Grayscale's selling pressure is strong, and BlackRock and Bitwise are working together to reverse the flow of funds, but the short-term market is under pressure.

Author: Nan Zhi, Odaily Star Daily

Last night, on the first day of trading after the listing of Ethereum spot ETF, 9 ETFs accumulated a trading volume of over 1 billion US dollars, about 23% of the 46 billion US dollars in trading volume on the first day of the Bitcoin spot ETF listing in January this year, with a net inflow of 106 million US dollars.

How are the specific data of the Ethereum spot ETF and whether it can mirror the trend of the Bitcoin spot ETF, Odaily will analyze the data and market views in this article.

Ethereum spot ETF data

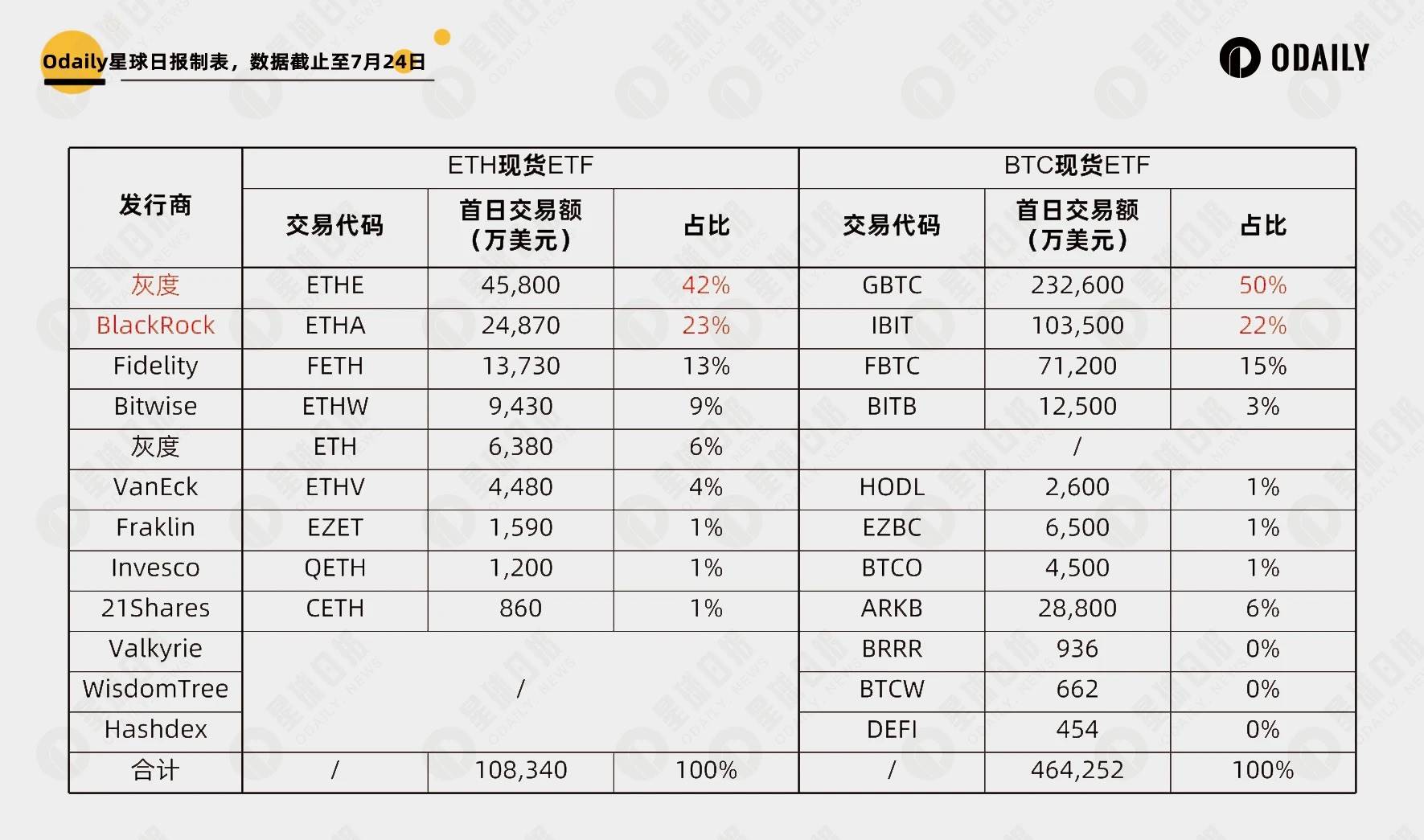

According to data released by Bloomberg ETF analyst Eric Balchunas, the trading volume of 9 ETFs on the first day was 10.83 billion US dollars (The Block disclosed data was 10.19 billion US dollars), among which:

The highest trading volume was Grayscale's ETHE, reaching 4.58 billion US dollars, accounting for 42% of the total trading volume. For comparison, Grayscale's Bitcoin spot ETF GBTC had a trading volume of 23 billion US dollars on the first day of listing in January, accounting for 50% of the total at that time.

The second highest trading volume was BlackRock's ETHA, reaching 2.48 billion US dollars, accounting for 22.9% of the total trading volume. For comparison, BlackRock's IBIT had a trading volume of 10.3 billion US dollars on the first day of listing in January, accounting for 22.7% of the total, very close.

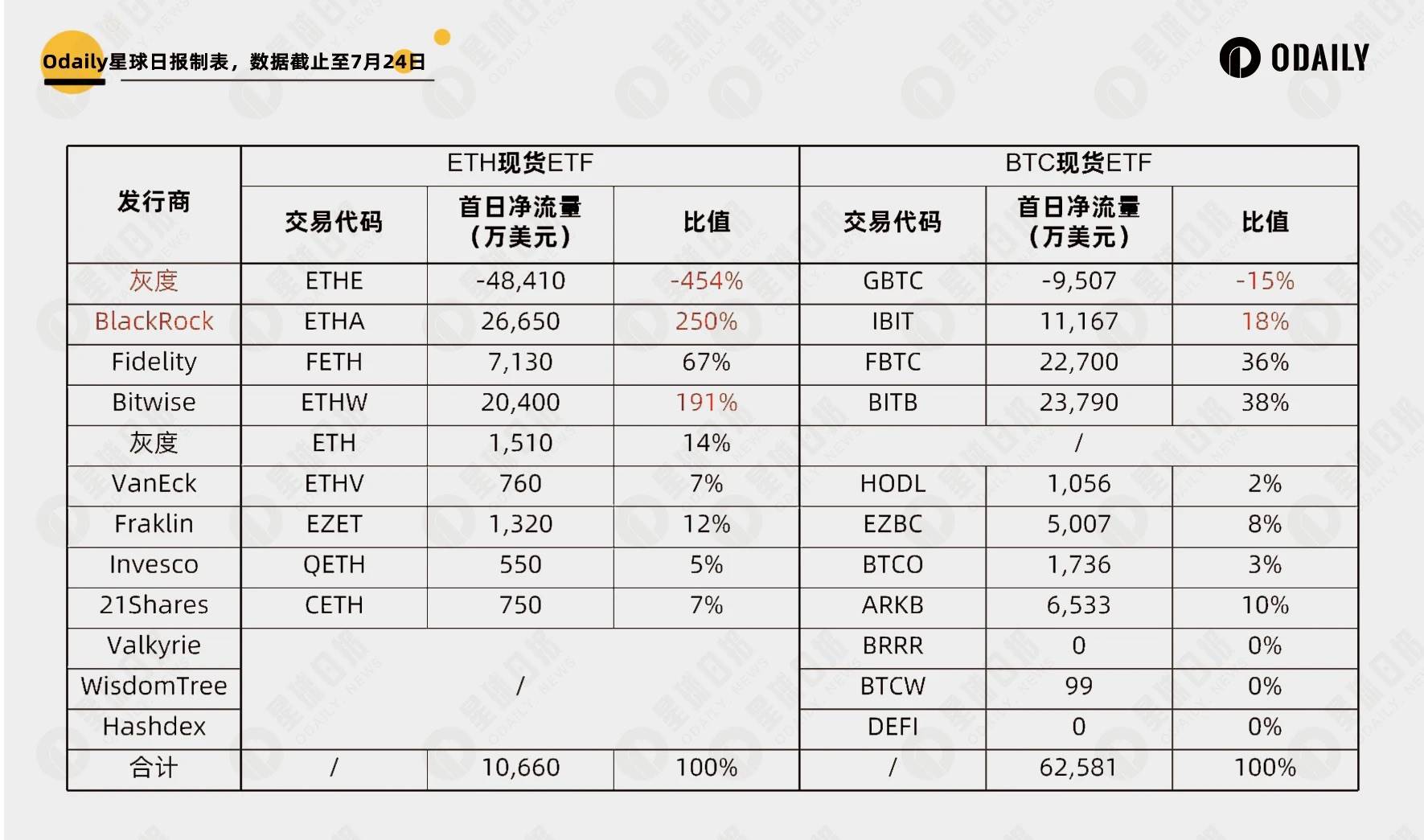

In terms of net fund flow, the net inflow of the Ethereum spot ETF on the first day was 106 million US dollars, which is 17% of the 620 million US dollars on the first day of the Bitcoin spot ETF. Among them:

Grayscale ETHE had a net outflow of 484 million US dollars on the first day, with the main net inflows coming from BlackRock's ETHA at 266 million US dollars and Bitwise's ETHW at 204 million US dollars. It can be seen from the table below that the balance is not as good as the Bitcoin spot ETF, and the selling pressure from Grayscale is stronger.

Since the launch of the Bitcoin spot ETF a few months ago, the net inflow of IBIT has been the core force resisting the continuous selling pressure of Grayscale GBTC. From the initial data, it seems that both the trading volume and net fund flow ratios are quite close, but initially, Grayscale is likely to dominate, or it may replicate the previous trend.

Looking back at the trend of Bitcoin in January

So how did the trend of the Bitcoin spot ETF before and after play out?

On January 1st, the opening price of Bitcoin was about 42,280 USDT;

On January 11th, after the launch of the Bitcoin spot ETF, it peaked in the short term, rising to a high of 48,960 USDT, with a 15.7% increase on the 11th, and then began to bear the selling pressure from GBTC and fell, with a 7.6% drop the next day;

On January 23rd, Bitcoin bottomed out in the short term, falling to a low of 38,550 USDT, with a 21.2% drop on the 12th, and then began a journey to a new high of 73,777 USDT.

The recent high point appeared the day before yesterday (July 22nd). According to the highest price and the price 12 hours after the opening of the Ethereum ETF, BTC fell by 4.2%, and ETH fell by 3.7%.

How does the market view the trend after the launch of the ETH spot ETF, is it a mirror image or an early run?

Market view

Short-term pressure

Most institutions believe that in the early stage after the ETF is launched, the market will be sideways or downward due to the selling pressure from Grayscale ETHE:

Haseeb Qureshi, managing partner of Dragonfly, stated in a post that the opening trading volume of the Ethereum spot ETF was strong, but the price of ETH has not changed significantly, indicating that Grayscale's ETHE is mainly selling, which will offset a lot of the first day's fund inflows.

Jupiter Zheng, partner of Hashkey Capital Liquid Fund, stated that the outflow of funds from Grayscale's Ethereum Trust Fund may put pressure on the price of ETH after the ETF is launched today, and may also suppress market sentiment in the short term. However, like the Bitcoin ETF, investors may transfer funds to lower-cost options.

The latest report from QCP Capital pointed out that the market's response to the release of the Ethereum spot ETF is relatively flat, and investors are observing whether a "speculative buy, news sell" pattern will emerge. Due to the impact of the US government and Mt. Gox news, the options market seems to expect more downward trends in the near future. Due to the possibility that the spot price of ETH may not be immediately affected by the ETF, coupled with the potential selling pressure from the US government and Mt. Gox, the spot price may remain low until momentum accumulates before the election.

Option data: High IV, slightly bullish

Adam, a macro researcher at Greeks.live, stated that the end-of-day IV for ETH has exceeded 80%, significantly higher than the recent average level (60%). From the distribution of transactions, active buying of calls accounted for nearly half of the daily trading volume, and the skew is slightly biased towards calls. Today, the options market is mainly dominated by bullish forces, with a stronger bullish force. However, it is also noted that during the launch of the BTC ETF, a large amount of selling led to a decline, so the bullish force today is weaker than during the launch of the BTC ETF.

Another interesting point is that today's large trades are more concentrated on BTC, with over 5000 contracts of deep out-of-the-money call options traded, while ETH is more concentrated on the order book, and market makers are actively adjusting their positions while the market is active.

BRN: Target price of $2800 - $3100

Valentin Fournier, an analyst at digital asset research company BRN, stated in an email, "We recommend maintaining a positive exposure to the cryptocurrency market, but we prefer Bitcoin over Ethereum, as we believe that the speculation and (ETF) inflows of Ethereum have already been digested by the market. We expect Ethereum to fall to a level between $2800 and $3100, and then rebound to $4000 in September."

Markus Thielen, founder of 10x Research, expressed a similar view in a communication on Tuesday, saying, "Once the (Ethereum spot) ETF is launched, investors will take profits."

Lack of staking rewards makes Ethereum ETF less attractive

Investor attitudes towards the launch of the Ethereum ETF in the United States are more cautious and divided than the widespread enthusiasm before the launch of the Bitcoin ETF. One major concern for some investors is that the U.S. Securities and Exchange Commission (SEC) has excluded the "staking" mechanism, which is a key feature on the Ethereum blockchain. Staking allows Ethereum users to lock their ether to earn rewards to help secure the network. Rewards or returns appear in the form of newly issued ether and a portion of network transaction fees. Under the current architecture, the SEC will only allow the ETF to hold regular, unstaked ether.

Mike McGlone, an analyst at CoinShares, stated, "Institutional investors focusing on Ethereum know that staking can generate returns." "It's like a bond manager saying, I want to buy bonds, but I don't want to earn interest, which is contrary to the original intention of buying bonds." McGlone believes that investors will continue to stake Ethereum outside of the ETF and earn returns, rather than pay fees and hold Ethereum in the ETF.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。