Author: Weilin, PANews

Attitudes towards cryptocurrencies have become an important topic in the US presidential election in November this year. Interestingly, users not only see traditional polling agencies continue to provide data, but also see the increasing popularity of the cryptocurrency-based prediction market platform Polymarket. As of May 16, nearly $127 million has been bet on the topic of "winner of the 2024 presidential election," with $15 million bet on Trump, giving him a 50% chance of winning, and $14.55 million bet on Biden, giving him a 42% chance of winning. The chances of the other three candidates winning are all less than 3%.

Just a few days ago, on May 14, Polymarket announced that it had raised $70 million through two rounds of financing. The latest round of financing was led by Peter Thiel's venture capital firm Founders Fund, and Polymarket's investors also include Ethereum co-founder Vitalik Buterin.

The establishment of Polymarket is related to the widespread dissemination of misinformation during the COVID-19 pandemic. The project was established in May 2020, and the platform went online in mid-June of the same year. It also coincided with the US presidential elections in 2020 and 2024, bringing this cryptocurrency-based prediction market platform gradually into people's sight and market hotspots.

Dropping Out of the Computer Science Department at NYU, Advocating Hayek

Polymarket founder Shayne Coplan, 26, studied computer science at New York University, according to his LinkedIn page. Publicly, Coplan embodies the qualities of a new generation of entrepreneurs in many ways. He is an artist who became fascinated with P2P file sharing during the era when people liked to share music. From that time on, he came into contact with Bitcoin and easily understood the intrinsic value of the global peer-to-peer asset network.

When Ethereum was announced in 2014, Coplan became an early follower and is believed to be the youngest participant in the presale. Two years later, at the age of 18, Coplan began to participate in blockchain projects. In June 2016, he interned at Chronicled in the San Francisco Bay Area, where his responsibilities included "following the chief product officer and helping to determine the interaction between the product and the Ethereum blockchain."

After that, Coplan has been immersed in cryptocurrencies and launched a series of startups, founding a DeFi startup called Union.market, which directly led to the predecessor of Polymarket. Despite dropping out later, he has been thinking for a long time and understanding the specific problems faced by the creation of prediction markets and decentralized markets in recent years. He cited Hayek's famous paper "The Use of Knowledge in Society" as an early entrepreneurial inspiration and also referred to years of academic research on prediction markets. Hayek's related thoughts are that when economic incentives are at play, people are more likely to accurately understand uncertain possibilities. People read more and better sources of information, think more deeply, and try to place their money on more likely actual outcomes.

"When the new coronavirus broke out, there was so much uncertainty and so many different opinions, (I thought) if there were only free markets on these topics, people could connect their money with their opinions," Coplan once told the media.

On June 16, 2020, the test version of the cryptocurrency prediction market Polymarket was launched, but there was high friction for users at the time, with only support for Metamask login, high Ethereum transaction fees, and limited liquidity. Three months later, with the release of Polymarket's second phase, Coplan's approach to building Polymarket became increasingly clear. The platform was ported to the second layer of Ethereum, Matic (now Polygon), to reduce betting gas fees. He also designed a system for users without an Ethereum wallet. All bets are made with the stablecoin USDC pegged to the US dollar, which can be purchased with a debit or credit card.

Just a few months after its initial launch, Polymarket successfully attracted attention and completed a large-scale $4 million seed round of financing, led by well-known investors Polychain Capital and Naval Ravikant.

The 2020 US election became a catalyst for Polymarket. On November 3 of that year, influenced by the US election, Polymarket's trading volume surged to $1.297 million, from obscurity to prominence.

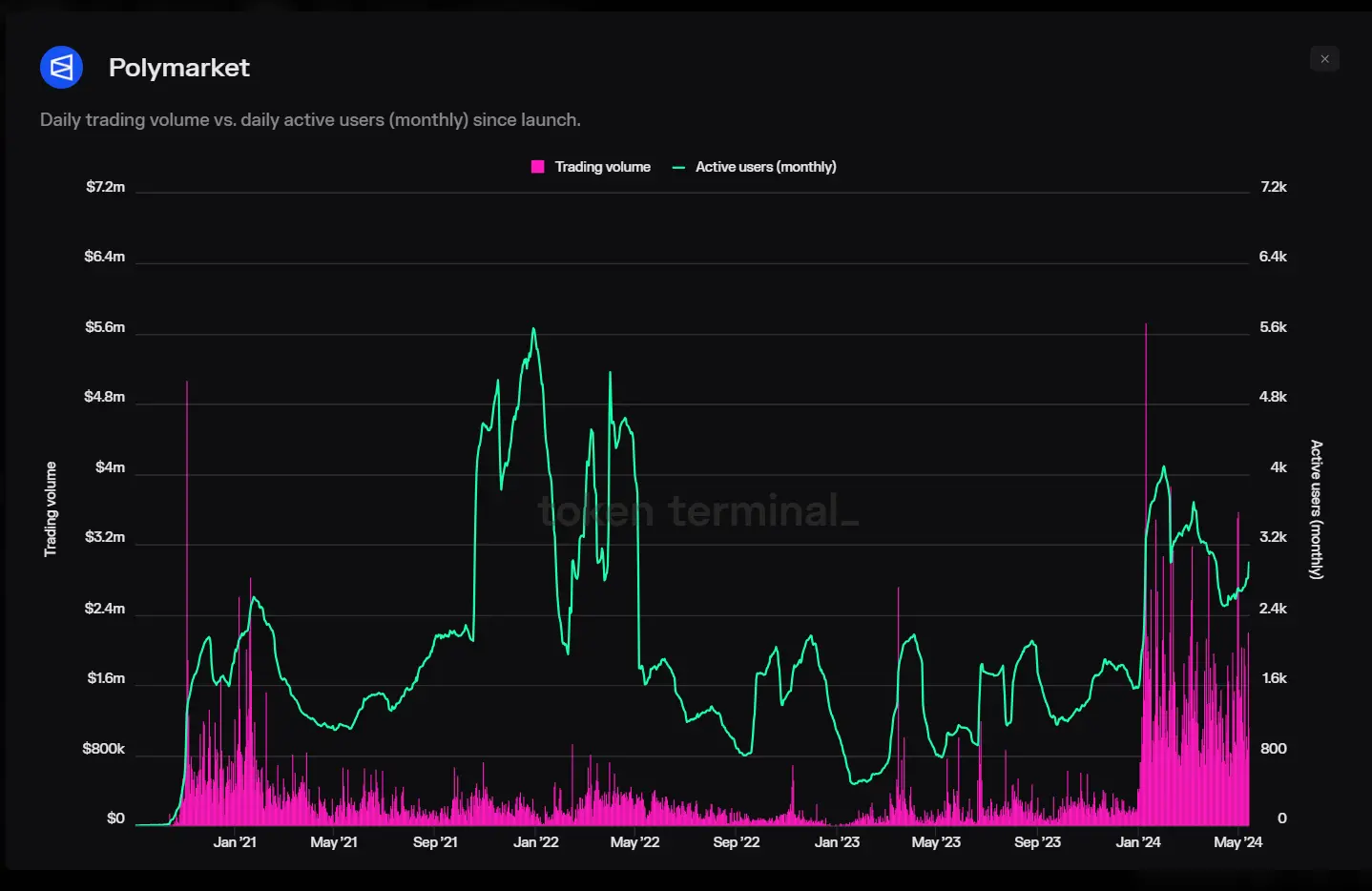

Polymarket's trading volume and monthly active users since its release in 2020

With more positive feedback from the community and market recognition, Polymarket later attracted Series A financing, with General Catalyst helping the company raise $25 million in Series A financing, with participation from Airbnb's Joe Gebbia and Polychain, among others.

Most recently, Polymarket's Series B financing reached $45 million, led by Peter Thiel's Founders Fund and existing investors 1confirmation and ParaFi, with participation from Ethereum co-founder Vitalik Buterin, Dragonfly, and Eventbrite co-founder Kevin Hartz.

Fined $1.4 Million by CFTC, Controversy over Submarine Predictions

Polymarket's development has not been smooth sailing. In January 2022, Polymarket was fined $1.4 million by the US Commodity Futures Trading Commission (CFTC) for violating regulations and received a cease and desist order for failing to register as a Swap Execution Facility. As part of the settlement agreement, Polymarket committed to reducing its services in the US and continuing to operate overseas.

However, Polymarket has also strengthened its efforts in compliance. In May 2022, Polymarket appointed former CFTC Commissioner J. Christopher Giancarlo as chairman of its advisory committee.

In addition to this fine, in June 2023, according to Mother Jones, a tweet about the result of a Titan submarine went viral, bringing some negative impact to Polymarket. There was a bet on Polymarket about whether the submarine would be found by a certain date, with users betting over $300,000 on whether the missing submarine would be "found by June 23." This sparked online discussions about the ethical issues of profiting from potentially fatal events.

"At what stage of capitalism is betting on someone's death?" a Twitter user asked, posting a screenshot showing the odds on Polymarket. This sentiment struck a chord with people, and the post quickly went viral, receiving over 9,000 retweets and over 150,000 likes. "It's insane. Imagine making money off of whether someone will die," another user replied, garnering over 1,000 likes. Others began to directly criticize Polymarket for opening this prediction.

Polymarket, in response to the ethical issues, described the submarine market as "unrelated to the fate of the passengers." "We understand that there has been some confusion due to the misunderstanding of our prediction market's connection to the fate of the passengers," Polymarket wrote. "We want to emphasize that this is not the case. Our goal is not to profit from this unfortunate event. We have not done so. Instead, we aim to help people better understand the world around them."

"Breakthrough" in the Cryptocurrency Prediction Market Race, When Will It Mature?

The prediction market itself has a long history, but in the cryptocurrency field, the first decentralized prediction market was Augur, launched on Ethereum in July 2018. Augur was developed by the Forecast Foundation, founded in 2014 by Jack Peterson, Joey Krug, and Jeremy Gardner. The Forecast Foundation received advice from Ron Bernstein, the founder of the now-defunct company Intrade, and Ethereum founder Vitalik Buterin.

In addition to Augur, there are other prediction markets in the market, not only Polymarket, but also Gnosis, Hedgehog, PlotX, Projection Finance, Sanr.app, Better.fan, Feel.market, and more. However, Gnosis shifted to community management projects after failing to meet its targets. Other cryptocurrency prediction markets, such as Veil, simply closed down.

Early experiments with cryptocurrency-based prediction markets, such as Augur and Gnosis, suffered greatly due to Ethereum's long-standing scalability issues. Additionally, they initially used native tokens, adding friction to the user experience. Polymarket learned from the mistakes of its predecessors.

After four years of development, Polymarket has now successfully "broken through" and is even cited by the media and industry research as a reference for public opinion on some key issues.

As of May 14, there are many hot topics on the Polymarket website: for example, who will win the 2024 presidential election? Will the Ethereum ETF be approved by May 31? Will $GME reach a new all-time high by Friday?

According to Token Terminal data, Polymarket's highest trading volume this year occurred on January 10, reaching $5.73 million. The platform experienced significant growth in monthly active users in January, rising from 1,600 on January 1 to 4,100 on February 1, with a slight slowdown in monthly active users after April. As of May 15, the predicted amount on Polymarket has reached $202.7 million.

Following the recent financing, Coplan stated on LinkedIn, "What is most gratifying is seeing Polymarket being widely adopted as an alternative news source. The trend is clear: because of Polymarket's existence, people have a better understanding of what is happening in the world. Tired of the empty talk of experts and algorithm-generated news. In this era of rampant misinformation, Polymarket provides a new form of information driven by financial incentives for truth, rather than clickbait. People want fair information. Polymarket is providing that."

As a firm believer in market theory, Coplan believes that prediction platforms are a better way to understand the reality.

Polymarket has attracted the attention of many industry insiders. Vitalik once used Polymarket to track Sam Altman's board exit event. Packy McCormick, an advisor at a16z Crypto, has also said that Polymarket's page might be the best place to start a day on the internet.

Riding the wave of social hot topics and with the support of celebrity users, Polymarket has become the largest cryptocurrency prediction market. However, to achieve its original intention, continuous optimization of the product experience and the avoidance of risks and ethical dilemmas are crucial challenges for its future development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。