The article discusses the strengths of several excellent Layer 1 projects.

Author: Kane Pepi / Source

Translation: Plain Blockchain

Layer 1 cryptocurrencies play a crucial role in the cryptocurrency world, providing a framework for blockchain networks and offering scalability, security, and decentralization.

As we look forward to 2024, understanding the dynamics of these platforms is crucial for investors seeking growth potential in the cryptocurrency industry.

This article lists the best Layer 1 cryptocurrency projects for 2024, exploring their unique features and the advantages they offer.

1. Layer 1 Cryptocurrency List

For anyone interested in Layer 1 projects, here is a brief list of Layer 1 blockchains:

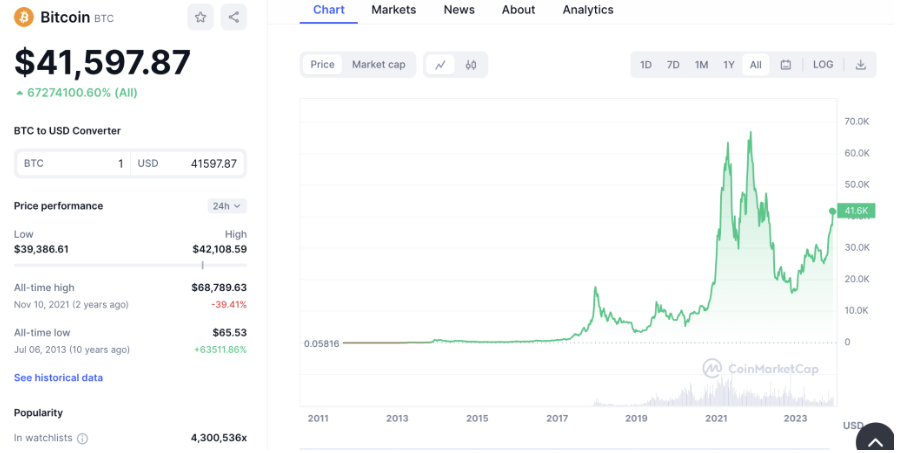

Bitcoin (BTC): As the highest market value, the world's first and largest cryptocurrency, Bitcoin remains the best Layer 1 project. With a limited supply of only 21 million tokens, Bitcoin is an ideal store of value. Bitcoin will undergo its next halving event in April 2024, which may trigger a prolonged bull market. Bitcoin is also expected to receive the first ETF approval from the U.S. Securities and Exchange Commission.

Ethereum (ETH): Thousands of secondary tokens operate on the Ethereum blockchain, making it the most popular Layer 1 blockchain for developers. Ethereum has everything from the metaverse and play-to-earn games to decentralized financial ecosystems. Despite Ethereum's large market value, many analysts believe its actual value represents only a small portion of its future potential.

Solana (SOL): This Layer 1 blockchain provides a good alternative to Ethereum in terms of speed, cost-effectiveness, and scalability. Solana can handle smart contracts and decentralized applications without sacrificing security or energy efficiency.

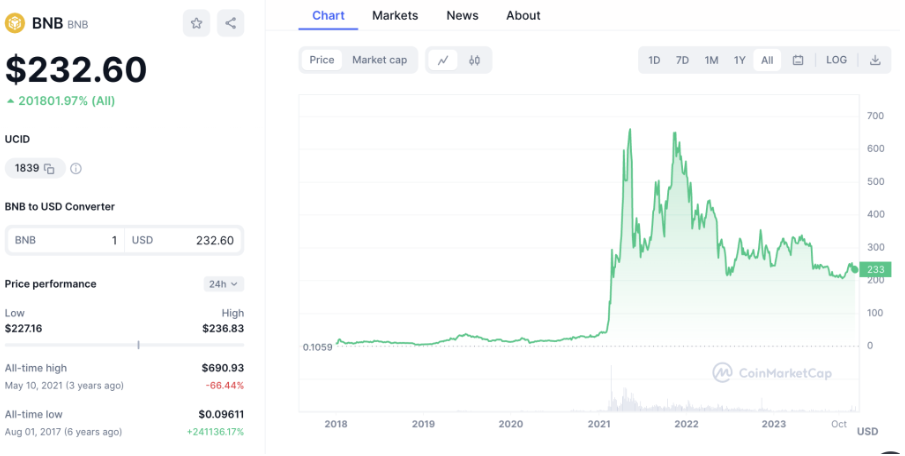

BNB (BNB): Supporting the world's largest cryptocurrency ecosystem, BNB is Binance's Layer 1 blockchain. Settling transaction fees on the BNB chain is mandatory and offers a 25% discount on Binance fees. BNB is a deflationary Layer 1 project; Binance regularly removes tokens from the circulating supply. Investors can purchase BNB at a price 66% lower than its all-time high.

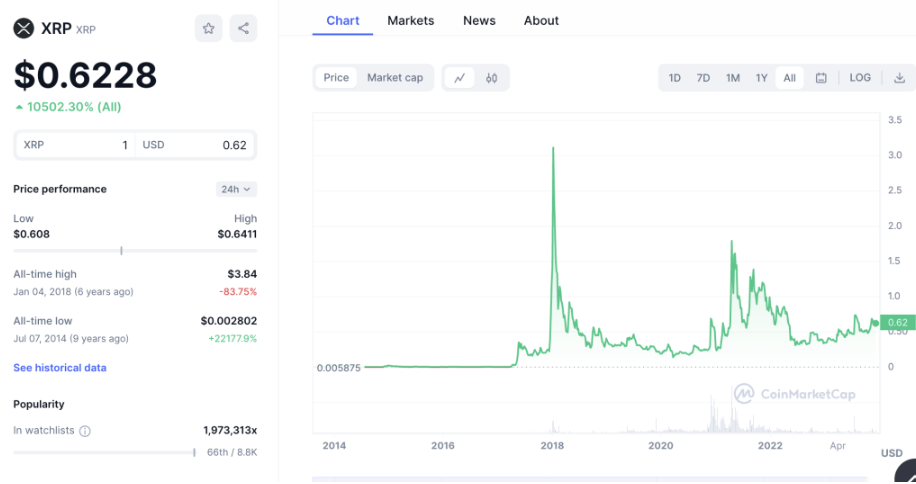

Ripple (XRP): This Layer 1 blockchain facilitates cross-currency transactions for financial institutions. XRP provides real-time liquidity bridges, ensuring its long-term practicality. Ripple is used by some of the world's largest banks, which means it may eventually replace the SWIFT network. XRP has risen by 60% in the past 12 months but has fallen 84% from its all-time high.

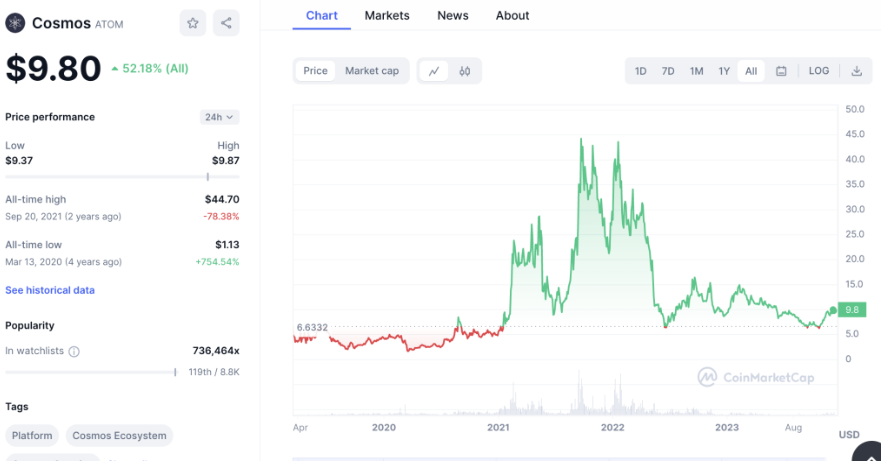

Cosmos (ATOM): Launched in 2019, Cosmos developed the Inter-Blockchain Communication protocol. This allows competing blockchains to communicate and share data without the need for centralized providers. ATOM is the supporting Layer 1 cryptocurrency for Cosmos. Currently, its trading price is 78% lower than its all-time high. ATOM's market value exceeds $3.7 billion.

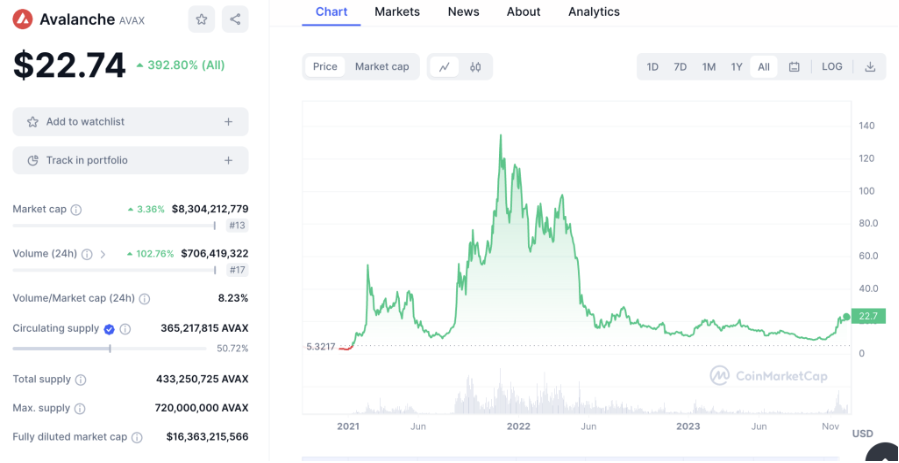

Avalanche (AVAX): Claiming to achieve infinite scalability, the Avalanche Layer 1 blockchain network provides almost instant transaction confirmations. Avalanche also allows ERC-20 projects to bridge to its network, charging a 0.025% bridge fee. Its native cryptocurrency AVAX's trading price is 85% lower than its all-time high in 2021.

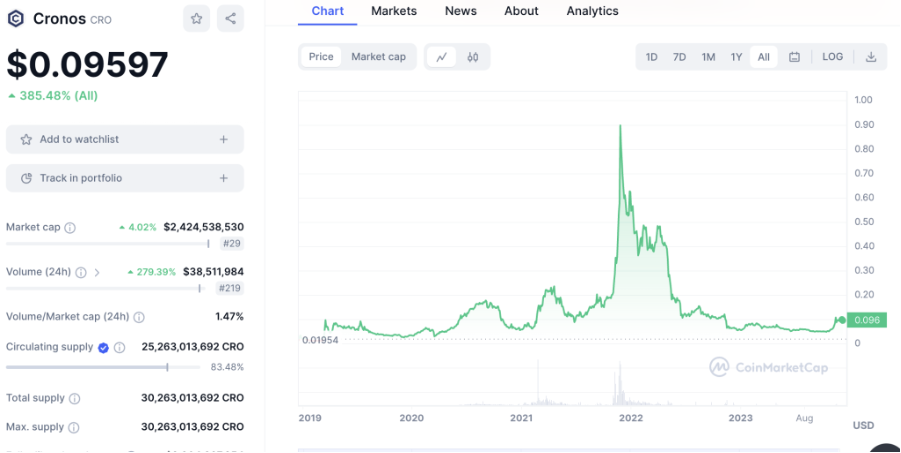

Cronos (CRO): Supporting the Crypto.com trading platform, Cronos is a highly scalable and low-cost Layer 1 blockchain. The Cronos network supports smart contracts and dApps, with transaction fees paid in CRO tokens. Crucially, CRO gives you access to the Crypto.com trading platform, which aims to increase its market share in the next bull market.

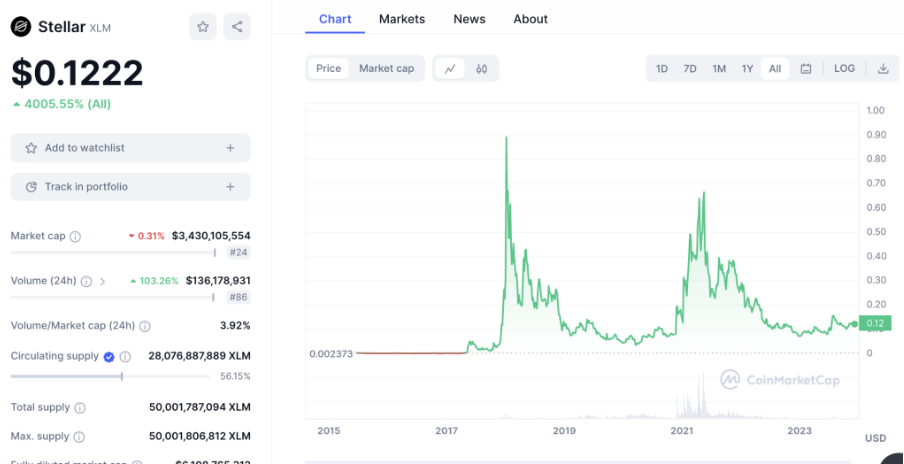

Stellar (XLM): Launched in 2014, Stellar is a Layer 1 blockchain that supports fast, low-cost, and scalable cross-border transactions. It has partnered with IBM, MoneyGram, and other well-known entities. XLM is the native cryptocurrency of the project, with a current market value of $3.4 billion. Investors can enjoy an 86% discount from its all-time high today.

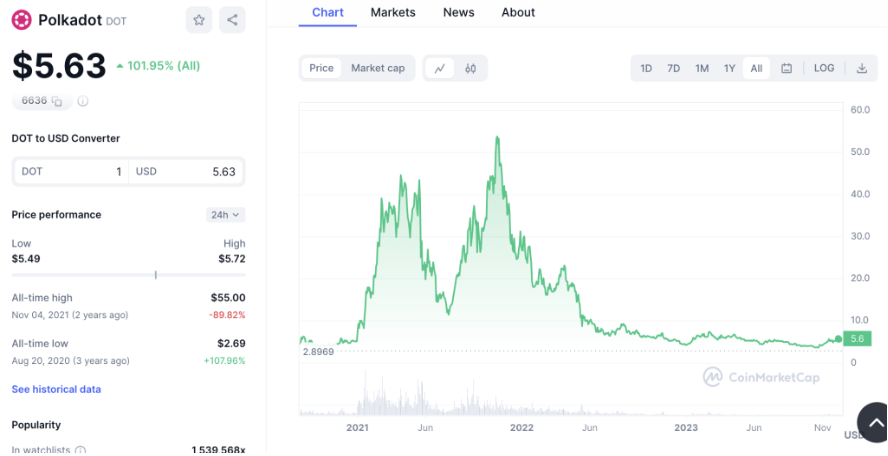

Polkadot (DOT): Another top Layer 1 blockchain, driving the development of network interoperability, Polkadot aims to be the "blockchain of blockchains" in the Web 3.0 era. As one of the most energy-efficient Layer 1 protocols, Polkadot's market value is close to $8 billion. DOT, its native token, has fallen by 90% from its all-time high.

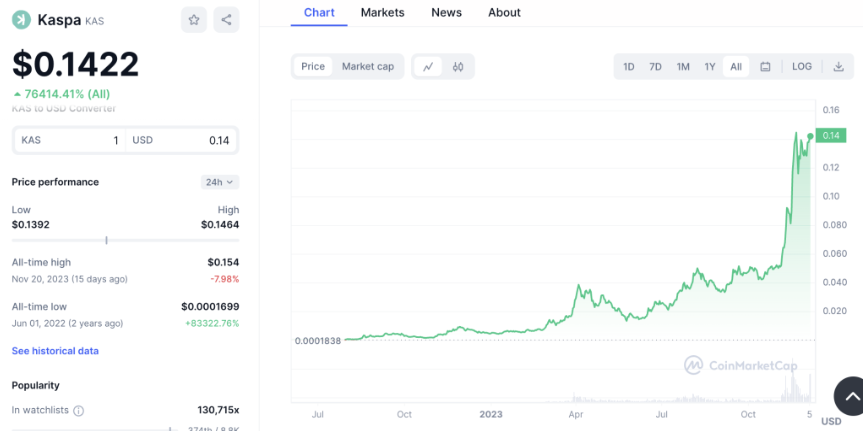

Kaspa (KAS): One of the fastest-growing cryptocurrencies, Kaspa has risen by over 7000% since its launch in July 2022. In the past 12 months, this Layer 1 cryptocurrency has grown by over 1800%. Kaspa uses a proof-of-work model but can confirm transactions in seconds.

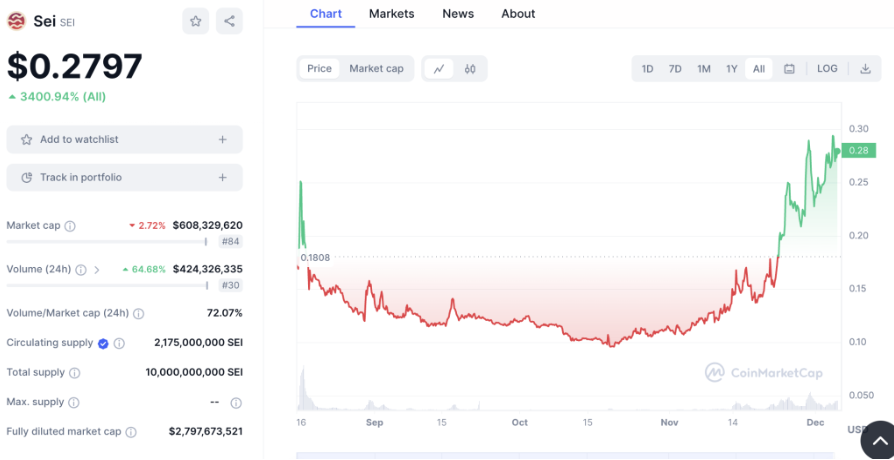

Sei (SEI): This is a new Layer 1 project launched in August 2023. Since then, Sei has risen by over 3400%, making it one of the best-performing cryptocurrencies this year. The Sei blockchain can process up to 20,000 transactions per second and has a finality speed of 380 milliseconds.

2. Best Layer 1 Cryptocurrency Projects - Comprehensive Analysis

The following sections will help you understand the long-term potential of each of the aforementioned Layer 1 cryptocurrencies. Keep reading to discover the best Layer 1 tokens for your investment portfolio.

1) Bitcoin (BTC): Comprehensive best Layer 1 blockchain for long-term investors

Despite potentially moderate short-term gains compared to other cryptocurrencies, we still believe Bitcoin is the overall best choice. It is the original Layer 1 blockchain launched in 2009. Bitcoin has the largest market value of all cryptocurrencies. At its peak, its value exceeded $1.4 trillion.

This is when the Bitcoin trading price was close to $69,000. Last year, Bitcoin dropped to below $16,000 but has since recovered to over $61,000.

There is currently a lot of bullish sentiment surrounding Bitcoin. Firstly, analysts predict that the U.S. Securities and Exchange Commission will approve the first Bitcoin exchange-traded fund (ETF) in 2024. This could trigger a massive influx of institutional investment.

Equally noteworthy is Bitcoin's next halving event; expected to occur in April 2024. This will reduce the 10-minute supply of new bitcoins by 50%, to 3.125 BTC. Ultimately, while some analysts believe Bitcoin may surpass $100,000 next year, this may only be the beginning. Therefore, we are confident that Bitcoin is one of the top Layer 1 cryptocurrency projects for long-term holders.

2) Ethereum (ETH): Most popular Layer 1 blockchain favored by dApp developers

Ethereum is the most popular Layer 1 cryptocurrency project, favored by decentralized application (dApp) developers. Although most dApps are inactive, there are hundreds of thousands of secondary tokens on the Ethereum network. The active tokens represent some of the largest cryptocurrencies, including metaverse projects such as Sandbox, Axie Infinity, and Decentraland.

Ethereum also hosts some of the best decentralized exchanges, including Uniswap and Sushiswap. Decentralized finance platforms also favor Ethereum, whether it's Aave, Yearn.finance, or Compound. It is crucial that every project on the Ethereum network uses ETH to pay transaction fees, ensuring strong demand for the world's second-largest cryptocurrency.

Despite facing increasing competition from other Layer 1 blockchains, Ethereum still dominates the majority of the dApp market. After all, Ethereum was the first project to launch a smart contract platform, giving it a significant first-mover advantage. In terms of valuation, Ethereum's current market value exceeds $350 billion.

Now, its trading price is over $2900, higher than 12 months ago. However, like most top Layer 1 blockchains, Ethereum still trades at an attractive discount. Those investing today will purchase at a price 58% lower than its near $5000 all-time high. Considering BlackRock recently submitted an Ethereum ETF application to the U.S. Securities and Exchange Commission, this could be the start of the next bull market.

3) Solana (SOL): One of the most worthwhile long-term investment Layer 1 blockchains

Solana is the most suitable Layer 1 cryptocurrency project for long-term investors. Analysts are keying in on whether Solana will capture a significant market share from Ethereum. According to CoinMarketCap's data, there are only 218 cryptocurrencies in the Solana ecosystem. In contrast, Ethereum has thousands.

Furthermore, most Solana-based projects are small-cap cryptocurrencies with limited trading volume. Nevertheless, Solana outperforms in terms of performance as a Layer 1 blockchain. This is a crucial metric as dApp developers want their projects to run on the fastest and most efficient blockchain.

While Ethereum can handle about 30 transactions per second, Solana has successfully processed over 65,000 transactions in testing. This makes it better suited for handling high transaction throughput. Additionally, Solana's transaction fees are much cheaper than Ethereum, averaging only 0.00025 SOL, equivalent to $0.00025.

So, what is Solana's potential for growth? Currently, Solana is one of the best-performing cryptocurrencies. In the past 12 months, the SOL token has grown by over 360%. Since the beginning of 2020, the SOL token has grown by over 7,300%. However, you can still enter the market at a huge discount; Solana's current trading price is $116.25.

4) BNB (BNB): Layer 1 blockchain supporting the Binance ecosystem

Ranked third by market value, the Layer 1 cryptocurrency BNB is also worth considering. This blockchain network supports the Binance ecosystem. Like Ethereum and Solana, the BNB chain supports smart contracts and dApps. There are thousands of projects operating on the BNB, known as BEP-20 tokens.

When settling fees, BEP-20 projects need to use BNB as the transaction token. BNB also has utility on the Binance trading platform; it offers a 25% discount on standard trading commissions. BNB is also a deflationary Layer 1 cryptocurrency. This is because Binance regularly burns BNB tokens, meaning they are removed from the circulating supply.

In terms of price performance, BNB has risen by over 20,000% since its launch at the end of 2017. However, in the past 12 months, BNB has fallen by 20%. Additionally, BNB's current price is $376.90, about 46% lower than its previous all-time high of around $690. Ultimately, Binance is the largest cryptocurrency exchange by trading volume, providing exposure to its growth for investors.

5) Ripple (XRP): Layer 1 payment network for cross-currency transactions

Ripple is one of the earliest Layer 1 blockchains; the network was launched in 2012. The technology is aimed at large financial institutions needing to conduct international transactions. Ripple streamlines the process, with cross-border transfers completed in less than five seconds.

Additionally, fees are typically less than a cent, and the network can handle up to 1500 transactions per second. Ripple is particularly useful for cross-currency transactions, especially when moving funds to emerging countries. Its native cryptocurrency XRP provides real-time liquidity.

This means financial institutions no longer need to rely on the SWIFT network, which typically depends on corresponding bank networks. As some of the world's largest banks are already using Ripple, XRP is one of the best Layer 1 cryptocurrency projects to consider. In February 2024, XRP's price is $0.5359.

6) Cosmos (ATOM): Inter-Blockchain Communication allowing Layer 1 networks to share data

Cosmos is a Layer 1 cryptocurrency project that developed the Inter-Blockchain Communication protocol. In simple terms, this allows two or more blockchain networks to share data without using centralized providers. For example, consider Kava and Cronos, which specialize in decentralized finance and trading services.

These two blockchains operate independently, meaning they have their own consensus methods and underlying code. Typically, Kava and Cronos blockchains cannot communicate. However, when deploying the Cosmos protocol, Kava and Cronos will be able to share data in real-time. This means Cosmos has a very wide range of use cases.

Cosmos has a native Layer 1 cryptocurrency, ATOM, which is required when using the Inter-Blockchain Communication protocol. ATOM's market value exceeds $3.8 billion. Its growth has been relatively moderate; since 2019, ATOM has only risen by 52%. Additionally, ATOM's price has fallen by almost 78% from its all-time high of around $45.

7) Avalanche (AVAX): High-performance Layer 1 network with infinite scalability

Avalanche is another high-performance blockchain aiming to gradually capture market share from Ethereum. It claims to offer "infinite scalability," meaning it can handle an unlimited number of transactions without compromising security. It also provides almost instant transactions, making it highly suitable for smart contracts and dApps.

Avalanche's another feature is its ability to support ERC-20 projects. Avalanche charges a fee of 0.025% for bridging, with a minimum of $3. According to CoinMarketCap's data, 282 projects have already bridged to Avalanche, including Tether, Chainlink, Dai, SushiSwap, and Frax.

In terms of price performance, Avalanche has risen by 63%. Although this is lower than the industry average, Avalanche's trading price is 85% lower than its 2021 all-time high. Therefore, investors can get an attractive discount before the next altcoin season arrives. Avalanche's market value is just over $13 billion, leaving plenty of room for growth.

8) Cronos (CRO): Crypto.com's Layer 1 network, trading at a 90% discount

Cronos, launched in November 2021, is one of the new Layer 1 blockchain projects entering the market. It achieves scalability, low transaction fees, and can support smart contracts and dApps. That being said, Cronos is known for its association with Crypto.com. Crypto.com, considered one of the best cryptocurrency trading platforms, offers some of the lowest trading commissions in the market.

Crypto.com has processed over $10 billion in trading volume, only a small fraction of the $180 billion on Binance. However, considering Binance's recent $4 billion fine for money laundering, Crypto.com is confident in increasing its market share. Therefore, those investing in the Cronos blockchain will gain exposure to Crypto.com's growth.

Cronos' native cryptocurrency CRO is currently valued at $2.4 billion. In comparison, Binance's BNB is valued at over $35 billion. In the past 12 months of trading, CRO token has grown by 42%. However, its trading price is 90% lower than its all-time high, providing a substantial discount.

9) Stellar (XLM): Cross-border payment network for individuals and businesses

Stellar is an open-source Layer 1 blockchain that uses the proof-of-agreement consensus mechanism. Stellar is not only energy-efficient but also provides extremely fast confirmation times. With an average completion time of 5-6 seconds, Stellar also offers low fees and can scale to 1,500 transactions per second.

Stellar aims to become the de facto payment network for global remittances, "banking the unbanked." However, it also enables businesses to process low-cost cross-border transactions. To achieve this, it has partnered with IBM, MoneyGram, and other well-known entities. XLM is the native cryptocurrency of the project launched in 2014.

XLM has experienced several bull and bear market cycles. Nonetheless, since its launch, the token has risen by 4000%. Those purchasing XLM today will receive an 86% discount compared to its previous all-time high. XLM's market value is $3.2 billion.

10) Polkadot (DOT): Leading interoperability in the Web3.0 era

Polkadot is another Layer 1 blockchain focused on interoperability. Its proprietary network aims to connect competing blockchains to adapt to the Web3.0 era. This means cross-blockchain transfers can occur while maintaining decentralization. Polkadot has achieved this at a high level of efficiency.

Through its nominated proof-of-stake consensus model, Polkadot's blockchain energy consumption is equivalent to 6.6 American households. Polkadot's native Layer 1 token DOT has three main functions. Firstly, DOT is a governance token, allowing holders to vote on protocol upgrades and fixes. Secondly, DOT is also one of the best staking coins.

Thirdly, DOT is used for "bonding," a way to facilitate cross-blockchain transactions. According to CoinMarketCap's data, Polkadot's market value exceeds $9.4 billion. In the past 12 months, DOT token has experienced minimal fluctuations, with less than 1% slight loss. At the current price, DOT's trading price is 90% lower than its all-time high.

11) Kaspa (KAS): Proof-of-work consensus model with one-second confirmation time

Kaspa is one of the fastest-growing cryptocurrencies in 2024. In the past 12 months of trading, its native token KAS has grown by over 1800%. Since the launch of KAS in July 2022, the token has grown by over 7600%.

However, Kaspa's market value is only $3 billion, so its upward trajectory may continue as we enter the bull market. Additionally, there is still a slight 8% discount compared to its previous all-time high. In terms of utility, Kaspa is a Layer 1 blockchain using a proof-of-work (PoW) consensus mechanism.

However, unlike other proof-of-work networks like Bitcoin, transaction speeds are very fast. Kaspa's transactions typically complete in seconds and do not compromise security. One of Kaspa's main goals is to increase scalability globally. It currently processes one block confirmation per second, but this speed will increase over time.

12) Sei (SEI): New Layer 1 cryptocurrency growing by 3400% since August 2023

As we enter 2024, Sei has become one of the hottest cryptocurrencies. Importantly, it is one of the newest Layer 1 blockchains in the market. According to CoinMarketCap's data, Sei launched its native cryptocurrency SEI in August 2023.

Since its launch, the SEI token has grown by over 3400%. In just the past month, SEI has grown by 137%. However, Sei's market value is only slightly above $21 million. Considering the other Layer 1 blockchains discussed today have valuations in the billions, this provides a good entry point for new investors.

So, why is Sei so popular now? Simply put, this Layer 1 network can process up to 20,000 transactions per second. It can complete transactions in just 380 milliseconds. Additionally, the network has already tested over 100 million transactions to date, demonstrating high efficiency.

3. Basics of Layer 1 Cryptocurrencies

Simply put, Layer 1 cryptocurrencies operate on proprietary blockchain networks. They have unique underlying code and their own consensus mechanisms. From an investment perspective, Layer 1 cryptocurrencies are an attractive choice.

After all, only a very small number of active cryptocurrencies are considered Layer 1. In contrast, the vast majority of tokens operate on a secondary network. For example, consider that over 450,000 tokens are built on the Ethereum blockchain. These include Decentraland, Dai, Sandbox, and Tether.

These secondary tokens follow the ERC-20 standard and do not impact the operation of the Ethereum blockchain. Therefore, any changes made to Ethereum—whether positive or negative—will directly affect the operation of ERC-20 tokens.

Difference Between Layer 1 and Layer 2 Blockchains

Blockchain terminology can be confusing. Here's a quick overview of the differences between Layer 1 and Layer 2 blockchains:

Layer 1 Blockchain: Layer 1 blockchains are the foundation of decentralized networks. They handle all aspects of the blockchain, including consensus mechanisms, security, and transaction processing. Examples of Layer 1 blockchains include Bitcoin, Ethereum, Solana, and BNB.

Layer 2 Blockchain: Layer 2 blockchains aim to improve the shortcomings of Layer 1. This typically means increased scalability, lower fees, and faster transactions. For example, Polygon is a Layer 2 solution for the best ERC-20 tokens, ensuring projects can operate more efficiently. Layer 2 networks can also help Layer 1 cryptocurrencies expand their use cases, such as supporting smart contracts and dApps.

Both Layer 1 and Layer 2 blockchains play a role in the broader cryptocurrency market. However, ultimately, Layer 1 networks are more favored by long-term investors.

4. Conclusion

In conclusion, the importance of Layer 1 cryptocurrencies is evident, providing a framework for various applications and assets. Our review of the best Layer 1 cryptocurrency projects highlights their popularity and their potential for investment profitability.

However, it's important to note that the cryptocurrency market is highly volatile, so thorough research should be conducted before investing in any cryptocurrency assets.

Source: Techopedia

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。