Uncontrolled, with continuous growth and no reduction, without concealment.

Written by: James Lavish

Translated by: DeepTechFlow

"Printing money" seems simple, but it is actually confusing. When the Federal Reserve can print more dollars to cover any expenses the government needs to pay, why sell bonds to the public? The answer is simple, but it requires some critical thinking.

If you visited Twitter last week, you might have seen a video clip of Jared Bernstein, the chairman of the Council of Economic Advisers (an organization that provides economic policy advice to the White House), "explaining" bonds.

However, he seems to have a hard time understanding the basic concepts of bonds and how they work. To be honest, these concepts are indeed difficult to grasp, so let's break down these concepts in a simple and understandable way.

Basic Knowledge of Money Supply

To understand "printing money," we must first understand the basics of money supply. Or more precisely, the basic knowledge of "money supply," which we will keep at a very high level and make it easy to understand.

Narrow Money

In the measure of money supply, the strictest is the so-called narrow money, namely M0 ('em-zero'). This only includes currency in circulation and cash in bank reserves. M0 is usually referred to as the base money. Moving up one level, we have the so-called M1. M1 includes all of M0 plus demand deposits, plus any outstanding traveler's checks. Demand deposits are just liquid deposits in bank accounts that customers can withdraw at any time, such as checking and savings accounts.

Banks do not keep all of their cash in their vaults; they use risk analysis to estimate how much available funds each branch needs in case of a bank run, leaving only 0s and 1s on their balance sheets.

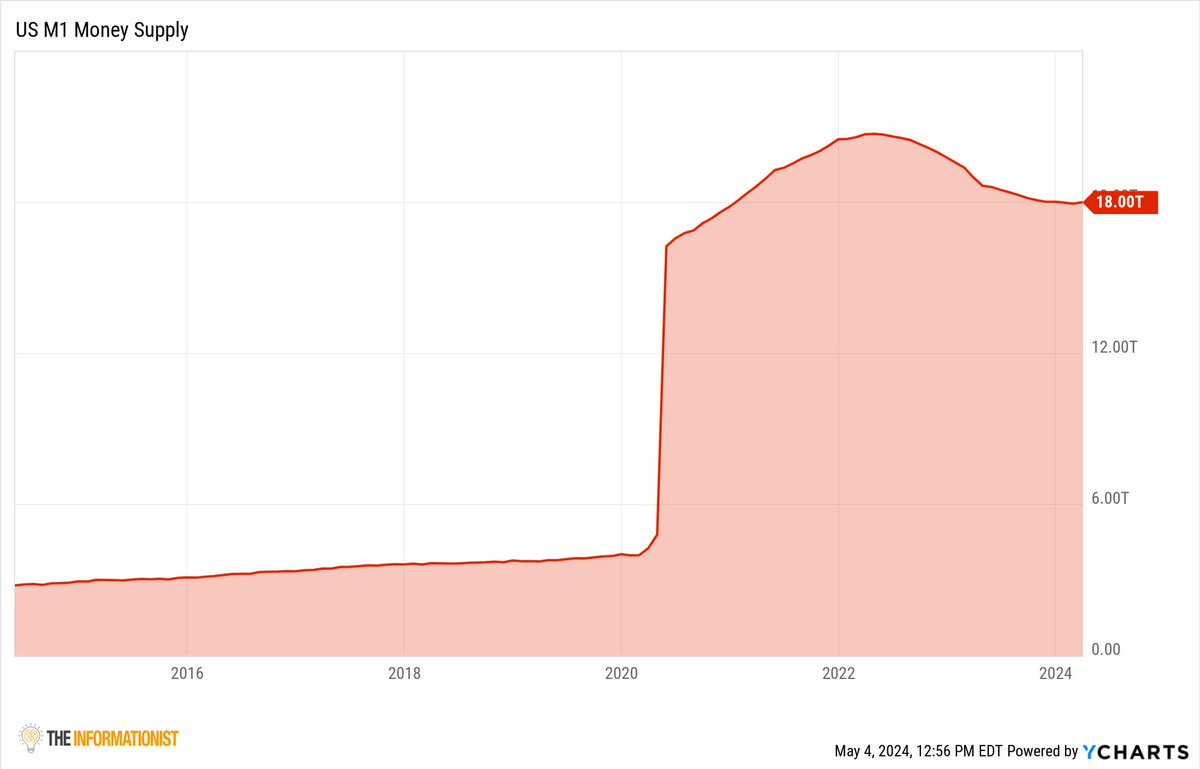

Anyway, M1 includes any cash that can be withdrawn (including those traveler's checks), that's it. Therefore, M1 is usually referred to as narrow money. Here is the amount of M1 in dollars:

I know what you're thinking: What happened in 2020 that caused the M1 money supply to skyrocket? You guessed it: through printing money. We will discuss this issue later, but let's first unlock the next level of money supply, namely broad money.

Broad Money

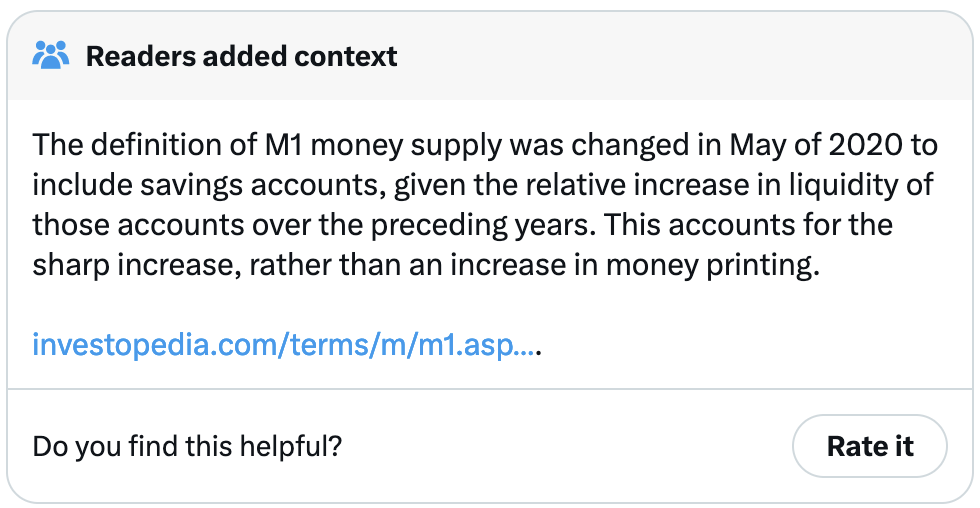

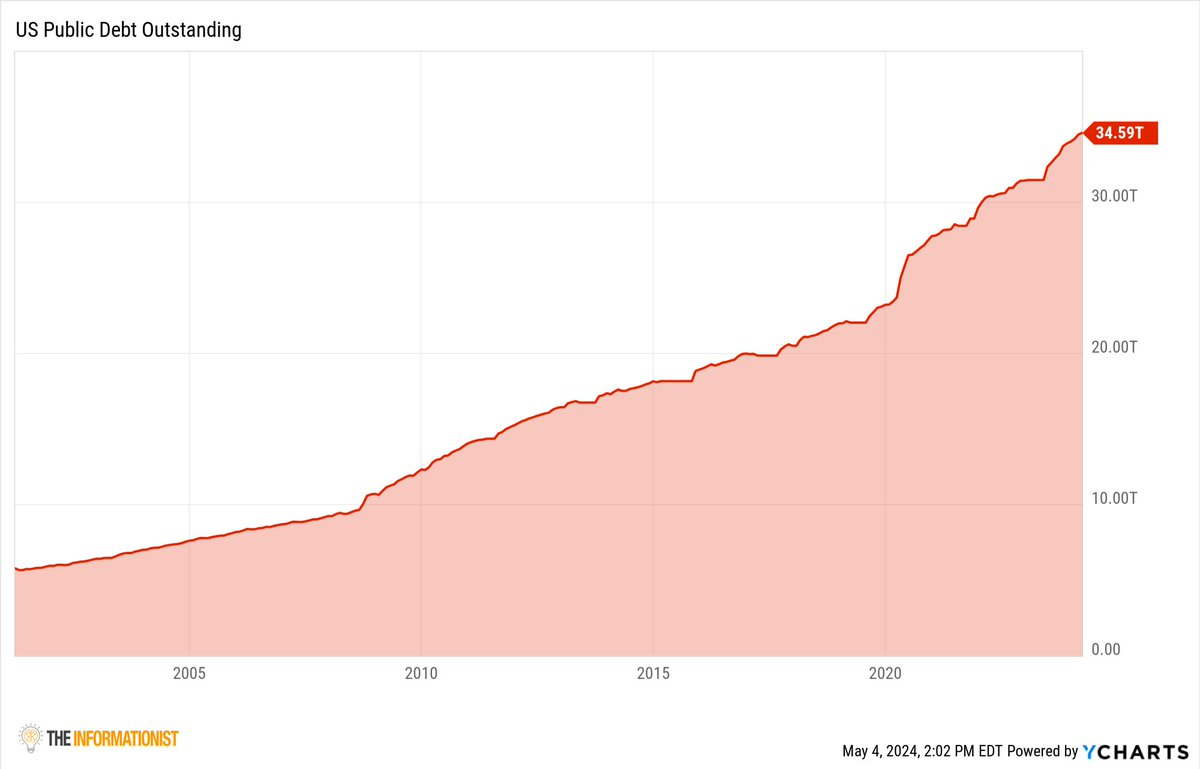

Expanding our scope a little, M2 includes all of M1 plus savings deposits, time deposits under $100,000 (i.e., CDs and money market deposits). In other words, M2 includes all funds held in cash equivalent accounts, liquid and semi-liquid accounts.

Expanding to M2, here is the amount of dollars today. You can see how the expansion of M2 after 2020 gradually increased and took some time to "penetrate" into individual accounts.

Why? Because of the Cantillon Effect. The Cantillon Effect, named after the 18th-century economist Richard Cantillon, describes how those who receive new funds first (i.e., banks, governments, or financial institutions) benefit, while others experience delayed effects.

Now, let's explain the difficulties Jared Bernstein encountered (apparently he didn't understand it himself) when describing U.S. bonds.

Basic Knowledge of Bonds

From the most basic definition, U.S. bonds are bonds issued by the U.S. government. This is no different from bonds issued by Apple, Microsoft, or Tesla, except that it is the country (or company) borrowing money from the people who buy the bonds.

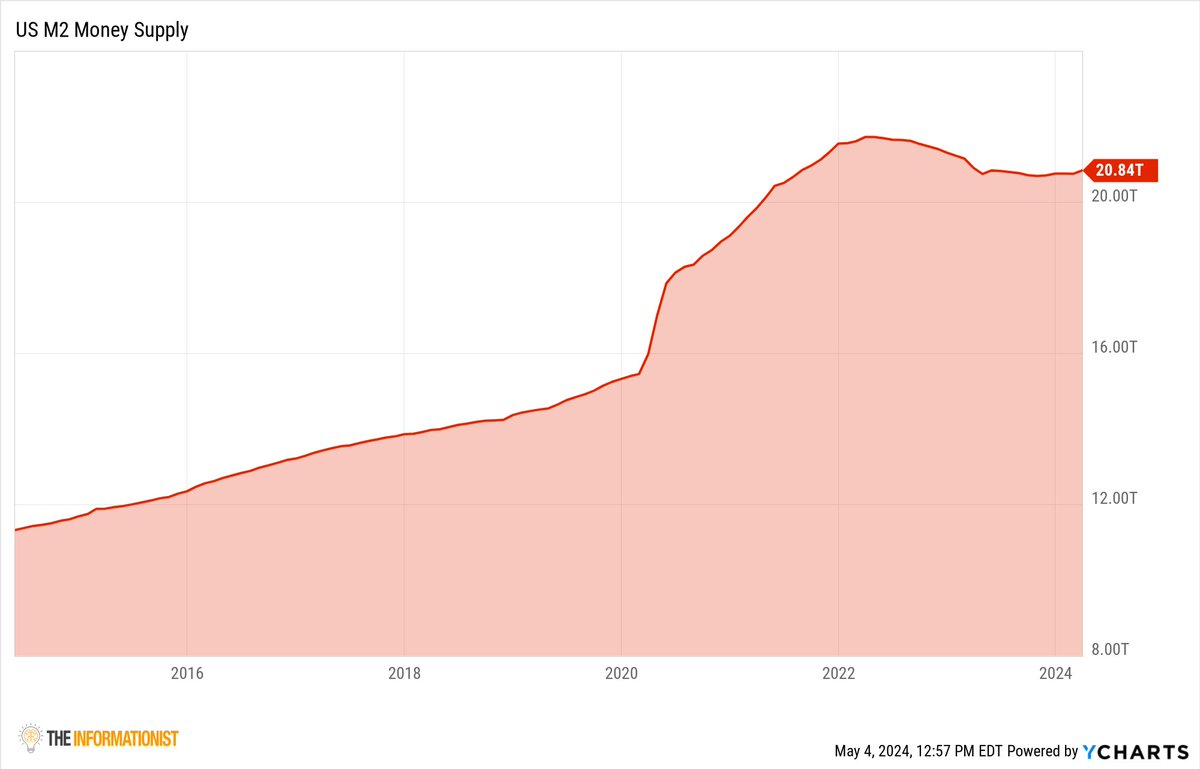

What happens when you borrow money? You pay interest to the person lending you the money, just like you pay interest to the bank for a mortgage. When you borrow money to buy a house, you pay interest to the bank for that loan. We all know that the government has been borrowing a lot lately because it is in a deficit (spending exceeds tax revenue) and is borrowing to make up the difference, increasing the U.S. public debt.

How much money has the U.S. borrowed, and how much does it owe to everyone who lent it money?

Can you believe it's a total of $34.6 trillion!

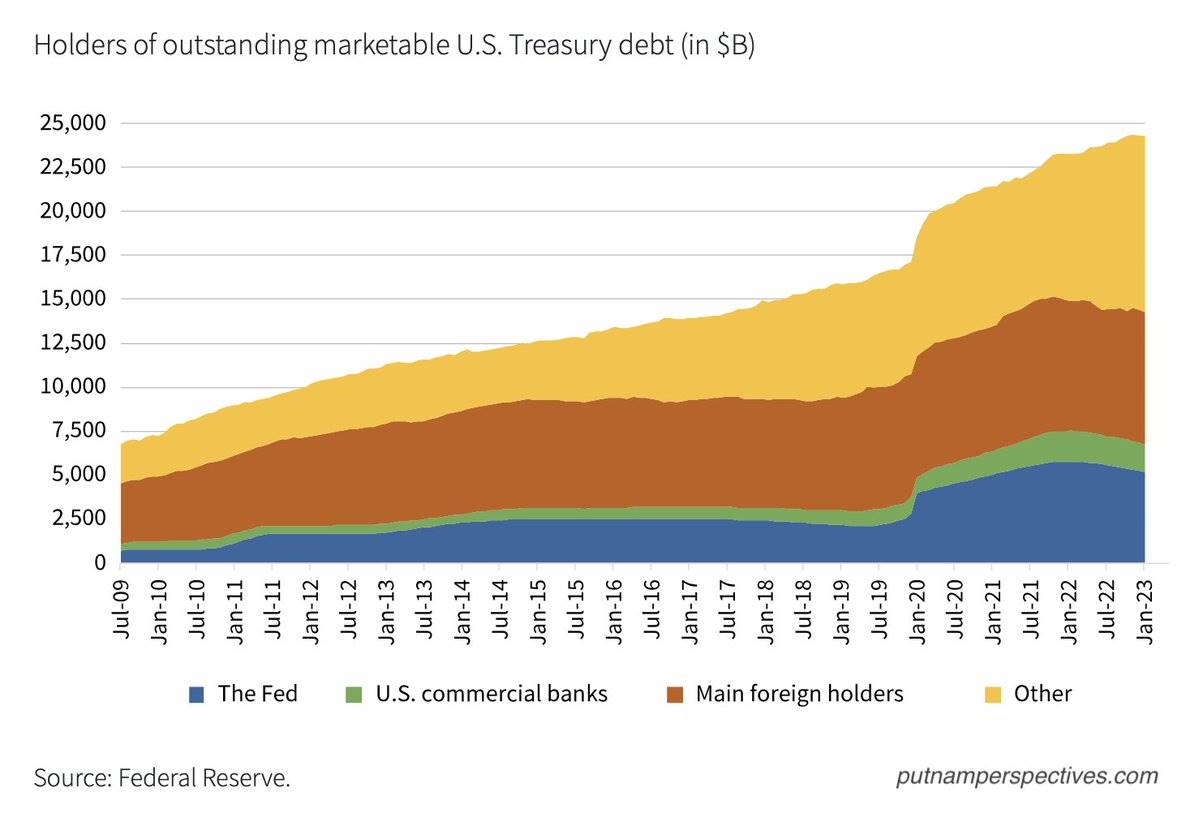

So who is buying all these bonds? In other words, who is lending so much money to the U.S.?

Basically, you and I, as well as others, directly purchase bonds in their IRAs, 401Ks, and personal accounts, and indirectly purchase bonds through mutual funds and money markets, U.S. banks, and foreign central banks (such as the Bank of Japan, the Bank of China, and other foreign banks), including the Federal Reserve itself also buying bonds.

You might wonder, how can they possibly own all these U.S. bonds? Let me explain step by step.

How Money Is "Printed"

This involves quantitative easing (QE) and quantitative tightening (QT).

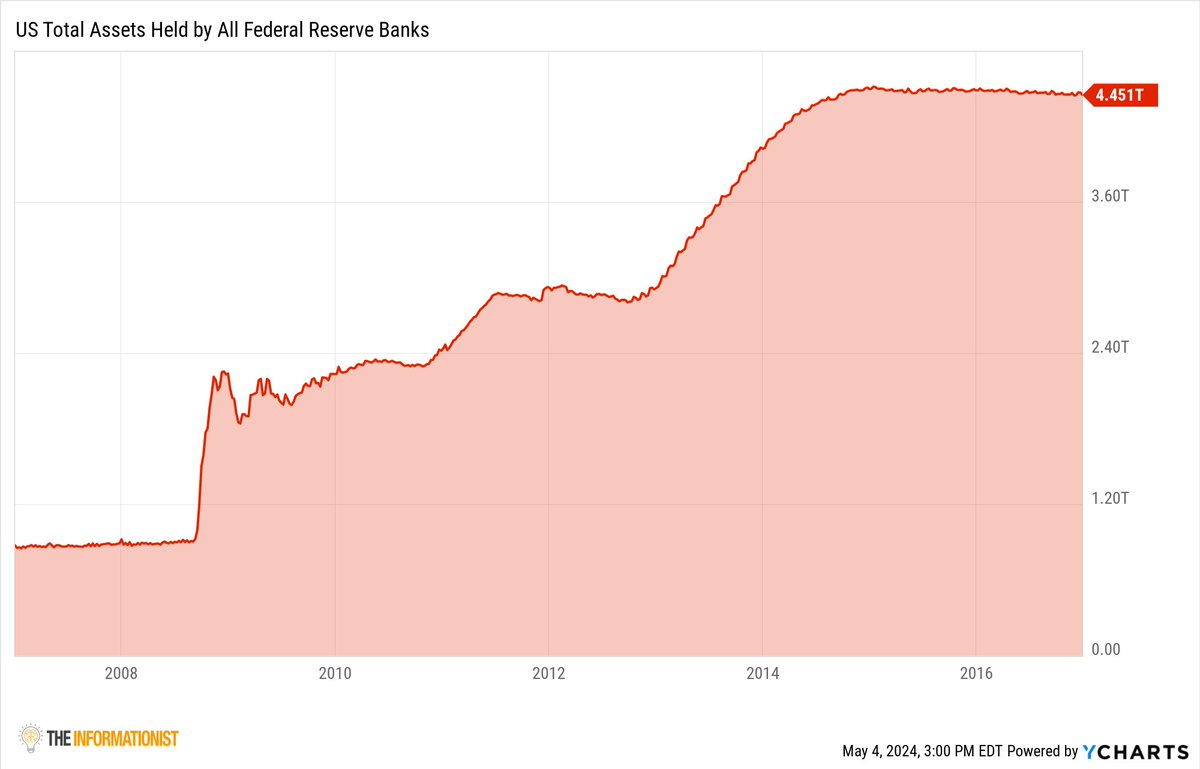

During a financial crisis or economic recession, such as the financial crisis, we saw the Federal Reserve use QE in a shotgun manner, indiscriminately purchasing U.S. bonds and MBS (mortgage-backed securities). QT is the time when the Federal Reserve sells them back to the market.

During the global financial crisis, the Federal Reserve purchased over $1.5 trillion of these assets within a few years (and continued to increase for several years).

Fast forward to 2020, the market was in distress due to the lockdowns, and the Federal Reserve added cash "rockets" to its arsenal. This means that over $5 trillion was added in just 2 years, look at the difference between 2009 and 2020.

But how did they do it?

As the central bank of the United States, the Federal Reserve has the unique ability to create money. When the Federal Reserve uses QE to purchase securities such as U.S. bonds, it does so by creating bank reserves out of thin air, which is the digital process of money creation. Here's how it works:

The Federal Reserve announces its intention to purchase securities and the amount it will purchase.

Primary dealers (large intermediary banks) represent the Federal Reserve in purchasing these securities in the open market.

After the purchase is completed, the Federal Reserve records the newly created money in the primary dealers' reserve accounts and adds the bonds to its balance sheet.

This process increases the total reserves of these banks, injecting liquidity directly into the banking system.

Essentially, primary dealers act as brokers and settle the transactions, sending this newly found money to the sellers of the bonds and sending the bonds to the Federal Reserve, and more cash enters the system.

Imagine you are playing a game of Monopoly, and all the money has been allocated and is already in the game. Then, a new player appears in the game, holding money from "his" own game of Monopoly at home, and he starts buying properties everywhere. The situation now is that he has introduced new money into the game that wasn't there before, expanding the money supply, so Park Place and Boardwalk become more expensive. This is exactly how the Federal Reserve operates when implementing QE policies and buying bonds in the open market.

The Federal Reserve introduces money into the market that wasn't there before, injecting liquidity into the market. Look at how the M2 money supply (blue line) rises with the expansion of the Federal Reserve's balance sheet. This is the typical printing press.

As for why we don't skip the entire QE and Treasury borrowing system and just print money, if we did that, we would become a full-fledged "banana republic," openly and excessively printing money to fund government deficits would lead to hyperinflation. Imagine in such a world, the Treasury (actually Congress) spends as much money as it wants, and the Federal Reserve just prints as much money as needed to meet the spending.

Uncontrolled, with continuous growth and no reduction, without concealment.

With the sharp inflation of the money supply, prices will skyrocket exponentially (Park Place and Boardwalk will be sold for millions, billions, trillions), people will lose confidence in the dollar as a store of value, and at times, as a medium of exchange. There will be dollars everywhere on the street, as buying anything will require a cart full of dollars, and prices will change every minute.

(If you think this is an exaggeration, just go and see the situation in Venezuela or Lebanon for yourself.)

This will lead to loss of confidence, chaos, and rapid descent into hyperinflation, and the dollar will collapse. The Federal Reserve and the Treasury will do everything they can to confuse and distract people from the infinite printing press.

They will sell bonds.

Even to themselves.

If the chief economists of this country are confused by this system, then surely others will be too.

So, the show will go on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。