The Bitcoin ecosystem is entering its glorious moment.

Author: Delphi Digital

Translation: Followin

The cryptocurrency research institution Delphi Digital recently released a Bitcoin ecosystem research report titled "Bitcoin Ordinals and Runes Frenzy". The report believes that the Bitcoin ecosystem is thriving, driven by the emergence of Ordinals. It is an exciting time to explore Bitcoin. More and more users are actively participating in the Bitcoin ecosystem. Ordinals have sparked the development activity on the previously dormant chain. This feels very much like the explosive growth Ethereum experienced from 2020 to 2021. The report also lists some upcoming projects worth paying attention to.

The following content is translated by Followin:

Introduction

The Bitcoin ecosystem is entering its glorious moment.

It was once considered a boring asset in the cryptocurrency field, but it is now experiencing a revival. Bitcoin's recovery is driven by multiple factors, including the recent Bitcoin ETF, the anticipated halving in April, and the possibility of reaching a historic high, all of which have attracted widespread media attention.

Looking back, the launch of Ordinals in December 2022 greatly stimulated the vitality of the Bitcoin developer community and brought about many downstream effects.

The popularity of Ordinals has driven the continuous growth of block space demand on the Bitcoin network, and the resulting high transaction fees have promoted the growth of Bitcoin's Layer 2 solutions and DeFi projects. These areas have become the focus of discussion in the cryptocurrency field this year.

Bitcoin, the "trillion-dollar casino"

While institutions and cryptocurrency natives continue to accumulate Bitcoin as a store of value and "digital gold," there is more brewing behind the scenes.

Bitcoin may become the world's largest on-chain "casino."

From the early Satoshi Dice (the first gambling application on the Bitcoin network), Bitcoin has evolved into a renewed and more interesting form of speculation in recent months. This includes BRC-20 meme coins, Ordinals, Runes (soon to be launched), and new token releases.

The argument for the growing speculation on the Bitcoin network is simple:

Bitcoin is a multi-trillion-dollar asset with the strongest monetary status in the cryptocurrency world. However, until recently, most of Bitcoin's capital remained passive due to limited use cases.

Some users will seek to use their capital for entertainment, speculation, and generating income while hoping to stay within the Bitcoin ecosystem. Unlike other cryptocurrencies, they see Bitcoin as hard currency.

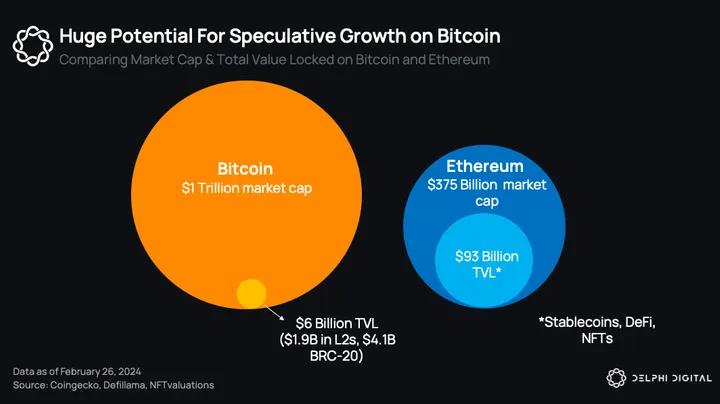

Even a small portion of this capital, as it continues to expand, represents a significant amount. Despite Bitcoin's market value being three times that of Ethereum, the locked value of Bitcoin in L2 and BRC-20 (totaling about $6 billion) still only accounts for a small portion of Ethereum's TVL (locking about $93 billion in stablecoins, DeFi, and NFTs). This indicates enormous growth potential.

More and more retail investors familiar with Bitcoin are participating in speculative activities. Videos circulating on platforms like X show how Chinese "aunties" are getting involved in speculation.

The fusion of these factors will lead to a continuous increase in interest and capital inflow into Ordinals, Layer 2 solutions, and other Bitcoin network applications.

Bitcoin positioned as an attractive center for speculative activities

We have recently released several reports covering various aspects of Bitcoin:

The current state of Bitcoin

Bitcoin games

The significant cultural opportunities brought by Bitcoin Ordinals

In this follow-up report, we delve into the latest developments of Ordinals and Runes, and focus on specific projects worth noting.

The current state of Bitcoin

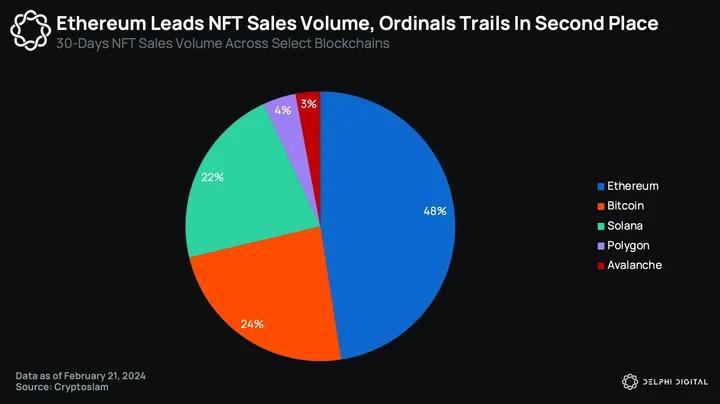

In terms of NFT trading volume, Bitcoin Ordinals ranks second in the NFT ecosystem, with a 24% trading volume share. This is slightly higher than Solana, which ranks third with a 22% trading volume share in the past month.

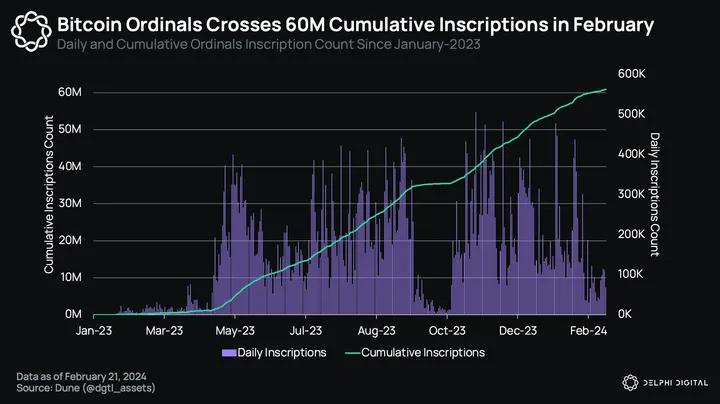

Inscriptions continue to be popular. Since our last report, the total number of inscriptions has doubled to over 60 million, with no signs of slowing down. This is mainly driven by the increasing popularity of BRC-20 tokens and wallets that support Ordinals, such as UniSat, which allows retail investors to purchase Ordinals and BRC-20 tokens on-chain. While Ordinals took a brief rest in September to October 2023, activity picked up in November with the emergence of new token standards.

Interestingly, the Bitcoin inscription craze has spread to other chains such as Polygon, Avalanche, Fantom, and Solana, all of which now have their own inscription protocols.

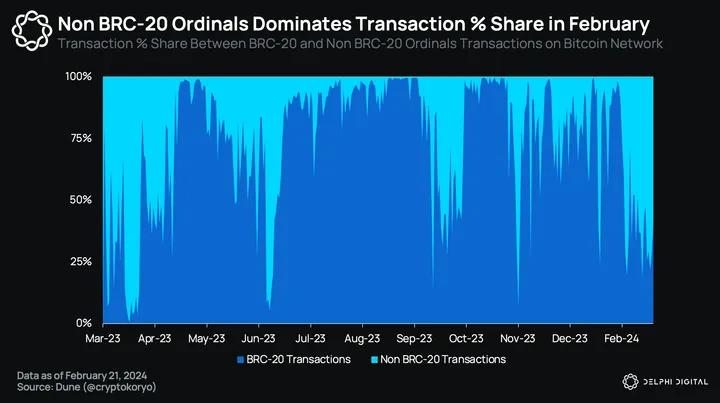

While BRC-20 still accounts for a large portion of Bitcoin transactions, non-BRC-20 Ordinals have also performed well and have had a larger market share for most of the past year. However, please note that this includes newer experimental token standards such as BRC-420, ARC-20, and bitRC-20. It is still too early to judge which token standards will become popular over time.

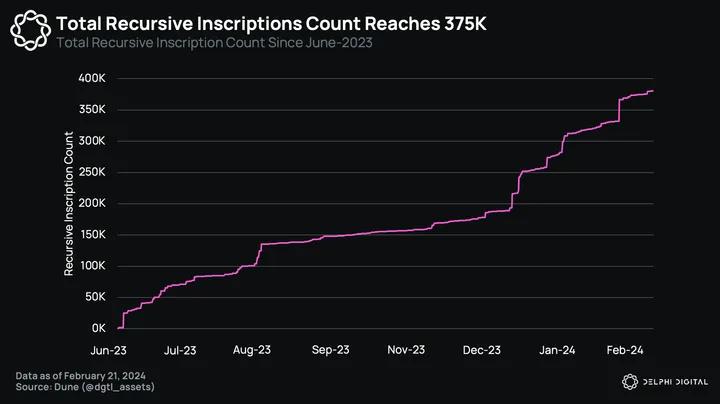

Since its launch in June 2023, recursive inscriptions have been slowly gaining momentum as builders begin to learn and appreciate the benefits of recursive inscriptions, mainly due to their ability to expand the 4MB data limit constraint for each inscription number and allow for greater interoperability and design space around Ordinals. As of February, there are over 375K recursive inscriptions on the Bitcoin network, and there is no sign of slowing down.

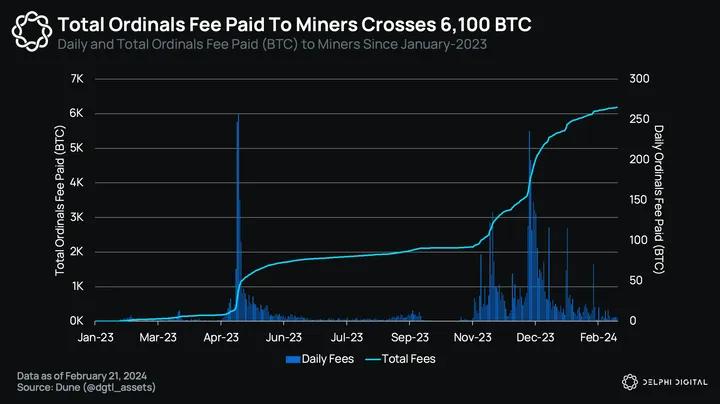

The importance of Ordinals to Bitcoin is often underestimated because it introduces a new fee flow to miners. Due to the correlation between file size and fees, the cost of including data in Bitcoin blocks can be high. Over the past 15 months, the total fees paid to miners for recording Ordinals has exceeded 6,175 BTC (3.0875 billion USD).

During the peak of Ordinals inscription activity from November to December last year, the monthly fees paid to miners skyrocketed from 26.4 BTC in October 2023 to an astonishing 2,095.8 BTC in December 2023, a 79-fold increase in fee income over two months. Although the enthusiasm may have waned, Ordinals fees in February continue to steadily climb, albeit at a more moderate pace. If this trend continues, it may help alleviate the issue of declining Bitcoin security budgets.

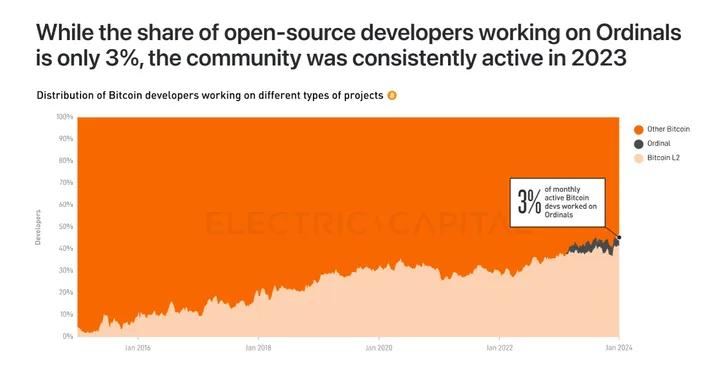

Source: 2023 Developer Report by Electric Capital

While most Bitcoin developers focus on the Bitcoin mainnet and Layer 2 solutions, there has been consistent activity in the Ordinals space in 2023. Looking ahead to 2024 and beyond, we expect this momentum to continue and gradually expand. The Ordinals developer scene is passionate.

Market

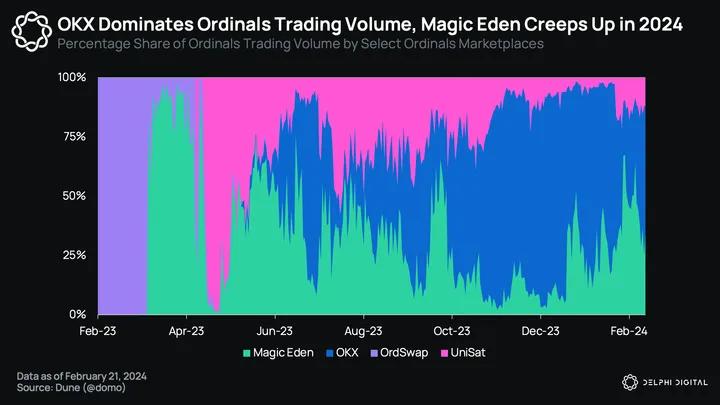

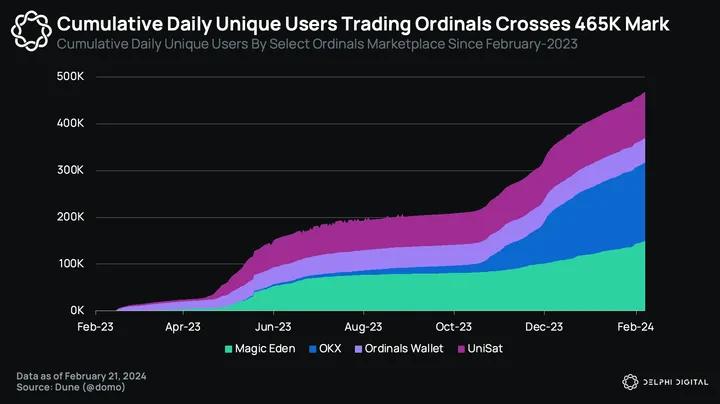

There is a clear oligopoly in the Ordinals market, with Magic Eden and OKX vying for market dominance for most of 2023. Magic Eden initially had an early advantage in the third quarter of last year but faced strong competition from OKX starting in August. OKX eventually emerged as the leader in the second wave of inscription craze from November to December 2023, capturing 84% of the Ordinals trading volume market share during this period.

Currently, OKX maintains market leadership with 53.5% of the trading volume, followed closely by Magic Eden with 31.1% of the trading volume. OKX has the most Ordinals users, with a cumulative user count of 165,000. Magic Eden follows closely with 146,700 users. At the time of writing, the cumulative user count for Ordinals has reached a peak of 468,300.

We expect the competition between these two markets to intensify in 2024.

Runes: Native fungible tokens on Bitcoin

Casey loves his Viking outfit

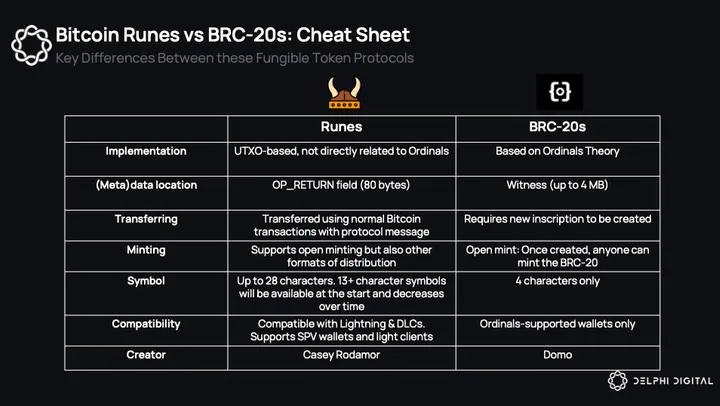

Ordinals introduced a groundbreaking method for creating non-fungible tokens (NFTs) on Bitcoin. Now, a new protocol called Runes is emerging to facilitate the creation of fungible tokens on the Bitcoin network, providing an alternative to the BRC-20 standard. Unlike Originals, which are not designed for fungible tokens, Runes utilize the OP_RETURN field instead of witness data, simplifying the process and potentially reducing confusion.

Runes operate based on Unspent Transaction Outputs (UTXOs), and during Bitcoin transactions, the balance of Runes on input UTXOs is automatically transferred to new UTXOs when the UTXOs holding the Rune balance are destroyed. There are also "Runestones," which use data in the OP_RETURN field to include instructions on how to transfer Runes in outputs, specific transfer addresses, and creating new Runes.

BRC-20 has created a large number of unspent UTXOs. To spend Runes, you must destroy UTXOs, which is beneficial for the entire system. This also benefits users, allowing for simpler PSBT-based exchanges. Since UTXOs can only be spent once, you can create a set of transactions and ensure that only one of them can be mined. BRC-20 transactions cannot do this.

Similar to BRC-20, Runes can be minted openly and fairly distributed. However, they can also be created by sending the entire supply to a single address. Runes' naming will be carefully considered, with a maximum length of 28 characters. Upon release, only names with 13 or more characters will be available, and shorter names will be gradually released (reducing by 1 character every 4 months) to prevent wasting valuable low-character names.

Runes adopt a commit-reveal naming scheme to prevent front-running (a common issue with BRC-20). They are also designed to be compatible with SPV (Simple Payment Verification) wallets, allowing users of lightweight Bitcoin wallets to use them.

Each Rune token will be uniquely identified, similar to the inscription numbers of Ordinals, and the initial ten Runes (0-9) may be hardcoded into the protocol to ensure a fair launch without the need for pre-mining. Runes are scheduled to go live on the mainnet at block 840,000 (block halving, expected around April 20). Hundreds of different Runes have already been etched on the testnet.

Notable Rune Projects

RuneCoin (RSIC)

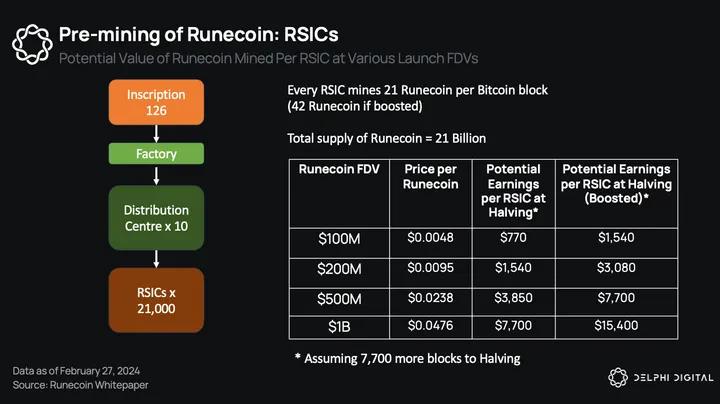

Runecoin (RSIC) emerged as an anonymous project aiming to be one of the earliest Runes created. Initially, 21,000 RSIC inscriptions were mysteriously airdropped for free to 9,211 wallets. Each RSIC is linked to 10 distribution centers, which in turn are connected to the early Inscription 126.

Each RSIC held in a wallet can earn 21 Runecoins on the Bitcoin network per block. To boost RSIC inscription earnings to 42 Runecoins per block, individuals can engrave a perfect copy of Inscription 60750020 in wallets holding RSIC, at a cost of approximately 300 USD. Holding this boosted inscription upgrades all RSIC at the same address. Earned Runecoins can be monitored on Ordiscan. The total supply of Runecoin is set at 21 billion and is planned to be released when the Runes protocol goes live.

In its gamified mechanism, Runecoin introduces a system of 24 runic symbol rarity, ranging from 1 to 8192 symbols. Each symbol is assigned a hash value, and if the symbol matches the latest block hash through JavaScript, the symbol turns orange. Additionally, there is a lottery where each RSIC held can earn a ticket for every block, and a large portion of the Runecoin supply will be provided to five lucky winners.

As of February 27, 2024:

- There are approximately 7,700 blocks until the halving. Each RSIC purchased today (at a base price of 0.09 BTC = 4,950 USD) will earn 161,700 Runecoins until the halving—if boosted, it will be 323,400 Runecoins.

- If Runecoin is issued at a 10 billion FDV, it will be 0.048 USD/Runecoin. In this case, each RSIC purchased today may earn 15,400 USD.

- Based on the current base price of RSIC, the implied market value at the launch of Runecoin is 160 million USD (21,000 * 323,400 / 4,950 * 21B = 160 million USD).

- We estimate the circulating range of Runecoins at the halving to be between 5.9B – 10.1B, depending on how many RSICs are boosted. For estimation purposes, we can take the middle range = 8B.

Runestones

Runestones is a program created by the renowned Ordinals influencer Leonidas, aimed at rewarding individuals who participated in the first year of the Ordinals protocol. This aims to fairly distribute runestones based on participants' on-chain activities, marking the first anniversary of Ordinals' release.

Initially, runestones will be distributed in the form of inscriptions, with the goal of each eligible wallet receiving only one runestone inscription, regardless of their level of participation. They all have the same artwork, with no rarity or differences between them. This means that even before the launch of Runecoin, runestones will have a market price.

When the Runes protocol launches at block height 840,000, holders of runestone inscriptions will receive runestone runes based on the number of inscriptions held. Runestone runes will serve as a commemorative collection for the first-year supporters of Ordinals, with no utility or roadmap. Runestone runes will act as collectible meme tokens and speculative coins.

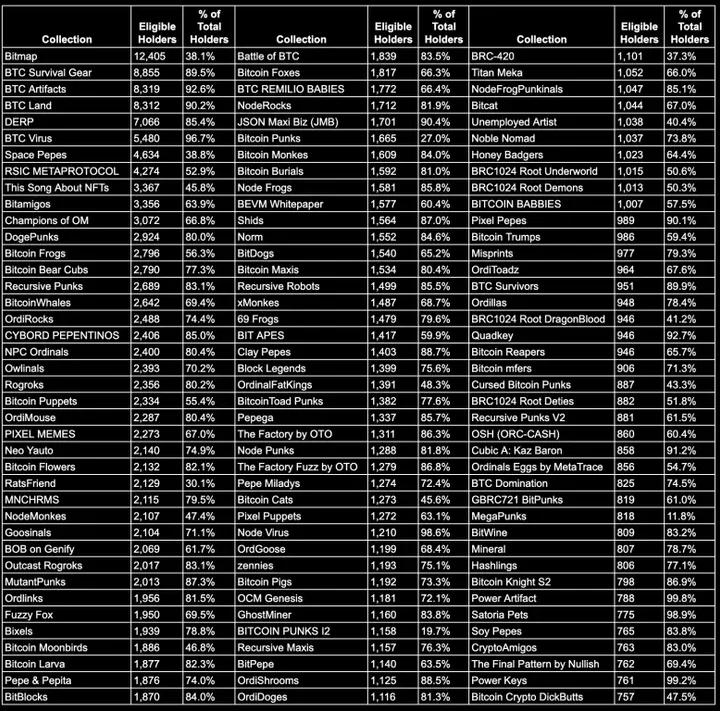

Runestones hold the title of the largest Bitcoin airdrop, with eligibility requiring participants to hold at least three inscriptions, at block height 826,600. Runestone has over 2000 collectibles and 113,376 addresses, promising a fair release for all participants. This airdrop has no team allocation and is entirely funded by community donations. Users can track their wallet eligibility here (https://runestone.lfg.cash/).

Distribution of runestones to Ordinals holders

Our View on Runes

While there is no clear new use case, Runes represents a new avenue for entertainment, speculation, and community building. We like that it is built on top of Bitcoin, a solid foundational asset and store of value. When Runes launches, it can revitalize Bitcoin by attracting liquidity and attention, essentially transforming it into a thriving casino ecosystem capable of generating significant transaction fees.

Although many new token standards have failed, we believe that Runes as a new fungible token standard may persist, given the reputation of its creator (Casey) and the high expectations and acceptance within the Ordinals community.

The total market value of BRC-20 tokens currently stands at 4.1 billion USD, with the leading token ordi accounting for 1.5 billion USD of that market value. This gives us an understanding of the potential scale of the Runes market.

Runes are likely to pose a challenge to existing BRC-20 tokens. We expect that, driven by the appeal of shiny new tokens, funds will significantly shift from BRC-20 tokens like ordi and sats to Runes after its launch. Of course, this depends on the technical deployment at the launch of Runes not encountering major issues.

Warning: Similar to meme coins, most Runes may eventually have little to no value, tending towards zero. Only those that can attract attention and build a community around them will survive.

Notable Ordinals Collectibles

Unlike Ethereum, linking multiple inscriptions/NFTs to a single collectible collection is not as straightforward. Parent-child provenance is the industry standard used today to create collections with clear origins. Danny (Onchain Monkeys) published an insightful tweet on this topic, showcasing the top ten series using this method:

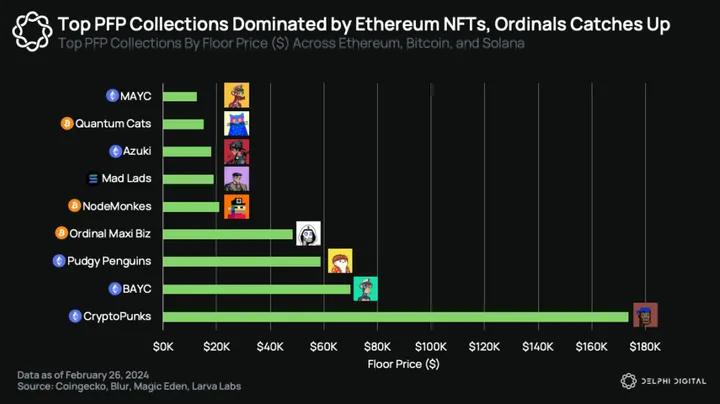

While the top-ranked PFP series by base price still primarily consists of Ethereum NFT series like Punks and Bored Apes, Bitcoin Ordinals is catching up, with three Ordinals PFP series (Quantum Cats, NodeMonkes, and OMB) ranking at the forefront.

If we consider the value of these top PFP collections relative to the total market value of their native chains—Bitcoin's market value is three times that of Ethereum, but the top Ordinal collection for Bitcoin is one-third of the base price of CryptoPunks. There is reason to believe that the top Ordinals series has the potential for significant appreciation.

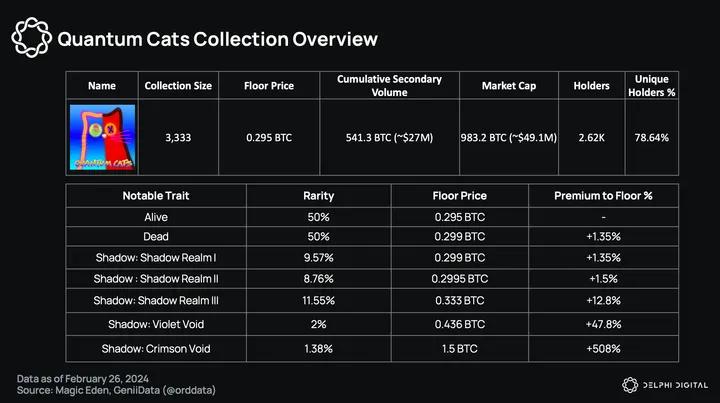

Quantum Cats

Quantum Cats is a collection of 3333 recursive ordinal inscriptions launched by the Taproot Wizards team. The series pays homage to Satoshi Nakamoto, as its origin can be traced back to the OP_CAT script function (included in the original Bitcoin codebase), which was subsequently removed by Satoshi Nakamoto in 2010 due to the risk it posed to the Bitcoin network.

One of the goals of Quantum Cats is to revive the OP_CAT functionality, paving the way for secure cross-chain BTC transfers and strengthening the development and improvement of Bitcoin's layer 2 network. By leveraging Quantum Cats, the project aims to draw attention to the proposed BIP upgrade and also provide an educational platform for a wider audience.

The Quantum Cats series will gradually change its artwork through a process called "evolution inscriptions." Each version of Quantum Cats is pre-engraved, and the evolution process is also encrypted by the team. These artworks will evolve in a deterministic manner according to the OP_Cat proposal process. It is uncertain whether the new features of evolution will affect rarity, so the current "rarity" and appearance of Quantum Cats are subjective.

The series is divided into two different groups in a 50/50 ratio—"Dead Cats" and "Live Cats." The series was initially minted on February 7th at a price of 0.1 BTC per NFT, raising 300 BTC (approximately 13.3 million USD) as the primary income for the Taproot Wizards team.

Given its origin and purpose, Quantum Cats may accumulate value over time through its culture and community, especially if people believe that ordinals and the Bitcoin ecosystem will grow larger in the coming years. It will hope to gather people who want to participate in upgrading Bitcoin as a collective movement.

Owning a cat may benefit from the upcoming Taproot Wizards minting (date to be determined) as they come from the same team. Meanwhile, its market value can serve as a test before the launch of Taproot Wizards.

Catalysts for 2024:

If this BIP upgrade is implemented, the Bitcoin soft fork will include the revival of the OP_CAT functionality. Activation still has a long way to go, but if this BIP proposal is adopted, we can expect attention and price appreciation for Quantum Cats.

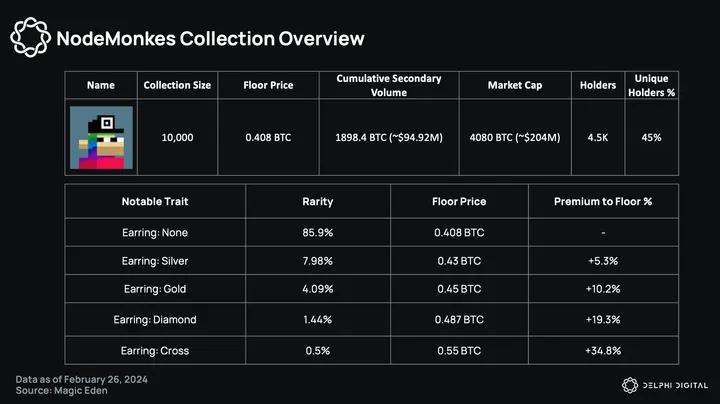

NodeMonkes

NodeMonkes is the first collection of 10,000 Ordinals PFP inscriptions minted on Bitcoin, with the minting quantity ranging from 83k to 110k. Although they were minted in February last year, the anonymous team behind the project waited until December 2023 to launch after the Ordinals infrastructure matured. The main sale was conducted through a Dutch auction, offering 8000 NFTs to collectors on December 21st last year. The final price for Monkes was set at 0.03 BTC.

The series features a range of interesting characteristics, showcasing the fusion of native crypto inside jokes and memes with original artwork. For example, its features reference famous CT meme culture such as Pepe, BTC maxi, laser eyes, and even Aliens from CryptoPunks. Collectors can use Monkedex to check the official rarity of each NodeMonke PFP.

The narrative brewing around NodeMonkes is simple: Monkes are the CryptoPunks of Bitcoin. There is no roadmap or execution risk. Less than two months since its launch, we believe it may be too early to grant Monkes the title of Bitcoin's de facto CryptoPunks—community members should continue to be influential builders and thought leaders in the Bitcoin space to truly earn this title, just like Cryptopunks and Ethereum. But if enough people believe in this narrative, it may come true.

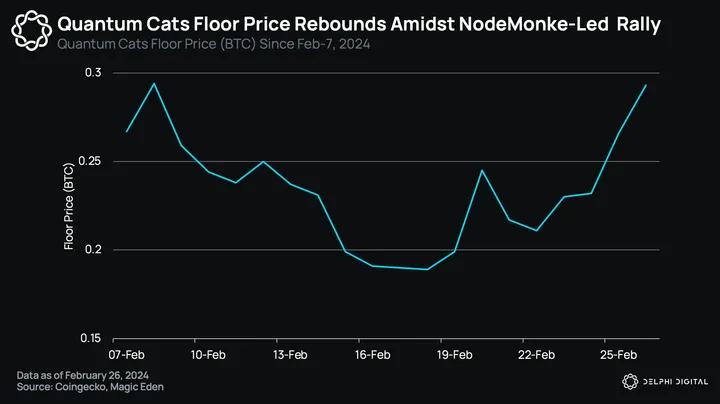

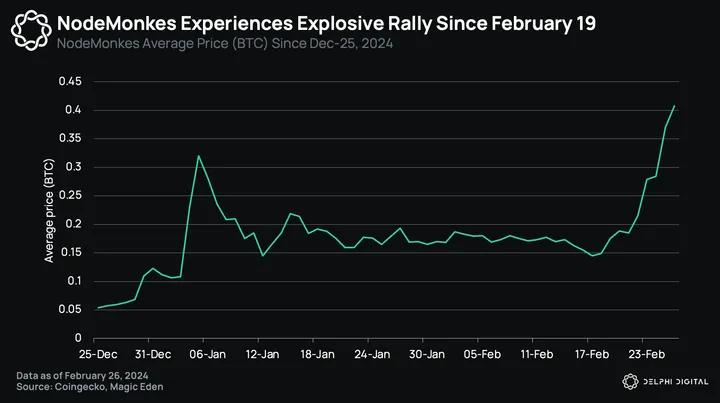

After the launch of NodeMonkes, trading activity was active, with the average price peaking at 0.32 BTC on January 5th, and the peak trading volume in the first week of January reaching 594 BTC (approximately 26.8 million USD). After a brief lull, NodeMonkes experienced another surge on February 19th, with the collection volume rising from 0.15 BTC to 0.4 BTC on February 26th. The project team mentioned that they would provide more Ordinals airdrops to NodeMonke holders, driving this surge. Notable mentions on Twitter, such as The Crypto Dog, Kevin Wu, and hentai avenger, also contributed to this.

The team customized 400 honorary NodeMonkes to commemorate CT celebrities such as Claire Silver, Grant Yun, and Batz. With a consistent visual language, the series has become an iconic collection in the Bitcoin Ordinals ecosystem, similar to Nouns Glasses, which can be immediately recognized.

Bitcoin Frogs

Bitcoin Frogs was launched on March 8, 2023, as a collection of 10,000 PFP ordinals minted on Bitcoin via the Lightning Network. Created by Frogtoshi Nakamoto, each layer of features in the series has equal rarity, fostering subjective appreciation for aesthetics and Satoshi-based rarity.

Bitcoin Frogs stands out for its fair distribution (setting it apart from Nodemonkes), as the entire series was minted for free, excluding transaction fees. The project has cultivated a vibrant community on X using expressions like "Ribbit!" and "Frogs follow Frogs." This frog PFP also serves as a social network, with holders regularly posting their frogs on Twitter to express their loyalty and belonging.

Although activity decreased after the inscription frenzy in May last year, attention and activity surged again in November when major L1/L2 inscriptions began, leading to a resurgence in the base price of Bitcoin Frogs.

What makes Bitcoin Frogs so popular? The frog resonates deeply with crypto culture, drawing inspiration from the popularity of Pepe the Frog. The collection holds significance as one of the earliest Ordinal PFP collections and the first to be minted via the Lightning Network. Bitcoin Frogs can be seen as a cultural face of the early Ordinals ecosystem, symbolizing participants' pioneering status.

OMB (Ordinal Maxi Biz)

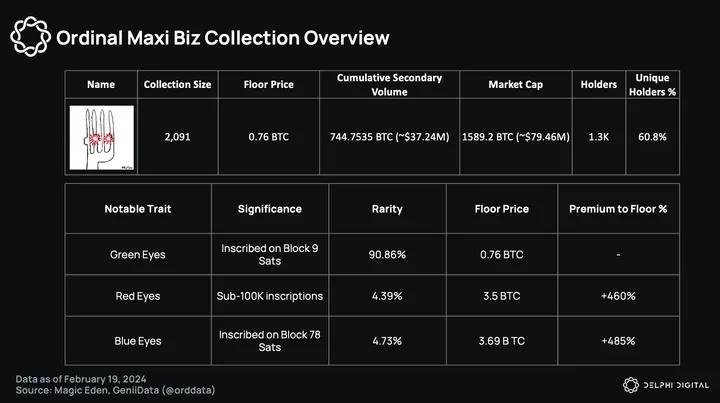

OMB is an Ordinals PFP project launched by the pseudonymous founder Zkshark in collaboration with artists Tony Tafuro and Nullish. The series consists of 2091 hand-drawn PFPs, each uniquely categorized based on eye color, including green, red, blue, and the newly introduced orange eye feature.

The first to be inscribed were the red-eyed ones, with 92 PFPs inscribed within the range of less than 100k inscriptions. Next were the blue-eyed ones, consisting of 99 PFPs inscribed in the 78th block ("Hal Finney") sats. The green-eyed ones were inscribed last, with a total of 1900 PFPs inscribed in the 9th block sats.

Among all Ordinals inscription series, OMB is one of the lowest-priced (0.76 BTC/38,000 USD) and highest-selling. After the inscription frenzy in November last year, the base price of many other series has declined, but the base price of OMB has steadily risen.

Notably, during the 2024 Super Bowl, over 3000 new OMBs with the orange eye feature were inscribed on Bitcoin, with some inscriptions appearing on some of the oldest Bitcoin sats. These products have not yet been listed, and relevant announcements are worth paying close attention to.

The project describes itself as a movement, sharing some similarities with Goblintown in cultivating a dedicated community. Serious OMB collectors believe that these PFPs are not just derivatives of punks but thoughtful artworks that support important political statements. For example, graffiti themed around OMB advocating "Buy Bitcoin, Free Ross" has appeared on the streets of London, symbolizing protest against the establishment. Collecting OMB can be a form of support for this movement.

Additionally, OMB collaborates with Luxor Technologies, allocating a portion of funds for Bitcoin mining. The proceeds will be used to fund a reserve treasury and support OBounties, rewarding developers, educators, and community members who contribute to open-source projects that align with Bitcoin's core values. Educational bounties will be specifically rewarded to OMB holders based on effort and participation. Holders are also encouraged to propose bounties for consideration.

Interestingly, OMB does not have a Discord server, and all community coordination takes place on Twitter.

Pizza Ninjas

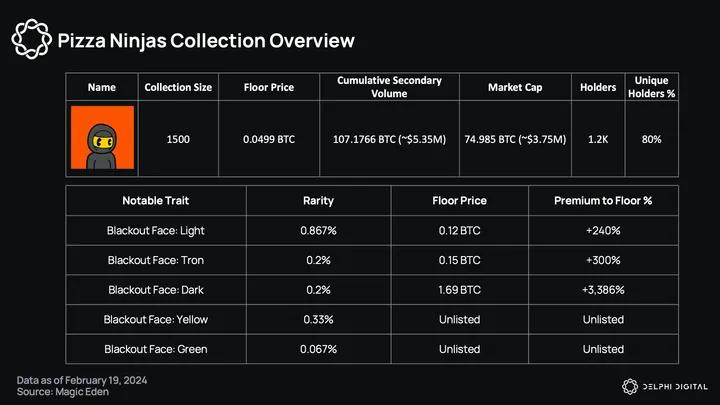

Pizza Ninjas was launched by the team behind Ninjalerts, a blockchain data insights tool for web and mobile applications that provides real-time push notifications for NFT-related activities. Founder Trevor is a well-known investor and influencer in the Bitcoin space, and operates a popular Twitter Space show.

The Pizza Ninjas series consists of 1500 PFPs inscribed on rare pizza sats, launched on January 17th at a minting price of 0.03 BTC. Notably, it is the first Ordinals PFP series with high-resolution 2000×2000 pixel images, utilizing recursion and featuring dynamic traits that change based on Bitcoin block height. We appreciate that it is a thoughtfully designed PFP series, detailed in their design whitepaper.

Each Ninja PFP serves as an interactive application, offering a built-in animation editor, one-click social media stickers, and an on-chain Super Nintendo emulator for in-PFP gaming.

Owning a Pizza Ninja PFP grants a lifetime license to Ninjalerts' Ordinal Portfolio Tracker and wallet viewing software. Additionally, the PFP serves as a membership pass for their alpha group, providing collaboration and licensing perks for top projects.

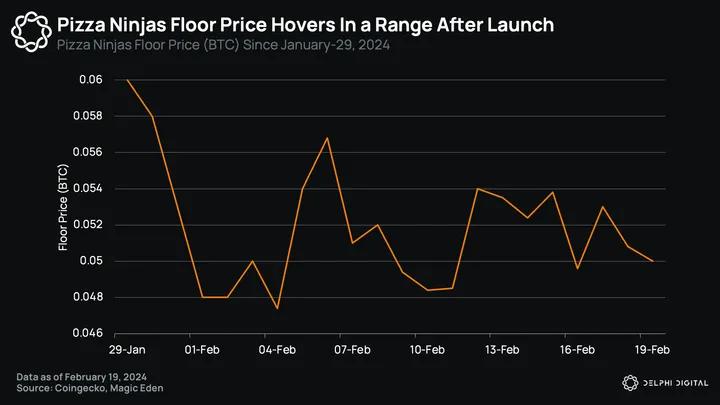

Although offering rich features, the base price of Pizza Ninja has decreased since its initial days after launch, currently hovering around 0.05 BTC (a 66% increase from the mint price). In the long run, the project aims to become the world's top Bitcoin-native IP—a ambitious vision that requires a significant amount of time and effort to achieve.

Catalysts in 2024:

- Ordinals entering a frenzy bull market. This has driven demand for the Ninjalerts product suite, as it facilitates early mint sniping and tracking of new projects. Pizza Ninjas serves as a gateway to access this product suite.

- Collaborations and partnerships initiated.

Bitcoin Art

In our conversations, many artists have observed the Ordinals space with a keen interest. The allure lies not only in the art itself but also in the innovative processes behind it, such as recursive techniques and the remixing of existing artworks. Ordinals art is also fully on-chain, setting it apart from most NFTs. This environment echoes the early digital art explorations on Ethereum, where boundaries were constantly tested and expanded.

A notable example of creative use comes from artist SpZjulien, who inscribed personal piano audio files on Bitcoin. This approach allows for the creation of fully on-chain songs through recursive inscriptions, showcasing the immense potential for composability in Bitcoin on-chain art.

However, Ordinals present unique challenges for artists, especially in terms of file size limitations, which directly impact the feasibility of creating and trading high-quality, complex art. For example, the cost of inscribing a 1MB AI-generated image on Ordinals could be as high as thousands of dollars, positioning such works as symbols of exclusivity for the wealthy rather than accessible art forms.

The limitations imposed by Ordinals have led to a surge in rasterized art (pixel-based) based on p5js, with less emphasis on 3D art. Ordinals artists are increasingly drawn to art that reflects Bitcoin network characteristics or integrates data into the art, creating a unique fusion of technology and creativity. Despite these innovations, the practical limitations of Ordinals force artists to work within a limited expressive range, particularly challenging for narrative art that requires a significant amount of data bandwidth.

As a result of these limitations, the cost of inscribing rasterized art (pixel-based) or complex vector art has become exceptionally high, prompting artists and collectors to seek lower-cost alternatives. However, a notion is emerging that early high-quality raster art may become very valuable due to its rarity.

A creative solution to address these limitations is the use of recursion in generated art on Ordinals. Artists inscribe a core script, and subsequent artworks use it as a base, adding unique data to generate different outputs. This approach significantly reduces the size and cost of each inscription.

Despite these innovations, discoverability remains a challenge in the generated art space, highlighting the need for improved platforms to showcase and promote Ordinals art.

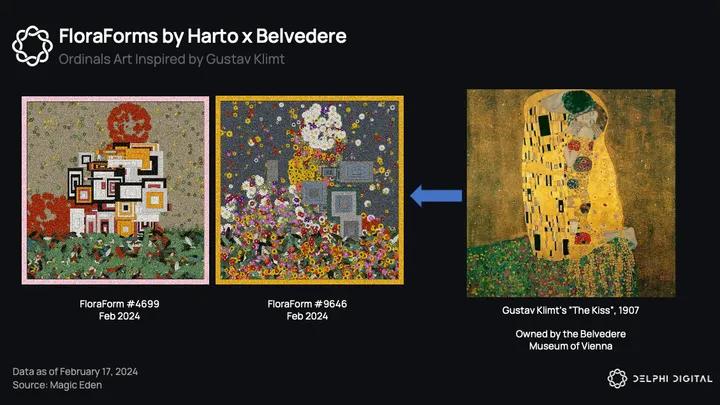

Harto's FloraForms

FloraForms is a collection of 10,000 fully on-chain generated art pieces created by artist Harto in collaboration with the Vienna Lich Museum. It draws inspiration from Gustav Klimt's "The Kiss," with its work also resembling generated art. It was released for free on February 14th (only charging inscription fees), and currently has a base price of 0.003 BTC (150 USD).

The collection uses parent-child lineage, allowing for clear origins of the on-chain collection. This benefits collectors, future dapps, markets, wallets, and explorers without the need for off-chain references. The generated collection uses recursive inscriptions: each piece downloads at over 2 megabytes, but the inscription is only 160 bytes. Parent recursive inscriptions are also effectively created through compression and are only 12 KB.

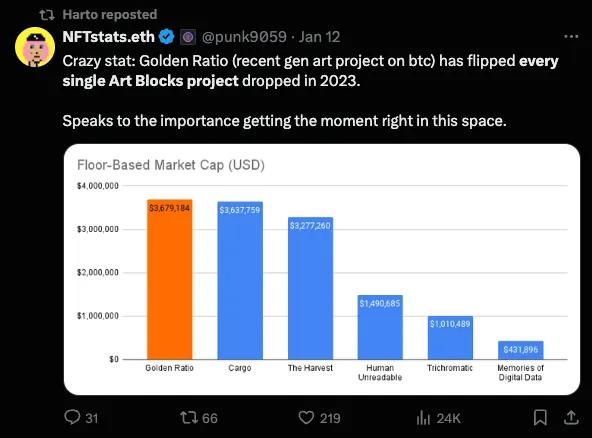

Harto's Golden Ratio

Another highly sought-after Ordinals art collection in recent weeks is Harto's Golden Ratio, curated by VIVID Gallery. The project offers 420 pieces for free minting, with a current base price of 0.1 BTC (5,200 USD). It may be one of the most intriguing generated art pieces on Bitcoin today.

Harto's series combines the Fibonacci sequence with recursive algorithms and fractal geometry, showcasing the harmony between numbers and nature. Inspired by the symmetry of the universe and chaos theory, each piece displays the beauty of randomness and order. The aesthetics of this series draw heavily from cryptography and the Bauhaus movement.

Golden Ratio is notable for being both "recursive" and "enchanted." Recursive inscriptions can reference data from other inscriptions. Due to its recursive artistic nature, it can be the "Holy Grail" of recursive collections, perfectly expressing the golden ratio, a symbol of natural proportion.

The "enchanted" inscriptions mark an important historical moment in Ordinals history, previously overlooked by the Ordinals indexer, resulting in negative numbers. This issue has since been fixed through updates. Enchanted inscriptions like the golden ratio may hold a special place in the origin of the evolving Bitcoin art culture movement.

0xfar’s FLARES

0xfar is known for being the artist behind Taproot Wizards and Quantum Cats (two of the most popular Ordinals projects). In February 2024, he launched FLARES, a collection of 512 pieces in the PARALLAX series of generated art.

FLARES explores world-building, terrain modification, and atmospheric elements, with 21 different types, each with a distinctly different dynamic appearance. It is created using algorithms from Three.js. It made its debut on Gamma through a Dutch auction and quickly sold out at a base minting price of 0.015 BTC.

More OG crypto artists have been experimenting on Ordinals and releasing some of their works. Examples include:

- Dutch-Canadian artist Ryan Coopman's "The Origin"

- Jack Butcher, known for his Check and Openen series on Ethereum, placed a series of 100 Ordinals checks on Bitcoin as digital artifacts.

- Rare Pepe artist Rare Scrilla's artwork

Another challenge facing Bitcoin art is its fragmented nature today, with no platform or community convincingly becoming the "Art Blocks" of Ordinals. This makes it harder for collectors to discover art they love.

- Inscribing Atlantis: A new platform for "digital artifacts on the Bitcoin monolith." Its next release is a 1/1 photo collection by Alex Kittoe and Nevin Johnson, titled "Fragmented Framework."

- Quadrillion art: Launched the first volume collection, featuring works from 21 artists including Amber Vittoria and Dirty Robot. The second volume collection may be released later this year.

- VIVID: A relatively new community initiative inviting generated artists to inscribe selected collections on Bitcoin. Harto and Cybersea are two artists on the platform.

Sotheby's Auction

Sotheby's has successfully held two Bitcoin Ordinals auctions in the past 3 months, indicating strong demand for Ordinals artworks. The first was a series of 3 BitcoinShrooms, pixelated to commemorate the first 13 years of Bitcoin and pay homage to 8 art styles. They are among the earliest Ordinals, with 1,000 inscriptions.

Following initial success, Sotheby's auctioned off a series of artworks and rare sats, all of which were sold out, often at prices far above their estimated value. The cumulative sales reached $2.4 million, indicating a strong interest in Ordinals art.

A deeper analysis of the auction results revealed some interesting trends regarding the valuation of these digital artifacts:

- Artworks with lower inscription numbers are highly sought after, especially those numbered below 100. For example, a piece simply inscribed as "Inscription 21" fetched an astonishing $101,000, mainly due to its early provenance.

- Even artworks with a higher number of inscriptions can fetch substantial prices. Genesis Cat is the most expensive Ordinal sold by Sotheby's to date, selling for $254,000. Despite having over 54 million inscriptions, its value still depends on its uniqueness as a one-of-a-kind piece in the Quantum Cat series.

In conclusion, blockchain art is still in its early stages. Bitcoin's unique properties provide fertile ground for artists and collectors to explore and redefine the boundaries of digital art.

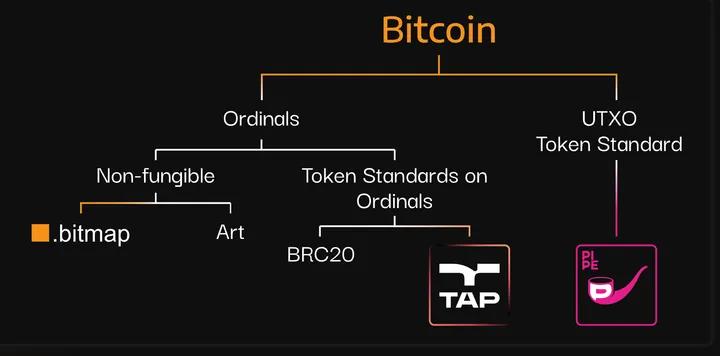

Bitcoin Meta-Protocols

"Meta-protocols" is a loosely defined term referring to protocols and token standards built on top of inscriptions. Various meta-protocols such as BRC-420, ORC-20, and BRC-69 have been introduced, but all except BRC-20 are striving to gain significant traction. The release of Ord v1.0 marks an important milestone, incorporating formal meta-protocol fields within inscriptions envelopes. This innovation streamlines the indexing process, allowing for more efficient identification of specific meta-protocols without the need to individually check each inscription.

Examples of meta-protocols include:

- BRC-420: Developed by the Merlin Chain team, BRC-420 endows inscriptions with "royalties" functionality. Interestingly, the highest-priced BRC-420 is Blue Box, a collection of 10K, with a base price of 0.5 BTC.

- BRC-1024 aims to facilitate the creation of new metaverses on Bitcoin, with a focus on emphasizing metadata. This metadata provides detailed descriptions of virtual objects stored as text-based artifacts on the Bitcoin blockchain. More details can be found on their website.

- BRC-100 expands the utility of the BRC-20 protocol by adding computational capabilities and states to tokens. This includes features such as lending pools, airdrops, decentralized stablecoins, and governance protocols, all BRC-100 extensions are interoperable across applications. More information can be found in their documentation: https://docs.brc100.org/

Each meta-protocol is developing its own ecosystem, but practical applications and usage are still limited at this early stage. Apart from Runes and BRC-20, one such standard and community worth watching is the Trac Network.

Trac Network and Tap Protocol

The Trac Network represents a comprehensive ecosystem of protocols and products stemming from the BRC-20 standard (TRAC, with a market cap of approximately $100 million) and led by the anonymous Bennythedev.

Trac Core is the first product in the Trac Network, aiming to decentralize control of the Ordinals protocol by providing decentralized indexers and oracles managed by TRAC holders. The functionality of Ordinal and BRC20 heavily relies on indexers, where ord v0.9 is the primary indexer. However, the introduction of ord v1.0 disrupted BRC20, prompting many to insist on using the previous version, highlighting the importance and challenges of indexers.

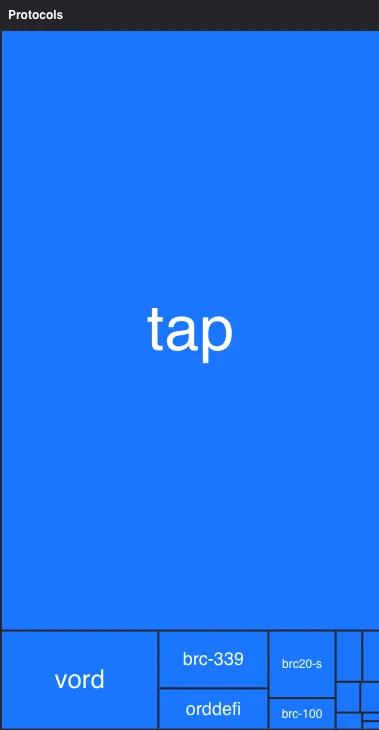

The Tap Protocol is the second product in the Trac Network. The protocol introduces the TAP token standard, aiming to simplify complex financial transactions within the Ordinals ecosystem without the need for layer 2 solutions. Its unique "eavesdropping" feature ensures transaction verification, enhancing flexibility and practicality.

The Tap Protocol also successfully raised $4.2 million, led by Sora Ventures.

TAP Protocol supports:

- Exchange and staking: Facilitating the exchange and staking of assets.

- Liquidity pools: Supporting the creation of decentralized trading pools.

- Token authentication: Allowing for token verification within the platform, with tokens usable as currency or items in games.

- TAP Art: Linking Ordinals with TAP Protocol tokens to allow for fractional ownership of valuable artworks. This extension ensures the maintenance of the source of token deployment and ordinal ownership.

- Multi-send functionality: Providing users with the ability to conduct multiple transactions simultaneously, simplifying the distribution of airdropped tokens.

- Multi-asset protocol: Supporting multiple asset types beyond a single standard on the Bitcoin blockchain. It also introduces a new type of token called "Non-Arbitrary Tokens" or NAT.

GeniiData's view shows that most inscriptions minted daily, apart from BRC-20 and standard Ordinals, are related to Tap. We also want to highlight the trac & Tap protocols as several airdrops are taking place:

Tap

The Tap protocol will kick off its token TAP through two airdrops. The original ecosystem token TRAC will receive 80% of the available airdrop allocation, while PIPE will receive 20%. Holders retaining tokens between snapshots will receive an additional 50% boost to their airdrop allocation.

The first snapshot is scheduled for February 28th, with a proportional distribution of the airdrop upon the listing of the TAP token. The second snapshot is planned for the second quarter of 2024, distributing the second batch of TAP airdrops to TRAC and PIPE holders.

KARMA

KARMA is the token of the OnChainMonkey community, a prominent NFT PFP community on Ethereum that is currently migrating to Bitcoin. It is currently uncertain what utility the token will have. The OCM community has decided to support TRAC and commit to being a trust vote validator in the decentralized sorter. It is currently in the process of being released:

- 70% of KARMA tokens will be airdropped to OnChainMonkey NFT holders, TRAC, and PIPE token holders.

- 20% will be allocated for token swaps for TRAC. It was fully allocated and completed on February 20th, with tokens available on February 26th.

- 10% will be deposited into the community treasury.

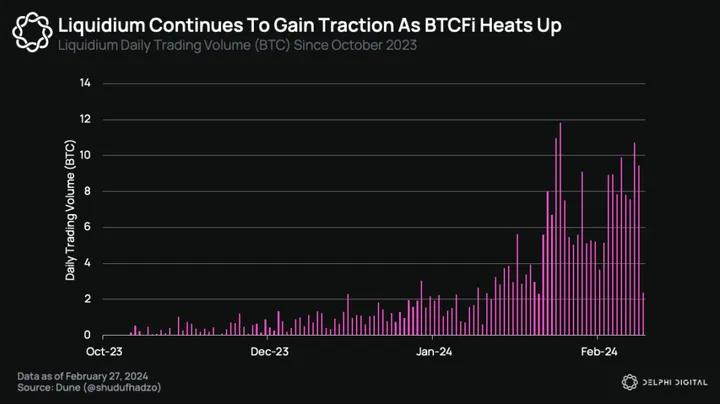

Liquidium: NFTfi on Bitcoin

Liquidium is a peer-to-peer (P2P) lending protocol tailored specifically for Bitcoin, utilizing assets based on Bitcoin such as Ordinal inscriptions and BRC-20 tokens as collateral. This innovative approach is achieved through partially signed Bitcoin transactions (PSBT) and discrete log contracts (DLC), all executed on the Bitcoin network itself.

Similar to P2P lending platforms on Ethereum, borrowers can flexibly collateralize their assets based on conditions they deem suitable, while lenders can choose to provide loans based on their risk preferences and terms. The platform's borrowing interest rate is 20%.

Liquidium supports various popular collections on Ordinals, including Nodemonkes, Bitcoin Frogs, and OMB. Lenders have the opportunity to earn competitive returns through BTC, with loan annual interest rates ranging from 65% to 100%.

Since its inception, Liquidium has facilitated a total transaction volume of over 201.5 BTC (approximately $10.49 million) for 4492 completed and active loans. Importantly, there is a noticeable upward trend in daily loans, indicating increasing demand. A points program is currently underway, allowing users to earn points by participating in lending activities on the platform.

BitSmiley – MakerDAO for Bitcoin

BitSmiley is a Bitcoin DeFi protocol covering three DeFi verticals: stablecoins, lending, and derivatives. The protocol allows for the minting of a stablecoin called bitUSD (based on the bitRC-20 standard) with over-collateralization, introducing the first native stablecoin backed directly by BTC. The bitRC-20 standard provides more powerful functionality to support the operation of bitUSD than the typical BRC-20 standard. To mint more bitUSD, users must collateralize BTC, similar to other over-collateralized stablecoins on Ethereum like DAI.

In addition to stablecoins, the protocol aims to introduce:

- BitLending, a native P2P lending protocol for Bitcoin

- Credit default swaps (CDS) allowing for bundling loans and assessing credit defaults based on different default rates.

In the coming years, as the number of inscriptions reaches into the billions, serious collectors may be drawn to early inscriptions due to their historical provenance. While a significant portion of inscriptions below 10K consist of single random images, there are some more cohesive collections among these early inscriptions that may attract collectors' interest.

These include (but are not limited to):

Ordinal Punks: 100 Ordinal PFP inscriptions among the first 650 Ordinal inscriptions

Bitcoin Shrooms: 210 pixelated mushroom art inscriptions among the first 1075 Ordinal inscriptions

The Fiat Collection: The earliest inscriptions on Bitcoin in the first 117 Ordinal inscriptions

Inscribed Pepes: A collection of 69 1/1 "Pepe frogs" inscriptions among the first batch of 2189 Ordinal inscriptions

Planetary Ordinals: 68 on-chain art collections among the 1103rd Ordinal inscription

Taproot Wizards: Udi Wertheimer-led 2625th Ordinal PFP inscription among the first 2121 Ordinal inscriptions

Timechain Collection: 21 Ordinal clock artifacts among the first 377 Ordinal inscriptions

To illustrate our point, Inscription #2, depicting a dancing bird, was sold for as much as 24.48 BTC (approximately $1.4 million) on February 28th, setting the record for the most expensive Ordinal inscription sale to date. It emphasizes the presence of serious collectors willing to invest heavily in owning a piece of early Ordinal history. Looking ahead, it can be imagined that modern art museums may begin to acquire and display Bitcoin digital artifacts with significant cultural and historical value.

The full list of collections below 10k Ordinals can be found here. Additionally, our previous coverage of Ordinal Punks, Bitcoin Shrooms, and Taproot Wizards can be found here.

Conclusion

Now is an exciting time to explore Bitcoin.

Despite Bitcoin's status as a trillion-dollar asset, much of its capital has remained passive until recently. However, more and more users are actively engaging in the Bitcoin ecosystem.

Ordinals have opened the door, stimulating development activity on a chain that has been essentially dormant. Today, Bitcoin's landscape is vibrant and diverse, filled with meme coins, digital art, profile picture (PFP) projects, layer 2 solutions, and DeFi products. It feels very much like the explosive growth Ethereum experienced from 2020 to 2021.

Interest in Bitcoin remains high, and its continued development will continue to be a news focus. Builders are uniting to pursue sustainable transaction fees for Bitcoin. The launch of Runes during the Bitcoin halving in April will be a key event to watch.

There is no doubt: 2024 will be an important year for the Bitcoin ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。