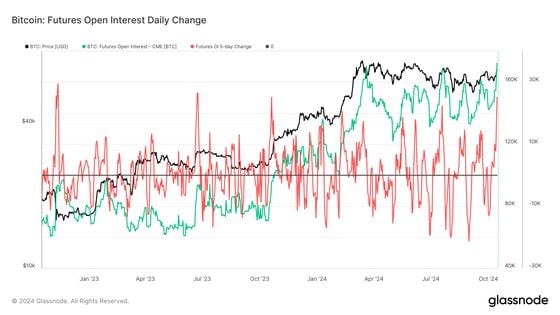

Bitcoin (BTC) futures open interest (OI) on the Chicago Mercantile Exchange (CME) has hit a new all-time high of 172,430 BTC ($11.6 billion).

On Tuesday, CoinDesk reported that cash-margin open interest reached a new all-time high, with CME accounting for 40% of the total. Open interest refers to the number of open or active futures contracts at any given time.

In the past five trading days, CME has seen open interest ramp up by 25,125 BTC. This is one of the highest levels recorded over a five-day period in recent years.

The last time we saw such a build up was June 2023 (26,525 BTC), which coincided with the BlackRock filing for the spot bitcoin ETF, iShares Bitcoin Trust (IBIT). During this period bitcoin surged from approximately $25,000 to $30,000.

Then, in October 2023, CME saw the addition of 25,115 BTC, which coincided with CME becoming the largest futures exchange for the first time, overtaking Binance. Once again, in this period, from October to year-end bitcoin rose from approximately $25,000 to over $40,000.

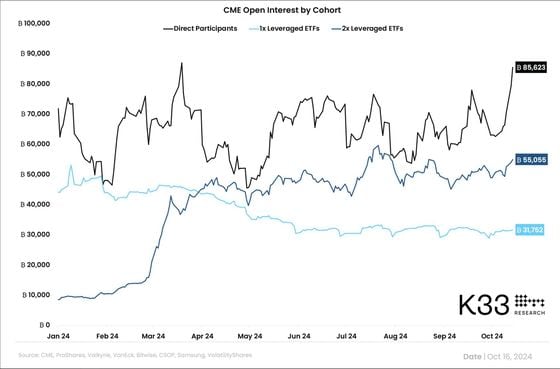

Vetle Lunde, senior analyst at K33 Research, also pointed out this milestone and explored which cohort is driving this growth.

Lunde notes that active and direct market participants are driving this growth on the CME, and it's not coming from futures-based ETFs such as ProShares Bitcoin ETF (BITO).

"The growth is clearly driven by active/direct market participants - not inflows to futures-based ETFs".

The chart below by Lunde, shows a breakdown of open interest by cohort on the CME. Active and direct participants currently hold 85,623 BTC a similar amount to what was held in March when bitcoin reached it's all-time high.

However, the 1x leveraged ETF has steadily declined throughout the year and holding just 31,752 BTC. While, the 2x leveraged ETF, which saw a significant surge in March has only experienced slight growth since then. This suggests speculation and leverage were key drivers in the early part of the year, but are no longer the primary drivers in the current market.

Lunde notes that the activity is structured around the November expiry, following the U.S. election.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。