This article is bearish in the short term but bullish in the long term on the Rune protocol, while also introducing some project opportunities and related tools.

Author: IGNAS | DEFI RESEARCH

Translated by: Plain Blockchain

Bitcoin halving is only 3 days away, and the Rune protocol will go live at the same time! I believe you have heard of the Rune protocol, but I want to share my views on why I am bearish in the short term but bullish in the long term, how to prepare, and which protocols/tools to use to avoid missing opportunities?

1. Bearish on the Rune protocol (short term)

I expect the market to remain hot before the launch of the Rune protocol. Assets like Runestone, RSIC, and PUPS have already surged, and those holding these assets will receive Rune Token airdrops. The new Rune Token may perform strongly for a period of time.

But the market will cool down just like the drop in NFTs. Here are a few reasons:

Bitcoin transaction fees will become too expensive for traders with less capital, making it difficult for them to actively trade Rune (which in turn will drive the story of Bitcoin Layer 2).

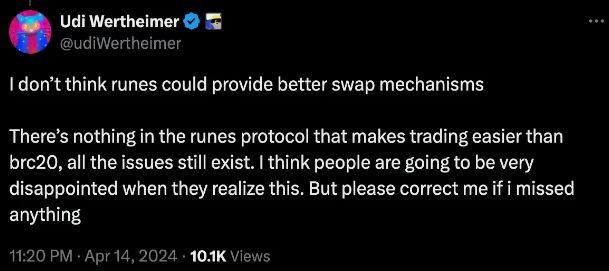

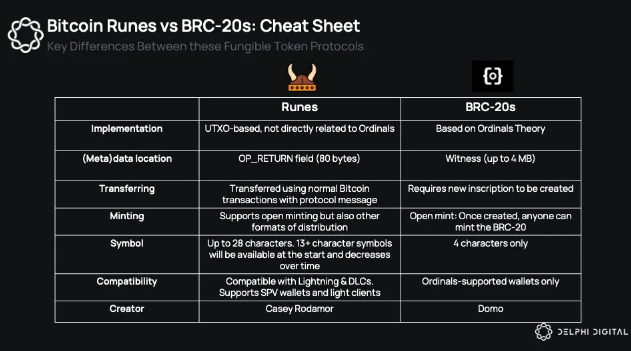

Rune may not significantly improve the BRC20 trading experience, as the transaction method for UTXO and BRC20 is similar to NFTs.

The early UniSat and Ordinal Wallet trading interfaces are similar to the BRC20 interface and include the following two aspects during trading: 1) the quantity of tokens traded in a single transaction, and 2) the price of each pack.

The number of newly issued Rune Tokens will be astonishing: dozens or even hundreds of new tokens will be minted every day (at high gas fees), which will dilute the attention of traders and the capital inflow of each token.

In terms of practicality, Rune is like BRC20. At least initially, it is, so the "freshness" will gradually fade. Especially if no Rune Token can sustain an increase, speculators will incur losses.

Additionally, the Rune 0 (UNCOMMON•GOODS) set by Casey Rodamor will be difficult to hype because 1) it can be minted for free for 4 years, and 2) only one can be minted per transaction.

2. Why I am bullish on the Rune protocol in the long term

If I am not mistaken, shortly after the launch of the Rune protocol, the hype around Rune will cool down, and the best opportunities will arise after the sell-off.

Here are the reasons:

Speculation on the narrative is segmented.

The first wave is driven by excitement about new things. This usually stems from innovative technology or simple meme potential. Meme Tokens are a bit like gambling: most meme tokens with significant gains rarely have a second wave.

However, speculation on the narrative based on technological innovation has a stronger chance of revival after the cooling of the first wave of hype.

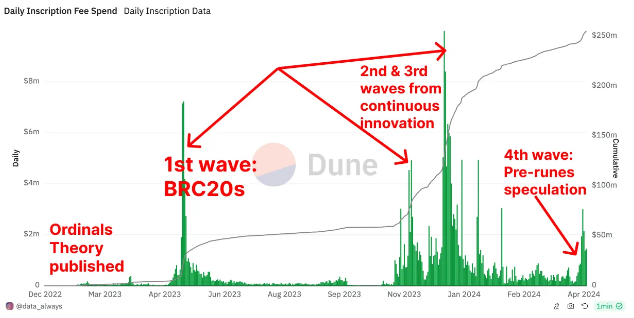

Ordinal Inscriptions were launched in December 2022. But the first major hype was when BRC20 was launched in May 2023. Free-minted BRC20 grew rapidly, but with continued development, the second and third waves arrived at the end of 2023.

Now we are in the fourth wave of speculation on Rune.

While many narratives did not survive the first wave (please refer to ERC404 transactions), I believe Rune will have a fifth, sixth, or even more waves.

Reasons are as follows:

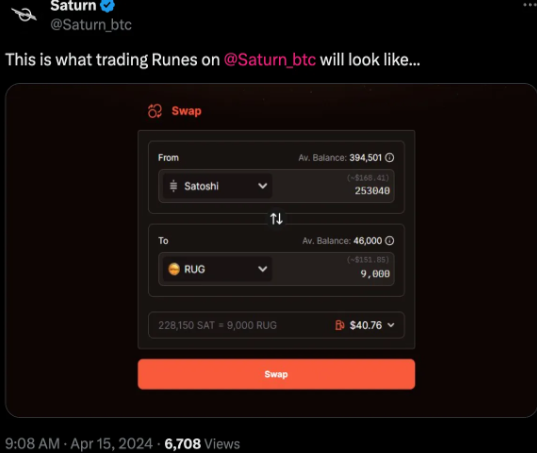

Multiple protocols are building infrastructure for Rune Tokens. However, developing new DEXes/markets takes time. For example, Saturn is building a familiar DEX for Rune, but it will take time to make the user experience smooth. I will share more protocols to watch below.

The Rune protocol aims to consolidate the BTCFi industry around a unified development standard. Just like imagining Ethereum without a unified ERC20 standard—tokens cannot be exchanged between Aave and Uniswap. This is the current situation with Bitcoin. Before Rune, we had BRC20, CBRC-20, ARC-20, BRC-420, and so on, a mess.

I am also bullish on the long-term development of Rune because it captures the three pillars of the thriving crypto ecosystem, which is my framework for this bull market.

In my view, the success of any crypto ecosystem is driven by three key elements: technological innovation, token minting opportunities, and engaging narratives. How does Rune fit into these elements?

1) Technological innovation: We were told that NFTs and tokens were not possible on Bitcoin. However, in this cycle, Bitcoin NFTs have outperformed Ethereum NFTs. And as the first BRC-20 on Bitcoin, ORDIs traded on Binance reached $1 billion in volume.

The magic is turning interchangeable sats into non-interchangeable ones. When there are inscriptions on top, one sat is no longer equal to another.

This is one of the most exciting zero-to-one innovations in this cycle. If you want to know how we got here, you can check out my previous blog posts on BTCFi.

2) Token issuance: This is one of the reasons we have crypto cycles. In every bull market, new tokens emerge like mushrooms and are given crazy valuations. Just as central banks can overprint fiat currency, we tend to issue too many tokens to keep up with the influx of funds and attention into the crypto space. As a result, the market will collapse.

This cycle is no exception. I wrote more about how this happened before this bull market started.

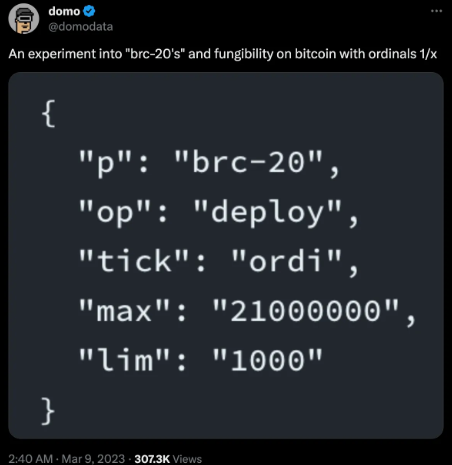

However, token issuance has always been the domain of smart contract blockchains (such as Ethereum/Solana). Until Ordinals inadvertently gave birth to BRC20.

I am concerned about BTCFi because it has unrestricted token issuance. BRC20 (and Rune) can be minted easily without any actual value accumulation, as Bitcoin has no smart contracts.

But the Ordinals community found a Schelling point that could converge by giving early Ordinal NFTs original value and airdropping tokens to those NFT collectors.

Furthermore, as there is no direct value accumulation, all BRC20 tokens are basically meme tokens. Only ORDI successfully attracted attention as the first BRC20 token, but now PUPS may have crossed the Rubicon to become a true meme token on Bitcoin. The higher the price of PUPS, the more confident speculators will be.

Finally, the BTCFi ecosystem is growing in local tokens, countering meme tokens and theorizing the legitimacy of holding BRC20/Rune as value accumulation tokens. More on this later.

3) Engaging narratives: Narratives are key to giving life to the technical and token economic models, transforming them into something people can relate to, trust, and become a part of.

For example, Bitcoin Ordinal as an immutable NFT on the most secure and decentralized blockchain is a fascinating story. Additionally, meme tokens on Bitcoin? Come on, that's much cooler than meme tokens on Solana or Ethereum.

Cryptocurrency Twitter is catching up with the technological innovation and narrative of Ordinals/Rune.

This short-term bearish but long-term bullish scenario may be the best situation, especially if you are late to participate in the pre-Rune Token. Once the hype cools down, you will have enough time to learn and prepare for the second wave of Rune frenzy.

The best time to learn was yesterday, and the second best time is today. Therefore, here is a brief introduction to Rune.

3. Things you need to know about the Rune protocol

The Rune protocol was developed by Casey Rodamor, the creator of the Ordinals theory, with the aim of challenging BRC20. Since Casey does not like BRC20, it can be expected that he will use what he did with NFTs for interchangeable tokens.

You know, BRC-20 tokens are engraved on sats using JSON data (a text-based data format). They are traded more like NFTs than interchangeable tokens. For example, you need to "engrave" (by on-chain transactions on Bitcoin) these tokens before selling or transferring them.

Additionally, BRC-20 generates "junk" or "residual" transactions, leading to network congestion.

In contrast, Rune uses the UTXO model, which confuses everyone. Here's my explanation: Ethereum uses an account-based model, while Bitcoin uses UTXO (Unspent Transaction Output) to track user state and balances.

For example, if you have a UTXO worth 1 Bitcoin and want to send 0.3 Bitcoin to someone, the transaction will use the entire 1 Bitcoin UTXO as input. The transaction will then create two outputs: one sending 0.3 Bitcoin to the recipient, and the other returning the remaining 0.7 Bitcoin (minus any transaction fees) as two new UTXOs to your address.

So technically, when you say "I have 1 Bitcoin," you should say "I have some UTXOs that allow me to spend 1 Bitcoin."

In the example above, when you use the 1 Bitcoin UTXO as input, that UTXO is 'destroyed' and two new UTXOs are minted: 0.3 UTXO to the recipient, and 0.7 UTXO (minus fees) returned to you. As you can see, these UTXOs are like NFTs!

However, while each inscription (like BRC20) is unique, each unit of Rune is the same. They are interchangeable tokens. You can transfer Runes just like regular Bitcoin without having to engrave BRC20 every time.

In the case of Rune, UTXOs can now store 1 Bitcoin, 100 Rune Token A, and 50 Rune Token B, as Runestones.

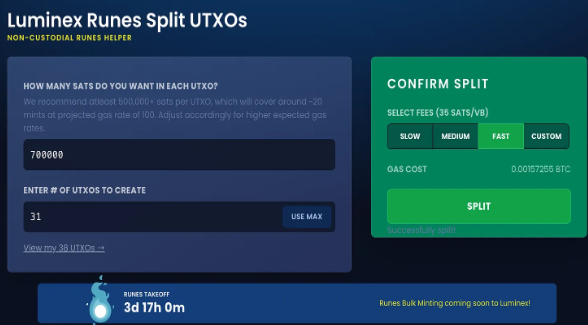

Tip: Create multiple UTXOs by sending the Bitcoin amount you are willing to invest in each Rune to a new wallet. This way, you can invest in multiple tokens quickly without waiting for the previous transaction to complete, or use Luminex.

Runestones (not to be confused with Rune Ordinals) are a way for Rune protocol messages to be stored in Bitcoin transaction outputs when you spend unspent transaction outputs (UTXOs).

I'm sharing this because once Rune goes live, you will soon start seeing terms like "Runestones," "engraving," and "ordinances" being discussed on Twitter. People will try to trade Rune but will encounter issues, and they will definitely look for answers on Twitter.

Runestones - Rune protocol messages - can include engraving (deploying) a new Rune, minting existing Runes, and transferring Runes between different addresses.

Engraving is the way Rune is minted for the first time by the "engraver." Once the engraving is complete, the attributes cannot be changed.

4. Other background information about Rune

Finally, here are some other simple terms and facts about Rune that you should be aware of:

Rune Names: Initially, only names with 13 or more characters were available; this limit decreases by one character every 4 months until all names are available after 4 years.

Rune Numbers: Represent the order of creation of Runes, starting from "Rune 0," then "Rune 1," and so on.

The first Rune UNCOMMONGOODS - free to mint, no supply limit, and only 1 UG minted per mint. 1 UG is basically equal to the transaction fee of Bitcoin.

Rune ID: Generated based on transaction blocks and positions, for example, "500:20"

You can mint Runes by inputting the Rune ID. For example, the RuniGun bot on Telegram will allow you to mint Runes by using the Rune ID. So, if you know the ID, you don't have to rely on a third-party UI to mint. You can check out this bot here (disclaimer: I am not affiliated with it, just found it on X).

Rune Symbols: A non-unique currency symbol for a Rune, such as $, ⧉, or 🧿, or a generic currency symbol ¤. More technical terms provided by Leonidas.

5. Projects, protocols, and tools worth paying attention to

I initially planned to write an article on "How to prepare for the release of the Rune protocol." However, there are already multiple posts on X that look similar, involving the same protocol.

1) Projects worth paying attention to

It is crucial to know that the Rune game is underway, with several similar pre-run protocols launched, promising Rune Token airdrops after the Bitcoin halving block when the protocol is released.

The hype started with the RSIC protocol (RSIC stands for Rune Specific Inscription Circuits, an NFT on Ordinals, with a total of 21,000, 10% reserved by the project team), mysteriously airdropping RSIC NFTs to Ordinal OG/miner wallets.

At the time, I said "the Bitcoin financial (BTCFi) field is brewing a huge revolution," but I didn't actually know how it would develop. Now we know that RSIC initiated a competition to attract the attention of Rune speculators.

If you don't hold RSIC, I don't think now is the right time to enter: by holding RSIC, you can mine RSIC points, earning RSIC Rune Tokens as a reward. In theory, RSIC should trade at $0 at the halving block.

In response to the RSIC team (reserving 10% of RSIC for themselves and the airdrop standard being opaque), Leonidas airdropped Runestone to 112.4k OG wallets. By holding Runestone, you will receive not just one, but three Rune meme tokens.

Runestone currently has a market value of $549 million, making it the second-largest (market value) project in the pre-Rune collection (second only to Rune Pups + PUPS).

Due to the continuous devaluation of RSIC approaching the halving, the real valuation of RSIC is estimated to be $5.88 billion based on the price of 0.028 USD for each RSIC Rune on whalesmarket.

The total market value of Rune Pups ($80 million) + PUPS meme tokens ($421 million) is $5.01 billion. Remember, Rune Pups and PUPS Token holders will migrate to Rune at a 23% allocation ratio, with 77% allocated to PUPS.

There are often good arbitrage opportunities in Rune Pups NFTs, PUPS on Unisat, and Pups bridged on Solana.

This is not financial advice, but would you be willing to invest at these valuation levels? If my short-term expectations are correct, their valuations should drop shortly after the release.

In any case, this is a speculative decision that you should make for yourself. There are several other Rune protocols with valuations below $1 billion. The complete list can be found on Magic Eden.

Nevertheless, I have no intention of selling; I entered this ecosystem early and am willing to hold. Additionally, these three main assets are becoming targets of the Rune ecosystem, hoping they can maintain value and receive more airdrops.

In the long term, new protocols will emerge to capitalize on the Rune protocol hype. Here are the starting protocols and tools.

2) Notable Protocols

Luminex: Mint Runes and can split UTXOs to mint multiple Runes in the same wallet. Promoted by Xverse wallet, so it might be good.

Sovryn: Runes trading/lending platform with a built-in sidechain. Will be launched at the halving. Sovryn will launch their DEX on Bob L2, the platform I recommended.

RunePro: Building a DEX and engraving protocol. Not yet live. https://twitter.com/Rune_Pro

Rune Bitcoin: Offers engraving and transfer services for Runes, and is also building a marketplace and a DEX.

Runessance: Provides lending protocols for Runes and Bitcoin.

Liquidium: Lending for Ordinals and Runes. Or earn on Bitcoin. Point system is enabled. Liquidium airdrops reward points.

Saturn: AMM/order book trading platform for Bitcoin assets. May not have enough liquidity during the Rune release.

RuniGun: Telegram bot for minting, creating, and managing Runes. Cannot export private keys, so use with caution.

You may use Magic Eden and Unisat to trade Runes, as well as the OKx Web3 wallet (if you are a mobile user). Personally, I would alternate between Unisat, Xverse, and OKx wallets.

3) Useful Tools

SatScreener: Real-time token aggregator for the Rune and Bitcoin ecosystems. Best choice for understanding token information due to Coingecko/CMC's poor support for the Bitcoin ecosystem.

Runesmarketcap: Find Rune protocols by source, market value, type, etc.

Runealpha: Rune browser with real-time data, engraving (minting) protocol, very practical.

Runes Terminal: Building a scanner, minter, and launchpad. Has its own Ordinals and will reward RUNI airdrops after the halving.

It's still early, so please supplement the best tools and protocols for other Runes in the comments!

Also, please note that BTCFi is in its early stages. It's like going back in time to the period before Ethereum DeFi and even the birth of Uniswap in 2019-20. The opportunities will be abundant, so be sure to keep learning.

Source: https://www.ignasdefi.com/p/navigating-runes-protocol-launch?utm_source=%2Finbox&utm_medium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。