Writing: Zhou Zhou, Foresight News

The Ethereum spot ETF is undervalued. Traditional institutions have shown strong demand for the Ethereum ETF in the first seven trading days.

On July 23, 2024, the US Ethereum spot ETF officially started trading, just half a year after the US Bitcoin spot ETF. In this half year (up to July 2024), the net inflow of assets for the Bitcoin spot ETF reached $17 billion, equivalent to an average net inflow of over $1 billion per trading day after the launch of the Bitcoin ETF. The market reacted swiftly, with Bitcoin rising 50% within two months of the ETF approval.

The impact of the Bitcoin spot ETF on the current cycle of Bitcoin prices is unparalleled. He Yi, co-founder of Binance, mentioned in an interview with Foresight News, "From 2021 to 2024, this so-called bull market is not innovation-driven, but rather driven by independent events such as ETFs." This is not an exaggeration. According to "Caixin Weekly," the daily trading volume of the Bitcoin spot ETF is about $4-5 billion, accounting for 15%-20% of the total trading volume of global cryptocurrency exchanges. ETFs have brought massive liquidity to the Bitcoin market.

The US Bitcoin ETF has also created miracles in the US ETF market. In just half a year, among nearly 2,000 ETFs launched in the past 5 years, two Bitcoin spot ETFs (IBIT and FBTC) have entered the top 10 in terms of fund inflows. BlackRock's IBIT became the fastest ETF to reach $20 billion in the US, taking only 137 days (the previous record holder was JPMorgan's actively managed fund JEPI, which took 985 days to reach $20 billion). As of July 31, 2024, BlackRock's IBIT had a net inflow of $20.23 billion, and Fidelity's FBTC had a net inflow of $9.52 billion.

As possibly the most significant "single variable" currently affecting the Bitcoin and cryptocurrency markets, the data performance of the Bitcoin spot ETF has provided a rare and valuable template and reference for subsequent cryptocurrency ETFs, including Ethereum. People can intuitively compare the daily net inflows and trading volumes of Bitcoin and Ethereum spot ETFs.

So, will Ethereum replicate the success of the "Bitcoin spot ETF"? At what scale of fund trading volume and net inflow can the Ethereum spot ETF be considered to outperform the Bitcoin spot ETF? Will the impact of the Ethereum ETF on Ethereum liquidity and prices be as significant as the impact of the Bitcoin ETF on Bitcoin prices and liquidity?

The Undervalued "Ethereum Spot ETF"

Traditional institutions have shown strong demand for the Ethereum ETF in the first seven trading days. Based on market share (30%), the net inflow of funds for the Ethereum spot ETF has even exceeded that of the Bitcoin spot ETF.

As of August 1, Ethereum's market value is 30% of Bitcoin's. Based on this ratio, the first-day and first-week data performance of the Ethereum ETF has surpassed that of the "Bitcoin spot ETF."

In the first day of trading, the net inflow of eight Ethereum ETFs, excluding Grayscale, reached $591 million, while in comparison, the net inflow of nine Bitcoin ETFs, excluding Grayscale, on the first day was $750 million, with Ethereum ETF accounting for 78% of the latter. Considering Ethereum's market value is 30% of Bitcoin's, the first-day performance of Ethereum is quite impressive, surpassing that of the Bitcoin spot ETF.

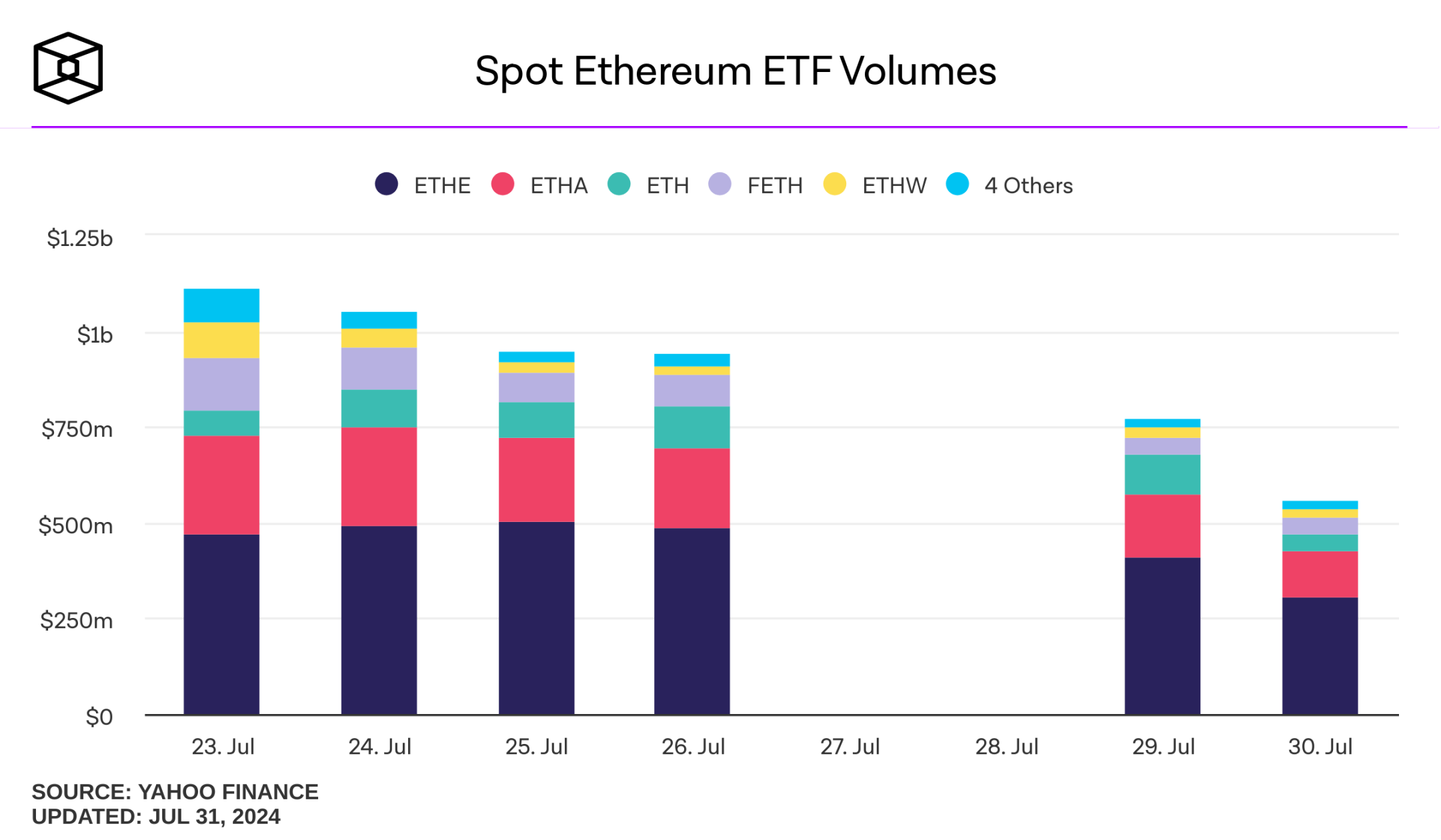

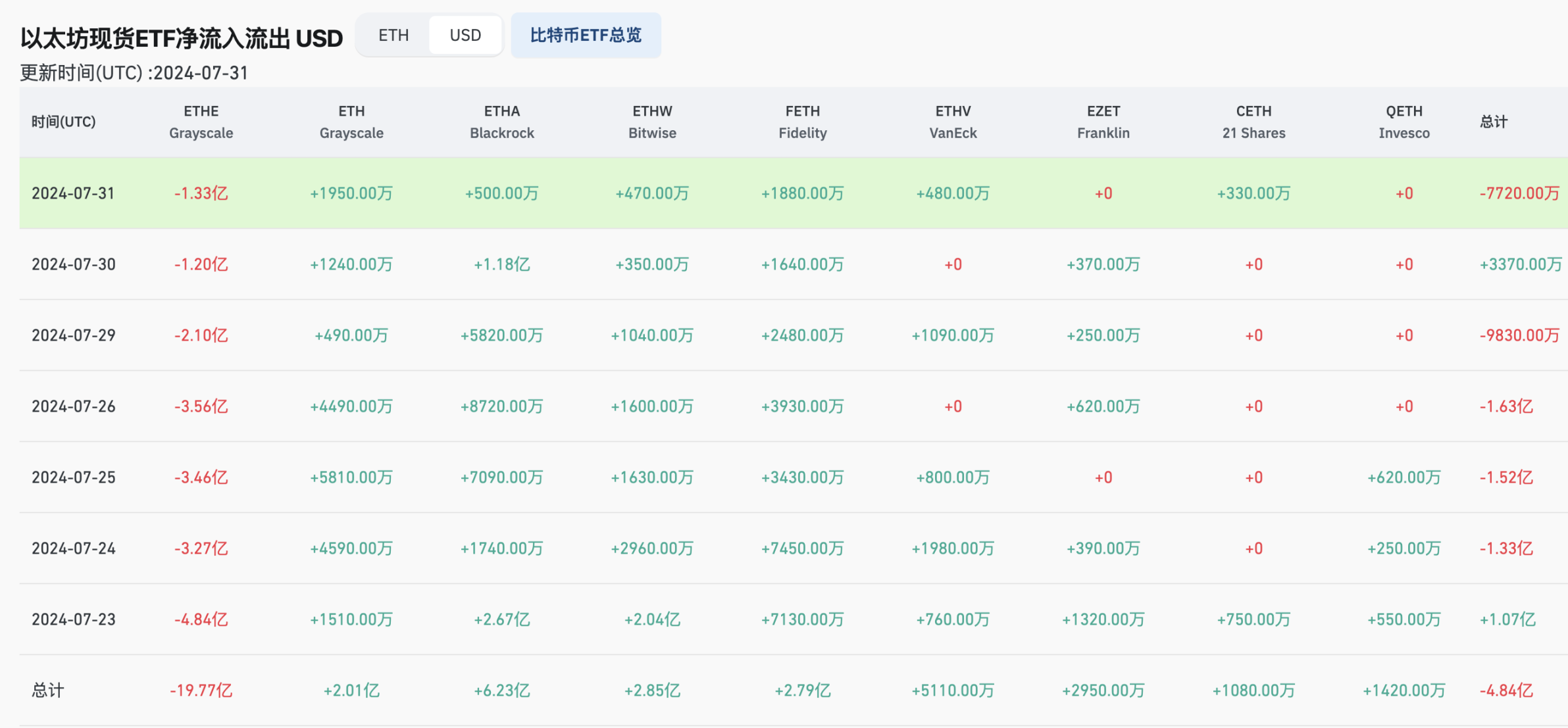

Data for the first 7 trading days of the Ethereum spot ETF (Source: Coinglass)

If we extend the time frame to one week, we still find that the performance of the Ethereum spot ETF is no less than that of the Bitcoin spot ETF.

In the first seven trading days, the net inflow of eight Ethereum ETFs, excluding Grayscale, was $1.494 billion. In comparison, the net inflow of nine Bitcoin ETFs, excluding Grayscale, in the first few trading days was $4.536 billion, with the former accounting for 32% of the latter. Considering Ethereum's market value is 30% of Bitcoin's, the performance of the Ethereum ETF in the first seven days is no less than, or even slightly better than, that of the Bitcoin ETF.

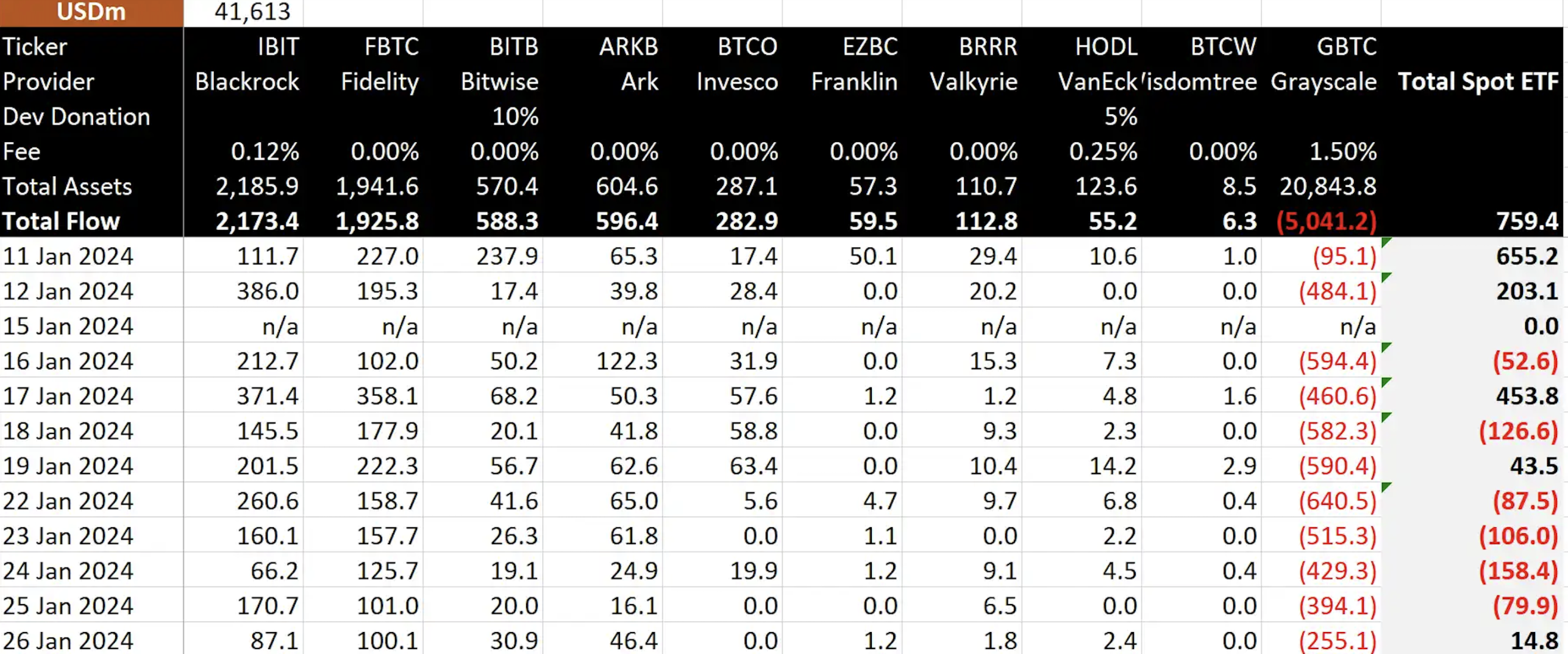

Data for the first 11 trading days of the Bitcoin spot ETF (Source: BitMEX Research)

From the two charts above, it can be seen that in the first 11 trading days, both the Bitcoin spot ETF (10) and the Ethereum spot ETF (9) had only Grayscale selling, while others were buying. Moreover, Grayscale's selling volume was much higher than the total buying volume of the other eight companies.

This is because Grayscale entered the market earlier, acquired a low amount of Bitcoin and Ethereum chips, and faced high fees after the ETF was listed, resulting in massive selling pressure from Grayscale alone for both Bitcoin and Ethereum in the first few weeks. Therefore, the prices of Bitcoin and Ethereum will not directly rise as a result.

According to Coinglass data, as of July 30, 2024, the total assets under management of the US Ethereum ETF were $9.009 billion, while Grayscale's ETHE assets under management were $6.896 billion, accounting for 76% of the overall US Ethereum spot ETF market. Grayscale's Ethereum selling pressure will continue for some time.

Grayscale's ETHE assets under management are $6.896 billion, accounting for 76% of the market (Source: The Block)

In the first seven trading days, the nine Ethereum spot ETFs collectively saw an outflow of $484 million. Among them, Grayscale's ETHE saw an outflow of $1.977 billion. Despite the other eight ETFs buying, Grayscale alone caused a net outflow for the Ethereum spot ETF.

So, how long will Grayscale's Ethereum spot ETF continue to bring selling pressure to the market? When will the funds of the Ethereum ETF start to accelerate, bringing a continuous stream of net inflows and liquidity to the Ethereum market? Will it even begin to directly impact Ethereum prices?

Will the Ethereum ETF Surpass the "Bitcoin ETF" in the Future?

How do we judge the performance of the "Ethereum spot ETF"?

US ETF analysts believe that BlackRock's ETF data performance will be an important reference point (Indicator One).

Whether it's the Bitcoin spot ETF or the Ethereum spot ETF, BlackRock is the largest ETF buyer, and over time, it is expected to completely absorb Grayscale's selling.

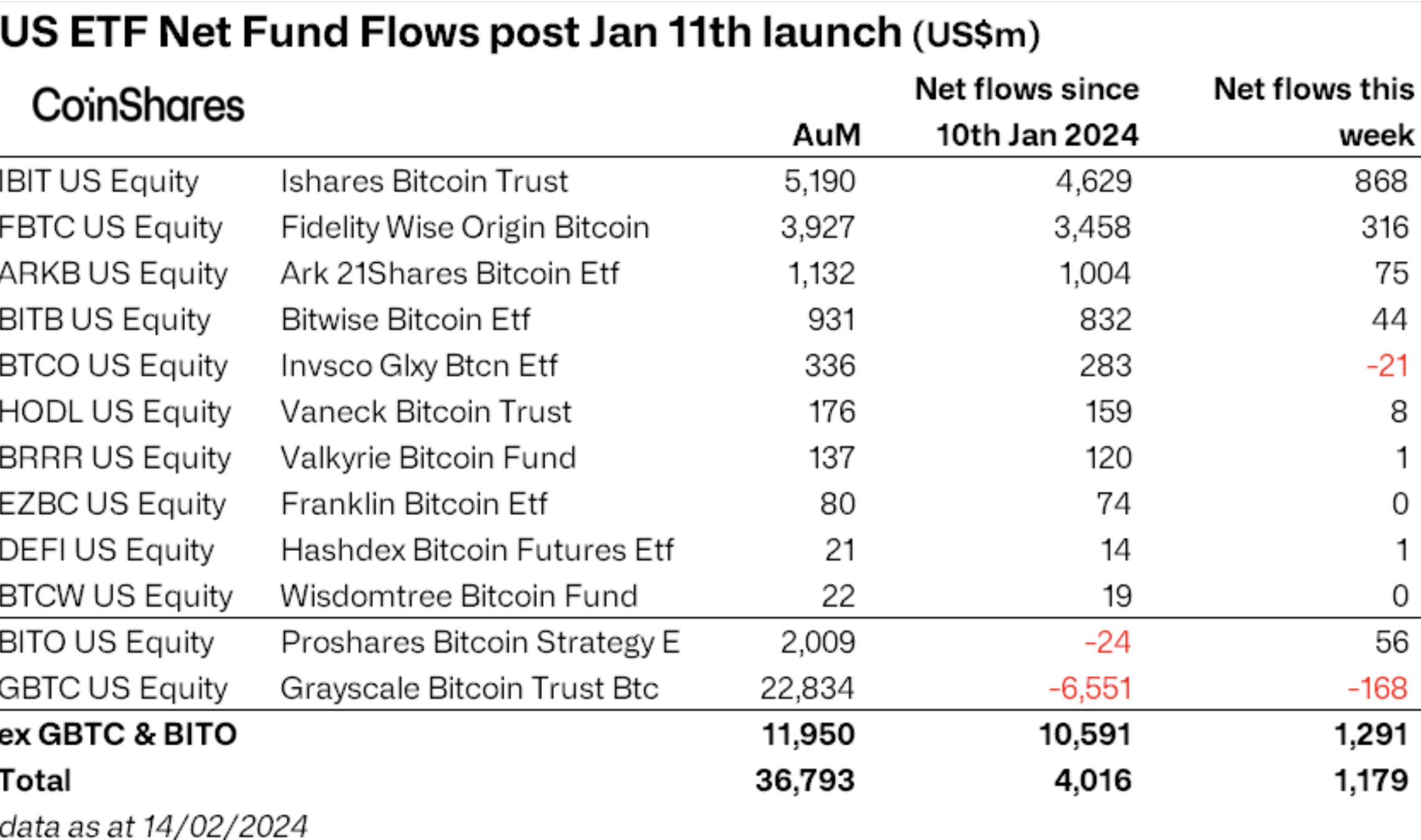

As the world's largest asset management company controlling $10 trillion, BlackRock alone bought more Bitcoin ETFs than the total of the other nine Bitcoin ETFs. In the six months from January 11, 2024, to July 31, 2024, BlackRock attracted a net inflow of $20.23 billion in Bitcoin, while the net inflow of the other eight Bitcoin spot ETFs, excluding Grayscale, totaled $16.6 billion, and Grayscale's selling amounted to $19 billion. BlackRock completely "absorbed" the Bitcoin sold by Grayscale.

Based on the data of the Bitcoin ETF, on the 12th working day after the issuance of the Bitcoin ETF (January 29), BlackRock's Bitcoin spot ETF first exceeded the trading volume of the Grayscale Bitcoin Trust (GBTC). Some professional ETF analysts in the US believe that this indicates a significant weakening of the selling pressure from Grayscale holding Bitcoin, serving as one of the signals for the bottoming out of Bitcoin.

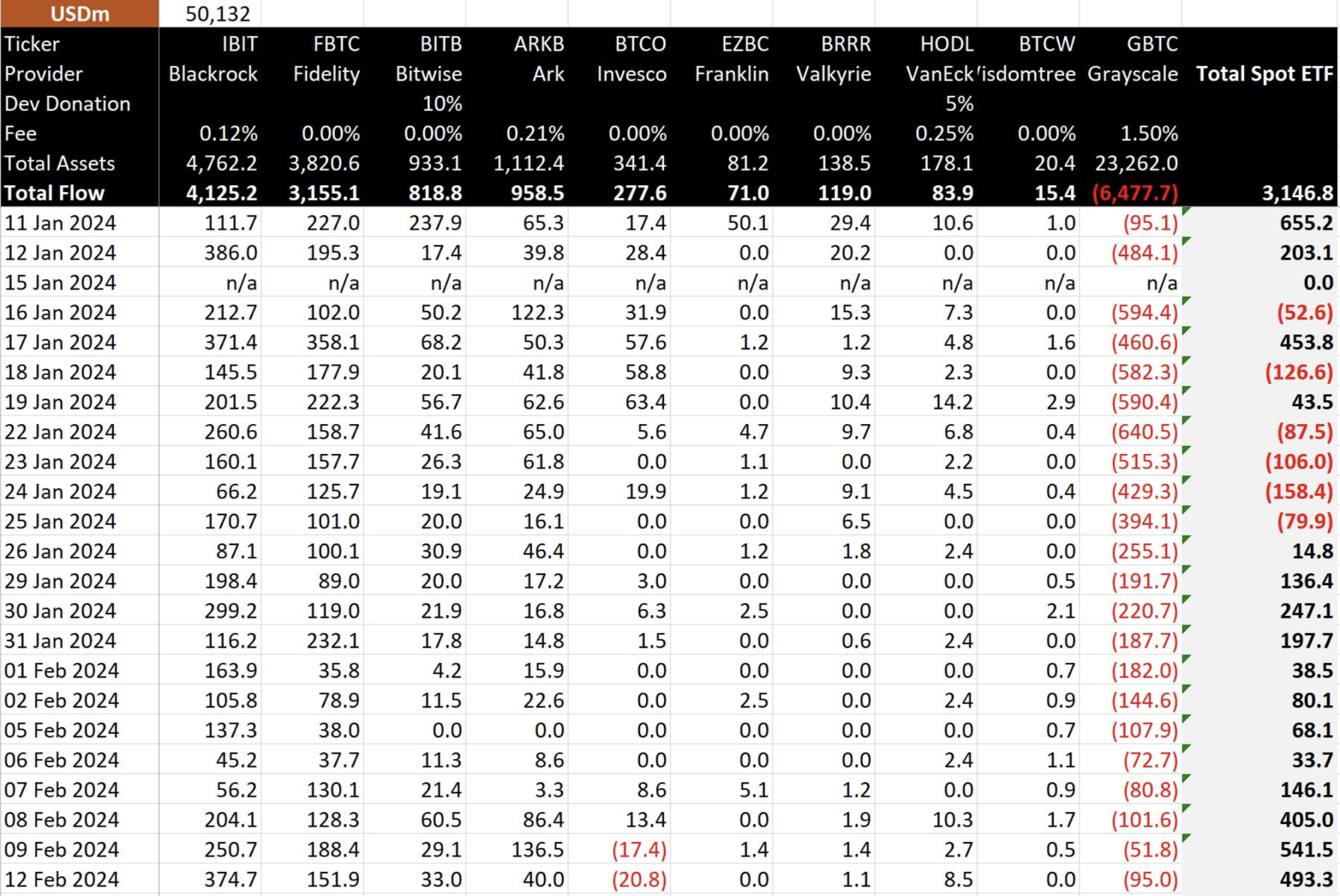

Data for the first 23 trading days of the Bitcoin spot ETF (Source: BitMEX Research)

In fact, since that day (the 12th working day after issuance), the Bitcoin ETF has started to experience continuous net inflows of funds.

As shown in the above chart, after the 12th trading day, the selling pressure from Grayscale was difficult to maintain at the previous level, while the buying from BlackRock and Fidelity could still maintain the previous level. The price of Bitcoin also started to rise from January 26 and continued to rise until reaching a peak on March 14. During these two months, the Bitcoin ETF injected nearly billions of dollars in net assets into the Bitcoin market.

The second indicator worth noting is whether the net inflow of assets after the issuance of the Ethereum ETF can reach 30% of the Bitcoin ETF (Indicator Two).

Eugene, the head of institutional business at Bybit, told Foresight News, "For traditional financial institutions, it may take a little longer to understand ETH than BTC. We expect the net inflow of assets for the Ethereum ETF to be approximately 25%-30% of the Bitcoin ETF, based on the market value ratio of Ethereum to Bitcoin."

Source: CoinShares Research Director James Butterfill

Net inflow of assets represents the actual net inflow of funds into the Ethereum market, i.e., incremental inflow.

As shown in the above chart, around the first month after the formal issuance of the Bitcoin spot ETF (February 14), the total net inflow reached $4 billion. This brought real incremental funds to the Bitcoin market.

Further quantifying Indicator Two:

1) In the first month, around August 23, 2024, will the net inflow of assets for the Ethereum ETF reach $1 billion?

2) Two months later, around September 23, will the net inflow reach $2.7 billion, and will the total assets under management reach $16.5 billion (as of July 31, the total assets under management of the Ethereum ETF were $9.119 billion)?

3) Six months later, around January 23, 2025, will the net inflow of funds reach $4.6 billion (after 6 months, the net inflow of the Bitcoin spot ETF reached $15.2 billion)?

When all Ethereum spot ETFs generate net inflows of assets for the first time, it will be another key signal (Indicator Three).

As shown in the chart below, as of July 31, the net outflow of the Ethereum ETF was $484 million. This means that Grayscale's selling pressure is greater than the buying of the other eight Ethereum spot ETFs.

Source: Coinglass

However, the current assets under management of Grayscale ETFE are $6.896 billion. At the current average daily selling rate of $282 million, the assets under management of Grayscale ETFE will halve after 12 trading days. This is clearly unsustainable and illogical. According to the data on the selling of Grayscale's Bitcoin ETF, even after almost daily selling for six months, it has only sold more than half of the Bitcoin it holds.

From the perspective of Grayscale's holdings and selling speed of the Ethereum ETF, it is difficult for Grayscale to continue selling Ethereum with the same intensity as in the first seven weeks, while institutions like BlackRock are expected to continue maintaining their purchasing power. If this is true, the net inflow of the Ethereum ETF will reach a turning point in a few weeks.

ETF, the Biggest Short-Term Variable Affecting Ethereum Prices?

The Bitcoin ETF is the "biggest variable" affecting Bitcoin prices in this cycle. After the Ethereum ETF appears, will it become the "biggest variable" affecting Ethereum prices in the current cycle?

As Eugene, the head of institutional business at Bybit, told Foresight News, this depends on whether traditional institutions can understand Ethereum as quickly as they understand Bitcoin and invest in it.

"Many people believe that the main attraction of Bitcoin lies in its scarcity, but many also believe that the attraction of Ethereum lies in its utility. You can think of Ethereum as a global platform for applications that can operate without a decentralized intermediary," said Eric Balchunas, an ETF analyst at Bloomberg, introducing Ethereum.

"Ethereum is a global application platform that can operate without a central authority, making it the first truly decentralized platform in history," as described by some professionals. In any case, in the next six months, Ethereum will be under observation from traditional institutions, and they will use funds to prove whether they support the technology, builders, business narrative, and future prospects of Ethereum.

The good news is that, based on the 30% market share, in the known data of the first seven trading days, excluding the factor of Grayscale, traditional institutions have shown strong demand for the Ethereum ETF. The Ethereum ETF accounts for 32% of the net inflow of funds for the Bitcoin ETF, and this single data indicates that the performance of the Ethereum spot ETF currently slightly exceeds that of the Bitcoin spot ETF.

Indicator One: https://farside.co.uk/?p=1518

Indicator Two: https://x.com/jbutterfill

Indicator Three: https://www.coinglass.com/zh/eth-etf

Grayscale holdings ratio: https://www.theblock.co/data/crypto-markets/ethereum-etf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。