Original Title: $TIA - an OTC story

Author: Taran, STIX

Translation: Ismay, BlockBeats

Editor’s Note: TIA will unlock approximately 176 million tokens today at 20:00, accounting for 80.13% of the current circulating supply, equivalent to about $900 million. According to Coinglass data, the total open interest in TIA contracts across the network is nearing a historical high. Celestia has attracted market attention during this crypto cycle due to its active OTC trading, especially with the upcoming massive unlock bringing new volatility opportunities to the market. This article delves into the key dynamics of OTC trading and changes in investor behavior as TIA has transitioned from the early bull market to its current volatility. With a large number of unlocks about to commence, supply shocks, discount pressures, and adjustments in funding rates may bring an unprecedented "unlock effect" to the $TIA market.

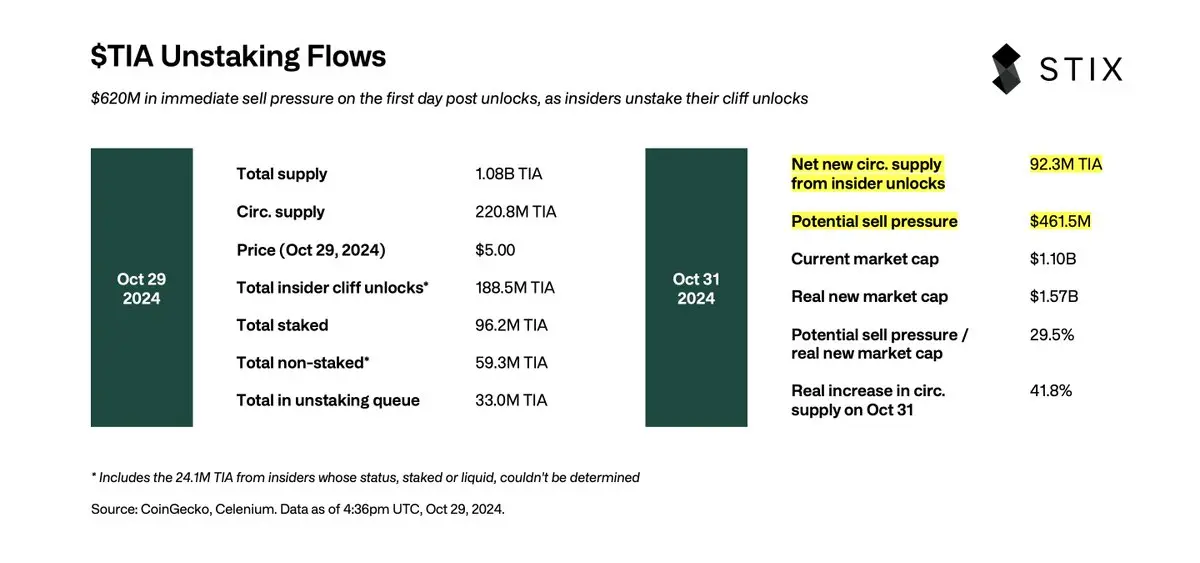

We used on-chain data from the @celenium_io API to analyze the potential impact of the unlocking dynamics on TIA's price movements in November. The results are summarized in the table above, indicating that a total of 92.3 million TIA will enter the circulating market post-unlock, which will constitute the upper limit of overall spot selling pressure.

TIA has a 21-day unstaking period, and users who have unlocked and are ready to trade as of October 31 have completed their unstaking. The total of unstaked tokens, those in the 21-day unstaking queue, and approximately 24.1 million unrecorded tokens amounts to 92.3 million TIA, equivalent to about $460 million in maximum selling pressure.

Notably, this accounts for less than half of the total unlock amount, indicating that the selling pressure is half of what the market expected.

Another interesting data point is the actual increase in circulating supply relative to the current circulating amount, which shows a dilution rate of approximately 41.8%.

The first batch of unlocked tokens was largely sold to OTC buyers, who hedged through perpetual contracts, leading to a surge in open interest over the past few months. We expect many of these short positions to gradually close, partially offsetting the spot selling pressure, and this round of capital reset may signal a positive outlook for spot buyers.

Our analysis assumes that the 11 million TIA cliff unlock for OTC buyers is included in the unstaked pool (these tokens come from treasury wallets not marked on the blockchain explorer). We identified a total of 292 belonging wallets, some of which were not fully marked, so this discrepancy is included in the unstaked pool.

TIA OTC Trading History on STIX:

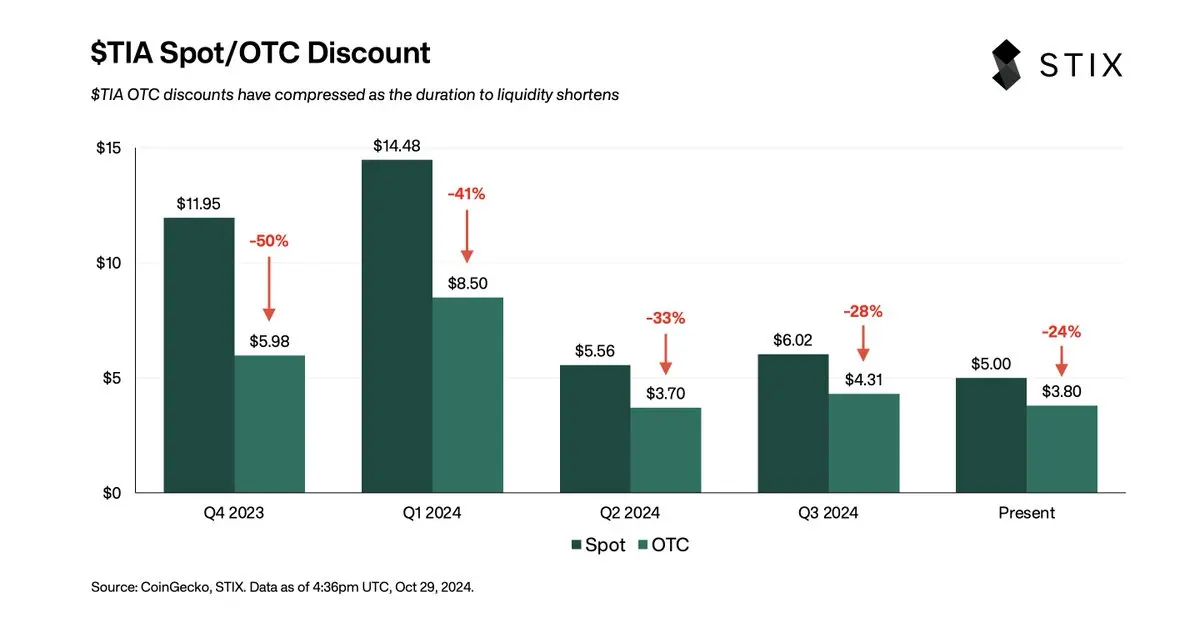

Undoubtedly, Celestia is one of the most active assets in OTC trading during this cycle, primarily because it provided an early long opportunity for directional buyers eager to position themselves at the beginning of the cycle. Sellers, on the other hand, actively sold due to unrealized large profits and a lack of expectations for the upcoming bull market (Q3 2023).

In Q1 2024, as the bull market matured, TIA rose above $20, but OTC trading activity was low at this time, as sellers were unwilling to accept discounts of over 40%, while buyers were also reluctant to bid above the $8.5 ceiling. We saw almost no trading activity, as sellers "felt" financially secure, preferring to maintain their risk exposure despite the opportunity to realize returns of 100 to 800 times.

The situation changed when TIA fell below $5, coinciding with the Celestia Foundation starting a $100 million OTC financing at a price of $3. The unlocking conditions for buyers were the same as for private investors—33% unlock on October 31, 2024 (less than two months from the financing), followed by linear unlocking over the next 12 months.

In Q3 and Q4 2024, OTC trading activity for TIA surged, with sellers offloading various positions, and we traded a significant amount of both the first batch of unlocked tokens and the overall unlocks.

According to STIX data, since July, the total trading volume for TIA has been approximately $60 million, suggesting that the actual trading volume through various liquidity channels may exceed $80 million (assuming STIX holds a 75% market share in OTC).

Shorts will continue to close positions before the unlock, and funding rates may reset to 0 or positive values. Those who missed the October 9th unstaking deadline may also complete their unstaking in October, leading to an increase in spot supply (preparing to sell in November).

In any case, the supply shock is significant, and this is one of the most closely watched unlocks of this cycle, combined with depressed OTC discounts, which may create numerous trading opportunities for the token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。