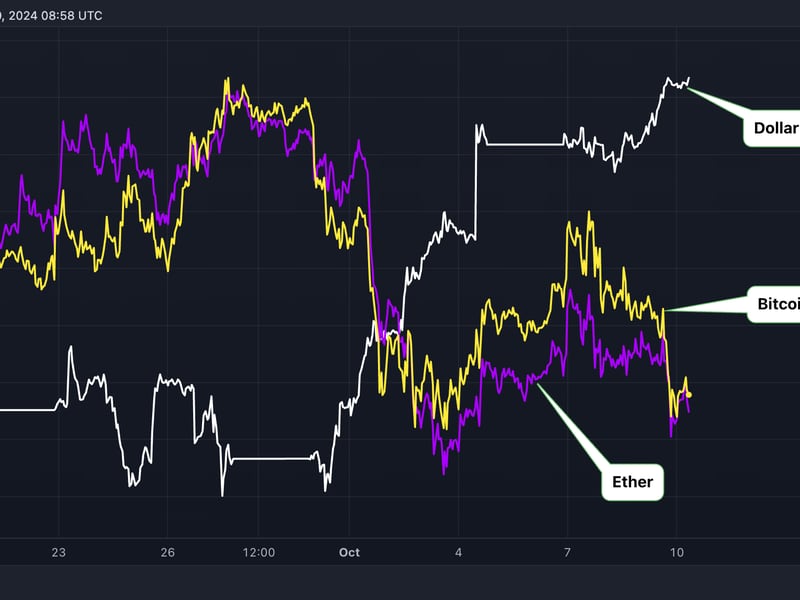

The crypto market was listless during the European morning as a hawkish rethink of the odds of outsized Fed interest-rate cuts kept the U.S. dollar bid ahead of a pivotal inflation report.

Bitcoin (BTC), the leading cryptocurrency by market value, traded near $61,000, slightly higher than the overnight low of $60,400 but still down more than 1.5% over 24 hours. Ether (ETH) saw similar price action, trading 1.9% lower at $2,395. Other major alternative cryptocurrencies, BNB and SOL, traded 1% lower, with XRP down 0.6%, according to CoinDesk data.

The dollar index (DXY), which gauges the greenback's exchange rate against major fiat currencies, rose to 102.97, the highest since Aug. 16, taking the cumulative gain since the Sept. 30 low of 100.18 to 2.7%, according to data source TradingView.

The CME's FedWatch tool showed traders assigning an 85% probability to the Fed cutting interest rates by 25 basis points at its Nov. 7 meeting instead of 65% a week ago. Back then, markets saw a 35% chance of the Fed delivering another 50 basis-point cut by year-end, having made the first in September.

Friday's blowout nonfarm jobs report revived the "U.S. exceptionalism" story, forcing traders to reassess expectations for faster and bigger rate reductions.

The minutes from the September Fed meeting, released Wednesday, showed policymakers were divided on how aggressive the central bank should be. "A substantial majority of participants" favored cutting by half a percentage point, though some expressed misgivings about going that large, the minutes said.

"Crypto sentiment has moved back into the fear zone (39), reinforcing the contrast with 72 (greed) in equities," Alex Kuptsikevich, a senior market analyst at FxPro, said in an email. "This dynamic is easily explained by the appreciation of the dollar and the increased attractiveness of bonds, which reduces institutional traction in bitcoin."

Kuptsikevich said Thursday's U.S. inflation report could breed market volatility if it deviates from expectations.

The data due at 12:30 UTC is expected to show the consumer price index rose 0.1% month-on-month and 2.3% year-on-year in September, following August's 0.2% month-on-month and 2.5% year-on-year. The core CPI, which excludes food and energy prices, is forecast to print at 0.2% month-on-month and 3.2% year-on-year, according to FXStreet.

Hotter-than-expected CPI prints could strengthen calls to stop rate cuts, potentially adding to DXY's upward momentum and leading to risk aversion.

ING, however, said early this week that the CPI won't lead to material changes in the market positioning, given the Fed's focus has shifted to the labor market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。