Author: NingNing

After the Intent Centric paradigm was proposed by Paradigm, it became a hot topic in the industry for a period of time last year. However, the terminology of this new paradigm is a bit esoteric, and many people in the market find it somewhat difficult to understand.

Essentially, the Intent Centric paradigm is a computational paradigm that abstracts user intent and encapsulates complex execution logic. By introducing an intent layer as an intermediate abstraction layer, it decouples user needs from underlying execution.

Still having trouble understanding? Let's take a more down-to-earth example:

- Traditional on-chain operation: Call function X of contract A, obtain token B, then call cross-chain bridge contract C to transfer B to chain D, and finally exchange it for token F using DEX contract E on chain D.

- Intent Centric approach: Exchange A for F on chain D.

See the difference? The Intent Centric approach abstracts complex multi-step operations into a single intent, greatly simplifying the user interaction model.

Why Intent Centric?

Why are VC institutions and developers excited about this new paradigm at its inception? This is because the Intent Centric paradigm is not just a technical paradigm innovation; it represents the beginning of Web3's transition from "mechanism design" to "experience design". It has the potential to reshape the entire blockchain computing model and pave the way for true large-scale adoption.

The Intent Centric paradigm has revolutionary effects in the following 5 aspects:

- Computational complexity optimization: By consolidating multi-step operations into a single intent, global optimization can be performed at the execution level. This not only reduces gas consumption but also significantly improves execution efficiency.

- State space compression: Under traditional methods, each intermediate step results in on-chain state changes. The Intent Centric mode can compress multiple state changes into a single state transition, greatly reducing on-chain storage pressure. This is particularly important for public chains with severe state explosion issues like Ethereum.

- Enhanced parallelism: The abstract nature of intent allows the system to be more flexibly scheduled at the execution level. For example, cross-chain intents from multiple users can be batch processed, thereby increasing overall throughput.

- Enhanced interoperability: Intent, as a standardized abstraction, can greatly promote interoperability between different protocols. This lays the foundation for building a truly cross-chain, cross-protocol ecosystem. UniswapX's practice has shown that intent-based routing can seamlessly integrate liquidity from multiple DEXs, providing users with better execution prices.

- Improved security: By encapsulating complex logic in auditable intent executors, the security risks of direct user operations can be greatly reduced. According to CoW Swap's data, adopting the Intent mode has reduced losses caused by user operation errors by over 90%.

Instantiation of the Intent Centric Paradigm

Currently, there are instantiation application cases of the Intent Centric paradigm (not limited to):

- dappOS's Intent Assets: This is a typical application of state polymorphism. Intent Assets appear as a single asset logically, but may be distributed across multiple chains physically. When a user expresses the intent to use them, the system automatically performs the optimal cross-chain routing and aggregation. This design not only optimizes capital utilization efficiency but also provides users with a seamless cross-chain experience. Technical highlights: It adopts a ZK-based state proof mechanism to ensure the security and low latency of cross-chain operations.

- Renzo's "Restake from Anywhere": This is an innovative application of Intent Centric in the staking field. By abstracting staking operations as intents, Renzo has successfully solved the liquidity and composability issues of ETH staking. Core innovation: It introduces a new staking token standard, allowing staking intents to freely circulate between different chains, thereby achieving true "cross-chain staking".

- Everclear's liquidation layer: Everclear cleverly solves the liquidity dispersion issue in cross-chain operations by introducing an intent liquidation layer. It virtualizes liquidity from multiple chains into a global liquidity pool, greatly improving capital utilization efficiency. Technical highlights: It uses innovative multi-party computation (MPC) technology to coordinate cross-chain operations, ensuring security and significantly improving execution efficiency.

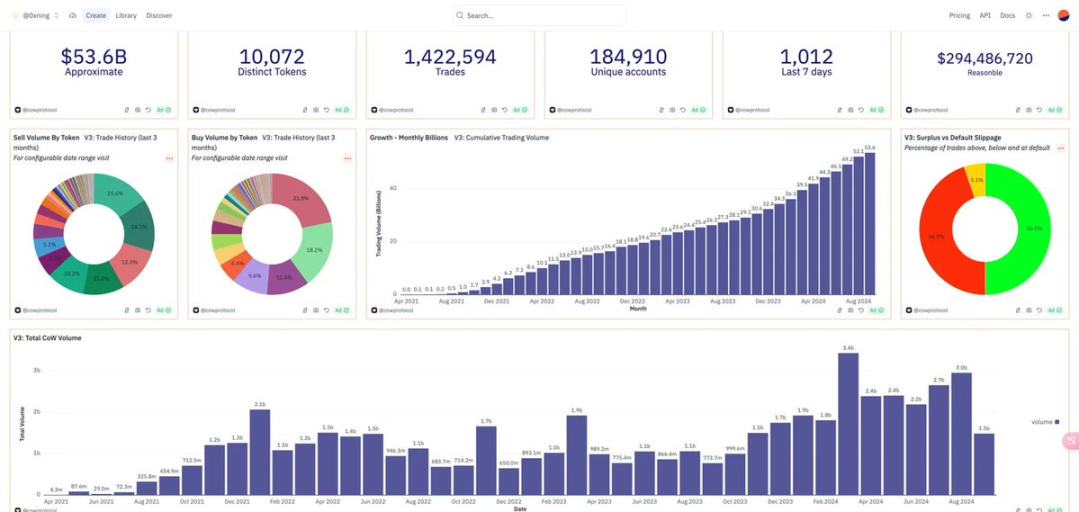

- CoW Swap's batch auction mechanism: CoW Swap ingeniously solves the MEV (Maximum Extractable Value) problem in DEX and greatly improves transaction efficiency by introducing a batch auction mechanism. This is a revolutionary application of the Intent Centric paradigm in the decentralized trading field. Core innovation: a) Batch order matching: CoW Swap collects user trading intents in batches instead of executing them immediately. This allows the system to find the best match in a larger order pool, greatly increasing the probability of execution and price optimization space. b) Off-chain solving, on-chain settlement: Order matching is done off-chain, and only the final settlement result is recorded on-chain. This design significantly reduces gas costs and improves system scalability. According to CoW Swap's data, this method can reduce gas costs by as much as 90%. c) Competitive Solver mechanism: CoW Swap introduces a competitive Solver mechanism, allowing multiple Solvers to compete to provide the best order matching solution. This not only improves matching efficiency but also introduces decentralized elements, enhancing the robustness of the system. d) MEV protection: By batch processing and off-chain matching, CoW Swap effectively eliminates common MEV attacks such as front-running and sandwich attacks in traditional DEX.

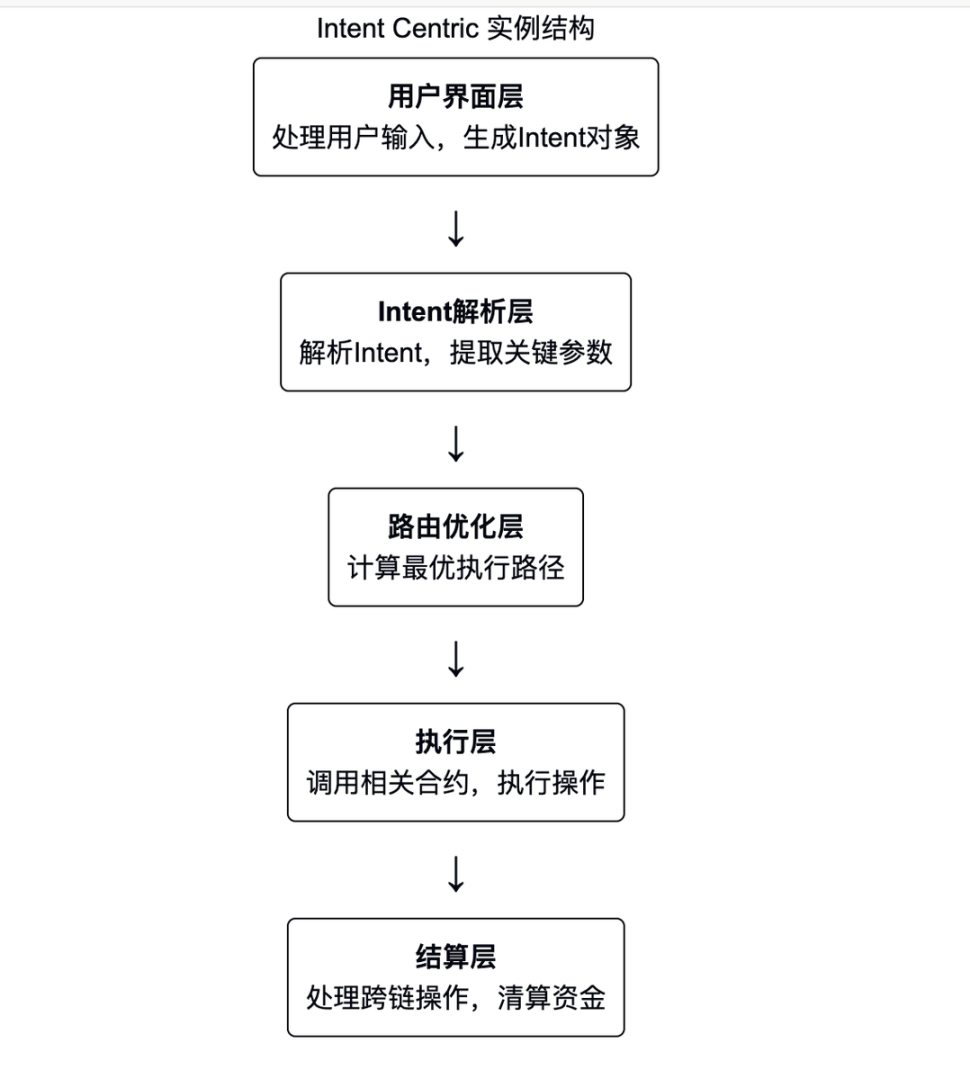

From the above application examples, we can summarize the common architecture of the instantiation of the Intent Centric paradigm:

User Interface Layer:

Function: Receive user input and generate standardized Intent objects.

Examples: CowSwap: User specifies the tokens and quantity to exchange.

UniswapX: User selects input and output tokens, as well as slippage tolerance.

DappOS: User expresses the intent to use Intent Assets, such as cross-chain transfers or trades.

Intent Parsing Layer:

Function: Parse Intent objects, extract key parameters such as token addresses, quantities, and price limits.

Examples: CowSwap: Parse the user's trading request and determine the trading pair and quantity.

UniswapX: Analyze the user's trading intent, including token pairs and price requirements.

DappOS: Parse the user's Intent Assets usage request and determine the operation type and parameters.

Routing Optimization Layer:

Function: Calculate the optimal execution path based on the parsed Intent.

Examples: CowSwap: Use batch auction mechanism to find the best matching solution.

UniswapX: Calculate the optimal token exchange path, which may involve multiple DEXs.

DappOS: Calculate the best cross-chain path and execution strategy for using Intent Assets.

Execution Layer:

Function: Call relevant smart contracts to perform operations based on the optimized path.

Examples: CowSwap: Execute batch orders using the selected Solver.

UniswapX: Call the selected DEX contract to perform token exchange.

DappOS: Execute relevant operations for Intent Assets, such as cross-chain transfers or trades.

Settlement Layer:

Function: Handle cross-chain operations, settle funds, and ensure that all parties receive their due assets.

Examples: EverClear: As a dedicated settlement layer, it coordinates fund flow and settlement between different chains.

DappOS: Handle settlement and synchronization of Intent Assets across different chains.

These projects have abstracted complex on-chain operations into simple user intents, greatly simplifying user interactions. They also have a high degree of flexibility to adapt to different application scenarios and user needs.

On-chain Data Performance and Hidden Layer 0

Unverifiable truth is not science, and a primitive that cannot achieve PMF is just empty talk.

Looking at the Dune data dashboards of the 4 examples above, we can see that Cowswap's data performance stands out, Renzo's "Restake from Anywhere" has relatively impressive performance, while DappOS and EverClear's on-chain data currently have relatively average performance.

Cowswap has addressed the real pain points of on-chain trading users in terms of MEV resistance, gas-free trading, advanced orders, and more. It only requires a signature, no need to spend gas for Approve and Swap, to execute a single transaction. Of course, you still need to pay the transaction fee.

Renzo's "Restake from Anywhere" solves the interaction complexity and additional cross-chain operation costs of Wrap ETH participating in Restaking points farming on other L2/L1 platforms.

DappOS's Intent Assets addresses the need for users to maintain on-chain native income while maintaining high asset liquidity and lossless interchangeability.

EverClear's liquidation layer provides new underlying infrastructure for protocols in the era of chain abstraction, addressing the pain points of Solver rebalancing, programmable liquidation, and permissionless chain extension.

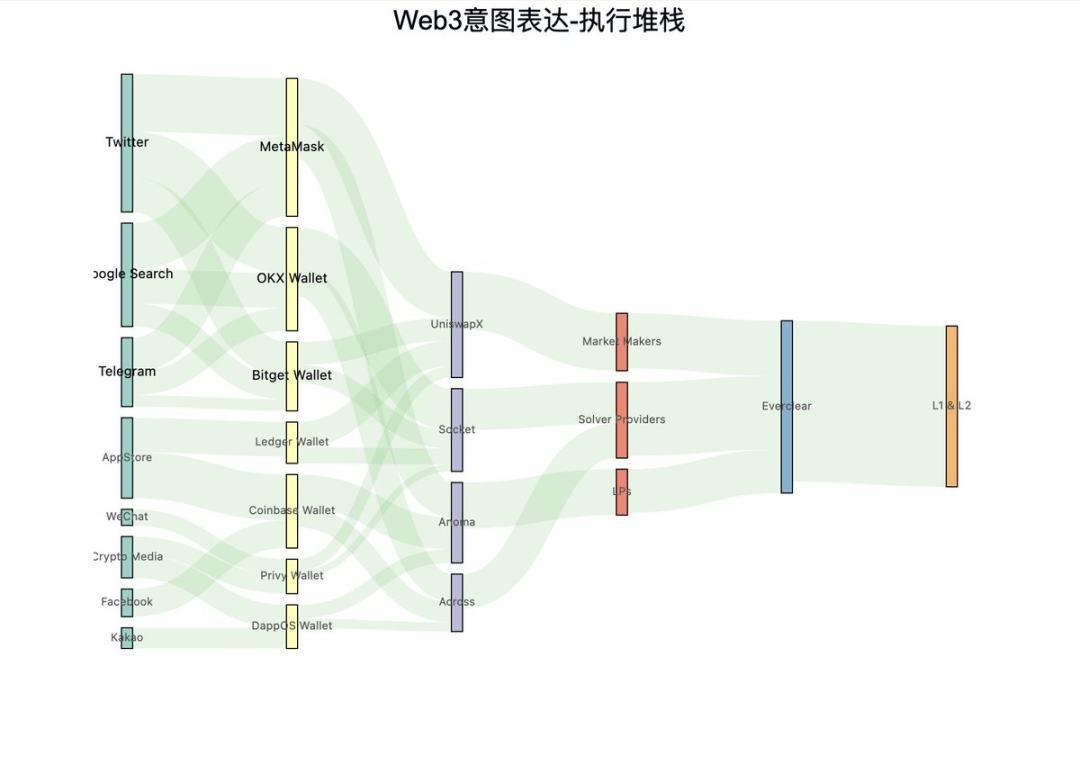

The uneven performance of these examples' on-chain data is due to their positioning in the Web3 intent expression - execution stack and the different competitive environments.

The Web3 intent expression - execution stack can be divided into 5 layers:

- 0th layer entry layer: Twitter, Google search, Telegram, AppStore, crypto vertical media, Facebook, Kakao, WeChat, etc.

- 1st layer wallet account layer: MetaMask wallet, OKX wallet, Bitget wallet, Coinbase wallet, Ledger wallet, DappOS wallet, Privy wallet, etc.

- 2nd layer intent expression layer: Cowswap, UniswapX, Anoma, Socket, Across, etc.

- 3rd layer intent execution layer: Liquidity providers, LP, Solver service providers

- 4th layer liquidation layer: Everclear

- 5th layer settlement layer: L1&L2

Currently, Cowswap and Renzo's "Restake from Anywhere" are thriving in the 2nd layer. Everclear, positioned in the 5th layer as a freshly baked middleware, is still in the early stages of growth. DappOS, positioned in the 1st, 2nd, and 3rd layers, faces intense competition from both ends. As a latecomer, it is struggling to compete with giants such as MetaMask, OKX wallet, Bitget wallet, by snatching market share with its self-built Intent Assets and Solver network.

It is worth mentioning that the 0th layer of the Web3 intent expression - execution stack is currently in a stealth state in the design architecture of the Intent Centric instances. However, the 0th layer, as the entry point of the Web3 ecosystem, not only provides user acquisition channels but also shapes user cognition, influencing product positioning and market competition.

For Intent Centric instance projects, it may be beneficial to take a cue from Solana Blinks and move intent expression from the 2nd layer to the 0th layer, establishing direct contact with users, which will be key to achieving and maintaining PMF.

Future Prospects: Potential Revolution of the Intent Centric Paradigm

Beyond the existing instances, the Intent Centric paradigm has the following untapped potential:

Paradigm shift in computation: The shift from "imperative" to "declarative" may completely change the way smart contracts are written. Imagine, in the future, DApp developers may only need to describe the desired results, rather than detailed execution steps.

New model for inter-chain state synchronization: Intent may become a new carrier for inter-chain state synchronization, laying the foundation for true interoperability. This could lead to a shift from "single-chain centralization" to "multi-chain collaboration".

AI-driven Intent optimization: Combining Large Language Model (LLM) technology, we may see AI agents that can understand natural language intents and automatically optimize execution paths. This will further lower the barrier to entry for Web3.

Decentralized Intent marketplace: With the standardization of Intent, we may see decentralized markets specifically for matching and executing Intents. This will create new opportunities for arbitrageurs and liquidity providers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。