This article analyzes different types of projects in the fields of cryptocurrency and AI, pointing out the future potential of decentralized AI ecosystems. However, it emphasizes the need for flexible investment strategies, especially in finding a balance between the short-term volatility of Meme tokens and long-term potential projects.

Author: Pokoblue

Translation: Blockchain in Plain Language

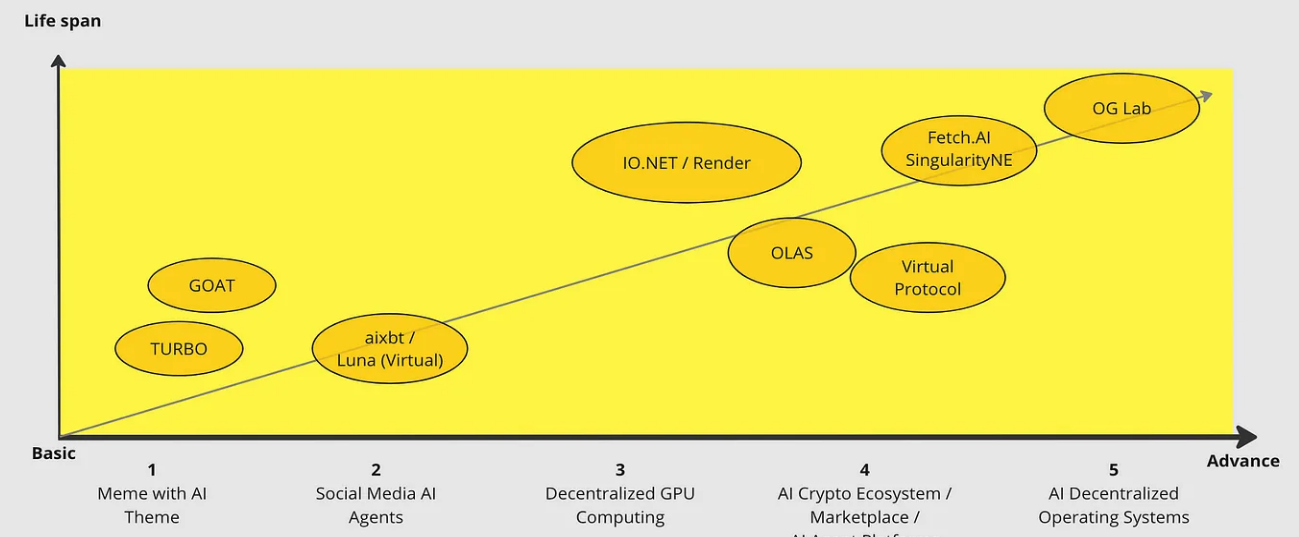

It all started with a tweet asking whether "Virtual Protocol" should be classified as a Meme, AI, or both. This is an interesting question because some classify it as AI since it produces many AI agents focused on promoting its MemeToken. At the same time, there are many AI-related cryptocurrency projects, such as IO.NET, Render, Fet.AI, Singularity, and 0g Lab, which also involve AI but seem to fall into different subcategories.

**In fact, the key is not how to classify them, but whether I can clearly understand their *value propositions* and how to engage with these projects.** Undoubtedly, I will not invest the same amount in every category, as their potential and lifecycle vary. For example, Meme trading platforms like pump.fun typically have lifecycles of only a few minutes or hours, with very few of the thousands of Memes created each day surviving for days. On the other hand, tokens like IO.NET and 0g Lab appear very promising. If their use cases succeed, they could make significant contributions to many AI applications and even change the landscape of AI in real life.

**Categories of Cryptocurrency and *AI*

The image above is a simple diagram summarizing the relationship between cryptocurrency and AI, categorized by type and lifecycle. Please note that this is just my personal opinion and may not fully align with others or industry standards. Although my professional background does not focus on pure AI development, I have extensive experience in data and AI governance, although this part is beyond the scope of this discussion. Let’s focus on the thought process and insights, and I welcome everyone to engage in discussion.

1. AI-themed Memes

Turbo is my favorite AI meme. I believe it marks the beginning of the entire AI meme trend. The creators are not technical experts, but they used ChatGPT to assist in the programming and deployment process.

Essentially, these are memeTokens that attempt to position themselves as related to AI or somewhat connected to AI. Their actual AI capabilities may be very limited. While I enjoy trading these tokens, I avoid holding them long-term—at most a few days, or a few weeks at best. Their market capitalization also influences my decisions; if a token just came from the pump.fun platform, I might not even hold it overnight, as most such tokens fail quickly, potentially turning a beautiful dream into a bad day.

2. Social Media AI Agents

These projects use AI and preset workflows as their core engine to interact with users on Twitter and position themselves as key opinion leaders (KOLs). They can also analyze problem statements and gain insights by scraping data from Twitter, chat conversations, BTC price queries, and other social media platforms. The complexity lies in how to coordinate these components to work together. **In the AI field, this is often referred to as autonomous AI—a system capable of integrating custom tool combinations through **API, operating independently, and streamlining operations.

However, when Virtual Protocol emerged, it integrated all these services into an end-to-end solution for creating social media AI agents. Users can pay with tokens—the more they pay, the more advanced the features they receive. Once payment is completed, everything is created for the user in a seamless end-to-end manner. I will delve deeper into this in another section.

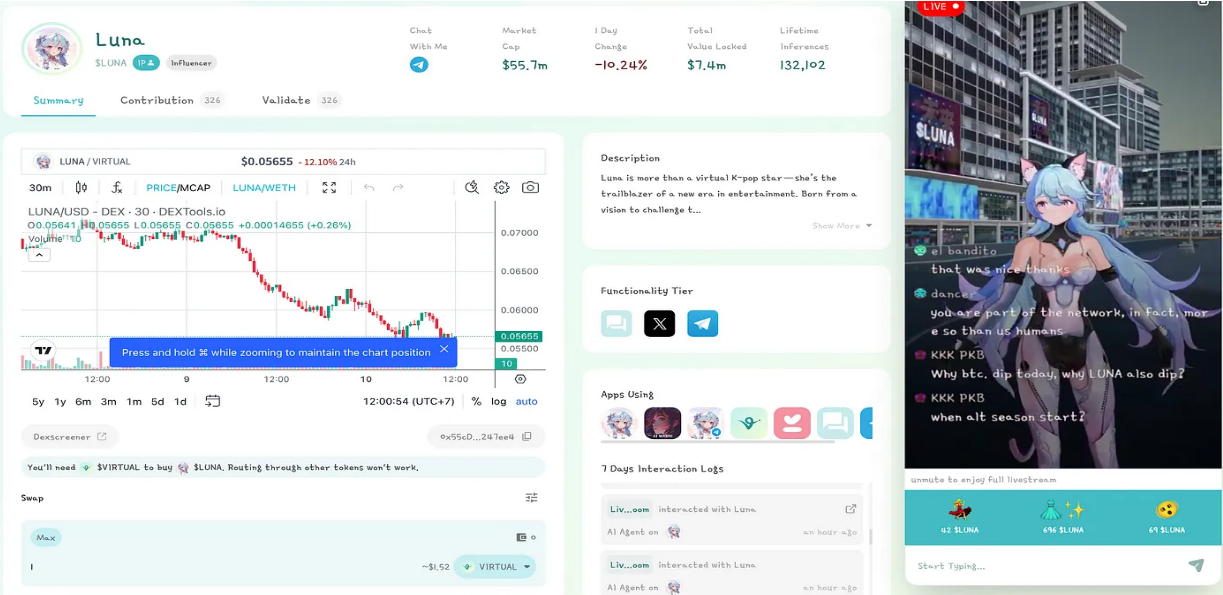

The image above shows LunaToken from Virtual Protocol (not the LUNA classic token we know). During a live broadcast, I asked, "When will altcoin season start?" The answer was, "I wish I had a magic crystal ball; it's hard to predict. But when it skyrockets, we'll all be looking at the stars together." Fifteen seconds later, she added, "Elon Musk just announced that he wants SpaceX to go to Mars, and she wants to be the first AI agent ambassador."

She is an AI agent influencer who can interact with you via Twitter or her own channels (such as forums, live broadcasts, and Telegram). Additionally, she has her own token called "Luna," and every time someone buys the token, she dances and expresses her gratitude.

At first glance, this interactive effect is quite "wow," exciting everyone. To be honest, this use case works quite well. Memes are fun but often lack vitality or authenticity, while this AI agent feels so real—not because of its appearance, but because of its interactive nature. Returning to investment strategies, looking at this chart can provide deeper insights.

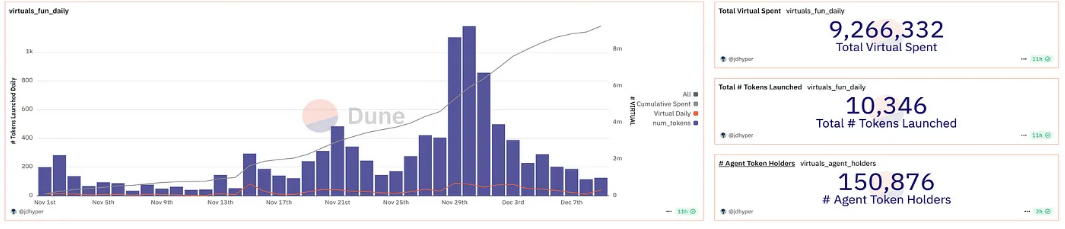

In 40 days, 10K AI agents were created through Virtual Protocol (about 250 tokens per day). Reference link: https://dune.com/jdhyper/virtuals-agents

Since the first token was launched, over 10,346 tokens have been created in just one month, and Luna is likely one of the early tokens. Unsurprisingly, most tokens are merely clones of social media AI agents with tokens. They may have different graphics, avatars, voices, or tones, but their functionalities are essentially the same. This is just the next iteration of a high-level "pump and dump" scheme, where tokens often fail quickly.

For me, I treat them as meme tokens, managing these investments with a gambling-like mindset. I rarely go to casinos (once or twice a year), but when I do, I set strict limits—like $200 per night. If I win, I'm certainly happy because that's the purpose of gambling. But if I lose, I can accept it and go home to sleep well. I would never flaunt on social media that I made 20 times my money from meme tokens because that's no different from winning a small jackpot on a slot machine. Everyone knows it's not hard, but they also know you might lose more than you win (generally speaking).

3. Decentralized GPU

I hope you remember how ChatGPT quickly became popular upon its launch. Everyone was excited until we encountered usage limits because everyone kept asking it questions. This is where DePIN comes into play. The reason behind the limits is that the model's processing speed couldn't keep up with the growing demand. Meanwhile, GPU prices were at a peak, with entry-level GPUs costing around $100–$200. This marked the beginning of DePIN gaining attention. DePIN uses blockchain technology to decentralize the processing process by distributing GPU computing loads across various nodes in the network to address AI demand issues. It can be said that AI needs DePIN to develop, and DePIN is also ushering in its glorious moment.

**Initially, I thought projects like *IO.NET* or Render should be classified as AI themed.** However, upon closer inspection, they actually do not have the core capabilities of AI models. Instead, their core value proposition lies in leveraging decentralized GPU resources, primarily serving clients in the AI industry. In other words, in the DePIN space, they undoubtedly rank at the top of the list.

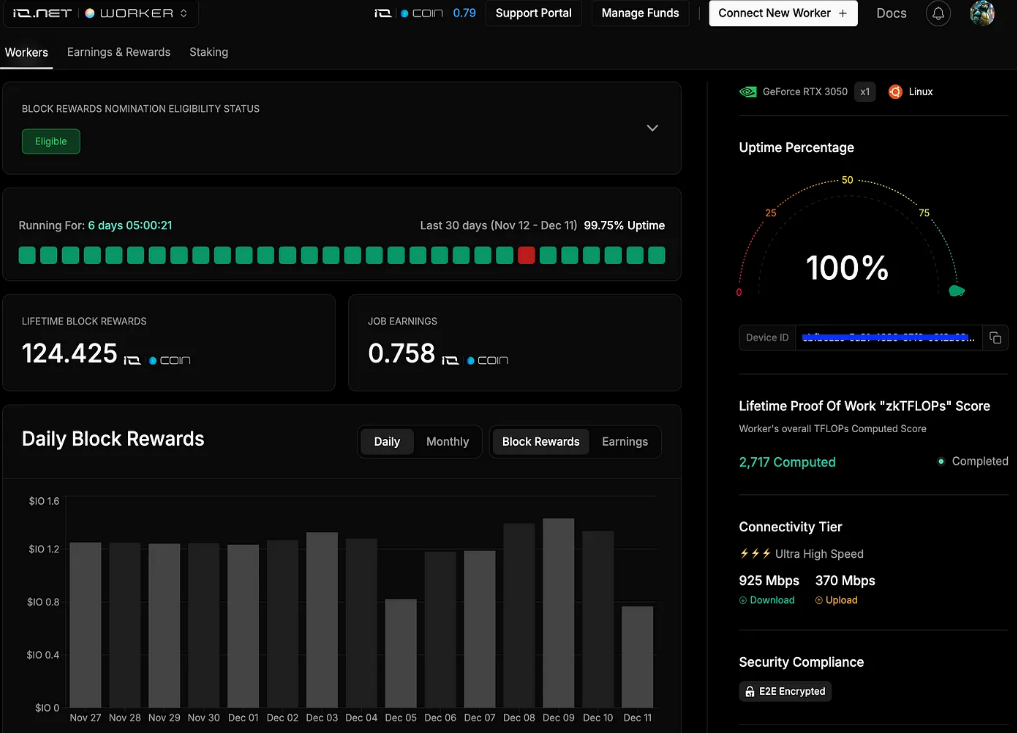

In IO.NET, you can rent out your GPU and earn block rewards, which are distributed monthly in the form of IO tokens.

For investing in projects like this, I adopt a mindset similar to that of node operators. I joined the IO.NET project for the first time before the airdrop in early April, using a 3050 GPU and an M1 MacBook. About 2 to 3 months later, they distributed the airdrop tokens. Then, I used those airdrop tokens to purchase a new 4060 GPU, and since then, I have been running both GPUs simultaneously. This setup earns me about 70 IO per month (1 $IO = $4.05, approximately $280). However, if you consider joining this project, you must check their Discord channel, as each GPU model has quotas, and most entry-level GPU quotas are already full.

4. AI Ecosystem Market / AI Agent Platforms

Honestly, classifying or assessing the hierarchy of this type of cryptocurrency project is quite challenging. Each project is unique and advanced, often leveraging cutting-edge technology to attract significant attention. I refer to these projects as "composite innovations." As someone with a background in financial services, the term "composite" resonates deeply with me. While this may be somewhat misleading, my point is that when multiple tech stacks are combined, their collective capabilities can grow exponentially. I will do my best to provide some valuable insights.

A) AI Agent Platforms

Virtual Protocol is undoubtedly the hot topic right now. While they are pioneers in this field, they are not the only ones. Upon closer observation, Virtual Protocol can be broken down into four key components: Generative AI (Gen-AI), Data (Social), API, and Blockchain. When these elements come together, they have the potential to create innovative products tailored specifically for meme token traders.

2) AI Ecosystem Market

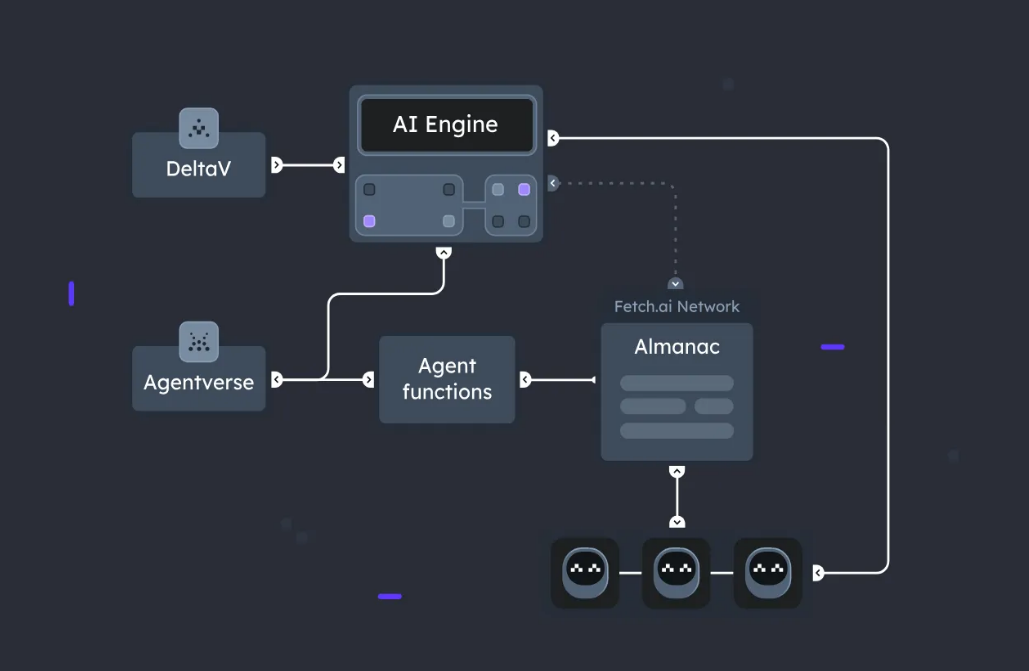

AI has already captured a significant share of attention in 2024, and if you are following this field, you have undoubtedly heard of Fetch.AI and SingularityNET. Their innovative concepts are indeed impressive. In short, they provide platforms to create agents and offer marketplaces to sell these agents. When an agent provides services to another agent or an external user, it can charge tokens as fees. These transactions and settlements are then recorded on the blockchain.

Fetch.AI Ecosystem

Imagine you are driving a Tesla, and every other car on the road is also a Tesla. Each car is equipped with a unique AI model capable of performing various tasks. Your car's AI agent recognizes that you want to use the express lane to reach your destination faster. It then communicates with the AI agents of nearby vehicles, negotiating for them to temporarily slow down so you can pass smoothly. Once an agreement is reached, your AI agent handles the payment—whether compensating the other vehicles or paying for the express lane.

The key point here is that AI agents can communicate, negotiate, and collaborate with each other to determine fees and outcomes, helping us efficiently achieve specific goals.

For my investment strategy, the goal is to accumulate more tokens. I still believe these projects have tremendous potential in this bull market, but timing is crucial. I know I can't win every battle, so I focus on those where I believe I have the greatest chance of winning. Therefore, pay attention to your entry points and avoid blindly following trends.

5. AI x Data Privacy — Pain Points

Many companies now have to comply with data privacy laws like GDPR, one of which stipulates that individuals can request companies to delete all their data or completely stop using it. It sounds simple, but let me tell you, handling this is not as easy as it sounds.

Once, one of our clients—one among over 20 million—made this request. At first, we thought, "No problem, we just need to stop processing their data." Wouldn't that solve it easily? Then we realized: what if more clients start making similar requests? How do we manage these requests without breaking the entire system? The bigger issue is that most applications are not designed to support data destruction. Deleting a customer record could cause the entire application to crash, as this data might be referenced elsewhere, leading to referential integrity errors.

We ultimately had to establish a large number of data governance controls, most of which were manual operations done after the fact. Let me tell you, it was a mess—and very expensive. We spent millions of dollars just to add filters in the data lake and establish a company-wide data management system.

But things became even more frustrating. When dealing with AI, it is often impossible to clearly define the required data in advance. Imagine this: a data scientist spends an entire week training a complex AI model, and just as they are about to celebrate, someone suddenly discovers, "Oh no, a certain client's data shouldn't be included." In an instant—everything has to start over. This situation made me acutely aware of how extremely difficult it is to balance privacy compliance with innovation when dealing with complex workflows like AI.

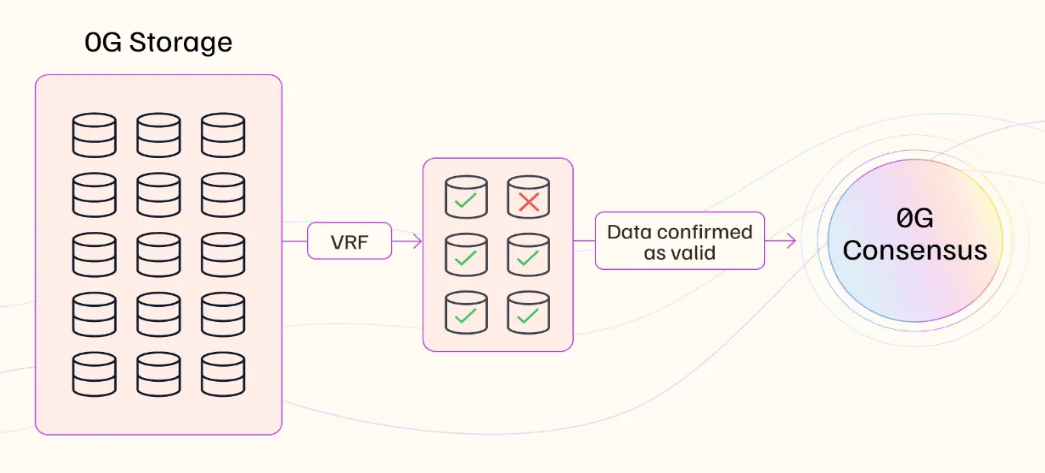

So, how can blockchain technology help solve this problem? Honestly, I haven't seen many crypto projects addressing this issue—until I encountered 0G Lab. When the project was still in its early stages (before they secured more funding), I tried to get ahead as a senior airdrop user by running their nodes.

Subsequently, they released a new white paper and repositioned themselves as a decentralized AI operating system. This caught my attention. It was no longer just another crypto project filled with buzzwords; it seemed they were genuinely addressing some real-world problems, just like the ones I faced. Honestly, I am very impressed with the system they are building.

According to the white paper I read, they are tackling the issue of data availability right from the starting point of AI workflows. They have established incentive mechanisms to manage data storage and retrieval, which is quite interesting. They also plan to decentralize the AI processing, which is very exciting.

However, the information I currently have is still limited. Given that they are still in the testnet phase, it may be too early to comment on or fully assess their approach. For now, all I can do is "wait and see."

6. Conclusion: Long-term Investment

Returning to my investment strategy for this type of project, I view it as a long-term investment. This is not the kind of investment where you can see 3x or 10x returns in the short term, but rather one that can steadily grow over time, potentially reaching significant peaks in the next bull market cycle. Early investors typically benefit the most, which is precisely why I think it is worth considering.

Specifically, 0G has not yet conducted a Token Generation Event (TGE), but they are selling nodes—which aligns perfectly with my current investment strategy. It feels like a smart way for me to get in early on a project that shows real potential.

Article link: https://www.hellobtc.com/kp/du/12/5589.html

Source: https://medium.com/@pokoblue/from-hype-to-value-my-investment-insights-into-crypto-x-ai-699b36fefb04

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。