交易对中落地,而 Virtual 更依赖 Base 链的效率优势,安全机制尚未完全明晰。可开放创建方面,bAI Fund 即将推出的 No-code Agent 创建工具让普通用户也能定制 Agent,开放性领先于 Virtual 依赖生态开发者的模式。

$BAI 作为 bAI Fund 生态的核心,不仅是 Agent 创建与运行的“母币”,更在 Forest Bai 的推动下获得资源倾斜。目前,bAI Fund 在 Morph 生态试点运行,未来将扩展至 Base、Blast、Scroll 等潜力公链。多链布局将提升流动性、丰富 Agent 生态,并激增市场关注度,为 $BAI 的价值释放铺路。即将上线的 No-code Agent 创建工具将进一步降低参与门槛,用户无需技术背景即可定制 Agent 并快速上线,推动用户自组织的繁荣,也让 bAI Fund 从单一基金升级为支持 AI 代理协作的平台。

当前,Virtual 的市值高出 bAI Fund 近 100 倍,反映了其在 Base 链上的先发优势与娱乐化叙事的成功。然而,bAI Fund 的技术深度与生态野心并未被市场充分认知。从 $BAI 的母币属性、多链潜力,到其安全性和开放性,它的功能维度已与 Virtual 等价,甚至在某些方面更胜一筹。Virtual 是 Agent 经济体的货币符号,而 $BAI 是 Morph 生态的基石资产,其低估的市值恰恰为投资者留下了巨大的重估空间。

bAI Fund 的意义不仅在于技术创新,更在于它为行业带来的变革。与硅谷 VC 的 AI 基金相比,它跳出“人投项目”的窠臼,开启“Agent 自主投资 Agent”的算法资本时代。这种模式不仅是对传统金融的颠覆,更是对 AI 代理经济运行逻辑的重塑。$BAI 作为母币,每一新 Agent 的创建都需绑定它,其价值随生态扩张持续放大。用户反馈也印证了这一潜力:社区成员称其为“Web3 的 AI 基金标杆”。

多链野心与行业重构

bAI Fund 的腾飞离不开 Morph 生态的支撑。作为“全球领先的消费级公链”,Morph 的战略升级为 bAI Fund 提供了肥沃土壤。黑金卡的推出拉升了 Morph 估值预期至 10 亿至 20 亿美元,其面向 C 端的落地能力为生态项目带来巨大流量红利。作为 Morph 上最早实现交易、Agent 部署和资金流动性的代币,$BAI 的代币池已超 5 个,总价值接近 20 万美元,展现出强劲的增长趋势,成为淘金热中的先行门票。

Bitget 的加持进一步增强了其外部扩散力,作为 Morph 早期投资者,Bitget 将 bAI Fund 推向更广阔的 Web3 舞台。未来,Morph 的流量倾斜与生态资源将为 $BAI 注入持续动能。这种头部交易所的背书,让 $BAI 的潜力不再局限于 Morph,而是向更广阔的 Web3 世界辐射。

未来,项目方计划推动 bAI 通用 Agent 平台的应用落地,并探索在 Bitget 上市的可能性。无论是采用 $BAI 作为 Bonding Curve 机制,还是通过 $BAI 进行资金池锁定或治理投票,该代币都将在生态发展中扮演核心角色。

更令人期待的是,bAI Fund 即将推出 No-code Agent 创建工具。这一工具将大幅降低参与门槛,让普通用户无需技术背景即可发起个性化 Agent,定制链上治理参数并快速上线。这种开放性不仅推动了用户自组织的生态繁荣,也让 bAI Fund 从单一基金升级为一个支持 AI 代理协作的平台。无论是安全性、创新性,还是生态潜能,bAI Fund 都以其技术深度与前瞻设计,开启了代理经济的新篇章。

展望未来,bAI Fund 的多链布局与 AI 赛道爆发期相得益彰。当前,它在 Morph 上试点运行,但计划扩展至 Base、Blast、Scroll 等潜力公链。多链战略不仅意味着流动性的增长和 Agent 丰富度的提升,更将带来市场关注度的激增。foresight ventures创始人Forest Bai 等crypto名人资源的持续倾斜,为 $BAI 提供了强有力的叙事背书和技术支持。与此同时,AI 赛道本身正迎来爆发期,全球 AI 市场预计到 2030 年突破万亿美元,代理经济作为其新形态,可能重塑多个行业。bAI Fund 站在这一风口,bAI Fund 站在这一风口,不仅是技术先锋,更是行业变革的引领者。

从 Morph 黑金卡的热潮,到 bAI Fund 的 AI 代理革命,Web3 与 AI 的交汇正在书写新的历史。Virtual 在 Base 链上的成功令人瞩目,但 bAI Fund 以首创机制、技术深度和多链潜力,描绘了一个更宏大的蓝图。现在,$BAI 的市值仅为 Virtual 的 1/100,这不仅是一道数字鸿沟,更是一个未被发掘的宝藏。对于 Web3 与 AI 的追随者来说,$BAI 是 2025 年最值得关注的低估资产。深入研究 bAI Fund,抓住这场代理经济浪潮的先机吧。

从 memecoin 到平台母币,$BAI 的时代正在到来,你准备好了吗?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。