Macroeconomic Interpretation: Recently, both the global financial market and the cryptocurrency market have shown complex dynamic changes, from the traditional increase in gold reserves to the profit expectations in the U.S. stock market, and the cyclical analysis of cryptocurrencies, especially Bitcoin. Various fields are releasing different signals. This time, we aim to conduct an in-depth discussion on the current status and future trends of the global financial market and the cryptocurrency market.

1. The People's Bank of China Resumes Gold Accumulation: Diversification of Reserves and Rising Gold Prices

The People's Bank of China has released the latest data, resuming gold purchases after a six-month hiatus, which has attracted widespread attention in the international financial market. As of the end of November, China's gold reserves reported 72.96 million ounces, an increase of 160,000 ounces from the previous month. Since November 2022, the People's Bank of China has continuously purchased gold, pausing only in April this year, accumulating a total of 10.16 million ounces over 18 months. What is the reason behind this move? What signals does it send?

The World Gold Council pointed out that the People's Bank of China led gold demand in the first quarter of this year and became the largest gold buyer in 2023. The resumption of purchases indicates that even with gold prices at historical highs, the People's Bank of China is still keen on achieving reserve diversification and preventing currency depreciation. The reasons for increasing gold reserves include optimizing the structure of international reserves and increasing the proportion of gold reserves; on the other hand, gold, as a widely accepted ultimate means of payment, can enhance the credibility of sovereign currency and create favorable conditions for the prudent advancement of the internationalization of the renminbi.

Additionally, changes in geopolitical risks have also impacted gold prices. The Syrian opposition's occupation of the capital Damascus and the overthrow of President Bashar al-Assad have made the Middle East situation more chaotic, which has also pushed up gold prices. Spot gold rose by 0.46% to $2,645.04 per ounce. The precious metals sector in the A-shares and Hong Kong stock markets performed actively, with stocks like Hunan Gold and Xiaocheng Technology seeing significant gains.

2. U.S. Stock Market: Profit Growth and Valuation Adjustment

Meanwhile, the U.S. stock market is also undergoing complex changes. With the conclusion of the U.S. elections and the continued rise of the Trump trade, the U.S. stock market has repeatedly hit new highs. However, from a performance perspective, the overall growth of the U.S. stock market has declined due to the drag from cyclical industries, and the market's profit consensus expectations have also been downgraded. Nevertheless, the U.S. stock market has not stopped; instead, it has continued to reach new highs, with the strength of different sectors diverging from performance conditions, as the cyclical style of the Dow Jones even temporarily outperformed the growth style of the Nasdaq.

The main reason lies in the warming of the Trump trade after the elections and the easing of financial conditions following the interest rate cuts, which have prompted the interest rate-sensitive real estate and investment sectors to recover first. Additionally, the market has also priced in more favorable growth expectations following Trump's election. However, at the current position, U.S. stock valuations (94% historical percentile since 1990) and sentiment (risk premium at 28% historical percentile since 1990) are at high levels, raising concerns about the subsequent space for growth.

The key to assessing the future space of the U.S. stock market still lies in profits, with the critical factors being whether the technology sector can sustain its growth and whether the cyclical sectors can restart. Although the technology sector is experiencing a slowdown, "software" is outperforming "hardware," with media entertainment and software services still seeing profit growth. Cyclical sectors such as finance and energy benefit from Trump's proposed tax cuts, the interest rate cut cycle, and financial deregulation.

Considering the U.S.'s own growth path and the growth expectations of overseas income, it is estimated that the profit growth of the U.S. stock market may reach 10% by 2025, slightly higher than this year's 9%. However, the U.S. stock market's space is also constrained by limited further expansion of valuations. It is expected that the reasonable central point for the 10-year U.S. Treasury yield will be around 3.8% to 4%, with limited room for further declines in risk premiums. Therefore, the U.S. stock market may face short-term correction pressure, but there is still long-term growth potential.

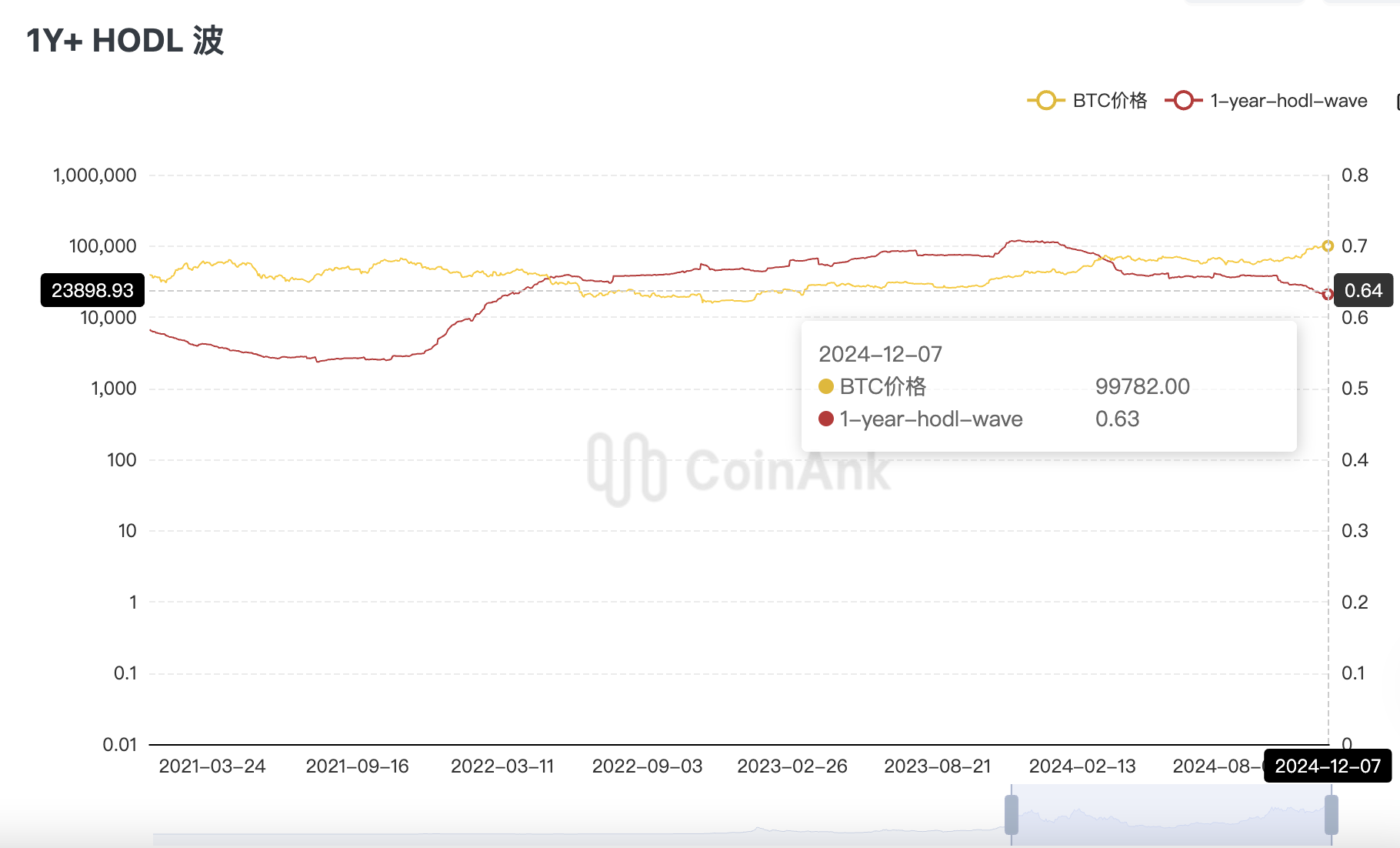

3. Bitcoin Cycle Analysis: New Capital Inflows and Local Tops

In the cryptocurrency market, the cyclical analysis of Bitcoin is also receiving significant attention. By analyzing on-chain data for Bitcoin, we can determine our position in this cycle.

Long-term holders (Smart Money) are currently selling Bitcoin, which is not surprising given that Bitcoin rose by 45% last month, increasing by 600% from the cycle low. 69% of the circulating supply of Bitcoin is held by long-term holders, and as the bull market continues, we expect to see long-term holders transferring their tokens to short-term holders.

Short-term holders are new entrants to the market, and this group typically trends upward during a bull market. Currently, 16.6% of the Bitcoin supply is held by short-term holders, and with new capital inflows, there may be even more new funds entering the Bitcoin market in the future.

The decline in exchange balances also indicates an unusual phenomenon, as Bitcoin has not entered exchanges in large quantities with rising prices but has instead left exchanges, possibly existing in self-custody. Additionally, the financing rate in the futures market is also at a low level, indicating that leverage is not high and the market structure is relatively robust.

The MVRV Z-Score helps us understand the relationship between Bitcoin's current market value and its "realized value." The current MVRV is 3.17, meaning that the average holder has an unrealized gain of 217%. Historical data shows that both long-term and short-term holders' MVRV could rise before the end of this cycle.

The Pi-Cycle Top Indicator also indicates that the shorter 111-day moving average has not yet shown a parabolic trend, suggesting that sharp rises and falls could occur at any time. Although the market has entered an "extreme greed" phase, there are still subtle differences to explore. For example, the viewership of cryptocurrency YouTube channels is still about half of the peak during the last cycle, and the ranking of the Coinbase App is also lower than in the previous cycle.

Finally, while there are some signs of prosperity (such as the rise of meme coins), more extreme greed is likely to come. Expectations of volatility are human nature, and investors need to remain vigilant.

Conclusion and Outlook

In summary, we can see that both the global financial market and the cryptocurrency market are experiencing complex changes. The People's Bank of China has resumed gold purchases, achieving reserve diversification and driving up gold prices; the U.S. stock market is seeking balance amid profit growth and valuation adjustments; the Bitcoin market is fluctuating between new capital inflows and local tops. Looking ahead, we have reason to believe that as the global economic environment continues to change and policies are adjusted, these markets will face new opportunities and challenges. For investors, it is essential to maintain a cautious and rational attitude, closely monitor market dynamics and policy changes, and develop reasonable investment strategies.

BTC Data Analysis:

Data shows that long-term holders have seen a noticeable decline since early October this year, currently accounting for about 69% of the total supply, which is what we discussed earlier; long-term holders and short-term holders are in a phase of exchanging chips. If we refer to the corresponding holding ratios in the previous two bull markets, we are approaching past values, namely: in 2021 and 2017, about 58% and 51% of the circulating supply was held by long-term holders when BTC prices peaked. It is expected that this round, due to ETF capital involvement, will slightly increase the ratio, as ETFs roughly account for 5.57% of the supply. Therefore, if the long-term holding ratio falls below 65%, we should adopt a conservative attitude towards the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。