25 年春,加密市场寒意正浓,比特币价格从年初的 10.9 万美元一路下跌,最低触及 7.5 万美元。

交易量萎靡与市场震荡相伴而来,各类赛道相继熄火,板块效应销声匿迹,只有零星的币种异动抢占市场短期注意力。

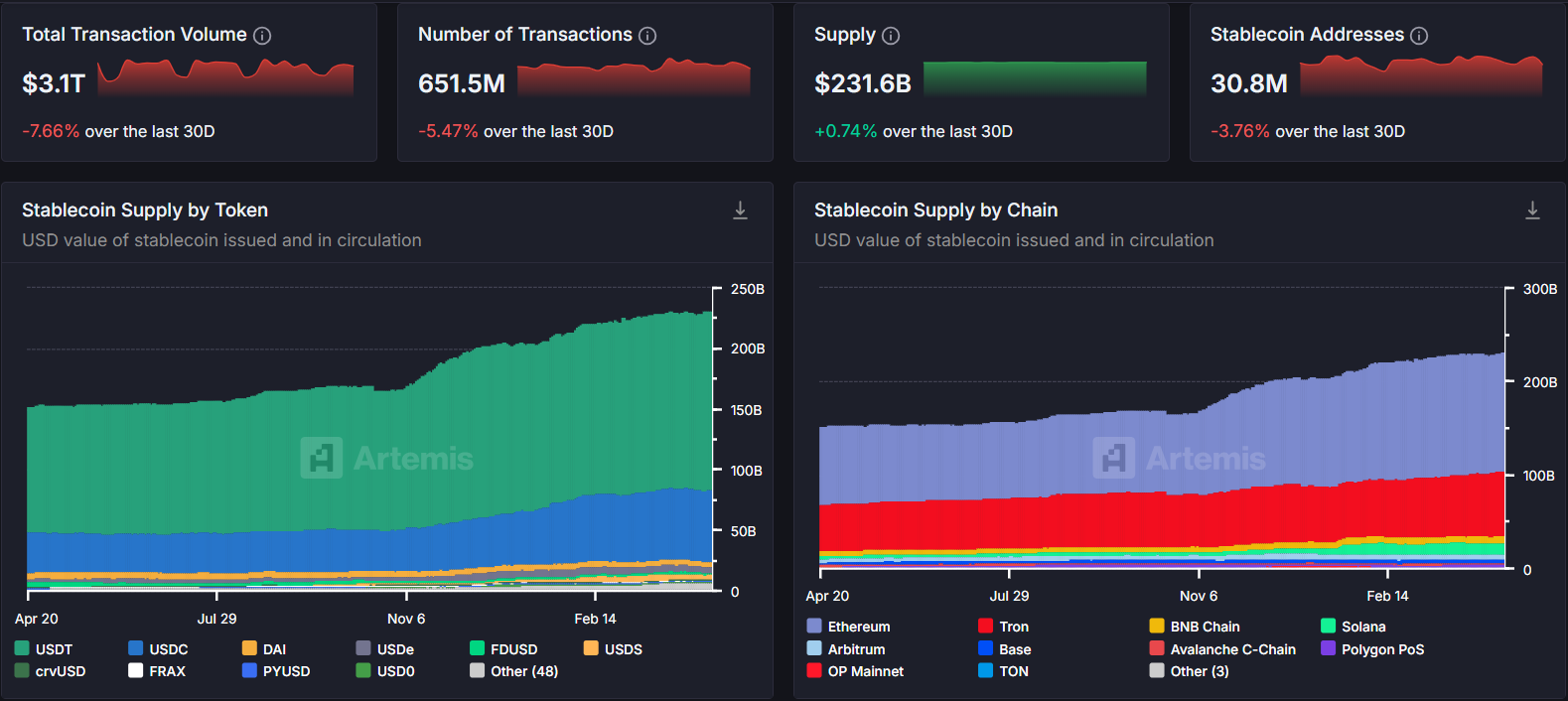

然而,在这般低迷的市况下,稳定币市场却呈现出截然不同的景象:根据 Artemis 的数据显示,截至 2025 年 4 月,稳定币的总市值已达到 2316 亿美元,相比 2024 年同期的 1526 亿美元,实现了 51%的显著增长。

当整体加密资产市场表现疲软之际,稳定币却在持续扩张。那么问题来了:不断发行的稳定币,既然没有流向加密货币投资,那么究竟去向何方?

加密之外,稳定币快速扎根现实世界

作为区块链世界的基础设施,稳定币不仅主导着链上交易,更是加密用户进行代币兑换、DeFi 操作和转账的核心工具。

然而,它的影响力早已突破加密边界,正在现实世界扎根生长。

从市值来看,稳定币直接占据加密货币总市值的 5%,若计入管理稳定币的公司和以稳定币为主要业务的区块链(如 Tron),这一比例更达到 8%。

值得注意的是,主流稳定币发行商采用了类似 MasterCard 的运营模式,通过交易所、支付服务商等中间机构触达终端用户。

以阿根廷为例,尽管当地加密交易所 LemonCash、Bitso、Rippio 在全球知名度不高,但用户基数却达到惊人的 2000 万,相当于 Coinbase 用户群的一半,而阿根廷人口仅为美国的七分之一。单是 Lemon Cash 一家去年就创造了约 50 亿美元的交易量,主要集中在稳定币相关交易。

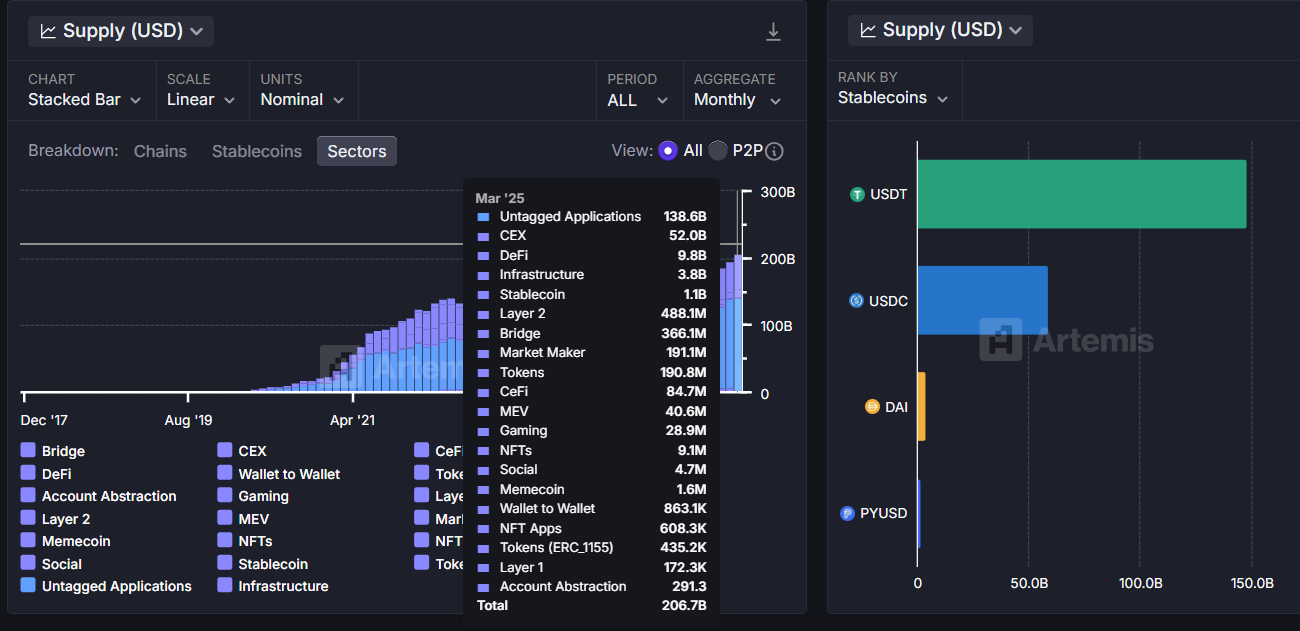

更引人深思的是,根据 Artemis 数据显示,截至 2025 年 3 月的 2067.8 亿美元稳定币流通总量中,传统的 CEX、DeFi 等加密场景反而只占很小份额,高达 67%(1386 亿美元)的稳定币流向了"未分类应用"领域。

大部分稳定币流动于未被明确追踪的数据盲区,它的秘密装在加密之外的黑箱里。

黑灰贸易中,稳定币正在“稳定”流通

在社会规则的暗面,稳定币正编织着一张庞大的黑灰产业网络。

从事跨境电商的刘萍(化名)介绍,虽然正规的美元收款平台如空中云汇、派安盈、PingPong 都要求严格的资质审核和真实订单数据,但"总有人需要其他的解决方案",特别是那些经营仿牌、侵权或军火违禁品的商户。这些非法商户要么通过高价购买平台"黑灰后门"的开户权限,要么直接使用 USDT 收付款。

正如刘萍所解释,相应的产业链在暗处滋生,非法商户通过平台"黑灰后门"收款后,迅速借助地下钱庄兑换成 USDT 撤离,"相当于为违规商户开后门的人吃自己公司的亏损"。

在广告投放领域,她还提到一些更为隐蔽的操作:"有黑灰产账户专门在 Facebook 等平台投违法广告,比如枪支弹药,广告商充值的资金来源多数靠盗刷信用卡。有人专门收购被盗刷的信用卡额度,充值到广告账户后,再以 USDT 折价出售,一个价值 2000 美元的广告账户,用 USDT 可能只需要支付 1500 到 1700 美元。"

"跨境商户其实挺想用 USDT 进行结算的,灵活、没差价,还能一定程度上规避资产风险。但正规平台有牌照,收的是美元,换汇也得合规。"刘萍坦言。

"但正规平台有牌照,收的是美元,换汇也得合规。黑灰后门本质上是给骗子留个时间窗口,让他们找机会用 USDT 跑路。" 金额小的直接提走,平台吃亏;"有时候走后门的诈骗商和平台业务员分成,比如诈骗商收了 300 万,最终可以提走 200 万,那 100 万差价可能是平台和开后门的业务员按比例分走了。"

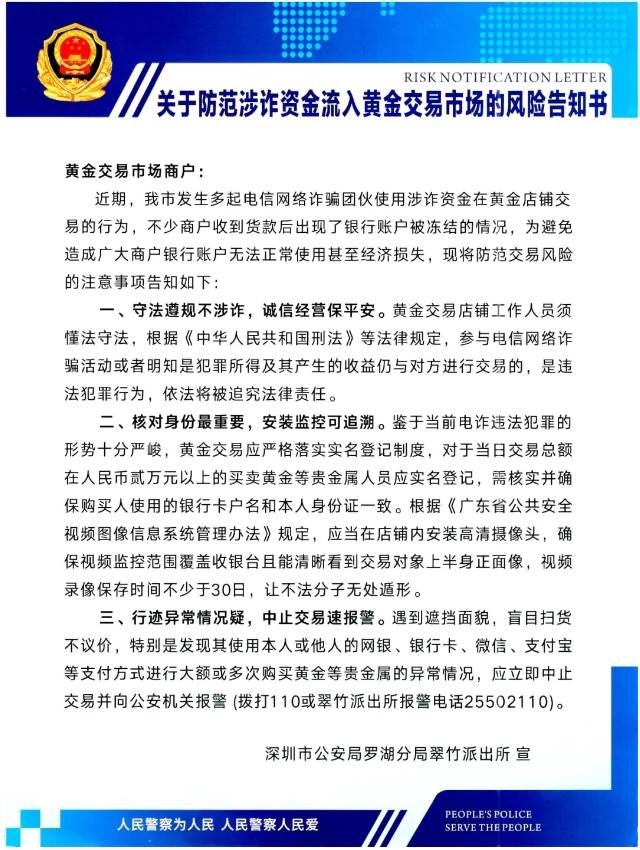

这种情况延伸至国内市场,深圳水贝市场,这个中国最大的黄金珠宝交易集散地,—平方公里内集聚上万家黄金商家,占中国市场份额 75%,稳定币成为灰色换汇的隐秘工具。

2024 年,深圳市公安局罗湖分局发布风险告知书,要求当日交易总额超 2 万元的黄金买卖需实名登记,剑指水贝的地下交易。

业内人士透露,水贝的换汇交易 "成熟且便捷",客户通过熟人介绍联系 "换汇服务商",后者安排交易流程。

市场内一些不起眼的摊位,每天都有大量资金流水。"熟客" 用现金或刷卡购买金条,店员按实时金价交付实物,一气呵成。

换汇服务商为了规避风险,小额交易(1000 万以下)一般由 "马仔" 代为操作。而大额交易则通过在黄金交易所的会员席位完成。相对于线下摊位,走交易所更适合短时、大额资金转移,当然相应的手续费也会更高。

在这一买一卖之间,客户的人民币就转变为匿名化的黄金实体。

当然,换汇最关键的一步是将手中的黄金兑换为 USDT 等稳定币。服务商会协助客户安装冷钱包(如 imToken),将黄金换成 USDT 后存入,如果客户希望立即换汇,也可以直接兑换美元、欧元等外币。整个交易最快一天即完成,佣金通常为交易额的 6% 以内。

这种交易并非万无一失。实名登记新规虽未强制执行,但监管已盯上大额交易。

业内人士表示,在黄金换汇交易中"黑吃黑" 的风险一直存在,不法商家可能伪造凭证卷款跑路,随着金价一路暴涨,这种违约风险也会相应增加。

当地"换汇服务商"通过复杂的黄金交易网络,帮助客户将人民币转化为匿名化的黄金实体,再兑换成 USDT 或其他外币,整个流程最快一天即可完成,佣金通常控制在交易额的 6%以内。

这种操作虽然存在"黑吃黑"风险,但仍然是稳定币参与非法资金流动的一个典型缩影,折射出一个更为庞大的地下洗钱网络正在全球范围内运作。

价值千亿的稳定币洗钱链条

地下钱庄是稳定币洗钱链条中绕不开的一环。

地下钱庄,又称 "地下银行",是一种非法的金融服务机构,主要通过非正规渠道进行跨境汇款和资金转移。这些非法的金融服务机构大多位于东亚和东南亚,是整体洗钱网络的核心角色。通常,它们通过与赌场、在线赌博平台及跨国犯罪集团的协作,将非法资金快速洗白,嵌入全球经济的阴影地带。

USDT 因其与美元挂钩的稳定性,成为洗钱者的首选工具——仅 2023 年,东南亚地区涉及 USDT 的非法加密交易就超过 50 亿美元。

犯罪分子通常通过场外交易市场将非法所得兑换为 USDT,再转换为现金或存入冷钱包,实现资金的匿名化和跨境转移。

这一现象在东南亚博彩业尤为普遍,据慢雾科技 UNODC 报告显示,该地区目前已有超过 340 个持牌和非法赌场,主要分布在湄公河下游边境地区。

赌场与地下钱庄的关系用 “互利共生” 来形容最合适。

东南亚的赌场通过 “保管” 交易和 “投资” 隐匿资金来源,形成复杂的洗钱链条。在线赌博平台的匿名性和非面对面交易特性,进一步加大了资金追踪的难度。

博彩中介在整个洗钱链条居于枢纽地位。全球最大的两家博彩中介——太阳城和德晋的创始人因洗钱和有组织犯罪,分别获刑 18 年和 14 年。他们通过赌场、在线赌博平台和地下钱庄,处理了超过 1000 亿美元的资金。这些中介利用稳定币转移资金,规避资本管制,并依赖不受监管的支付公司完成交易。

汇旺集团(Huione Group)是柬埔寨的金融实体,通过担保业务为东南亚在线赌博和诈骗提供资金转移服务,集团旗下支付平台 Huione Pay 深度参与洗钱活动。

2024 年 7 月,Tether 冻结了与汇旺相关的 TRON 钱包,事件涉及 2962 万 USDT,但尽管汇旺的账户被冻结,他们仍通过新地址维持运作。

由于地区监管不足和未经授权的虚拟资产服务提供商(VASP)激增,地下钱庄的活动空间持续扩大,致使 2023 年东亚和东南亚因网络诈骗造成的经济损失估计高达 180 亿至 370 亿美元。

地缘政治下的稳定币

地缘政治冲突中,稳定币也在扮演着越来越重要的角色。

自 2022 年西方制裁切断俄罗斯的 SWIFT 通道以来,加密货币特别是稳定币已成为俄罗斯跨境结算的重要替代渠道。俄罗斯企业通过将卢布兑换为 USDT 来支付海外供应商,以此绕过美元结算体系。

为适应这一现状,俄罗斯政府采取了积极应对措施,决定从 2024 年 9 月 1 日起允许在跨境交易中使用数字货币,并于 11 月开始将加密货币挖矿合法化,这使得在俄罗斯联邦数字发展部登记的法人和个体企业家可以合法从事加密挖矿业务。

与此同时,大量俄罗斯富豪选择在未加入西方制裁的阿联酋进行资产转移,通过加密货币在迪拜进行套现或直接购置房产。

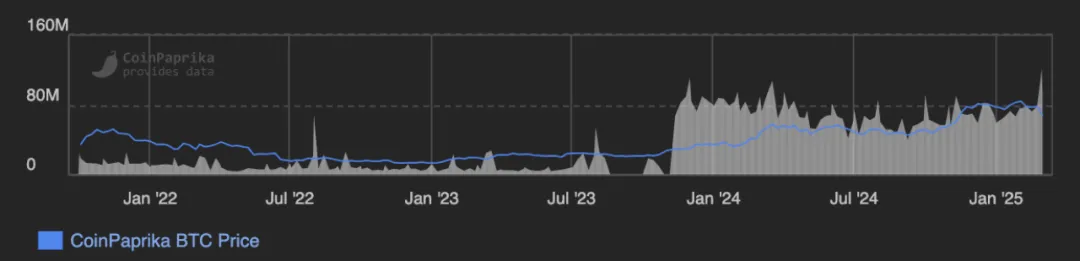

然而,美国也采取了相应的反制措施。俄罗斯加密交易所 Garantex 就是一个典型案例:尽管在 2022 年 4 月被美国财政部外国资产控制办公室(OFAC)制裁,该交易所的日交易量不降反升,从 2022 年 3 月的约 1100 万美元飙升至 2025 年 3 月的 1.216 亿美元,增长超过 1000%。

好景难长,随着监管力度加大,2025 年 2 月欧盟发布第 16 轮对俄制裁,将 Garantex 列入制裁名单。

3 月 6 日,Tether 更是直接冻结了约 2800 万美元的 USDT,涉及多个 Garantex 关联钱包,导致该交易所被迫暂停所有交易和提现业务,并向俄罗斯用户发出资产风险警告。

稳定币站上了国际地缘政治博弈的舞台。

拉美地区高通胀的避风港

在拉丁美洲,稳定币正成为对抗高通胀和货币贬值的重要避风港。

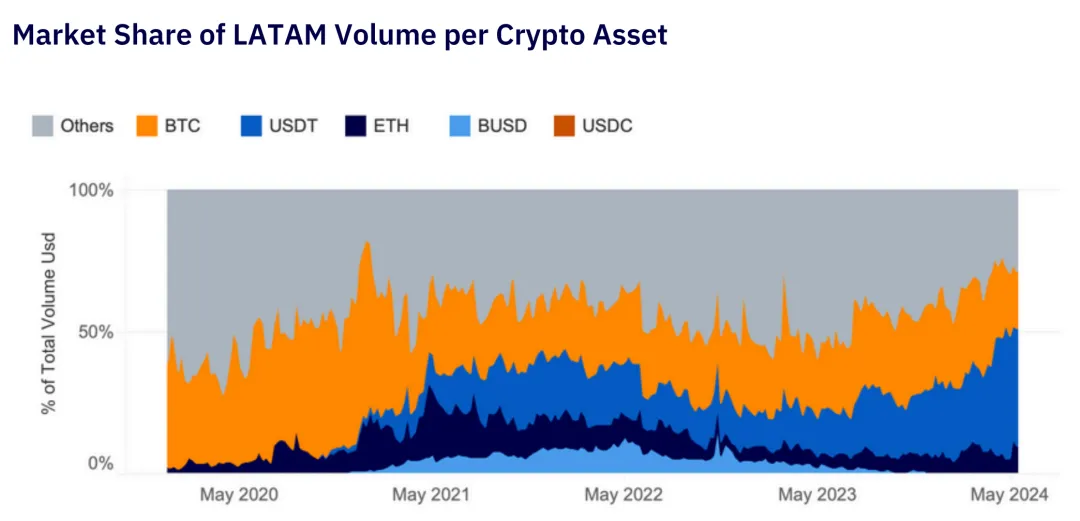

根据 Aiying Compliance 发布的《LATAM Market Report》显示,该地区的政治不稳定和经济危机推动了加密货币的普及,尤其在阿根廷、委内瑞拉和巴西等国家。2024 年,拉美地区加密货币交易总量达 162 亿美元,其中 USDT 相关交易占比超过 40%。

拉美地区的加密货币交易量持续增长,稳定币增幅尤甚

图源《LATAM Market Report》,作者 Aiying Compliance

以阿根廷为例,2024 年阿根廷的通胀率突破 200%,比索持续贬值,“昨天的比索买不到今天的东西”是经济危机之下阿根廷民众的日常。

Chainalysis 一项报告指出,为了应对经济危机,一些阿根廷人开始转向黑市购买外币,最常见的是美元(USD)。

这种所谓的「蓝色美元」,以非正式的平行汇率交易,通常在遍布全国的地下兑换点「cuevas」获取。

此外,与美元挂钩的稳定币也成为阿根廷居民资产保值对抗通胀的选择。

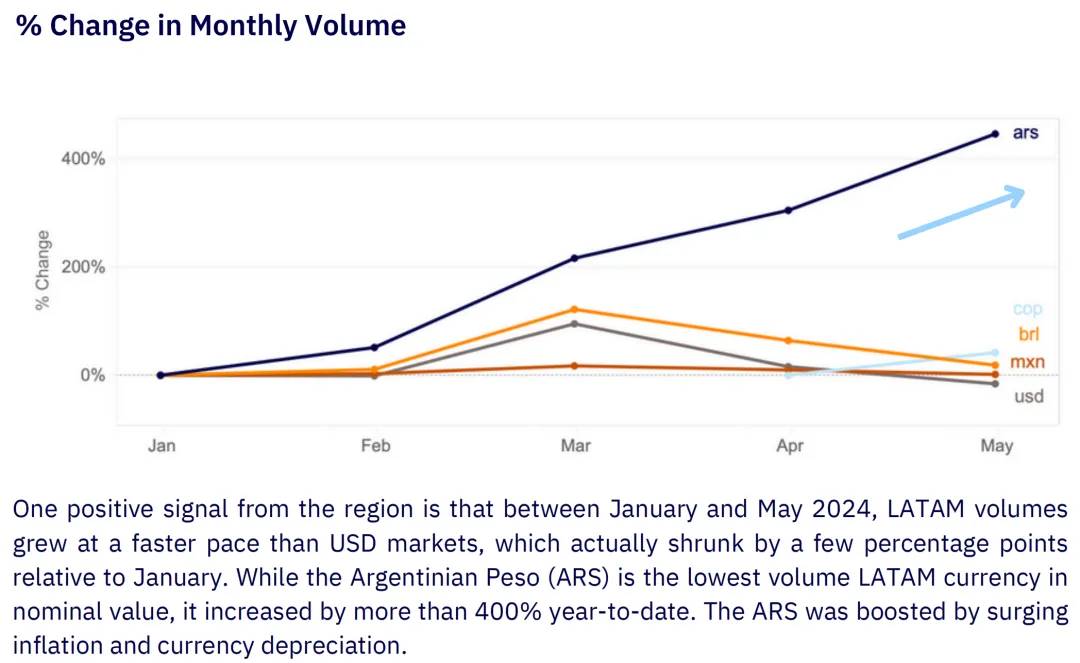

阿根廷的稳定币市场在拉丁美洲地区处于领先地位,其稳定币交易量占比为 61.8%,略高于巴西的 59.8%,并远高于全球平均水平的 44.7%。在 2024 年 1 月至 5 月期间,阿根廷的加密货币交易量就增长了 400% 以上。

阿根廷加密货币交易量在2024年1-5月增长400%

图源《LATAM Market Report》,作者 Aiying Compliance

稳定币的普及不仅为对抗通胀提供了解决方案,也为拉美地区数千万无银行账户的民众开辟了新的经济通道。

在拉美,数千万人因缺乏银行服务而依靠智能手机和 USDT 钱包进行交易。墨西哥最大的交易所 Bitso 占据当地 99.5% 的加密市场份额。在拉美人储蓄和转账的日常中, USDT 交易量稳步增长。

明暗交织的未来

持续扩张的稳定币,流向世界金融体系的明暗两面。

明面上,稳定币担起了加密资产交易与流通的大任,为用户提供一份资产波动之外的平静;而在暗面,稳定币为黑灰产业链搭建起更为隐秘的利益输送通道。

稳定币正独立于加密市场,渗透进全球经济的每一道缝隙。

2025 年,稳定币总市值已逼近 2500 亿美元。这一数字背后,是加密与现实、守序与违规、自由与监管的多层博弈。

或许,稳定币还没有像比特币一样,给世界极为直观的冲击,但它无疑正在以一种更隐秘且细致的方式改变着资金流动的规则,成为全球金融体系中不可忽视的一环。

一方面,它为数字经济提供了稳定的价值锚定,服务了包括发展中国家数千万无银行账户人群在内的广大用户群体;另一方面,其匿名性也为跨境资金流动提供了更隐蔽的渠道,引发了全球监管机构的持续关注。

在为用户提供价格的稳定的同时,“稳定币”也在悄然动摇着传统金融体系的根基。这种看似矛盾却又统一的特质,或许正是理解未来金融世界新格局的一把新钥匙。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。