作者:Stacy Muur

编译:Tim,PANews

我们已经见识过法币支持的稳定币,也见识过加密货币抵押的稳定币。而Aegis的思路却有所不同:一种比特币支持的稳定币。

以下为其设计大胆之处及可能成功的原因。

当今绝大多数稳定币都依靠一种中心化体系,而这种体系是比特币被设计时所避免的:

- 法币托管

- 银行清算

- 监管制约

Aegis采取了不同的策略,选择围绕比特币而非银行构建体系。

Aegis将其稳定币命名为YUSD:

- 锚定1美元价格

- 由比特币抵押支持

- 通过做空永续合约维持稳定

无需预言机,无法币储备,无第三方中介

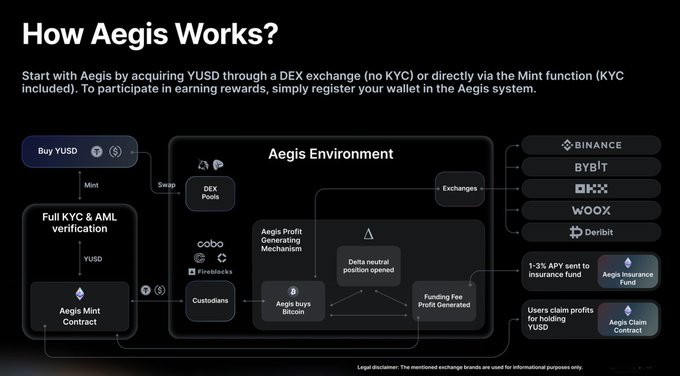

YUSD只有在USDT、USDC或DAI等稳定币存入Aegis Mint智能合约时才会被铸造。

一旦验证通过,YUSD即被生成,相应的抵押品将转移至安全的托管金库。

无链下铸造开关,无人工干预,一切仅由智能合约逻辑控制。

那么,Aegis到底是如何实现端到端运作的?

- 你可以拿资金进行铸造或兑换(链上或去中心化交易所)操作,以获取YUSD

- Aegis使用这些资金购买BTC

- 通过开设空头永续合约对冲价格波动风险

- 空头仓位赚取资金费率收益

- 收益分配:部分注入保险池,部分分配给YUSD持有者

这就是YUSD的循环机制。

但是,这些利润从何而来?

当Aegis做空比特币永续合约时,它会通过看涨押注的交易者支付资金费率获利。

只要存在做多需求,这些费用每天将收取三次。

这不是质押,也不是通胀。

这就是对手盘压力转化成收益。

Aegis不会要求你做任何额外的事情。

持有YUSD→ Aegis赚取费用 → 快照记录份额 → 奖励生成 → 通过APP领取

看,收益就是大风刮来的。

Aegis的构建旨在确保安全可靠,独立规避中心化风险,并避开常见的单点故障:

- 无法定货币支持

- 无USDC储备

- 无预言机依赖

仅限比特币,抵押对冲处理,场外持有,实时监控。

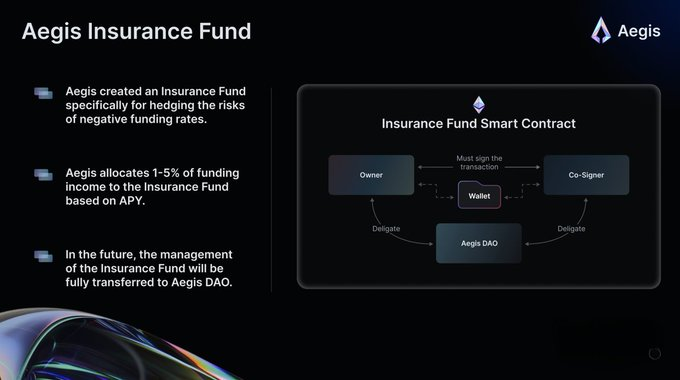

没有一种收益模型是完美的,尤其是与资金费率挂钩的模型。那么,如果资金费率转为负值会怎样?

Aegis已为此建立了保险基金。

- 收益的1-5%会转入保险基金

- 当资金费率转为负值,做空成本升高时启用该基金

- 由多重签名智能合约进行管理

- 后续控制权将移交至Aegis DAO

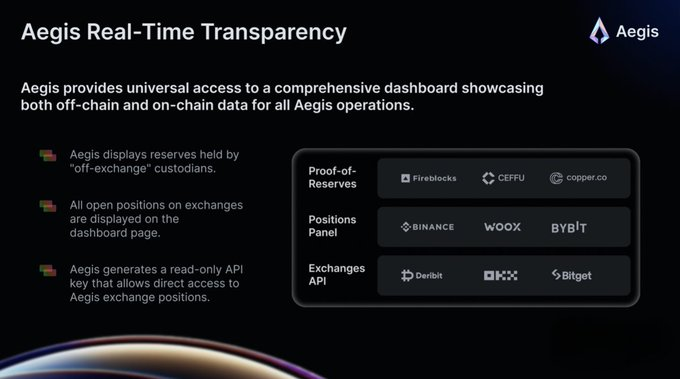

Aegis似乎非常注重透明度:

- 托管储备金可验证

- 交易所头寸公开

- 只读API公开系统状态

你不必猜测它的内在运行逻辑,但你可以实时观察结果。

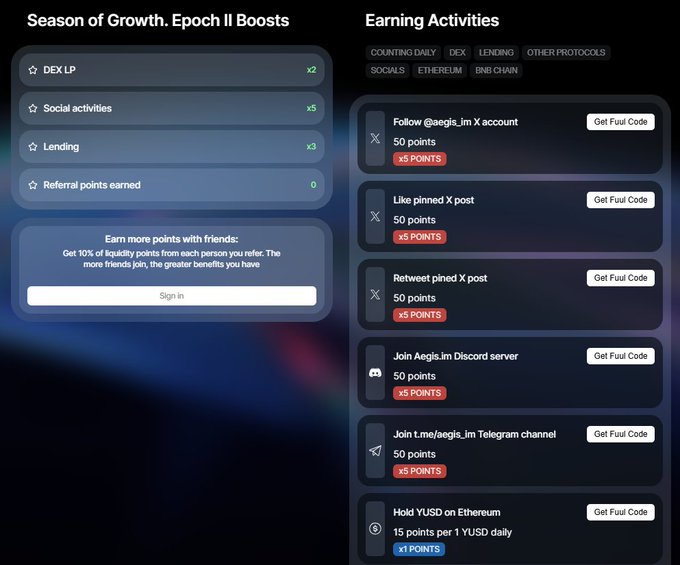

保险基金负责管理风险,Aaegis积分系统则负责推动增长。用户每日可通过以下方式获取积分:

- 持有 YUSD(每天每1美元获得15积分)

- 提供流动性(每天每1美元获得30积分,2倍加成)

- 通过Euler借贷(每天45积分,3倍加成)

- 完成社交任务(每个任务50积分,5倍加成)

该产品和服务现已全面上线以太坊和BNB链。

在Season 1中,所有积分收益都将获得50%的加成奖励,这让早期用户可以分得更高比例的AEG代币奖励。

超额奖励:Euler集成解锁循环策略——存入YUSD→赚取积分→借入稳定币→重复此过程。

这样可以最大化收益,倍增积分。

积分并非只是数字而已。每周,0.2%的AEG总供应量将根据你的积分份额进行分配。

不用担心空投延期发放,也无需猜测分配规则。

透明公开,一切按计划进行,并与协议使用直接挂钩。

Aegis是一个早期项目,旨在构建不依赖法币、预言机或许可抵押品的稳定币。

该模型在动荡市场中是否仍然有效,或在真实使用场景下能否扩展,目前仍不确定。

但这是迄今为止在基于比特币的货币设计中最清晰的实验之一。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。