“The time has come,” stated Fed chairman Jerome Powell back in August at the Jackson Hole central bank symposium. Last week, the Fed cut its federal funds target rate by 50 bps to 5.00% p.a. (upper limit) which was slightly more than markets had priced in before the FOMC meeting. In other words, the Fed positively surprised markets with this rate cut.

It is quite likely that the Fed is just getting started with rate cuts. At the time of writing, the market already expects 3 additional cuts (75 bps) by year-end and another 5 cuts (125 bps) next year through December 2025. The Fed has also telegraphed additional cuts via its latest Summary of Economic Projections (SEP) (aka “dot plot”).

Nonetheless, despite this more-than-expected interest rate reduction of 50 bps, it is quite likely that the Fed still remains “behind the curve.”

You're reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

For instance, a standard Taylor rule based on the unemployment rate and core PCE inflation implies that a fed funds target rate of around 3.6% p.a. is already warranted based on the underlying economic and inflationary momentum.

In addition, the latest fund manager survey by Bank of America indicates that monetary policy was still “too restrictive” in September 2024 – in fact, the most restrictive since October 2008 according to this survey.

There still remains an increased risk of a recession as several reliable indicators such as the prominent “Sahm rule” remain triggered.

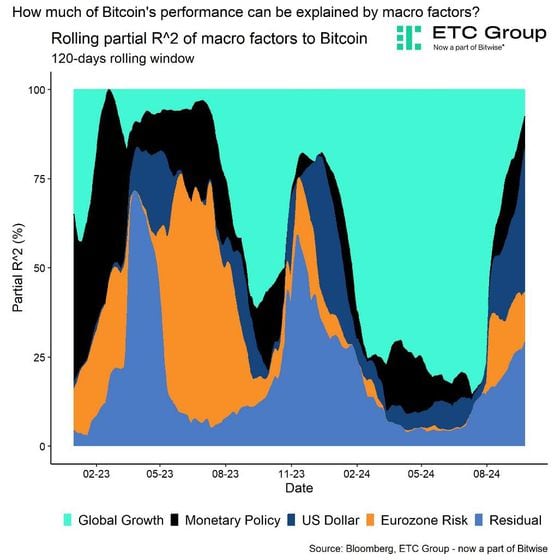

That being said, our quantitative analyses imply that global growth has become less relevant for the performance of bitcoin while other factors like monetary policy or the US dollar have become more important.

In other words, a US recession might not be as negative as widely anticipated for bitcoin and other cryptoassets. To the contrary, it may lead to even more Fed rate cut expectations and US Dollar weakness which could provide even more tailwind.

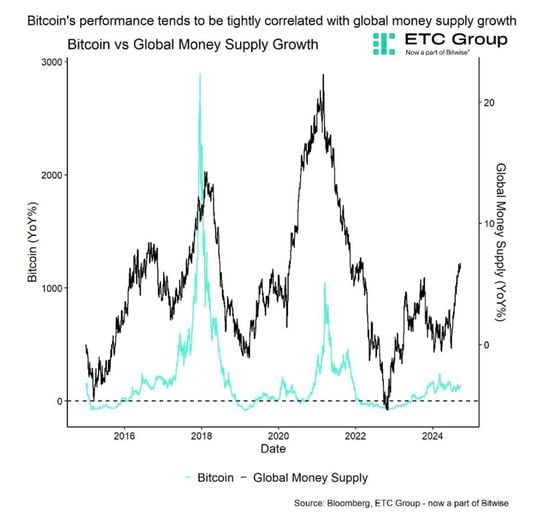

With the latest move by the Fed and other major central banks, the global liquidity tide is clearly turning; global money supply has already reached new all-time highs and is accelerating. Expansionary money supply growth periods are usually associated with bitcoin bull runs.

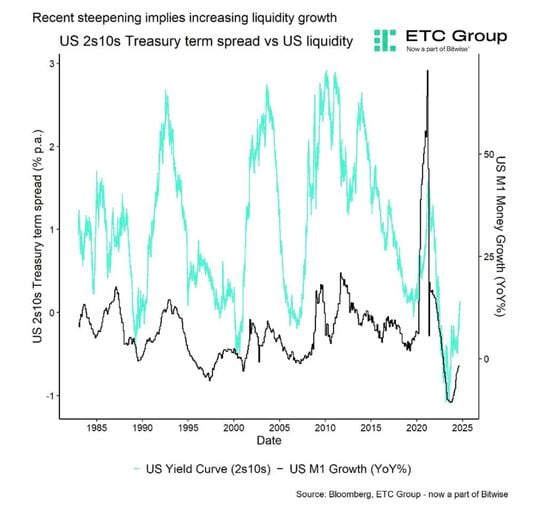

The re-steepening of the US yield curve which tends to be a recessionary indicator is also an indicator for increasing liquidity and therefore bullish for scarce assets like bitcoin.

What is more is that the increase in global liquidity is coinciding with the increasing supply scarcity of bitcoin which has been intensifying since the latest halving in April 2024.

Our analyses have shown that there tends to be a significant lag between the halving event itself and the moment the supply shock starts to become significant, as the supply deficit only tends to accumulate gradually over time.

So, it appears as if there is a perfect confluence between an increase in potential demand via global money supply and a simultaneous reduction in available supply via the halving.

The market has been mired in “chopsolidation” – a choppy consolidating range-bound market – since the latest all-time high in March 2024. This was due to several factors such as government sales of bitcoin, Mt. Gox trustee’s distribution of bitcoins, or the macro capitulation in early August 2024.

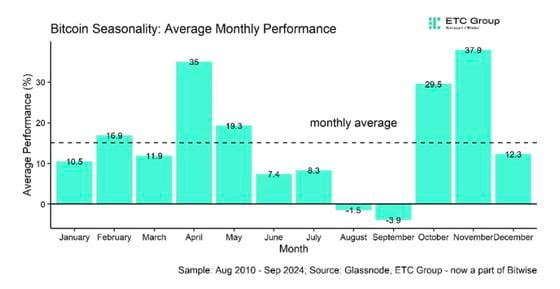

In this context, the summer months have generally been one of the worst performing months for bitcoin historically with September being the worst month of the year.

However, Q4 tends to be the best month for bitcoin from a pure performance seasonality perspective and we also expect bitcoin to break out of this chopsolidation in Q4.

It seems as if the wait for a new break-out to the upside is finally over. The Fed pivot may have just delivered the perfect catalyst for that.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。