The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Oct. 10, 2024, it was penned by Bitcoinminingstock.io author Cindy Feng.

TeraWulf (WULF) has emerged as a notable player in the Bitcoin mining industry in 2024, drawing attention due to its significant stock performance and institutional backing. While the company was not widely recognized in previous years, its recent performance deserves closer examination.

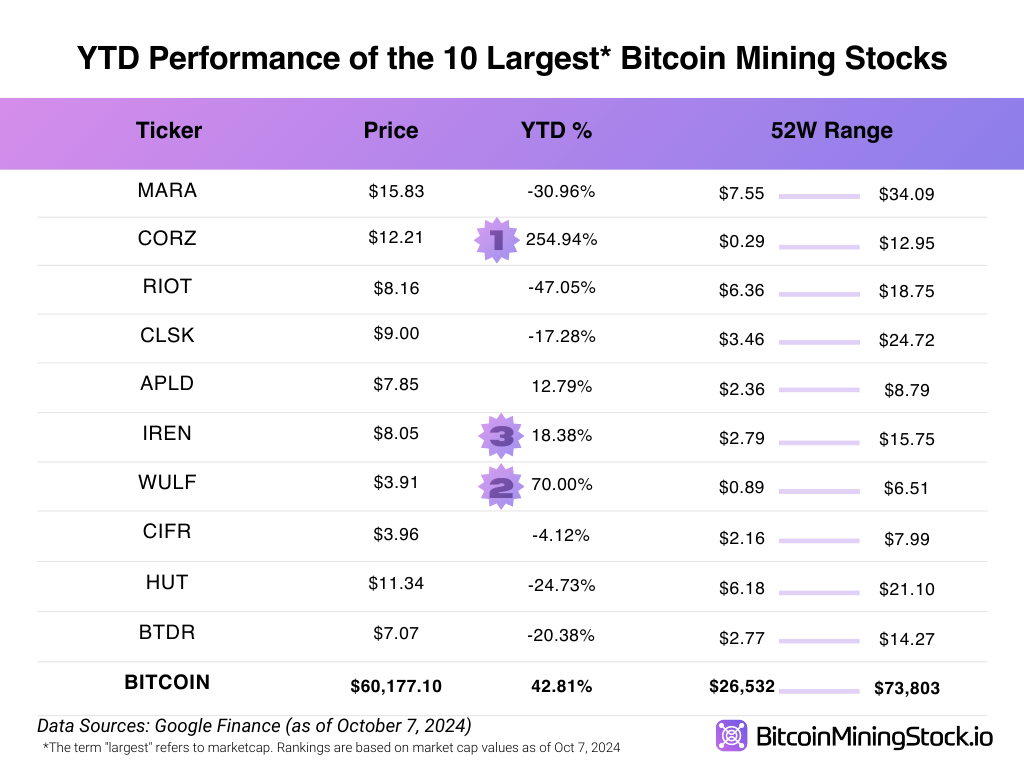

As of October 7, 2024, TeraWulf’s share price increased by 70% YTD, outperforming Bitcoin’s own 42.81% rise and ranking second among the top 10 largest Bitcoin mining stocks, following Core Scientific‘s 254.94% surge. Additionally, 62.49% of TeraWulf’s shares are owned by institutions (as of Oct 7), suggesting considerable interest from professional asset managers. This analysis aims to decode the factors contributing to TeraWulf’s investor appeal.

Year-to-Date (YTD) Performance of the 10 Largest Public Bitcoin Mining Companies

Financial Health: Zero Debt and Positive EBITDA

TeraWulf’s financial standing is a key aspect of its appeal. According to their latest 10-Q filings and press releases:

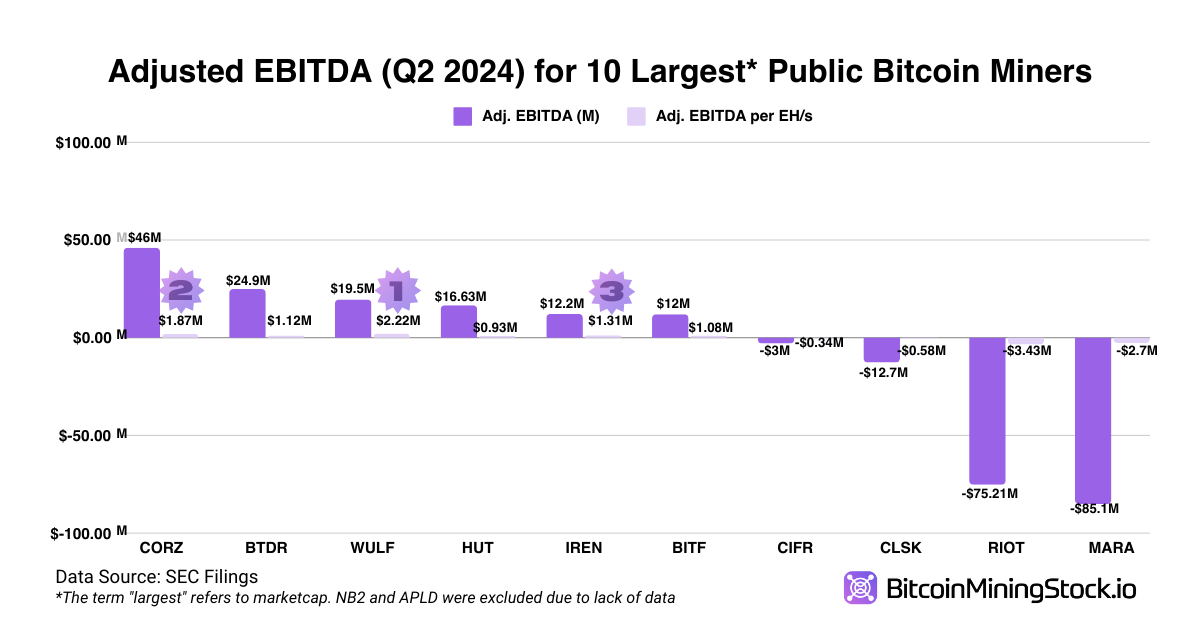

- Adjusted EBITDA: Reported a non-GAAP adjusted EBITDA of $19.5m for Q2 2024, with $104.1m cash and cash equivalents (excluding of $0.9m BTC)

- Debt Status: Announced the early repayment of its final $77.5m debt installment on July 9, resulting in zero outstanding debt.

In contrast, 4 of the 10 largest public Bitcoin miners reported negative EBITDA in Q2 2024, ranging from -$3m to -$85.1m. TeraWulf outperformed its peers with the highest adjusted EBITDA per EH/s among these top ten companies. Its debt-free status and cash positions provide greater financial flexibility for scaling operations and investing in infrastructure, positioning it favorably against competitors.

Adjusted EBITDA (Q2 2024) for the Top 10 Public Bitcoin Miners” (excluding NB2 and APLD due to lack of data)

Operational Expansion: Hash Rate Scaling and HPC Investment

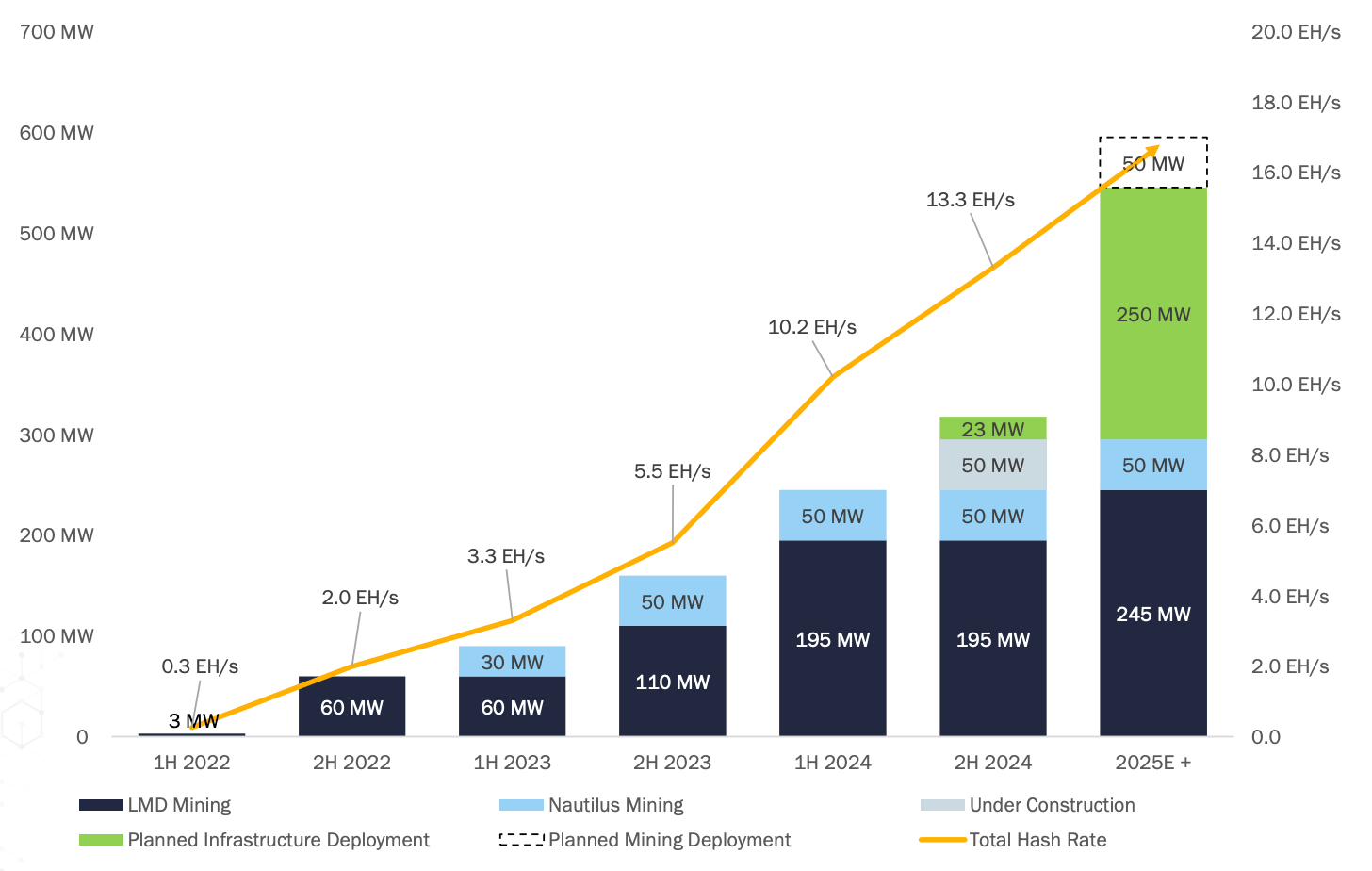

TeraWulf is actively expanding its operational capacity, achieving 81.82% YoY growth (as of Sep 30) in hash rate:

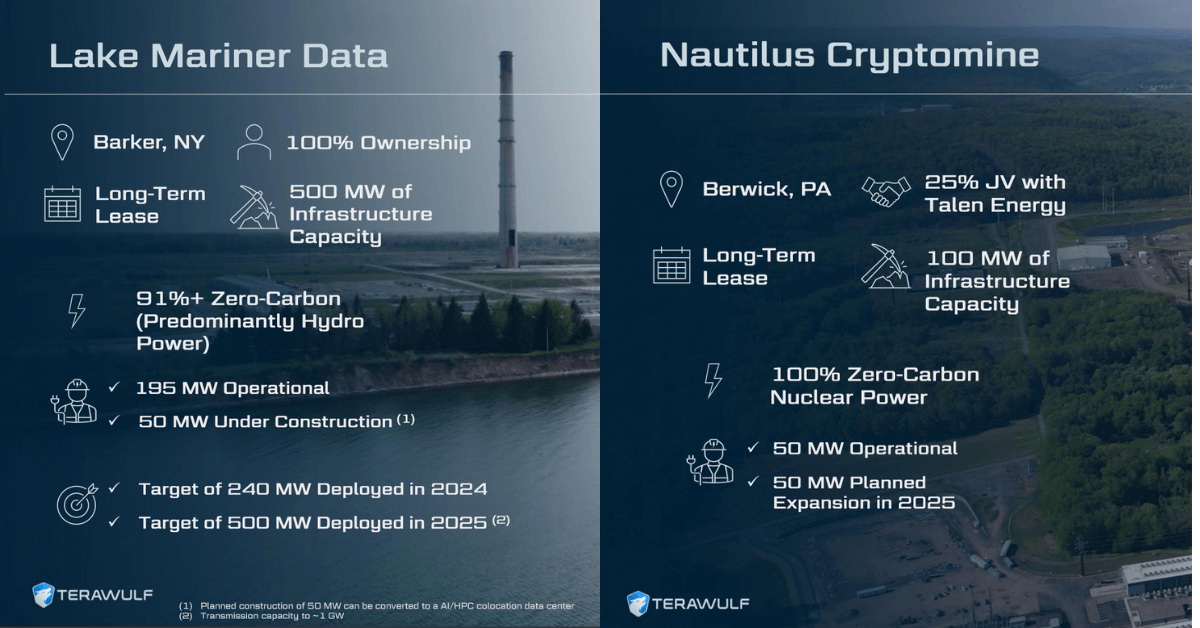

Mining Facilities

- Lake Mariner: Currently operates at 195 MW, with potential expansion to 500 MW.

- Nautilus: Operated at 50 MW, scalable to 100 MW (operations exited following the stake sale announcement).

TeraWulf’s Data Centers (screenshot from its August Investor Presentation)

Growth Plan

- Targets 13.3 EH/s by the second half of 2024, with further expansion planned in 2025.

TeraWulf’s Hash Rate Expansion Roadmap (screenshot from its August Investor Presentation)

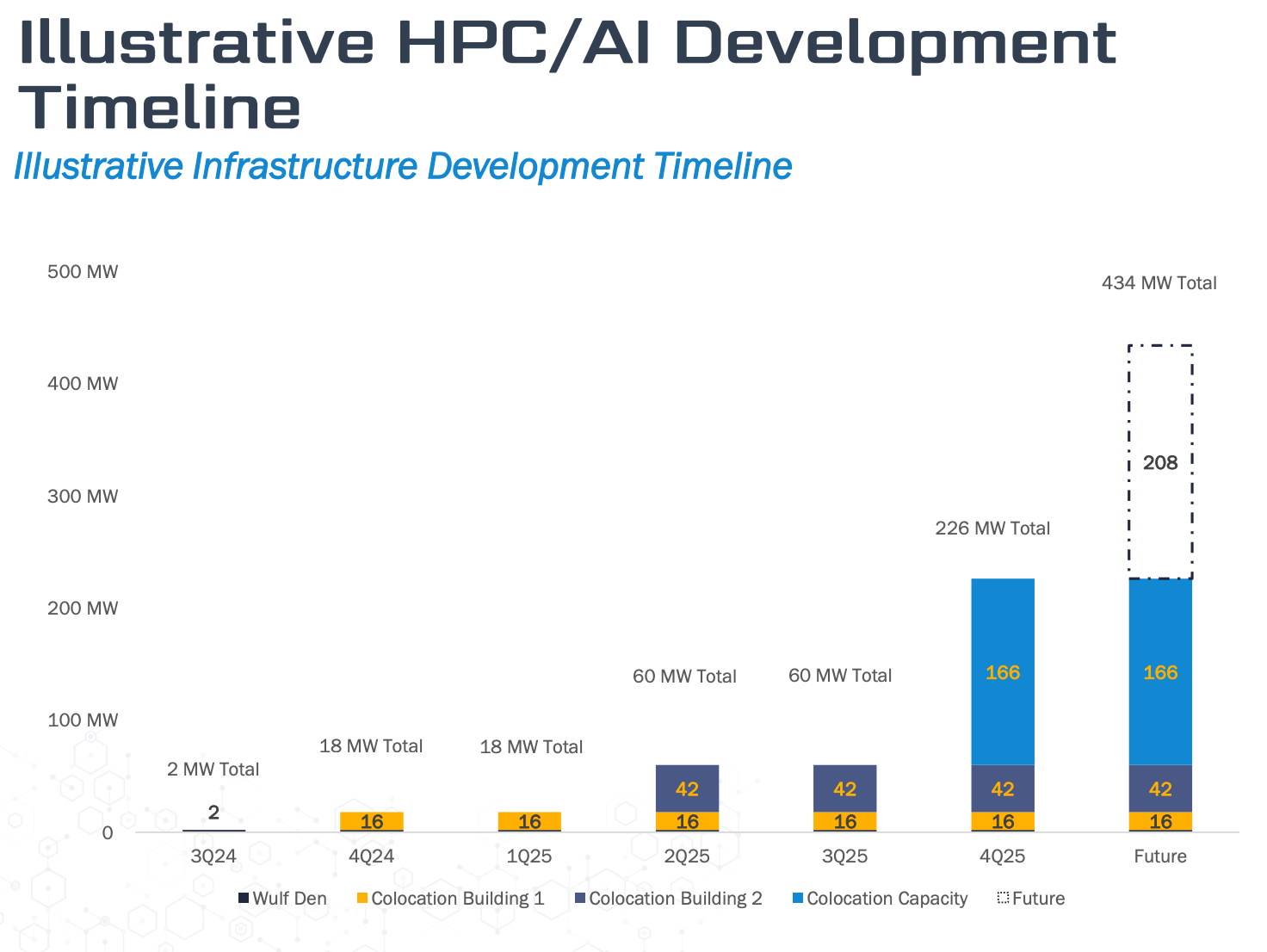

Additionally, TeraWulf is investing in HPC and AI data centers which aligns with the industry trend toward diversification:

- CB-1 Building at Lake Mariner – Scheduled for completion in Q1 2025.

- CB-2 Facility – A planned 50 MW facility expected by Q2 2025.

According to CFO Patrick Flury, TeraWulf plans to secure a one-year revenue prepay from customers as equity for these projects, with the remaining 70-80% financed using traditional project finance methods, similar to energy infrastructure projects. This approach differs from peers who rely on customer-funded capital expenditures, enabling TeraWulf to maintain greater control over project financing and to minimize shareholder dilutions.

Clear Bitcoin Production Costs

According to its CFO Patrick Flury, TeraWulf approaches Bitcoin mining like a traditional commodity business, focusing on the marginal cost per unit—similar to dollars per barrel in oil. The production cost consists of three main components:

- Power Costs

- Lake Mariner: Average rate of $0.04 per kWh.

- Nautilus: Fixed rate of $0.02 per kWh (operations exited as of October 3).

- Selling, General & Administrative (SG&A) Expenses

- Site-Level Operating Expenses

These factors contribute to an all-in production cost of approximately $40,000 per Bitcoin. With Bitcoin prices above $60,000 as of September 2024, this results in a margin of more than $20,000 per mined Bitcoin. In September, the company produced 176 BTC, suggesting a net cash flow from mining operations exceeding $120,000 per day under similar market conditions.

This cost breakdown approach provides clarity for both institutional and retail investors, reducing uncertainty. In contrast, most mining companies either stay mysterious or report only electricity costs, making it difficult to gauge the true cost of production per Bitcoin (BTW, the market and investors in general hate uncertainty!).

Updates on Nautilus Joint Venture: Nuclear Power Access

Prior to October 3, 2024, TeraWulf held a 25% equity stake in the Nautilus joint venture with Talen Energy, which equates to 50 MW of the 200 MW capacity. The Nautilus facility is a unique Bitcoin mining site because it operates behind the meter at one of the largest nuclear facilities in the U.S., making TeraWulf the only public mining company with direct access to nuclear power.

Key details about Nautilus Site

- Power Contract: Secured a fixed rate of $0.02 per kWh until Q1 2028.

- Post-2028 Rates: Will transition to nodal market rates in the PJM West market, which include Pennsylvania, New Jersey, and Maryland.

- Lease Term: Extends until 2033.

- Estimated Value: The low-cost power contract was valued at $30m to $35m based on the power market price.

Sale of Nautilus

In early 2024, Talen Energy sold the land and substation of the Nautilus site to Amazon for approximately $650m, making Amazon the landlord. On October 3, TeraWulf announced the sale of its 25% equity stake in Nautilus to Talen Energy for approximately $92m. This sale includes $85m in cash and 30,000 miners contributed by Talen, valued at around $7m. The company achieved a 3.4x return on its original investment.

Following this divestment, TeraWulf is now focusing on expanding its Lake Mariner facility, using proceeds from the sale to enhance HPC/AI capabilities and mining capacity, which includes constructing new facilities (CB-1 and CB-2).

TeraWulf’s HPC Development Roadmap (screenshot from its investor presentation)

Note: If you’re interested in diving deeper into TeraWulf’s Nautilus site, I found this X Space Discussion with its CFO and SVP of Operations incredibly helpful.

By reading and analyzing multiple materials, I sense the company’s board has extensive experience in finance and energy, which is a critical advantage as Bitcoin mining enters a pivotal period. TeraWulf’s prudent management approach, including its focus on shareholder value, could even position it to be one of the first Bitcoin mining companies to distribute dividends. During one interview, Patrick Flury mentioned that as they diversify into HPC and continue generating positive cash flow, they may consider shareholder returns such as dividends or stock buybacks. However, it’s important to note that the industry remains highly volatile, given the nature of Bitcoin itself, making any investment is inherently risky.

The original version of this article can be found here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。