原文标题:《SUI 三天暴涨 54%!DeFi 狂潮+资本疯抢,4 美元只是起点?》

原文作者:Lawrence,火星财经

SUI 逆势狂飙:技术、生态与资本共振下的价值觉醒

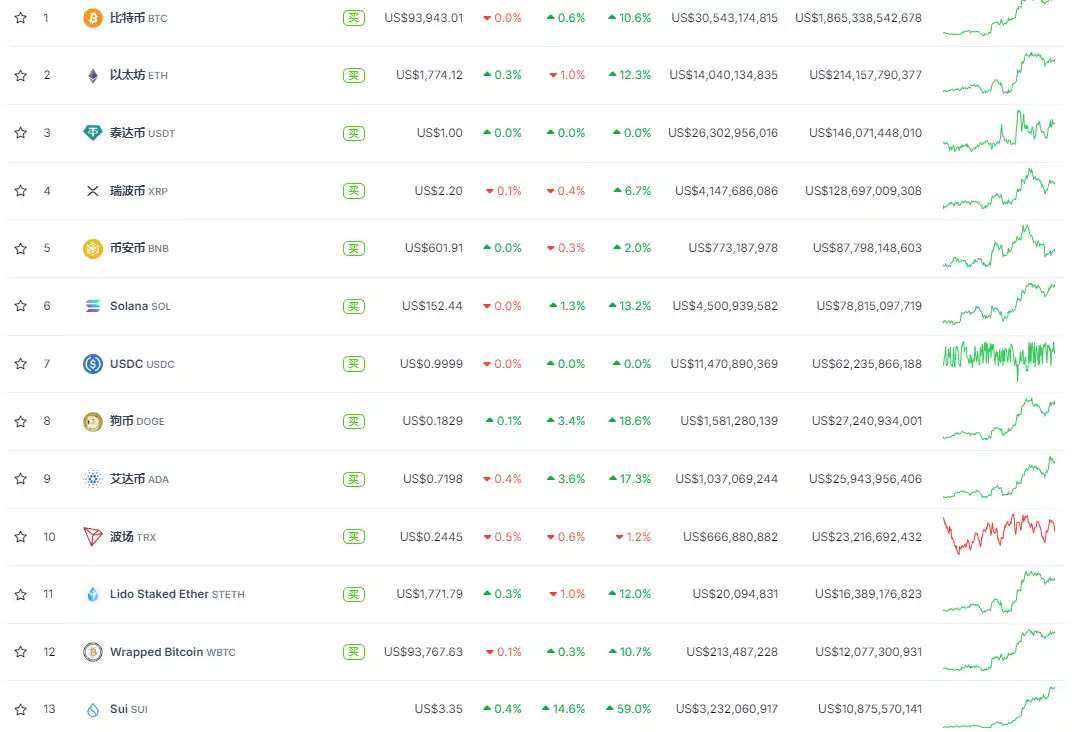

2025 年 4 月 25 日,SUI 代币以三日 54% 的惊人涨幅突破 3.39 美元,全网合约持仓量飙升至 11 亿美元,成为市值前 20 代币中唯一逆势突破历史压力位的项目。

核心数据对比(截至 4 月 25 日):

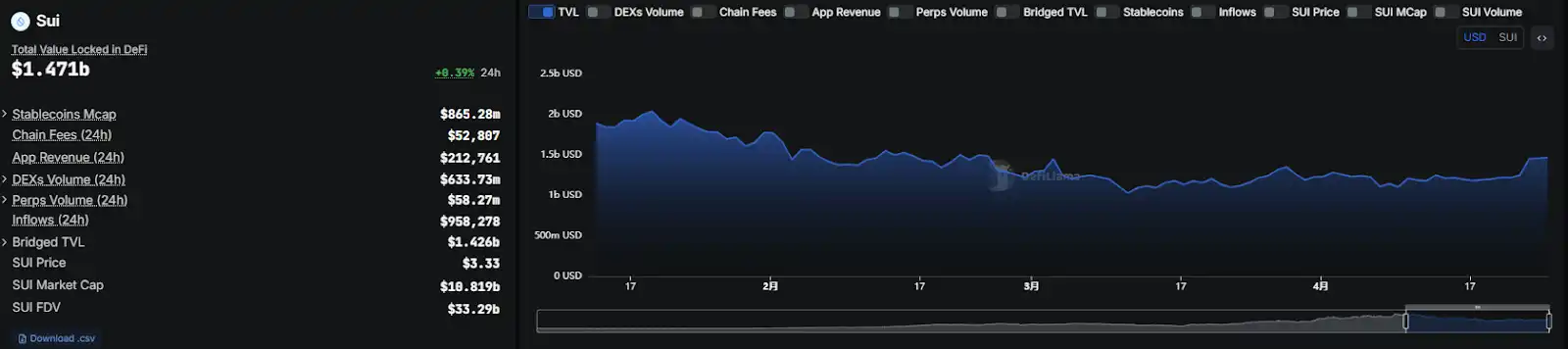

· TVL 增速:Sui 网络总锁仓价值(TVL)达 14.6 亿美元,周增幅 10%,远超同期 Solana(+3.2%)和 Avalanche(-1.8%)

· 稳定币占比:链上稳定币市值突破 8.8 亿美元,USDC 市占率 71%,流动性深度较三个月前提升 200%

· DEX 爆发力:单日 DEX 交易量突破 6.2 亿美元,单周 DEX 交易量 27.7 亿美元,较市场均值高出 8 倍,其中 Meme 币贡献超 60% 交易量。

这种「背离式增长」的背后,是 Sui 构建的全新生态范式——通过技术栈重构、资本共振与社区裂变的三重引擎,完成了从底层协议到应用生态的闭环突破。

技术革命:公链 3.0 时代的操作系统级架构

Sui 的技术架构绝非传统公链的线性升级,而是以「全栈操作系统」理念重构区块链架构:

1. 共识机制的范式跃迁

Mysticeti V2 引擎:采用 DAG(有向无环图)结构,将共享对象交易确认时间压缩至 0.25 秒,实测 TPS 突破 12 万。这使得 Sui 成为首个支持高频量化交易的公链,DeepBook 订单簿的滑点较 Uniswap V4 降低 40%Remora 分片机制:通过将验证节点任务拆分为计算、存储、验证三大模块,实现线性扩展能力。测试网环境下,每增加 1 组节点集群可使 TPS 提升 4.3 万

2. 存储层的颠覆性突破

Walrus 分布式网络:作为首个可编程存储侧链,采用纠删码技术将存储成本降至传统方案的 10%。主网上线首月即承载 200TB 的 AI 训练数据集,为 Render Network 等计算型项目提供基础设施SEAL 动态加密协议:实现 NFT 内容分级授权,华纳音乐已基于此技术发行动态音乐 NFT,播放量突破 1.2 亿次

3. 开发者体验的代际跨越

· Move Prover 智能验证:通过形式化证明将合约漏洞率降至 0.3%,较 Solidity 提升 5 倍安全性

· RPC 2.0 响应体系:基于 GraphQL 的查询系统将数据调用延迟压缩至 50ms 内,配合 Bugdar AI 审计工具,开发效率提升 3 倍

· 这种技术架构使 Sui 摆脱了「性能-去中心化」的二元悖论。Artemis 数据显示,其活跃验证节点达 297 个,远超 Solana 的 183 个,真正实现高性能与去中心化的兼得。

生态爆发:多赛道协同的飞轮效应

Sui 生态已形成「基础设施-中间件-应用层」的完整矩阵,各赛道呈现协同爆发态势:

1. DeFi 的机构化转型

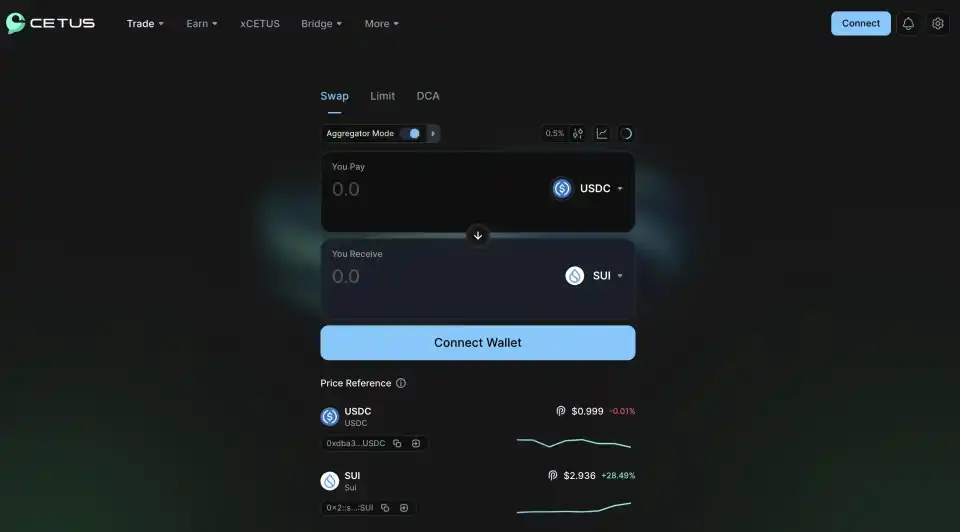

· Cetus Protocol:流动性聚合协议深度整合 DeepBook,实现百万美元级交易滑点稳定在 0.3% 以内,吸引 Jump Crypto 等顶级做市商入驻,平台代币 CETUS 月涨幅达 180%

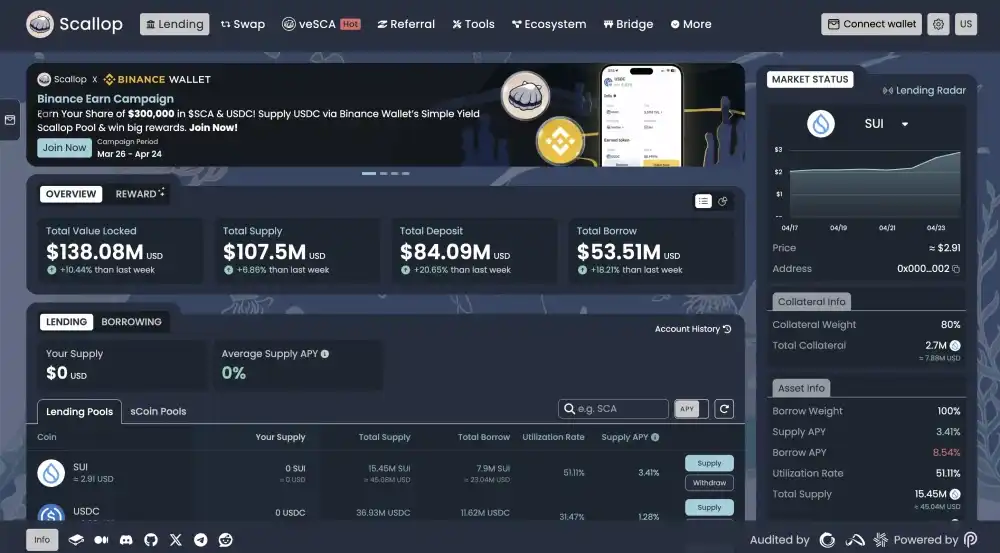

· Scallop 跨链枢纽:通过模块化设计支持 20 条链资产无缝流转,其「收益分层」机制使稳定币存款 APY 达 15%,TVL 突破 5 亿美元

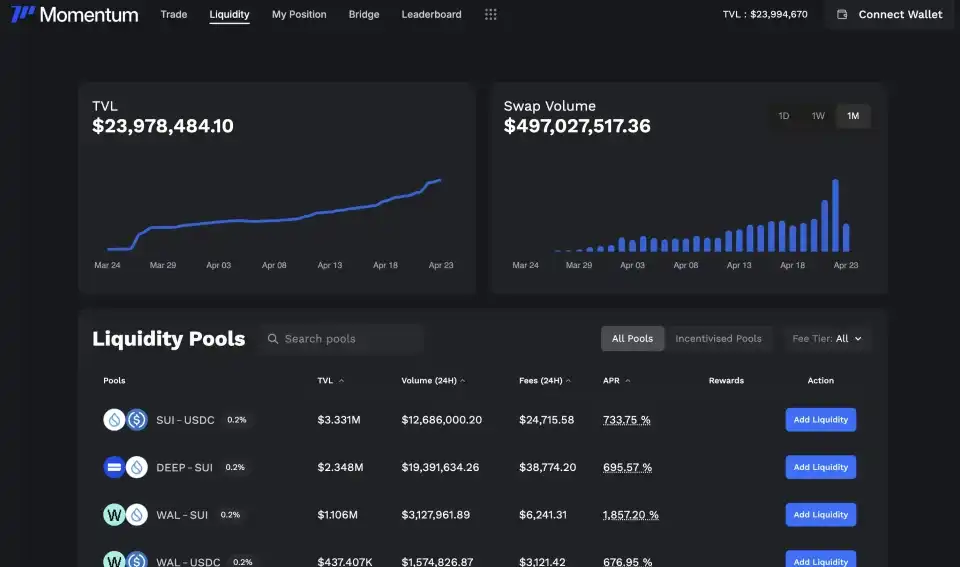

· Momentum 稳定币平台:算法稳定币与超额抵押混合机制日均交易量 1.2 亿美元,成为 Sui DeFi 流动性基石

2. Meme+AI 的流量奇点

· LOFI/BLUB 现象:两大 Meme 币单日涨幅分别达 124% 和 100%,带动链上活跃地址突破 170 万。其成功源于 Sui 独特的 Gas 费补贴机制,使小额交易成本稳定在$0.01

· RockeeAI:集成自然语言处理的 DeFi 协议,实现「语音指令交易」功能,社交媒体情绪分析模块覆盖 2000+社区,预测准确率 78%

· Zeromorph 永续合约:AI Agent SDK 支持用户训练个性化策略,「风险对冲引擎」使爆仓率降至行业均值 1/3

3. 硬件破圈的生态扩展

· SuiPlay0X1 游戏掌机:硬件与链游生态深度融合,预售 70 万订单中 62% 来自传统游戏玩家。该设备支持 NFT 装备的无感获取,带动 Sui 游戏类 DApp 数量激增 300%7

· Sui Frens 动态 NFT:通过基因突变算法实现 NFT 属性实时交互,稀有款地板价突破 420 SUI,铸造量周环比增长 470%

· 这种多维度爆发形成生态飞轮:技术优势吸引开发者→丰富应用提升用户留存→资本流入强化流动性→反哺技术迭代。

资本共振:传统势力入场重构估值逻辑

Sui 的价值重估本质是主流资本对 Web3 基础设施的重新定价:

1. 机构入场三部曲

· ETF 破冰:Canary Capital 提交首支 SUI ETF 申请,VanEck 预测获批后将带来 35 亿美元增量资金

· RWA 布局:与富兰克林邓普顿共建代币化平台,管理 1.5 万亿美元传统资产上链

· 合规突破:获迪拜 VARA 牌照,成为中东首个合规公链,阿布扎比主权基金已配置 2.3 亿美元

2. 流动性结构质变

· 稳定币杠杆:USDC 发行量周增 7.77%,机构通过 CCTP 协议实现跨链套利,日均套利规模超 8000 万美元

sui 全网合约持仓量突破 11 亿美元

· 合约持仓异动:Coinglass 数据显示,3.5 美元行权价的看涨期权持仓量周增 320%,市场押注 5 月突破 4 美元

3. 估值模型的颠覆

传统公链估值多采用 Metcalfe 定律(价值∝用户数²),而 Sui 的全栈能力催生「梅特卡夫-齐夫复合模型」:

· 估值=开发者数×(DApp 数+TVL)^1.5

· 按此模型,Sui 当前估值应达 200 亿美元,较现价存在 80% 上行空间。

· 这种预期得到链上数据的支撑:当前 SUI 链上每日新增 DApp 17 个,是 Solana 的 2.3 倍,生态网络效应进入指数级增长阶段。

结语:公链竞争的下半场开幕

SUI 的崛起标志着区块链竞争进入「全栈能力」时代。当其他公链还在 TPS 数字上缠斗时,Sui 已悄然完成从协议层到应用层,从线上生态到线下硬件的立体化布局。其通过技术深度、资本厚度与生态广度的三重共振,正在改写 Web3 的基础规则。

这场价值重构的本质,是区块链从「金融实验场」向「数字经济操作系统」的进化。当 SUI Play0X1 掌机开始出现在地铁乘客手中,当华纳音乐的粉丝为动态 NFT 疯狂,我们或许正在见证区块链技术真正意义上的「出圈时刻」。这场盛宴,或许才刚刚拉开帷幕。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。