The success of the SaaS industry is the best evidence for the rise of vertical AI Agents.

Compiled by: Jiang Ye, AIGC New Knowledge

Text: Summarized using Alibaba Tongyi Efficiency, thanks for the corrections.

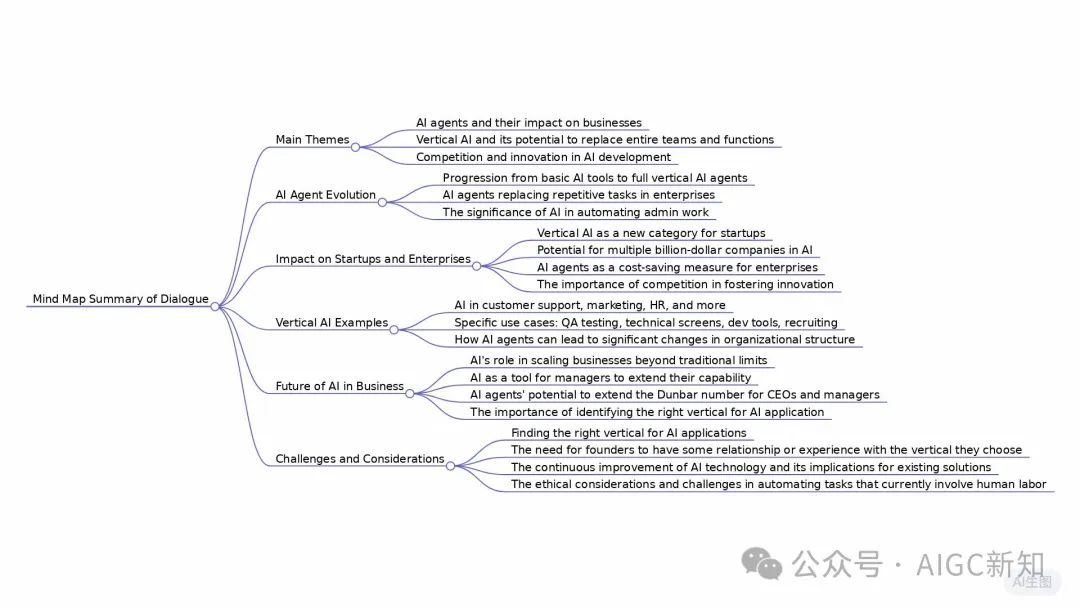

In the latest YC interview titled “Vertical AI Agents Could Be 10X Bigger Than SaaS”, four senior investors from YC, Gary, Jared, Harj, and Diana, deeply analyzed why vertical AI agents will become the next entrepreneurial trend, starting from the development history of the SaaS industry and combining numerous examples.

As AI models continue to improve rapidly and compete with each other, a new business model is emerging: vertical AI agents. In this episode of Lightcone, the host considers what impact vertical AI agents will have on existing SaaS companies, which use cases are most meaningful, and the fact that there are companies worth $300 billion just in this category.

1. The success of the SaaS industry is the best evidence for the rise of vertical AI Agents

Jared believes that the market size for vertical AI agents will be enormous, potentially giving birth to companies with a market value exceeding $300 billion.

He argues that the success of the SaaS industry is the best evidence for the rise of vertical AI agents. The emergence of the SaaS (Software as a Service) model has completely transformed the software industry. In the past, companies needed to purchase expensive software licenses and spend a lot of time and resources on installation and maintenance. The SaaS model hosts software in the cloud, allowing users to pay a subscription fee to use it, significantly lowering the barriers and costs of software usage.

Jared believes that vertical AI agents, as an emerging B2B software, have the potential to surpass SaaS in market size. Because AI agents can not only provide software services like SaaS but also achieve automated operations through AI technology, further improving efficiency and reducing costs.

2. LLM technology lays the foundation for the explosion of vertical AI Agents

LLM (Large Language Model) technology provides new possibilities for software development, combining software with human operations to create more powerful vertical AI agents that can replace traditional SaaS software and manual operations.

LLM technology can understand and generate human language, which can be used to build chatbots, automatically generate text, translate, and other applications.

3. Why did large companies miss the B2B SaaS market?

The main reason large companies missed the B2B SaaS market is that it is highly fragmented, with each vertical requiring deep expertise and attention to specific issues. Large companies tend to focus on a few large markets rather than spreading their efforts across numerous niche areas.

Gusto is a SaaS company focused on payroll management, and its success comes from its deep understanding of the various details and regulations in the payroll management field.

For giants like Google, developing a product similar to Gusto would require a significant investment of time and resources to learn and understand the payroll management domain, which is not cost-effective for them.

4. How will AI Agents affect the personnel structure of companies?

LLM applications are changing the hiring patterns of startups, and in the future, companies will need fewer employees (even one-person businesses) to achieve rapid growth.

In the past, startups typically expanded their team size as their business grew, but LLM can help companies achieve automation, reducing reliance on human labor.

In AI interviewing, Triplebyte is a company that recruits software engineers, and its software can automatically screen resumes, conduct technical tests, and perform initial interviews, significantly reducing the workload of recruiters.

5. How large is the market potential for vertical AI Agents?

The market size for vertical AI agents will be ten times that of SaaS because they can not only replace existing SaaS software but also a large number of manual operations.

Traditional SaaS software still requires human operations to complete many workflows, while vertical AI agents can combine software and manual operations to achieve higher efficiency and lower costs.

Momentic is a company that uses AI technology for QA testing; their AI agent can automatically execute test cases and generate test reports, completely replacing traditional QA teams.

6. Application cases of vertical AI Agents

The four senior YC investors listed several examples of vertical AI agent companies.

Outset: Improving the field of surveys and questionnaires.

Traditional survey and questionnaire software requires manual design of questions, data collection, and result analysis.

Outset's AI agent can automatically complete these tasks, adjusting questions and answers in real-time based on user feedback, thus improving the efficiency and accuracy of surveys.

Powerhelp: Handling complex customer support workflows.

Traditional customer support requires humans to answer calls, respond to emails, and resolve issues.

Powerhelp's AI agent can automatically complete these tasks and provide personalized solutions based on user inquiries and history, thus improving customer satisfaction and efficiency.

Salient: Automating debt collection in the auto loan sector.

Traditional collection work requires humans to make calls, communicate with borrowers, and record collection results.

Salient's AI agent can automatically complete these tasks and adjust collection strategies based on the borrower's situation and repayment ability, thus improving collection efficiency and success rates.

7. AI voice calling technology

AI voice calling technology has developed rapidly in recent years. With advancements in AI voice synthesis and natural language processing technologies, AI voice calling can be used in more complex scenarios, such as debt collection, customer service, marketing, etc.

AI voice synthesis T2V technology: Converts text into fluent speech, allowing AI agents to converse with users like real people.

Natural language processing NLP technology: Enables AI agents to understand user intentions and emotions and respond accordingly based on user inquiries and feedback.

8. How to choose the right AI Agent entrepreneurial direction?

Jared suggests that founders looking to start AI agent companies should seek out tedious, repetitive administrative tasks. These tasks typically require a lot of manpower and are easily replaceable by AI technology.

For example, Sweet Spot company recognized the presence of a large amount of repetitive work in the government contract bidding process, thus developing AI agents to help companies automate these tasks.

Interview Translation Original Text

Opening

Every three months, the situation gradually improves. Now we are talking about fully vertical AI agents that will replace entire teams, departments, and enterprises. This progress is still exciting to me. A lot.

The foundational model is a way of direct contact. There used to be only one player from OpenAI in town, and this situation has been changing in the last batch.

Thank God. It’s like competition is the soil for a very fertile market ecosystem, where consumers will have choices, and founders will have opportunities. This is the world I want to live in.

Welcome to another episode of Lightcone. I am Gary. This is Jared, Harj, and Diana, and we co-funded startups worth hundreds of billions of dollars when they started with just one or two people. Today, Jared is a hot topic, and he will talk about vertical AI agents.

Passionate about Vertical AI Agents

I am very excited about this because I think people, especially founders of startups, particularly young founders, do not fully realize how large the scale of vertical AI agents will be. This is not a new idea. Some people have been talking about vertical AI agents, and we have funded many, but I think the world has not yet realized how big it will become. So I will explain why I believe there will be companies worth over $300 billion in this category, which is great.

I will do this by drawing an analogy with SaaS, as I think in a similar way, people do not understand how big SaaS is because most startup founders, especially young founders, tend to view the entrepreneurial industry through the products they use as consumers. As consumers, you do not tend to use that many SaaS tools because most of them are built for companies. So I think many people overlook a fundamental point, which is that if you look at what Silicon Valley has funded the most in the past 20 years, it’s like we mainly produce SaaS companies, guys, just like most of the things that come out of Silicon Valley. During that period, over 40% of venture capital funding went into SaaS companies, and we produced over 300 SaaS unicorns in 20 years, which is more than any other category.

The software is fantastic. I'm reflecting on the history of this matter because we always like to talk about how the history of technology influences the future, and the true catalyst for the SaaS boom. This is one; do you remember XML HttpRequest? My goodness, I would argue that this was indeed the catalyst for this explosion.

Like Ajax, yes. In 2004, browsers added this JavaScript function, XML HttpRequest, which was the missing piece that allowed you to build rich internet applications in web browsers. So this was the first time you could create something on a website that looked like a desktop application, and then Google Maps and Gmail were created, establishing this whole ecosystem like SaaS. Essentially, the key technology that was locked in was that software transitioned from something you got on a CD and installed on your desktop to something you used through websites and mobile devices.

Paul Graham actually shared this lineage because he was one of the first to realize he could accept HTTP requests and then actually connect them to a Unix prompt. And you didn't actually need, you know, a separate computer program to change a website. So, through the web, it was like an online store, a bit like Shopify. But in the old days.

It was basically like the first SaaS application ever, just like Pg actually invented SaaS in 1995. It’s just that those first SaaS applications were a bit terrible because they didn’t have XML HttpRequest. Every time you clicked a button, it had to reload the entire page, which was just a hard experience. So it wasn’t until 2005 when XML HttpRequest became popular that it really took off, right? Anyway, I think this lum thing is actually very similar. It’s like a new computing paradigm that makes it possible to do fundamentally different things. And in 2005, when cloud and mobile finally took off, there was a big open question, like, well, this new technology, how should you use it?

Similarities Between Traditional SaaS and LLM

Where will value accumulate? Where are the good opportunities for startups?

I was browsing the list of all the billion-dollar companies created, and I realized you could divide the different paths people take into three buckets. The first bucket is like, I would call them obvious good ideas that could become mass consumer products. So it’s like documents, photos, emails, calendars, chat—everything we used to do on the desktop but can obviously be moved to browsers and mobile devices. Interestingly, there’s a 100% value stream in startups that goes to legacy companies, right? Just like Google, Facebook, and Amazon, they own all these businesses.

People forget that Google Docs wasn’t the only company trying to bring Microsoft Office online. There were like 30 companies trying to bring Microsoft Office online, but they all lost to Google 1. Then there’s the second category, which is ideas for mass consumers that aren’t obvious and no one predicted. It’s like Uber, Instacart, DoorDash, Coinbase, Airbnb—those that came out of the left field, like the point between XML HttpRequest and Airbnb, which looks very non-obvious. Therefore, legacy companies didn’t even try to compete in these areas until it was too late. So startups were able to win there.

Then there’s the third category, which is all the B2B SaaS companies, about 300 of them. In terms of the number of logos, there are more billion-dollar companies created in the third category than in the first two categories. I think one reason this happens is that there isn’t a SaaS company like Microsoft; there isn’t a company that is like SaaS in every vertical of every product due to structural reasons. It seems like all the different companies are the same, which is why there are so many companies.

I think Salesforce might be the first true SaaS company. I remember Marc Benioff came to YC to speak, and he told this story about how early on, people just didn’t believe you could build complex enterprise applications through the cloud or SaaS. So it was like a perception issue, right? It’s like, no, it’s like you don’t buy your boxed software; that’s like real software.

You always do this. Doing this is quite difficult because early web applications were terrible over the web; you had to be visionary like Pg and understand that browsers would get better and eventually it would become good.

This reminds me of the same thing today, oh no, you won’t be able to build complex enterprise applications using these LLM or AI tools because they will hallucinate, or they are imperfect, or they are a bit like toys, but yes, it’s like the early SaaS story.

So when I think about the similarities with LLMs, it’s easy to imagine the same thing happening, that there are a bunch of categories like mass consumer applications that are obviously huge opportunities, but maybe existing companies will win all of these, so it’s like a general AI voice assistant that you can ask to do anything, and it will go do that thing that should obviously exist, but all the big players will compete to be that thing.

Right? Apple is a bit slow on that front; why, sir, so foolish, it still has no perception.

I mean, it seems there’s a counterpoint, that the obvious thing is search, and maybe Google will still win in search, but confusion will definitely make them run for their money.

Yes, that’s the classic innovator’s dilemma that eventually faces them. I mean, you could argue against your points about Uber or Airbnb, that from a regulatory perspective, these are actually very dangerous things, so if you’re Google, you basically have a guarantee, you know, a huge pot of gold coming to you every month, why would you jeopardize that pot of gold to pursue these things that could be scary or could ruin it?

I think this might be the main reason legacy companies ultimately didn’t develop these products, and even after they became huge, didn’t clone them. Clearly, they would work hard. Google never launched a U clone, nor did they ever launch an Airbnb clone. I was listening to Travis’s talk, and one thing he said that really troubled me was that in the early years of Uber, he was very afraid he would go pursue and end up in prison for a long time, as if he was actually risking going to jail to build that company. So yes, no high-paid Google executive would do that.

Why Big Companies Can’t Enter the B2B SaaS Space

What do you think about why big companies haven’t entered B2B? Is SaaS part of the reason? Are many use cases widely distributed?

That’s a good question. I’d love to hear your thoughts. My view is that as a company, doing so many things is too difficult, just like every B2B SaaS company needs to have someone running the product in the business who is very deeply focused on one area and cares very deeply about a lot of very obscure issues, like eagerly taking action. For example, why didn’t Google build a competitive competitor? Well, at Google, no one really understands payroll systems and has the patience to deal with all the nuances of all those stupid payroll regulations. It’s like it’s not worth it for them. It’s easier for them to just focus on a few very large categories.

In the B2B SaaS world, there’s a bit of a debate about software unbundling and bundling, and I think this debate often comes up and expands. Why are all these vertical B2B SaaS products evolving, and not like Oracle, SAP, or NetSuite? Yes, NetSuite is like having everything. I think this might also be due to the shift to selling software as old as SaaS and the internet.

Again, it’s like you have this boxed software that’s really expensive, and you have a complete ecosystem around it. Anytime you want something customized, it’s like the integrators would say, oh no, it’s like we can build a UA custom like payroll functionality. Then Salesforce came along as a SaaS solution, and it never seemed as powerful or complex as the expensive enterprise installation you just paid for. But they proved to be completely like that. I think it opened the door for everyone. These are like vertical SaaS solutions that do exactly what you said.

Another issue is that for many enterprise software, if you’re a user of Oracle and NetSuite, because they have to cover so many areas, the user experience is actually quite poor. They try to be the jack of all trades in every industry but master of none. So ultimately, it becomes a kitchen-sink experience. That’s where if you go to build a B2B SaaS vertical company, you can provide a 10x better experience and a more pleasant experience because there’s a clear distinction between consumer products and enterprise user experiences.

Is software only at three price points? $5 per seat, $500 per seat, or $5000 per seat? This directly maps to consumer SMB or enterprise sales. Then I think ancient times taught us this, thank goodness, for new software, this is becoming less and less true. But enterprise software is bad software because it’s not purchased by users, you know, in the Fortune 1000 companies, some senior muckety-muck is eating and drinking for this large seven-figure contract. And you know, they will choose something that may not be that good for the end user (the person actually using the software every day). I’m a bit curious to see how this changes in LMS.

I mean, so far, what we’ve seen is that the more prominent thing about SMB and enterprise software companies is that all software companies, all startups, during the period, you know, as revenue scales up, there’s a perception. The number of people you have to hire is related to its scale. So when you see unicorn companies, even in today’s YC portfolio, it’s common to see a company with annual revenue reaching $100 million or $200 million. They already have about 501,000 employees. I’m just very curious, as I start advising those companies that are one or two months old, it feels a bit different from the advice I would have given a year or two ago.

In the past, you might have said, let me find the absolute smartest people in all the other parts of the organization, like customer success or sales or something like that. I want to find someone I’ve worked with before, and I know they’re great. Then I’m going to go sit at their door until they quit to work for me. I hope they can build a team for me and hire a lot of people. That might still be true, but I’m starting to perceive that the meta shift is a bit like you actually might want to hire more really good software engineers who understand large language models and can really automate the specific things you need, which are the bottlenecks in your growth. So this could lead to, you know, a very subtle but significant change in how startups grow their businesses, a bit of a late-stage market adaptation. This means I’m going to build LM systems, lower my costs, so I don’t have to hire 1000 people. I think we are at the beginning of this revolution.

I mean, we talked about this in the previous episode, we talked about how in the future there will be a unicorn company that can operate with only 10 employees. That’s completely reasonable.

They are writing evals and prompts.

I think what you’re saying is like a trend that started even before LLMs. Like I remember when I was running ThreeByte, for example, we needed to build marketing or user acquisition. Especially after we raised our Series B, the traditional way you should adopt is to hire a marketing director, build a marketing team, and start this machine to do sales and marketing.

But I actually met someone like YC founder Mike, whose company is basically building a smart frying pan. It sounds strange, but he’s an engineer from MIT. Yes, do you remember this? He’s an MIT engineer. And to sell the smart frying pan, he had to be very, very good at understanding paid advertising and things like Google Ads. So he took an engineering mindset, and I remember just talking to him about this, I realized that if an MIT engineer was doing our marketing, it would be so much better than any marketing candidate I had talked to. He was able to scale us, and we were spending about a million dollars a month just on marketing and various activities.

In the great marketing trifecta, like I remember, for example, the takeover of the Caltrain station, you did everything you did at home. It was like real high-quality stuff. It got stuck in it. You could see he wasn’t the kind of person who was doing marketing.

That person, that was Mike, just like I often get comments when people ask me at that time, like how big is ThreeByte? We were like 50 people, and we were doing better. It was like there were hundreds of people. I thought at the time, no, it’s all because if you let a very smart engineer do some similar tasks, they just find a way to get it done, they find leverage, and now like an LLC, they can surpass the pure software leverage.

Okay, this is the talk I’m giving about 300 vertical AI agent unicorns. In fact, for every company evaluated as a unicorn, you can imagine there’s a vertical AI unicorn equivalent, just like some new universe, like most of these SaaS unicorns, there are some companies like boxed software companies making the same thing, disrupted by SaaS companies. You can easily imagine the same thing happening again. Now basically every SaaS company is building some software for some people to use. The vertical AI equivalent is just software plus people in a product.

One thing might just be that companies are now generally a bit uncertain about what they actually like and what agents they need. I’ve seen a way, coming from particularly experienced founders, like Brett Taylor, the Chief Operating Officer of Facebook, who founded this company. I don’t know all the details, but as far as I know, it’s basically more about customizing businesses to deploy these AI agents rather than saying, “Oh, hey, we have this specific agent to do this.”

This is what I see from a company called Vector Chef, which got funded about a year ago. They are two very smart Harvard computer scientists who found they were trying to build a platform to make it easier for businesses to build their own platforms, like using no-code or SDKs to build their own internal LLM-powered agents. But businesses often don’t know what they want to do with these things. So bringing it back, I wonder if, like in the boxed software world, you start out like some vendors who are basically just trying to persuade people to use the software. It’s like, it can do anything, and then it becomes more complex and higher resolution, and you’ll get a lot of players like vertical SaaS players. We went through the same period with LLMs, where the early winners might just be these generic ones, like we like to make it easy for you to do LLM things. Then vertical agents will come in over time. Or do you think there’s a different reason now that vertical agents will take off from day one?

Yes, it’s interesting because if you think about the history of SaaS, initially, consumer applications like from 2005 to 2010 were mainly consumer applications like email, chat, and maps. People got used to using these tools themselves. I think this made it easier to sell SaaS tools to companies because, you know, the same people are both employees and consumers.

Yes, I think the answer might be like, this is just a continuation of software, just without a reason to reset, just like LLMs don’t have to reset back to some general-purpose enterprise LLM platform, doing everything enterprises have been trained on, like the value of point solutions and vertical solutions, and the user experience won’t be that different. These things will just become more powerful. So if enterprises have built enough confidence that startups or vertical solutions can do better than traditional broad platforms, they might be willing to bet on a startup that promises to deliver very good vertical AI agent solutions today. I feel like we’re seeing this now; some of our companies are gaining traction in these vertical AI agents faster than we’ve seen before.

I think we’re just in the early stages of the game, right? Like all software, starting out quite vertically. Then as the industry actually becomes more developed, I mean, I just answered my previous question, like, you know, why does a company end up with 1000 employees? Actually, you know, in the early stages of the game, everyone is making these specific point solutions. Then at some point, you have to move horizontally, just like you’ve been spending like crazy on sales and marketing. Then, once you reach 100%, or you know, the vast majority of the market, the only way you can continue to grow is that you actually not only have to do a point solution but also do some common things.

Maybe the bold case for vertical AI agents could be that they might be larger than SaaS because SaaS still requires an operations team or a group of people to operate the software to get all the workflows done. I don’t know about approval workflows, or you have to input data. The argument here is that you can not only replace all the SaaS software, so this will be a 1-to-1 mapping, but it will also eat up a lot of payroll because you’ll find that a large portion of these expenses in many companies is still payroll, and software is small.

Exactly, they spend much more on employees than on software.

So these smaller companies are more efficient and require less manpower for random data entry, approvals, or clicking software.

I agree, I think the vertical equivalence is likely to be 10 times what they are disrupting in SaaS companies.

I mean, there are two scenarios. The vertical point solutions might be big enough that you don’t need to do the soup-breathing thing, right? That could be a nice scenario.

Examples of AI Agent Applications in Vertical Fields

Should we give some examples? I feel like we’ve all worked with so many verticals and AI agent companies, and we have news from the front lines about how it’s actually developing.

There’s one example. Aaron Cannon is working with me on a YC company called Stray, which is basically bringing LLMs to the survey and quality space. So Qualtrics is almost certainly not going to build the best large language model with reasoning capabilities.

Then the interesting thing about surveys is, you know, who is it actually for? It’s for people running products. For marketing teams, it’s for those trying to perceive what our customers really want and what the survey results look like. Guess what? That’s language. So I feel like these types of businesses actually have to thread the needle because enterprise and SMB software is often sold based on specific personnel of key decision-makers. You have to go high enough in the organization so that the people you’re selling to aren’t afraid that their whole job or their whole team’s job will completely disappear.

This is what I see many sales companies need to take action on because if you’re going to sell to teams, that will be replaced by AI.

So I think this is an interesting way; a lot of it is top-down, you have to get through at some point, you can get the CEO to sign off.

I’m working with a company called Mee, which is essentially an AI agent, but at least where they started was like QA testing. They are now gaining very significant traction.

It’s interesting because do you remember ten years ago, why we worked with a company like Rainforest QA, for example, Rainforest is a QA service company, and they had this exact tension of not being able to really replace your QA team. So they needed to build software to make QA more efficient. But in reality, this obviously meant trying to replace them as much as possible. They couldn’t replace the whole team, so they were always trying to sell software to engineering managers, like walking a tightrope, as if this meant you needed fewer QA people, which is great, but you also had to sell it to QA teams that didn’t want to be replaced. So I think this has always been like the friction of how that business scales and grows, but now with AI, like Meic can actually replace QA people. So their pitch isn’t, oh, this makes your QA people faster. It’s like, it means you don’t need a QA team at all. So they can focus the cells on engineering, and engineering currently doesn’t need to buy from QA, and you can also go in, I mean, first, you can go sell to companies that don’t even have large QA teams.

They’re just using something like Meic, and then it will scale like crazy. They will never build an 18-quarter. This is a real case study that tells why these vertical AI agent companies can be 10 times larger than SaaS companies.

I find this interesting now, just like in hiring, I’m encountering the exact same problem in building software to make it easier to screen and hire software engineers; you need to buy from the engineering teams they join, and there’s also the recruiting team. In fact, the software we’re developing is trying to replace recruiters, but we can’t fully replace recruiters. But now with New York.

So recruiters are always against it because it poses a threat to them.

Yes, so there’s always friction, just like when you’re trying to sell to customers who are worried about being replaced, how far can you get? But I think we’re still in the early stages, but now with AI, you can build something that does the whole stack, like recruiting. We have a company working with the last patch like Nico, which is actually just doing full technical screens, full initial recruiter screens, and gaining significant traction. So I think as these things continue, it’s like they won’t have the same thing, so you won’t have friction. Although I need to persuade recruiters to use this, you might not have to build a recruiting team like before.

I mean, another example is even for developer tool companies, they have to do a lot of developer support. I’m working with a company called Capillo AI, which is basically building one of the best chatbots that can respond to a lot of difficult technical details. I think many companies starting to use them are actually much smaller than my devrel team because there’s only so much developer documentation, even YouTube videos released for developer tools, and there’s a lot of chat history. So it just keeps getting better, like giving very good answers. It’s actually one of the best I’ve seen.

Yes, I also worked with a customer support company, like an AI customer support agent company called "Power Assist." Well, actually, we all did the last batch, and I learned some interesting things from Power Assist. First, the customer support category like AI agents is known to be crowded, with supposedly 100 options. If you Google AI customer support agents, you’ll get 100 results. But what I learned from working with Power Assist is that this is actually a bit of nonsense, as almost all of these companies do very simple things, like zero-data LLM prompts that cannot really replace a real customer support team that does a lot of very complex workflows. It’s just a nice demo that actually replaces a customer support team, like a company with about 100 customer support representatives doing a lot of complex things every day. You like very complex software that can handle everything Jack Heller talks about, but only three or four companies are trying to do that. And, cumulatively, they have less than 1% market penetration. So the market is completely open.

I can also see this as another case of hyper-specialization or hyper-verticalization, like there won’t be, I mean, maybe eventually there will be a general customer support agent software company, but we’re like in a victory, you know, it’s like the eighth or ninth inning. We’re really in the first inning. So, you know, conversely, you know, you will have companies like Giga ML, you know, doing 30,000 tickets a day for Zepo and replacing a team of 1,000, but it’s very specific, you know, it’s not a general demo where there’s a very detailed eval set with 10,000 test cases, you know, basically only 4 Zepo and things like that. But if you’re, you know, any other market company, you might use it because it’s a very clear market, you know, the instant delivery market.

I think this is a dynamic that leads to there being like $300 billion SaaS companies instead of something like $10 trillion meta SaaS that provides all software for the world, just like customers need very customized solutions, making it hard to build a company like engineering for everyone.

Exactly, we’ve given three examples of customer support, but there are very different verticals, like developer tool companies, where you need to be very different in the training set from the market, very different, right?

Yes, I guess whether you have agents or real people working for you, you ultimately run into the same problem, which is that every company violates the theory of the company’s cost, which states that any given company will only grow to the point where it becomes inefficient compared to larger companies. That’s why they are networks and ecosystems, and you, a mature economy. Every company you like will specialize in what it does best. Then there are the constraints, the external constraints of these companies, which are actually based on your ability as a manager. So that part makes me quite happy because, you know, when we were with Parker Conrad, one of his favorite points was actually, you know, everyone is very obsessed with the fact that rocks can talk, you know, maybe they can draw. But what’s more interesting to him is running HR IT software, you know, he spends a lot of time thinking about HR, and actually, the coolest thing about LMS is that rocks can read, from his perspective, like he has 3,000 employees, and he still runs payroll for all 3,000 employees through Ripple. So I think he spends a lot of time thinking about how a person can scale their ability as a manager? And I think we will see more of the opposite view, that tools for managers and CEOs will become more powerful.

It can increase the scale of the company you run, right? That’s definitely what Ripple is trying to do, like he’s trying to build this HR tool suite, and if he wins, he will eat a huge chunk of value from SaaS companies worth billions of dollars in a massive company.

An interesting point, Gary. I think what it makes me think of is that having all these AI tools will enable all these leaders and all these organizations to basically open the aperture of the context window or how much information they can parse, because the number of meaningful relationships we can build is limited. Dunbar’s number is like the whole thing, you can have about 300 people, and you can build meaningful relationships with 150 people. But with AI, because all these rocks can now read, I think we will be able to expand the Dunbar limit we have.

Yes, I think Flo Crevello posted an interesting post on Twitter that went viral. I think someone took voice chats as CEOs, like weekend projects, but it would call all 1,500 of their employees, you know, these are very short calls, sounding like they’re from the CEO, just personally checking in. I mean, this kind of reminds me of her scene, it shrinks down, and actually, you know, you’re following a person using her operating system experience, but actually, her operating system is really talking to 15 people, you know, thousands or tens of thousands at the same time, and many others 8316. Yes, I mean, large language models can talk and can have conversations, so to what extent does knowing this ability actually expand one or a few people’s ability to understand what’s going on?

I heard you, and that definitely made me think because based on my understanding of this project or similar projects, it would just call all your employees, and then your employees could walk through what they’re doing, and it would just extract meaning from that and provide the CEO with a summary of the most important things.

And there’s a bunch of SaaS-like companies trying to do weekly pulse operations through employees using traditional SaaS software, but this version is actually 100 times better than the pre-LLM version of this idea.

But I wonder about that specific tool, like it’s not, it goes beyond reading and summarizing. That’s an argument, if writing is thinking, then there’s actually a lot of work involved in figuring out who is an effective communicator, like what are the most important things, what key matters does the company need to focus on? I just wonder if at some point, LLMs would like to go beyond summarizing, reading, and doing actual thinking, at this point, like who actually manages the organization, such interesting thoughts.

I guess there’s another interesting thing in Parker Conrad’s mind that I found out when I was recently interviewed by Matt McGinnis for the provenance of Rippling, now there are over 100 founders working at Rippling, and they are some specific people, like the whole SAS operating vertically within Rippling.

The way he builds teams is very cool. Hal probably knows a lot about this because you’ve done a lot of interviews.

Yes, I mean, it’s definitely very focused on recruiting founders. I mean, like Ripple, it’s essentially against the case of vertical verticalization. And trying to horizontally take over all HR and IT software.

Just like the whole paper, basically there’s a huge value underlying platform he wants to recruit founders and teams built on the platform, like Amazon’s Squee, like shared infrastructure.

Yes, I think every product they release, I mean, time tracking and stuff like that, I mean, basically they released something that hit millions of dollars on the first day of release. This is exactly what we talked about before. It’s like once you, once you have a vertical industry, once you have a foothold, you mean, anyway, I have to spend this money on sales and marketing, can I? You can basically get a higher LTV and keep my CAC constant, if you look at all the top software companies today, it’s like Oracle, Microsoft, Salesforce are all Ripple. Knock on wood, it will be the next, but it’s an interesting alternative, completely relying on itself from 0 to 1.

AI Voice Technology (Companies)

For you, I want to talk about some of the voice companies we have, I think this is an interesting subcategory, and these things are really exploding now.

I worked with a company called Salient, which basically automates the collection and automatic ending space through AI voice calls.

Traditionally, they would call people, and then they would say, hey, you owe a thousand dollars for your car, yes, that’s actually how it is.

The work is one of those butter pass jobs. It’s a bit bad because a lot of low-paid workers work in all these call centers, and it’s like a terrible and boring job. Such a high turnover rate and a huge number of employees to operate these banks because there are too many accounts, which is a perfect task for AI to automate. And what Salient does is able to get very, very accurate results. And it’s already launched in many big banks, which is very exciting. This is a company from last year that proved the part they could enter is because they sell in a top-down manner.

I guess this field feels like it’s moving very fast, and we have some incredible companies, like Vappie, a voice infrastructure company. Then people can get started right away. And retail, I mean, these companies have scaled quite rapidly, just because it’s more exciting, like one of the exciting things you can start and run in. I mean, literally the process of time.

Then there are some questions, you know, still unanswered, and we hope they figure out how to stick around, especially when you encounter things like the new OpenAI voice APIs? You know, would you go directly like you? Trying to use the underlying APIs offline might take more work. But these platforms are obviously very low. Then the question is, can you continuously raise the ceiling to forever capture customers?

Heart, you raised an interesting point earlier about the changes in applications built on LLMs from the beginning of 2023 to now.

The voice we just talked about is a good example. I think even if you go back six months, it feels like those voices weren’t real enough. The latency was too high. Just like that, it feels like we might have a way to have AI voice applications that can meaningfully replace, just like humans calling people. Just like, we’ve arrived. Yes, it just shrinks a bit, recalling the first YC batch where LLM-driven applications first appeared, probably in the winter of 2023, you know, almost two years ago. And these applications were basically just spitting out some text, not even perfect.

More like copy editing, marketing, editing, email editing. It’s just a more incremental way. Yes.

Just like I have a company, I mean, that company that has been in my mind is called Quick Brand, and what they do is make it easy for small businesses to generate a blog and spit out content marketing. It’s a very obvious idea, although not perfect, but it was cool at the time. This is what we’ve been talking about throughout the program, but just like ChatGPT said at that time, hey, this is what a large language model application looks like, it’s just a wrapper around ChatGPT. It does very basic things, will spit out some text, just like it will be crushed by OpenAI in the next version, and it did.

Yes, I don’t know if that one did, but the first wave of LLM applications was mostly crushed by the next wave of GPT.

But I feel like we've had this frog effect bullying, in our case, it's like every three months, things gradually get better. And now we are at a stage where we are talking about comprehensive vertical AI agents that will replace entire teams, functions, and businesses. This progress is still exciting to me, as it feels relatively early after two years, and the pace of progress is unlike anything we've seen before.

I think it's interesting that we discussed this in the last episode, where many foundational models are somewhat face-to-face. Previously, there was only one player in town, OpenAI, which we saw in the last batch. This situation has been changing. Claude is a huge competitor.

How Founders Choose the Vertical Field for AI Agents

It's like competition is the soil for a very fertile market ecosystem, where consumers have choices and founders have opportunities. This is the world I want to live in. So people are paying attention and considering starting a business, or maybe they already have, and they’ve heard all of this. How do you know what vertical direction is right for you?

You have to find some boring, repetitive management tasks somewhere, which seems to be a common thread in everything. If you can find a boring, repetitive management task, if you dig deeper, there’s likely to be a billion-dollar AI agent startup.

But it sounds like you should pursue something you have some direct experience or relationship with.

That’s very common. This is definitely a common point I see in promising companies. Another one that just popped into my mind, I think I mentioned before, is that they are basically building an AI agent to bid on government contracts. They found this idea about a year ago when they had a friend with a full-time job sitting there, like refreshing a government website, looking for new bidding proposals. They turned to each other and were like, this seems like something LLMs could do. Recently, a batch of companies pivoted to a new idea that got a lot of attention, like they are basically building an AI agent to handle medical billing for dental clinics. They found this idea because one of the founders' mothers is a dentist. So he decided to work with her for a day, sitting there watching what she did. She said, oh, like all of this, handling claims seems very boring, like an LLM should be able to do that completely. He just started writing software for his mother’s dental clinic.

So I guess, I mean, in the robotics field, the classic saying is, you know, the robots that will be profitable and able to work will be for dirty and dangerous jobs. In this case, for vertical SaaS, look for boring butter passes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。