Half of the losses come from entering the market at the wrong time, and the other half comes from information asymmetry.

Author: Bei Ban, BayFamily

Bitcoin and altcoins are surging. The market always experiences peaks and then crashes. However, retail investors consistently lose their money following a uniform pattern. I recently read a journal article that described how retail investors lose their money during the boom and bust cycles.

The title is "Wealth Redistribution During Bubbles and Crashes."

The historical event this paper is based on is the 2014 A-share bubble.

From July 2014 to December 2015, the Chinese stock market experienced a rollercoaster journey: the Shanghai Composite Index rose over 150% from early July 2014 to its peak of 5166.35 on June 12, 2015 (including a moderate rise from July to October 2014 and a rapid rebound from October 2014 to June 2015), and then plummeted by 40% by the end of December 2015.

The authors of this paper obtained trading data from all users of the Shanghai and Shenzhen stock exchanges at that time and analyzed the reasons for retail investors' losses. Let's start with the conclusion.

The wealthiest top 0.5% of households gained over 250 billion RMB, while the bottom 85% of households lost 30% of the same amount. In this process, money was transferred from the pockets of the poor to the pockets of the rich.

As commonly said, money is transferred from those who need it most to those who need it least.

So why does this happen? The main reason is that in the early stages of the bubble, the top 0.5% of wealthy households increased their market risk exposure, while households below the 85th percentile did the opposite. In the late stages of the bubble, middle-tier investors were indecisive in cutting losses.

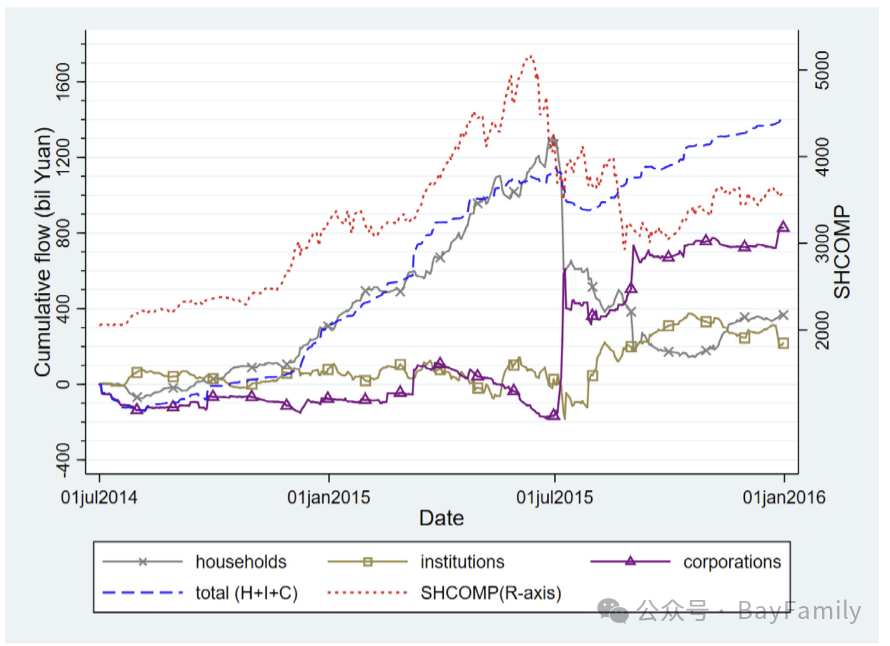

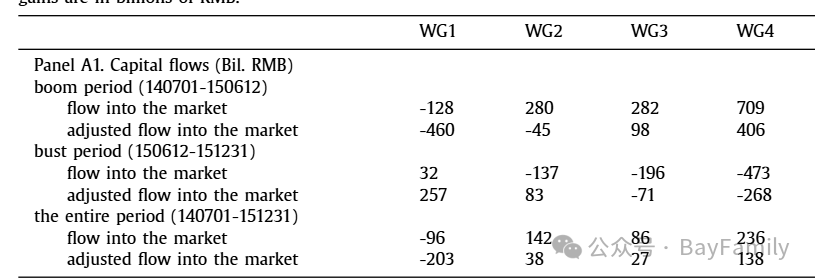

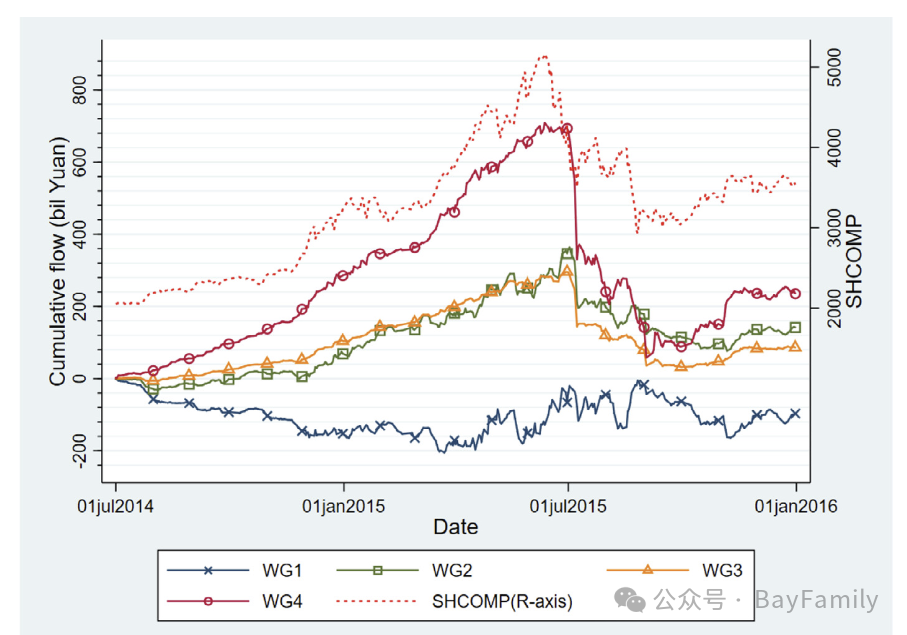

First, let's look at the capital inflow situation. The authors categorized all accounts into three types: household, institutional, and corporate accounts. (Account types and ownership information can be directly observed in our management data. The last category includes cross-holdings from other companies and ownership of government-funded entities. Household accounts are further divided into four groups based on account value (defined as the sum of stocks held on the Shanghai and Shenzhen stock exchanges and cash in the account) with the following cutoff values: below 500k RMB (WG1), 500k to 3 million RMB (WG2), 3 million to 10 million RMB (WG3), and above 10 million RMB (WG4).

The authors then plotted the daily capital inflow for each category against the Shanghai Composite Index.

From July 1, 2014, to June 12, 2015, the cumulative inflow for the household sector was 1.1 trillion RMB, while the other two sectors had cumulative inflows of 80 billion and -130 billion respectively. By June 29, 2015, household inflows continued to rise, peaking at 1.3 trillion RMB. Shortly after, the household sector began selling their stocks to companies, primarily government-funded investment tools. These government-related entities were instructed by market regulators to "maintain" the market after one of the most severe crashes in Chinese stock market history. By the end of December 2015, relative to the market peak on June 12, corporate cumulative inflows were 950 billion RMB, while the household sector had cumulative outflows of 800 billion.

In our bubble crash event, large investors profited while small investors lost. Specifically, from July 2014 to December 2015, due to active trading (i.e., compared to a buy-and-hold strategy), the bottom 85% of households lost 250 billion RMB, while the top 0.5% of households gained 254 billion RMB during this 18-month period.

About 100 billion of this wealth redistribution can be attributed to market-level trading gains and losses. The remaining 150 billion RMB redistribution is a result of heterogeneous portfolio choices, meaning differences in stock selection. Large investors may have special information channels.

From these figures, as of the end of June 2014, the total holding value of the bottom household group was 880 billion RMB, so the cumulative loss during this 18-month period was equivalent to 28% of their initial stock wealth. Meanwhile, the total holding value of the wealthiest household group at the start of the sample was 808 billion RMB, which grew by 31%.

There are two reasons why small retail investors lose money.

- Retail investors, especially the poorest ones, make the biggest mistake of not daring to take risks. In the early stages of a bull market, they are hesitant to invest large amounts and instead add funds as the bull market rises. See the chart below. WG1 (the retail investors with the least money) even saw capital outflows during the early stages of the bull market.

- Medium-tier retail investors are indecisive in cutting losses. Large investors, WG4, quickly exit decisively after stock prices fall. Small retail investors hesitate, even trying to add funds to catch the bottom.

- Retail investors rush into high-risk stocks (High beta), hoping to get rich overnight. They look for cheap stocks. As a result, they get trapped.

The paper's original words regarding these phenomena are as follows:

"Our analysis shows that in the early stages of the bubble, the largest household accounts, specifically the top 0.5% of stock wealth distribution, actively increased their market exposure by inflowing into the stock market and leaning towards high beta stocks. They then quickly reduced their market exposure shortly after the market peaked. Households below the 85th percentile exhibited completely opposite trading behavior. During this 18-month period, the top 0.5% of households gained over 250 billion RMB, while the bottom 85% of households lost over 250 billion RMB, or about 30% of the initial account value for any group. In stark contrast, during the two and a half years prior to June 2014, when the market was relatively calm, the gains and losses experienced by these four household wealth groups were an order of magnitude smaller. From the perspective of a systematic investment portfolio selection model, we suggest that this wealth redistribution is unlikely to be driven by investors' rebalancing or trend-chasing trading, but rather reflects the heterogeneity of household investment skills.

During the boom-bust period, the returns of the largest 0.5% of households far exceeded those of the lowest 85% of households, which is significant for policymakers. It is commonly believed that greater participation in the stock market is a path to prosperity and equality, especially in developing countries where financial literacy and market participation are generally low. However, if the poor and financially less mature individuals end up actively investing in financial markets that are prone to bubbles and crashes, such participation may harm their wealth. This is particularly concerning given recent research findings that prominent early experiences can have lasting impacts on individuals' economic decisions decades later. Therefore, while greater stock market participation can enhance welfare, it is crucial to emphasize that active investing may lead to completely opposite outcomes."

The crypto market is very similar to the early A-share market. It is dominated by retail investors. Whales control the market. Carefully reading this paper may help everyone make their investment decisions. Half of the losses for small retail investors come from entering the market at the wrong time, and the other half comes from information asymmetry and poor stock selection.

The current market characteristics align very well with the above analysis. A large number of zombie coins defined in March 2024 are being revived.

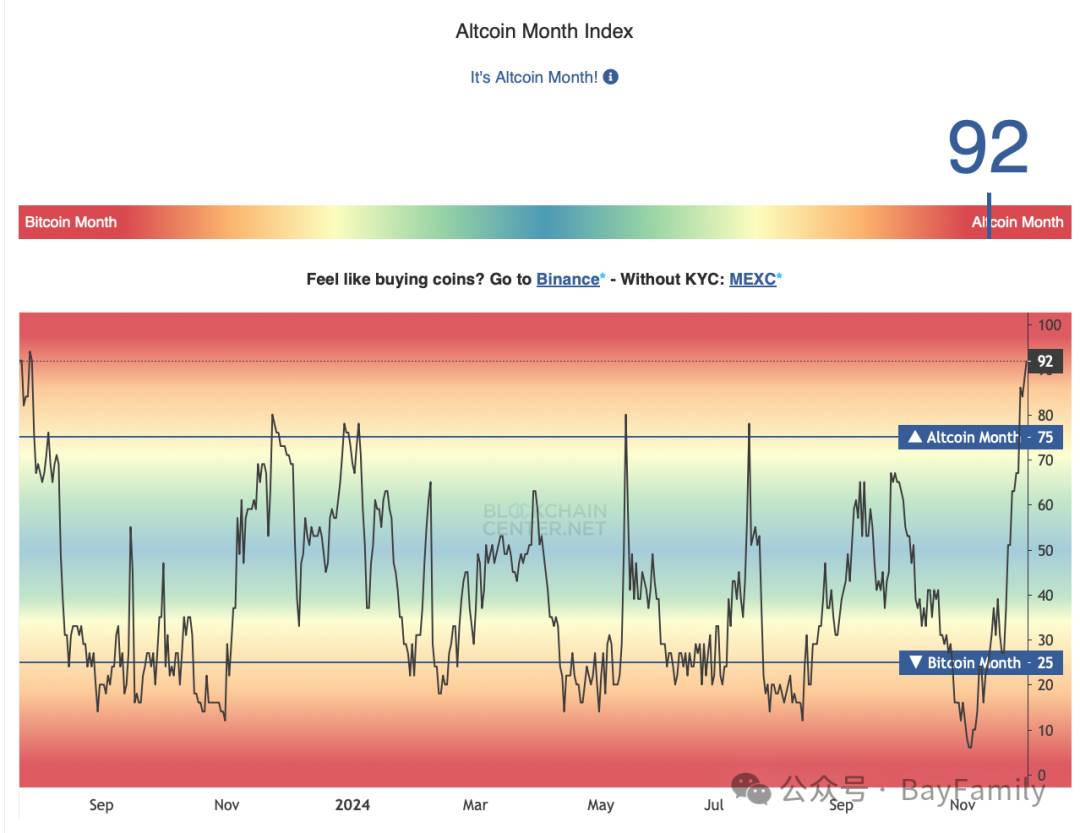

The altcoin index is being rapidly pushed up.

These all indicate that small retail investors are rushing in. Sector rotation is often a signal that the market is entering the later stages.

Binance has 200 million users, and the backend data can actually provide a very clear view of the current market stage. Unfortunately, they do not disclose this data. It only benefits a specific group of people.

The conclusion is two sentences.

- Do not chase the market highs. 2. Do not touch altcoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。