December has been a whirlwind for cryptocurrencies. Bitcoin (BTC) smashed records, surging past $108,000 to set a new all-time high on Dec. 17. A few days later on Dec. 22, defillama.com reports the stablecoin market value has reached $204 billion. While tether (USDT) and usd coin (USDC) supplies gained 7.4% and 12.6% respectively, Ethena’s USDE and the newcomer USD0 by Usual emerged as standout performers in the ever-growing stablecoin arena.

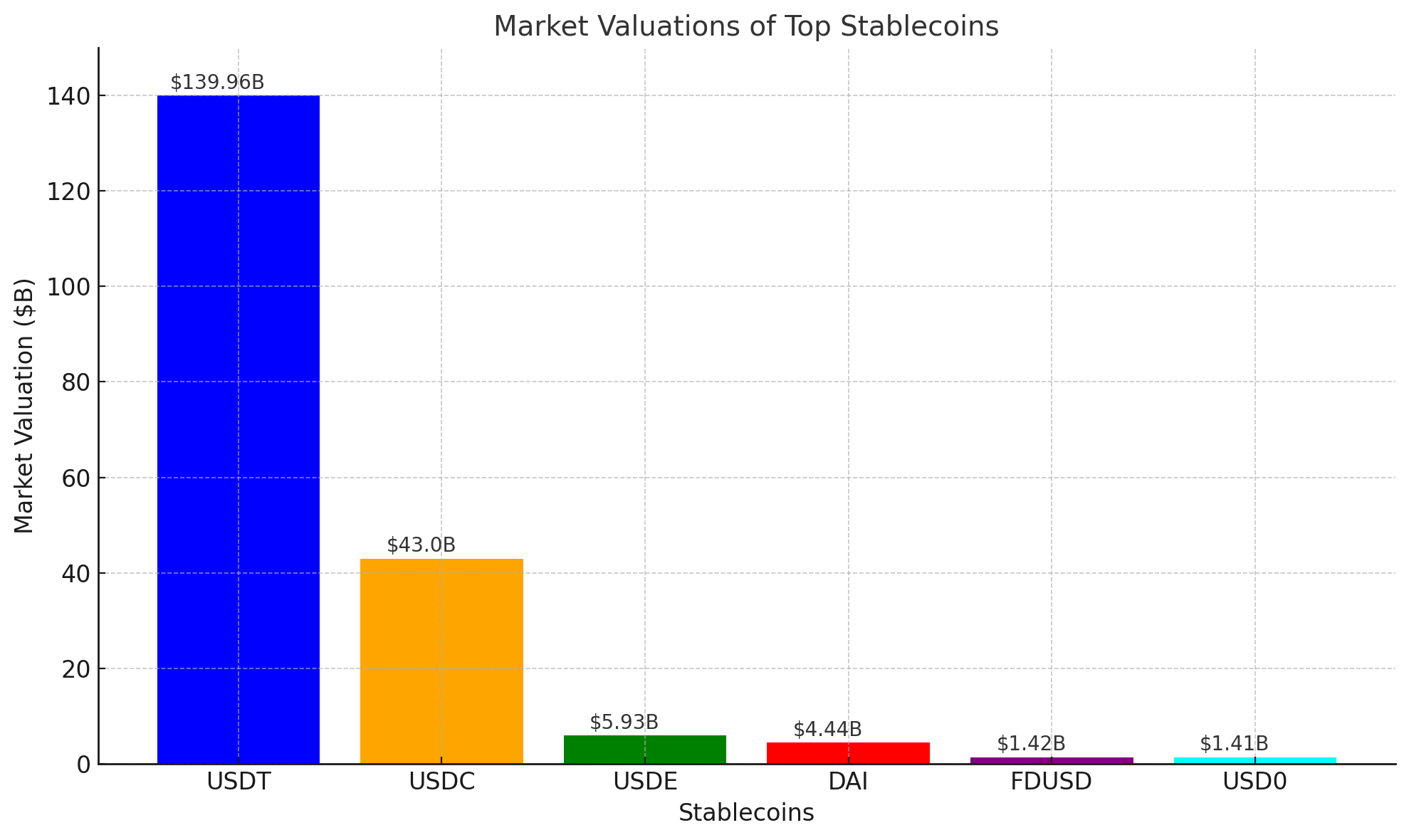

Ethena’s USDE, a yield-bearing stablecoin, draws attention with its enticing annual percentage yield (APY), often touted at 30%. However, as of Sunday, the ethena.fi website lists a more modest 12% APY, reflecting frequent fluctuations. USDE’s ability to generate returns through staking ETH and employing delta-hedging strategies has cemented its status as a standout player in the stablecoin sector. Currently, USDE boasts a market valuation of $5.93 billion, earning it the title of the third-largest stablecoin by market value.

Top six stablecoins by market cap on Dec. 22, 2024.

Data reveals that USDE’s supply expanded by an impressive 61.3% since Nov. 22, 2024, even as a wave of new yield-bearing stablecoins entered the scene. Meanwhile, Ethena’s governance token, ENA, has faced challenges, losing over 30% of its value from its peak—a drop that some interpret as reflecting concerns over the protocol’s stability, governance, and management of funding rates. Despite these hurdles, USDE’s supply continues to grow steadily.

Shifting focus to another rising star in the stablecoin world, a newcomer has climbed into the top ten fiat-backed crypto tokens. Usual usd (USD0) has seen a jaw-dropping 246% supply increase over the past 30 days, dating back to Nov. 22. Created by Usual Labs, a company founded in 2022 by Pierre Person, Adli Takkal Bataille, and Hugo Sallé de Chou, USD0 owes its launch to a successful $7 million funding round and additional commitments.

As of Sunday, Dec. 22, USD0 has reached an impressive market valuation of $1.41 billion, surpassing competitors like Paypal’s PYUSD. This achievement places USD0 as the sixth-largest stablecoin by market valuation, with its rapid rise largely fueled by growing adoption in decentralized finance (defi).

The rapid expansion of USDE and USD0 highlights a shifting appetite in the stablecoin arena, where innovation and utility drive adoption. As yield-bearing mechanisms gain traction, investors may increasingly prioritize protocols offering tangible returns. However, with rising competition and fluctuating governance metrics, maintaining user trust and sustaining growth will likely determine the long-term success of these promising projects.

This competitive surge among stablecoins hints at a growing maturation of decentralized finance (defi), where protocols must balance innovation with stability. As market valuations climb, the pressure to address governance concerns and evolving user needs will only intensify. For investors and developers alike, the challenge will be navigating this dynamic market while ensuring sustained growth and resilience in an ever-evolving crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。