When publicly traded companies start hoarding Bitcoin.

Written by: Pzai, Foresight News

On April 24, Fidelity stated on X, "Due to purchases by publicly traded companies, the supply of Bitcoin on exchanges is declining. This situation is expected to accelerate in the near future." Since the U.S. elections, the relaxed expectations brought by Trump to the crypto space have undoubtedly raised the market's potential outlook, with publicly traded companies acquiring nearly 350,000 Bitcoins. The market competition among exchanges, on-chain whales, and publicly traded companies is also in full swing. With the market in turmoil, where will Bitcoin head in the future? This article will analyze Bitcoin data indicators and provide an overview of market dynamics.

The current stock of Bitcoin on exchanges is 2.6 million, the lowest level since November 2018. Since November 2024, over 425,000 Bitcoins have been transferred from exchanges. An important time point in this indicator is the second half of 2024, especially after Trump's victory, which saw significant outflows as U.S. publicly traded companies made large purchases, and this trend continues to show a downward trajectory, reflecting that relevant entities (such as publicly traded companies) are increasing their Bitcoin reserves.

Bitcoin exchange stock trend (Source: CryptoQuant)

Since the U.S. elections, publicly traded companies have increased their holdings by nearly 350,000 Bitcoins. Looking at the Bitcoin holding growth curve of major holder Strategy, since November 10, 2024, they have significantly increased their holdings by 107,000 Bitcoins within two weeks, and continued to increase to over 531,000 Bitcoins, averaging an increase of 42,000 Bitcoins per month. Among the distribution of publicly traded company holdings, eight companies hold over 10,000 Bitcoins, and all have maintained a growth trend in the past six months.

The Bitcoin mNAV (market value of stocks to market value of holdings) of these publicly traded companies mostly falls between 1.4 and 2.25. If benchmarked at a 1:1 ratio, it is expected to release $50 billion in liquidity to the Bitcoin market. Outside the U.S., Asian publicly traded companies such as Japan's Metaplanet and Hong Kong's HK Asia Holdings are also increasing their allocations, with Metaplanet's CEO Simon Gerovich stating plans to double their Bitcoin holdings from 5,000 this year.

Before January 2025, the spot Bitcoin ETF data also aligns with the outflows from exchanges, with a maximum single-day inflow reaching 18,000 Bitcoins, which has somewhat contributed to the surge in Bitcoin prices. Before the elections, Strategy's average holding price was $42,000, and they subsequently continued to increase their holdings to $67,000, proving that the long-term value of Bitcoin is recognized by the market.

Additionally, U.S. policymakers are accelerating the compliance reserve process. According to Bitcoin Laws data, among the 27 states that have submitted Bitcoin reserve bills, three have entered the second submission phase (Arizona, New Hampshire, Texas), with Arizona already in the second review phase. On March 7, White House AI and cryptocurrency advisor David Sacks stated that President Trump has signed an executive order regarding Bitcoin strategic reserves, but only for Bitcoins seized through criminal or civil processes.

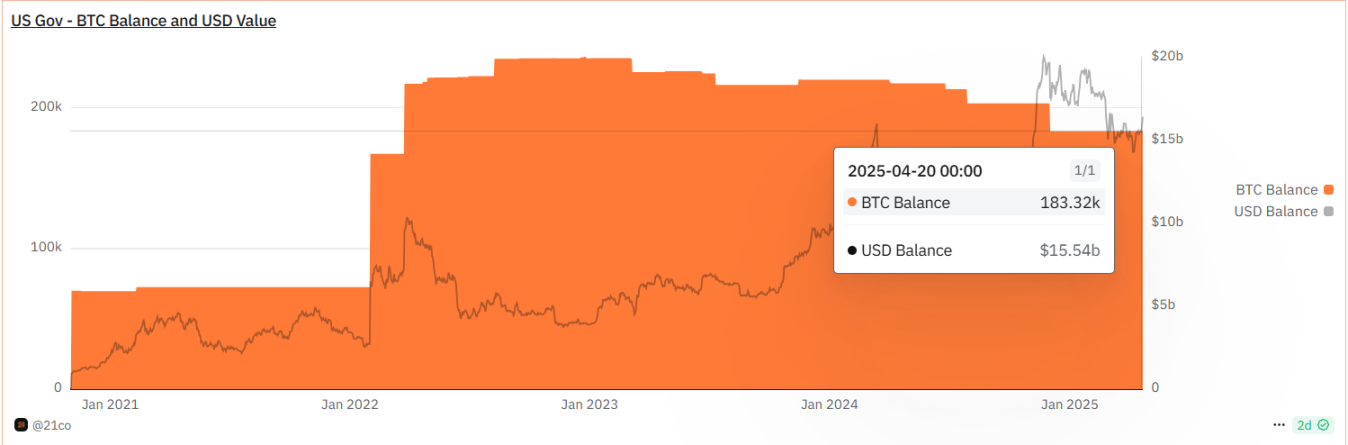

According to on-chain data statistics, the U.S. government holds over 183,000 Bitcoins, accounting for 0.92% of the current circulating Bitcoin supply, with a market value exceeding $16.4 billion. As state bills gradually take effect, this number will further increase, which will lower the threshold for U.S. companies in Bitcoin reserves.

For the industry, the entry of traditional funds provides reassurance to the market, and since most publicly traded companies' Bitcoin investments are above the cost line (for example, Strategy at 1.4 times, Tesla at 2.78 times), the expectations for Bitcoin investment are also optimistic. As the compliance direction in the crypto space and the "Trump reserve" settle, ETF inflows are also increasing again, likely to continue strengthening the buying trend of publicly traded companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。