Author: Yue Xiaoyu

Pumpfun is a meme coin issuance and trading platform on the Solana chain, focusing on fair distribution.

Pumpfun launched in January 2024 and quickly became a sensation in the community, riding the wave of the meme coin craze, or rather, directly propelling the meme coin trend into a new phase.

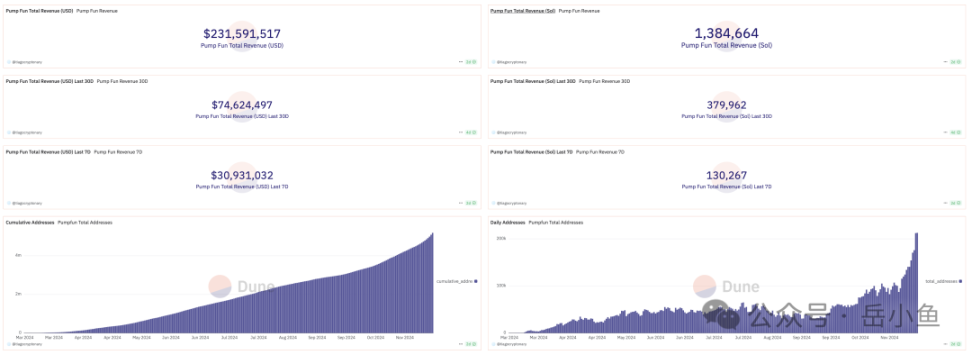

The data from Pumpfun is quite impressive, having accumulated over $200 million in revenue. During peak periods, Pump.fun's daily revenue can reach millions of dollars, at one point surpassing Uniswap Labs to become the fourth largest protocol across all blockchain networks.

If trading meme coins is like gambling, then pump is the most profitable casino. Instead of betting, why not run the casino?

Pump is a phenomenal product in this cycle, making it very straightforward to study and learn from.

01 Team Background

The Pump team initially did not start as a launchpad; they originally created an NFT marketplace but shifted to their current direction after several attempts.

Pump is a European team, and the founding members are quite young. Their CTO didn't even attend university, with the highest education being high school, yet they possess strong technical skills. Their youth and technical prowess allow them to view problems differently and have a keen intuition for products.

Thus, the success of the Pump project hinges on the youth and innovative capabilities of their team. Many people have thought of this idea, but only the PUMPFUN team could truly execute it.

The road to success is not crowded because most people cannot persist.

When you have an idea, there may be a thousand people in the world who have the same thought, but only a hundred can turn that idea into action and truly put in the effort. Among those, only a few will continue to persist and solve one difficulty after another.

This is not just in Web3; there are many such cases throughout the development history of various industries in Web2.

02 Operating Principle

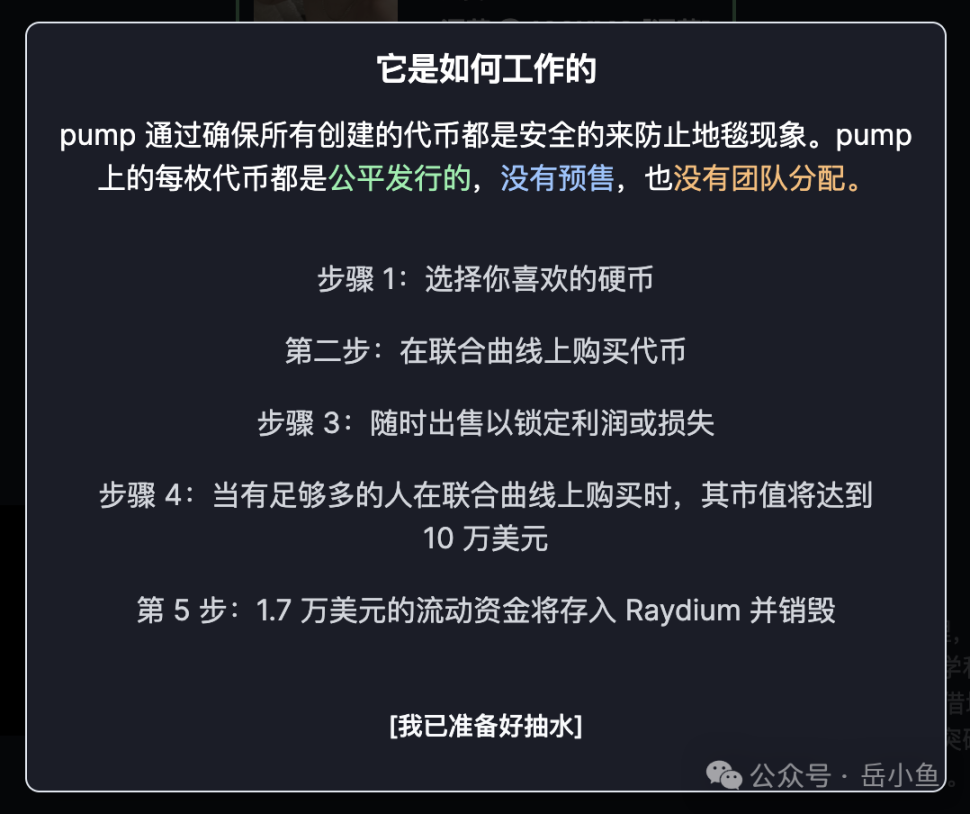

Pump emphasizes fair distribution, with no presales or team allocations. So how is this achieved?

Unlike decentralized exchanges (DEX) that use automated market makers (AMM) and require the creation of a liquidity pool to inject initial liquidity, Pump.fun employs a bonding curve pricing model, which directly uses a function curve to implement price changes.

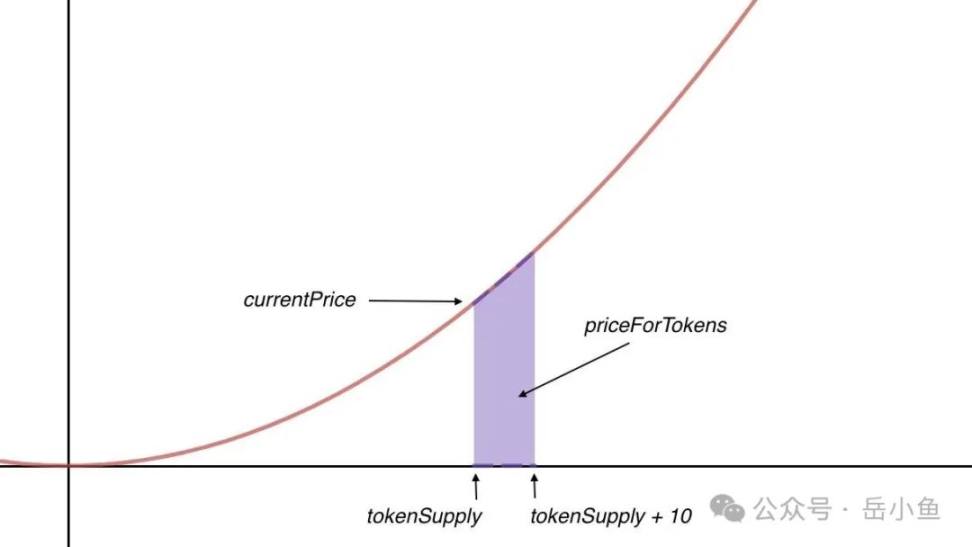

In simple terms, in the bonding curve pricing model, there is a positive exponential relationship between the token price and the number of tokens. The higher the token price, the more tokens are released.

This means that tokens will gradually enter circulation based on purchases. As users buy tokens, they will be "minted" or "released."

The bonding curve function will cause the price growth rate to accelerate as the token supply increases.

This allows for a situation where the price does not rise quickly during early purchases, but later purchases can significantly increase the price with the same amount of funds.

In the early purchase phase, since the number of tokens in circulation is relatively small, each purchase has a relatively minor impact on the price. In other words, the price increase will not be substantial.

When the number of tokens in the market reaches a considerable base, the number of tokens that can be purchased with the same amount of funds (SOL or other currencies) will decrease, but due to the characteristics of the price function, these purchases will lead to a more significant price increase.

What results can such function characteristics bring?

First, it encourages early investment. Early buyers can acquire tokens at a lower price, and as the price rises rapidly afterward, the value of the tokens they hold will increase significantly.

Second, later investments have a leverage effect. In the later stages, the same investment amount will have a greater impact on the price due to the characteristics of the price curve, providing stronger incentives for later entrants, aligning more with the characteristics of meme coins. Unlike some large-cap tokens, where later investments have little impact on the price, leading to a lack of participation.

Of course, the price increase is not without limits. The setting for Pump is that when a certain market cap is reached, a liquidity pool will automatically be constructed on the DEX, transferring to the DEX for trading.

In other words, the fundraising phase for tokens issued on Pump uses the bonding curve function, providing a price discovery mechanism for the early stages of the token.

However, without external intervention, prices may rise indefinitely due to excessive speculation. By transferring to a DEX and using AMM (automated market makers), a natural market balance mechanism can be introduced to avoid excessive price fluctuations.

Building a liquidity pool on the DEX can provide a stable trading environment for the tokens, alleviating extreme price volatility that a single curve model might bring to some extent.

When the market cap of the tokens is relatively large, a trading mechanism that can maintain price stability is needed, with better market liquidity depth to avoid severe price fluctuations.

03 Overall Process

The overall process can be divided into two stages: the fundraising phase before listing and the trading phase after listing.

- Create Token: First, users can create a token with one click, at a very low cost (0.02 SOL), without needing a technical background. The creation process only requires inputting the token name, symbol, description, and an image.

- Fundraising Phase: The creator attracts other users to purchase the token. All token models on Pump.fun are the same, with a total supply fixed at 1 billion, an initial circulation of 0, and an initial "virtual market cap" set at 30 $SOL, releasing tokens through user purchases.

- Reaching Listing Threshold: When the market cap reaches $100,000 (valued in SOL), meaning the fundraising amount reaches $17,000, the token circulation will be 800 million, and Pumpfun will mint an additional 200 million tokens, forming a trading pair to be added to the decentralized exchange Raydium, ultimately launching a decentralized issued Memecoin with a market cap of $69,000 and a total token supply of 1 billion.

- Successful Listing: Upon listing on Raydium, the price of each token at the moment of fundraising completion is $0.00000041 $SOL, which is 14.64 times the initial virtual pool price. Throughout the process, Pumpfun charges a 1% transaction fee during the fundraising phase and a listing fee of 6 SOL when the token goes live on Raydium.

04 Highlight Feature: Live Streaming

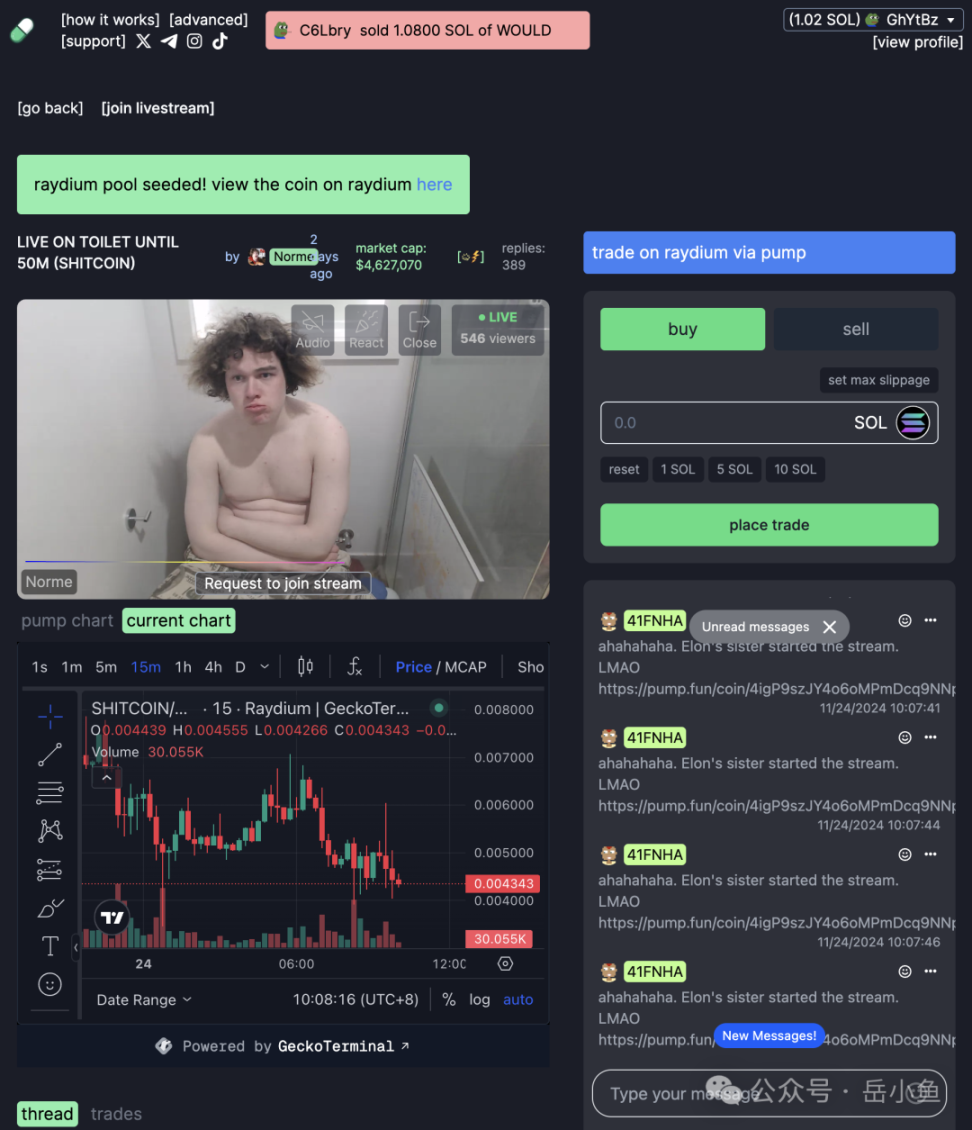

Recently, Pump's live streaming feature has gone viral. After browsing around, I was utterly shocked; there are streams featuring adult content, streams where a grandmother is locked up until a certain market cap is reached, and streams where people sit on the toilet to hype things up—it's truly extreme.

When it comes to live streaming for trading coins, I initially thought of people streaming their specific trading operations, but I didn't expect it to evolve into various abstract methods to attract attention, similar to live commerce.

Attention is a scarce resource.

Meme coins themselves are tools for attracting attention, drawing people's eyes through humor and elements of pop culture.

Live streaming further amplifies this attraction through real-time interaction, making viewers more willing to participate and engage.

In simple terms, meme tokens inherently possess entertainment value, and live streaming magnifies this entertainment aspect. Users can engage in a market that resembles a game, providing both entertainment and a sense of participation.

More importantly, the model of "Meme Coin + Live Streaming = Attention Economy" creates a new economic model within the cryptocurrency ecosystem.

Through this combination, creators of meme coins can quickly accumulate a large following, and live streaming provides direct opportunities for interaction with the community, transforming this attention into investments and trades in meme coins.

Live streaming offers meme coins instant promotion and real-time marketing opportunities. Creators can directly communicate with users, sharing the token's concept, market analysis, or real-time trading activities.

Pump's live streaming feature is not just a technical innovation; it changes the way meme tokens are marketed, making the issuance and trading of tokens more social and entertaining.

This not only increases user engagement but also provides a platform for creators who wish to promote meme tokens through social media influence.

Everything has its pros and cons.

In the Web2 industry, various streamers also try to attract attention in various ways, ultimately profiting through tips or sales.

In the Web3 industry, however, with Pump's live streaming, the platform's constraints are very weak, and since money is closer, streamers can directly issue and trade coins, which may catalyze even more abstract and boundary-less behaviors.

This can lead to typical issues related to adult content, gambling, and drugs, as these are rooted in human nature.

For instance, there are already many adult content streamers.

It must be said that the adult industry has a keen sense of smell, often being the first to adopt innovative technologies. For example, after AI became popular, adult videos featuring AI face-swapping quickly emerged, placing celebrities' faces onto adult videos to satisfy many people's sordid fantasies.

While Pump's live streaming feature has indeed achieved significant results in attracting attention and increasing user participation, the lack of a certain review mechanism could turn the platform into a breeding ground for unhealthy content, ultimately backfiring on the platform itself.

Not all traffic is valuable; some are toxic.

Currently, it seems that Pump is indulging in the proliferation of such harmful content. While it may help the platform achieve explosive popularity in the early stages, if not restricted later, it could lead to more negative incidents, prompting regulatory intervention.

Therefore, Pump needs to find a balance between attracting user attention and maintaining a healthy, compliant platform ecosystem.

05 Conclusion

The Pump team is highly product-oriented, and Pump's product mechanism design is very innovative, meeting the market's demand for meme coin issuance and speculation.

More critically, Pump's live streaming feature has further propelled its popularity, with meme coins + live streaming = an explosion of the attention economy.

Pump is no longer just a phenomenal product in the crypto industry; it is continuously gaining popularity and breaking out.

Although meme coins are gambling and pure speculation, they may also align with the most primitive desires and needs of human nature.

Meme coins are also a unique manifestation of crypto culture and decentralized culture.

The craze for meme coins essentially tells the market: blockchain technology is so complex, and the threshold for Web3 applications is so high, so ordinary users should come to this big casino to experience the thrill of trading and satisfy their desire for quick wealth.

Meme coins are the most primitive and purest form of capital, and Pump meets the demand for everyone to issue and trade coins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。