0. 投资概览(Executive Summary)

0.1 TL;DR

Pendle 项目本身构建扎实,数据透明,代币分布合理。团队履历与技术能力优秀,核心成员长期稳定,具备独立推进复杂系统的能力。代币结构上,尽管团队和基金会的代币已全部解锁,但整体抛售节奏理性克制,展现出良好的长期主义。Pendle 在“可托付性”和“中长期交付力”上表现出色,是典型的“硬核派”DeFi 项目。

从产品和技术上来看,Pendle 的核心机制(PT + YT 拆分)构建出一个全新的链上利率逻辑,AMM设计具有高度金融工程理解,成功商品化了收益权交易。同时引入点数、空投权益等创新叠加,使得收益性与博弈性兼具。Pendle 在“产品工程力”与“机制设计能力”上远超同类项目,是具有深度护城河的协议。

从产品路线图来看,Pendle 的发展路径清晰且稳健,2023–2024完成了从 LRT 驱动向生息稳定币主导市场的转型,2025明确提出向资金费率、非EVM生态等扩展,持续延长生命周期。从这部分来看,Pendle 的战略执行力强,方向明确,是极少数能“自主寻找第二增长曲线”的 DeFi 项目。

从经济模型来看,Pendle 采用 veToken 架构,实现代币价值闭环:锁仓参与治理、获取分润、提升LP收益。议收入主要来自 YT 收益费与 PT 交易手续费,且不设官方抽成,全部回馈社区。但是手续费下的估值存在一定的高估,也反映了市场对其未来的高预期。

从市场潜力来看,Pendle 所处的链上利率市场远未被充分开发,潜在市场包括:稳定币息差、LRT、RWA、资金费率,规模可能达到数千亿美元。目前 Pendle 已主导以太坊生态,在向 Solana、TON、Hyperliquid 等拓展。作为一个处于链上利率市场爆发临界点的协议级平台,Pendle 具备极高的长期成长潜力,但其发展仍高度依赖于利率产品整体规模的持续扩张。

0.2 叙事和投资

Pendle 所打造的利率市场基础设施极具前瞻性,构建出链上固定收益与收益权交易的标准层,成功承接了 LRT、稳定币、空投点数市场等多轮市场主题。其 业务方向 与趋势高度契合,治理机制完善,收入结构闭环明确。从本部分来看,Pendle 拥有明确的叙事锚点与估值预期,具备典型的“强叙事 + 弹性基本面”项目特征,适合中长期配置。

●短期:随着稳定币赛道迎来“第二春”,PayFi 与空投叙事持续发酵,Pendle 有望获得市场博弈空间;但需注意当前链上数据呈现下滑态势,或对短期币价构成一定压力。

●中期:随着 Boros 推出,资金费率市场接入,将激活全新客群,迎来新的叙事阶段。

●长期:Pendle 有望成为链上利率市场的“结构性核心设施”,扮演类似 TradFi 里的利率互换平台角色,所面向的市场空间巨大,具备持续扩张的潜力与成长性。

对于长期投资者:

尽管 Pendle 在当前阶段可能存在一定短期溢价,但从长期视角来看,其品牌认知、用户结构的多样性、抗风险能力以及市场份额的潜在增长空间均具备显著优势。项目的中长期成长性明确,适合通过定投方式逐步建立仓位,建议可即刻开始布局。

短中期参与者:

由于短期内市场动荡,同时Swap fees目前正在经历周级别的缓慢下降,我们建议紧密观察:

1.稳定币市场是否迎来第二波行情:近期多个稳定币项目获得融资支持,短期内有望推动赛道再度活跃,Pendle 作为主要承接平台之一,可能受益于这一轮资金与用户流入。

2.是否出现新的用户群体:从早期的 LRT 到当前的稳定币用户,Pendle 的核心吸引力在于与利率相关的资产交易能力。若接下来能覆盖如 PayFi 等新场景或新增生态用户群,将成为推动中期增长的关键节点。

1. 基本概况

1.1 项目简介

Pendle Finance 是一个构建于以太坊生态的去中心化利率交易协议,其愿景是成为链上利率市场的基础设施。Pendle 创造了一种链上原生的收益权利市场,为 DeFi 中“固定收益”与“收益衍生品”打开全新赛道,被誉为 “DeFi 中的利率市场 Uniswap”。

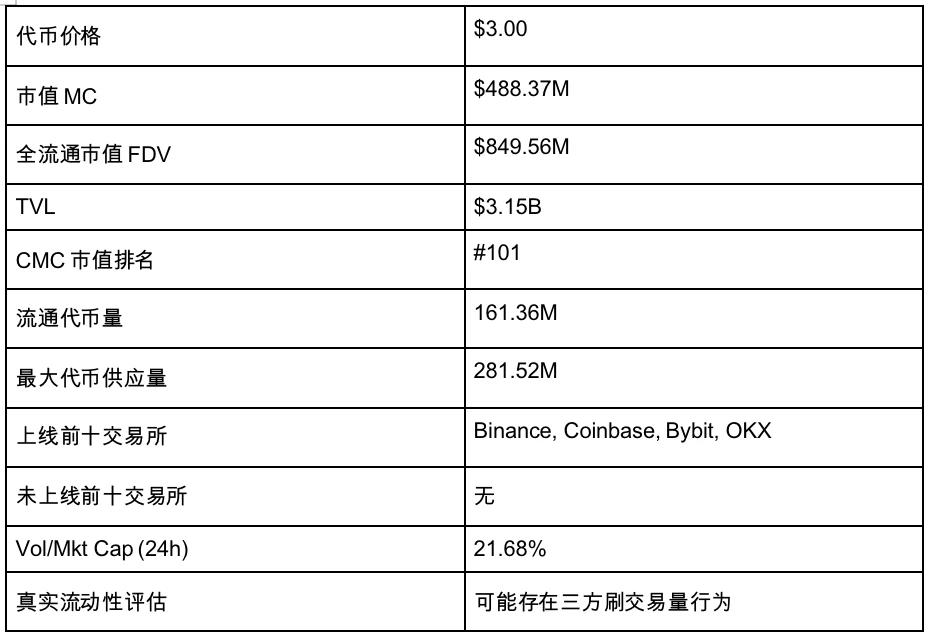

1.2 基本信息

1.3团队与背调

Pendle 成立于 2021 年,团队成员 base 在新加坡和越南,目前在 LinkedIn 注册有 30 人左右,平均任职时间在 2.1 年左右,管理层较为稳定。

TN Lee(X: @tn_pendle):Co-Founder,曾经在 Kyber Network 是创始团队成员以及业务负责人,后加入矿企 RockMiner,该矿企运营着大约 5 个矿场。在 2019 年成立 Dana Labs,主要是做 FPGA 客制化半导体的。

Vu Nguyen(X: @gabavineb):Co-Founder,曾经在 Digix DAO 担任 CTO,专门从事实物资产的代币化 RWA 项目,后与 TN Lee 共同创建了 Pendle。

Long Vuong Hoang(X: @unclegrandpa925):工程主管,获得新加坡国立大学计算机学士学位,在 2020 年 1 月加入新加坡国立大学担任助教,2021 年 5 月加入 Jump Trading 担任软件工程实习生,2021 年 1 月加入 Pendle 担任智能合约工程师,后于 2022 年 12 月升职为工程主管。

Ken Chia(X: @imkenchia):机构关系主管,获得莫纳什大学的学士学位,曾在马来西亚第二大银行 CIMB 担任投行实习生,之后在摩根大通担任私人投行的资产规划专家。2018 年进入 Web3,在一家交易所担任 COO,2023 年 4 月加入 Pendle 担任机构主管,负责机构市场——自营交易公司、加密货币基金、DAO / 协议国库、家族办公室。

Daniel Anthony Wong:增长主管,获得南洋理工大学电子电器学士学位,毕业后即加入 Pendle,目前已任职四年左右。

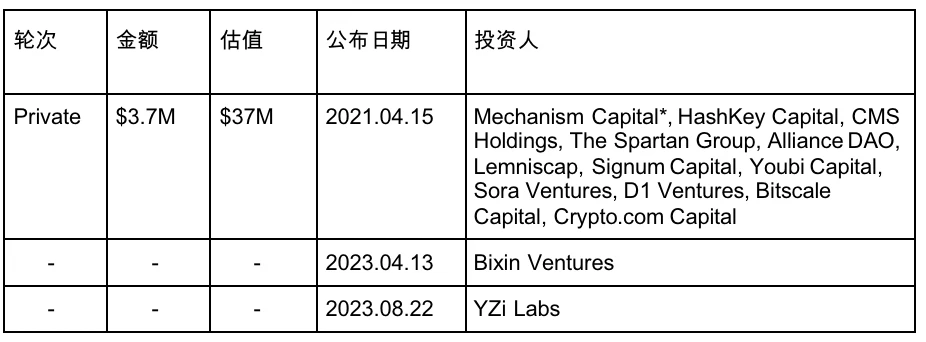

1.4 资金 / 融资情况

2. 产品与技术

2.1 产生背景

DeFi 世界缺乏原生利率市场,传统利率工具无法在链上复制,Pendle 通过收益权分离机制,开辟出一条链上固定收益赛道。Pendle的核心愿景:将所有带收益资产转化为可交易的收益产品,实现固定收益、利率投机和收益金融商品化。

2.2 核心产品介绍

Pendle 将自己定位为利率互换市场。其是一个构建于以太坊上的去中心化收益交易协议,允许用户将未来的收益现金流进行拆分、定价、交易和组合。

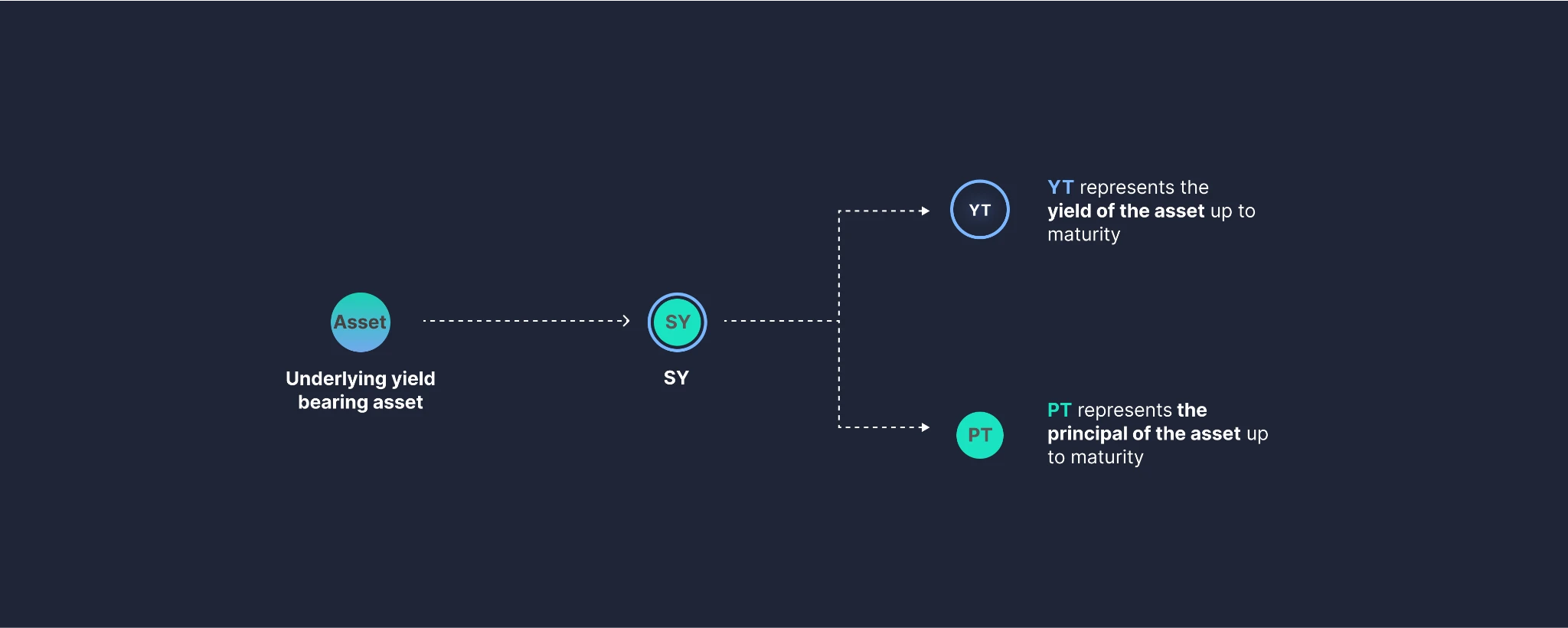

其核心功能是将具有收益性的资产(如生息稳定币、质押代币等)拆解为两个可交易组件:本金(PT,Principal Token)和收益权(YT,Yield Token),从而形成一个“利率互换市场”。

这一机制为 DeFi 提供了前所未有的灵活性,使用户能够像在传统金融市场中那样,管理利率风险、锁定固定收益,或投机于未来收益走势。

Pendle mechanism, source: Pendle

Pendle 通过一个通用的收益化资产接口(Standardized Yield, SY)支持多种带收益的资产。进入 Pendle 后,这些资产被拆解为:

●PT(Principal Token):仅代表本金权利,到期可 1:1 赎回;

●YT(Yield Token):代表未来收益权利,价格取决于未来的利率预期。

此外,Pendle 构建了一个自动化做市系统,使 PT 与 YT 的市场具备流动性和可组合性,并引入交易滑点低、挖矿激励强的池子结构,吸引长期资本与DeFi专业用户。

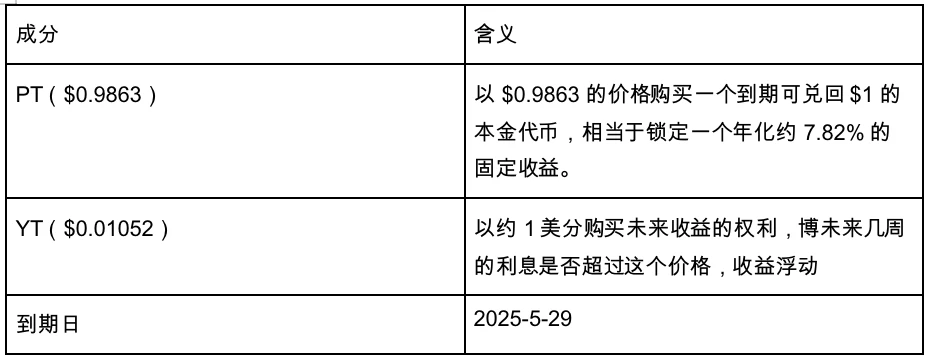

比如:sUSDe 2025-05-29 到期池

●买 PT 或者卖 YT,锁定未来的收益。如果你持有经过 Pendle 封装后的 sUSDe(即由 USDe 转换而来),那么你可以通过 AMM 将 sUSDe 拆分成 YT 和 PT。你可以选择出售 YT(也就是未来 7.82% 的收益权),从而提前锁定你的 7.82% 收益;或者你也可以直接在市场上折价买入 PT,在到期后按 1:1 赎回,这也是一种锁定 7.82% 收益的方式。

●买 YT,押注未来收益上涨。如果你认为未来链上行情或其他因素会导致 USDe 的收益率上升,那么你可以买入当前在低利率下定价的 YT,博取未来 YT 收益超过买入时收益率的可能。

而 PT / YT 的买卖主要依赖于 Pendle Finance 的自动做市商(AMM),它是协议的核心组件和主要利润来源,专为交易本金代币(PT)和收益代币(YT)而设计。与传统的恒定乘积公式(如 Uniswap 的 AMM)不同,Pendle 的 AMM 会考虑时间对资产价值的影响,能随着时间推移动态调整其曲线,以反映收益的积累和 PT 价格范围的变化。

其核心组件是:PT 和 SY 的虚拟 AMM。这种设计允许用户直接使用 SY 购买 PT,从而锁定未来收益,也可以通过“闪电交换”(Flash Swap)机制买卖 YT(收益代币)。

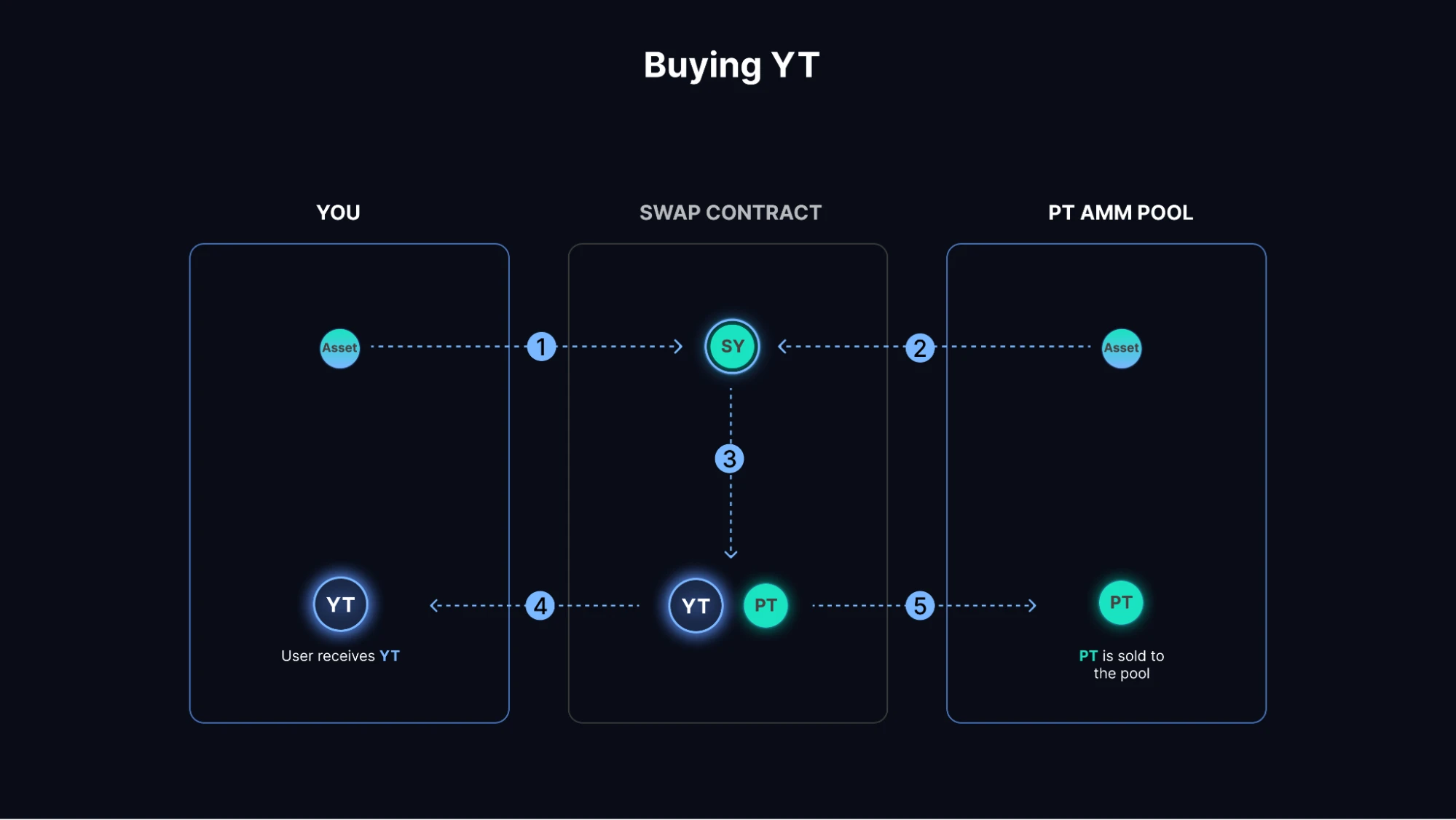

具体交易流程如下(用户持有 USDC,但想买入 USDe 的 YT):

Swap 合约接收到 USDC 后,会将 USDC 用于购买虚拟 AMM 池中对应的 SY 资产,这里是 sUSDe。随后,sUSDe 会被 Mint 合约拆分成 YT 和 PT 资产,YT 资产发送到用户地址,而 PT 资产则在 AMM Pool 中被售出。这样,用户便获得了 Ethena USDe 资产的限期收益权以及点数权利(Ethena Points)。

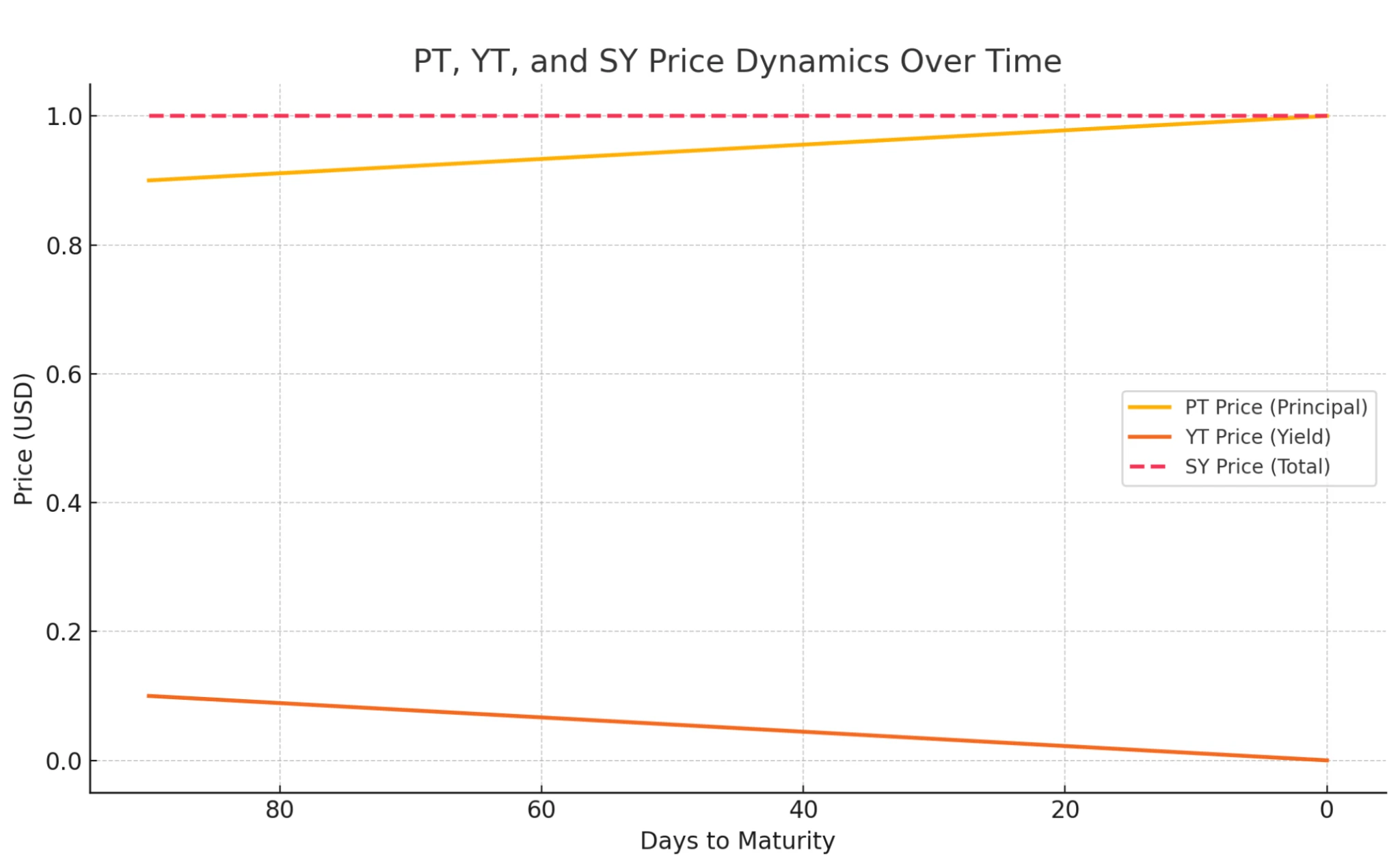

PT(Principal Token)+ YT(Yield Token) = SY 的当前价值

这是 AMM 机制的核心算法,意味着 PT 价格与 YT 价格之间具有直接的关联性。如果市场抛售 PT,那么 YT 往往会上涨,以此抵消 PT 抛售所带来的价格下跌,最终实现恒等于 SY 的资产价值。因此,即使池子中只有 PT 和 SY,也能推导出 YT 的价格,无需构建两个 AMM 池。

PT YT and SY correlation

另一方面,以 sUSDC 为例,假设到期日为 90 天,随着到期日的临近,收益会逐步趋近于 0,那么 YT 的价格也将逐步归零,而 PT 则会逐步趋近于 1。我们可以将 YT 理解为一定时间内的资本收益权。

Pendle 衍生玩法:结合当前空投市场的点数机制。例如 Ethena、EigenLayer、Renzo、KelpDAO 等项目,会向持有代币(如 sUSDe、ezETH、rsETH)或进行质押的用户发放点数(Points),这些点数意味着未来的代币空投份额。你可以“卖掉”未来的点数收益权,或者“借出资产赚取点数收益,由他人支付利息”。这种玩法的逻辑与 YT(资本收益权)相同,只不过标的物是“点数”而非“利息”。

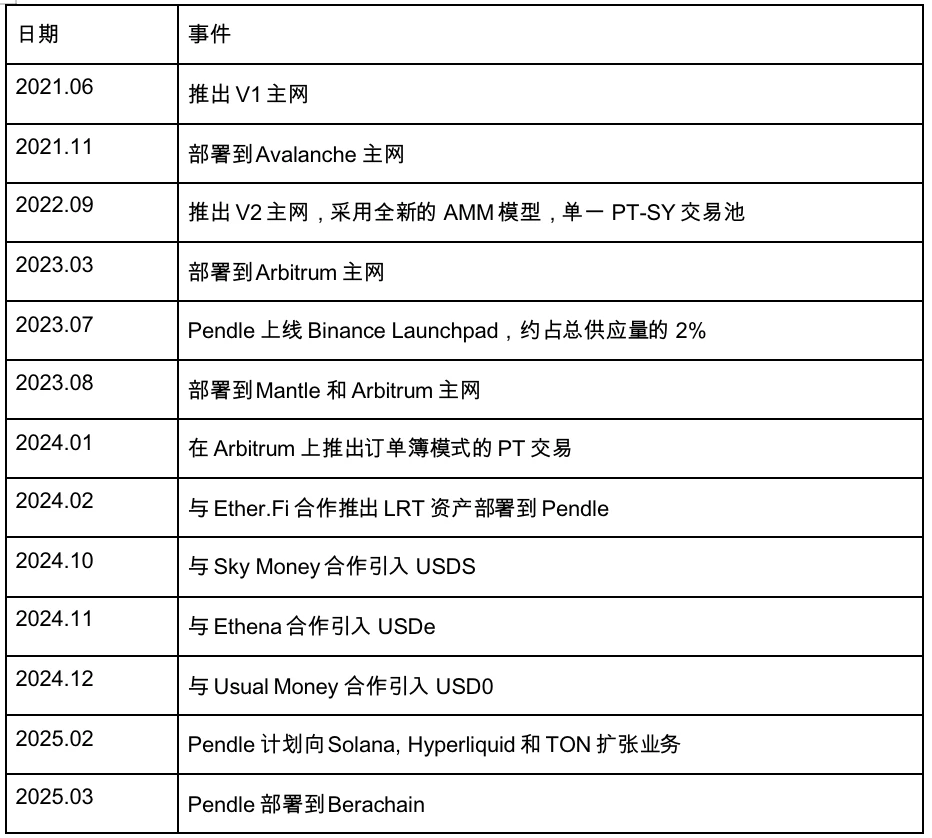

3. 项目发展历程

3.1 过去

3.2 现在

3.2.1 生态发展

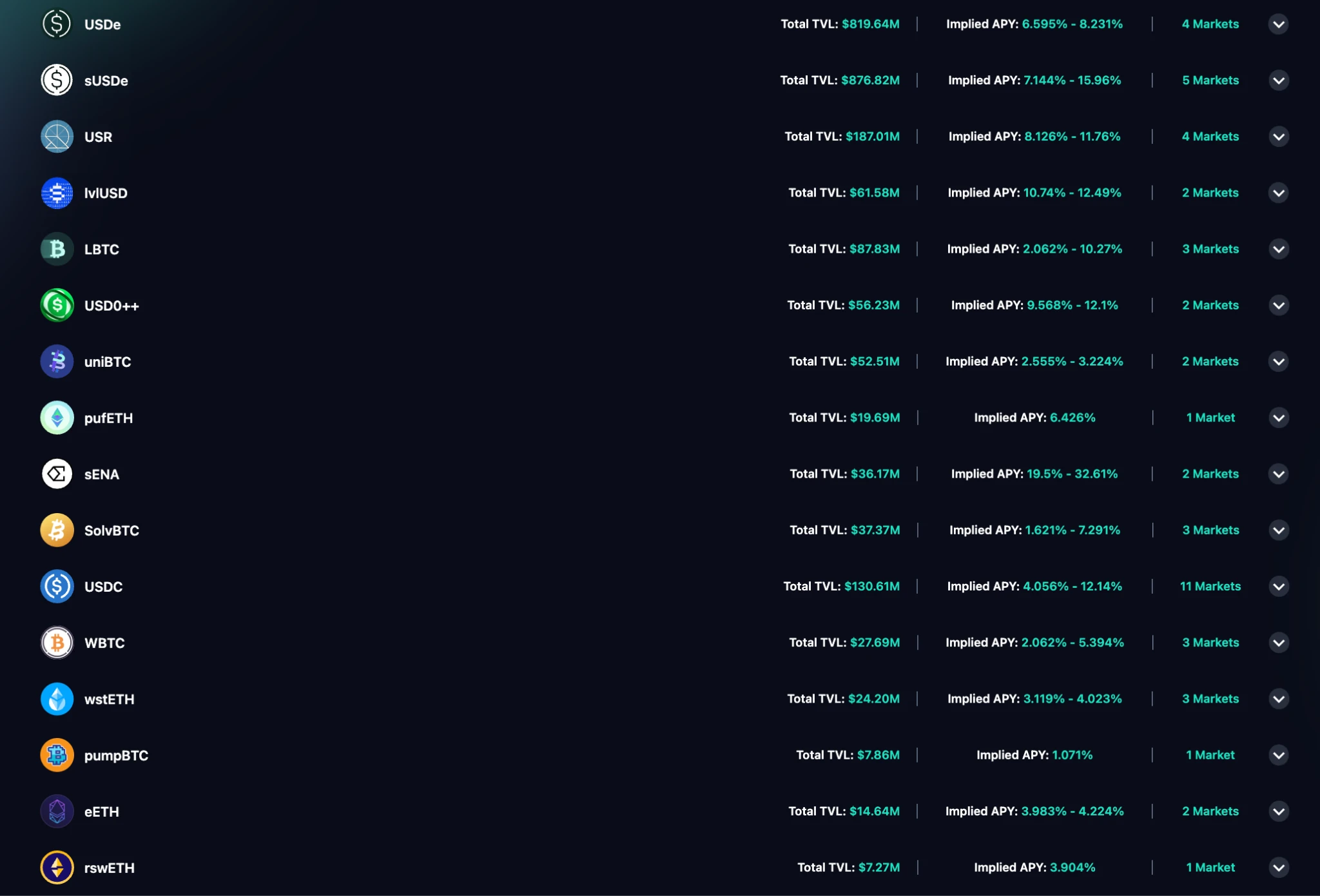

在去年,其生态主要以 LRT 为主。伴随着 EigenLayer 空投的结束,LRT 赛道开始下滑,Pendle 的 TVL、币价以及生态活跃度也都出现了显著下滑。在契合了稳定币的增长趋势后,重新迎来增长,以下是其主要的稳定币生态合作项目:

The landscape of ecosystem, source: Pendle

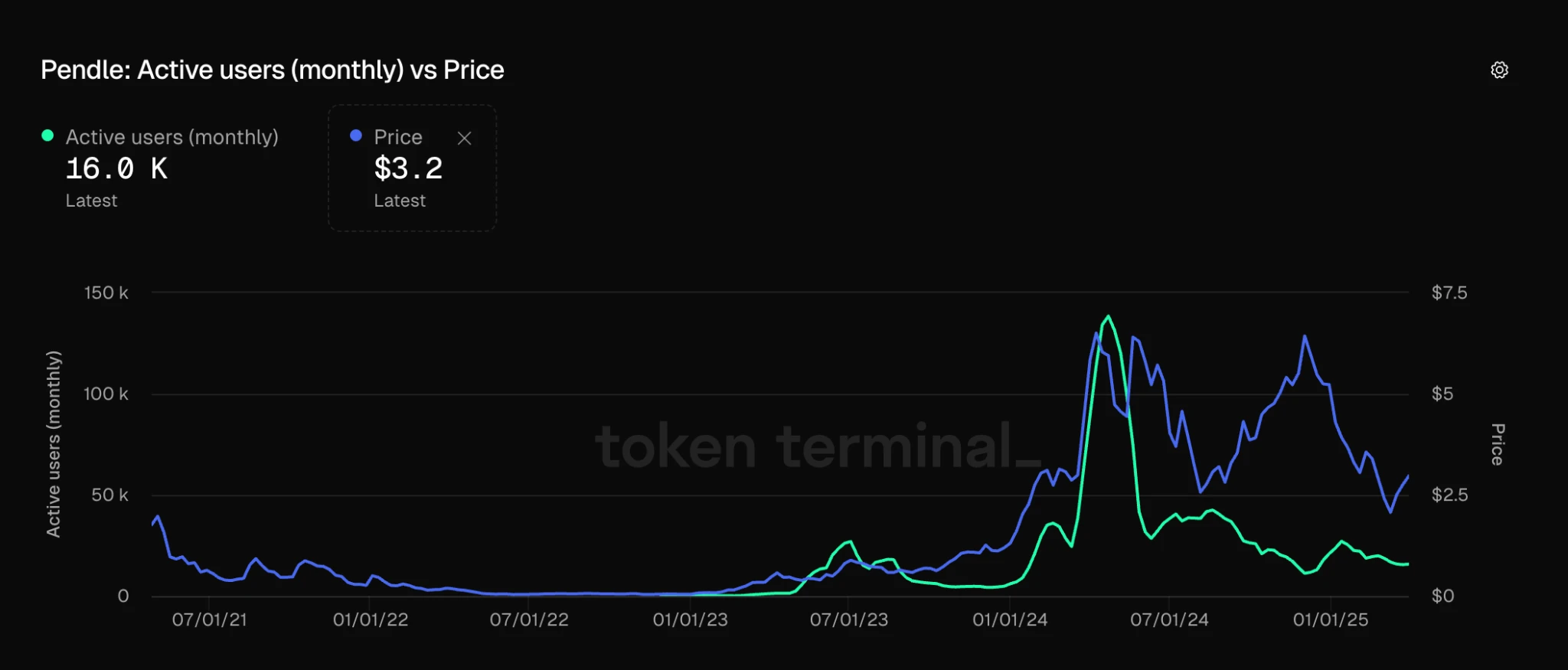

Active Users, source: Tokenterminal

近一个月Pendle的月活跃用户在16K左右,活跃用户呈现下滑的趋势。

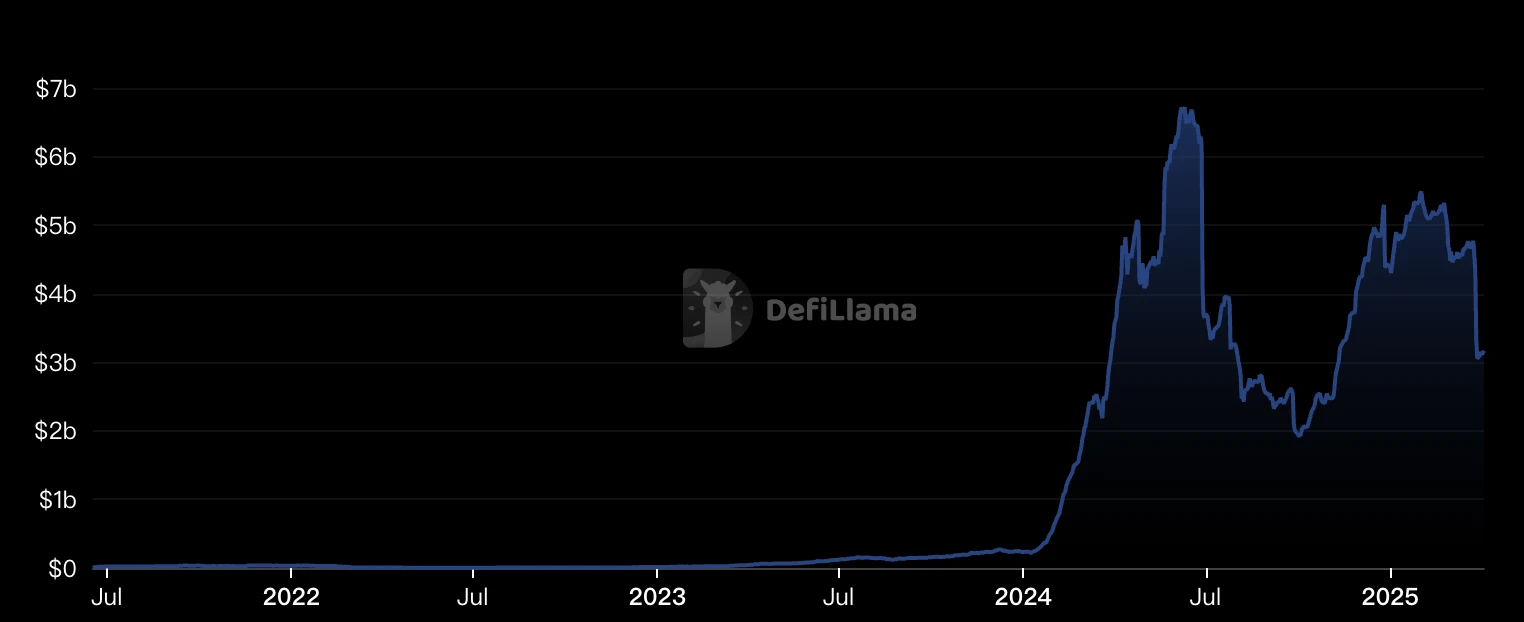

TVL, source: Defillama

DeFi产品在近期均受行情波动影响较大,因此TVL U本位计算下滑严重。从年初的48亿下降到现在的31亿美元,降幅高达35%。

Fees and Revenue, source: Defillama

Pendle的手续费收入在最近两个月均为一百万美元左右。

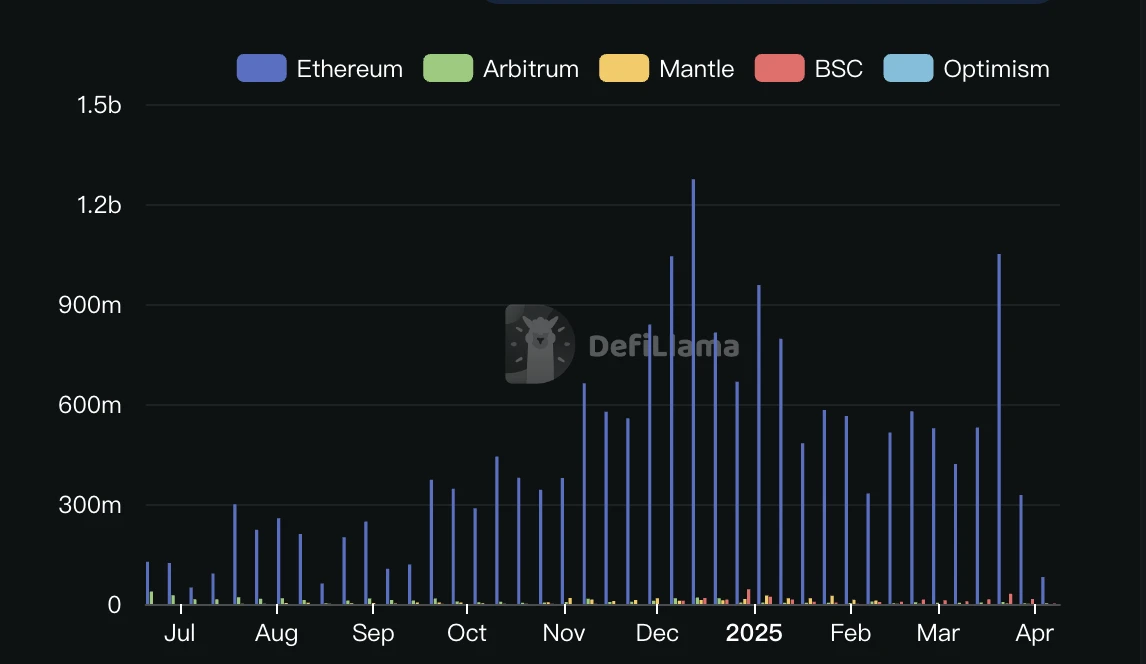

DEX Trading Volume, source: Defillama

DEX交易量大约虽然在3月中旬有所反弹,但整体维持下降的趋势。反映了整体以太坊链上行情的持续萎靡。3月份,Pendle DEX的交易量为27.5亿美元,日均1亿美元,该水平仅和Hyperliquid的日均现货交易量相当,同时期Uniswap的日均交易量为17亿美元。

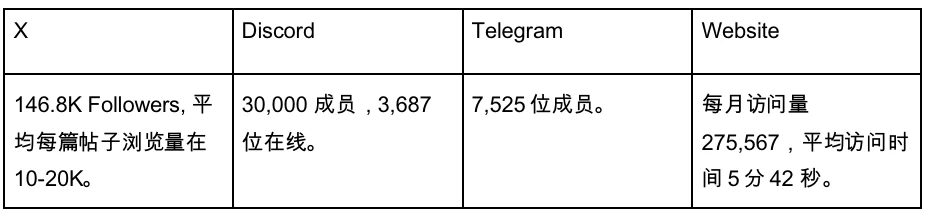

3.2.2 社交媒体

总体来看,Pendle 拥有稳定的社区基础与良好的市场关注度。

3.3 未来

根据 Pendle 团队在 2025 年 2 月 4 日发布的文章《Pendle 2025: Zenith》,Pendle 在 2025 年的主要计划包括以下三个方面:

Pendle V2 改进:计划通过以下方式提升协议性能和用户体验:

●开放性增强:在用户界面上提供功能,允许用户自行创建收益市场,从而实现社区驱动的增长。

●动态费用调整:实施动态费用再平衡机制,确保流动性提供者、用户和协议之间的利益平衡。

vePENDLE 改进:扩展 vePENDLE 的功能,允许所有用户参与投票,并优化 vePENDLE 持有者的协议收益。

建立 Citadels(堡垒):旨在扩展 Pendle 的影响力,具体措施包括:

●支持非 EVM 生态系统的 PT:将固定收益产品扩展到 Solana、TON 等非 EVM 链,吸引新的用户群体。

●面向传统金融的 PT:开发合规产品,为机构投资者提供加密固定收益产品的访问渠道。

●面向伊斯兰基金的 PT:创建符合伊斯兰教法的金融产品,进入伊斯兰金融市场。

推出 Boros:这是一个新的平台,旨在支持任何类型的收益交易,初期重点关注加密市场中的资金费率(funding rates)。

4. 经济模型

4.1 初始代币分配

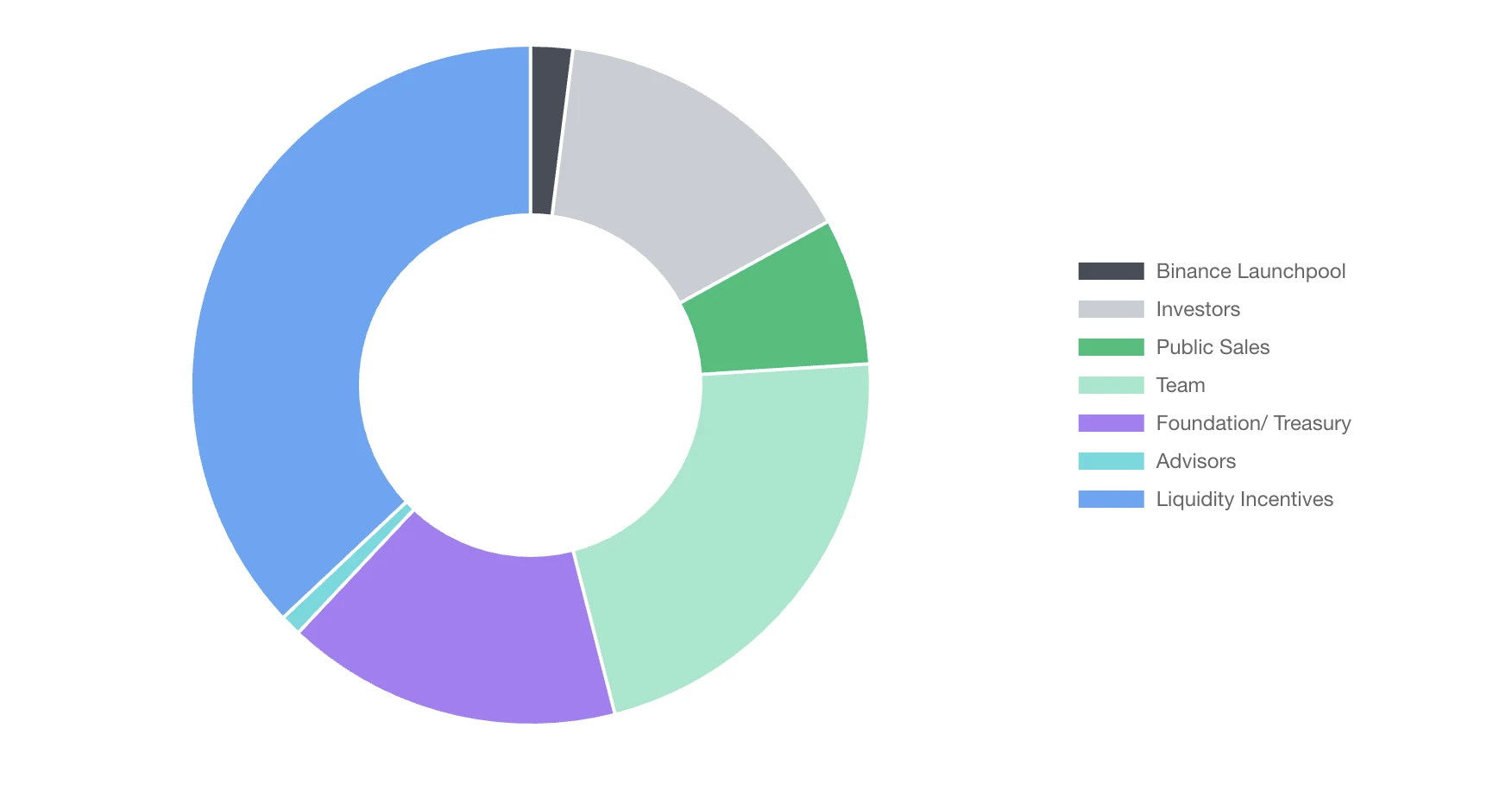

Token Distribution, source: Binance

该图源于2023年7月Binance Launchpad的代币分布,流动性激励占据37%,由团队分发;基金会以及财库占据16%,团队占据22%,投资人15%,公募7%,Binance Launchpad 2%。截止2024年9月,所有投资人以及团队的代币均完全归属。

4.3 代币用途

Pendle代币可以转换为vPendle,享受:

1.投票决定将 $PENDLE 激励措施引入哪些资金池,投票权和Pendle质押量和质押时间相关。

2.如果参与了该pool的投票,获得该Pool swap fee的80%手续费收入。

3.从YT产生的收益收取3%,给到所有vPendle持有者。

从 YT 收取的利息3%和到期的 PT 奖励构成了 vePENDLE基本 APY,再加上积极的投票,构建了总奖励。

总的来说,在代币赋能方面,Pendle协议的所有功能基本上都于vPendle相关。

4.2 持币地址分析

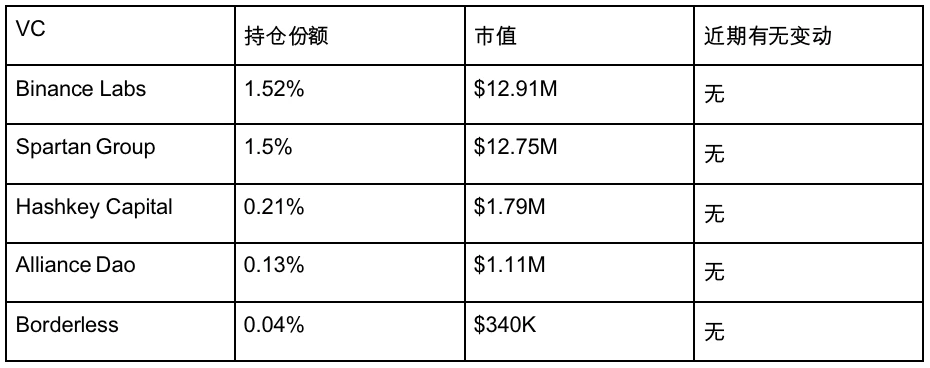

链上Pendle持仓情况,source:Nansen

根据链上可查数据,Pendle的主要持仓VC如下所示:

主要交易所的持仓如下:

Binance 沉淀了大量的 Pendle 代币,包括 Binance Labs 在内,共计占据总供应量的 14%。但由于目前总供应量中仅有 50% 处于流通状态,这部分持仓实际上占据了市场流通筹码的 24%,具备显著影响市场价格的能力。

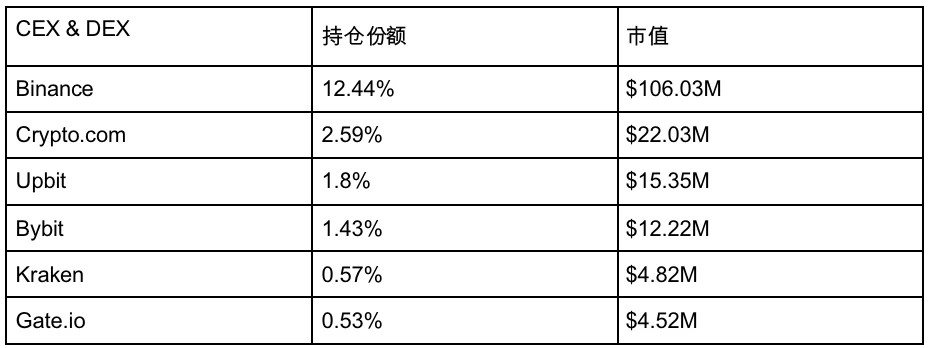

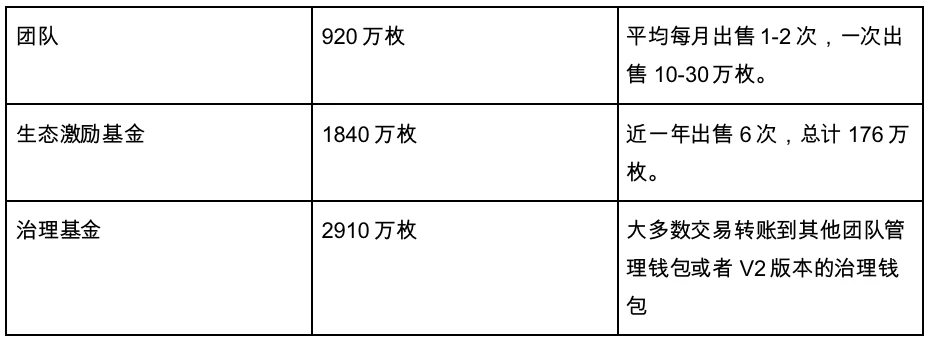

目前团队(非 Foundation & Treasury)仍持有 920 万枚代币,价值约为 2,760 万美元。这部分被团队归类为非流通代币,但实际上已完全解锁。团队出售代币的频率不高,平均每月出售 1–2 次,每次出售 10–30 万枚,按当前价格约为 30–90 万美元。

生态系统激励基金在过去一年中共出售了 6 次,累计出售 336 万枚代币,并接收了 160 万枚代币。

总体来说,无论是团队还是生态激励基金的代币额度维持在较高水平,代币售出较为克制,可持续性强。

4.4 代币市值 & 流通

以下是我们重新测算的代币分布情况:

基本数据是对的上的。值得注意的是,Pendle 团队在官方文档中明确指出,团队预留、生态激励与治理基金部分虽已全部解锁,但并未计入流通筹码。

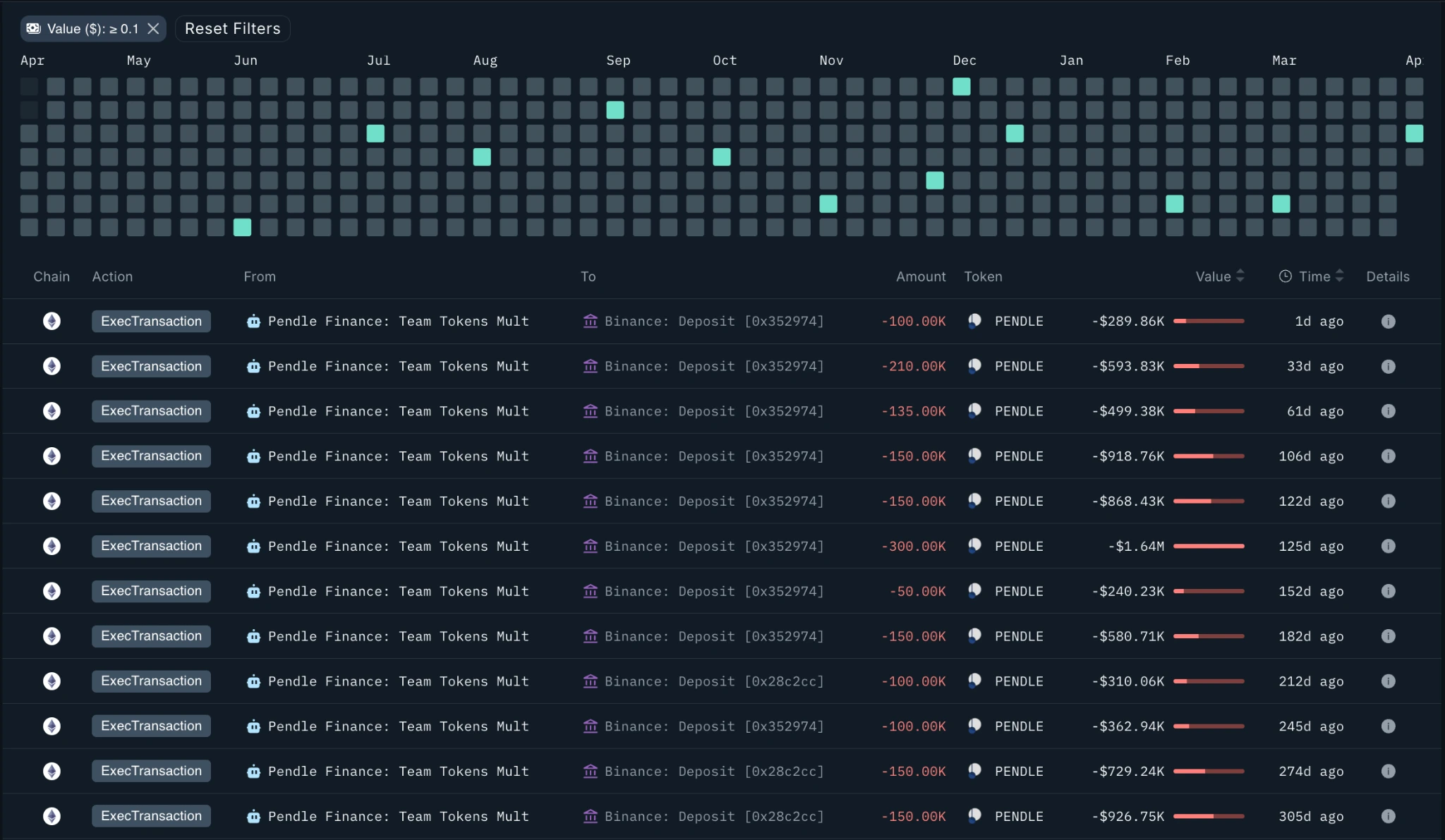

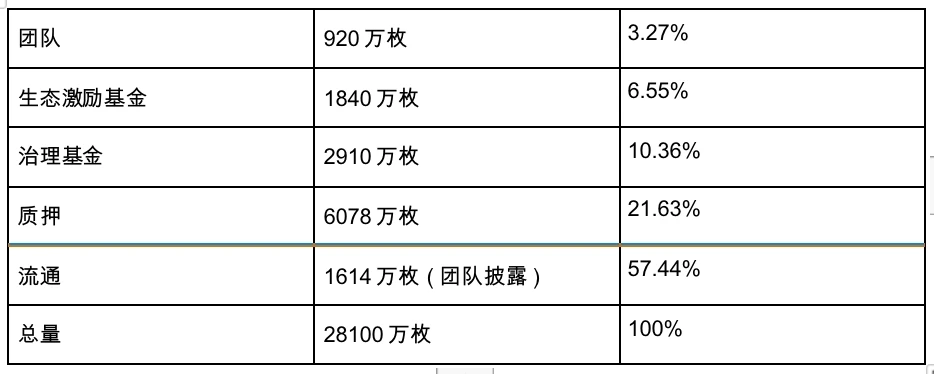

Token Inflation, source: Pendle

截至 2024 年 9 月,每周排放量为 216,076,每周减少 1.1%,直到 2026 年 4 月。届时,Pendle的通胀模型将转为每年 2% 的最终通胀率以提供生态激励。通过计算,2025年总共将排放7,119,017 枚 PENDLE,大约平均年化通胀率为2.2%。2026年将无限接近于2%。通胀率较为健康。

5. 市场潜力

5.1 可获取市场

Pendle 具备一眼看上去十分亮眼的数据,但我们在深入调研后发现,和其他分红型产品类似,Pendle 的分红能力并不足以支撑其高达 9 亿美元的 FDV(Fully Diluted Valuation,全稀释估值)。我们认为,Pendle 当前出现的估值溢价,主要来源于其巨大的市场潜力,以及其作为链上利率市场开拓者的独特地位。

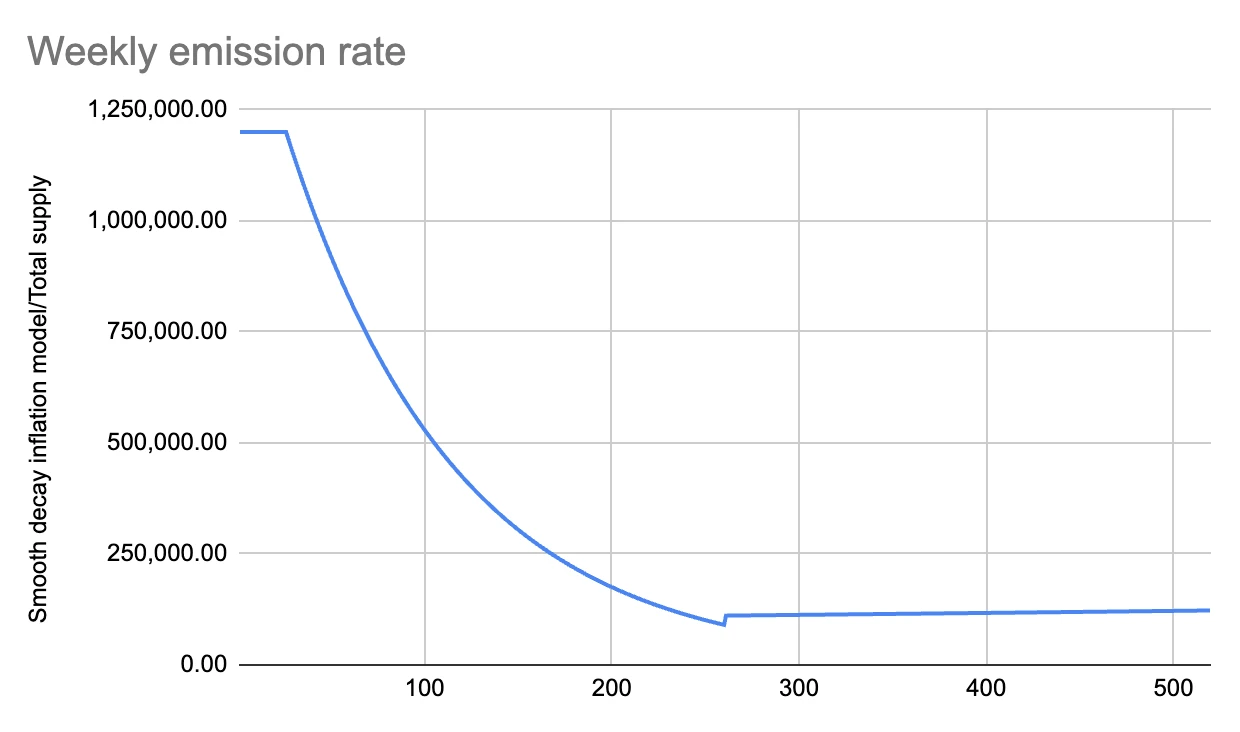

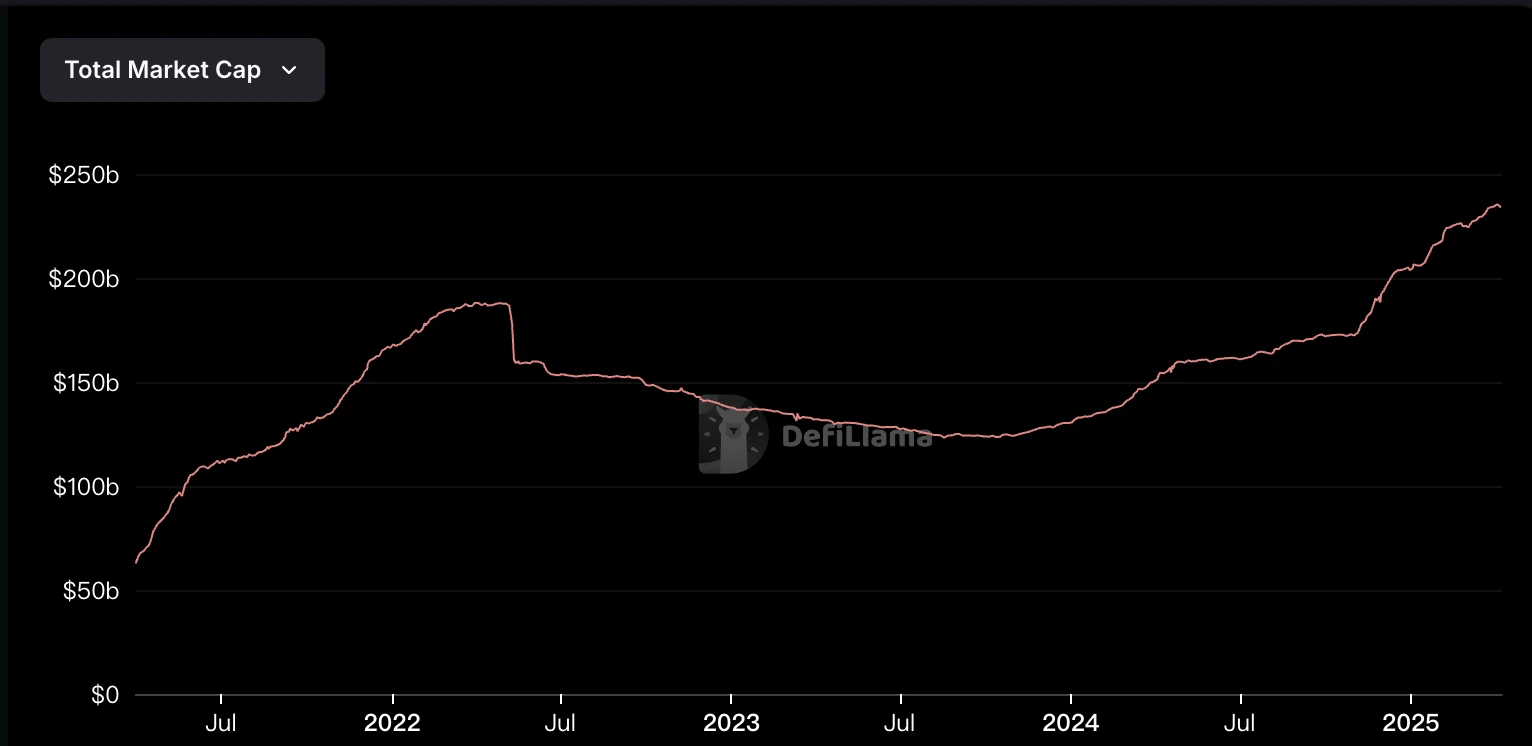

The market cap of Stablecoins, source: RWA.xyz

稳定币行情的到来,与加密货币市场本身的价格表现也有密切关联。在 BTC 上一轮进入熊市的阶段,大约是 2022 年 1 月至 2023 年 1 月,这一时期也是稳定币赛道表现活跃的阶段,散户更倾向于追求稳定币的利率回报。从经验来看,稳定币行情通常会持续一年左右。再结合一级市场的融资情况来看,MegaEth 上的 CAP 项目,以及以太坊主网的 M^0 项目刚刚完成融资,这些项目大多会优先选择与 Pendle 合作。

目前,Pendle 约 80% 的业务仍集中在 Ethereum 主网上。根据其 2025 年的路线图,团队已明确计划向多链拓展,包括 Solana、Hyperliquid 和 Ton。我们认为,鉴于 Pendle 在链上利率市场中独树一帜的品牌影响力,其大概率将主导这三条链在利率赛道上的市场份额。

与此同时,未来所有分红型玩法 / 赛道都将对 Pendle 类型的产品产生需求。例如,过去由 LRT 主导 Pendle 的 Swap 手续费收入,如今则被高息稳定币所驱动。这表明其商业模式并不依赖于单一客户群体,而是具有较高的弹性与长期运营的潜力。

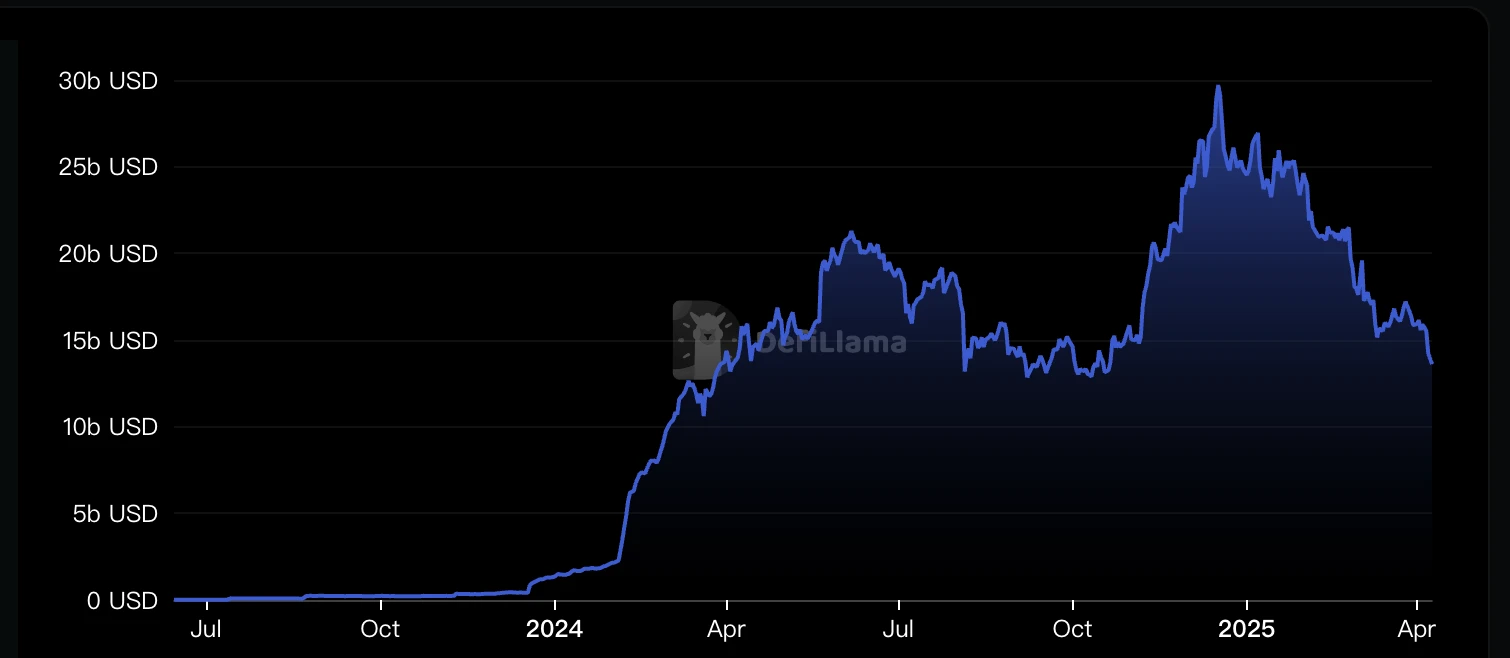

Liquid Staking Market, source: Defillama

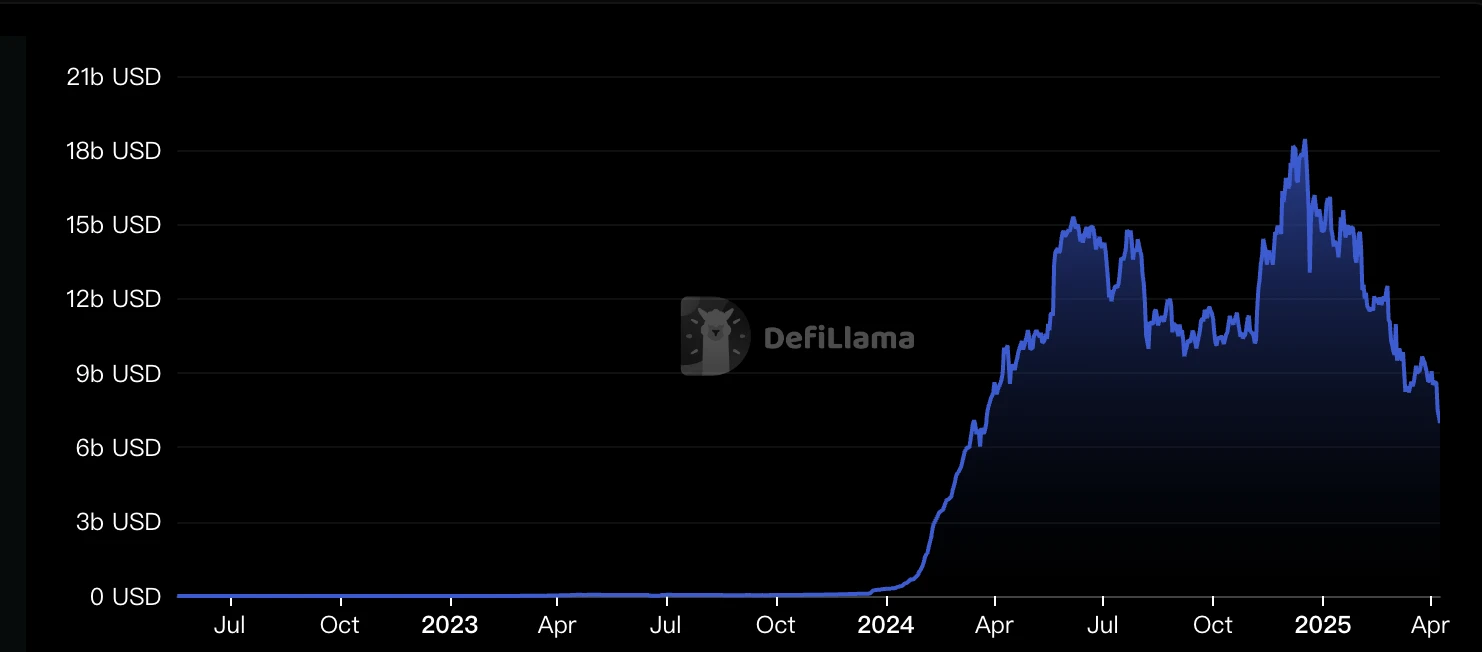

Liquid Restaking Market, source: Defillama

Stablecoins Market, source: Defillama

Liquid Staking($150 亿)+ Liquid Restaking($70 亿)+ 稳定币($2,335 亿)市场,目前总计约为 $2,550 亿的可获取市场份额。而 Solana、Hyperliquid 以及 Ton 链仍处于开发阶段,稳定币的利率互换需求也刚刚起步。

与此同时,Pendle 后续还计划开发与传统金融兼容的利率产品,并将在 2025 年推出针对永续合约资金费率的利率互换工具。值得注意的是,合约市场的交易量通常是现货市场的数十倍,这将进一步扩大其潜在市场。

总而言之,Pendle 所切入的利率互换赛道不仅具有巨大的应用前景和真实的市场需求,同时,随着传统金融与 DeFi 的日益融合,Pendle 将凭借其先发优势,有望长期占据该赛道的主导地位。

5.2 商业模式和营收

手续费的增长分为swap fee和YT,绝大部分来自于swap fee。值得注意的是,与我们熟悉的 Uniswap 等按交易量收取固定比例手续费(如 0.3%)的模式不同,Pendle采取的不是按照交易量收取手续费,而是按PT所代表的未来收益比例来收。这意味着:即使一笔交易的交易量很高,但如果所交易的 PT 临近到期、对应的剩余收益已经很低(此时 YT 价值接近归零),那么实际产生的 Swap Fee 也会非常有限。

6. 投资

6.1 盈利能力和估值

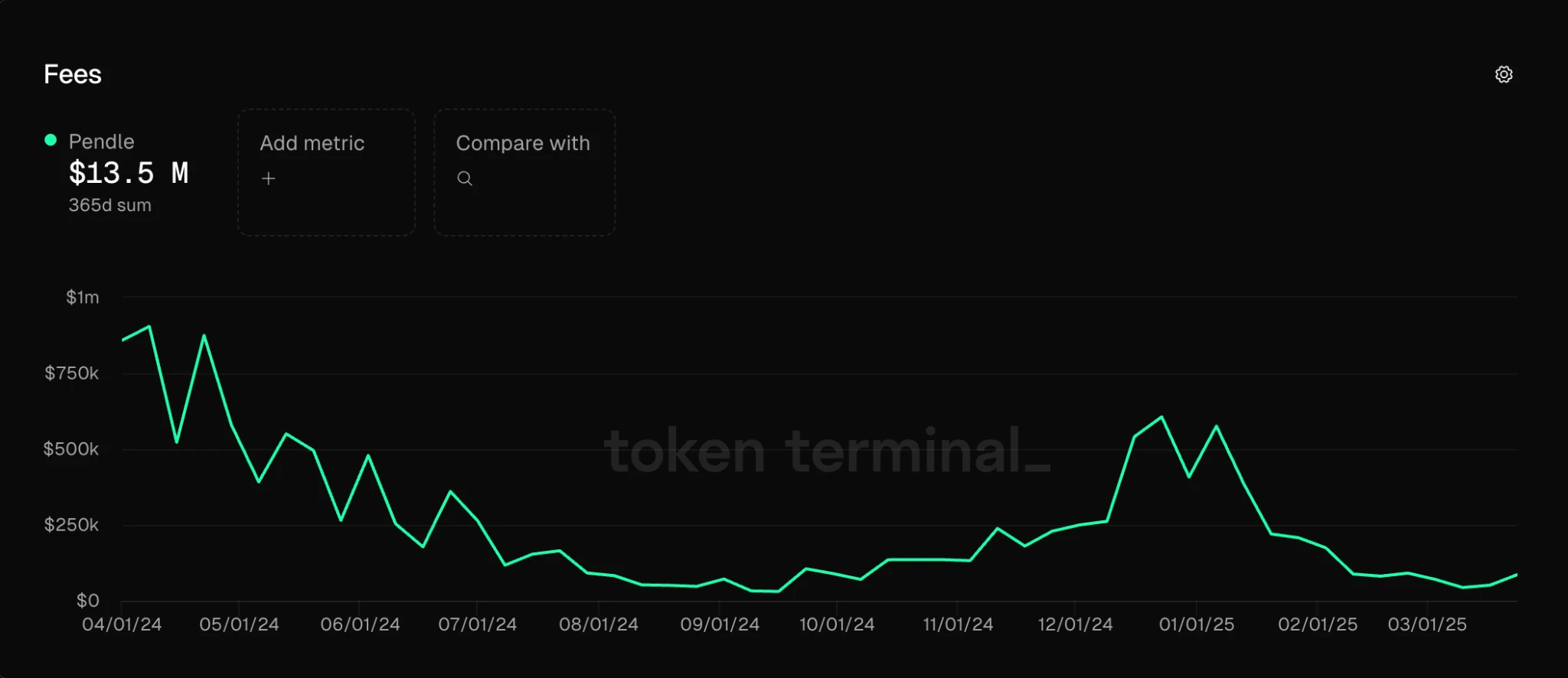

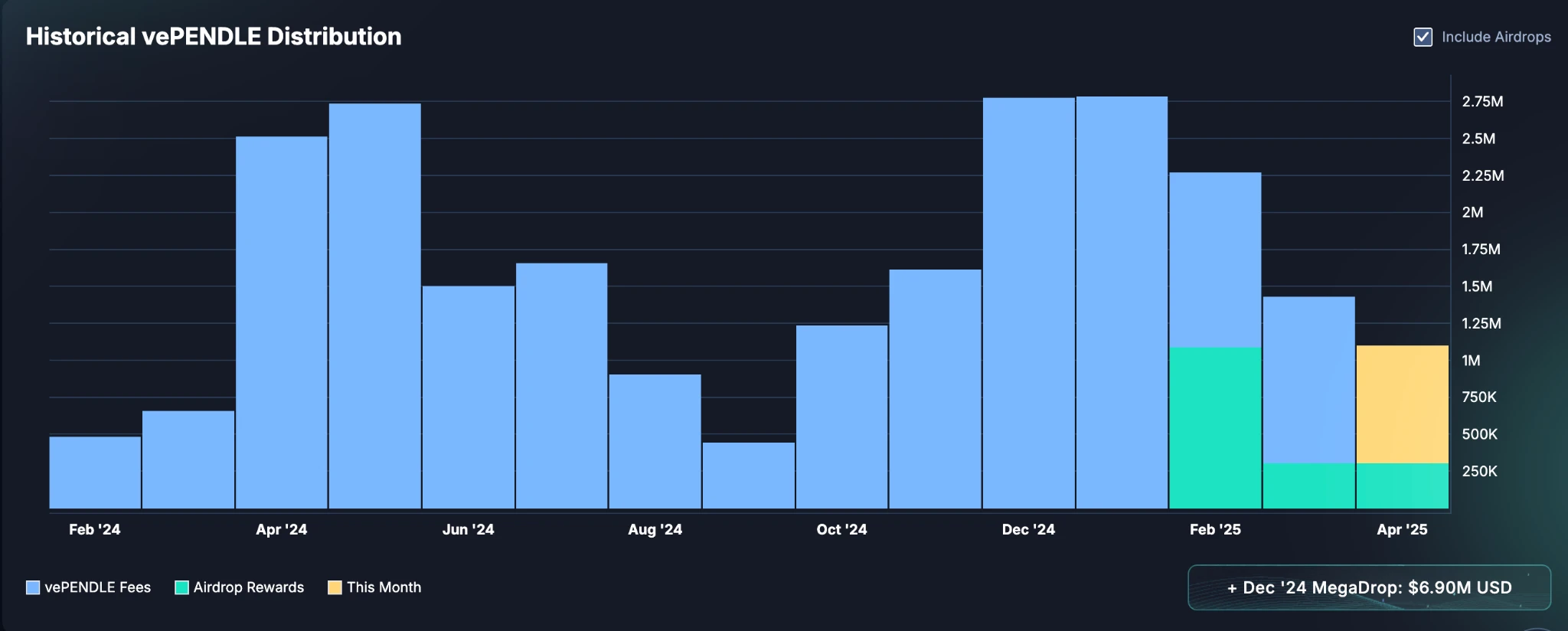

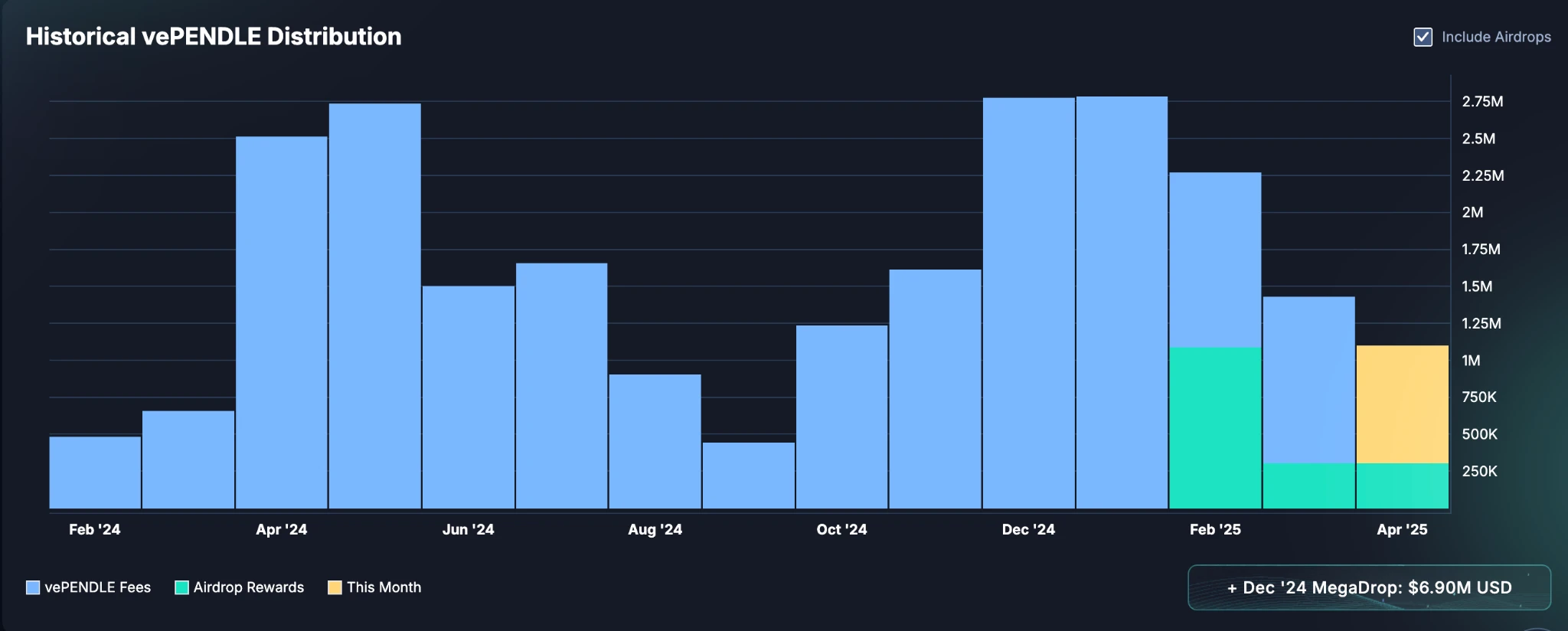

Pendle Fees, source: Pendle

近一年Pendle的swap fees手续费收入在$13.5m,这一部分是全部给到vPendle持有者。但是由于协议本身不收取费用,同时vPendle还有其他的费用,大约为$24m,我们将以vPendle的最终现金收入来对Pendle代币进行估值。

vPendle Holder Dividend, source: Pendle

上图中,蓝色部分为vePendle拿到的总费用,绿色加入了空投奖励,黄色代表了该月实时的分润。目前锁仓的 PENDLE 数量是 60.78M枚,大约占据总Pendle数量的21% ,平均锁仓期是 388 天。

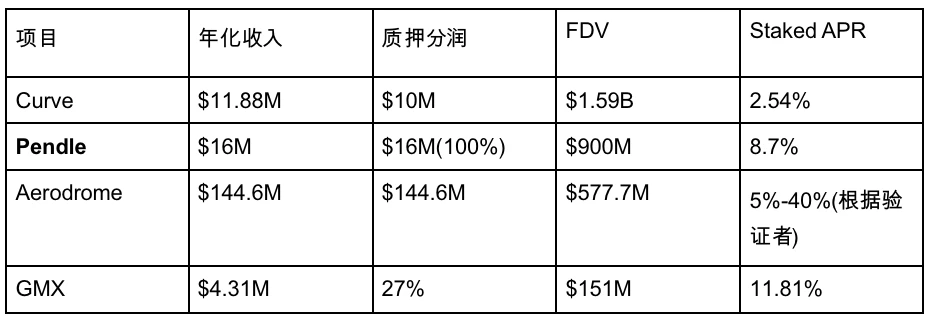

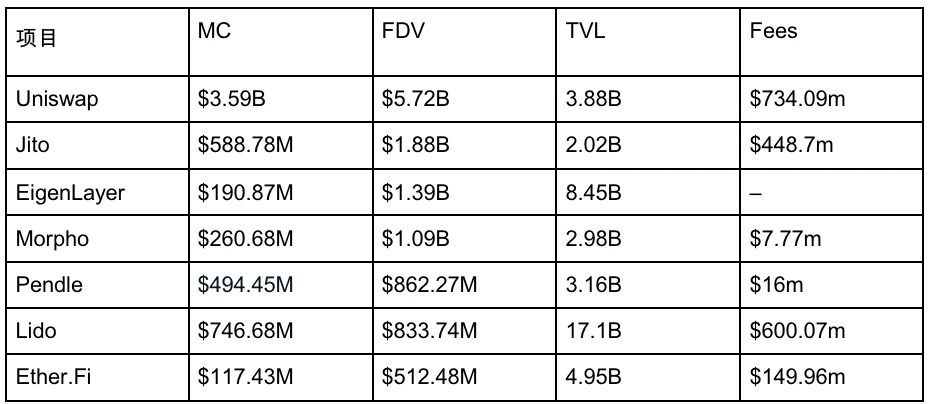

对于项目估值的选择上,由于vPENDLE是完全分红类型的,所以我们主要是和提供代币Incentives的项目相比,比如Unsiwap和Lido都未开通费用转换功能,所以不纳入比较范围。

相比较之下,Pendle的Staked APR不算特别出色。如果从这一点来看,市场对于Pendle存在一定溢价。接下来主要是横向比较一些典型项目的TVL和市值之比。

典型项目数据比较

如上图所示,我们发现,项目的FDV/MC和TVL不成正比。主要原因是,FDV仅仅代表项目托管的资产,并不能转化为实际未来收益,因此TVL估值实际上已经并不奏效,市场对项目定价更加理智和精细。

总的来说,从手续费收入来看,Pendle存在一定的溢价。从TVL来看,市场已经从TVL估值转向,悄然的从过去唯TVL论转而更加理智和精细化。TVL和FDV之间方差较大,已经不适合用于估值。

6.2 窗口期

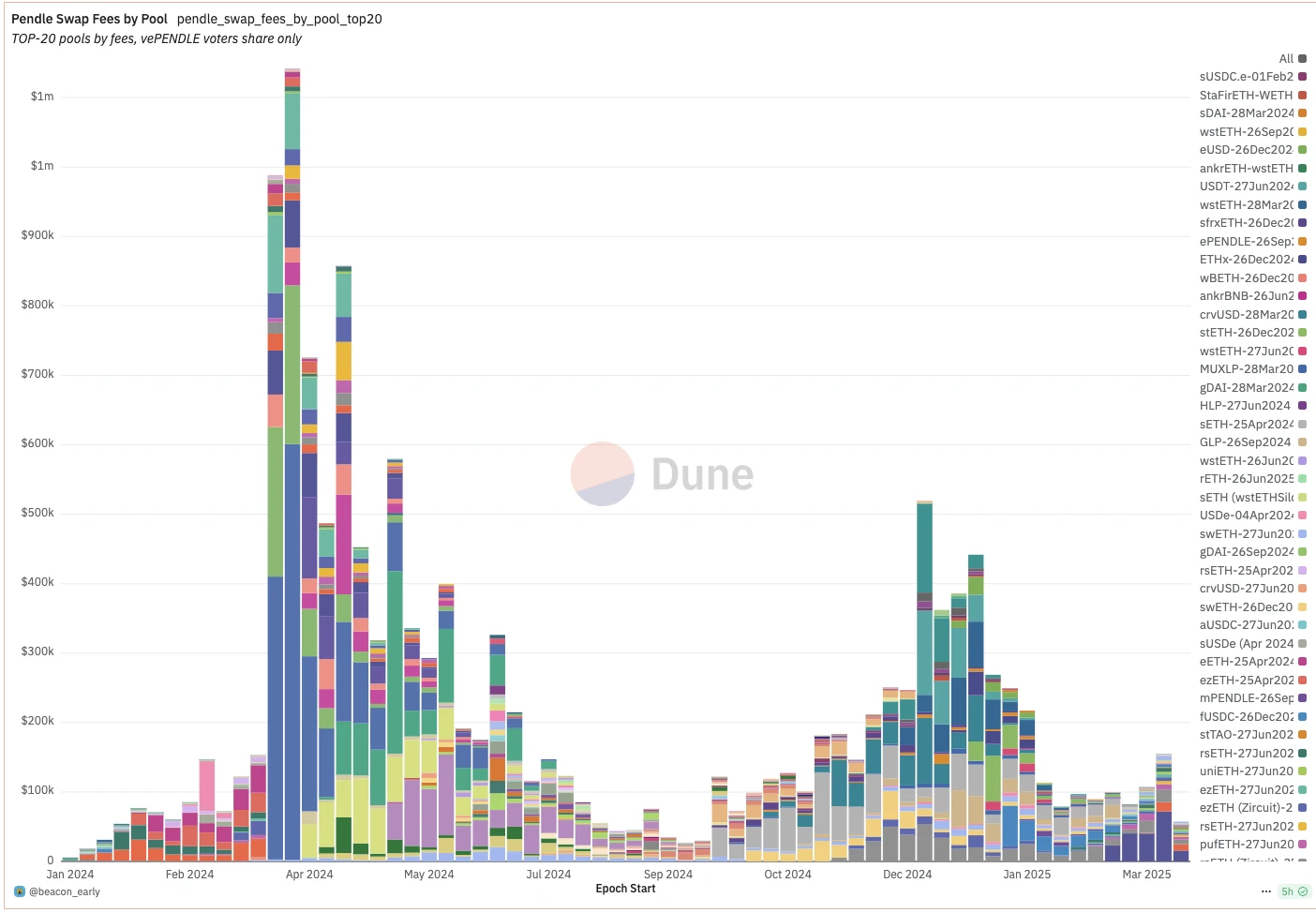

上图是按照月份计算,所以会把顶峰忽略,并且其中还包含了非手续费收入,主要是空投收入。如果我们只看手续费,同时按照周来计算,如下图所示:

Pendle swap fees, source: Dune

我们观察到,Pendle 的 Swap Fees 与币价走势高度相关,两者之间存在显著的联动性:手续费的顶部往往是两次币价的顶部。手续费的顶部也是币价的顶部。

Pendle swap fees过去高度和LRT Token相关,主要是当时以EigenLayer为首的LRT赛道的火热,大众对积分市场和YT交易需求旺盛相关。在2024年6月到10月,Pendle生态随着LRT赛道的降温而逐步降温。但是到2024年12月之后,随着市场逐步步入熊市,散户对于生息稳定币的需求开始增加,Pendle Swap市场也反映出由稳定币主导。

Pendle Price, source: CMC

LRT生态结束,也是币价的底部,手续费的底部。转机是找到了生息稳定币的新赛道,随着生息稳定币生态在2024年9月来到高潮,币价也随之来到高潮。我们认为,稳定币行情仍具延续性。特别是在 PayFi 叙事升温、Altcoins 整体收益率下行、外部风险上升等因素影响下,散户对链上稳健收益的需求将持续增长,进一步驱动生息稳定币的市场热度。

总体来看,稳定币行情有望延续至 2025 年全年,这是过往周期中常见的特征。从基本面来看,目前面临着数据上手续费的下滑,同时从手续费估值方式来看,也本身存在溢价,这是一个代币价格短期下滑的主要风险点。

6.3 交易策略

长期投资者:对于这种短期可能存在部分溢价,但是长期无论是品牌、客户群体的多样性和抗风险的弹性、市场份额潜在增长都非常不错的项目,我们建议即刻以定投的方式参与。通过定投来平衡FOMO和短期业务下滑的风险。

短中期参与者:由于短期内市场动荡,以及Pnedle的swap Fees与币价呈现相当关联性,同时Swap fees目前正在经历周级别的缓慢下降,我们建议紧密观察:

1.稳定币市场是否出现第二波行情,就目前的稳定币项目又出现了多个融资,很有短期可能会出现稳定币的第二波行情。

2.是否会出现新的客户群体,过去是LRT,现在是稳定币,都与利率相关。这个属于中期的转折点,也意味着一个赛道的火热,观察这个比较明显。

6.4 风险提示

1.智能合约风险:尽管 Pendle 已运行三年无重大安全事故,并通过多次审计(如 Spearbit 和 ChainSecurity),但作为一个高度复杂的 DeFi 协议,仍然存在潜在的合约漏洞风险。部分合约具有暂停功能(如 SY 合约),可在紧急情况下暂停操作以保护用户资产。

2.底层资产风险:PT 的价值来源于其底层资产的稳定性。例如,如果某个资产如 stETH 或 sUSDe 出现价格脱锚,将会影响 PT 的最终价值。对应资产的流动性不足、中心化风险或治理失败也会传导至 Pendle 协议。

3.AMM范围之外的价格风险:Pendle 的 AMM 是针对 PT/SY 构建的,具有固定的最大支持收益率范围。当实际收益率超过这个范围时,PT 的交易价格可能会“移出范围”,导致 AMM 无法提供有效报价,只能依赖挂单簿(Order Book),流动性因此大幅下降。若 PT 被用于抵押借贷,可能导致估值过高、套利机会、或清算失败等问题。

7. 参考资料

1.《Pendle PT Risk Framework》,chaos labs

2.《Pendle v2 Mechanism Risk Assessment》,chaos labs

3.《Pendle 2025: Zenith》,pendle

4.《Pendle Me Softly: Unraveling the Complexities of Yield Tokenization》,Alexander Abramovich

免责声明:

本内容不构成任何要约、招揽、或建议。您在做出任何投资决定之前应始终寻求独立的专业建议。请注意,Gate.io及/或 Gate Ventures可能会限制或禁止来自受限制地区的所有或部分服务。请阅读其适用的用户协议了解更多信息。

关于 Gate Ventures

Gate Ventures 是 Gate.io 旗下的风险投资部门,专注于对去中心化基础设施、生态系统和应用程序的投资,这些技术将在 Web 3.0 时代重塑世界。Gate Ventures 与全球行业领袖合作,赋能那些拥有创新思维和能力的团队和初创公司,重新定义社会和金融的交互模式。

官网:https://ventures.gate.io/

Twitter:https://x.com/gate_ventures

Medium:https://medium.com/gate_ventures

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。