作者: Arthur Hayes

编者按:

特朗普的关税“滑雪切割”引发金融市场雪崩,但也暴露了决策者稳定市场的底线。面对债券市场的剧烈波动,财政部祭出“非量化宽松”的回购计划,如同2022年第三季度耶伦的操作,预示着新一轮美元流动性注入即将到来。

BitMEX 联合创始人Arthur Hayes在本文中大胆预测比特币已触及本轮牛市底部,将摆脱与科技股的关联,重回“数字黄金”的避险叙事,并在未来的流动性浪潮中领涨加密市场。投资者应密切关注宏观政策动向,把握这轮由政策驱动的市场机遇。

以下为正文:

今年三月中旬,我的北海道滑雪季结束了。然而,从山上学到的经验教训仍然可以应用于特朗普总统的“关税发脾气”。每天都不一样,变量相互作用如此之多——没人知道哪片雪花或哪次滑雪转弯会引发雪崩。我们能做的最好的事情就是大致估计引发雪崩的概率。一种更明确评估斜坡不稳定性的技术是“滑雪切割”。

在下滑之前,团队中的一名滑雪者会横穿起始区域,上下跳跃,试图引发雪崩。如果成功,雪崩如何在斜坡表面传播将决定向导是否认为该斜坡安全可滑。即使引发了雪崩,我们可能仍然会滑这个斜坡,但会谨慎选择哪些区域,以避免引发比松散粉雪滑落更大的雪崩。如果我们看到裂缝急速扩展或巨大的雪板裂开,我们就得赶紧离开。

关键在于根据当前条件尝试量化最坏情况,并据此采取行动。特朗普自称的4月2日“解放日”是对全球金融市场这一陡峭而危险斜坡的滑雪切割。特朗普团队从一本名为《平衡贸易:终结美国贸易赤字不堪重负的成本》的经济学贸易书籍中借鉴了关税政策,并采取了极端立场。宣布的关税税率比主流经济学家和金融分析师的最坏预测还要糟糕。用雪崩理论来说,特朗普触发了一场持久的薄弱层雪崩,威胁要摧毁整个虚假的分数准备金肮脏法定金融体系。

最初的关税政策代表了最坏的结果,因为美国和中国都采取了相互对立的极端立场。虽然金融资产市场的剧烈波动导致全球数万亿美元的损失,但真正的问题是美国债券市场波动性上升,通过MOVE指数测量。该指数几乎达到日内最高纪录172,然后特朗普团队迅速撤离危险区域。在宣布关税后一周内,特朗普调整了计划,暂停对除中国外的所有国家实施关税90天。

随后,波士顿联邦储备银行行长苏珊·柯林斯在《金融时报》上撰文表示,美联储随时准备采取一切必要措施确保市场正常运作,几天后,当波动性拒绝大幅下降时。最后,美国财政部长斯科特·贝森特(BBC)接受彭博社采访时表示,他的部门可以大幅增加国债回购的步伐和金额。我将这一系列事件描述为决策者从“一切正常”到“一切都完了,我们必须做点什么”的转变,市场飙升,最重要的是,比特币触底。是的,我宣布局部底部在74,500美元。

无论你将特朗普的政策变化描述为撤退还是精明的谈判策略,结果是政府故意引发了金融市场雪崩,严重到一周后他们调整了政策。现在,作为市场,我们知道了一些事情。我们了解了最坏情况下债券市场波动性的情况,我们认识到触发行为变化的波动性水平,我们也知道将采取哪些货币杠杆来缓解这种情况。利用这些信息,作为比特币持有者和加密货币投资者,我们知道底部已经到来,因为下次特朗普加大关税言论或拒绝降低对中国的关税时,比特币将会上涨,预期货币当局将以最大“印刷”水平运行印钞机,以确保债券市场波动性保持低迷。

本文将探讨为何关税的极端立场导致债券市场功能失调,以MOVE指数衡量。然后我将讨论贝森特的解决方案——国债回购,将如何为系统增加大量美元流动性,尽管技术上通过发行新债券购买旧债券本身并不会为系统增加美元流动性。最后,我将讨论为何这种比特币和宏观经济格局类似于2022年第三季度,当时贝森特的前任珍妮特·耶伦(坏女孩耶伦)提高了国库券发行量以抽干逆回购计划(RRP)。比特币在2022年第三季度FTX事件后触及局部低点,而现在在2025年第二季度,贝森特推出“非量化宽松”的量化宽松火箭筒后,比特币触及本轮牛市的局部低点。

最大痛苦

我要重申,特朗普的目标是将美国经常账户赤字降至零。要快速做到这一点需要痛苦的调整,关税是他政府的首选武器。我不在乎你认为这是好是坏。也不在乎美国人是否准备好在iPhone工厂工作8小时以上的轮班。特朗普当选的部分原因是他的支持者认为他们被全球化坑了。他的团队一心要兑现竞选承诺,用他们的话来说,提升“主街”而非“华尔街”的关切。这一切假设特朗普身边的人能通过这条路连任,这并非板上钉钉。

金融市场在“解放日”暴跌的原因是,如果外国出口商赚不到美元或赚得更少,他们就无法购买或少买美国股票和债券。此外,如果出口商必须改变供应链甚至在美国重建供应链,他们必须通过出售流动资产(如美国债券和股票)来为部分重建提供资金。这就是为什么美国市场和任何过度暴露于美国出口收入的市场崩盘了。

至少最初的亮点是,受惊的交易员和投资者涌向国债。国债价格上涨,收益率下降。10年期国债收益率大幅下跌,这对贝森特来说是好事,因为这有助于他将更多债券塞进市场的喉咙。但债券和股票价格的剧烈波动提高了波动性,这对某些类型的对冲基金来说是致命的。

对冲基金,有时是对冲……但总是使用一大堆杠杆。相对价值(RV)交易员通常会识别两种资产之间的关系或价差,如果价差扩大,他们会利用杠杆买入一种资产并卖出另一种,预期均值回归。一般来说,大多数对冲基金策略在宏观意义上隐性或显性地做空市场波动性。当波动性下降时,均值回归发生。当波动性上升时,情况变得一团糟,资产之间的稳定“关系”崩溃。这就是为什么银行或交易平台的风险管理者在市场波动性上升时会提高对冲基金的保证金要求。当对冲基金收到追加保证金通知时,他们必须立即平仓,否则就会被清算。一些投资银行乐于在极端波动时期通过追加保证金通知干掉客户,接管破产客户的头寸,然后在决策者不可避免地印钞以压低波动性时获利。

我们真正关心的是股票和债券之间的关系。由于其作为名义上无风险资产和全球储备资产的角色,当全球投资者逃离股票时,美国国债价格会上涨。这是有道理的,因为法定货币必须放在某个地方以赚取收益,而美国政府凭借其无成本运行印钞机的能力,在美元条款下永远不会自愿破产。国债的实际价值能量价值可能会也确实会下降,但决策者并不关心充斥全球的任何垃圾法定资产的实际价值。

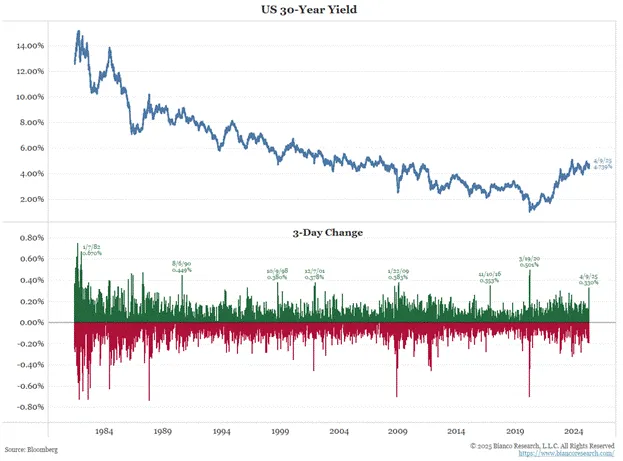

在“解放日”后的最初几个交易日,股票下跌,债券价格上涨/收益率下降。然后,发生了什么事,债券价格与股票一起下跌。10年期国债收益率的往返波动程度自1980年代初以来未见。问题在于,为什么?答案,或者至少决策者认为的答案,极为重要。市场是否存在结构性问题,必须通过美联储和/或财政部的某种印钞方式来修复?

Bianco Research的底部面板显示,30年期国债收益率3天变化的程度非同寻常。由于“关税发脾气”导致的变化水平与2020年新冠疫情、2008年全球金融危机和1998年亚洲金融危机等金融危机期间的市场波动相当。这可不好。

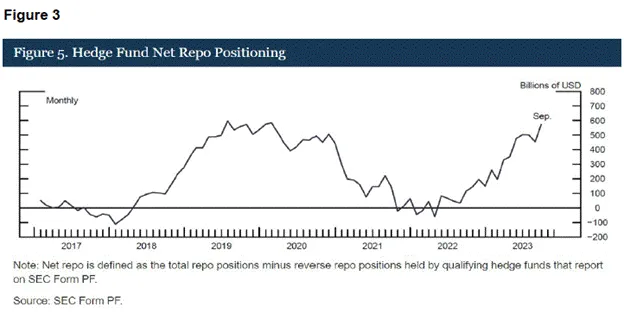

RV基金国债基差交易头寸的可能平仓是一个问题。这个交易规模有多大?

2022年2月对国债市场来说是一个重要的月份,因为美国总统拜登决定冻结全球最大商品生产国俄罗斯的国债持有。这实际上表明,无论你是谁,财产权不是权利,而是特权。因此,外国需求继续减弱,但RV基金填补了这一空白,成为国债的边际买家。上图清楚地显示了回购头寸的增加,这代表了市场上基差交易头寸的规模。

基差交易简述:

国债基差交易是当一个人购买现货流通债券并同时卖出债券期货合约。银行和交易平台端的保证金影响在这里很重要。RV基金的头寸规模受所需现金保证金的限制。保证金要求因市场波动性和流动性问题而异。

银行保证金:

为了获得购买债券的现金,基金进行回购协议(repo)交易,银行同意以小额费用立即提供现金用于结算,以将要购买的债券作为抵押品。银行将要求对回购交易的一定现金保证金。

债券价格波动越大,银行要求的保证金就越多。

债券流动性越低,银行要求的保证金就越多。流动性总是集中在收益率曲线的某些期限上。对于全球市场,10年期国债是最重要和流动的。当发行时最新的10年期国债被拍卖时,它成为流通中的10年期债券,流动性最高。然后,随着时间推移,它越来越远离流动性中心,被认为是离场债券。随着流通债券自然变成离场债券,资助回购交易平台需的现金量增加,而基金等待基差崩溃。

本质上,在高波动性时期,银行担心如果需要清算债券,价格会下降得太快,而且市场卖单的流动性低,无法吸收。因此,他们提高了保证金限额。

期货交易平台保证金:

每个债券期货合约都有一个初始保证金水平,决定每份合约所需的现金保证金量。这个初始保证金水平会根据市场波动性而波动。

交易平台担心在全部初始保证金用完之前清算头寸的能力。价格变动越快,确保偿付能力就越困难;因此,当波动性上升时,保证金要求也会上升。

平仓担忧:

国债基差交易对市场的巨大影响以及主要参与者自我融资的方式一直是国债市场的热门话题。国债借款咨询委员会(TBAC)在过去的季度再融资公告(QRA)中提供了数据,证实了自2022年以来美国国债的边际买家是参与基差交易的RV对冲基金。这里有一篇提交给CFTC的详细论文链接,依赖于TBAC 2024年4月提供的数据。

循环反射的市场事件链在每个周期中以恐怖的方式放大,具体如下:

如果债券市场波动性上升,RV对冲基金将被要求向银行和交易平台提供更多现金。 在某一时刻,基金无法承受额外的保证金要求,必须同时关闭所有头寸。这意味着卖出现货债券并买回债券期货合约。 现货市场的流动性下降,因为做市商在特定价差下减少报价规模,以保护自己免受单向流动的毒性。 随着流动性和价格一起下降,市场波动性进一步增加。 交易员很清楚这种市场现象,监管机构及其金融记者打手们已经对此发出了警告信号。因此,随着债券市场波动性增加,交易员抢先于强制卖出的壁垒,这在下行中放大了波动性,事情解体得更快。

如果这是一个已知的市场压力源,贝森特可以在他的部门内单方面实施什么政策,以保持这些RV基金的杠杆流动?

国债回购

几年前,财政部开始了一项回购计划。许多分析师展望未来,思考这将如何协助一些印钞阴谋。我将提出我对回购对货币供应影响的理论。但首先让我们逐步了解该计划的运作机制。

财政部将发行新债券,并使用发行所得回购流动性较低的离场债券。这将导致离场债券价值上升,甚至可能超过公允价值,因为财政部将是流动性低的市场中最大的买家。RV基金将看到他们的离场债券与债券期货合约之间的基差缩小。

基差交易 = 做多现货债券 + 做空债券期货

由于财政部预期购买,离场债券价格上涨,现货债券价格上涨。

因此,RV基金将通过卖出价格更高的离场债券并关闭其空头债券期货合约锁定利润。这在银行和交易平台端释放了宝贵的资本。由于RV基金的业务是赚钱,他们在下一次国债拍卖中立即重新投入基差交易。随着价格和流动性上升,债券市场波动性降低。这降低了基金的保证金要求,使它们能够持有更大的头寸。这是最好的顺周期反射性。

现在市场将放松,知道财政部为系统提供了更多杠杆。债券价格上涨;一切都好。

贝森特在采访中吹嘘他的新工具,因为理论上财政部可以无限回购。财政部不能在没有国会批准的支出法案的情况下发行债券。然而,回购本质上是财政部发行新债务以偿还旧债务,这已经是为到期债券的本金支付所做的。交易是现金流中性的,因为财政部以相同的名义金额与主要交易商银行之一买卖债券,因此不需要美联储借钱给它进行回购。因此,如果回购的规模减少了市场对国债市场崩溃的恐惧,并导致市场接受尚未发行的债务的较低收益率,那么贝森特将全力以赴进行回购。停不下来,不会停。

关于国债供应的说明

贝森特内心深处知道,今年某个时候债务上限将会提高,政府将继续以越来越猛烈的速度大肆挥霍。他也知道,由于各种结构性和法律原因,埃隆·马斯克通过他的政府效率部门(DOGE)无法快速削减开支。具体来说,埃隆今年的节省估计从每年1万亿美元降至微不足道的(至少考虑到赤字的巨大规模)1500亿美元。这导致一个显而易见的结论,即赤字实际上可能会扩大,迫使贝森特发行更多债券。

截至目前,2025财年截至3月的赤字比2024财年同期高出22%。 给埃隆一点信任——我知道你们中有些人宁愿在特斯拉里听着Grimes烧死也不愿这样做——他只削减了两个月。更令人担忧的是,关于关税严重性和影响的商业不确定性,结合股票市场下跌,将导致税收大幅下降。这将指向赤字继续扩大的结构性原因,即使DOGE成功削减更多政府开支。

贝森特内心深处担心,由于这些因素,他将不得不提高今年的借款估计。随着大量国债供应的逼近,市场参与者将要求显著更高的收益率。贝森特需要RV基金站出来,使用最大杠杆,大量买入债券市场。因此,回购是必要的。

回购对美元流动性的正面影响不像中央银行印钞那样直接。回购是预算和供应中性的,这就是为什么财政部可以无限量进行回购,以创造RV基金的巨大购买力。最终,这使政府能够以可承受的利率为自己融资。发行的债务越多,不是用私人储蓄购买,而是通过银行系统创造的杠杆基金购买,货币数量的增长就越大。然后我们知道,当法定货币数量上升时,我们唯一想持有的资产是比特币。

显然,这不是美元流动性的无限来源。存在的离场债券数量是有限的。然而,回购是一个工具,可以使贝森特在短期内缓解市场波动性,并以可承受的水平为政府融资。这就是为什么MOVE指数下降了。以及随着国债市场稳定,对整个系统崩溃的恐惧也减少了。

布局

我将这种交易布局比作2022年第三季度的布局。在2022年第三季度,合适的白人男孩山姆·班克曼-弗里德(SBF)破产了;美联储仍在加息,债券价格下跌,收益率上升。坏女孩耶伦需要一种方法来刺激市场,这样她就可以用红色底的高跟鞋撬开市场的喉咙,倾倒债券而不引发呕吐反射。简而言之,就像现在一样——由于全球货币体系的转变导致市场波动性上升——增加债券发行是个糟糕的时机。

逆回购余额(白色)与比特币(金色)

就像今天一样,但原因不同,耶伦不能指望美联储宽松,因为鲍威尔正在进行受保罗·沃尔克启发的杂耍节制巡演。耶伦,或者某个狡猾聪明的员工,正确推断出货币市场基金持有的逆回购中的无菌资金可以通过发行更多国库券被诱导进入杠杆金融体系,这些基金乐于拥有这些国库券,因为它们的收益率略高于逆回购。这使她从2022年第三季度到2025年初为市场增加了2.5万亿美元的流动性。在那段时间,比特币上涨了近6倍。

这是一个相当看涨的布局,但人们害怕。他们知道高关税和中美贸易战对股票价格不利。他们认为比特币只是纳斯达克100的高贝塔版本。他们看跌,不明白一个听起来无害的回购计划如何导致未来美元流动性的增加。他们袖手旁观,等待鲍威尔宽松。他无法以2008年至2019年期间前任美联储主席的方式直接宽松或提供量化宽松。时代变了,现在财政部负责大量印钞。如果鲍威尔真正关心通货膨胀和美元的长期强势,他会抵消耶伦和现在贝森特的财政部行动的影响。但他当时没有,现在也不会;他将坐在被支配的椅子上,被支配。

就像2022年第三季度,人们认为比特币可能跌破1万美元,因为在周期低点1.5万美元后,市场不利因素汇聚。今天,一些人认为我们将跌破74,500美元,跌至6万美元以下,牛市结束了。耶伦和贝森特可不是闹着玩的。他们将确保政府以可承受的利率获得资金,债券市场波动性被压制。耶伦发行了比债券更多的票据,以注入系统中有限的逆回购流动性;贝森特将通过发行新债券购买旧债券,最大化RV基金吸收增加的债券供应的能力。两者都不是大多数投资者所知道和认可的量化宽松。因此,他们错过了机会,一旦突破确认,他们不得不追高。

验证

为了使回购具有净刺激作用,赤字必须继续上升。5月1日,通过美国财政部的季度再融资公告(QRA),我们将知道即将推出的借款计划以及与之前估计的比较。如果贝森特必须或预计要借更多,意味着税收预计下降;因此,在支出不变的情况下,赤字扩大。

然后,在5月中旬,我们将从财政部获得包含4月15日税收实际数据的官方4月赤字或盈余。我们可以比较2025财年迄今为止的同比变化,观察赤字是否在扩大。如果赤字上升,债券发行将增加,贝森特必须尽其所能确保RV基金能够增加其基差交易头寸。

交易策略

特朗普对危险的陡坡进行了滑雪切割,引发了雪崩。我们现在知道特朗普政府能忍受的痛苦或波动性(MOVE指数)水平,在市场认为对法定金融体系基础产生负面影响的政策实施之前会进行调整。这引发了政策反应,其影响将增加可以购买国债的法定美元供应。

如果回购的频率和规模增加不足以平息市场,那么美联储最终会找到宽松的方法。他们已经说过会这样做。最重要的是,他们在最近的3月会议上降低了量化紧缩(QT)的速度,从长远来看,这是美元流动性的积极因素。然而,美联储还可以做得更多,超越量化宽松。以下是一些非量化宽松但增加市场吸收增加国债发行能力的程序性政策清单;其中之一可能在5月6日至7日的美联储会议上宣布:

豁免银行补充杠杆比率(SLR)中的国债。这允许银行使用无限杠杆购买国债。

进行量化紧缩扭曲,将到期抵押贷款支持证券(MBS)筹集的现金重新投资于新发行的国债。美联储的资产负债表规模保持不变,但这将为国债市场增加每月350亿美元的边际购买压力,持续多年,直到MBS总存量到期。

下次特朗普按下关税按钮——他会这样做,以确保各国尊重他的权威——他将能够要求额外的让步,比特币不会与某些股票一起被压垮。比特币知道,鉴于肮脏金融体系运行所需的当前和未来债务的疯狂水平,通缩政策无法长期持续。

对夏普世界山的滑雪切割,引发了二级金融市场雪崩,可能迅速升级到最高级别的五级。但特朗普团队做出了反应,改变了路线,将帝国置于不同的方面。斜坡的基础在使用了由国债回购提供的晶莹美元钞票制成的干爽粉雪上得到巩固。是时候从背着充满不确定性的背包艰难上山,转变为跳下粉雪枕头,欢呼着比特币将升到多高。

正如你所见,我非常看涨。在Maelstrom,我们已经最大化了我们的加密货币敞口。现在就是买卖不同加密货币以积累聪(satoshis)。在从11万美元跌至74,500美元的下跌中,购买量最大的币是比特币。比特币将继续引领潮流,因为它是未来货币流动性注入的直接受益者,这些注入是为了软化中美贸易的影响。现在全球社会认为特朗普是一个粗暴野蛮挥舞关税武器的疯子,任何持有美国股票和债券的投资者都在寻找反体制的价值。物理上,那是黄金。数字上,那是比特币。

黄金从未被认为是美国科技股的高贝塔版本;因此,随着市场普遍崩盘,它作为最古老的反体制金融对冲表现良好。比特币将摆脱与科技股的关联,重新加入黄金的“只涨”拥抱池。

那山寨币呢?

一旦比特币突破11万美元的前高,它可能会飙升,进一步增加主导地位。也许它只是差一点到20万美元。然后从比特币到山寨币的轮动开始。

除了那些闪亮的新山寨币Token元趋势,表现最好的Token将是那些与既赚取利润又将利润返还给质押Token持有者的项目相关的Token。这样的项目只有少数。Maelstrom一直在勤奋积累某些符合条件的Token的头寸,还没有买完这些珍宝。它们是珍宝,因为它们在最近的抛售中与其他山寨币一样被重创,但与99%的山寨项目不同,这些珍宝实际上有付费客户。由于Token数量庞大,在以“只跌”模式在中心化交易平台(CEX)上推出Token后,很难说服市场再次给你的项目机会。山寨币的潜水者想要更高的质押年化收益率(APY),这些回报来自实际利润,因为这些现金流是可持续的。

本文链接:https://www.hellobtc.com/kp/du/04/5756.html

来源:https://mp.weixin.qq.com/s/x3c9a9L7sl-ViFeKtqoUPQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。