From a fundamental perspective, SOL is overvalued.

Author: Flip Research

Translation: Deep Tide TechFlow

Lately, my social media timeline has been filled with bullish points about $SOL, interspersed with some promotion of meme coins. I started to believe that the meme coin supercycle is real, and that Solana will surpass Ethereum and become the primary layer-one blockchain. However, as I delved deeper into the data, the results were concerning, to say the least… In this article, I will present my findings and explain why Solana might be a house of cards.

First, let's take a look at the bullish points, succinctly explained by @alphawifhat:

Explanation of the image:

Nachi: "I watched @BanklessHQ's recent program about $SOL, which mentioned that its price is 83% lower than $ETH. I was completely shocked by the pricing error of Solana relative to ETH, despite Solana being my largest holding.

Based on the second quarter's performance, Solana's data is as follows:

50% of ETH+L2 users

27% of ETH+L2 fees

36% of DEX trading volume

190% of ETH+L2 stablecoin trading"

Integrated Kyle e/acc: "We almost never make specific predictions, especially for our liquidity providers.

In our annual letter, we predicted that by the end of the year, Solana will surpass Ethereum on most major chain metrics. We specifically noted that trading volume is the most important data."

Regarding the metrics with ETH and L2, there are four distinct claims:

Higher proportion of user base

Relatively higher fees

High DEX trading volume

Significantly higher stablecoin trading volume

Comparison of user base

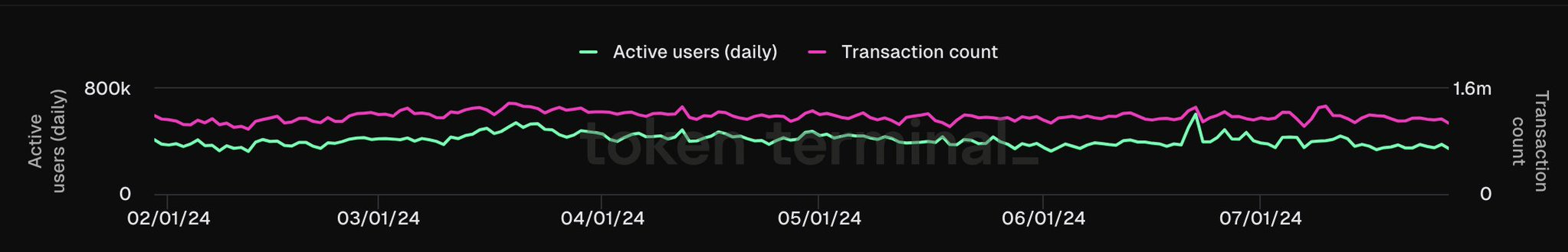

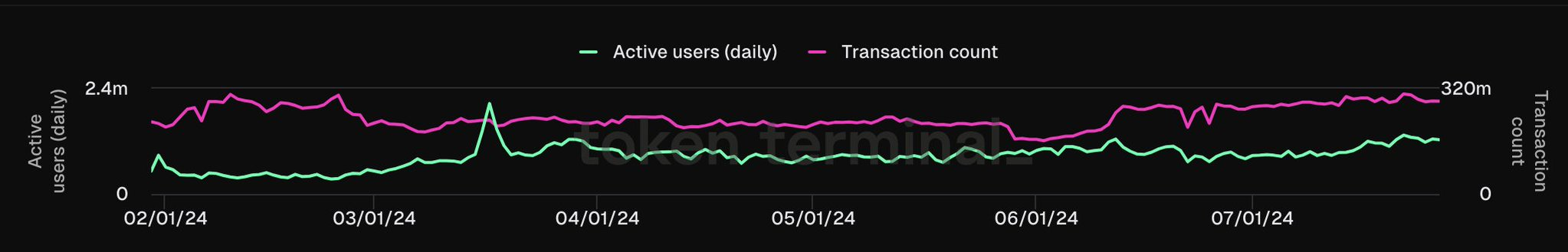

Below is a comparison of ETH mainnet and SOL (only comparing the mainnet, as the vast majority of fees come from here, source: @tokenterminal):

ETH user base + transaction volume

SOL user base + transaction volume

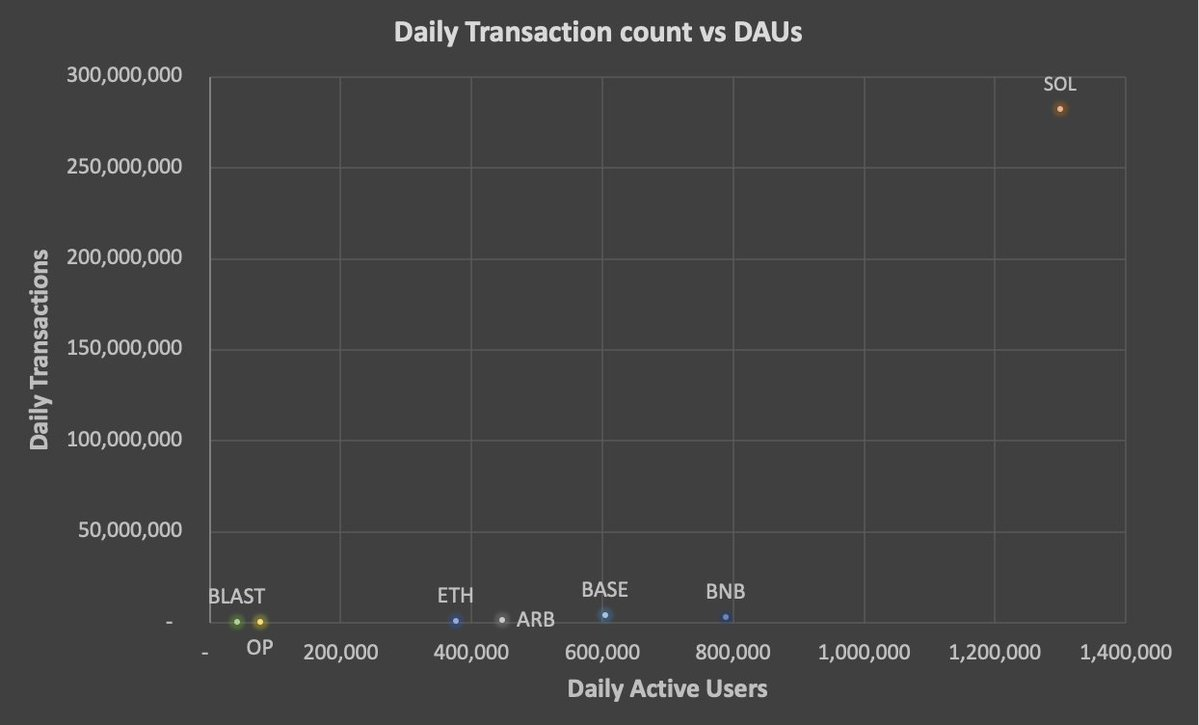

At first glance, these numbers look very favorable for SOL, with over 1.3 million daily active users (DAUs), while ETH has only 376,300 DAUs. However, when we take transaction volume into consideration, I noticed some strange phenomena.

For example, on Friday, July 26th, ETH had 1.1 million transactions, while ETH only had 376,300 DAUs, averaging about 2.92 transactions per user per day. However, SOL had 282.2 million transactions and 1.3 million DAUs, averaging 217 transactions per user per day.

I believe this may be due to lower transaction fees, leading to more transactions, more frequent position compounding, increased arbitrage robot activity, etc. So I compared it to another popular chain, Arbitrum. However, Arbitrum's average user transaction volume on the same day was only 4.46 transactions. Similar results were found when looking at other chains.

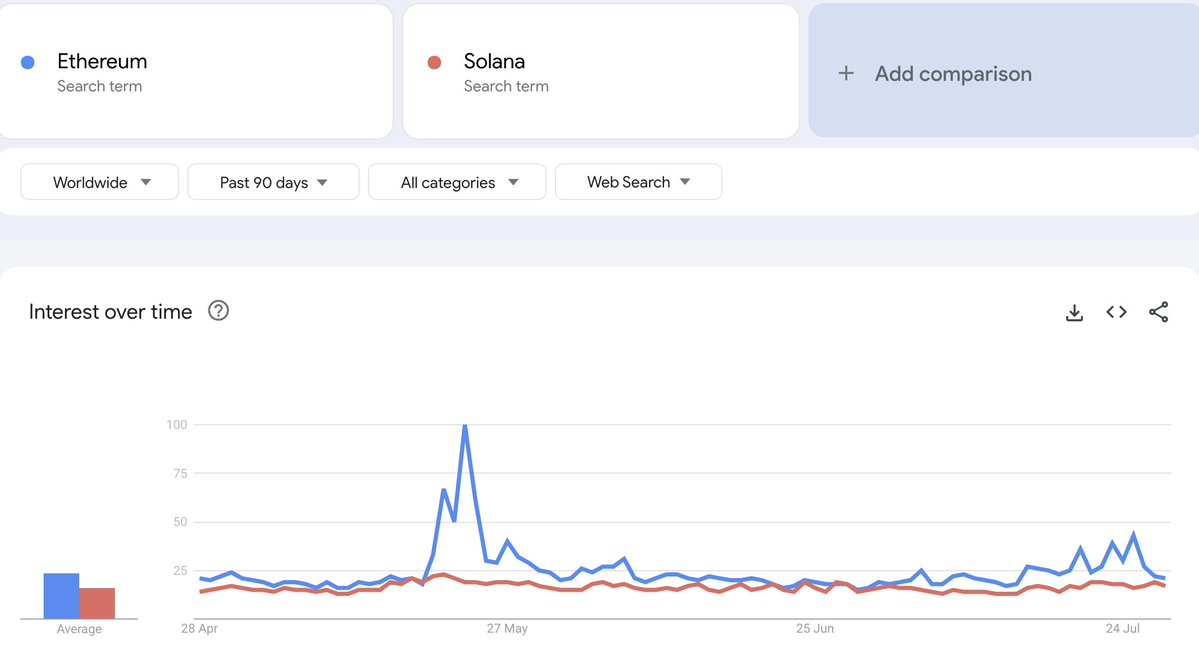

Given the higher number of users than ETH, I looked at Google Trends, which should be relatively unbiased in terms of user value:

ETH's trend is either equal to or ahead of SOL. Considering the difference in DAUs and all the hype surrounding SOL meme coin trends, I shouldn't have expected such results. So what exactly is happening?

DEX trading volume analysis

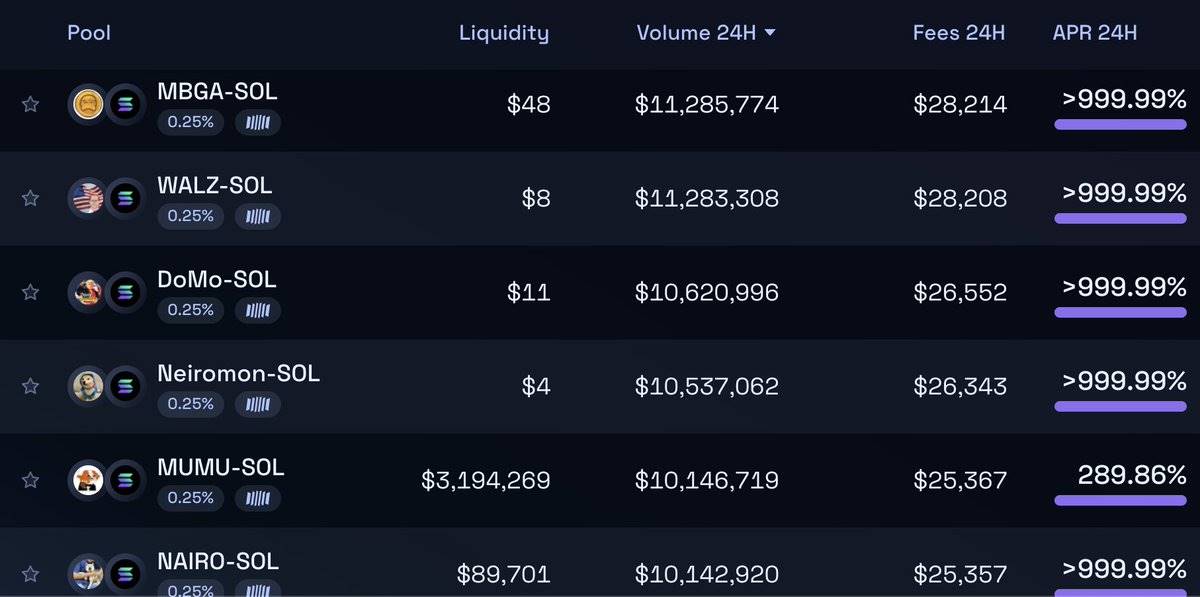

To understand the difference in transaction volume, looking at Raydium's liquidity providers (LPs) can be enlightening. Even at first glance, something seems off:

Initially, I thought this was just wash trading on low-liquidity honey pots on LPs to attract occasional meme coin speculators, but from the charts, the situation is far worse than that:

Every low-liquidity pool has experienced "pump and dump" projects in the past 24 hours. For example, with MBGA, in the past 24 hours, there were 46,000 transactions, with a trading volume of $10.8 million, involving 2,845 unique wallets buying and selling, generating over $28,000 in fees on Raydium. (Note that a similarly sized legitimate LP, $MEW, only generated 11,200 transactions)

Looking at the participating wallets, most of them seem to be bots within the same network, conducting tens of thousands of transactions. They independently generate false trading volume, random amounts of SOL, and random numbers of transactions, until the project is pumped and then moved to the next project.

On standard liquidity pools on Raydium, there have been over 50 pump and dump incidents in the past 24 hours, with a trading volume exceeding $2.5 million, generating a total of over $200 million in trading volume and over $500,000 in fees. Orca and Meteora have significantly fewer pump and dump incidents, and I could hardly find any substantial trading volume pump and dump incidents on Uniswap (ETH).

Clearly, there is a serious pump and dump problem on Solana, leading to various impacts:

Considering the abnormally high ratio of transactions to users, as well as the prevalence of wash trading and pump and dump transactions on the chain, it seems that the majority of transactions are non-organic. On the main ETH L2, the highest daily transaction to user ratio is 15.0x, on Blast (where fees are also low, and users are mining Blast S2). As a rough comparison, if we assume that the true SOL transaction to user ratio is similar to Blast, it would mean that over 93% of transactions (and corresponding fees) on Solana are non-organic.

These scams exist because they are profitable. Therefore, the amount lost by users every day is at least equal to the generated fees and transaction costs, reaching millions of dollars.

Once the deployment of these scams becomes unprofitable (i.e., when actual users tire of losses), you would expect most of the transaction volume and fee revenue to decrease.

Therefore, user, organic fee, and DEX trading volume are all significantly exaggerated.

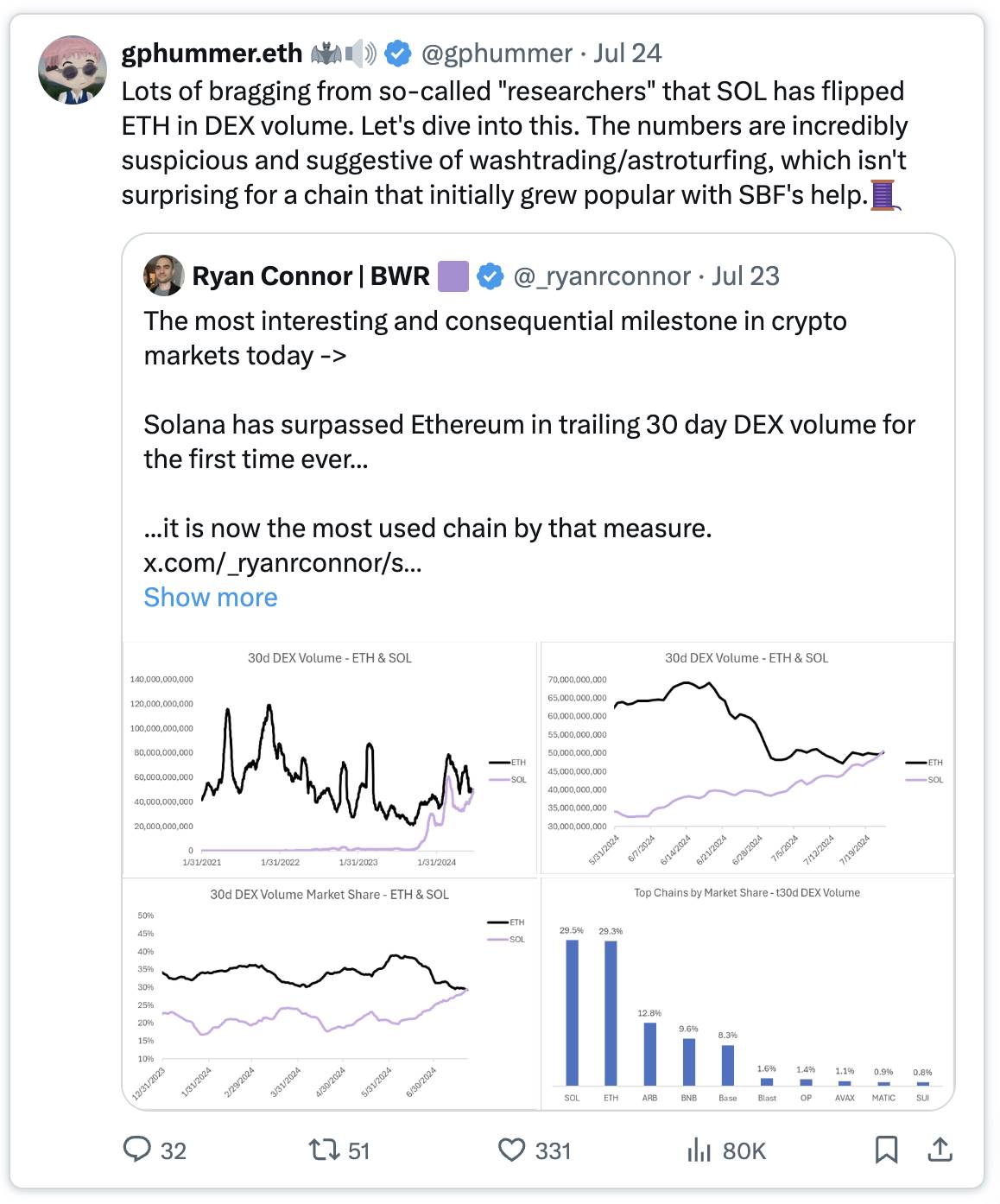

I am not the only one drawing these conclusions, @gphummer recently posted similar content:

gphummer.eth: "Some self-proclaimed 'researchers' are boasting that SOL has already surpassed ETH in DEX trading volume. Let's take a closer look. This number is highly suspicious and suggests the existence of money laundering transactions and falsification, which is not surprising for a chain that initially gained popularity with the help of SBF."

Ryan Connor | BWR: "The most interesting and important milestone in today's crypto market - > Solana has surpassed Ethereum in DEX trading volume for the first time in the past 30 days. From this perspective, it is now the most used chain."

MEV on Solana

MEV on Solana has unique characteristics. Unlike Ethereum, Solana does not have built-in transaction pools; instead, participants like @jito_sol have created (now deprecated) off-chain protocol infrastructure to simulate the functionality of transaction pools, allowing for MEV opportunities such as front-running, sandwich attacks, etc. Helius Labs has compiled an in-depth article detailing MEV.

The issue on Solana is that the tokens for the vast majority of transactions are highly volatile, low-liquidity meme coins, and traders typically set slippage of over 10% to ensure successful execution. This provides a rich attack surface for MEV:

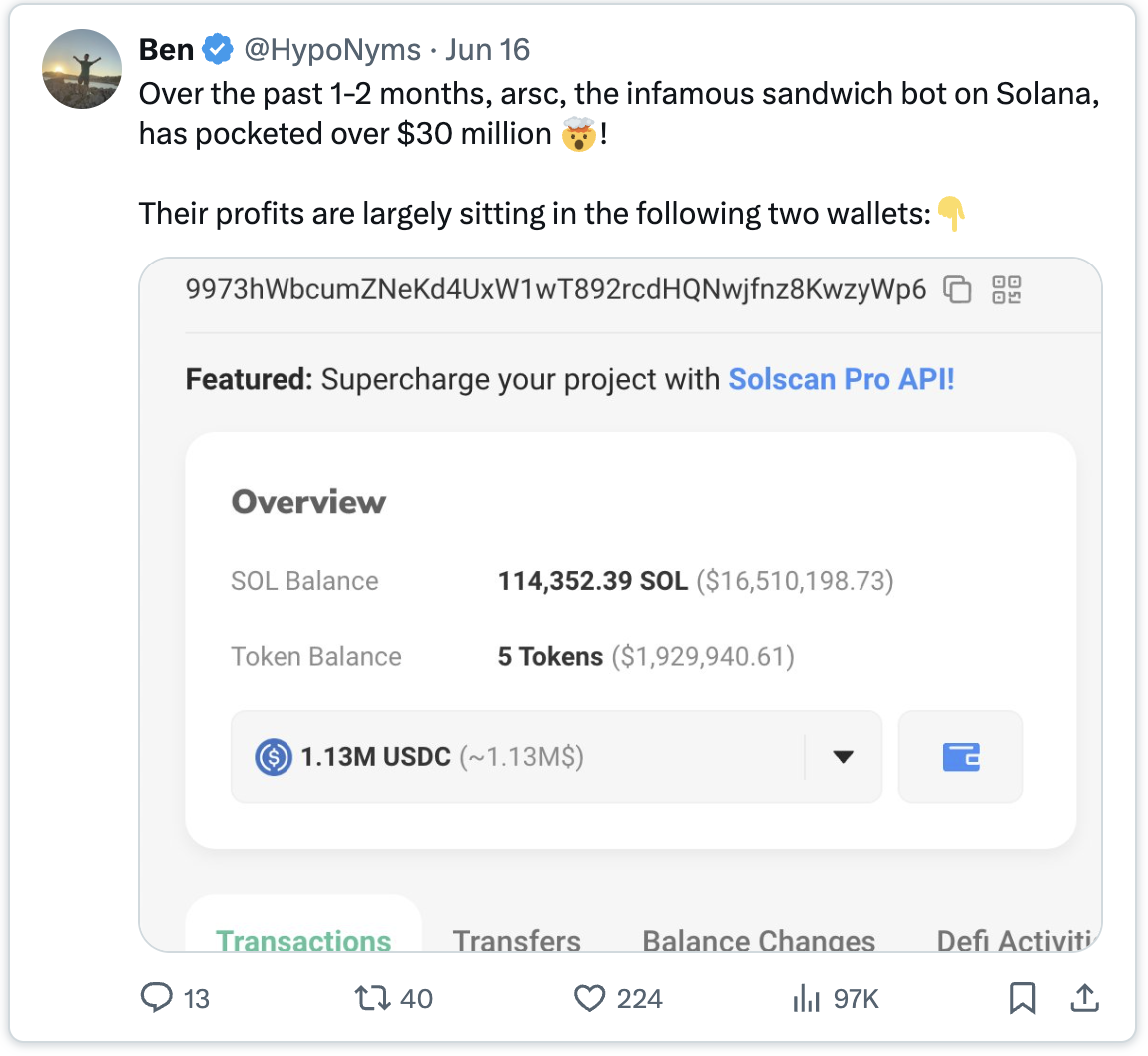

Ben: "In the past 1-2 months, the famous sandwich bot arsc has made over $30 million in profit on Solana! Their profits are mainly stored in the following two wallets."

If we look at the profitability of block space, it is evident that most of the value now comes from MEV fees:

Dan Smith: "Solana generated $5.5 million in total fees yesterday, the highest level in the past three months. 58% of the value comes from MEV fees, 37% from priority transaction fees. Most of the activity comes from spot DEX trading."

While strictly speaking this is real value, MEV only occurs when profitable, i.e., as long as retail continues to participate and lose on memes. Once memes start to cool off, MEV income will also collapse.

I have seen many arguments about SOL mentioning a shift towards infrastructure projects like $JUP, $JTO, etc. This may be possible, but it's worth noting that their volatility is lower and liquidity is higher, and they simply do not provide the same MEV opportunities.

Complex participants are incentivized to build the best infrastructure to take advantage of this situation. In my investigation, some sources mentioned rumors of these participants investing in controlling the trading pool space and then selling access to third parties. However, I could not verify this information.

However, some obvious distortions of incentives are at play—by maximizing meme coin activity on SOL as much as possible, complex individuals are able to continue profiting from MEV, insider trading on the mentioned memes, and the rise in SOL price.

Stablecoins

There is another strange phenomenon in the trading volume and total value locked (TVL) of stablecoins. The trading volume is significantly higher than ETH, but when we look at stablecoin data from @DefiLlama, ETH's stable TVL is $80 billion, while SOL is only $3.2 billion.

I believe stablecoin (and more broadly) TVL is a metric that is less susceptible to manipulation than trading volume and fees on low-fee platforms, showing the actual commitment of participants.

The stablecoin trading volume dynamics highlight this—@WazzCrypto points out that once the CFTC announced an investigation into Jump, the trading volume suddenly decreased:

Wazz: "Since Jump was investigated by the CFTC, the chart of stablecoin trading volume on Solana has actually flattened. This is a big mystery, what caused this situation."

Mainstream Value Extraction

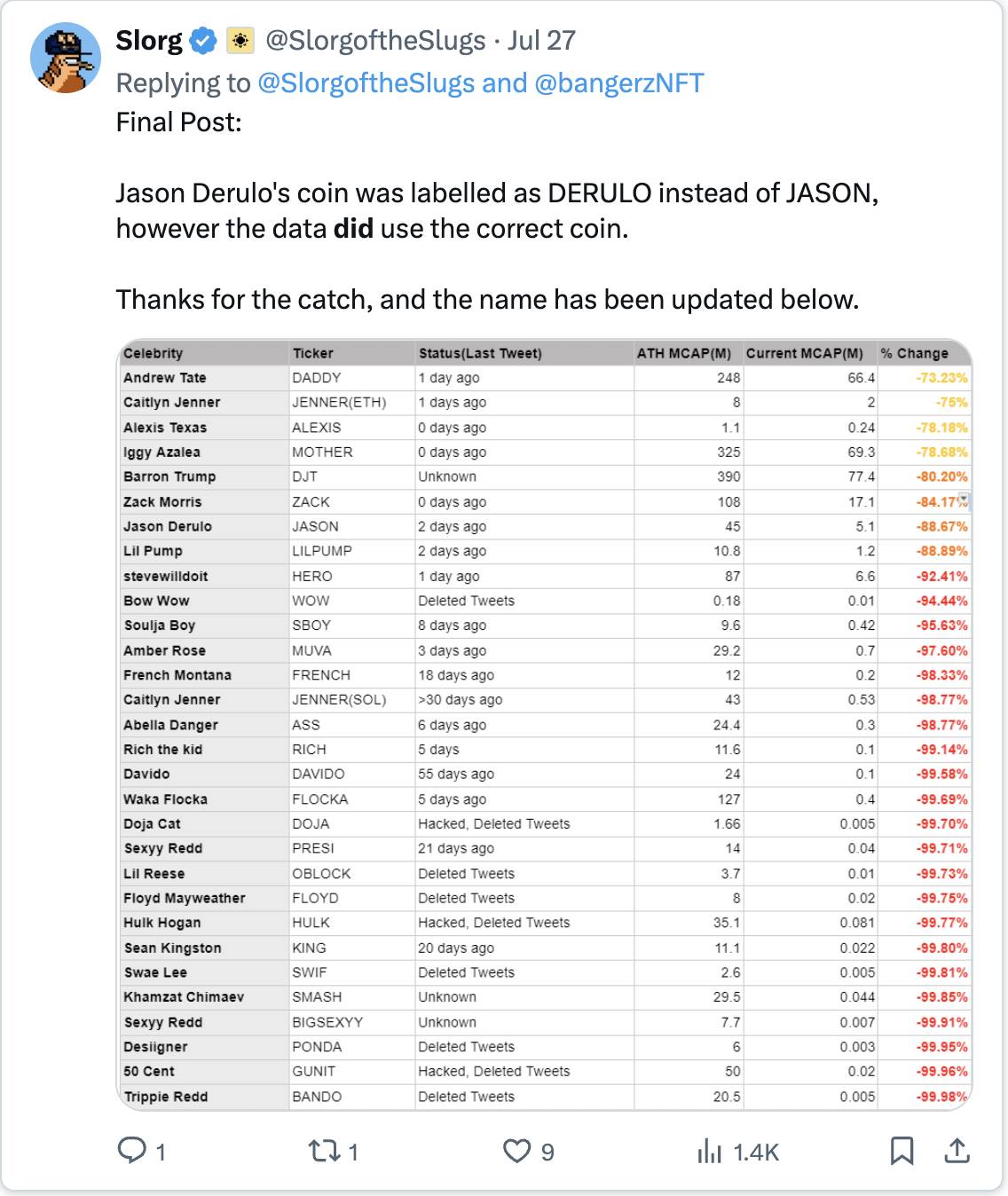

Apart from scams and MEV, the outlook for the mainstream market is still not optimistic. Celebrities chose Solana as their preferred blockchain, but the results are not ideal:

Slorg: "Jason Derulo's coin is marked as DERULO instead of JASON, but the data does use the correct coin." Andrew Tate's DADDY is the best-performing celebrity token, but with a return rate of -73%. On the other end, the situation is equally bad:

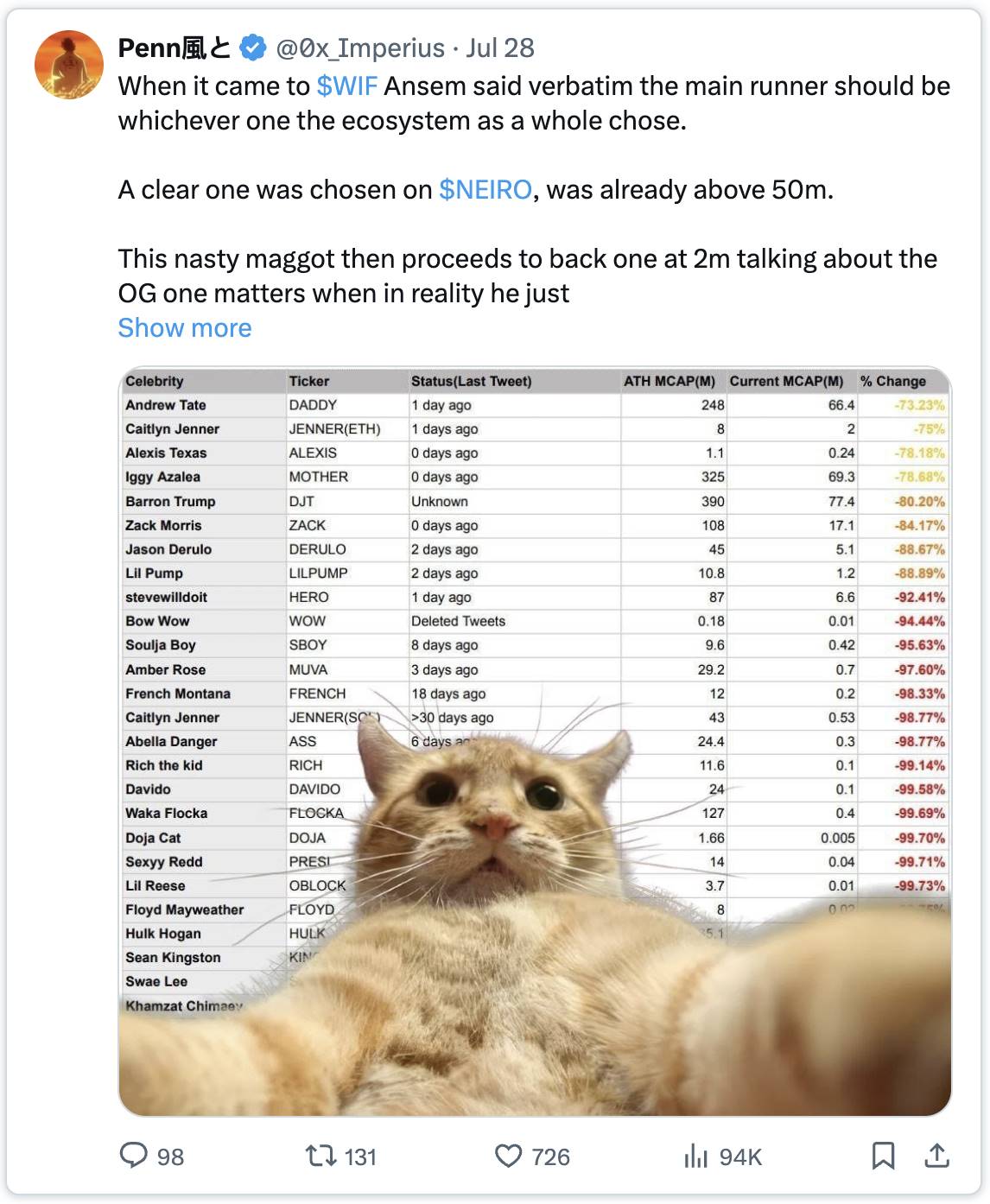

Penn風と: "Regarding $WIF, Ansem once said verbatim that the main participants should be the ones chosen by the entire ecosystem. On $NEIRO, it is clear that one has already been chosen, with a trading volume exceeding 50 million. This annoying guy then supported one based on 2 million, talking about the importance of old projects, when in fact he just missed the main opportunity. This is the result after WIF, you guys need to stop worshiping this celebrity idol."

A quick search on X also shows rampant insider trading and developers dumping on buyers:

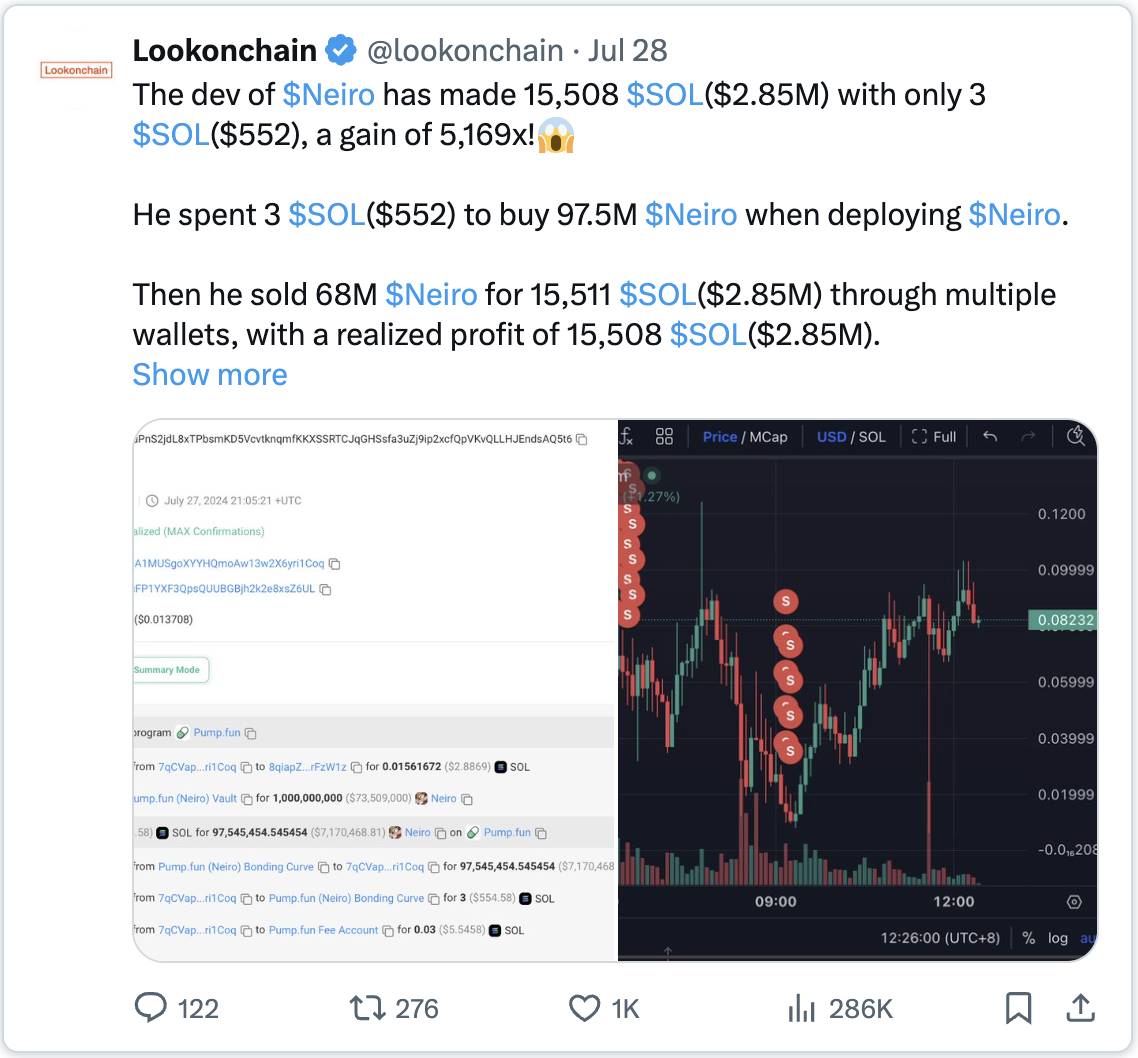

Lookonchain: "The developer of $Neiro made 15,508 $SOL (2.85 million USD) with just 3 $SOL (552 USD), a return rate of 5,169 times! 😱

He spent 3 $SOL (552 USD) to purchase 97.5 million $Neiro when deploying $Neiro.

Subsequently, he exchanged 15,511 $SOL (2.85 million USD) through multiple wallets, sold 68 million $Neiro, and made a profit of 15,508 $SOL (2.85 million USD).

He also sent 10 million $Neiro to a burn wallet, leaving 19.5 million $Neiro (1.8 million USD), unrealized profit of 1.8 million USD!

$Neiro is a #MEMEcoin on #Solana, named after the new dog adopted by the owner of $DOGE (Kabosu)."

But Flip, my timeline is filled with news of people trading memes on Solana and making millions. How does this relate to what you said?

I simply don't believe that KOL posts on X can represent a broader user base. In the current frenzy, they are easily able to build positions, promote their tokens to followers, profit, and repeat. There is definitely a survivorship bias here—the voices of winners far outweigh the losers, creating a distorted perception of reality.

Objectively, the mainstream market is suffering losses of millions every day, from scammers, developers, insiders, MEV, KOL, and this doesn't even include the fact that most tokens traded on Solana are just unsupported memes. It's hard to argue against the fact that most memes will ultimately meet the same fate as $boden.

Additional Considerations

The market is fickle, and when sentiment changes, factors that buyers have overlooked will come to light:

Blockchain instability, frequent outages

High transaction failure rates

Difficult-to-use block explorers

High development barriers, Rust's user-friendliness is far lower than Solidity

Poor interoperability with EVM. I believe that multiple interoperable chains competing for our attention is healthier than being stuck on a single (relatively centralized) chain.

The likelihood of ETFs is low, both from a regulatory and demand perspective. This article emphasizes the reasons for low institutional demand in the current state of Solana. @malekanoms also emphasizes some points that I think are related to traditional finance (and @0xmert's rebuttal):

Omid Malekan: "ETH is a high-quality liquid asset (HQLA) in crypto. To prepare for the launch of an ETH ETF, I wrote a brief paper explaining what HQLA is, why we need a native digital asset, and why ETH is the most likely choice. My analysis compares it to BTC and SOL."

Up to 67,000 SOL (12.4 million USD) in new token generation every day

41 million SOL (7.6 billion USD) is still locked in FTX asset sales. 7.5 million (1.4 billion USD) will unlock in March 2025, with an additional 609,000 (113 million USD) unlocking monthly until 2028. The purchase price for most tokens is around 64 USD each.

Conclusion

As usual, those who profit are often the ones selling the shovels, while speculators often suffer losses unknowingly.

I believe that the commonly cited SOL metrics are significantly exaggerated. Additionally, the vast majority of organic users are rapidly suffering losses from malicious actors. We are currently in a frenzy stage, with inflows of ordinary funds still exceeding outflows, creating a positive appearance. Once users become weary from sustained losses, these metrics will quickly collapse.

As mentioned above, SOL also faces many fundamental headwinds, which will surface once sentiment changes. Any price increase will exacerbate inflationary pressure and unlocks.

Ultimately, I believe that SOL is overvalued from a fundamental perspective, although existing sentiment and momentum may drive short-term price increases, the long-term outlook is more uncertain.

Disclaimer: While I have held SOL at different times in the past, I currently do not hold any substantial SOL positions. Many of the points I mentioned above are my personal speculative opinions and not facts. I may be wrong in my assumptions and conclusions. Please do your own research—this is not investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。