1.市场观察

关键词:BONK、ETH、BTC

特朗普将于4月29日迎来第二个任期的百日执政节点,但其支持率持续下滑至39%,创下过去80年来历任总统的最低百日支持率。民调显示,72%的美国人认为其经济政策可能引发短期衰退,53%的受访者认为国家经济状况恶化,41%的人感受到个人财务状况承压。特朗普政府的贸易保护主义政策及关税举措加剧了市场波动,标普500指数自其就职以来累计下跌约8%,创1974年以来最差百日表现;美元指数同期暴跌9%,为尼克松时代以来最弱开局,资金加速流向黄金及非美资产。与此同时,美联储因通胀压力和经济衰退风险并存而陷入政策两难,降息空间受限,叠加特朗普对央行独立性的干预言论,进一步削弱市场信心。华尔街策略师普遍建议逢高减持美股和美元资产,美银强调全球资本配置正从“美国例外论”转向多元化布局,黄金及新兴市场成为避险优选。

比特币近期突破9.5万美元关键阻力位,稳定运行于21周均线上方,还站稳87,045美元的23.6%斐波那契回撤位,为多头提供明确止损参考。尽管2024年4月减半后比特币仅录得43.4%的涨幅,显著弱于历史周期表现,但黄金走强与美元资产多元化趋势仍赋予其长期配置价值。加密分析师Willy Woo则认为,链上资金流入加速为突破历史高点奠定基础,中期目标指向10.3万至10.8万美元区间。花旗银行预测,若稳定币市场规模按基准情景增长至1.6万亿美元,比特币价格或于2030年达到28.5万美元,乐观情形下甚至上看47.5万美元,即使在保守假设下,价格也可能翻倍至19万美元以上。但分析师Ali警告称,比特币在94,125-99,150美元区间面临261万个钱包地址的176万枚BTC抛压,市场流动性薄弱时段仍需警惕波动。

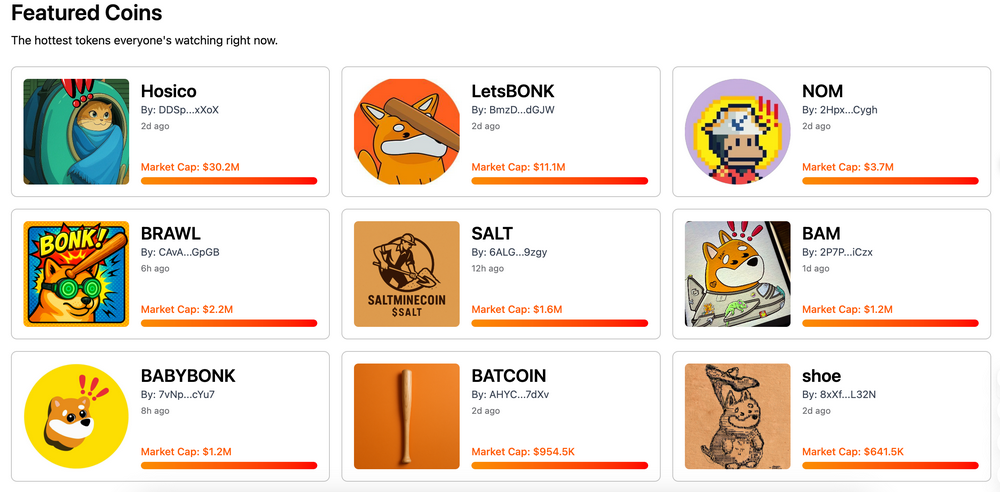

Sui生态热度持续不减,其代币SUI将于5月1日解锁7400万枚(占流通量2.28%),价值约2.67亿美元,其生态项目DeepBook、MemeFi、Walrus近期也有较明显的涨幅,而Binance Alpha也将于4月29日上线其生态项目Haedal Protocol。目前SOL依旧在150美元附近徘徊,生态项目PENGU近一周涨幅迅猛,拉升超两倍,新MEME代币HOUSE近日短暂突破7800万美元市值后目前已回落至6700万美元附近。此外,龙头Meme项目BONK昨日宣布推出与Raydium联合开发的Meme币发行平台Letsbonk.Fun,目前已涌现Hosico、LetsBONK、NOM等多个百万市值项目。

2. 关键数据(截至4月28日12:00 HKT)

(数据来源:Coinglass、Upbit、Coingecko、SoSoValue、Tomars、GMGN、Letsbonk.Fun)

比特币:94,179.39美元(年初至今+0.5%),日现货交易量177.2亿美元

以太坊:1,794.82美元(年初至今-46.15%),日现货交易量为97.49亿美元

恐贪指数:54(中性)

平均GAS:BTC 1 sat/vB,ETH 0.4 Gwei

市场占有率:BTC 63.3%,ETH 7.3%

Upbit 24 小时交易量排行:XRP、DEEP、TRUMP、JST、WAL

24小时BTC多空比:1.0153

板块涨跌:NFT板块上涨7.2%,PayFI板块上涨5.78%

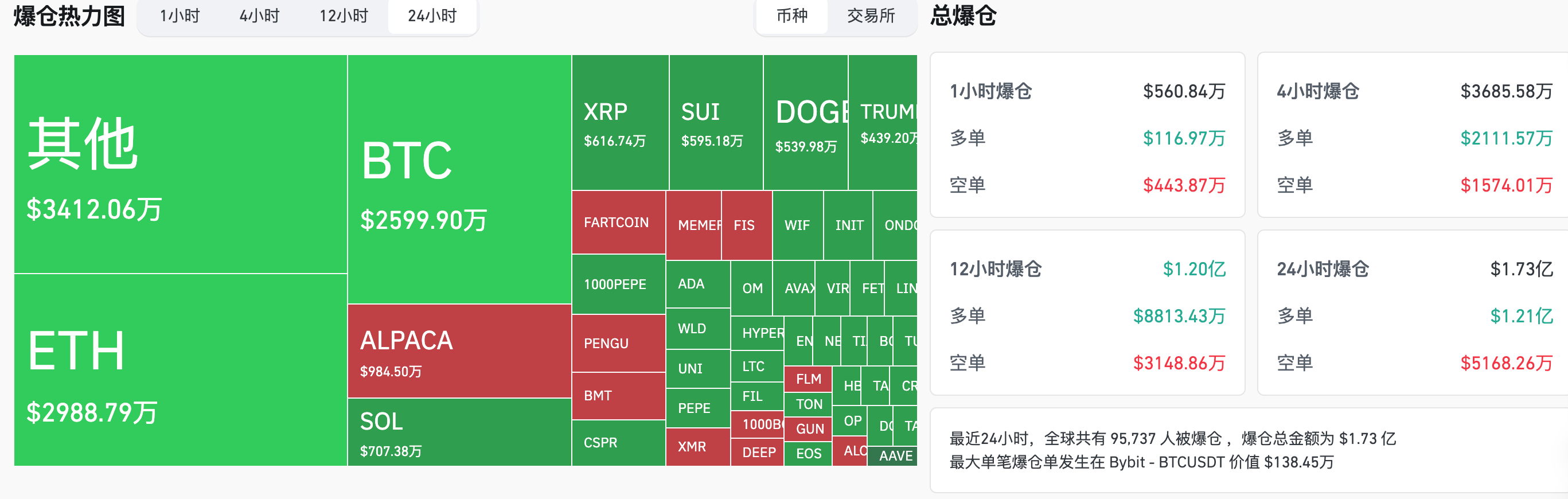

24小时爆仓数据:全球共95737人被爆仓 ,爆仓总金额为1.73亿美元,其BTC爆仓2599万美元、ETH爆仓2988万美元、ALPACA爆仓984万美元

BTC中长线趋势通道:通道上沿线(90816.14美元),下沿线(89017.80美元)

ETH中长线趋势通道:通道上沿线(1733.27美元),下沿线(1698.95美元)

*注:当价格高于上沿和下沿时则为中长期看多趋势,反之则为看空趋势,当价格在区间内或短期反复通过成本区间则为筑底或筑顶状态。

3.ETF流向(4月21日至4月25日)

比特币ETF:30.6亿美元(创历史流入第2高)

以太坊ETF:1.57亿美元(结束8周净流出)

4. 今日前瞻

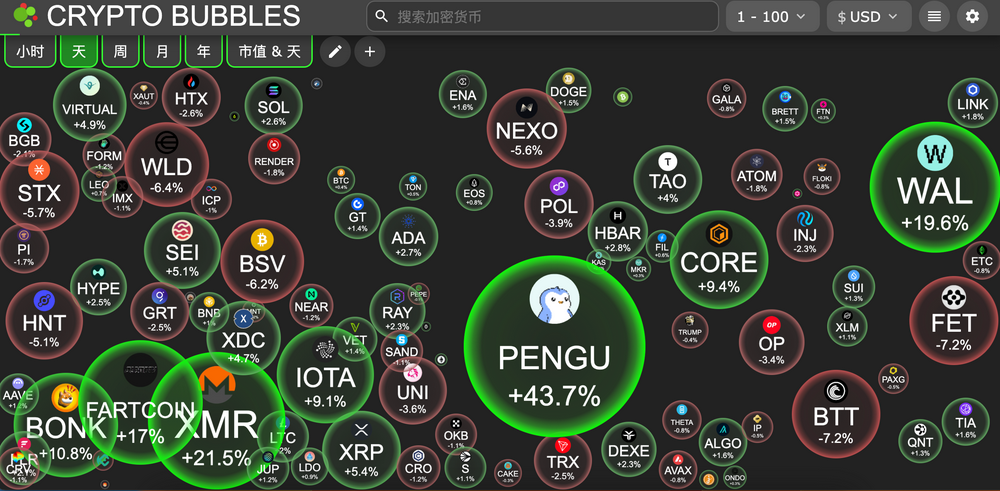

今日市值前500最大涨幅:CSPR涨63.43%,UNP涨52.19%,PENGU涨44.23%,XMR涨22.61%,FWOG涨18.87%。

5. 热点新闻

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。